Академический Документы

Профессиональный Документы

Культура Документы

MAS Preweek Quizzer

Загружено:

Erma CaseñasАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

MAS Preweek Quizzer

Загружено:

Erma CaseñasАвторское право:

Доступные форматы

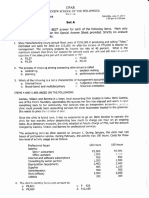

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

Quality Costs

1. The following activities are typical in production management:

1. Warranty work

2. Labor and overhead incurred for rework of defective products

found by an inspector

3. Quality training program

4. The costs of a consumer complaint department

5. In-process inspection costs

6. Reinspection of reworked products

7. Downtime attributed to quality problems

8. Product recalls

9. Lower sales due to poor product performance

10.Quality audits

To what classification of quality costs do the foregoing described

costs belong?

Prevention

Appraisal

Internal Failure External

Failure

A.

3,7,10

3,5

2

1,4,8,9

B.

3,10

5

2,6,7

1,4,8,9

C.

10

3

2,5,6

1,4,7,8,9

D.

3,10

5

1,2,10

4,7,8,9

Pre-week Quizzer

2. As a result of quality improvements, profits have increased by

A. P32,500

C. P7,500

B. P20,500

D. P5,00

Questions 2 thru 4 are based on the following information.

At the beginning of the year, Joshua Corporation initiated a quality

improvement program. The program was successful in reducing scrap

and rework costs.

To help assess the impact of the quality

improvement program, the following data was collected for the current

and preceding year.

Preceding Year

Current Year

Sales

P1,000,000

P 1,000,000

Recruiting

1,000

1,500

Packaging inspections

2,500

4,000

Downtime

20,000

15,000

Reinspection

40,000

25,000

Product inspection

5,000

10,000

Product liability

35,000

27,500

May 9, 2004

Page 1 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

3. If quality costs had been reduced to 2.5 percent of sales in the

current year, profits would have increased by

A. P177,000

C. P61,000

B. P58,000

D. P25,000

4. For the current year, the respective percentages based on sales of

the different quality costs, respectively, are:

Prevention

Appraisal

Internal

External

Failure

failure

A.

0.15%

1.40%

2.50%

1.50%

B.

0.15%

1.40%

4.00%

2.75%

C.

0.65%

1.00%

1.50%

4.25%

D.

0.65%

1.00%

2.50%

1.50%

Productivity Measures

Questions 5 & 6 are based on the following information.

Information about Rose Company is as follows:

2001

Output (units)

80,000

Selling price per unit

P25

Input quantities:

Materials (pounds)

4,000

Labor (hours)

3,200

Input prices:

Materials (per pound)

P5.00

Labor (per hour)

P7.00

2002

84,000

P25

4,000

3,250

P5.50

P7.50

5. What are the materials productivity, and labor productivity ratio for

2001?

A.

B.

C.

D.

Materials

20.00

100.00

25.00

20.00

Labor

25.00

95.45

24.00

24.00

6. By how much did profits change as a result of changes in

productivity related to materials, and labor, respectively?

A.

B.

C.

D.

Materials

P(1,100)

P1,100

P(625)

P625

May 9, 2004

Labor

Pre-week Quizzer

P (825)

P 825

P 625

P625

Activity-Based Costing

7. Designing and changing are activities that are classified as:

A. Unit-level

C. Product-level

B. Batch-level

D. Facility-level

8. How are the following activities classified using ABC system?

1. Security

2. Product inspections

3. Insurance on the plant

4. Materials handling

5. Modifications made by engineering to the product design of

several products

6. Machine-related overhead

7. Set-ups

8. Providing space and utilities

9. Moving of inventory

Unit Level

Batch Level

Product Level Facility Level

A.

4,6,8

2,4,7

1,3

10

B.

2,6

4,5

1,7

3,10

C.

6

2,4,7,10

5

1,3,8

D.

2

1,6,7

10

3,4,5,8

9. Protex Company makes two products, X and Z. X is being

introduced this period, whereas Z has been in production for 2

years. For the period about to begin, 1,000 units of each product

are to be manufactured. The only relevant overhead item is the

cost of engineering change orders. X and Z are expected to require

eight and two change orders, respectively. X and Z are expected to

require 2 and 3 machine hours, respectively. The cost of a change

orderis P600.

If Protex applies engineering change order cost on the basis of

machine hours, the overhead cost per unit to be assigned to X and

Z, respectively, are

A. P2.40 and P3.60, respectively C. P4.80 and P3.60, respectively

B. P3.60 and P2.40, respectively D. P3.60 and P4.80, respectively

Page 2 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

10.Zeta Co. is preparing its profit plan. As part of its

profitability of individual products, the controller

amount of overhead that should be allocated to

product lines from the information given as follows:

Wall mirrors

analysis of the

estimates the

the individual

Special

windows

Units produced

25

25

Material moves per product line

5

15

Direct labor hours per unit

200

200

Budgeted materials handling costs

P50,000

Under each of the systems of costing, how much materials handling

costs should be allocated to one unit of wall mirrors?

A.

B.

C.

D.

Based on direct labor

P1,000

P 500

P2,000

P5,000

hours

Under activity-based

P 500

P1,000

P1,500

P2,500

costing

Life-Cycle Costing

11.Richards, Inc. developed the following budgeted life-cycle income

statement for two proposed products. Each products life cycle is

expected to be two years.

Product Product

Total

X

Y

Sales

P200,000 P200,0

P400,000

00

Cost of goods sold

( 120,00

(130,0

( 250,000)

0)

00)

Gross Profit

P 80,000

P

P150,000

70,000

Period expenses:

Research & development

( 70,000)

Marketing

( 50,000)

Life-cycle income

P 30,000

May 9, 2004

Pre-week Quizzer

A 10% return on sales is required for new products. Because the

proposed products did not have a 10% return on sales, the products

were going to be dropped.

Relative to Product Y, Product X requires more research and

development costs but fewer resources to market the product.

Sixty percent of the research and development costs are traceable

to Product X and 30 percent of the marketing costs are traceable to

Product X.

If research and development costs and marketing costs are traced

to each product, life-cycle income for Product Y would be

A. P35,000

C. P12,000

B. P20,000

D. P7,000

Cost Behavior

12.The following cost functions were developed for manufacturing

overhead costs:

Manufacturing Overhead Costs Cost Function

Electricity

P100 + P20 per direct labor

hour

Maintenance

P200 + P30 per direct labor

hour

Supervisors salaries

P10,000 per month

Indirect materials

P16 per direct labor hour

Page 3 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

If July production is expected to be 1,000 units requiring 1,500

direct labor hours, estimated manufacturing overhead costs would

be

A. P109,300

C. P76,300

B. P99,000

D. P10,366

Cost-Volume-Profit Analysis

13.The Ship Company is planning to produce two products, Alt and

Tude. Ship is planning to sell 100,000 units of Alt at P4 a unit and

200,000 units of Tude at P3 a unit. Variable costs are 70% of sales

for Alt and 80% of sales for Tude. In order to realize a total profit of

P160,000, what must the total fixed costs be?

A. P80,000

C. P240,000

B. P90,000

D. P600,000

14.Glow Co. wants to sell a product at a gross margin of 20%. The cost

of the product is P2.00. The selling price should be

A. P1.60

C. P2.40

B. P2.10

D. P2.50

15.The following relates to Gloria Corporation, which produced and

sold 50,000 units during a recent accounting period:

Sales

P850,000

Fixed manufacturing costs

210,000

Variable manufacturing costs

140,000

Fixed selling and administrative expense

300,000

Variable selling and administrative expense

45,000

Income tax rate

40%

For the next accounting period, if production and sales are

expected to be 40,000 units, the company should anticipate a

contribution margin per unit of

A. P1.00

C. P3.10

B. P13.30

D. P7.30

16.Madden, Company has projected its income before taxes for next

year as shown below. Madden is subject to a 40% income tax rate.

Sales

(160,000

P8,000,000

May 9, 2004

Pre-week Quizzer

units)

Cost of sales

Variable costs

P 2,000,000

Fixed costs

3,000,000

5,000,000

Income

before

P 3,000,000

taxes

Maddens net assets are P36,000,000. The peso sales that must be

achieved for Madden to earn a 10 percent after tax return on assets

would be

A. P8,800,000

C. P12,000,000

B. P16,000,000

D. P6,880,000

17.The following data relate to Homer Company which sells a single

product:

Unit selling price

P 20.00

Purchase cost per unit

11.00

Sales commission, 10% of selling price

2.00

Monthly fixed costs

P80,000

The firms salespersons would like to change their compensation

from a 10 percent commission to a 5 percent commission plus

P20,000 per month in salary. They now receive only commission.

The change in compensation plan should change the monthly

breakeven point by

A. 1,071 Increase

C. 1,538 Increase

B. 1,071 Decrease

D. 1,538 Decrease

18.Brunei Corp. is developing a new product, surge protectors for highvoltage electrical flows. The cost information for the product are:

Direct materials, P3.25 per unit; Direct labor, P4.00 per unit;

Distribution, P0.75 per unit. The company will also be absorbing

P120,000 of additional fixed costs associated with this new product.

A corporate fixed charge of P20,000 currently absorbed by other

products will be allocated to this new product.

How many surge protectors (rounded to the nearest hundred) must

Brunei sell at a selling price of P14 per unit to increase after-tax

income by P30,000? (effective income tax rate is 40%)

A. 10,700

C. 20,000

Page 4 of 36

MANAGEMENT ADVISORY SERVICES

B. 12,100

CPA Review School of the Philippines

D. 28,300

19.A manufacturer produces a product that sells for P10 per unit.

Variable costs per unit are P6 and total fixed costs are P12,000. At

this selling price, the company earns a profit equal to 10% of total

peso sales. By reducing its selling price to P9 per unit, the

manufacturer can increase its unit sales volume by 25%. Assume

that there are no taxes and that total fixed costs and variable costs

per unit remain unchanged. If the selling price were reduced to P9

per unit, the profit would be

A. P3,000

C. P5,000

B. P4,000

D. P6,000

Pre-week Quizzer

20.Last year, the marginal contribution rate of Lamesa Company was

30%. This year, fixed costs are expected to be P120,000, the same

as last year, and sales are forecasted at P550,000 a 10% increase

over last year. For the company to increase income by P15,000 in

the coming year, the marginal contribution margin rate must be

A. 20%

C. 40%

B. 30%

D. 70%

21.Wilson Co. prepared the following preliminary forecast concerning

product G for next year assuming no expenditure for advertising:

Selling price per unit

P

10

Units sales

100,000

Variable costs

P600,000

Fixed costs

P300,000

Based on a market study in December of this year, Wilson

estimated that it could increase the unit selling price by 15% and

increase the unit sales volume by 10% if P100,000 were spent on

advertising. Assuming that Wilson incorporates these changes in its

forecast, what should be the operating income from product G?

A. P175,000

C. P205,000

B. P190,000

D. P365,000

22.Shoes, Unlimited operates a chain of shoe stores around the

country. The stores carry many styles of shoes that are all sold at

the same price. To encourage sales personnel to be aggressive in

their sales efforts, the company pays a substantial sales

commission on each pair of shoes sold. Sales personnel also

receive a small basic salary.

The following cost and revenue data relate to Store 21 and are

typical of the companys many sales outlets:

Selling price

P 800

Variable expenses:

Invoice costs

P360

Sales commission

140

500

Fixed expenses per year:

Rent

P1,600,000

May 9, 2004

Page 5 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

Advertising

3,000,000

Salaries

1,400,000

Total

P6,000,000

The company is considering paying the store manager a P60

commission on each pair of shoes sold in excess of break-even

point. If this change were made, what will be the stores before tax

profit or loss assuming 23,500 pairs of shoes are sold in a year?

A. P(360,000)

C. P840,000

B. P2,930,000

D. P1,330,000

Administration

Total fixed costs

Net income before income taxes

Income taxes (40%)

Net income after income taxes

Pre-week Quizzer

45,000

247,500

P157,500

(63,000)

P 94,500

24.The breakeven volume in tons of product for the year is

A. 420

C. 1,100

B. 495

D. 550

23.BE&H Co. is considering dropping a product. Variable costs are

$6.00 per unit. Fixed overhead costs, exclusive of depreciation,

have been allocated at a rate of $3.50 per unit and will continue

whether or not production ceases. Depreciation on the equipment

is P20,000 a year. If production is stopped, the equipment can be

sold for P18,000, if production continues, however, it will be useless

at the end of 1 year and will have no salvage value. The selling

price is P10 a unit. Ignoring taxes, the minimum units to be sold in

the current year to break even on a cash flow basis is

A. 4,500 units

C. 1,800 units

B. 5,000 units

D. 36,000 units

Questions 24 through 28 are based on the Statement of Income of

Davao, Inc. which represents the operating results for the current

fiscal year ending December 31. Davao had sales of 1,800 tons of

product during the current year. The manufacturing capacity of

Davaos facilities is 3,000 tons of product. Consider each questions

situation separately.

Sales

P900,000

Variable costs

Manufacturing

P315,000

Selling costs

180,000

Total variable costs

495,000

Contribution margin

P405,000

Fixed costs

Manufacturing

P 90,000

Selling

112,500

May 9, 2004

Page 6 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

25.If the sales volume is estimated to be 2,100 tons in the next year,

and if the prices and costs stay at the same levels and amounts

next year, the after-tax net income that Davao can expect for the

next year is

A. P135,000

C. P110,25

B. P283,500

D. P184,500

26.Davao has a potential foreign customer that has offered to buy

1,500 tons at P450 per ton. Assume that all of Davaos costs would

be at the same levels and rates as last year. What net income after

taxes would Davao make if it took this order and rejected some

business from regular customers so as not to exceed capacity?

A. P297,500

C. P252,000

B. P211,500

D. P256,500

Pre-week Quizzer

29.Dahl Company, a clothing manufacturer, uses a standard costing

system. Each unit of finished product contains 2 yards of cloth.

However, there is unavoidable waste of 20% calculated on input

quantities, when the cloth is cut for assembly. The cost of the cloth

is P3 per yard. The standard direct material cost for cloth per unit

of finished product is:

A. P4.80

C. P7.00

B. P6.00

D. P7.50

27.Without prejudice to your answers to previous questions, and

assume that Davao plans to market its product in an new territory.

Davao estimates that an advertising and promotion program

costing P61,500 annually would need to be undertaken for the next

two or three years. In addition , a P25 per ton sales commission

over and above the current commission to the sales force in the

new territory would be required. How many tons would have to be

sold in the new territory to maintain Davaos current after-tax

income of P94,500?

A. 307.5

C. 1,095

B. 273.33

D. 1,545

28.Without prejudice to preceding questions, assume that Davao

estimates that the per ton selling price will decline 10% next year.

Variable costs will increase P40 per ton and the fixed costs will not

change. What sales volume in pesos will be required to earn an

after-tax net income of P94,500 next year?

A. P1,140,000

C. P825,000

B. P1,500,000

D. P1,350,000

Standard Costing & Variance Analysis

May 9, 2004

Page 7 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

30.The following information relates to Ore Companys 2003

manufacturing activities:

Standard direct labor hours per unit

2

Number of units produced

5,000

Standard variable overhead per standard direct labor hoursP3

Actual variable overhead

P28,000

Unfavorable overhead efficiency variance

P 1,500

The number of actual direct labor hours are

A. 10,500

C. 10,000

B. 11,000

D. 12,400

Questions 31 & 32 are based on the following information.

Rainbow Company uses a standard cost system. Information about its

direct labor costs for Product Lux for the month of January follows:

Standard hours allowed for actual production

1,500

Actual hourly rate paid

P61.00

Standard hourly rate

P60.00

Labor efficiency variance, Favorable

P6,000

31.How many direct labor hours were actually worked during the

month of January?

A. 1,400

C. 1,402

B. 1,498

D. 1,600

32.How much was the direct labor rate variance?

A. P1,400 F

C. P1,400 U

B. P1,600 F

D. P1,600 U

33.STA Company uses a standard cost system.

The following

information pertains to direct labor costs for the month of June:

Standard direct labor rate per hour

P10.00

Actual direct labor rate per hour

P 9.00

Labor rate variance

P12,000 favorable

Actual output

2,000 units

Standard hours allowed for actual production

10,000 hours

How many actual labor hours were worked during March for STA

Company?

May 9, 2004

A. 10,000

B. 12,000

Pre-week Quizzer

C. 8,000

D. 10,500

34.If annual overhead costs are expected to be P1,000,000 and

200,000 total labor hours are anticipated (80% direct, 20%

indirect), the overhead rate based on direct labor hours is

A. P6.25

C. P25.00

B. P5.00

D. P4.00

35.ABC had a P28,000 favorable volume variance, a P25,000

unfavorable variable overhead spending variance, and P12,000

total overapplied overhead. The fixed overhead budget variance

was

A. P9,000 favorable

C. P9,000 unfavorable

B. P26,000 favorable

D. P26,000 unfavorable

36.Given for the variable factory overhead of X Products Inc.: P39,500

actual input at budgeted rate, P41,500 flexible budget based on

standard input allowed for actual output, P2,500 favorable flexible

budget variance. Compute the spending variance:

A. P500 U

C. P500 F

B. P2,000 F

D. P2,000 U

37.Bacon had a P28,000 unfavorable volume variance, a P5,000

unfavorable fixed overhead budget variance, and P22,000 total

underapplied overhead. The variable overhead spending variance

was

A. P11,000 favorable

C. P11,000 unfavorable

B. P1,000 favorable

D. P23,000 unfavorable

38.Acme had a P22,000 favorable fixed overhead budget variance, a

P15,000 unfavorable variable overhead spending variance, and

P2,000 total overapplied overhead. The volume variance was

A. P13,000 overapplied

C. P5,000 overapplied

B. P13,000 underapplied

D. P5,000 underapplied

Page 8 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

39.Aldorp had a P10,000 unfavorable fixed overhead budget variance,

a P6,000 unfavorable variable overhead spending variance, and a

P2,000 favorable volume variance. The total overhead was

A. P14,000 overapplied

C. P18,000 overapplied

B. P14,000 underapplied

D. P18,000 underapplied

Pre-week Quizzer

40.Fidelity Company uses a flexible budget system and prepared the

following information for the year: Fidelity operated at 80 percent

of capacity during the year, but applied factory overhead based on

the 90 percent capacity level.

Assuming that actual factory

overhead was equal to the budgeted amount of overhead, how

much was the overhead volume variance for the year?

Percent of Capacity

80

90

Percent

Percent

Direct labor hours

24,000

27,000

Variable factory overhead

P54,000

P60,750

Fixed factory overhead

P81,000

P81,000

Total factory overhead rate pre DLH

P5.625

P5.25

A. P9,000 U

C. P9,000 F

B. P15,750 U

D. P15,750 F

41.Using the information presented below, calculate the total overhead

spending variance.

Budgeted fixed overhead

P10,000

Standard variable overhead (2 DLH at P2 per DLH) P4 per unit

Actual fixed overhead

P10,300

Actual variable overhead

P19,500

Budgeted volume (5,000 units x 2 DLH)

10,000 DLH

Actual direct labor hours (DLH)

9,500

Units produced

4,500

A. P500 U

C. P1,000 U

B. P800 U

D. P1,300 U

42. STA Companys standard fixed overhead cost is P3 per direct labor hour

based on budgeted fixed costs of P300,000. The standard allows 2 direct labor

hours per unit. During 2001, STA produced 55,000 units of product, incurred

P315,000 of fixed overhead costs, and recorded 106,000 actual hours of direct

labor. What are the fixed overhead variances?

Fixed OH spending (budget)

variance

Fixed OH Volume variance

May 9, 2004

A.

P15,00

0U

P30,00

0F

B.

P33,00

0U

P30,00

0F

C.

D.

P15,00 P33,000

0U

U

P18,00 P18,000

0F

F

Page 9 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

Questions 43 and 44 are based on the following information.

Raff Co.s monthly normal volume is 50,000 units (100,000 direct labor

hours.)

Raff Co.s standard cost system contains the following

overhead costs:

Variable

P6 per unit

Fixed

8 per unit

Pre-week Quizzer

The following information pertains to the month of March

Units actually produced

38,000

Actual direct labor hours worked

80,000

Actual overhead incurred:

Variable

P250,000

Fixed

384,000

43.For March, the unfavorable variable overhead spending variance

was

A. P6,000

C. P12,000

B. P10,000

D. P22,000

44.For March, the fixed overhead volume variance was

A. P96,000 U

C. P80,000 U

B. P96,000 F

D. P80,000 F

45.Smile Corporation uses a standard cost system. Information for the

month of April is as follows:

Actual manufacturing overhead costs (P13,000 is fixed)P40,000

Direct labor:

Actual hours worked

12,000 hours

Standard hours allowed

10,000 hours

Average actual labor cost per hour

P9

The factory overhead rate is based on a normal volume of 12,000

direct labor hours

Standard cost data at 12,000 direct labor hours was:

Variable factory overhead

P24,000

Fixed factory overhead

12,000

Total factory overhead

P36,000

What are the following overhead variances?

A.

B.

C.

D.

Variable

OH

P3,000 U

P3,000 U

P7,000 U

P7,000 U

Spending

Variable

OH P2,000 U

P4,000 U

P2,000 U

P4,000 U

Efficiency

Fixed

OH

P4,000 U

P1,000 U

P1,000 U

P4,000 U

Spending

May 9, 2004

Page 10 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

Questions 46 thru 48 are based on the following information.

Edney Company employs standard absorption system for product

costing. The standard cost of its product is as follows:

Raw materials

P14.50

Direct labor (2 DLH x P8)

16.00

Manufacturing overhead (2 DLH x P11)

22.00

The manufacturing overhead rate is based upon a normal activity level

of 600,000 direct labor hours. Edney planned to produce 25,000 units

each month during the year. The budgeted annual manufacturing

overhead is

Variable

P3,600,000

Fixed

3,000,000

During November, Edney produced 26,000 units. Edney used 53,500

direct labor hours in November at a cost of P433,350.

Actual

manufacturing overhead for the month was P260,000 fixed and

315,000 variable. The total manufacturing overhead applied during

November was P572,000.

Actual variable overhead

Actual fixed overhead

Actual machine time

Pre-week Quizzer

P405,000

P122,000

40,500 machine hours

Standard cost and budget information for Roadtrek Company follows:

Standard variable overhead rate

P9.00 per MH

Standard quantity of machine hours

4 hours per case

Budgeted fixed overhead

P1,440,000 per year

Budgeted output

10,000 cases per month

46.The variable manufacturing overhead variances for November are

A.

B.

C.

D.

Spending

P9,000 U

P6,000 F

P4,000 U

P 9,000 F

Efficiency

P3,000 U

P9,000 U

P1,000 F

P12,000 U

47.The fixed manufacturing overhead variances for November are

A.

B.

C.

D.

Spending

P10,000 F

P10,000 U

P6,000 F

P 4,000 U

Volume

P10,000 f

P10,000 F

P3,000 U

P22,000 F

48.The total variance related to efficiency of the manufacturing

operation for November is:

A. P9,000 U

C. P21,000 U

B. P12,000 U

D. P12,000 U

Questions 49 thru 53 are based on the following information.

The following data are actual results for Roadtrek company for

October:

Actual output

9,000 cases

May 9, 2004

Page 11 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

49.The variable overhead spending variance for the month of October

is

A. P40,500 U

C. P45,000 U

B. P81,000 U

D. P81,000 F

50.The overhead efficiency variance is

A. P4,500 U

C. P4,500 F

B. P40,500 U

D. P40,500 F

51.The amount of fixed overhead controllable variance is

A. P2,000 U

C. P42,500 U

B. P2,000 F

D. P42,500 F

52.The amount of fixed overhead volume variance is

A. P12,000 F

C. P21,000 F

B. P12,000 U

D. P21,000 U

53.The amount variable overhead volume variance is

A. Zero

C. P12,000 F

B. P9,000 U

D. P2,250 U

Absorption Costing & Variable Costing

54.Which of the following statements is true for a firm that uses

variable (direct) costing?

A. The cost of a unit of product changes because of changes in the

number of units manufactured.

B. Profits fluctuate with sales

C. An idle facility variation is calculated

D. Product costs include direct (variable) administrative costs.

55.At its present level of operations, a small manufacturing firm has

total variable costs equal to 75% of sales and total fixed costs equal

to 15% of sales. Based on variable costing, if sales change by

P1.00, income will change by

A. P0.25

C. P0.75

B. P0.12

D. P0.10

May 9, 2004

Pre-week Quizzer

Relevant Costing

56.An important concept in decision making is described as the

contribution to income that is forgone by not using a limited

resources in its best alternative use. This concept is called

A. Marginal cost

C. Potential cost

B. Opportunity costs

D. Relevant cost

57.If revenues are P210,000 under alternative A and P216,000 under

alternative B, and costs are P190,000 for A and P204,000 for B,

then using the basic approach in incremental analysis, incremental

revenues, costs, and net income, in comparing B to A are

respectively

A. P6,000, P(14,000), P(8,000)

C. P6,000, P14,000, P8,00

B. P(6,000), P14,000, P8,000

D. P(6,000), P(14,000), P(8,000)

58.For the year ended April 30, 2003, Leba Company incurred direct

costs of P800,000 based on a particular course of action. Had a

different course of action been taken, direct costs would have been

P650,000. In addition, Lebas fixed costs during the fiscal year were

P110,000.

The incremental (decremental) costs was:

A. P40,000

C. P(40,000)

B. P150,000

D. P(150,000)

59. Wallace Company produces 15,000 pounds of Product A and 30,000 pound of

Product B each week by incurring a common variable costs of P400,000.

These two products can be sold as is or processed further. Further processing

of either product does not delay the production of subsequent batches of the

joint product. Data gathering there two products are as follows:

Product Product

A

B

Selling price per pound without further

P

P 9.00

Processing

12.00

Selling price per pound with further

P

P 11.00

Processing

15.00

Total separate weekly variable costs of P50,00 P45,000

Further processing

0

Page 12 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

To maximize Wallace Companys manufacturing contribution

margin, the total separate variable costs of further processing that

should be incurred each week are

A. P45,000

C. P95,000

B. P50,000

D. P0

60.Blue & Company sells a product for P20 with variable cost of P8 per

unit. Blue could accept a special order for 1,000 units at P14. If

Blue accepted the order, how many units could it lose at the regular

price before the decision become unwise?

A. 1,000 units

C. P500 units

B. P200 units

D. 0 units

61.Geary Manufacturing has assembled the following data pertaining

to two popular products.

Blender

Electric

mixer

Direct materials

P 6

P 11

Direct labor

4

9

Factory overhead @ P16 per

16

32

hour

Cost if purchased from an

20

38

outside supplier

Annual demand (units)

20,000

28,000

Past experience has shown that the fixed manufacturing overhead

component included in the cost per machine hour averages P10.

Geary has a policy of filling all sales orders, even if it means

purchasing units from outside suppliers.

If 50,000 machine hours are available, and Geary Manufacturing

desires to follow an optimal strategy, it should

A. produce 25,000 electric mixers, and purchase all other units as

needed

B. produce 20,000 blenders and 15,000 electric mixers, and

purchase all other units as needed

C. produce 20,000 blenders and purchase all other units as needed

D. purchase all units as needed

May 9, 2004

Pre-week Quizzer

62.The Hingis Corporation manufactures two products: X and Y.

Contribution margin per unit is determined as follows:

Product X

Product Y

Revenue

P 130

P80

Variable costs

70

38

Contribution

P 60

P42

margin

Total demand for X is 16,000 units and for Y is 8,000 units. Machine

hours is a scarce resource. 42,000 machine hours are available

during the year. Product X requires 6 machine hours per unit while

product Y requires 3 machine hours per unit.

How many units of X and Y should Hingis Corporation produce?

A.

B.

C.

D.

Product X

16,000

8,000

7,000

3,000

Product Y

-04,000

-08,000

63.Wagner sells product A at a price of P21 per unit. Wagners cost

per unit based on the full capacity of 200,000 units is as follows:

Direct materials

P 4

Direct labor

5

Overhead (2/3 of which is fixed)

6

P15

A special order offering to buy 20,000 units was received from a

foreign distributor. The only selling costs that would be incurred on

this order would be P3 per unit for shipping. Wagner has sufficient

existing capacity to manufacture the additional units

To achieve an increase in operating income of P40,000. Wagner

should charge a selling price of

A. P14

C. P16

B. P15

D. P18

64.Yardley Co. has considerable excess manufacturing capacity. A

special job orders cost sheet includes the following applied

manufacturing overhead costs:

Variable costs

P56,250

Fixed costs

45,000

Page 13 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

The fixed costs include a normal P6,800 allocation for in-house

design costs, although no in-house design will be done. Instead,

the special job will require the use of external designers costing

P13,750. What is the minimum acceptable price of the job?

A. P63,050

C. P101,250

B. P70,000

D. P108,200

65.MC Industries manufactures a product with the following costs per

unit at the expected production of 30,000 units:

Direct materials

P 4

Direct labor

12

Variable manufacturing overhead

6

Fixed manufacturing overhead

8

The company has the capacity to produce 40,000 units. The

product regularly sells for P40. A wholesaler has offered to pay P32

a unit for 2,000 units.

If the firm is at capacity and the special order is accepted, the

effect on operating income would be

A. a P20,000 increase

C. a P4,000 increase

B. a P16,000 decrease

D. P0

66.Gata Co. plans to discontinue a department with a P48,000

contribution to overhead, and allocated overhead of P96,000, of

which P42,000 cannot be eliminated. What would be the effect of

this discontinuance on Gatas pretax profit?

A. increase of P48,000

C. increase of P6,000

B. decrease of P48,000

D. increase of P6,000

67.Pili Company plans to discontinue a segment with a P32,000

segment margin. Common expenses allocated to the segment

amounted to P45,000, of which P20,000 cannot be eliminated if the

segment were closed. The effect of closing down the segment on

Pili Companys before tax profit would be

A. P12,000 decrease

C. P12,000 increase

B. P 7,000 decrease

D. P 7,000 increase

May 9, 2004

Pre-week Quizzer

68.Division B earns a contribution margin of P200,000 and has a

divisional margin of P70,000. If Division B is closed, all of the direct

divisional expenses and P110,000 of common expenses can be

eliminated. These facts indicate that closing the division will cause

the firms operating income to

A. increase by P90,000

C. increase by P40,000

B. decrease by P90,000

D. decrease by P40,000

69.Consider the following portion of a segmented income statement for

the year just ended. Assume that the fixed expenses of Division X

include P30,000 of direct expenses and that the discontinuance of

the department will not affect the sales of the other departments

nor reduce the common expenses:

Net sales

P100,000

Variable manufacturing costs

60,000

Gross profit

P 40,000

Fixed expenses (direct and allocated)

50,000

Loss from operations

P (10,000)

What would be the effect on the firms operating income if Division

X were discontinued?

A. increase of P10,000

C. decrease of P100,000

B. decrease of P40,000

D. decrease of P10,000

70.Condensed monthly operating income data for Cosmo Inc. for

November 2000 is presented below.

Additional information

regarding Cosmos operation follows the statement.

Total

Hall

Town

Store

Store

Sales

P200,000

P80,000 P120,000

Less Variable costs

116,00

32,000

84,00

0

0

Contribution margin

P 84,000

P48,000

P

36,000

Less direct fixed expense

60,00

20,000

40,00

0

0

Store segment margin

P 24,000

P28,000

P

( 4,000)

Page 14 of 36

MANAGEMENT ADVISORY SERVICES

Less

common

expenses

Operating income

fixed

10,00

0

P 14,000

CPA Review School of the Philippines

4,000

6,00

0

P24,000

P

(10,000)

One-fourth of each stores direct fixed expenses would continue

through December 31, 2001, if either store were closed.

Management estimates that closing the Town Store would result in

a ten percent decrease in Hall Store. Hall Store would not affect

Town Store sales. The operating results for November 2000 are

representative of all months.

A decision of Cosmo, Inc. to close the Town Store would result in a

monthly increase (decrease) in Cosmos operating income during

2001 of

A. P4,000

C. (P800)

B. (P10,800)

D. (P6,000)

Pre-week Quizzer

Manufacturing overhead (150% of direct labor)

12,000

Material handling represents the direct variable costs of the Receiving

department that are applied to direct materials and purchased

components on the basis of their cost. This is a separate charge in

addition to manufacturing overhead. Lelands annual manufacturing

overhead budget is one-third variable and two-thirds fixed. Scott

Supply, one of Lelands reliable vendors, has offered to supply Part No.

KJ137 at a unit price of P15,000.

72.If Leland purchases the KJ37 units from Scott, the capacity Leland

used to manufacture these parts would be idle. Should Leland

decide to purchase the parts from Scott, the unit cost of KJ37 would

A. increase by P4,800

C. decrease by P3,200

B. decrease by P6,200

D. increase by P1,800

71.Peluso Company, a manufacturer of snowmobiles, is operating at 70

percent of plant capacity. Pelusos plant manager is considering

making the headlights now being purchased for P1,100 each, a

price that is not expected to change in the near future. The Peluso

plant has the equipment and labor force required to manufacture

the headlights. The design engineer estimates that each headlight

requires P400 of direct materials and P300 of direct labor. Pelusos

plant overhead rate is 200 percent of direct labor costs, and 40

percent of the overhead is fixed cost.

A decision by Peluso

Company to manufacture the headlights will result in a gain (loss)

for each headlight of

A. P(200)

C. P40

B. P160

D. P280

Questions 72 thru 74 are based on the following information:

Leland Manufacturing uses 10 units of Part Number KJ37 each month in

the production of radar equipment. The unit cost to manufacture one

unit of KJ37 is presented below.

Direct materials

P1,000

Materials handling (20% of direct material cost)

200

Direct labor

8,000

May 9, 2004

Page 15 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

73.Assume Leland Manufacturing is able to rent all idle capacity for

P25,000 per month. If Leland decided to purchase the 10 units

from Scott Supply, Lelands monthly cost for KJ37 would

A. increase P48,000

C. decrease P7,000

B. increase P23,000

D. decrease P57,000

74.Assume that Leland does not wish to commit to a rental agreement

but could use idle capacity to manufacture another product that

would contribute P52,000 per month.

If Leland elects to

manufacture KJ37 in order to maintain quality control, Lelands

opportunity cost is

A. P18,000

C. P4,000

B. (P20,000)

D. (P48,000)

Responsibility Accounting & Transfer Pricing

75.A management decision may be beneficial for a given profit center,

but not for the entire company.

From the overall company

viewpoint, this decision would lead to

A. goal congruence

C. suboptimization

B. centralization

D. maximization

76.Company L had its operating asset turnover increased by 50% and

the operating income margin increased by 50%. Company U had its

operating asset turnover increased by 30% and the operating

income margin decreased by 30%. What changes are expected for

ROI of Company L and Company U, respectively?

A.

B.

C.

D.

Company L

50%

125%

225%

125%

increase

increase

increase

increase

Company U

9%

9%

no change

no change

decrease

decrease

77.The manager of the Queen Division of Pusoy Company expects the

following results in 2004 (pesos in millions):

Sales

P49.60

Variable costs (60%)

29.76

Contribution margin

P19.84

May 9, 2004

Fixed costs

Profit

Investment:

Plant equipment

Working capital

Pre-week Quizzer

12.00

P 7.84

P19.51

14.88

P34.39

ROI P7.84/P34.39

22.80%

The division has a target ROI of 30 percent, and the manager has

asked you to determine how much sales volume the division would

need to reach that. He states that the sales mix is relatively

constant so variable costs should be close to 60 percent of sales,

fixed cost and plant and equipment should remain constant, and

working capital (cash, receivables, and inventories) should vary

closely with sales in the percentage reflected above. The peso

sales that the division needs in order to reach the 30 percent ROI

target is

A. P19,829,032

C. P57,590,322

B. P44,373,871

D. P59,510,000

78.Ace Division of Card, Inc. expects the following result for 2004:

Unit sales

70,000

Unit selling price

P

10

Unit variable cost

P

4

Total fixed costs

P 300,000

Total investment

P 500,000

The minimum required ROI is 15 percent, and divisions are

evaluated on residual income. A foreign customer has approached

Houstons manager with an offer to buy 10,000 units at P7 each.

Houston Division has capacity of 75,000 units and the foreign

customer will not accept fewer than 10,000 units. Accepting the

order would increase fixed costs by P10,000 and investment by

P40,000.

At the price of P7 offered by foreign customer, what is the

maximum number of units in regular sales that Houston could

sacrifice and still maintain its expected residual income?

A. 2,333

C. 2,667

B. 3,333

D. 3,667

Page 16 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

79. Family Company has two division, Ma and Pa. Information for each division

is as follows:

Ma

P20,000

P50,000

15%

10%

12%

Pa

P65,000

P300,000

18%

20%

12%

Net earnings for division

Asset base for division

Target rate of return

Operating income margin

Weighted average cost of

capital

What is the Economic Value Added for Ma and Pa, respectively?

A. P20,000, P36,000

C. P12,500, P11,000

B. P14,000, P29,000

D. P20,000, P29,000

Pre-week Quizzer

80.An appropriate transfer price between two divisions of the Star

Corporation can be determined from the following data:

Fabrication Division

Market price of subassembly

P50

Variable cost of subassembly

P20

Excess capacity (in units)

1,000

Assembling Division

Number of units needed

900

What is the natural bargaining range for the two divisions?

A. Between P20 and P50

C. Any amount less than

P50

B. Between P50 and P70

D. P50

is

the

only

acceptable price

81.Pacific Company has three plants: one located in Malaysia, one in

India and another plant located in the Philippines. Both plants

manufactures a component used in a finished product

manufactured in the Philippine plant. Currently, both plants are

operating at 70 percent capacity. In Malaysia the income tax rate is

42% while in India the tax rate 35%; in the Philippines, the

corporate income tax rate is 40%.

The market price of the component, in peso equivalent, is P100 and

the foreign plants costs to manufacture the component are as

follows:

Direct materials

P10

Direct labor

20

Variable overhead

5

Fixed overhead

25

Which transfer price would be in the best interest of the overall

corporation?

A.

B.

C.

D.

Malaysia

P35

P 35

P100

P100

India

P35

P100

P100

P 35

82.The Engine Division provides motors for the Auto Division of a

company. The standard unit costs for Engine Division are as

follows:

May 9, 2004

Page 17 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

Direct materials

10,000

Direct labor

20,000

Variable Overhead

5,000

Fixed Overhead

2,500

Market price

P45,500

What is the best transfer price to avoid transfer price problems?

A. P45,500

C. P35,000

B. P30,000

D. P37,500

Pre-week Quizzer

83.To avoid waste and maximize efficiency when transferring products

among divisions in a competitive economy, a large diversified

corporation should base transfer prices on:

A. Full cost

C. variable costs

B. replacement cost

D. market price

Product Pricing Decision

84.Garden Corp. had the following information:

Revenues

Cost of goods sold:

Direct materials

P100,000

Direct labor

75,000

Overhead

125,000

Gross profit

Selling and admin expenses

Operating income

What are the mark up based on:

A.

B.

C.

Cost of goods

66.7%

166.7%

66.7%

sold

Prime costs

185.7%

42.9%

42.9%

Direct

400.0%

500.0%

400.0%

materials

P500,000

300,000

P200,000

75,000

P125,000

D.

166.7%

185.7%

500.0%

Master Budget

85.The method of budgeting which adds one months budget to the

end of the plan when the current months budget is dropped from

the plan refers to

A. Long-term budget

C. Incremental budget

B. Operations budget

D. Continuous budget

86.Jakarta Corporation plans to sell 200,000 units of Batik products in

October and anticipates a growth in sales of 5 percent per month.

The target ending inventory in units of the product is 80% of the

next months estimated sales. There are 150,000 units in inventory

as of the end of September. The production requirement in units of

Batik for the quarter ending December 31 would be

May 9, 2004

Page 18 of 36

MANAGEMENT ADVISORY SERVICES

A. 670,560

B. 691,525

CPA Review School of the Philippines

C. 665,720

D. 675,925

Pre-week Quizzer

Questions 87 & 88 concern Paradise Company, which budgets on

annual basis for its fiscal year. The following beginning and ending

inventory levels (in units) are planned for the fiscal year of July 1, 2000

through June 30, 2001.

July 1, 2000

June 30, 2001

Raw material*

40,000

50,000

Work-in-process

10,000

10,000

Finished goods

80,000

50,000

*Two (2) units of raw material are needed to produce each unit of

finished product.

87.If Paradise Company plans to sell 480,000 units during the 2002001 fiscal year, the number of units it would have to manufacture

during the year would be

A. 440,000

C. 510,000

B. 480,000

D. 450,000

88.If 500,000 finished units were to be manufactured during the 20002001 fiscal year by Paradise Company, the units of raw material

needed to be purchased would be

A. 1,000,000 units

C. 1,020,000 units

B. 1,010,000 units

D. 990,000 units

89.The Pentagon Co. expects sales of P4,400,000 in June, P5,300,000

in July, and P6,100,000 in August. On average, 30% of its sales are

cash, 50% of credit sales are collected in one month, and 45% are

collected in the second month. The remainder are written off to

bad debt in the third month after sale. What are the expected cash

inflow for August and expected receivable balance on August 31?

A.

B.

C.

D.

Cash Inflow

P5,050,00 P4,084,00 P1,830,00 P5,071,00

0

0

0

0

Aug

31

AR P7,140,00 P6,093,50 P7,232,00 P6,279,00

Balance

0

0

0

0

90.Dolyar, Inc. prepared the following sales budget:

Month

Cash Sales

May 9, 2004

Credit Sales

Page 19 of 36

MANAGEMENT ADVISORY SERVICES

February

March

April

May

June

P 80,000

100,000

90,000

120,000

110,000

CPA Review School of the Philippines

P340,000

400,000

370,000

460,000

380,000

Pre-week Quizzer

Collection pattern is: 40% percent in the month of sale, 45% in the

month following the sale, and 10% two months following the sale.

The remaining 5% is expected to be uncollectible. The companys

total budgeted collection from April to June amounts to

A. P1,090,000

C. P1,468,500

B. P1,325,500

D. P1,397,500

91.Beta Co. has the following sales forecasts for the selected threemonth period in 2004

April

P120,000

May

70,000

June

80,000

Seventy percent of sales are collected in the month of the sale, and

the remainder are collected in the following month.

Accounts receivable balance (April 1, 2004)

P100,000

Cash balance (April 1, 2004)

50,000

Minimum cash balance is P50,000. Cash can be borrowed in

P10,000 increments from the local bank (assume no interest

charges).

What is the cash balance at the end of April, assuming that cash is

received only from customers and that P200,000 out during April?

A. P34,000

C. P54,000

B. P50,000

D. P55,000

Capital Budgeting

92.Which of the following would decrease the net present value of a

project?

A. A decrease in the income tax rate

B. A decrease in the initial investment

C. An increase in the useful life of the project

D. An increase in the discount rate

93.A weakness of the internal rate of return method for screening

investment projects is that it:

A. does not consider the time value of money

B. implicitly assumes that the company is able to reinvest cash

flows from the project at the companys discount rate

May 9, 2004

Page 20 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

C. implicitly assumes that the company is able to reinvest cash

flows from the project at the internal rate of return

D. fails to consider the timing of cash flows

Pre-week Quizzer

94.Sensitivity analysis, if used with capital projects,

A. Is used extensively when cash flows are known with certainty

B. Measures the change in the discounted cash flows when using

the discounted payback method rather than the net present

value method.

C. Is a what-if technique that asks how a given outcome will

change if the original estimates of the capital budgeting model

are changed.

D. Is a technique used to rank capital expenditure requests.

95.If Sol Company expects to get a one-year loan to help cover the

initial financing of capital project, the analysis of the project should

A. offset the loan against any investment in inventory or receivable

required by the project

B. show the loan as an increase in the investment

C. show the loan as a cash outflow in the second year of the

projects life

D. ignore the loan

96.Royal Industries is replacing a grinder purchased 5 years ago for

P15,000 with a new one costing P25,000 cash. The original grinder

is being depreciated on a straight-line basis over 15 years to a zero

salvage value. Royal will sell this old equipment for P6,000 cash.

The new equipment will be depreciated on a straight-line basis over

10 years to a zero salvage value. Assuming a 40% marginal tax

rate, Royals net cash investment at the time of purchase is the old

grinder is sold and the new one purchased is

A. P19,000

C. P17,400

B. P15,000

D. P25,000

97.Flow Industries is analyzing a capital investment proposal for new

machinery to produce a new product over the next 10 years. At the

end of the 10 years, the machinery must be disposed of with a net

zero book value but with a scrap salvage value of P20,000. It will

require some P30,0000 to remove the machinery. The applicable

tax rate is 35%. The appropriate end of life cash flow based on

the foregoing information is

May 9, 2004

Page 21 of 36

MANAGEMENT ADVISORY SERVICES

A. inflow of P30,000

B. outflow of P6,500

CPA Review School of the Philippines

C. outflow of P10,000

D. outflow of P17,000

98.Sarah Company is planning to purchase a new machine for

P600,000. Depreciation for tax purposes will be P100,000 annually

for six years. The new machine is expected to produce cash flow

from operations, net of income taxes, of P150,000 a year in each of

the next six years. The accounting (book value) rate of return on

the initial investment is expected to be

A. 8.3%

C. 16.7%

B. 12.0%

D. 25.0%

Pre-week Quizzer

99.Barf is considering a 10-year capital investment project with

forecasted revenues of P40,000 per year and forecasted cash

operating expenses of P29,000 per year. The initial cost of the

equipment of the project is P23,000 and Barfield expects to sell the

equipment for P9,000 at the end of the tenth year. The equipment

will be depreciated over 7 years. The project requires a working

capital investment of P7,000 at its inception and another P5,000 at

the end of year 5. Using a 40% marginal tax rate, the expected net

cash flow from the project in the tenth year is

A. P32,000

C. P20,000

B. P24,000

D. P11,000

100. Brand is considering, an investment in a new cheese-cutting

machine to replace its existing cheese cutter. Information on the

existing machine and the replacement machine follow:

Cost of the new machine

P40,000

Net annual savings in operating costs

9,000

Salvage value now of the old machine

6,000

Salvage value of the old machine in 8 years

0

Salvage value of the new machine in 8 years

5,000

Estimated life of the new machine

8 years

What is the expected payback period for the new machine?

A. 4.44 years

C. 8.50 years

B. 2.67 years

D. 3.78 years

101. Cause Company is planning to invest in a machine with a useful

life of five years and no salvage value. The machine is expected to

produce cash flow from operations, net of income taxes, of P20,000

in each of the five years. Causes expected rate of return is 10%.

Information on present value and future amount factors is as

follows:

1

2

3

4

5

Present value of P1

.909

.826

.751

.683

.621

at 10%

Present value of an

annuity of P1 at

.909 1.736 2.487 3.170

3.791

10%

May 9, 2004

Page 22 of 36

MANAGEMENT ADVISORY SERVICES

Future amount of P1

1.100

at 10%

Future amount of an

annuity of P1 at

1.000

10%

How much will the machine cost?

A. P32,220

C.

B. P62,100

D.

CPA Review School of the Philippines

1.210

1.33

1.464

1.611

2.100

3.310

4.641

6.105

P75,820

P122,100

102. Janet Company has a payback goal of 3 years on new equipment

acquisitions. A new sorter is being evaluated that costs P450,000

and has a 5-year life. Straight-line depreciation will be used; no

salvage value is anticipated. Janet is subject to a 40% income tax

rate. To meet the companys payback goal, the sorter must

generate reductions in annual cash operating costs of

A. P60,000

C. P150,000

B. P100,000

D. P190,000

Pre-week Quizzer

discount rate, the net present value of the cash flows associated

with just the tangible costs and benefits is a negative P184,350.

How large would the annual net cash inflows from the intangible

benefits have to be to make this a financially acceptable

investment?

A. P18,435

C. P35,000

B. P30,000

D. P37,236

Questions 105 thru 107 are based on the following information.

A firm must choose between leasing a new asset of purchasing it with

funds from a term loan. Under the purchase option, the firm will pay

five equal principal payments of P1,000 each and 6% interest on the

unpaid balance. Principal and interest are due at the end of each year

for five years. Alternatively, the firm can lease the asset for five years

at an annual rental cost of P1,400 with payments due at the beginning

of each year. The corporate tax rate is 35% and the appropriate after

tax cost of capital is 12%.

103. Moorman Products Company is considering a new product that

will sell for P100 and have a variable cost of P60. Expected volume

is 20,000 units. New equipment costing P1,500 and having a fiveyear useful life and no salvage value is needed, and will be

depreciated using the straight-line method. The machine has cash

operating costs of P20,000 per year. The firm is in the 40 percent

tax bracket and has cost of capital of 12 percent. The present

value of 1, end of five periods is 0.56743; present value of annuity

of 1 for 5 periods is 3.60478.

How many units per year the firm must sell for the investment to

earn 12 percent internal rate of return?

A. 12,838

C. 8,225

B. 10,403

D. 7,625

104. Highpoint, Inc., is considering investing in automated equipment

with a ten-year useful life. Managers at Highpoint have estimated

the cash flows associated with the tangible costs and benefits of

automation, but have been unable to estimate the cash flows

associated with the intangible benefits. Using the companys 10%

May 9, 2004

Page 23 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

105. Which of the following is closest to the PV of the after-tax

interest payment?

A. P360

C. P640

B. P453

D. P726

B. 3.0 years

Pre-week Quizzer

D. 5.0 years

110.Logos expected IRR on its investment in this machine is

A. 3.3%

C. 12.0%

B. 10.0%

D. 15.3%

106. Which of the following is closes to the present value of cost if

leasing the asset?

A. P3,694

C. P3,849

B. P3,779

D. P3,992

107. Which of the following is closest to the PV of cost of purchasing

the new asset with a term loan?

A. P3,777

C. P4,058

B. P3,952

D. P4,153

Questions 108 through 110 are based on the following information:

Logo Co. is planning to buy a coin-operated machine costing P40,000.

For book and tax purposes, this machine will be depreciated P8,000

each year for five years. Logo estimates that this machine will yield an

annual cash inflow, net of depreciation and income taxes, of P12,000.

Logos desired rate of return on its investments is 12%. At the

following discount rates, the NPVs of the investment in this machine

are:

Discount rate

NPV

12%

+P3,258

14%

+ 1,197

16%

708

18%

- 2,474

108. Logos accounting rate of return on its initial investment in this

machine is expected to be

A. 30%

C. 12%

B. 15%

D. 10%

109.Logos expected payback period for its investment in this machine

is

A. 2.0 years

C. 3.3 years

May 9, 2004

Page 24 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

111.Lawton Co. is expanding its manufacturing plant, which requires

an investment of P4,000,000 in new equipment and plant

modifications.

Lawtons sales are expected to increase by

P3,000,000 per year as a result of the expansion. Cash investment

in current assets averages 30% of sales; accounts payable and

other current liabilities are 10% sales. What is the estimated total

investment for this expansion?

A. P3,400,000

C. P4,600,000

B. P4,300,000

D. P4,000,000

112.Par Co. is reviewing the following data relating to an energy saving

investment proposal:

Investment

P50,000

Residual value at the end of 5 years

10,000

Present value of an annuity of 1 at 12% for 5 years

3.60

Present value of 1 due in 5 years at 12%

0.57

What would be the annual savings needed to make the investment

realize a 12% yield?

A. P8,189

C. P12,306

B. P11,111

D. P13,889

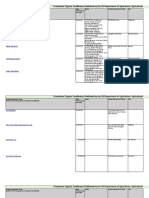

98)

Profitability index

98%

101%

Internal rate of

11%

13%

return

Which project(s) should Investors, Inc. select

year under each budgeted amount of funds?

No

Budget P600,000 Available

Restriction

Funds

A. Projects 2, 3 & 4

Projects 3 & 4

B. Projects 1, 2 & 3

Projects 2, 3 & 4

C. Projects 1, 3 & 4

Projects 2 & 3

D. Projects 3 & 4

Projects 2 & 4

Pre-week Quizzer

106%

14%

105%

15%

during the upcoming

P300,000Available

Funds

Project 3

Projects 3 & 4

Project 2

Projects 2 & 4

113.Investors Inc. uses a 12% hurdle rate for all capital expenditures

and has done the following analysis for four projects for the

upcoming year.

Project Project 2 Project 3 Project

1

4

Initial cash outlay

P200,0

P298,00 P248,000 P272,0

00

0

00

Annual net cash

inflows

Year 1

P

P100,00 P 80,000

P

65,000

0

95,000

Year 2

70,000

135,000

95,000 125,00

0

Year 3

80,000

90,000

90,000 90,000

Year 4

40,000

65,000

80,000 60,000

Net present value (

3,7

4,276

14,064 14,662

May 9, 2004

Page 25 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

Questions 114 thru 117 are based on the following information.

In order to increase production capacity, Gunning Industries is

considering replacing an existing production machine with a new

technologically improved machine effective January 1, 2002. The

following information is being considered by Gunning Industries:

The new machine would be purchased for P160,000 in cash.

Shipping installation, and testing would cost an additional P30,000.

The new machine is expected to increase annual sales by

20,000 units at a sales price of P40 per unit. Incremental operating

costs include P30 per unit in variable costs and total fixed costs of

P40,000 per year.

The investment in the new machine will require an immediate

increase in working capital of P35,000. This cash outflow will be

recovered at the end or year 5.

Gunning uses straight-line depreciation for financial reporting

and tax reporting purposes.

The new machine has an estimated useful life of 5 years and

zero salvage value

Gunning is subject to a 40% corporate income tax rate.

Gunning uses the net present value method to analyze investments

and will employ the following factors and rates:

Period

PV of 1 at 10%

PV of an ordinary annuity of 1 at

10%

1

.909

.909

2

.826

1.736

3

.751

2.487

4

.683

3.170

5

.621

3.791

B. P16,762

Pre-week Quizzer

D. P22,800

116.The acquisition of the new production machine by Gunning will

contribute a discounted net-of-tax contribution margin of

A. P242,624

C. P363,936

B. P303,280

D. P454,920

114.Gunning Industries net cash outflow in a capital budgeting

decision is

A. P190,000

C. P204,525

B. P195,000

D. P225,000

115.Gunning Industries discounted annual depreciation tax shield for

the year 2002 is

A. P13,817

C. P20,725

May 9, 2004

Page 26 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

117.The overall discounted cash flow impact of Gunnings working

capital investment for the new production machine would be

A. P(7,959)

C. P(13,265)

B. P(10,080)

D. P(35,000)

Inventory turnover (based on

Gross profit margin

Sheridans net sales for the year

A. P800,000

B. P480,000

Pre-week Quizzer

cost of sales)

8 times

40%

were

C. P1,200,000

D. P672,000

Financial Statement Analysis

118. Sales (in millions) for a three year period are: Year 1 P4, Year 2

P4.6, and Year 3 P5.0.

Using Year 1 as the base year the

percentage increase in sales in Years 2 and 3 are, respectively

A. 115% and 125%

C. 115% and 130%

B. 115% and 109%

D. 87% and 80%

119. A company has total sales of P300,000 with a gross profit ratio

of 35%. Inventory at the beginning of the period was P50,000 and

at the end of the period was P70,000. Net income is P40,000.

Inventory turnover is

A. 5 times

C. 1.75 times

B. 3.25 times

D. 0.67 times

120. The times interest earned ratio of McHoggan Company is

4.5times. The interest expense for the year was P20,000 and the

companys tax rate is 40%. The companys net income is:

A. P22,000

C. P42,000

B. P54,000

D. P66,000

121. If the North Division of Alliance Products Company had an

operating asset turnover of 4.2 and an operating income margin of

0.10, the return on investment would be

A. 23.8%

C. 42.0%

B. 420.0%

D. 4.2%

122. Selected data from Sheridan Corporations year-end financial

statements are presented below. The difference between average

and ending inventory is immaterial.

Current ratio

2.0

Quick ratio

1.5

Current liabilities

P120,000

May 9, 2004

Page 27 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

123. Jade Corporation has a practical production capacity of a million

units.

The current years master budget was based on the

production and sales of 700,000 units during the current year.

Actual production for the current year was 720,000 units, while

actual sales amounted to only 600,000 units. The units are sold for

P20 each and the contribution margin ratio is 30%. The peso

amount that best qualifies the Marketing Departments failure to

achieve budgeted performance for the current year is:

A. P720,000 unfavorable

C. P2,400,000 unfavorable

B. P600,000 unfavorable

D. P2,000,000 unfavorable

124. The gross profit of Rea Company for each of the years ended as

indicated follow:

2001

2000

Sales

P792,000

P800,000

Cost of goods sold

463,000

480,000

Gross profit

P328,000

P320,000

Assuming that 2001 selling price was 10% lower, what would be the

decrease in gross profit due to change in the selling price?

A. P8,000

C. P79,200

B. P72,000

D. P88,000

125. Garfield Company, which sells a single product, provided the

following data from its income statements for the years 2001 and

2000:

2001

2000

Sales (150,000 units in 2001; 180,000 P750,000 P720,0

units in 2000)

00

Cost of goods sold

525,00

575,0

0

00

Gross profit

P225,000 P145,0

00

In an analysis of variation in gross profit between the two years,

what would be the effects of changes in sales price and sales

volume, respectively?

A. P150,000 F; P120,000 U

C. P180,000 F; P150,000 U

B. P150,000 U; P120,000 F

D. P180,000 U; P150,000 F

May 9, 2004

Pre-week Quizzer

Working Capital Management

126.Gear Inc., has a total annual cash requirement of P9,075,000

which are to be paid uniformly. Gear has the opportunity to invest

the money of 24% per annum. The company spends, on the

average, P40 for every cash conversion to marketable securities.

What is the optimal cash conversion size?

A. P60,000

C. P55,000

B. P45,000

D. P72,500

127. Lyman Company has the opportunity to increase annual sales

P100,000 by selling to a new riskier group of customers. The

uncollectible expense is expected to be 15% and collection costs

will be 5%. The companys manufacturing and selling expenses are

70% of sales, and its effective tax rate is 40%. If Lyman should

accept this opportunity, the companys after tax profits would

increase by

A. P6,000

C. P10,200

B. P10,000

D. P14,400

128.The following information regarding a change in credit policy was

assembled by the Willis Company. The company has a required

rate of return of 10% and a variable cost ratio of 60%.

Old Credit Policy New Credit Policy

Sales

P3,600,000

P3,960,000

Average

Collection

30 days

36 days

period

The pretax cost of carrying the additional investment in receivable,

using 360-day year would be

A. P5,760

C. P8,160

B. P9,600

D. P960

129. The sales director of Lloyd Company suggested that certain

credit terms be modified. He estimates the following effects:

Sales will increase by at least 20%

Accounts receivable turnover will be reduced to 8 times

from the present turnover of 10 times

Page 28 of 36

MANAGEMENT ADVISORY SERVICES

CPA Review School of the Philippines

Bad debts, now at 1% of sales will increase to 1.5%

Sales before the proposed changes is at P900,000. Variable cost

ratio is 55% and the desired rate of return is 20%. Fixed expenses

amount to P150,000.

Should the company allow revision of its credit terms?

A. Yes, because income will increase by P64,800

B. Yes, because losses will be reduced by P73,800

C. No, because income will be reduced by P13,000

D. No, because losses will be increased by P28,000

130.A spindle manufacturer uses about 200 cases of raw wood per

month. It pays a broker P50.00 to locate a supplier and handle the

ordering and delivery arrangements. Storage and handling costs

are P0.02 per case per month. If each case costs P0.78 the most

economical order quantity (rounded to the next whole number) is

A. 884 cases

C. 1,133 cases

B. 625 cases

D. 1,000 cases

Pre-week Quizzer

131.Expected annual usage of a particular raw material is 2,000,000

units and the standard order size is 10,000 units. The invoice cost

of each unit is P500, and the cost to place one purchase order is

P80. The estimated annual order costs is

A. P16,000

C. P32,000

B. P100,000

D. P50,000

132.The Handy Company has the following information available

concerning one of its inventory items:

Cost of placing an order

P 32.00

Unit of carrying cost per year

P 4.00

Annual unit demand

5,625

Safety stock

100

Average daily demand

25

Normal lead time in days

10

The reorder point for the inventory item is

A. 250

C. 350

B. 600

D. 300

133.The G Corporation purchases 60,000 headbands per year. The

average purchase lead time is 20 working days. Maximum lead

time is 27 working days. The corporation works 240 days per year.

The appropriate safety stock level and the reorder point for the

company are:

A.

B.

C.

D.

Safety

1,750

1,750

1,167

1,167

Stock

Reorder

6,750

5,250

6,750

5,250

Point