Академический Документы

Профессиональный Документы

Культура Документы

Agile - Prersistent Systems

Загружено:

Anil KardamАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Agile - Prersistent Systems

Загружено:

Anil KardamАвторское право:

Доступные форматы

Software is Eating the World! Here's How to Profit from it.

'Uber and Ola are not taxi companies. They are technology companies.'

With these words, he began to answer my question. I was meeting the management of a software

company in Pune. I had asked about the kind of work the company does.

The company in question, and this month's Hidden Treasure recommendation, is in the business

of transforming other businesses with software.

This is not your typical IT company. It is a pioneer of Outsourced Product Development (OPD).

Delivering IT services and developing software products are as different as day and night. Large

Indian IT companies have mastered the former. Persistent Systems has mastered the latter.

Software Product Development is a tough business. Just look at Silicon Valley. The competition

is brutal. The technology changes constantly. Building domain knowledge is hard. Retaining

employees who have good domain knowledge is harder.

Now imagine an Indian IT firm working as an outsourcing partner in the product development

space. It would face a lot of the problems Silicon Valley firms face. In addition, it would face

many other uncertainties.

Large, long-term contracts would be rare. Cash flows would be lumpy. Employee attrition would

be a problem. Scaling up would be a challenge. It's very survival would be uncertain.

Persistent Systems has not only survived but thrived. It can provide full lifecycle product

development. Its employees think and work like those at a startup. In other words, the company

has the DNA to thrive in the digital world.

This is what he meant when he spoke about Uber and Ola. The management understands

technology inside out. More importantly, they understand their client's needs in this digital world.

It's no wonder Microsoft and HP have been loyal customers since 1991 and 1994 respectively.

This is an IT company that operates like an agile startup.

So it didn't surprise us when IBM picked Persistent as a preferred alliance partner for its big bet

for the future: The 'Watson' artificial intelligence platform. IBM has big plans for Watson. CEO

Virginia Rometty has said she wants Watson to generate US$10 billion in annual revenue within

ten years.

Under the collaboration, Persistent will invest in the Watson platform to build Internet of Things

(IoT) solutions for IBM's customers. IBM is the world leader in IoT. The company will also be

involved in the continuous software engineering projects related to Watson. The alliance opens

up major cross-selling and up-selling opportunities for Persistent. This alliance will significantly

enhance Persistent's stature and presence in the software world. It will also be a key growth

driver going forward.

So how good are the numbers?

Persistent's sales, operating profit, and net profit have all grown 21.4%, 24.1%, and 24% CAGR

respectively in the last seven years. Operating cash flow has grown 20.3% CAGR. During this

time, the return on equity and return on invested capital have averaged 18.5% and 24.3%

respectively. The dividend payout has increased from 5.4% to 21.5%. All this with almost no

debt.

So far so good. But are the valuations attractive enough? Read on to find out...

How Persistent Will Boost its Fortunes

The Agile Edge!

The digital revolution has brought with it a big challenge for Indian IT firms. The core

strength of these companies is their highly skilled employee base. Unfortunately, their

skills were developed well before this revolution came along. Digital projects are

typically of a shorter duration vis-a-vis traditional IT services work. The company's

annual report explains this quite well.

Traditional IT Services projects follow what is known as the Software Development Life

Cycle (SDLC). These projects start by clearly defining the final requirement. This is

usually fixed and known well in advance. The main objective of the project manager of

such a project is to get the optimal result using time and resources in the best possible

way.

Persistent Systems does not operate in this way.

Employees developing software products need to adhere to the Product Development

Life Cycle (PDLC). In a PDLC, the result of the project is not clearly known at the start.

What is known is the launch date. Budgets are planned only after the launch date is fixed.

However, the requirements are variable. The objective of the product manager in this case

is to build the best possible product within the given budget and time.

The best way to work under such conditions is to develop the product in iterations. It

works like this:

1. First, develop a prototype quickly.

2. Ask the client to review it.

3. The client will provide specific suggestions.

4. Implement those suggestions in their most basic form.

5. Repeat 2.

6. The client will now provide detailed suggestions.

7. Implement all of them with the most important suggestion as the highest priority.

8. Repeat 2.

9. After the client responds, repeat the process in the descending order of the client's

priorities.

Ensure highest quality standards at each step.

Over time, this process came to be known as 'Agile Development'.

Persistent Systems has implemented Agile Development across the company. This is no

mean feat. Large IT companies are yet to do this in a meaningful way. Due to their huge

employee base, it could take those companies years to do so.

The Agile DNA of the company is its primary differentiator in a highly fragmented global

software market. Over-time as more and more industries are disrupted by software; we

believe Persistent will grab an increasing share of the outsourced product development

(OPD) market.

The IBM Alliance

In February 2016, the company announced a significant collaboration with IBM. The tieup pertains to IBM's 'Watson' software platform. Watson is IBM's big bet for the future.

Watson deals with the futuristic Internet of Things (IoT) technologies. IoT is by far the

fastest growing sub-category of the new disruptive digital technologies. IBM is the world

leader in IoT.

IBM has signed-on Persistent Systems as a preferred alliance partner for the

Watson platform. Under this collaboration, Persistent will invest in the Watson platform

to build IoT solutions for IBM's customers. The company will also be involved in the

continuous software engineering projects related to Watson.

This alliance will significantly enhance Persistent's stature and presence in the software

world. Persistent will take over about 500 people over the next one year from various

IBM locations around the world.

The two companies will follow a joint go-to-market strategy. Persistent's recent

acquisition of Apeona will be aligned with the IBM alliance. The alliance also opens up

significant cross-selling and up-selling opportunities for Persistent.

The management had to re-organise the business in the wake of this development. From

1st April 2016, the business has been re-categorised into 4 divisions with a competent

individual in charge of each one.

1. The IBM alliance

2. The non-IBM digital business

3. The IT services business

4. Accelerite (Persistent's product business)

We believe this corporate structure is appropriate considering the nature of the company's

business.

In terms of the numbers, the alliance will immediately add 15%-16% to the company's

FY16 consolidated topline in FY17.

However, the alliance will cost Persistent in terms of margins, at least for FY17. This

is due to the addition of the additional onsite employees of IBM.

This is a major blow to the company's bottomline, in the short-term. However, we believe

the IBM alliance is a hugely positive long-term development for the company.

Competing successfully with the big boys with innovative marketing

The agile development model has helped the company diversify its client base as well.

Instead of competing with the big boys of Indian IT via the traditional Request for

Proposal (RFP) route to acquire large clients, Persistent has played it smart. The company

adopted multiple innovative marketing strategies.

Here are just a couple of examples.

Persistent has inexpensively acquired strong portfolio Intellectual Property (IP) assets

from global software majors. These IP are usually close to the end of their productive

lifecycle. The company extends their life cycles to generate high RoI from these assets. It

then packages them as a differentiated service offering to large enterprise clients.

Another method is called the 'sell-with' strategy. The company combines its in-house

developed IP as well as its acquired IP. Then it sells with its partner network (Salesforce,

Apigee, etc). This allows the company to get a foot in the door with a large client via a

small deal. The company later attempts to cross-sell other services to gain the customer's

wallet-share. Thus, the attempt is to position the company as a differentiated software

vendor right from the beginning.

The key question is this. Are these strategies working? The answer is yes! Revenue from

large enterprise customers has grown to about 27% of sales overall.

As one would expect, deal sizes have also grown. This is as clear an example as you can

get of a company strengthening the moat around its business.

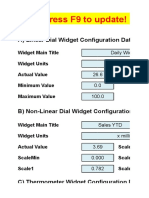

Enterprise Segment Growing Well

Healthy Trend in Deal Sizes

Вам также может понравиться

- Management of Transaction ExposureДокумент22 страницыManagement of Transaction ExposurePeter KoprdaОценок пока нет

- Excel Dashboard WidgetsДокумент47 страницExcel Dashboard WidgetskhincowОценок пока нет

- META Q1 2023 Earnings Call TranscriptДокумент19 страницMETA Q1 2023 Earnings Call TranscriptGMG EditorialОценок пока нет

- 1893 Shadow RunДокумент6 страниц1893 Shadow RungibbamonОценок пока нет

- SWOT Analysis of Infosys TechnologiesДокумент16 страницSWOT Analysis of Infosys TechnologiesNavya Punyah83% (6)

- CCTV Camera Hack With Google Dork ListДокумент3 страницыCCTV Camera Hack With Google Dork ListsarahdianewhalenОценок пока нет

- Data Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewДокумент14 страницData Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewSara GuimarãesОценок пока нет

- AI For Entreprender: How to successfully build, grow or expand your business using artificial intelligenceОт EverandAI For Entreprender: How to successfully build, grow or expand your business using artificial intelligenceОценок пока нет

- Volvo 850 GLT Owners Manual 1993Документ176 страницVolvo 850 GLT Owners Manual 1993jpaulorosado2186Оценок пока нет

- Project Report For System Analysis & DesignДокумент73 страницыProject Report For System Analysis & DesignMd Moazzem Hossain67% (3)

- Business Plan For Offshore Software Development Center in IndiaДокумент8 страницBusiness Plan For Offshore Software Development Center in Indiadrikadrika100% (1)

- 7 Ways APIs, Microservices and DevOps Can Transform Your Business - 0Документ37 страниц7 Ways APIs, Microservices and DevOps Can Transform Your Business - 0javaarchОценок пока нет

- THE FUTURE OF NO CODE-UpdatedДокумент7 страницTHE FUTURE OF NO CODE-UpdatedGayathri JoshiОценок пока нет

- Winning in The API Economy Ebook 3scaleДокумент52 страницыWinning in The API Economy Ebook 3scaleOana CalugarОценок пока нет

- Learning Resource Management Made SimpleДокумент12 страницLearning Resource Management Made SimpleJosenia ConstantinoОценок пока нет

- SIS - Plano Hidráulico de Motoniveladora 140H CATДокумент9 страницSIS - Plano Hidráulico de Motoniveladora 140H CATRoy Huaripata100% (1)

- 4 Pillars For Creating A Winning Enterprise AI StrategyДокумент21 страница4 Pillars For Creating A Winning Enterprise AI StrategyKartik ChoudharyОценок пока нет

- A Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreДокумент65 страницA Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreBabasab Patil (Karrisatte)100% (1)

- Data Science For BusinessДокумент6 страницData Science For BusinessChaitali GawandeОценок пока нет

- LTE Advanced - Leading in Chipsets and Evolution: August 2013Документ33 страницыLTE Advanced - Leading in Chipsets and Evolution: August 2013Muneeb JavedОценок пока нет

- Wipro's Strategy For GrowthДокумент10 страницWipro's Strategy For GrowthChryshels Dcosta100% (1)

- Business Plan: Hisham Ud Din Usama Ehsan Jehanzeb Waqar Muhammad Ali MunirДокумент35 страницBusiness Plan: Hisham Ud Din Usama Ehsan Jehanzeb Waqar Muhammad Ali Munirosama haseebОценок пока нет

- Employment Scenario:: BA Identifies Opportunities For Improvement To Processes andДокумент12 страницEmployment Scenario:: BA Identifies Opportunities For Improvement To Processes andaviansoul28Оценок пока нет

- RetailДокумент1 страницаRetailAnilОценок пока нет

- Conti Summe IntДокумент35 страницConti Summe IntVinothini MuruganОценок пока нет

- Istrat Recruitment and SelectionДокумент82 страницыIstrat Recruitment and SelectionJoginder GuptaОценок пока нет

- UntitledДокумент61 страницаUntitledMani KandanОценок пока нет

- Izon Technologies Industry and Company ProfileДокумент56 страницIzon Technologies Industry and Company ProfileeswariОценок пока нет

- Asset6 Looking Ahead Cloud Report From 2015Документ2 страницыAsset6 Looking Ahead Cloud Report From 2015chawla_sonamОценок пока нет

- INFO661-Final Individual AssignmentДокумент6 страницINFO661-Final Individual AssignmentReetu RahmanОценок пока нет

- Elevator Pitch: High Net-Promoter ScoreДокумент4 страницыElevator Pitch: High Net-Promoter ScorealiendroidsОценок пока нет

- IT Strategies and Ford's BPR Case StudyДокумент5 страницIT Strategies and Ford's BPR Case StudyMahfuz NayemОценок пока нет

- Sip Project ReportДокумент51 страницаSip Project ReportSatendra KumarОценок пока нет

- Infosys Limited Is An Indian Information Technology Company That Provides Global BusinessДокумент15 страницInfosys Limited Is An Indian Information Technology Company That Provides Global BusinessShweta sinha0% (1)

- Infosys Limited Is An Indian Information Technology Company That Provides Global BusinessДокумент14 страницInfosys Limited Is An Indian Information Technology Company That Provides Global BusinessShweta sinhaОценок пока нет

- Enterprise Resource PlanningДокумент13 страницEnterprise Resource PlanningSonal GuptaОценок пока нет

- IBM SWOT Analysis and Business StrategyДокумент6 страницIBM SWOT Analysis and Business StrategySahil ShahОценок пока нет

- Orios Case StudyДокумент6 страницOrios Case StudyNitish KumarОценок пока нет

- 7 Predictions For Enterprise in 2014Документ10 страниц7 Predictions For Enterprise in 2014Pluto7 IncОценок пока нет

- META Q4 2022 Earnings Call TranscriptДокумент19 страницMETA Q4 2022 Earnings Call TranscriptSahar FrankОценок пока нет

- InfosysДокумент10 страницInfosysLei WangОценок пока нет

- Ijcrt2205099 PDFДокумент15 страницIjcrt2205099 PDFAsmita MenganeОценок пока нет

- 00 Unit 1 Digital Trans Trends Worksheet Class 1Документ6 страниц00 Unit 1 Digital Trans Trends Worksheet Class 1brijufijuОценок пока нет

- A Chennai-Based Company Is Expected To Start Operations in A Month's Time The Minimum Occupancy at The Park by A Company Should Be 5,000 SQ - FTДокумент10 страницA Chennai-Based Company Is Expected To Start Operations in A Month's Time The Minimum Occupancy at The Park by A Company Should Be 5,000 SQ - FTAbhishek JainОценок пока нет

- Life Technologies Case StudyДокумент6 страницLife Technologies Case StudyroambiОценок пока нет

- Inmail TemplatesДокумент2 страницыInmail TemplatesSaurabh ThakurОценок пока нет

- 2023 Annual ReportДокумент93 страницы2023 Annual Reportanshgarg1007Оценок пока нет

- Part A A) Detail Your Understanding of ERP. (400-500 Words)Документ11 страницPart A A) Detail Your Understanding of ERP. (400-500 Words)coolriksОценок пока нет

- Bpo ThesisДокумент5 страницBpo Thesisbufukegojaf2100% (2)

- CslSoft ProfileДокумент10 страницCslSoft ProfileLiaqut Ali KhanОценок пока нет

- Openpath Raises 36 Million Report For WillisДокумент8 страницOpenpath Raises 36 Million Report For WillissthoutirОценок пока нет

- About Apple and Digital DivideДокумент16 страницAbout Apple and Digital Dividessvarma09Оценок пока нет

- Rohan J Philips Roll No..127Документ15 страницRohan J Philips Roll No..127Rohan PhilipsОценок пока нет

- ERP Final Report 10036Документ27 страницERP Final Report 10036Talal AsifОценок пока нет

- Pre-Feasibility Study: Social Media Marketing AgencyДокумент21 страницаPre-Feasibility Study: Social Media Marketing AgencyNauman QureshiОценок пока нет

- 4 Ways to Become a Freelance AI Pro & Earn OnlineДокумент3 страницы4 Ways to Become a Freelance AI Pro & Earn OnlineTauqir ahmedОценок пока нет

- Intel It Midyear Performance Report 2012Документ4 страницыIntel It Midyear Performance Report 2012Intel ITОценок пока нет

- 4 Steps to Monetizing Your Company's Data with AIДокумент7 страниц4 Steps to Monetizing Your Company's Data with AIRosa LazaroОценок пока нет

- How the antivirus industry is adapting to ongoing changesДокумент10 страницHow the antivirus industry is adapting to ongoing changesUtkarsh AwasthiОценок пока нет

- SAS Tech: Providing Educational Software for DisabledДокумент32 страницыSAS Tech: Providing Educational Software for DisabledZarmeenaGauharОценок пока нет

- DirectoryДокумент12 страницDirectorykavenindiaОценок пока нет

- A VC's View of Web 2.0Документ8 страницA VC's View of Web 2.0vgopikОценок пока нет

- Lenovo Company, Mis AssingmentДокумент20 страницLenovo Company, Mis AssingmentNarendra RaoОценок пока нет

- Thesis Bpo IndustryДокумент5 страницThesis Bpo Industrygjh9pq2a100% (2)

- Social Enterprise Resource PlanningДокумент32 страницыSocial Enterprise Resource PlanningUsama Islam0% (1)

- Embee ProjectДокумент60 страницEmbee ProjectSaransh SharmaОценок пока нет

- APIs Aren't Just For Tech CompaniesДокумент8 страницAPIs Aren't Just For Tech CompanieskartiknamburiОценок пока нет

- IFS CASE STUDY 2. KshitizДокумент3 страницыIFS CASE STUDY 2. KshitizKshitiz BhandulaОценок пока нет

- Master Thesis Sap BiДокумент6 страницMaster Thesis Sap Birobinandersonwestvalleycity100% (2)

- CG ProjectДокумент14 страницCG ProjectAnil KardamОценок пока нет

- Supply ChainДокумент14 страницSupply ChainAnil KardamОценок пока нет

- What Is The Satyam Scam About?Документ3 страницыWhat Is The Satyam Scam About?Anil KardamОценок пока нет

- INventory MGT (OM)Документ114 страницINventory MGT (OM)Anil KardamОценок пока нет

- SatyamДокумент57 страницSatyamFaisal Malek100% (1)

- Risk and ReturnДокумент239 страницRisk and ReturnAnil KardamОценок пока нет

- Managing Image & Reputation at Religious PlacesДокумент14 страницManaging Image & Reputation at Religious PlacesAnil KardamОценок пока нет

- Governance Failure at SatyamДокумент19 страницGovernance Failure at SatyamAnil KardamОценок пока нет

- Case2 InventoryДокумент1 страницаCase2 InventoryAnil KardamОценок пока нет

- General GiapДокумент24 страницыGeneral GiapAnil KardamОценок пока нет

- Case Fiats Strategic Alliance With TataДокумент29 страницCase Fiats Strategic Alliance With TataDiego Andrés0% (1)

- Strategic Alliances: An OverviewДокумент13 страницStrategic Alliances: An OverviewAnil KardamОценок пока нет

- Project Management: PERT, CPM, Resource Allocation and GERTДокумент43 страницыProject Management: PERT, CPM, Resource Allocation and GERTAnil KardamОценок пока нет

- Casio Fx-350MS ManualДокумент40 страницCasio Fx-350MS ManualGarrett Lewis100% (3)

- ICF - Basic Letter of CreditДокумент2 страницыICF - Basic Letter of CreditAnil KardamОценок пока нет

- Session 13 (Six Sigma-2)Документ46 страницSession 13 (Six Sigma-2)Anil KardamОценок пока нет

- Moffett 286383 08 PDFДокумент40 страницMoffett 286383 08 PDFAnil KardamОценок пока нет

- Dominion CaseДокумент3 страницыDominion CaseAnil KardamОценок пока нет

- Numerical Ability - Data Interpretation 3: 25 QuestionsДокумент6 страницNumerical Ability - Data Interpretation 3: 25 QuestionsAvishek01Оценок пока нет

- Detector of FM SignalДокумент4 страницыDetector of FM SignalR. JaNNaH100% (1)

- MNDOT Distress Identification ManualДокумент51 страницаMNDOT Distress Identification ManualcrojastОценок пока нет

- Gysmi-Note UC3845BDGДокумент1 страницаGysmi-Note UC3845BDGfrance locatelОценок пока нет

- 0.9PF PW 380v 3phase HF UPS10-120kvaДокумент8 страниц0.9PF PW 380v 3phase HF UPS10-120kvaArmandinho CaveroОценок пока нет

- Week 2 PlanДокумент3 страницыWeek 2 Planapi-427127204Оценок пока нет

- Mini System LG-RAD-226B PDFДокумент65 страницMini System LG-RAD-226B PDFAndres Lecaro JarrinОценок пока нет

- Ite 001aДокумент6 страницIte 001ajoshuaОценок пока нет

- Transient and Random VibrationДокумент19 страницTransient and Random VibrationAman SharmaОценок пока нет

- Product Portfolio ManagementДокумент10 страницProduct Portfolio ManagementSandeep Singh RajawatОценок пока нет

- Shipping Label GuideДокумент41 страницаShipping Label GuidebriggantiiОценок пока нет

- Oracle Baseline Security ChecklistДокумент15 страницOracle Baseline Security ChecklistChidi OkerekeОценок пока нет

- Item No. Specification Requested Offered Specifications 1.1. 1.1 Law and CertificatesДокумент23 страницыItem No. Specification Requested Offered Specifications 1.1. 1.1 Law and CertificatesSaša StankovićОценок пока нет

- Recovering Valuable Metals From Recycled Photovoltaic ModulesДокумент12 страницRecovering Valuable Metals From Recycled Photovoltaic ModulesNguyễn TriếtОценок пока нет

- LR Phono PreampsДокумент44 страницыLR Phono PreampsMartin FernandezОценок пока нет

- Industry 4.0 FinaleДокумент25 страницIndustry 4.0 FinaleFrame UkirkacaОценок пока нет

- Qcs 2010 Section 5 Part 8 Transportation and Placing of ConcreteДокумент7 страницQcs 2010 Section 5 Part 8 Transportation and Placing of Concretebryanpastor106Оценок пока нет

- Manual Instalaciones Electricas para Centros de ComputoДокумент65 страницManual Instalaciones Electricas para Centros de ComputoJorge Estrada0% (3)

- How To Unbrick AT&T Galaxy S5 SM-G900A Soft-Brick Fix & Restore To Stock Firmware Guide - GalaxyS5UpdateДокумент21 страницаHow To Unbrick AT&T Galaxy S5 SM-G900A Soft-Brick Fix & Restore To Stock Firmware Guide - GalaxyS5UpdateMarce CJ100% (1)

- How The Draganflyer Flies: So How Does It Work?Документ5 страницHow The Draganflyer Flies: So How Does It Work?sav33Оценок пока нет

- Documentation of Xabe - FFmpegДокумент11 страницDocumentation of Xabe - FFmpegTomasz ŻmudaОценок пока нет