Академический Документы

Профессиональный Документы

Культура Документы

Standalone Financial Results For September 30, 2016 (Result)

Загружено:

Shyam SunderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Standalone Financial Results For September 30, 2016 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

Machino plastics Limited

@ffi

Registered Office & Plant:

3, Maruti J.V. Complex, Delhi-Gurgaon Road,

Haryana 122 015, India.

12th

e|

0 124-23 4121 8, 23

Fax: 0124-2340692

40806

CIN:L25209HR2003PLC035034

Email : admin@machino.com

Website: www.machino.com

November,2Ot6

The Executive Director

The Stock Exchange of Mumbai

PJ Tower, Dalal Street,

Mumbai-400001

Sub: Outcome of the Board Meeting held on 12tt'November,2016

We wish to inform you that pursuant to Regulation 33 of SEBI (Listing 0bligations and

Disclosure RequirementsJ Regulations, 2015, the unaudited financial results for the quarter

September 2016 have been approved by the Board of Directors of the Company

held

today.

in its meeting

ended on

3Oth

Please find enclosed herewith a signed copy of unaudited financial results

ended on 3Oft September,2016.

This is for your kind information and record.

Thanking you

For Machino Plastics Li

n-7,

_/

Saniiiw lindall

Managing Director

ri

H

for the quarter

lS0iIS

16949:2009 Certifled

E'"tuur,%"

o.dN

6r=:E

.a r\'. b;:-'',

l/.,

r

'F'

a.*''ft6^.;:

Machino Plastics Limited

'%,

sFrenco'

ABS Certificate No: 40683

IATF Certificate No: 28290

Registered Office & Plant

Plot No. -3 , Maruti Joint Venture Complex,

Udyog Vihar Phase lV, Gurgaon-122015, lndia

Part

E-mail : admin@machino.com

Website : www.machino.com

Tel. : 0124-2341218, 2340806

Fax : 0124-2340692

CIN

: L25209HR2003PLC035034

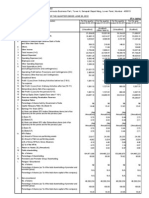

STATEMENT OF UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND THE HALF YEAR ENDED 30TH SEP 2016 (Rs. ln Lakhs)

Ouarter ended

Sr. No.

Pa

rticula rs

30Jun-16

30-5ep-15

30-Sep-16

30-Sep-15

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Income from Operations

a) Net Sales

Revenue from Operations (net of excise duty and service tax)

bl other Ooeratins lncome

)

Half vear ended

30-Sep-16

Total lncome from Operations

6,703.70

5,622.03

5,21,3.24

i2,325.13

6.29

389

s.18

10.18

6,109.39

5.625.92

2r8.42

3.924.14

3,603.21

3,480.11

9,946 98

I

0.58

9.951.56

:XPenSeS

)) cost of material consumed

)) Changes in inventories offinished goods, WIP and stock-in-trade

r) Employee benefit expenses

l) Depreciation & amortisation expense

r) operation & Maintenance expense

') Other expense!

Total Expenses

)rofit / (Loss) from operation before other income, financial cost and exceptional

temsl1 2)

Ither lncome

A q7d

n)

170.101

15.50'

11 45

600.48

544.59

391.47

!,145.07

lag 46

246.19

274.72

758 05

560.91

521.77

675.15

589.21

473.59

L,264.36

457 57

648.58

551 06

451.09

1,199 64

877.99

5,051.11

11.709.48

9,561.88

6.315.73

7.528.05

181.55

392.66

233

(8.93

17

164.65

625.83

3S5 68

I.45

048

0.66

194

0.81

394.r2

233.65

165.31

627.77

396 49

26.27

L1

367.85

151.54

132.01

519.39

251.03

367.85

151.54

132.01

519.39

761 03

Profit/(Loss) from ordinarv activities before finance cost & exceptional items{3+4)

.5

Finance Costs

Profit/(Loss) from ordinary activities after finance cost but before exceptional items (!

6l

1OB

38

Exceptional items

9

)rofit/(Lossl from ordinarv activities before tax (718)

10

Tax Expense

- lncome Tax

I]

l2

13

14

Deferred Ta

Net Profit/(Loss) from ordinarv ativities after tax (9-10)

Extraordrnarv ltems {net ol tar cxpcnsps)

Net Profit/(toss) for the period {11-12)

other comprehensive lncome, net of lncome Tax

r) ltems that will not be reclassified to profit or loss

b) ltem' thdt will be reclassifled to profit or loss

15.91

16.97

82.33

53.90

42.02

(34.27)

95.92

{69 92

296.98

92.55

83.95

389.53

205.11

296.98

92.55

83.95

389.53

?o5

125 84

15

16

Total comprehensive lncome for the period (13r14)

Paid-up Equitv Share Capital (face value of Rs. 10/- each)

17

Reserves excluding revalution reserves as per balance sheet of previous acaounting

18i

296.98

92.55

513.68

513.58

a) Basic EPS {Rs.)

4.84

1.5',l

b) Diluted

4.84

1.51

r) Basic EPS {Rs.)

4.84

1.51

)) Diluted

4.44

1.s1

389.53

613.68

613.68

Earning per share {EPS) before Extraordinary items

EPs {Rs.)

6.35

!.37

6.35

(face value of Rs. 10/- each)

18 ii

:arning per share

(EPS)

after Extraordinary items

EPS (Rs.)

face value of Rs.

10/

each)

5.35

1.3

334

MACHINO PLASTICS LIMITED

Continuation Sheet

STATEMENT OF ASSETS AND LIABILITIES AS AT 3OTH SEPTEMBER,20T6

(Rs. ln Lakhs)

As at

Particulars

Half Year Ended

30.09.2016

Unaudited

ASSETS

Non-Current assets

Property, plant and equiPment

Ca pital work-in-progress

Other lntangible assets

9,237.53

935.92

0.06

Financial assets

lnvestment

125.00

37.81

Loans

Other non-current assets

Total non-current assets

lnventories

Financial assets

Trade receivables

Cash and cash equivalent

Other balances with banks

Other financial assets

Other current assets

Total current assets

0.60

10,336.92

790.20

3,240.72

420.96

2r.73

10.93

864.20

5,348.74

lTotal assets

15,685.66

EQUITY AND LIABILITIES

lrquity

I rquity share capital

I o*'"r. equity

lror"t Equity

613.68

5,610.01"

6,223.69

lli"uiti.i",

ton-.urr"nt liabilities

I

I rlnancial

liabilities

sorro*ing,

I provisions

(Net)

I o"f"rruO tax liabilities

lTotal non-current liabilities

lcrrr"nt liabilities

I Pinancial liabilities

I

I

I

gorro*ing,

rrro"

payables

4,204.65

10.13

316.96

4,53L.74

2,41"5.69

322.30

o,n"r. financial liabilities

1,443.09

I provisions

(Net)

I Curr"nt tax liabilities

I Other current liabilities

5.63

liabilities

Itotal current

153.06

590.47

4,93O.23

lroar, equity and liabilities

15,685.66

Continuation $heet

MACHINO PLASTICS LIMITED

NOTES:

The above unaudited financial results for the quarter ended 30th September, 2016 has reviewed by the audit committee and has taken on record by the

Boardof Directors intheirmeetingheldonl2thNovember,2016.TheStatutoryAuditorsoftheCompanyhavecarriedoutaLlmitedReviewoftheaforesald

res u lts;

The company has adopted lndian Accoutning Standards ("lnd AS") from 1st April, 2016 and accordingly these financial results have been prepared in

accordance with the recognition and measurement principles laid down in the lnd AS 34 lnterim Financial Reporting prescribed under Section 133 of the

Companies Act, 2013 read with the relevant rules issued thereunder and the other accounting principles generally accepted in lndia. Financial results for all

the periods presented have been prepared in accordance with the recognition and measurement principles of lnd AS 34

The lnd AS Compliant financial results for corresponding previous quarter and half year ended 30th September, 2015 have not been audited or reviewed by

Statutory Auditors and has been presented based on the information complied by management after exercisiE due diligence and making necessary lnd AS

adjustment to ensure a true and fair view of the results in accordance with lnd AS and as per exemption given in para 2.6.1 (ii) of the SEBI circular no.

ctR/cFD/FAC/62120L6 dated 05th July, 2016

ThelndAScompliantfinancial resultsforpreviousyearended3lstMarch,2016and'statementof assetsandliabilitiesfortheyear ended3lstMarch,2016

have not been provided, as per the exemption given in parc2.6.1, (iii) of the

SEBI

circular no. CIR/CFD/FAC/62/20L6 dated 05th July, 2016;

Reconciliation of Net profit for the quarter and half year ended 30th September, 2015 between lnd AS complaint results as reported above with results

previously reported (referred to as "Previous GAAP") are given below:

Description of GAAP adjustments

Sr#

Half Year

Quarter

ended

30 Sep 15

ended

30-Sep-15

206.47

Net Profit as per under Previous lndian GAAP

84.62

ii

a)

b)

lnd As Adiustments

Effect of accounting for loans at amortised cost using effective interest rate

(1.03)

(2.08)

0.36

o.72

ilt

Net Profit under lnd AS Complaint Financial Results

83.9s

205.11

83.95

205.11

Deferred taxes assets

Other comprehensive income

Total comprehensive income under lnd ASs

Prices fixed with customers are subject to revision;

The company is exclusively engaged in the business of manufacturing of plastic moulded parts for automotive, appliances and industrial application and allied

products, which is considered as the only reportable segment referred to in statement on Accounting Standard (AS) - 17 "Segmental Reporting". The

geographicai segmentation is not relevant, as there is inignificant export;

Previous period figures have been recast wherever considered necessary;

Place . GURGAON

Date : 12th November.2016

Вам также может понравиться

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ8 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Документ8 страницFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ8 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- TTR RRL: LimitedДокумент5 страницTTR RRL: LimitedShyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For The Quarter Ended 30 June 2012Документ2 страницыFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Документ6 страницAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ8 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- M iYN: Standalone Limited BoДокумент5 страницM iYN: Standalone Limited BoHimanshuОценок пока нет

- Pdfnews PDFДокумент5 страницPdfnews PDFMurthy KarumuriОценок пока нет

- Standalone Financial Results, Form A For March 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ8 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- 28 Consolidated Financial Statements 2013Документ47 страниц28 Consolidated Financial Statements 2013Amrit TejaniОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ9 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Документ6 страницAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ8 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ5 страницFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Документ6 страницAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedДокумент2 страницыSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderОценок пока нет

- Mutual Fund Holdings in DHFLДокумент7 страницMutual Fund Holdings in DHFLShyam SunderОценок пока нет

- Order of Hon'ble Supreme Court in The Matter of The SaharasДокумент6 страницOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderОценок пока нет

- HINDUNILVR: Hindustan Unilever LimitedДокумент1 страницаHINDUNILVR: Hindustan Unilever LimitedShyam SunderОценок пока нет

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Документ1 страницаPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderОценок пока нет

- JUSTDIAL Mutual Fund HoldingsДокумент2 страницыJUSTDIAL Mutual Fund HoldingsShyam SunderОценок пока нет

- Financial Results For June 30, 2014 (Audited) (Result)Документ3 страницыFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliДокумент5 страницExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of R.R. Corporate Securities LimitedДокумент2 страницыSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Dec 31, 2013 (Result)Документ4 страницыFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Документ2 страницыFinancial Results For Mar 31, 2014 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Financial Results For June 30, 2013 (Audited) (Result)Документ2 страницыFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For September 30, 2013 (Result)Документ2 страницыFinancial Results For September 30, 2013 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Aisc Research On Structural Steel To Resist Blast and Progressive CollapseДокумент20 страницAisc Research On Structural Steel To Resist Blast and Progressive CollapseFourHorsemenОценок пока нет

- Dbms UPDATED MANUAL EWITДокумент75 страницDbms UPDATED MANUAL EWITMadhukesh .kОценок пока нет

- Spa ClaimsДокумент1 страницаSpa ClaimsJosephine Berces100% (1)

- Project 1. RockCrawlingДокумент2 страницыProject 1. RockCrawlingHằng MinhОценок пока нет

- BS As On 23-09-2023Документ28 страницBS As On 23-09-2023Farooq MaqboolОценок пока нет

- SyllabusДокумент9 страницSyllabusrr_rroyal550Оценок пока нет

- CEC Proposed Additional Canopy at Guard House (RFA-2021!09!134) (Signed 23sep21)Документ3 страницыCEC Proposed Additional Canopy at Guard House (RFA-2021!09!134) (Signed 23sep21)MichaelОценок пока нет

- Ewellery Ndustry: Presentation OnДокумент26 страницEwellery Ndustry: Presentation Onharishgnr0% (1)

- Toshiba Satellite L200 M200 M203 M206 KBTIДокумент59 страницToshiba Satellite L200 M200 M203 M206 KBTIYakub LismaОценок пока нет

- MG206 Chapter 3 Slides On Marketing Principles and StrategiesДокумент33 страницыMG206 Chapter 3 Slides On Marketing Principles and StrategiesIsfundiyerTaungaОценок пока нет

- CoP - 6.0 - Emergency Management RequirementsДокумент25 страницCoP - 6.0 - Emergency Management RequirementsAnonymous y1pIqcОценок пока нет

- Manual Generador KohlerДокумент72 страницыManual Generador KohlerEdrazGonzalezОценок пока нет

- Brand Guidelines Oracle PDFДокумент39 страницBrand Guidelines Oracle PDFMarco CanoОценок пока нет

- Management Interface For SFP+: Published SFF-8472 Rev 12.4Документ43 страницыManagement Interface For SFP+: Published SFF-8472 Rev 12.4Антон ЛузгинОценок пока нет

- S 101-01 - PDF - User Interface - Computer MonitorДокумент130 страницS 101-01 - PDF - User Interface - Computer Monitormborghesi1Оценок пока нет

- 990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Документ25 страниц990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Marvin NerioОценок пока нет

- HW4 Fa17Документ4 страницыHW4 Fa17mikeiscool133Оценок пока нет

- Expected MCQs CompressedДокумент31 страницаExpected MCQs CompressedAdithya kesavОценок пока нет

- Tax Accounting Jones CH 4 HW SolutionsДокумент7 страницTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraОценок пока нет

- Introduction To Radar Warning ReceiverДокумент23 страницыIntroduction To Radar Warning ReceiverPobitra Chele100% (1)

- Module 5 - Multimedia Storage DevicesДокумент10 страницModule 5 - Multimedia Storage Devicesjussan roaringОценок пока нет

- TRX Documentation20130403 PDFДокумент49 страницTRX Documentation20130403 PDFakasameОценок пока нет

- Ahakuelo IndictmentДокумент24 страницыAhakuelo IndictmentHNNОценок пока нет

- Admission Notice: Weekend Masters Program (WMES)Документ4 страницыAdmission Notice: Weekend Masters Program (WMES)masud100% (1)

- Mutual Fund Insight Nov 2022Документ214 страницMutual Fund Insight Nov 2022Sonic LabelsОценок пока нет

- Is 778 - Copper Alloy ValvesДокумент27 страницIs 778 - Copper Alloy ValvesMuthu KumaranОценок пока нет

- 01 RFI Technical Form BiodataДокумент8 страниц01 RFI Technical Form BiodataRafiq RizkiОценок пока нет

- Bs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Документ52 страницыBs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Tan Gui SongОценок пока нет

- ARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiДокумент5 страницARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiGAURAV DANGARОценок пока нет

- CW February 2013Документ60 страницCW February 2013Clint FosterОценок пока нет

- The Hidden Wealth of Nations: The Scourge of Tax HavensОт EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensРейтинг: 4 из 5 звезд4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderОт EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderОценок пока нет

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionРейтинг: 5 из 5 звезд5/5 (27)

- Taxes Have Consequences: An Income Tax History of the United StatesОт EverandTaxes Have Consequences: An Income Tax History of the United StatesОценок пока нет

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyОт EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyРейтинг: 4 из 5 звезд4/5 (52)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProОт EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProРейтинг: 4.5 из 5 звезд4.5/5 (43)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderОт EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderРейтинг: 5 из 5 звезд5/5 (4)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessОт EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessРейтинг: 5 из 5 звезд5/5 (5)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОт EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОценок пока нет

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012От EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Оценок пока нет

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationОт EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationОценок пока нет

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsРейтинг: 3.5 из 5 звезд3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingОт EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingРейтинг: 5 из 5 звезд5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОт EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОценок пока нет

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreОт EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreРейтинг: 4.5 из 5 звезд4.5/5 (13)

- Canadian International Taxation: Income Tax Rules for ResidentsОт EverandCanadian International Taxation: Income Tax Rules for ResidentsОценок пока нет