Академический Документы

Профессиональный Документы

Культура Документы

Mba51 Wa1 201617

Загружено:

giorgos1978Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mba51 Wa1 201617

Загружено:

giorgos1978Авторское право:

Доступные форматы

MASTERS DEGREE PROGRAMME IN BUSINESS ADMINISTRATION

Module: Financial Management and Accounting (MBA51)

Academic Year: 2016-17

1st Written Assignment (WA1)

Subject 1 (25%)

Assume the following information concerning the commercial enterprise ABD as at 31 December

2015 (in ):

Cash

Accounts receivable

Land

5,000

42,000

100,000

Building

200,000

Office equipment

240,000

Merchandise

30,000

Suppliers

35,000

Interest payable

6,000

Long-term loan

210,000

Equity

100,000

Profit carried forward (as at 31/12)

Dividends paid

Sales

Wages

Selling expenses

Other operational expenses

Interest expenses

80,000

19,800

792,000

44,100

123,000

42,100

6,000

In addition, take into consideration the following information:

1. The opening inventory of merchandise was 27,500 and the purchases of merchandise

during 2015 were 475,000.

2. The balance of Accumulated-depreciation Buildings as at 31/12/2014 was 42,000.

3. The balance of Accumulated-depreciation office equipment as at 31/12/2014 was

59,500.

4. An analysis of firms accounts receivable indicates that uncollectible accounts amount to

3,000.

5. The firm applies the straight-line depreciation method. The useful life of the building is 40

years while its salvage value equals to zero. The useful life of the office equipment is 15

years and its residual value is estimated to 15,000.

6. The accrued salaries as at 31/12/2015 totaled the amount of 50,100.

Required:

A. Prepare the balance sheet and the income statement for the year 2015 by taking into account

that the firms tax rate was 40% and the result was carried forward. (15%)

MASTERS DEGREE PROGRAMME IN BUSINESS ADMINISTRATION

B.

1. The credit manager of ABD estimates that an amount of 10,000 owned by customer B is

uncollectible due to customers bankruptcy. How should the claims against customer B be

reported in the financial statements of ABD? Explain your answer. (word limit: 150) (5%)

2. ABD is facing a legal claim for 100,000. The legal advisors of ABD estimate that the firm

will have to pay as compensation the amount of 50,000. How should the legal claim be

reported in the financial statements of ABD? Explain your answer. (word limit: 150) (5%)

Subject 2 (25%)

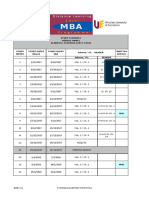

A. Company ABC on September 2016 had the following transactions on its inventories:

DATE

01/09

04/09

08/09

12/09

19/09

22/09

24/09

27/09

29/09

TRANSACTION

Beginning Inventory

Purchase

Sale

Purchase

Purchase

Sale

Purchase

Sale

Purchase

UNITS

PRICE PER

UNIT ()

60

70

95

65

40

105

80

25

40

15.00

17.50

16.00

19.50

21.50

18.50

17.50

15.00

22.00

On the basis of the above information calculate the value of the Inventory on hand on September

30, 2016 and the cost of Goods Sold during the month assuming that the firm adopts the following

inventory cost flow methods:

i)

First-in, first-out (FIFO) Periodic Inventor System and FIFO Perpetual Inventory

System, (7.5%)

ii)

Last-in, First-out (LIFO) Periodic Inventor System and LIFO Perpetual Inventory

System. (7.5%)

B. Financial Accounting Standards Board (FASB) and International Accounting Standards Board

hold different positions regarding the appropriateness of LIFO as an inventory cost-flow method.

International Financial Reporting Standards do not allow the use of LIFO formula to measure the

cost of inventories. On the other hand, FASB allows the use of LIFO formula. Discuss the main

advantages and shortcomings of the LIFO method and explain the reasons that may prompt a firm

to choose FIFO over LIFO as an inventory cost-flow method. (word limit: 350) (10%)

Subject 3 (25%)

ABC, Co., reported the following intangible assets book values on December 31, 2015, the end of

the annual reporting period:

License

120,000

Product-patent

48,000

Below are presented transactions that took place in 2016 and other information relating to

elements of the financial statements of ABC:

a. ABC purchased the license on July 1, 2012 for 120,000. The license has an initial term of

6 years. However, by paying a nominal fee, ABC can renew the license indefinitely for

2

MASTERS DEGREE PROGRAMME IN BUSINESS ADMINISTRATION

successive 6-years terms. ABC considers that there is no limit on the period of time over

which the license will generate economic benefits for the firm.

b. The product-patent was purchased from company ZXC on January 2, 2010 by paying

120,000. At the date of the acquisition the remaining legal life of the patent was 10 years.

On January 2, 2016 ABC determined that the remaining useful life of the product-patent

was 8 years from the date of its acquisition.

c. During the year ABC spent 30,000 in research and development costs for a new

process-patent. The economic viability of the project was established on October 1. Until

that date ABC had spent 25,000 in research costs. The costs incurred after 1 October

has been considered as development costs. On October 1, ABC estimates that the new

patent will generate economic benefits for the next 5 years, while the legal life of the

patent is 10 years.

d. On May 1, 2016 ABC purchased a trademark from company DEF. At the same date ABC

entered in a non-competition agreement with company DEF, relating with the purchase of

the trademark. In particular, ABC paid DEF 100,000, of which 75% related to the

trademark while 25% reflected DEF agreement not to compete for a period of 6 years in

the line of business covered by the trademark. ABC considered that the trademark will

generate economic benefits for 12 years from the date of the acquisition. The legal life of

the trademark is 10 years. At the end of this period ABC can renew the trademark by

paying an amount that is considered significant.

e. On December 31, 2016, purchased company KM by paying 300,000 in cash. At

December 31, 2016, the balance sheet of KM was as follows:

Land

Buildings (net)

Trademarks

Inventory

Accounts receivables

Cash

100,000

85,000

25,000

78,000

124,000

65,000

477,000

Equity

Long-term liabilities

Accounts payable

200,000

177,000

100,000

477,000

The recorded amounts all approximate fair values, with the following exceptions:

Land, fair value 115,000

Inventory, fair value 82,000

Accounts payable, fair value 103,000

Required

A. Prepare the intangible assets section of the balance sheet for ABC on December 31, 2016.

Provide a detailed presentation of the required calculations and explain your answer. Assume that:

-the fiscal year of ABC, Co., commences on January 1 and ends on December 31 of each year.

- ABC adopts the straight-line method for the amortization of its intangible non-current assets.

(18%)

B. Provide a definition of goodwill and explain the way is treated for financial reporting purposes.

(word limit: 250) (7%)

MASTERS DEGREE PROGRAMME IN BUSINESS ADMINISTRATION

Subject 4 (25%)

Firm ABC reported the following accounts balances on December 2016 31, before adjustment:

Bank deposits

Prepaid insurance

8,000

800

Office equipment

5,000

Accumulated depreciation, office equipment

2,500

Unearned revenues

6,000

Wages expenses

3,000

Notes payable

3,000

Services Revenues

4,000

Accounts receivable

1,200

Equity

The following information is also available:

a. Wages of 300 are accrued at December 31, 2016.

b. Revenues from services provided in December 2016 but not yet billed on December 31

amounted to 3,000

c.

Depreciation for the month of December totaled 400.

d. Insurance that expired during December amounted to 160.

e. The accrued interest on deposits in December amounted 20.

f.

The accrued interest on notes payable in December amounted to 180.

g. Revenues earned in December for services provided that were paid in advance totaled

230.

Required

A.

1. Journalize the adjusting entries on December 31, 2016.

2. Determine the amount of equity of ABC on December 31, 2016 after the adjustment.

Provide a detail presentation of the required calculations. Assume that the fiscal year of ABC, Co.,

commences on January 1 and ends on December 31 of each year, while income tax rate is 20%.

(18%)

B. Going concern is one of the fundamental concepts of Financial Accounting. Explain the goingconcern assumption and discuss its implications for financial reporting. (word limit: 200). (7%)

MASTERS DEGREE PROGRAMME IN BUSINESS ADMINISTRATION

Learning Outcomes (objectives)

(Subject 1)

Students should be able to prepare financial statements. In addition, they should exhibit a through

understanding of fundamental financial accounting principles, such as true and fair view and

conservatism principle.

(Subject 2)

Students should exhibit a thorough understanding of accounting for inventories. In particular, they

should be able to calculate cost of goods sold and closing inventory under various inventory costflow methods. In addition, they should explain the advantages and the limitations of various

inventory cost-flow methods

(Subject 3)

Students should exhibit a thorough understanding of accounting for intangible assets. In particular,

they should be able to identify and measure intangible assets at their initial recognition. In addition

they should be able to measure intangible assets subsequently to their initial recognition.

(Subject 4)

Students should exhibit an understanding of the recording process. In addition, they should exhibit

a thorough understanding of the fundamental financial accounting principle of going concern.

MASTERS DEGREE PROGRAMME IN BUSINESS ADMINISTRATION

Assignment guidelines

It is important that the coursework reflects your knowledge rather than it being simply an

accumulation of information.

The assignment should be well structured and easy to read.

The assignment should clearly present all aspects and perspectives of the subject area, i.e.:

o

efficiently develop all necessary elements

refer to actual case studies or statistics if required

present reasonable argumentation

omit irrelevant material

All questions are compulsory. The assignment, including possible diagrams, tables,

references etc., should not exceed n/a words. For every additional n/a words there will be a

penalty of n/a points.

Each question accounts for a percentage of the total mark. This is clearly marked at the

beginning of each question.

The assignment is due on Tuesday 15/11/2016. Please note that no assignment will be

acceptable after this date as the electronic submission system automatically locks at

23:59 on the last day of submission.

You should submit your assignment via http://study.eap.gr using your username and

password.

You may use any of the following file formats:

o

Rich Text Format (*.rtf)

Microsoft Word 97-2003 (*.doc)

Microsoft Word Open XML (*.docx)

Other document formats or read only file formats such as Portable Document Format (*.pdf)

are not acceptable formats for the submission of your assignment.

Please use the template offered by the MBA Programme and pay attention to the proper

naming of your assignment. The file should be named as follows: Surname-InitialWAnumber-YourClass. For example, if your name is Peter Drucker, you are sending in

your 3rd assignment, and you are in ATH1 Class, then you should name your file as follows:

Drucker-P-WA3-ATH1. Assignments that fail to comply with this requirement will receive a

lower mark in the presentation grade.

Copying is considered cheating and is not acceptable in any form. Copying large parts or

whole paragraphs of text found in any of the sources used for an assignment (printed

books, academic articles, or electronic media of any kind) is totally unacceptable. It is

considered plagiarism and leads to a severe penalty for the student(s) involved.

Students should cite all sources from which they take data, ideas or words, whether quoted

directly or paraphrased.

Good luck!!

Вам также может понравиться

- 3 Income Statement ExamplesДокумент3 страницы3 Income Statement Examplesapi-299265916100% (1)

- Classify Your Medical DeviceДокумент3 страницыClassify Your Medical DeviceChris HartoyoОценок пока нет

- Bilgisayarlı SistemlerДокумент14 страницBilgisayarlı Sistemlerttugce29Оценок пока нет

- Bsi MD MDR Readiness Review Es enДокумент9 страницBsi MD MDR Readiness Review Es enIAS IndiaОценок пока нет

- Risk Assessment Report - Proposal & Annotated BibliographyДокумент7 страницRisk Assessment Report - Proposal & Annotated BibliographyDaniel KounahОценок пока нет

- ICH E6-R3 GCP-Principles Draft 2021 0419Документ7 страницICH E6-R3 GCP-Principles Draft 2021 0419ramya sandraОценок пока нет

- Annex IV Part IV Audit Report Template v4.1 PDFДокумент6 страницAnnex IV Part IV Audit Report Template v4.1 PDFMichael FadjarОценок пока нет

- Clinical Trials Its Difficulties and The SolutionДокумент8 страницClinical Trials Its Difficulties and The SolutionSmartway PharmaceuticalsОценок пока нет

- Medical Devices Guideline 2017Документ70 страницMedical Devices Guideline 2017Robert SplinterОценок пока нет

- Guide To Agile Design and Development For Medical Devices-AMDD-Greenlight-GuruДокумент40 страницGuide To Agile Design and Development For Medical Devices-AMDD-Greenlight-Gururemliw101Оценок пока нет

- Iso13485 GDPR EbookДокумент9 страницIso13485 GDPR EbookMarlin PohlmanОценок пока нет

- 02 Sorting (Chap 13)Документ57 страниц02 Sorting (Chap 13)frankjamisonОценок пока нет

- The Production of Private Ramesside Tombs Within The West Theban FuneraryДокумент37 страницThe Production of Private Ramesside Tombs Within The West Theban FuneraryCirceSubaraОценок пока нет

- Medical Device Import PoliciesДокумент4 страницыMedical Device Import PoliciesRavia SharmaОценок пока нет

- Fda Udi Unique Device Identifier GuidanceДокумент11 страницFda Udi Unique Device Identifier Guidanceqfbfabyhola100% (1)

- GHTF Sg3 n18 2010 Qms Guidance On Corrective Preventative Action 101104Документ26 страницGHTF Sg3 n18 2010 Qms Guidance On Corrective Preventative Action 101104grovuОценок пока нет

- Lecture7 Introduction To Medical Devices ManagementДокумент7 страницLecture7 Introduction To Medical Devices ManagementRula BastoniОценок пока нет

- 510 (K) Program Comparison Chart - Greenlight GuruДокумент1 страница510 (K) Program Comparison Chart - Greenlight GuruSACHIN KUMARОценок пока нет

- Software Quality EnginneringДокумент26 страницSoftware Quality EnginneringVinay PrakashОценок пока нет

- Cybersecurity of Medical DevicesДокумент12 страницCybersecurity of Medical DevicesppisupaОценок пока нет

- Lecture4 Introduction To Medical Devices ManagementДокумент9 страницLecture4 Introduction To Medical Devices ManagementRula BastoniОценок пока нет

- Abbreviated 510k - When The Abbreviation Is AllowedДокумент5 страницAbbreviated 510k - When The Abbreviation Is AllowedRegulatonomous OpenОценок пока нет

- NEWS CENTER Maine (NCM) Sent A List of Questions To The FDA and These Were Their ResponsesДокумент2 страницыNEWS CENTER Maine (NCM) Sent A List of Questions To The FDA and These Were Their ResponsesNEWS CENTER MaineОценок пока нет

- CHAPTER 5 QUIZ QUESTIONS With ANSWERSДокумент3 страницыCHAPTER 5 QUIZ QUESTIONS With ANSWERSJonathan RyanОценок пока нет

- Embracing Agile PracticesДокумент4 страницыEmbracing Agile PracticesnikitoОценок пока нет

- Practise Exam CBA PDFДокумент11 страницPractise Exam CBA PDFasdrecvОценок пока нет

- Biblioteca en PapelДокумент18 страницBiblioteca en PapelCristina Garcia Aguilar0% (1)

- EU PMS PSUR Requirements MDR PDFДокумент9 страницEU PMS PSUR Requirements MDR PDFHiral PatelОценок пока нет

- Guidance Technical Documentation and Design Dossiers Fornon Active Medical DevicesДокумент25 страницGuidance Technical Documentation and Design Dossiers Fornon Active Medical DevicesCamila CamposОценок пока нет

- EAP MBA50 Vol.1 PDFДокумент219 страницEAP MBA50 Vol.1 PDFbessy_chОценок пока нет

- PPQ EvaluationДокумент22 страницыPPQ EvaluationmrknowyourbibleОценок пока нет

- Instrument Validation and Inspection MethodsДокумент13 страницInstrument Validation and Inspection MethodsHeena BhojwaniОценок пока нет

- Australia Post Market Activity GuidelinesДокумент31 страницаAustralia Post Market Activity Guidelinesspenceblack7999Оценок пока нет

- MDR Audit NB ChecklistДокумент2 страницыMDR Audit NB ChecklistJeevan JyotiОценок пока нет

- 3I0-008Документ102 страницы3I0-008dafes danielОценок пока нет

- CSTE Subjective QuestionsДокумент3 страницыCSTE Subjective Questionsvenkysh2uОценок пока нет

- Chapter 10 Quality AuditsДокумент13 страницChapter 10 Quality Audits12007856100% (1)

- BSI Technical Guide Medical Protective Clothing en UkДокумент6 страницBSI Technical Guide Medical Protective Clothing en Uksutu ram100% (1)

- How To Complete Basic Data of MDSAP Audited Facility: Content of This GuidanceДокумент27 страницHow To Complete Basic Data of MDSAP Audited Facility: Content of This Guidancegobu269104Оценок пока нет

- Imp Questions-CSTEДокумент17 страницImp Questions-CSTEindianprinceОценок пока нет

- ECPD - DT03 - ISO 13485 - 2016 LA - Day 3 Daily TestДокумент5 страницECPD - DT03 - ISO 13485 - 2016 LA - Day 3 Daily TestSandeep kulkarniОценок пока нет

- 510 (K) SUBSTANTIAL EQUIVALENCE DETERMINATIONДокумент2 страницы510 (K) SUBSTANTIAL EQUIVALENCE DETERMINATIONAlex JОценок пока нет

- Seventh Schedule, Medical Device RulesДокумент20 страницSeventh Schedule, Medical Device RulesGurneet Kaur KhalsaОценок пока нет

- Risks ISO 31000: C Is The Identification, Assessment, and Prioritization ofДокумент14 страницRisks ISO 31000: C Is The Identification, Assessment, and Prioritization ofgoodarshОценок пока нет

- Standard For Gowns and DrapesДокумент4 страницыStandard For Gowns and DrapesRonak choksiОценок пока нет

- Name of The Device: Iv Cannula/Peripheral Intravenous Catheter (Class-Iia-Sterile)Документ56 страницName of The Device: Iv Cannula/Peripheral Intravenous Catheter (Class-Iia-Sterile)Vishal Singh RaghuvanshiОценок пока нет

- DR Arshid Shah Research Report PDFДокумент10 страницDR Arshid Shah Research Report PDFromola613Оценок пока нет

- State of The Art Review Proposal GuidelinesДокумент1 страницаState of The Art Review Proposal Guidelineshesam khorramiОценок пока нет

- 26 Vigilance Control System-R5Документ18 страниц26 Vigilance Control System-R5hitham shehataОценок пока нет

- RFID in Healthcare A Six Sigma DMAIC and Simulation Case StudyДокумент31 страницаRFID in Healthcare A Six Sigma DMAIC and Simulation Case StudydrustagiОценок пока нет

- 354mb 01 A6 Basic RulesДокумент24 страницы354mb 01 A6 Basic RulesNurettin TERZİOĞLUОценок пока нет

- 10035480AM00 - Product Requirements Document PDFДокумент67 страниц10035480AM00 - Product Requirements Document PDFgameel alabsiОценок пока нет

- NC3 Processes Multiple Choice QuestionsДокумент6 страницNC3 Processes Multiple Choice Questionsdanibgg823Оценок пока нет

- Central Drugs Standard Control Organisation: in - Vitro Diagnostic (IVD) DevicesДокумент16 страницCentral Drugs Standard Control Organisation: in - Vitro Diagnostic (IVD) DevicesSusmita Ghosh0% (1)

- Procedure Medical Devices MaintenanceeeeДокумент8 страницProcedure Medical Devices MaintenanceeeeMikhael RanteОценок пока нет

- Lean Six Sigma Practice Test 1 - DoneДокумент1 страницаLean Six Sigma Practice Test 1 - Doneabhaymvyas1144Оценок пока нет

- 01 Introduction To The New Paradigm ICH Q 8,9, 10Документ12 страниц01 Introduction To The New Paradigm ICH Q 8,9, 10Sa'ed Abu YahiaОценок пока нет

- 10 Questions On 21 CFR Part 820Документ2 страницы10 Questions On 21 CFR Part 820Ali Imamudeen100% (1)

- European Union Regulation of in Vitro Diagnostic Medical DevicesДокумент26 страницEuropean Union Regulation of in Vitro Diagnostic Medical DevicesLuis Arístides Torres SánchezОценок пока нет

- CSTE - Preparation For Q& AДокумент1 страницаCSTE - Preparation For Q& Aapi-3828205Оценок пока нет

- Analytical 2500 Words 1Документ16 страницAnalytical 2500 Words 1Fun Toosh345Оценок пока нет

- Feizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed FirmsДокумент10 страницFeizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed Firmsgiorgos1978Оценок пока нет

- Καρότσι 2015.11 - Chrome - GL PDFДокумент55 страницΚαρότσι 2015.11 - Chrome - GL PDFgiorgos1978Оценок пока нет

- Mba61 Wa3 201718Документ2 страницыMba61 Wa3 201718giorgos1978Оценок пока нет

- Salihu 2015 Foreign Investort and Corporate Tax Avoidance PDFДокумент10 страницSalihu 2015 Foreign Investort and Corporate Tax Avoidance PDFgiorgos1978Оценок пока нет

- Study Schedule Module Mba61 ACADEMIC SCHEDULE (2017-2018)Документ2 страницыStudy Schedule Module Mba61 ACADEMIC SCHEDULE (2017-2018)giorgos1978Оценок пока нет

- Mbade HandbookДокумент21 страницаMbade Handbookgiorgos1978Оценок пока нет

- Module:Managerial Economics (Mba50) Academic Year: 2014-15: 4thwritten Assignment (Wa 4)Документ21 страницаModule:Managerial Economics (Mba50) Academic Year: 2014-15: 4thwritten Assignment (Wa 4)giorgos1978Оценок пока нет

- Mba60 Wa2 201415Документ3 страницыMba60 Wa2 201415giorgos1978Оценок пока нет

- Hellenic Open University: School of Social SciencesДокумент6 страницHellenic Open University: School of Social Sciencesgiorgos1978Оценок пока нет

- Hellenic Open University: School of Social SciencesДокумент12 страницHellenic Open University: School of Social Sciencesgiorgos1978Оценок пока нет

- Mba60 1617 Wa2Документ4 страницыMba60 1617 Wa2giorgos1978Оценок пока нет

- Hellenic Open University Master'S Degree Programme in Business AdministrationДокумент4 страницыHellenic Open University Master'S Degree Programme in Business Administrationgiorgos1978Оценок пока нет

- WML 803Документ24 страницыWML 803giorgos1978Оценок пока нет

- Hellenic Open University Master'S Degree Programme in Business AdministrationДокумент6 страницHellenic Open University Master'S Degree Programme in Business Administrationgiorgos1978Оценок пока нет

- Final Accounts of Companies QuestionsДокумент14 страницFinal Accounts of Companies QuestionsshashankОценок пока нет

- Genpact PlacementPapersДокумент7 страницGenpact PlacementPapersChandrasekhar UchihaОценок пока нет

- Welcome From Governor Brian Schweitzer: Montana Means BusinessДокумент2 страницыWelcome From Governor Brian Schweitzer: Montana Means BusinessMark ReinhardtОценок пока нет

- Chapter 3 Quiz KeyДокумент2 страницыChapter 3 Quiz KeyAmna MalikОценок пока нет

- POM Quiz FinalДокумент10 страницPOM Quiz FinalMarie GonzalesОценок пока нет

- SEBI Grade A Free Study Material Accountancy Accounting Standards RFДокумент15 страницSEBI Grade A Free Study Material Accountancy Accounting Standards RFshiivam sharmaОценок пока нет

- Budgeting WsДокумент5 страницBudgeting Wsapi-290878974Оценок пока нет

- 1697 - 24 (E)Документ2 страницы1697 - 24 (E)Shabnam Macanmaker100% (1)

- Dahlan IskanДокумент2 страницыDahlan IskanIzza AkbarОценок пока нет

- Design For AssemblyДокумент16 страницDesign For AssemblyOmkar Pradeep KhanvilkarОценок пока нет

- Colgate Case StudyДокумент10 страницColgate Case Studyapi-350427360100% (3)

- African Alliance Retail Card Web - 0Документ2 страницыAfrican Alliance Retail Card Web - 0Daud Farook IIОценок пока нет

- Bangladesh - Iqbal Abdullah HarunДокумент25 страницBangladesh - Iqbal Abdullah HarunAsian Development BankОценок пока нет

- Proforma Income TaxДокумент19 страницProforma Income TaxRocking SheikhОценок пока нет

- Cash Register ECR 6100 User GuideДокумент30 страницCash Register ECR 6100 User GuideJuanManuel Ruiz de ValbuenaОценок пока нет

- Chapter 3 - Combining Factors: Reminder ReminderДокумент5 страницChapter 3 - Combining Factors: Reminder ReminderLê Thanh TùngОценок пока нет

- Basic Butter Biscuit DoughДокумент9 страницBasic Butter Biscuit Doughmohd_puzi_1100% (1)

- Assignment of CopyrightДокумент2 страницыAssignment of CopyrightpravinsankalpОценок пока нет

- Carissa CarmelitaДокумент10 страницCarissa Carmelitawirdatul jannahОценок пока нет

- Characteristics of A Varactor DiodeДокумент2 страницыCharacteristics of A Varactor DiodeRecardo RamsayОценок пока нет

- Trains, Buses, Airplanes To - From MoldovaДокумент8 страницTrains, Buses, Airplanes To - From Moldovaseljak_veseljakОценок пока нет

- Company Profile - Future GroupДокумент16 страницCompany Profile - Future GroupHanu InturiОценок пока нет

- Michael Porter On How To Marry StrategyДокумент2 страницыMichael Porter On How To Marry StrategySaumya GargОценок пока нет

- International Business: Case Analysis - Bharathi Airtel in Africa Group - 7 Section - AДокумент4 страницыInternational Business: Case Analysis - Bharathi Airtel in Africa Group - 7 Section - AVignesh nayakОценок пока нет

- HiStory of Mozzarella CheeseДокумент2 страницыHiStory of Mozzarella CheesewijayantiОценок пока нет