Академический Документы

Профессиональный Документы

Культура Документы

Corporatecommunications Annexure

Загружено:

Asif RafiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Corporatecommunications Annexure

Загружено:

Asif RafiАвторское право:

Доступные форматы

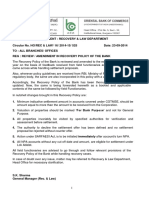

ANDHRA BANK

(A Government of India Undertaking)

Head Office, Hyderabad

RECOVERY MANAGEMENT DEPARTMENT

POLICY FOR COLLECTION OF DUES AND REPOSSESSION OF SECURED ASSETS

1. Introduction:

The debt collection policy of the bank is built around dignity and respect to customers. Bank

will not follow policies that are unduly coercive in collection of dues. The policy is built on

courtesy, fair treatment and pursuasion. The bank believes in following fair practices with

regard to collection of dues and repossession of secured assets and thereby fostering

customer confidence and long-term relationship.

The repayment schedule for any loan sanctioned by the bank will be fixed taking into account

paying capacity and cash flow pattern of the borrower. The bank will keep the customer

informed on the method of calculation of interest and how the Equated Monthly Instalments

(EMI) or payments through any other mode of repayment will be appropriated against

interest and principal due from the customers. The bank would expect the customers to

adhere to the repayment schedule agreed to and approach the bank for assistance and

guidance in case of genuine difficulty in meeting repayment obligations.

Bank's Secured assets Repossession Policy aims at recovery of dues in the event of default

and is not aimed at whimsical deprivation of the secured assets. Initiation of action for

repossession of secured assets would be set in motion only after all attempts by the bank to

discuss with the borrower the ways and means to overcome the financial hurdles have failed.

The policy recognises fairness and transparency in repossession, valuation and realisation of

secured assets. All the practices adopted by the bank for follow up and recovery of dues and

repossession of secured assets will be in consonance with the law.

2. General Guidelines:

All the members of the staff or any person authorised to represent our bank in collection or /

and secured assets repossession would follow the guidelines set out below:

1.

The customer would be contacted ordinarily at the place of his / her choice and in the

absence of any specified place, at the place of his / her residence and if unavailable

at his / her residence, at the place of business / occupation.

2.

Identity and authority of persons authorised to represent the bank for follow up and

recovery of dues would be made known to the borrowers at the first instance. The

bank staff or any person authorised to represent the bank in collection of dues or /

and secured assets, repossession will identify himself / herself and display the

authority letter issued by the bank upon request.

3.

The bank would respect privacy of its borrowers.

4.

The bank is committed to ensure that all written and verbal communication with its

borrowers will be in simple business language and bank will adopt civil manners for

interaction with borrowers.

5.

Normally the bank's representatives will contact the borrower between 0700 hrs and

1900 hrs, unless the special circumstance of his / her business or occupation requires

the bank to contact at a different time.

6.

Borrower's request to avoid calls at a particular time or at a particular place would be

honoured as far as possible.

7.

The bank will document the efforts made for the recovery of dues and the copies of

communication sent to customers, if any, will be kept on record.

8.

All assistance will be given to resolve disputes or differences regarding dues in a

mutually acceptable and in an orderly manner.

9.

Inappropriate occasions such as bereavement in the family or such other calamitous

occasions will be avoided for making calls / visits to collect dues.

3. Giving notice to borrowers:

While written communications, telephonic reminders or visits by the bank's representatives to

the borrowers place or residence will be used as loan follow up measures, the bank will not

initiate any legal or other recovery measures including repossession of the secured assets

without giving due notice in writing. Bank will follow all such procedures as required under

law for recovery / repossession of secured assets. Bank will give a final recall notice through

registered post acknowledgement due / courier / hand delivery under acknowledgement,

demanding repayment of entire dues within 15 days from the date of notice. If the borrower

fails to repay, Bank will issue notice to the borrower demanding repayment and the borrower

will be given minimum of 30 days time to repay the entire dues.

4. Repossession of Secured Assets:

Repossession of secured assets is aimed at recovery of dues and not to deprive the

borrower of the secured assets. The recovery process through repossession of secured

assets will involve repossession, valuation of secured assets and realisation of secured

assets through appropriate means. All these would be carried out in a fair and transparent

manner. Repossession will be done only after issuing the notice as detailed above. Due

process of law will be followed while taking repossession of the secured assets. The bank

will take all reasonable care for ensuring the safety and security of the secured assets after

taking custody, in the ordinary course of the business.

5. Valuations and Sale of Secured Assets

Valuation and sale of secured assets repossessed by the bank will be carried out as per law

and in a fair and transparent manner. To ensure that auction is done in a fair and transparent

manner due notice about the reserve value of the secured asset, time, date and the terms

and conditions of auction will be given to the public at large and to all the concerned

including the borrower. The bank will have right to recover from the borrower the balance

due if any, after sale of secured assets. Excess amount if any, obtained on sale of the

secured assets shall be paid to the person entitled thereto in accordance with his rights and

interests. Bank's right to general lien and its implications will be made clear to the borrower

while executing the loan documents.

6. Opportunity for the borrower to take back the Secured Assets.

As indicated earlier in the policy document, the bank will resort to repossession of secured

assets only for the purpose of realisation of its dues as the last resort and not with intention

of depriving the borrower of the secured assets. Accordingly the bank will be willing to

consider handing over possession of secured assets to the borrower immediately after

repossession and before concluding sale transaction of the secured assets, provided the

bank dues are cleared in full. If satisfied with the genuineness of borrower's inability to pay

the loan instalments as per the schedule, which resulted in the repossession of secured

assets, the bank may consider handing over the secured assets after receiving the

instalments in arrears. However this would be subject to giving an undertaking by the

borrower to repay the remaining instalments / dues in future and to maintain the loan account

as performing asset until closure of the account as per the terms of the loan agreements(s)

to the satisfaction of the Bank.

----

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- EPDP Overview Training For TeamsДокумент186 страницEPDP Overview Training For Teamsp.c abhishek50% (2)

- The Financial Statement Analysis and Cost Reduction Program at Tata Motors Ltd. by Chetan AherДокумент67 страницThe Financial Statement Analysis and Cost Reduction Program at Tata Motors Ltd. by Chetan AherChandrasekar Ravi100% (2)

- The Autobiography of William Henry Donner (CS)Документ166 страницThe Autobiography of William Henry Donner (CS)Ben DencklaОценок пока нет

- Dutch Impact Investors - 20140625Документ39 страницDutch Impact Investors - 20140625Debesh PradhanОценок пока нет

- Data Stream Global Equity ManualДокумент72 страницыData Stream Global Equity Manualfariz888Оценок пока нет

- Credit Manual: United Bank LimitedДокумент120 страницCredit Manual: United Bank LimitedAsif RafiОценок пока нет

- Adv 160Документ100 страницAdv 160Asif Rafi100% (1)

- Chapter 19Документ18 страницChapter 19Asif RafiОценок пока нет

- Peda ST SaarДокумент19 страницPeda ST SaarAsif RafiОценок пока нет

- SCB PK Report 2015 FinalДокумент212 страницSCB PK Report 2015 FinalAsif RafiОценок пока нет

- Corporatecommunications AnnexureДокумент3 страницыCorporatecommunications AnnexureAsif RafiОценок пока нет

- Credit Policy of IciciДокумент5 страницCredit Policy of IciciNirmalОценок пока нет

- MainMenuEnglishLevel-3 RLD2014016Документ291 страницаMainMenuEnglishLevel-3 RLD2014016Asif RafiОценок пока нет

- NIB Annual Report 2015Документ216 страницNIB Annual Report 2015Asif RafiОценок пока нет

- Annual Report 2015: The Way ForwardДокумент316 страницAnnual Report 2015: The Way ForwardAsif RafiОценок пока нет

- NBP Unconsolidated Financial Statements 2015Документ105 страницNBP Unconsolidated Financial Statements 2015Asif RafiОценок пока нет

- Luxury Housing Development in Ethiopia's CapitalДокумент13 страницLuxury Housing Development in Ethiopia's CapitalDawit Solomon67% (3)

- Chapter 9 SolutionsДокумент4 страницыChapter 9 SolutionsVaibhav MehtaОценок пока нет

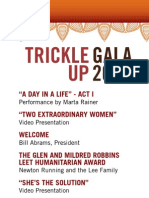

- Gala 2012 Program FinalДокумент2 страницыGala 2012 Program FinalaryairanpourОценок пока нет

- Case 3 Dupont AnalysisДокумент13 страницCase 3 Dupont AnalysisJannine Mae67% (12)

- Business Studies Notes: Unit 3Документ13 страницBusiness Studies Notes: Unit 3Matt Robson100% (1)

- Finbar Realty Investment AnalysisДокумент20 страницFinbar Realty Investment AnalysisPrecious Santos CorpuzОценок пока нет

- Eimco Elecon Equity Research Report July 2016Документ19 страницEimco Elecon Equity Research Report July 2016sriramrangaОценок пока нет

- ZuluTrade WSJ ArticleДокумент2 страницыZuluTrade WSJ ArticleMinura MevanОценок пока нет

- 4215 S 144th, Tukwila, WA. 98168 $489,000Документ1 страница4215 S 144th, Tukwila, WA. 98168 $489,000Team BouddhaОценок пока нет

- Practice HSC Papers General 2Документ47 страницPractice HSC Papers General 2DarrenPurtillWrightОценок пока нет

- Equity Research: (Series IV) 10th August 2012Документ18 страницEquity Research: (Series IV) 10th August 2012kgsbppОценок пока нет

- Corporate Finance: Cash ManagementДокумент29 страницCorporate Finance: Cash ManagementrubalОценок пока нет

- Three Essays On Mutual FundsДокумент181 страницаThree Essays On Mutual FundsIGift WattanatornОценок пока нет

- Malaysia PSCДокумент19 страницMalaysia PSCRedzuan Ngah100% (1)

- Vendor Data Bank Form CSG-003 Rev 2Документ5 страницVendor Data Bank Form CSG-003 Rev 2Deepak JainОценок пока нет

- How To Start With Direct EquityДокумент25 страницHow To Start With Direct EquityKrishna Kishore AОценок пока нет

- JBIL Steel Manufacturer ProfileДокумент17 страницJBIL Steel Manufacturer ProfileShashwat OmarОценок пока нет

- Week 5 SCEДокумент4 страницыWeek 5 SCEAngelicaHermoParas100% (1)

- Impact of Financial Technology On Payment and Lending in AsiaДокумент19 страницImpact of Financial Technology On Payment and Lending in AsiaADBI EventsОценок пока нет

- Sapm Work NotesДокумент138 страницSapm Work NotesShaliniОценок пока нет

- Annual Report 2012 PDFДокумент200 страницAnnual Report 2012 PDFzafarОценок пока нет

- Full Set - Investment AnalysisДокумент17 страницFull Set - Investment AnalysismaiОценок пока нет

- Zahid - Customer Service With Sevice Marketing PerespectiveДокумент78 страницZahid - Customer Service With Sevice Marketing PerespectiveMohammed Zahidul IslamОценок пока нет

- Mosing V ZLOOP Lawsuit Original ComplaintДокумент102 страницыMosing V ZLOOP Lawsuit Original ComplaintHickoryHero100% (1)

- Resume - Bharati Desai Senior Accountant..nДокумент4 страницыResume - Bharati Desai Senior Accountant..nJeremy SmithОценок пока нет