Академический Документы

Профессиональный Документы

Культура Документы

Chapter 9 Organizational Plan True/False Questions

Загружено:

JAPОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 9 Organizational Plan True/False Questions

Загружено:

JAPАвторское право:

Доступные форматы

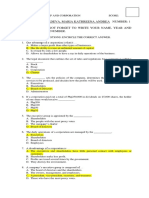

Chapter 9 The Organizational Plan

True/False Questions

1. Investors usually insist that the management team not operate the business as a parttime venture.

Answer: True Page: 265 Difficulty: Easy

2. Investors accept that the management team draws a large salary for their contributions

in early operations.

Answer: False Page: 265 Difficulty: Medium

3. The proprietor is personally liable for all aspects of the business.

Answer: True Page: 265 Difficulty: Medium

4. The corporation is considered a legal person that is taxable and absorbs liability.

Answer: True Page: 267 Difficulty: Easy

5. In a limited partnership, the limited partners are equally liable for the debts of the

partnership.

Answer: False Page: 267 Difficulty: Medium

6. In a partnership, the general partners usually share the amount of personal liability

equally, regardless of their capital contributions.

Answer: True Page: 267 Difficulty: Hard

7. The most expensive type of business to start is the partnership.

Answer: False Page: 268 Difficulty: Medium

8. The corporation can be created only by statute.

Answer: True Page: 268 Difficulty: Easy

9. In a partnership, the death of a general partner generally does not result in termination

of the partnership.

Answer: False Page: 268 Difficulty: Medium

70

Hisrich, Entrepreneurship, Seventh Edition

Chapter 9 The Organizational Plan

10. The corporation has the most continuity of the forms of business.

Answer: True Page: 268 Difficulty: Medium

11. In a limited liability partnership (LLP), the death or withdrawal of a partner has no

effect on the partnership.

Answer: True Page: 269 Difficulty: Easy

12. In an S Corporation, ownership can be freely transferred as long as the buyer is an

individual.

Answer: True Page: 269 Difficulty: Hard

13. Sole proprietors can access two sources of capitalpersonal contributions from the

entrepreneur and sale of stock.

Answer: False Page: 269 Difficulty: Medium

14. The only source of capital for a corporation is the sale of shares of stock.

Answer: False Page: 269-270 Difficulty: Medium

15. The corporate form of ownership gives owners the most control of business

operations.

Answer: False Page: 270 Difficulty: Medium

16. The limited partners in a venture share control of day-to-day operations with the

general partners.

Answer: False Page: 270 Difficulty: Medium

17. Stockholders in a corporation share day-to-day control of the entrepreneur.

Answer: False Page: 270 Difficulty: Medium

18. Corporations are not able to distribute profits to shareholders.

Answer: False Page: 271 Difficulty: Medium

71

Hisrich, Entrepreneurship, Seventh Edition

Chapter 9 The Organizational Plan

19. The corporation is the most attractive type of business formation for raising capital.

Answer: True Page: 271 Difficulty: Easy

20. Both partnerships and proprietorships serve as nontaxable conduits of income for their

owners.

Answer: True Page: 271 Difficulty: Medium

21. Income from the partnership is taxed twice: once at the business level and once as

personal income.

Answer: False Page: 271 Difficulty: Medium

22. Since a corporation is recognized as a separate tax, it has the advantage of being able

to take many deductions and expenses that are not available to the proprietorship or

partnership.

Answer: True Page: 273 Difficulty: Medium

23. The limited liability company is automatically taxed as a partnership.

Answer: True Page: 274 Difficulty: Medium

24. An S Corporation combines the tax advantages of the partnership and the corporation.

Answer: True Page: 274 Difficulty: Medium

25. The S corporation can deduct most fringe benefits for shareholders.

Answer: False Page: 275 Difficulty: Medium

26. In a limited liability company, every member has limited liability.

Answer: True Page: 275 Difficulty: Medium

27. The limited liability company is the only form of organization that allows members to

share liability.

Answer: False Page: 276 Difficulty: Medium

Hisrich, Entrepreneurship, Seventh Edition

72

Chapter 9 The Organizational Plan

28. When a business grows beyond stage one, submanagers are hired to coordinate aspects

of the business.

Answer: True Page: 278 Difficulty: Easy

29. When hiring employees for the venture, the entrepreneur should consider the

candidate's skills and abilities and avoid considering the individual's personality.

Answer: False Page: 279 Difficulty: Medium

30. The hiring process is one area of business operation that the entrepreneur can cut back

on and save time.

Answer: False Page: 279 Difficulty: Medium

31. The Sarbanes-Oxley Act reduced the responsibilities of the board of directors.

Answer: False Page: 280 Difficulty: Medium

32. The board of directors should be limited to 7-12 members with limited terms.

Answer: True Page: 280 Difficulty: Medium

33. A board of advisors has more decision making authority than a board of directors does.

Answer: False Page: 282 Difficulty: Medium

34. Once the board of advisors have been hired, the entrepreneur should not question their

advice.

Answer: False Page: 282 Difficulty: Hard

Multiple Choice Questions

35. The management team of a new venture:

A) is encouraged to operate the business as a sideline.

B) must operate the business full-time.

C) can expect to draw a large salary.

D) should be employed elsewhere to assure adequate income.

Answer: B Page: 265 Difficulty: Medium

73

Hisrich, Entrepreneurship, Seventh Edition

Chapter 9 The Organizational Plan

36. Some customers prefer to do business with a _______________ because this form of

business is sometimes viewed as a more stable form than the others.

A) proprietorship

B) limited partnership

C) full partnership

D) corporation

Answer: D Page: 265 Difficulty: Medium

37. _____________ have unlimited liability for the actions of the business.

A) General partners

B) Corporate shareholders

C) Limited liability company members

D) Limited partners

Answer: A Page: 267 Difficulty: Medium

38. In a limited partnership, the limited partners:

A) are liable only for the amount of their capital contributions.

B) share the amount of personal liabilities equally.

C) have only insurance as protection against liability suits.

D) are allowed to decide on the amount of individual liabilities.

Answer: A Page: 267 Difficulty: Medium

39. Liability is one of the most critical reasons for establishing a:

A) corporation.

B) limited liability company.

C) partnership.

D) sole proprietorship.

Answer: A Page: 267 Difficulty: Easy

40. In a limited liability partnership (LLP) death or withdrawal of a partner:

A) results in automatic transfer of ownership to surviving partner(s).

B) may result in problems trying to find a market for the shares.

C) always results in termination of the partnership.

D) has no effect on the partnership.

Answer: D Page: 268 Difficulty: Hard

Hisrich, Entrepreneurship, Seventh Edition

74

Chapter 9 The Organizational Plan

41. Which of the following types of ownership has the most continuity?

A) Corporation

B) General partnership

C) Limited partner

D) Sole proprietorship

Answer: A Page: 268 Difficulty: Medium

42. Sole proprietorships:

A) have no time limit on how long they may exist.

B) are perpetual.

C) continue even upon the death of the owner.

D) allow a member of the deceased partners family take over as a partner.

Answer: D Page: 268 Difficulty: Medium

43. In which of the legal forms of ownership is transferability of interest the easiest?

A) Sole proprietorship

B) Limited partnership

C) General partnership

D) Corporation

Answer: D Page: 269 Difficulty: Medium

44. In an S corporation, the transfer of interest can occur:

A) only with the consent of the other shareholders.

B) only if there is a charter provision for doing so.

C) only as long as the buyer is an individual.

D) depending on the agreement.

Answer: C Page: 269 Difficulty: Hard

45. The legal form of business with the most alternatives for raising capital is the:

A) proprietorship.

B) corporation.

C) limited partnership.

D) full partnership.

Answer: B Page: 269 Difficulty: Easy

75

Hisrich, Entrepreneurship, Seventh Edition

Chapter 9 The Organizational Plan

46. Bonds can be used to raise capital in which form of ownership?

A) Sole proprietorship

B) Limited partnership

C) General partnership

D) Corporation

Answer: D Page: 269-270 Difficulty: Medium

47. In which form of organization does the owner have greatest control?

A) Sole proprietorship

B) Limited partnership

C) General partnership

D) Corporation

Answer: A Page: 270 Difficulty: Medium

48. When it comes to decision making, in a limited partnership:

A) there is no separation of ownership and control.

B) limited partners have no control over business decisions.

C) limited partners have an equal say, but no liability.

D) the partners have control based on invested capital.

Answer: B Page: 270 Difficulty: Medium

49. Corporations distribute profits to owners through:

A) bonds.

B) taxes.

C) dividends.

D) interest.

Answer: C Page: 271 Difficulty: Hard

50. Organization costs in a proprietorship are:

A) amortizable over a period of 60 months.

B) amortizable over a period of 45 months.

C) not amortizable.

D) amortizable for a period of a year.

Answer: C Page: 272 Difficulty: Medium

Hisrich, Entrepreneurship, Seventh Edition

76

Chapter 9 The Organizational Plan

51. Which of the following statements is (are) true?

A) Corporates are not able to take deductions and expenses available to the

proprietorship or partnership.

B) Distribution of dividends is taxed once, as income of the corporation.

C) Bonuses, incentives,and profit sharing are allowable ways to distribute income of

the corporation.

D) Corporate tax may be higher than the individual rate.

Answer: C Page: 273 Difficulty: Hard

52. Which of the following ways of distributing the income of corporations is taxed twice?

A) Bonus

B) Salary

C) Dividends

D) Profit sharing

Answer: C Page: 273 Difficulty: Medium

53. A limited liability corporation:

A) has unlimited liability.

B) is automatically taxed as a partnership.

C) is decreasing in popularity among venture capitalists.

D) had been the most popular choice of organization structure by new ventures and

small businesses.

Answer: B Page: 273 Difficulty: Medium

54. S corporation status means:

A) shareholders do not have limited liability.

B) the corporation is subject to a minimum tax of 34 percent.

C) consent by a majority of shareholders is required for the election of this form of

business.

D) the corporation pays no tax.

Answer: D Page: 274 Difficulty: Hard

77

Hisrich, Entrepreneurship, Seventh Edition

Chapter 9 The Organizational Plan

55. In an S corporation:

A) gains or losses of the business are separate from the personal income of the

shareholder.

B) shareholders retain unlimited liability.

C) only one class of stock is permitted.

D) most fringe benefits for shareholders can be deducted.

Answer: C Page: 274 Difficulty: Medium

56. In a limited liability company:

A) owners are called shareholders.

B) members may transfer their interests at any time.

C) members are not allowed to share income, profit, expense, deduction, loss and

credit among themselves.

D) laws governing its formation differ from state to state.

Answer: D Page: 275-276 Difficulty: Medium

57. As an organization grows, submanagers are hired to coordinate the various aspects of

the business. The text describes this as:

A) Stage 1.

B) Management Phase.

C) Stage 2.

D) Organizing Phase.

Answer: C Page: 278 Difficulty: Medium

58. Our text tells us that much of an entrepreneur's time during start-up is spent:

A) delegating.

B) negotiating.

C) putting out fires.

D) allocating resources.

Answer: C Page: 278 Difficulty: Medium

59. To build a successful organization culture the entrepreneur:

A) should focus and not try out different things.

B) needs to remember that it is easier to change a persons attitude than it is to change

the persons behavior.

C) should spend extra time in the hiring process.

D) must create a workplace where communication from the top down is encouraged.

Answer: C Page: 279 Difficulty: Medium

Hisrich, Entrepreneurship, Seventh Edition

78

Chapter 9 The Organizational Plan

60. The board of directors:

A) lacks voting authority.

B) has responsibilities to represent all shareholders.

C) is less objective than the entrepreneur.

D) are always volunteers and need not be compensated.

Answer: B Page: 280 Difficulty: Medium

61. The _________ imposes oversight responsibilities on members of the board of

directors.

A) Social Security Act

B) Fair Labor Practices Act

C) Sarbanes-Oxley

D) Taft-Hartley Act

Answer: C Page: 280 Difficulty: Medium

62. The difference between a board of directors and a board of advisors is that:

A) the board of advisors meets less frequently.

B) the board of directors lacks voting authority.

C) the board of directors is subject to less pressure of litigation.

D) the board of advisors are compensated.

Answer: A Page: 282 Difficulty: Medium

79

Hisrich, Entrepreneurship, Seventh Edition

Вам также может понравиться

- 2010-01-06 025629 CnwokДокумент7 страниц2010-01-06 025629 CnwokShoniqua JohnsonОценок пока нет

- PRC 5: Scenario Based QuestionsДокумент7 страницPRC 5: Scenario Based Questionsishnaaltaf8Оценок пока нет

- BUSA101 Ch4 Q+AДокумент10 страницBUSA101 Ch4 Q+ASuelynn ParkerОценок пока нет

- Chap001 2019 Fall Assignment 1Документ4 страницыChap001 2019 Fall Assignment 1Taranom BakhtiaryОценок пока нет

- TB Ch01Документ14 страницTB Ch01CGОценок пока нет

- Chapter 1 Introduction To CF - Student VersionДокумент9 страницChapter 1 Introduction To CF - Student VersionMinh Vũ Ngô LêОценок пока нет

- CH 4 - Chapter 4 Description CH 4 - Chapter 4 DescriptionДокумент47 страницCH 4 - Chapter 4 Description CH 4 - Chapter 4 DescriptionThu NguyenОценок пока нет

- Foundations of Financial Management Multiple Choice ConceptsДокумент12 страницFoundations of Financial Management Multiple Choice Conceptsjhho2Оценок пока нет

- From Exam 1Документ22 страницыFrom Exam 1jarabbo100% (1)

- BH Tif08Документ24 страницыBH Tif08Andres R. OlguinОценок пока нет

- Entrepreneurship Chapter 9 MCQsДокумент4 страницыEntrepreneurship Chapter 9 MCQsTooba0% (1)

- Full Download Financial Management Theory and Practice 3rd Edition Brigham Test BankДокумент35 страницFull Download Financial Management Theory and Practice 3rd Edition Brigham Test Bankjosephkvqhperez100% (20)

- Midterm Exam ReviewДокумент12 страницMidterm Exam ReviewHakdog HatdogОценок пока нет

- Chapter 2 AnswersДокумент6 страницChapter 2 AnswersPrueyGee50% (4)

- Test Bank For Financial Management Principles and Applications 10th Edition by KeownДокумент19 страницTest Bank For Financial Management Principles and Applications 10th Edition by KeownPria Aji PamungkasОценок пока нет

- Module I Assignment: Section I: Conceptual Multiple Choice QuestionsДокумент11 страницModule I Assignment: Section I: Conceptual Multiple Choice QuestionsCatherine RenshawОценок пока нет

- Corporate Finance Scope and FunctionsДокумент7 страницCorporate Finance Scope and FunctionsGenesis E. CarlosОценок пока нет

- Name & Section: Adeva, Maria Kathreena Andrea Number: 1 Instruction: Do Not Forget To Write Your Name, Year and Section and Seat NumberДокумент15 страницName & Section: Adeva, Maria Kathreena Andrea Number: 1 Instruction: Do Not Forget To Write Your Name, Year and Section and Seat NumberMaria Kathreena Andrea AdevaОценок пока нет

- Quiz - 1Документ3 страницыQuiz - 1Faiz MokhtarОценок пока нет

- Quiz 2 - With AnswersДокумент16 страницQuiz 2 - With Answerszshaz64% (22)

- Busn 9th Edition Kelly Test BankДокумент14 страницBusn 9th Edition Kelly Test Bankbeckytaylorobmerjwxgs100% (30)

- Financial Management OverviewДокумент6 страницFinancial Management Overviewhussainhamid10100% (1)

- Revision Coporate FinanceДокумент22 страницыRevision Coporate FinanceThanh Thủy KhuấtОценок пока нет

- Financial Management (Chapter 1: Getting Started-Principles of Finance)Документ25 страницFinancial Management (Chapter 1: Getting Started-Principles of Finance)Bintang LazuardiОценок пока нет

- Accounting Corporation ExerciseДокумент5 страницAccounting Corporation ExerciseJennifer AdvientoОценок пока нет

- Test Bank For Corporate Finance A Focused Approach 7th Edition Michael C Ehrhardt Eugene F BrighamДокумент24 страницыTest Bank For Corporate Finance A Focused Approach 7th Edition Michael C Ehrhardt Eugene F BrighamDebraWrighterbis100% (40)

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionДокумент8 страницMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionnatashaОценок пока нет

- Orca Share Media1678615963343 7040625649514116497Документ13 страницOrca Share Media1678615963343 7040625649514116497Angeli Shane SisonОценок пока нет

- 102B - Business Organisation & Office ManagementДокумент22 страницы102B - Business Organisation & Office ManagementAnonymous WtjVcZCgОценок пока нет

- Macroeconomics 5Th Edition Hubbard Test Bank Full Chapter PDFДокумент36 страницMacroeconomics 5Th Edition Hubbard Test Bank Full Chapter PDFdonna.morales754100% (11)

- BUSN 9th Edition Kelly Test Bank DownloadДокумент14 страницBUSN 9th Edition Kelly Test Bank DownloadShirley Kinstler100% (29)

- F.M Chapter 1 PDFДокумент10 страницF.M Chapter 1 PDFpettgreentteaОценок пока нет

- Test Bank For Labor Relations 11th Edition John FossumДокумент20 страницTest Bank For Labor Relations 11th Edition John Fossumblanchesanguh08wmОценок пока нет

- Tutor Demonstration Questions: Partners. 2. Easy To EstablishДокумент7 страницTutor Demonstration Questions: Partners. 2. Easy To EstablishSalam AyadОценок пока нет

- Course Notes - Week 5 - SmartДокумент33 страницыCourse Notes - Week 5 - Smartqpjcvgb7htОценок пока нет

- Chapter 04 Testbank: of Mcgraw-Hill EducationДокумент59 страницChapter 04 Testbank: of Mcgraw-Hill EducationshivnilОценок пока нет

- Fundamentals of Corporate Finance Canadian 5th Edition Brealey Test BankДокумент68 страницFundamentals of Corporate Finance Canadian 5th Edition Brealey Test BankEricBergermfcrd100% (13)

- FMGT 3510 Midterm Exam Review Questions MC Summer 2019Документ38 страницFMGT 3510 Midterm Exam Review Questions MC Summer 2019Jennifer AdvientoОценок пока нет

- Multiple Choice Questions: Introduction To Corporate FinanceДокумент9 страницMultiple Choice Questions: Introduction To Corporate FinanceThu UyênОценок пока нет

- Better Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipДокумент40 страницBetter Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipAngelita Dela cruzОценок пока нет

- Better Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipДокумент40 страницBetter Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipAngelita Dela cruzОценок пока нет

- Question 2Документ17 страницQuestion 2Chetan DhimanОценок пока нет

- Worksheet To Assess Your SelfДокумент7 страницWorksheet To Assess Your SelfBUSHRA ILYASОценок пока нет

- Chapter 7 The Business Plan: Creating andДокумент9 страницChapter 7 The Business Plan: Creating andbeargreat100% (4)

- ITB Mcqs BankДокумент78 страницITB Mcqs Banksalwa asifОценок пока нет

- Economics 7th Edition Hubbard Test BankДокумент38 страницEconomics 7th Edition Hubbard Test Bankshannonswansonga0a100% (13)

- Wa0018.Документ8 страницWa0018.Raja RizwanОценок пока нет

- Form business ownership typesДокумент11 страницForm business ownership typesNouran Mohamed Abd AzeemОценок пока нет

- CH 02 - Business, Trade - Commecer AkДокумент17 страницCH 02 - Business, Trade - Commecer AkArundhoti MukherjeeОценок пока нет

- Chapter 10 The Financial Plan: True/False QuestionsДокумент10 страницChapter 10 The Financial Plan: True/False QuestionsSalman BaigОценок пока нет

- Quiz Chapter 1 Introduction To Corporate FinanceДокумент16 страницQuiz Chapter 1 Introduction To Corporate FinanceRosiana TharobОценок пока нет

- Ross12e Chapter01 TBДокумент12 страницRoss12e Chapter01 TBHải YếnОценок пока нет

- Test Bank Chapter 9Документ10 страницTest Bank Chapter 9Rebecca StephanieОценок пока нет

- BusFin ExamДокумент16 страницBusFin ExamBlessel Rose PaquinganОценок пока нет

- Meaning of Financial Management: (A) To Ensure Availability of Sufficient Funds at Reasonable Cost (Liquidity)Документ10 страницMeaning of Financial Management: (A) To Ensure Availability of Sufficient Funds at Reasonable Cost (Liquidity)Rana AhmedОценок пока нет

- Assignment 1Документ2 страницыAssignment 1Anika Gaudan PonoОценок пока нет

- 74337234-37a2-4f7a-b4c1-ae5ca9a80c95 (1)Документ3 страницы74337234-37a2-4f7a-b4c1-ae5ca9a80c95 (1)ATHARVA GHORPADEОценок пока нет

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCОт EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCОценок пока нет

- Top Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomОт EverandTop Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomОценок пока нет

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineОценок пока нет

- PROMOTIONДокумент8 страницPROMOTIONJAPОценок пока нет

- Financial Accounting and Reporting: Cash and Cash Equivalent CashДокумент4 страницыFinancial Accounting and Reporting: Cash and Cash Equivalent CashJAPОценок пока нет

- ReceivableДокумент9 страницReceivableJAPОценок пока нет

- Municipality Financial StatementДокумент12 страницMunicipality Financial StatementJAPОценок пока нет

- Cooperatives (Republic Act No. 9520 A.K.A. Philippine Cooperative Code of 2008)Документ8 страницCooperatives (Republic Act No. 9520 A.K.A. Philippine Cooperative Code of 2008)JAPОценок пока нет

- #4 Pas 8Документ3 страницы#4 Pas 8Shara Joy B. Parayno100% (1)

- #01 Accounting ProcessДокумент3 страницы#01 Accounting ProcessZaaavnn VannnnnОценок пока нет

- Judgment and PropositionДокумент7 страницJudgment and PropositionJAPОценок пока нет

- #02 Conceptual FrameworkДокумент5 страниц#02 Conceptual FrameworkJAPОценок пока нет

- PartnershipДокумент3 страницыPartnershipJAPОценок пока нет

- Business LawДокумент13 страницBusiness Lawwedd776Оценок пока нет

- David sm11 Basic 03Документ20 страницDavid sm11 Basic 03JAPОценок пока нет

- 01 Error Correction Answer KeyДокумент4 страницы01 Error Correction Answer KeyNile Alric AlladoОценок пока нет

- Boa Tos Mas - Revised.eaa.1Документ3 страницыBoa Tos Mas - Revised.eaa.1JAPОценок пока нет

- 00 ContentsДокумент2 страницы00 ContentsJAPОценок пока нет

- At ResponsibilitiesДокумент1 страницаAt ResponsibilitiesJAPОценок пока нет

- 02 x02 Management Information SystemДокумент8 страниц02 x02 Management Information SystemJAPОценок пока нет

- Business Law Quiz ObligationsДокумент17 страницBusiness Law Quiz ObligationsDanica PelenioОценок пока нет

- PRTC - Final Preboard - Taxation - 2017Документ5 страницPRTC - Final Preboard - Taxation - 2017Kenneth Bryan Tegerero Tegio50% (2)

- PWCPH Taxalert-08 PDFДокумент14 страницPWCPH Taxalert-08 PDFKyll MarcosОценок пока нет

- PROMOTIONДокумент8 страницPROMOTIONJAPОценок пока нет

- CH 03 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State University - Chairul AnwarДокумент27 страницCH 03 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State University - Chairul AnwarSjifa Aulia90% (10)

- FY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFДокумент16 страницFY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFTony MorganОценок пока нет

- Capital Gains TaxДокумент1 страницаCapital Gains TaxJAPОценок пока нет

- Auditing IT Governance ControlsДокумент37 страницAuditing IT Governance ControlsJAPОценок пока нет

- The Regular Corporate Income TaxДокумент1 страницаThe Regular Corporate Income TaxJAPОценок пока нет

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsДокумент7 страницBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaОценок пока нет

- PSRS-4410 Engagement To Compile Fin InfoДокумент14 страницPSRS-4410 Engagement To Compile Fin InfocolleenyuОценок пока нет

- Test Bank - Inc TX-MDGДокумент5 страницTest Bank - Inc TX-MDGjaysonОценок пока нет

- Auditing TheoryДокумент14 страницAuditing TheorySweete ManabatОценок пока нет

- Dwnload Full Financial Accounting A Business Process Approach 3rd Edition Reimers Test Bank PDFДокумент36 страницDwnload Full Financial Accounting A Business Process Approach 3rd Edition Reimers Test Bank PDFjosephkvqhperez100% (12)

- Cambridge IGCSE™: Business Studies 0450/11 May/June 2021Документ21 страницаCambridge IGCSE™: Business Studies 0450/11 May/June 2021Imran Ali100% (1)

- CF Mid Term - Revision Set 1Документ11 страницCF Mid Term - Revision Set 1linhngo.31221020350Оценок пока нет

- Types of Business OrganisationДокумент15 страницTypes of Business OrganisationLewis WorrallОценок пока нет

- Business Finance Essentials 1531172886. - Print PDFДокумент385 страницBusiness Finance Essentials 1531172886. - Print PDFWalter MataОценок пока нет

- Forms & Economic Roles of Business OrganizationsДокумент12 страницForms & Economic Roles of Business OrganizationsCherrielyn Lawas100% (3)

- Self-Employed PersonДокумент3 страницыSelf-Employed PersonqwertyОценок пока нет

- Business Economics Unit - 1Документ19 страницBusiness Economics Unit - 1Naresh GuduruОценок пока нет

- Basics of setting up business entities in MalaysiaДокумент2 страницыBasics of setting up business entities in MalaysiaLupaluli ApaОценок пока нет

- Philgeps Sworn Statement: Barangay Barbo Street, Dulag, LeyteДокумент2 страницыPhilgeps Sworn Statement: Barangay Barbo Street, Dulag, Leytesevera martin100% (2)

- Doing Business in The PhilippinesДокумент10 страницDoing Business in The Philippinesgilberthufana446877Оценок пока нет

- ACC501 Quiz 1 To 20 Solved Conf byДокумент19 страницACC501 Quiz 1 To 20 Solved Conf byMuhammad SherjeelОценок пока нет

- International Multidisciplinary Research JournalДокумент9 страницInternational Multidisciplinary Research Journalkahkashan khurshidОценок пока нет

- Duties & Liabilities of Advocates & Solicitors To The ProfessionДокумент21 страницаDuties & Liabilities of Advocates & Solicitors To The Professiontasneem anuarОценок пока нет

- Business and Accounting Studies: Grade 10Документ184 страницыBusiness and Accounting Studies: Grade 10Ashley GazeОценок пока нет

- IntroductiontoAccounting STДокумент328 страницIntroductiontoAccounting STAbsara Khan100% (1)

- Type of Business OrganizationsДокумент4 страницыType of Business OrganizationsThin Zar Tin WinОценок пока нет

- TAX2601 LU3 Content 2023Документ21 страницаTAX2601 LU3 Content 2023sibongileОценок пока нет

- Types of Business PartnershipsДокумент2 страницыTypes of Business PartnershipsPrisha GodwaniОценок пока нет

- ICAEW Professional Level Business Planning - Taxation Question & Answer Bank March 2016 To March 2020Документ382 страницыICAEW Professional Level Business Planning - Taxation Question & Answer Bank March 2016 To March 2020Optimal Management SolutionОценок пока нет

- Seminar Engleza Anul I 1Документ300 страницSeminar Engleza Anul I 1Cristian GrОценок пока нет

- Land Registry Information For A Property, Including A PlanДокумент3 страницыLand Registry Information For A Property, Including A Planshing wongОценок пока нет

- Business Organisations Law Summary Sample 2010 - SingaporeДокумент11 страницBusiness Organisations Law Summary Sample 2010 - SingaporeApish DahninОценок пока нет

- Abebe Project FinalДокумент47 страницAbebe Project FinalDagmawi TesfayeОценок пока нет

- Fim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementДокумент4 страницыFim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementJomar VillenaОценок пока нет

- Accounting 0452 Notes-Ch8Документ3 страницыAccounting 0452 Notes-Ch8Huma PeeranОценок пока нет

- Lesson1 Nature and Forms of Business OrganizationsДокумент15 страницLesson1 Nature and Forms of Business OrganizationsMarykay Bermeo100% (1)

- Chapter 2 Financial Statement Analysis For StudentsДокумент49 страницChapter 2 Financial Statement Analysis For StudentsRossetteDulinОценок пока нет

- Accounting12 3ed Ch03Документ31 страницаAccounting12 3ed Ch03rs8j4c4b5pОценок пока нет

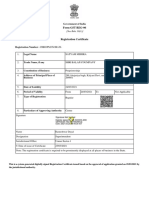

- GST Registration CertificateДокумент3 страницыGST Registration CertificateSurajОценок пока нет