Академический Документы

Профессиональный Документы

Культура Документы

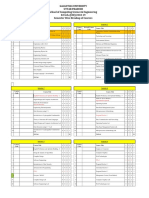

ATW108 Chapter 24 Tutorial

Загружено:

Shuhada Shamsuddin0 оценок0% нашли этот документ полезным (0 голосов)

99 просмотров1 страницаTry

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTry

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

99 просмотров1 страницаATW108 Chapter 24 Tutorial

Загружено:

Shuhada ShamsuddinTry

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

Chapter 24 - An Introduction to Macroeconomics

McConnell, Brue, and Flynn 20e

DISCUSSION QUESTIONS

3. Did economic output start growing faster than population from the beginning of the human inhabitation

of the earth? When did modern economic growth begin? Have all of the worlds nations experienced the

same extent of modern economic growth? LO2

Answer: No, rapid and sustained economic growth is a modern phenomenon. Before the

Industrial Revolution began in the late 1700s in England, standards of living showed virtually no

growth over hundreds or even thousands of years. For instance, the standard of living of the

average Roman peasant was virtually the same at the start of the Roman Empire around the year

500 B.C. as it was at the end of the Roman Empire 1000 years later. Similarly, historians and

archeologists have estimated that the standard of living enjoyed by the average Chinese peasant

was essentially the same in the year A.D. 1800 as it was in the year A.D. 100.

No, the vast differences in living standards seen today between rich and poor countries are almost

entirely the result of the fact that only some countries have experienced modern economic growth.

5. How does investment as defined by economists differ from investment as defined by the general public?

What would happen to the amount of economic investment made today if firms expected the future returns

to such investment to be very low? What if firms expected future returns to be very high? LO3

Answer: Economic Investment refers to the purchase of machinery, tools, etc that can be used

to produce goods and services in the future. This investment is undertaken by firms and the way

economists think about investment. Financial Investment captures what ordinary people mean

when they say investment, namely the purchase of assets like stocks, bonds, or real estate in the

hope of reaping a financial gain. If firms expect low returns on their investments they will

typically invest less. If firms expect high returns on their investment they will typically invest

more. However these results depend on how households respond to interest rates and the

availability of savings for investment purposes.

PROBLEMS

2. Suppose that Glitter Gulch, a gold mining firm, increased its sales revenues on newly mined gold from

$100 million to $200 million between one year and the next. Assuming that the price of gold increased by

100 percent over the same period, by what numerical amount did Glitter Gulchs real output change? If the

price of gold had not changed, what would have been the change in Glitter Gulchs real output? LO1

Answers: 0; $100 million.

Feedback: Since the price doubled and the sales revenue doubled between one year and the next,

this implies that the company sold and mined the same amount of gold over the period. The

change in real output is zero.

If the price of gold did not change and sales revenue doubled, the amount of gold sold and mined

must have doubled. The change in real output is $100 million (= $200 million (new revenue) $100 million (old revenue)).

Вам также может понравиться

- How To Invest Before The Collapse Version BДокумент14 страницHow To Invest Before The Collapse Version BMalik BeyОценок пока нет

- ECONOMY: Money and EnergyДокумент7 страницECONOMY: Money and EnergyPost Carbon InstituteОценок пока нет

- Ultimate Wealth: The Insider's Guide To Real Wealth' InvestingДокумент0 страницUltimate Wealth: The Insider's Guide To Real Wealth' InvestingShailesh KumarОценок пока нет

- Alexander Hamilton DissertationДокумент77 страницAlexander Hamilton DissertationArif KhanОценок пока нет

- Pro EcoДокумент5 страницPro EcochetanОценок пока нет

- Gold Ex Plainer September 19 2010Документ6 страницGold Ex Plainer September 19 2010Radu LucaОценок пока нет

- Pro EcoДокумент4 страницыPro EcochetanОценок пока нет

- IMT-20 Managerial Economics: NotesДокумент4 страницыIMT-20 Managerial Economics: NotesPrasanta Kumar NandaОценок пока нет

- Real Estate Development Great Reset ReviewДокумент9 страницReal Estate Development Great Reset ReviewNafisah FudaeelОценок пока нет

- HD Survive BustДокумент9 страницHD Survive BustRoland BrennerОценок пока нет

- IMT 20 Managerial Economics M3Документ3 страницыIMT 20 Managerial Economics M3solvedcareОценок пока нет

- The Housing Bubble Explained: What Is A Bubble?Документ12 страницThe Housing Bubble Explained: What Is A Bubble?f;ljas;ldfjОценок пока нет

- đất nước họcДокумент11 страницđất nước họcHương NgôОценок пока нет

- Interim ReportДокумент28 страницInterim ReportShekhar Saurabh BiswalОценок пока нет

- Five Ideas For A Budget For Growth: Laura ChappellДокумент8 страницFive Ideas For A Budget For Growth: Laura ChappellIPPRОценок пока нет

- The Great Depression Wheelock OverviewДокумент4 страницыThe Great Depression Wheelock OverviewNishant daripkarОценок пока нет

- The Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesОт EverandThe Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesРейтинг: 5 из 5 звезд5/5 (1)

- Five Ideas For A Budget For GrowthДокумент8 страницFive Ideas For A Budget For GrowthIPPRОценок пока нет

- Chap01 Tutorial AnsДокумент2 страницыChap01 Tutorial AnsLe Hong Phuc (K17 HCM)Оценок пока нет

- Finance and InvestmentДокумент4 страницыFinance and InvestmentThảo PhươngОценок пока нет

- Sol-0298commerce AnswersДокумент18 страницSol-0298commerce AnswersicewallowhaОценок пока нет

- Globalization and World EconomyДокумент3 страницыGlobalization and World EconomyAndrade Dos Lagos100% (1)

- Bubble: What Is A 'Bubble'Документ4 страницыBubble: What Is A 'Bubble'itika jainОценок пока нет

- Asset Allocation: Fall 2010: Olume CtoberДокумент30 страницAsset Allocation: Fall 2010: Olume Ctoberrichardck50Оценок пока нет

- Case Study The Great DepressionДокумент9 страницCase Study The Great DepressionBurak NaldökenОценок пока нет

- I. What Is Growth? Growth Vs Development: Definition of Economic GrowthДокумент4 страницыI. What Is Growth? Growth Vs Development: Definition of Economic GrowthchetanОценок пока нет

- Beyond The Credit Boom: Why Investing in Smaller Companies Is Not Only Responsible Capitalism But Better For Investors TooДокумент13 страницBeyond The Credit Boom: Why Investing in Smaller Companies Is Not Only Responsible Capitalism But Better For Investors TooIPPRОценок пока нет

- UK's Housing Boom - Is The Party Over?: by Jay Lakhani, President, Bindal FXДокумент4 страницыUK's Housing Boom - Is The Party Over?: by Jay Lakhani, President, Bindal FXPawan SharmaОценок пока нет

- Looking Up - May 2011: Comment and Analysis From Julian DobsonДокумент7 страницLooking Up - May 2011: Comment and Analysis From Julian DobsonJulian DobsonОценок пока нет

- The Next Great Bubble Boom: How to Profit from the Greatest Boom in History: 2От EverandThe Next Great Bubble Boom: How to Profit from the Greatest Boom in History: 2Оценок пока нет

- Islam and FinanceДокумент4 страницыIslam and FinancenasitОценок пока нет

- A. International Trade: Unit SixДокумент6 страницA. International Trade: Unit SixShoniqua JohnsonОценок пока нет

- A Comparison of Bubbles by John Chew - FinalДокумент7 страницA Comparison of Bubbles by John Chew - FinalJohn Aldridge Chew100% (1)

- Finnacial CrisiДокумент5 страницFinnacial Crisikarima salemОценок пока нет

- KRR 2 2 CanariesДокумент2 страницыKRR 2 2 Canariesosiris33ra8248Оценок пока нет

- Crash Proof Peter Schiff Interviews Jim RogersДокумент12 страницCrash Proof Peter Schiff Interviews Jim RogersDanny Danseco100% (1)

- 1892 Feb 28Документ3 страницы1892 Feb 28Eszter FórizsОценок пока нет

- Listening - GLOBALIZATIONДокумент4 страницыListening - GLOBALIZATIONBRISSA IVETT NARANJO LORENZOОценок пока нет

- How To Find Long-Run WinnersДокумент45 страницHow To Find Long-Run WinnersKrissy100% (2)

- What Does A Million Dollars BuyДокумент2 страницыWhat Does A Million Dollars BuyJuan Valbuena0% (1)

- Financial CrisisДокумент8 страницFinancial CrisisАнна РиякоОценок пока нет

- Grantham 4-25-11 Letter Part 1Документ19 страницGrantham 4-25-11 Letter Part 1wompyfratОценок пока нет

- Roots of The Current CrisisДокумент12 страницRoots of The Current CrisisMelanie O'HaganОценок пока нет

- Eichengreen Fetters of Gold and PaperДокумент32 страницыEichengreen Fetters of Gold and Papermercihey1467Оценок пока нет

- Bull Cat 4Документ66 страницBull Cat 4totochakraborty0% (1)

- How Secure Is The Global Financial System A Decade After The Crisis - McKinsey Set. 2018Документ11 страницHow Secure Is The Global Financial System A Decade After The Crisis - McKinsey Set. 2018GhaliОценок пока нет

- AjhfcevfxkДокумент6 страницAjhfcevfxkOdedeMapuaОценок пока нет

- Princeton Economics Archive Three-Faces-Inflation PDFДокумент3 страницыPrinceton Economics Archive Three-Faces-Inflation PDFadamvolkovОценок пока нет

- Economics Revision NotesДокумент33 страницыEconomics Revision NotesmehrajmОценок пока нет

- Global Eco-Political EnvironmentДокумент4 страницыGlobal Eco-Political EnvironmentElearnОценок пока нет

- 剑桥雅思7写作范文Документ10 страниц剑桥雅思7写作范文ooliu3411Оценок пока нет

- 1-23-12 More QE On The WayДокумент3 страницы1-23-12 More QE On The WayThe Gold SpeculatorОценок пока нет

- Gold N Silver Price Hikes!!Документ27 страницGold N Silver Price Hikes!!apurva2205Оценок пока нет

- Towards HyperinflationДокумент14 страницTowards Hyperinflationpaganrongs100% (1)

- Supply and Demand in CommoditiesДокумент8 страницSupply and Demand in CommoditiesRiaz AhmedОценок пока нет

- Eco - Economic BubblesДокумент9 страницEco - Economic BubblesHaiNgoОценок пока нет

- Prelim - Lesson 2 Economic GlobalizationДокумент7 страницPrelim - Lesson 2 Economic GlobalizationFeeОценок пока нет

- Top Ten Investments to Beat the Crunch!: Invest Your Way to Success even in a DownturnОт EverandTop Ten Investments to Beat the Crunch!: Invest Your Way to Success even in a DownturnОценок пока нет

- Business Ethics Now by Andrew GhillyerДокумент8 страницBusiness Ethics Now by Andrew GhillyerShuhada ShamsuddinОценок пока нет

- Marketing Intelligence & Planning: Article InformationДокумент26 страницMarketing Intelligence & Planning: Article InformationShuhada ShamsuddinОценок пока нет

- Case 1 - SolutionДокумент5 страницCase 1 - SolutionShuhada ShamsuddinОценок пока нет

- An Assessment of The Role of External Auditor in The Detection and Prevention of Fraud in Deposit Money Banks in Nigeria (2005-2014)Документ24 страницыAn Assessment of The Role of External Auditor in The Detection and Prevention of Fraud in Deposit Money Banks in Nigeria (2005-2014)Shuhada ShamsuddinОценок пока нет

- Bovee Bct13 Inppt 14Документ32 страницыBovee Bct13 Inppt 14Shuhada ShamsuddinОценок пока нет

- Bovee Bct13 Inppt 13Документ42 страницыBovee Bct13 Inppt 13Shuhada ShamsuddinОценок пока нет

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Документ27 страницLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- ATW108 Chapter 25 TutorialДокумент4 страницыATW108 Chapter 25 TutorialShuhada ShamsuddinОценок пока нет

- Part 1 Introduction To AccessДокумент11 страницPart 1 Introduction To AccessShuhada ShamsuddinОценок пока нет

- ATW108 Chapter 28 TutorialДокумент3 страницыATW108 Chapter 28 TutorialShuhada ShamsuddinОценок пока нет

- 2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivoДокумент2 страницы2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivopasferacosОценок пока нет

- SPC FD 00 G00 Part 03 of 12 Division 06 07Документ236 страницSPC FD 00 G00 Part 03 of 12 Division 06 07marco.w.orascomОценок пока нет

- Evidence Prove DiscriminationДокумент5 страницEvidence Prove DiscriminationRenzo JimenezОценок пока нет

- Bcom (HNRS) Project Final Year University of Calcutta (2018)Документ50 страницBcom (HNRS) Project Final Year University of Calcutta (2018)Balaji100% (1)

- Nantai Catalog NewДокумент30 страницNantai Catalog Newspalomos100% (1)

- 8 A - 1615864446 - 1605148379 - 1579835163 - Topic - 8.A.EffectiveSchoolsДокумент9 страниц8 A - 1615864446 - 1605148379 - 1579835163 - Topic - 8.A.EffectiveSchoolsYasodhara ArawwawelaОценок пока нет

- IR2153 Parte6Документ1 страницаIR2153 Parte6FRANK NIELE DE OLIVEIRAОценок пока нет

- 2500 Valve BrochureДокумент12 страниц2500 Valve BrochureJurie_sk3608Оценок пока нет

- XII CS Material Chap7 2012 13Документ21 страницаXII CS Material Chap7 2012 13Ashis PradhanОценок пока нет

- Chapter 5 Constructing An Agile Implementation PlanДокумент4 страницыChapter 5 Constructing An Agile Implementation PlanAHMADОценок пока нет

- Angle Modulation: Hệ thống viễn thông (Communication Systems)Документ41 страницаAngle Modulation: Hệ thống viễn thông (Communication Systems)Thành VỹОценок пока нет

- Kissoft 15,69,0.4Документ10 страницKissoft 15,69,0.4Daggupati PraveenОценок пока нет

- Test 2-Module 1 12-10-2017: VocabularyДокумент2 страницыTest 2-Module 1 12-10-2017: VocabularySzabolcs Kelemen100% (1)

- Test Bank For Psychology 6th Edition Don HockenburyДокумент18 страницTest Bank For Psychology 6th Edition Don HockenburyKaitlynMorganarwp100% (42)

- ST Arduino Labs CombinedДокумент80 страницST Arduino Labs CombineddevProОценок пока нет

- Literature Review Template DownloadДокумент4 страницыLiterature Review Template Downloadaflsigfek100% (1)

- Galgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesДокумент2 страницыGalgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesRohit Singh BhatiОценок пока нет

- Mecha World Compendium Playbooks BWДокумент12 страницMecha World Compendium Playbooks BWRobson Alves MacielОценок пока нет

- Simon Ardhi Yudanto UpdateДокумент3 страницыSimon Ardhi Yudanto UpdateojksunarmanОценок пока нет

- Session 1Документ18 страницSession 1Akash GuptaОценок пока нет

- SEILДокумент4 страницыSEILGopal RamalingamОценок пока нет

- Sla At&tДокумент2 страницыSla At&tCésar Lainez Lozada TorattoОценок пока нет

- Sample REVISION QUESTION BANK. ACCA Paper F5 PERFORMANCE MANAGEMENTДокумент43 страницыSample REVISION QUESTION BANK. ACCA Paper F5 PERFORMANCE MANAGEMENTAbayneh Assefa75% (4)

- Python in Hidrology BookДокумент153 страницыPython in Hidrology BookJuan david Gonzalez vasquez100% (1)

- Caring For Women Experiencing Breast Engorgement A Case ReportДокумент6 страницCaring For Women Experiencing Breast Engorgement A Case ReportHENIОценок пока нет

- A.meaning and Scope of Education FinalДокумент22 страницыA.meaning and Scope of Education FinalMelody CamcamОценок пока нет

- CHARACTER FORMATION 1 PrelimДокумент15 страницCHARACTER FORMATION 1 PrelimAiza Minalabag100% (1)

- CATaclysm Preview ReleaseДокумент52 страницыCATaclysm Preview ReleaseGhaderalОценок пока нет

- Enlightened ExperimentationДокумент8 страницEnlightened ExperimentationRaeed HassanОценок пока нет

- Lesson 1 3 Transes in Reading in Philippine HistoryДокумент17 страницLesson 1 3 Transes in Reading in Philippine HistoryNAPHTALI WILLIAMS GOОценок пока нет