Академический Документы

Профессиональный Документы

Культура Документы

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Загружено:

Shyam SunderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

iStreet Network Ltd.

ctN

L51 900t\4Hl 986P1C040232

513, Palmspring, Above Croma, Link Road, Malad West, Nlumbai 400064

Tel.: +91 22 42576767 Email : infQ@streetnetwork.com

-]d

istreet

'j

November 10,2016

To

The Department of Corporate Services

BSE Limited

Phiorze Jeejeebhoy Towers,

DalalStreet,

Mumbai- 400 001

Ref: Scrip code : 524622

Dear Sir/Madam,

Sub: Outcome of Board Meeting held today

This is to inform you that the Board of Directors of the Company at their meeting held today, have approved the

unaudited Results for the second quarter and halfyear ended September 30, 2016.

The copies of the results together with the Limited Review Report issued by the Auditors of the Company are

enclosed.

The meeting

ofthe Board of Directors ofthe Company commenced at 11.00 a.m and concluded at

Kindly take the same on record.J

Tha nking you,

Yours faithfully,

For

nka

Company Secrtary

1.30 p.m

istreet Network Limited

ctN 151900MH1986P1C040232

513, Palm Spring, Link Road, MaladWes! Mumbai 400 064 Website: 1^14.istreetneiwork.com

Phone_022 42s76767

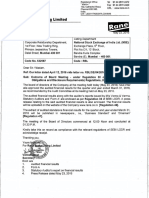

UNAUDITED FINANCIAL RESULTS fORTHE qUARTER AND HALF YEAR ENDED SOTH SEPTTMBER,20l6

sr.

30.09.2016

lncome from operations

a. Netsales/ hcomefrom operaiions

b. OtherOperatinslncome

Total lncome from operatio.s

:.

b,

c.

d.

e.

3

Purchaseof StockinTrade

changeininventories

EmplyeeBenefitlxpense

Depreciation&Amorti5ation

other Etpenditure

rotal Expenses la)+lb)+{c} +{d}+le)+(fl

P.ofit/(Lo5d t om oPerationt berore other income , fi..nce costs and

excptional items (r-2)

30,06,2016

1,722.69

5.10

7,A28.O7

7,727.79

1,032.82

L,6JO.24

964,09

2,54

20.66

15.01

!6.O7

4.08

111.-19

1,810.71

4.08

30.09.2015

30.09-16

2,750.76

30.09,15

510.48

31.03.2016

1,837.96

345.44

J.72

352.56

2,760.61

524.47

1,862,09

337.43

2.74

2,634.39

2a.20

494.62

6.21

1,77

30.23

31.03

3.81

8.16

1.54

z,aa7.5a

659,06

13.99

-10.32

-72.96

1,076.80

/.92

{13.66)

105.20

75.19

266 44

2,151.70

132.92)

(43.981

(66.07)

|.726.-921

(144.59)

{239.601

exce!tional iiems. {3+4)

{.82.-921

(43.98)

(66.07)

(1?6.92)

(144.s9)

(289.60)

Prorn/(Lo$)from ordinary activitie5 after finance.osts but befor

erceptionalitems,15 6)

(82.92)

(43.98)

(66.07)

(126.92)

(144.se)

(289.60)

9

10

Prott/(Los)

taz.ez;

(43.98)

(66.07)

1126.97)

(144.s9)

(arr.uo)

11

Net Profit/{Lost from ordinary activities after tax l9-10}

(82,92)

(oa.r")

tuu.ort

(126.92)

troo.rr)

lrrr.uot

tt."rl

(or.rr)

(66.07)

1726.921

11rr4.58)

{289.60)

(43.98)

(66.07)

825,00

{126.92)

844,00

(144.58)

(289.60)

Pront/{Los)from ordina.y a.tivities bero.e finance costs and

72

13

f rom

ordinary activities bef ore Tax

Net Pront/(Lo$lfor the Pe.iod from contineihs operaiions (u+121

Prof rl-os) f o' tne pefl od'rom oislor tinurn8 ooerur ons

actlit es

disoosalofassets

From ordrnarv

-on

15

16

t

"

Tar erpense on Profirfrom discontLnuinC oPeratior5

Profir/{Lo$) torrhe period from discontiiuinB operi'ionr art.r tar

lr4.151

i.

P.ont/(Los) for the peiod {13 + 16)

laz.92l

844.00

18

19

20

77

325,00

l(Netof 0ebit Balanceof Profit& Loss Account)

l-.f nc,pe'shdre{ParV. Jeqs.4ec!h)B-ror"Frtraord

I

I

ary tem

a,."

o

lrd.1irs,

pFr

'more15

P

(0.21)

(0.21)

(0.32)

(0.31)

(0.60)

(0.71)

(1.3e)

'(0.3e)

(0.60)

(0.6e)

(1.37)

(0.3e)

(0.21)

(0.32)

(0.60)

(0.71)

(1.39)

(0.39)

(0.21)

(0.31)

(0.60)

(0.6e)

(1.37)

4,741,L54

la,51a,186

a,741,154

9,4J0,932

L4,52\,2L4

\7,47J,454

12,029,068

{0.39)

rutea ,. '

(ha-

(Par

valL" Rs.4

ea(11)

8't4.00

(430.73)

Reserue ExcludinB Revaluation Resedes

After -^t'"ordilary

lrFr

14,5J4,146

10,090,709

ro,52r,2L4

11,009,291

and Promoier GroqF Sharehold ng

edeed/Encumbered

No. ofshares (in lact

'

Percentaseof sh es (as a%of Total sha.eholdins

of Plomoter and Promoter Group)

Percentase of shares las a % oiTotalShare c.p tal

Percentdge ofshares {a5 a% ofTotalShareholdlng

of Promoter and PromoterGroup)

Percentageof sharcs(asa%ofTotalshareCapital

Statement of Assts and

as at 3oth 5ptelnber,2016

31.03.2016

EOUIW ANO LIA8IIITIES

!.9!9!

Prsious period

There were no compl.inG pending atthe beginning of

year fisures have been

recasted, wherever appli*ble, to makethem comparable.

shareholdeB Funds

844.00

(607.6s)

(b) Reserves and surclus

444.00

(480-73)

Quanei; complaints received dJr.nC 2nd Qff

toans & Liabllitv

Complaints solved during 2nd Quarter NlL, complaints

Current Llabilities

3 rhe

14.30

(b) other curent Liabilities

s7.a6

LO,t7

84.13

308.51

457.57

above result h:s been reviewed bV the

commrllee and approved by he Bodrd ol Dre.toE in

meeting held on 10.11.2016

Non-Current Assets

5.40

27.60

(ii) lnbnglbleArsets

(b)Non-curent nvestmenG

Lois-Ierm

ended 30th September 2016

4 The

A!Sq!

(c)

Statutory Auditors of the company have

limited review of the results for the quarter and half

Loans and Advances

6.72

34.M

0.66

1.66

9.05

14.05

5,31

28,51

\.72

0.57

3.50

198,04

188.71

Current45set5

(c) ca5h and cash Equivalents

(d) short-Tem Loans and Adv:nces

(e) other currentA$ets

L79,47

457,57

Dated:10.11.2016

D N:00001959

rl

i

jHAWAR MANTRI & ASSOCIATES

CHARTERED ACCOUNTANTS

217, Great Eastern Galleria,

Plot No. 20, Sector 4,

Neru(, Navi Mumbai - 400 706.

Tel.

Telefax

email

022-27721467

022-27721557

jhawarmantrica@gmail.com

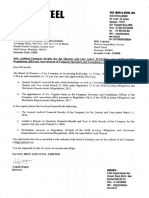

INDEPENDENT AUDITOR'S REVIEW REPORT ON REVIEW OF INTERIM

FINANCIAL RESULTS

.

TO THE BOARD OF DIRECTORS OF

ISTREET NETWORK LIMITED

We have reviewed the accompanying statement

unaudited financial results ("the

quarter and six months

statement") of iStreet Network Limited ("the Company") for

ended 30th September 2016, being submitted by the Company pursuant to the requirement of

Regulation 33 of

SEBI (Listing Obligation and Disclosure Requirements) Regulations,

2016,

2015 as modified by Circular No. CIRlCFD/FAC/62/2016 dated 5th

This Statement which is

responsibility the Company's Management and approved by

the Board of Directors, has been prepared in accordance with the recognition and

measurement principles laid down in the Indian Accounting Sta.ndard 34 "Interim Financial

Reporting" ("Ind AS 34"), prescribed under section 133 of the Companies Act, 2013 read

with relevant rules issued thereunder and other accounting principles generally accepted

India. Our responsibility is to issue a report on the statements based on our review.

We conducted our review

the Statements in accordance with the Standards on Review

Engagement (SRE) 2410, tfReview of Interim Financial Information perfonned by the

Independent Auditor the Entity" issued by the Institute of Chartered Accountants of India.

This Standard requires that we plan and perfoTIn the review to obtain moderate assurance as

to whether the financial statement is free of material misstatement. A review is limited

primarily to inquiries of company personnel and a.nalytical procedures applied to financial

data and thus provide less assurance than an audit. We have not performed an audit and

accordingly, we do not express an audit opinion.

Based on our review conducted as stated above, nothing has come to our attention that

causes us to believe that the accompanying statement prepared in accordance wiLh. the

aforesaid Indian Accounting Standards and other accounting pdnciples generally accepted in

has not disclosed the information required to be disclosed in terms of Regulation

of

the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as modified

by Circular No. CIRJCFDIFAC/62/2016 dated 5th July 2016, including the manner which

it is to be disclosed, or that it contains any material misstatement.

For Jhawar Mantri & Associates

Chartered Accountants

Firm Reg. No. 113""...,...,."....... ___

th

Date: 10 November, 2016

Place: Navi Mumbai

. Ma.ntri

Partner

M. No. 045701

Вам также может понравиться

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ11 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ10 страницStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ7 страницFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ8 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Документ8 страницFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Документ6 страницFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ8 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ7 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ12 страницStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ7 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ11 страницStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- 06-Infra & Property DevelopmentДокумент9 страниц06-Infra & Property Developmentmadhura_454Оценок пока нет

- Shalby Limited reports Q2 FY20 resultsДокумент12 страницShalby Limited reports Q2 FY20 resultsKhush GosraniОценок пока нет

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ8 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ8 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ7 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Mutual Fund Holdings in DHFLДокумент7 страницMutual Fund Holdings in DHFLShyam SunderОценок пока нет

- JUSTDIAL Mutual Fund HoldingsДокумент2 страницыJUSTDIAL Mutual Fund HoldingsShyam SunderОценок пока нет

- Order of Hon'ble Supreme Court in The Matter of The SaharasДокумент6 страницOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderОценок пока нет

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedДокумент2 страницыSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderОценок пока нет

- Financial Results For Mar 31, 2014 (Result)Документ2 страницыFinancial Results For Mar 31, 2014 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- HINDUNILVR: Hindustan Unilever LimitedДокумент1 страницаHINDUNILVR: Hindustan Unilever LimitedShyam SunderОценок пока нет

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Документ1 страницаPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderОценок пока нет

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliДокумент5 страницExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderОценок пока нет

- Financial Results For June 30, 2014 (Audited) (Result)Документ3 страницыFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderОценок пока нет

- Financial Results For Dec 31, 2013 (Result)Документ4 страницыFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedДокумент2 страницыSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2013 (Audited) (Result)Документ2 страницыFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For September 30, 2013 (Result)Документ2 страницыFinancial Results For September 30, 2013 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Acct Statement XX2938 16082023Документ5 страницAcct Statement XX2938 16082023Ganga YadavОценок пока нет

- Dani Martinez: Work ExperienceДокумент1 страницаDani Martinez: Work ExperienceNoura GamalОценок пока нет

- 7 P'sДокумент4 страницы7 P'sSumit ChandraОценок пока нет

- Cru Rental StudentДокумент19 страницCru Rental StudentRowann AwsmmОценок пока нет

- Ias 15Документ23 страницыIas 15Harsh KhandelwalОценок пока нет

- Nani FA1st (Theory)Документ4 страницыNani FA1st (Theory)Vikram NaniОценок пока нет

- Supply Chain Management in E-CommerceДокумент9 страницSupply Chain Management in E-CommerceAbhishek AgarwalОценок пока нет

- Cambridge IGCSE: Accounting 0452/13Документ12 страницCambridge IGCSE: Accounting 0452/13Khaled AhmedОценок пока нет

- Marketing Plan for Adidas Analyzes Segmentation, 4Ps, and Relationship StrategiesДокумент13 страницMarketing Plan for Adidas Analyzes Segmentation, 4Ps, and Relationship StrategiesDenis DobreОценок пока нет

- Confident Guidance CG 09-2013Документ4 страницыConfident Guidance CG 09-2013api-249217077Оценок пока нет

- EC611 - (CH 06) Production Theory & EstimationДокумент33 страницыEC611 - (CH 06) Production Theory & Estimationsilverster_123Оценок пока нет

- Case Analysis: Digital Age GamesДокумент1 страницаCase Analysis: Digital Age GamesJanine NicoleОценок пока нет

- Beljot, Lally Manlapat: Class #: 6Документ2 страницыBeljot, Lally Manlapat: Class #: 6Vivian Loraine BorresОценок пока нет

- Introduction To Operations ManagementДокумент16 страницIntroduction To Operations Managementgelay parmaОценок пока нет

- LenovoДокумент5 страницLenovoamin233Оценок пока нет

- Case Avon LorealДокумент9 страницCase Avon LorealimadОценок пока нет

- Appraisal - Cost ApproachДокумент4 страницыAppraisal - Cost ApproachBaguma Grace GariyoОценок пока нет

- SW One DXP Cost Sheet (4.5BHK+Utility) Phase 2Документ1 страницаSW One DXP Cost Sheet (4.5BHK+Utility) Phase 2assetcafe7Оценок пока нет

- Marketing Mix: The 4Ps FrameworkДокумент8 страницMarketing Mix: The 4Ps FrameworkjonaОценок пока нет

- 5 - Strategic Cost ManagementДокумент38 страниц5 - Strategic Cost ManagementJovelle AlcoberОценок пока нет

- VII Financial PlanДокумент36 страницVII Financial PlanAndrea Jane FaustinoОценок пока нет

- Audit Risk and Materiality Multiple Choice QuestionsДокумент18 страницAudit Risk and Materiality Multiple Choice QuestionsSamit Tandukar100% (1)

- Cfas 1-4 First QuizДокумент165 страницCfas 1-4 First QuizDona Kris GumbanОценок пока нет

- Construction Carpenter Business PlanДокумент35 страницConstruction Carpenter Business PlanjweremaОценок пока нет

- International Business Case StudyДокумент280 страницInternational Business Case Studyukqualifications89% (9)

- OFW taxi business planДокумент3 страницыOFW taxi business planLawrence Bugtong50% (2)

- Branding and Special Focus On Toon BrandingДокумент84 страницыBranding and Special Focus On Toon Brandingsowndaryan mОценок пока нет

- Brand Management and Digital MarketingДокумент20 страницBrand Management and Digital MarketingSatya ReddyОценок пока нет

- RFM Notes-Commercial and SMEДокумент8 страницRFM Notes-Commercial and SMEmuneebmateen01Оценок пока нет

- Grade 12 Office Administration Graded WorksheetДокумент5 страницGrade 12 Office Administration Graded WorksheetMildred C. WaltersОценок пока нет