Академический Документы

Профессиональный Документы

Культура Документы

HRA Payroll

Загружено:

Bhavik BhattАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

HRA Payroll

Загружено:

Bhavik BhattАвторское право:

Доступные форматы

HR WorkWays

Page 1 of 3

All the proofs have to be uploaded using the scan image option using the link "Upload IPSF Proof Images". Any proofs that are

dropped in the IPSF drop-box will not be accounted. Please ensure to consolidate all the images of your investment proofs; scan

the duly signed IPSF form & annexures (if any); create a ZIP file & upload.

Hewlett Packard Globalsoft Private Limited

Investment Proofs Submission Form for the Year 2016-2017

Employee ID * 60106737

Name *

Bhavik Bhatt

PAN *

Gender *

IPSF ID : 0094813046

Date of Joining

No. of Children going to School *

ALUPB7201M

No. of Children going to Hostel *

Section A - Rent Paid for claiming HRA exemption (Only Rent Receipts will be considered)

From Date

To Date

23/11/2016

As Per Last

Declaration

Address

C 105, Ittina Mahavir, Neelandri Road, Opp Moriz Restauran

31/03/2017 t, Electronic City Phase 1, Karnataka 560100, Bangalore,BAN

GALORE,KARNATAKA

Rent Paid Per

Month

14000.00

Section B - Chapter VI A - Deductions from Total Income

0 Medical Insurance Premium (U/s 80D)

0 Medical Insurance Premium (U/s 80D) - Parents not being Senior Citizens

0 Medical Insurance Premium (U/s 80D) - Parents being Senior Citizens

0 Medical Treatment/Handicapped Dependent (U/s 80DD) < 80%

0 Medical Treatment/Handicapped Dependent (U/s 80DD) > 80%

0 Interest on Educational Loan (U/s 80E)

0 Permanent Physical Disability (80U) < 80%

0 Permanent Physical Disability Severe Disabilitty (80U) > 80%

0 Rajiv Gandhi Equity Savings Scheme (80CCG)

0 Medical Treatment of Specified Diseases (80DDB)

0 Additional NPS Employee Contribution(80CCD1B)

Section C - Chapter VIA - Section 80C

Rent Paid Per

Year

59733.00

23/11/2016

0

0

PAN of

Landlord

ATXPD4354L

Value of Proof Attached.

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0 Contribution to Pension Fund ( 80CCC )

0.00

0 National Savings Certificate (NSC)

0.00

0 Public Provident Fund (PPF)

0 Infrastructure Bonds

0 Children Education Tuition fees

0 Equity Linked Savings Scheme (ELSS)

0 Mutual Funds

0 Unit Linked Insurance Plan

0 5 Year Deposit under Senior Citizen Saving Scheme

0 Cumulative Term Deposits

0 NPS Employee Contribution

0 Sukanya Samriddhi Scheme

0 5 Year Time Deposit in Post Office

0 Fixed Deposit Scheme (Block Period of 5 yrs)

0 NSC Interest (Will also be considered as Other Income)

Section G - Other Income

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0 Bank Interest (excluding interest on savings account)

0.00

0 Pension

0.00

0 Interest on Deposits in Savings Account (Considered as deduction u/s 80TTA upto Rs.10000)

0 Others

https://ess.excelityglobal.com/EPSF/EPSF_Report_FY_09_10.jsp?cuen=null

0.00

0.00

12/13/2016

HR WorkWays

Page 2 of 3

Declaration:

1. I hereby declare that I have read and understood the guidelines provided in 'Proofs Option Document' and that, all

information,documents provided

above is true and correct in all respects.

2. I also undertake to indemnify the company for any loss/ liability that may arise, in the event of any incorrect

information ,documents

provided by me.

Date:

Place:

Signature of Employee * ________________________________

* Indicates mandatory fields as per our database. Please verify the same and if blank, please fill and submit the form.

https://ess.excelityglobal.com/EPSF/EPSF_Report_FY_09_10.jsp?cuen=null

12/13/2016

HR WorkWays

Page 3 of 3

FORM NO.12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee

Bhavik Bhatt

3. Financial year

2016-2017

2. Permanent Account Number of the employee ALUPB7201M

Sl.

Nature of claim

No.

1

Details of claims and evidence thereof

Amount Evidence /

(Rs.)

particulars

House Rent Allowance

(i) Rent paid to the landlord : Rs.59733

(ii) Name of the landlord

Mani Kanchan Das

(iii) Address of the landlord

Rs.59733

232 Kumardubi, East Singbhunm Distric, Jharkhand 832101

House Rent

Receipts

(iv) Permanent Account Number of the landlord

ATXPD4354L

Note: Permanent Account Number shall be furnished if the aggregate rent paid during

the previous year exceeds one lakh rupees

Leave travel concessions or assistance

Deduction of interest on borrowing:

Rs.0

Travel

Receipts/Tickets

Rs.0.0

Provisional

Certificate from

Bank/Financial

Institution/Lender

Rs. 0.0

Photocopy of the

investment

proofs

(i)Interest payable/paid to the lender

3

(ii) Name of the lender

(iii) Address of the lender

(iv)Permanent Account Number of the lender

(a) Financial Institutions

(b) Employer

(c) Others

Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

4

(i) Section 80C

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

(a) Additional NPS Employee Contribution(80CCD1B)

Verification

:

: Rs.0

I, Bhavik Bhatt ,son/daughter of Kirit Bhatt . do hereby certify that the information given above is complete and correct

Place : Bangalore

Date : 13/12/2016

Designation :ITO Svc Delivery Cons II

(Signature of the

employee)

Full Name:Bhavik Bhatt

Note: The information/details above, as required for deduction of tax u/s 192 of the Income Tax Act,

has been entered by the employee through an authorized login on the portal. The information

submitted above is deemed to be e-signed by the employee.

https://ess.excelityglobal.com/EPSF/EPSF_Report_FY_09_10.jsp?cuen=null

12/13/2016

Вам также может понравиться

- Marathon Invoice PDFДокумент1 страницаMarathon Invoice PDFBhavik BhattОценок пока нет

- CEHv9 Exam Questions 1 To 200Документ61 страницаCEHv9 Exam Questions 1 To 200itzamurd0rkОценок пока нет

- 3 IPR and Cyberspace PDFДокумент120 страниц3 IPR and Cyberspace PDFBhavik BhattОценок пока нет

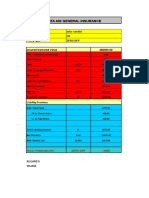

- Tata Aig Zero DepДокумент4 страницыTata Aig Zero DepBhavik BhattОценок пока нет

- 1 - Fundamentals of Cyber Law PDFДокумент135 страниц1 - Fundamentals of Cyber Law PDFJPYADAV27Оценок пока нет

- CCNP NotesДокумент12 страницCCNP NotesBhavik BhattОценок пока нет

- Installation Guide: Nortel Ethernet Routing Switch 4500 SeriesДокумент72 страницыInstallation Guide: Nortel Ethernet Routing Switch 4500 SeriesJasir AbdullaОценок пока нет

- VLAN Trunking Protocol (VTP)Документ15 страницVLAN Trunking Protocol (VTP)Alaa Eddin100% (2)

- Exit Form EmployeeДокумент4 страницыExit Form EmployeeBhavik BhattОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Court upholds collection on promissory notesДокумент11 страницCourt upholds collection on promissory notesJocelyn Desiar NuevoОценок пока нет

- ING Groep Jaarverslag 2012 PDFДокумент383 страницыING Groep Jaarverslag 2012 PDFsiebrand982Оценок пока нет

- Chattel Mortgage Law: Christian Arbiol San Beda College Alabang School of LawДокумент187 страницChattel Mortgage Law: Christian Arbiol San Beda College Alabang School of LawYieMaghirangОценок пока нет

- Practice Set - A3Документ6 страницPractice Set - A3Dayanara VillanuevaОценок пока нет

- Factors Affecting Growth of Plastic Money in PakistanДокумент5 страницFactors Affecting Growth of Plastic Money in PakistanArafat IslamОценок пока нет

- Quy Trình Hàng SEAДокумент4 страницыQuy Trình Hàng SEAVũMinhОценок пока нет

- Financing Your Franchised BusinessДокумент17 страницFinancing Your Franchised BusinessDanna Marie BanayОценок пока нет

- Annex 41 Notes To SK FS - CabangtalanДокумент2 страницыAnnex 41 Notes To SK FS - CabangtalanLikey PromiseОценок пока нет

- Johnson, E. J. Zeldes, S. P. (2015) - Keep The Change - Bank of Americas Savings ProgramДокумент9 страницJohnson, E. J. Zeldes, S. P. (2015) - Keep The Change - Bank of Americas Savings ProgramfrancinederbyОценок пока нет

- Convert Purchases to EMIs on LIC Credit CardДокумент2 страницыConvert Purchases to EMIs on LIC Credit CardvijaykannamallaОценок пока нет

- ACC112 Midterm RevisionДокумент17 страницACC112 Midterm Revisionhabdulla_2Оценок пока нет

- Sawadjaan Vs CA PDFДокумент9 страницSawadjaan Vs CA PDFRodney AtibulaОценок пока нет

- Critical Assessment of Performance of Mergers and AcquisitionsДокумент12 страницCritical Assessment of Performance of Mergers and AcquisitionsThe IjbmtОценок пока нет

- Chan Wan v. TanДокумент35 страницChan Wan v. TanSharmaine Sur100% (1)

- Pawnor's rights in a pledgeДокумент5 страницPawnor's rights in a pledgeovkgascrediff100% (1)

- Future ValueДокумент2 страницыFuture ValuezeyyahjiОценок пока нет

- Gravity Payments Salary AnalysisДокумент13 страницGravity Payments Salary AnalysisGhanshyam ThakkarОценок пока нет

- Objective Type Questions On ForexДокумент22 страницыObjective Type Questions On ForexMonu kumarОценок пока нет

- Spouses Francisco Sierra, Et Al Vs PAIC Savings and Mortgage Bank Inc, G.R. No. 197857Документ7 страницSpouses Francisco Sierra, Et Al Vs PAIC Savings and Mortgage Bank Inc, G.R. No. 197857Janskie Mejes Bendero LeabrisОценок пока нет

- Factoring and FoerfaitingДокумент34 страницыFactoring and FoerfaitingKuntal DasОценок пока нет

- Supreme Court: CIR v. Marubeni Corp. G.R. No. 137377Документ12 страницSupreme Court: CIR v. Marubeni Corp. G.R. No. 137377Jopan SJОценок пока нет

- Bank Rakyat's Al-Tawarruq Based Vehicle FinancingДокумент4 страницыBank Rakyat's Al-Tawarruq Based Vehicle FinancingNABILAH SYAHBUDINОценок пока нет

- WEIR010958 SuperCrypto 1 Online ReportДокумент7 страницWEIR010958 SuperCrypto 1 Online ReportBill100% (1)

- NPS Return 15052012 Credit Date May 01 To May 14 2012Документ302 страницыNPS Return 15052012 Credit Date May 01 To May 14 2012Yashpal TalanОценок пока нет

- WorkbookДокумент84 страницыWorkbookTheinfiniteroarОценок пока нет

- Meriton Suites BookingДокумент3 страницыMeriton Suites BookingJoshua HarperОценок пока нет

- Batunanggar, Indonesian Banking Crisis Resolution: Lessons Learnt and The Way ForwardДокумент25 страницBatunanggar, Indonesian Banking Crisis Resolution: Lessons Learnt and The Way ForwardMuhammad Arief Billah100% (2)

- G.R. No. 153134Документ2 страницыG.R. No. 153134Dan LocsinОценок пока нет

- Credit Cards Boon or BaneДокумент12 страницCredit Cards Boon or BaneJohn NashОценок пока нет

- Credit-Led Micro Finance in TamaleДокумент15 страницCredit-Led Micro Finance in Tamaledawuda72100% (1)