Академический Документы

Профессиональный Документы

Культура Документы

Conjugal Partnership of Gains

Загружено:

ChaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Conjugal Partnership of Gains

Загружено:

ChaАвторское право:

Доступные форматы

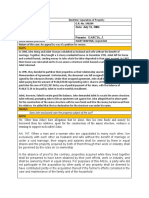

CONJUGAL PARTNERSHIP OF GAINS

(cases with * means they are repeat cases; person who is assigned to said case will again report the said case)

1. Belcodero vs. CA

2. Spouses Estonina vs.

CA

3. Quiao vs. Quiao

4. Orpiano vs. Tomas

5. Castro vs. Miat

6. Titan vs. David

Art. 160 -All property of the marriage is presumed to belong to the

conjugal partnership, unless it be proved that it pertains exclusively

to the husband or to the wife.

Given in the case that Alayo Bosing had legal impediment because

his marriage with Juliana is subsisting, his property cannot be

governed by Art. 144 but by Art. 160.

The presumption in Art. 160 that all property of the marriage

belongs to the conjugal property applies only when there is proof

that the property was acquired during the marriage.The mere fact

that the title was issued when the spouses were already married is

not sufficient proof of conjugality especially where there was no

proof as to when the property was acquired.

CPG shall be the presumed property relations in marriages

contracted under the Civil Code or in absence of an agreed

property relations.

Since at the time of the exchange of marital vows, the operative law

was the Civil Code and since they did not agree on a marriage

settlement, the property relations between the petitioner and the

respondent is the system of relative community or CPG.

Article 119 of the Civil Code - In the absence of marriage

settlements, or when the same are void, the system of relative

community or conjugal partnership of gains as established in this

Code, shall govern the property relations between husband and

wife

Consent of other spouse is required in sale of conjugal property.

The absence of the consent of one spouse to a sale renders the

entire sale null and void, including the portion of the conjugal

property pertaining to the spouse who contracted the sale.

The property is conjugal because it was purchased during Moises

and Concordias marriage. Even though it was made on installment

basis and the purchase was finalized after Concordias death, it is

still conjugal because what applies here would be Article 153(1) of

the Civil Code.

Art. 153 (1) of the Civil Code - All property acquired by onerous

title during the marriage is considered conjugal. Purchasing on

installment is considered onerous title because onerous means

burdensome, an installment payment imposes a burden on a

person to pay regularly.

The property was bought during the time of marriage thus the

presumption is that it is conjugal property, thus not requiring the

husband to furnish financial proof that he had the financial capacity

to buy it.

Art. 116 of the Family Code - all property acquired during the

marriage, whether the acquisition appears to have been made,

contracted or registered in the name of one or both spouses, is

presumed to be conjugal unless the contrary is proved.

Art. 117 (1) of the Family Code - Those acquired by onerous title

during the marriage at the expense of the common fund, whether

the acquisition be for the partnership, or for only one of the

7. Imani vs. Metrobank

8. Dewara vs. Lamela

9. Lim vs. Equitable PCI

Bank

10. Laperal vs. Katigbak

11. Francisco vs. CA

12. Tan vs. Andrade

13. Veloso vs. Martinez

14. Berciles vs. GSIS

15. Plata vs. Yatco

spouses.

All property of the marriage is presumed to be conjugal. However,

for this presumption to apply, the party who invokes it must first

prove that the property was acquired during the marriage. Proof of

acquisition during the coverture is a condition sine qua non to the

operation of the presumption in favor of the conjugal partnership.

Thus, the time when the property was acquired is material.

The presumption of conjugality of property is overturned only by

proper evidence. Even after having classified a property as

conjugal, it does not necessarily follow that it may automatically be

levied upon in an execution to answer for debts, obligations, fines,

or indemnities of one of the spouses. Before debts and obligations

may be charged against the conjugal partnership, it must be shown

that the same were contracted for, or the debts and obligations

should have redounded to, the benefit of the conjugal partnership.

Allegations of forgery, like all other allegations, must be proved by

clear, positive, and convincing evidence by the party alleging it. In

the present case, petitioner failed to provide sufficient proof of

forgery. As for the absence of his wifes signature, it has no bearing

in the case, as the nature of the property was never raised as an

issue.

All property of the marriage is presumed to be conjugal, unless it is

shown that it is owned exclusively by the husband or the wife.

The husband cannot bind the paraphernal property unless its

administration has been transferred to him, which wasnt the case.

Neither can the paraphernal property be made to answer for debts

incurred by the husband.

Property already owned by a spouse prior to the marriage, and

subsequently brought to the marriage, is considered as his or her

separate property. Acquisitions by lucrative title refer to properties

acquired gratuitously and include those acquired by either spouse

during the marriage by inheritance, devise, legacy, or donation.

The party who invokes the presumption of Art. 160 of the Civil Code

which provides that all property of the marriage is presumed to

belong to the conjugal partnership must first prove that the

property in controversy was acquired during the marriage.

All property of the marriage is presumed to belong to the conjugal

partnership, unless it be proved that it pertains exclusively to the

husband or to the wife.

The party who invokes the presumption of Art. 160 of the Civil Code

which provides that all property of the marriage is presumed to

belong to the conjugal partnership must first prove that the

property in controversy was acquired during the marriage.

Jewelry Inherited from her mother is the sole and separate property

of the wife. She had the exclusive control and management of the

same, until and unless she had delivered it to her husband, before

a notary public, with the intent that the husband might administer it

properly.

Retirement premiums are presumed conjugal property, if there is no

proof that the premiums were paid from the exclusive funds of the

deceased spouse.

The parcel of land that Plata acquired while she was single was

sold to Saldana and was later on resold to Plata, married to

Begosa. They mortgaged the land to Villanueva for a loan. It was

16. Laurena vs. CA

17. Veloso vs. Martinez*

18. Manotok Realty vs. CA

19. Ong vs. CA

20. Wong et al. vs. IAC

21. Dewara vs. Lamela*

held that the parcel of land is Platas exclusive property.

Art. 109 (3) of the Family Code- The following shall be the

exclusive property of each spouse:

(3) That which is acquired by right of redemption, by barter or by

exchange with property belonging to only one of the spouse.

The properties that were from the parents of a spouse is excluded

from the CPG.

Art. 109 (1-2) of the Family Code - The following shall be the

exclusive property of each spouse:

(1) That which is brought to the marriage as his or her own.

(2) That which each acquires during the marriage by gratuitous title.

Jewelry Inherited from her mother is the sole and separate property

of the wife. She had the exclusive control and management of the

same, until and unless she had delivered it to her husband, before

a notary public, with the intent that the husband might administer it

properly.

There is nothing in the records that show that Don Vicente Legarda

was the administrator of the paraphernal properties of Dona Clara

Tambunting during the lifetime of the latter.

Art. 136 of the Civil Code the wife retains the ownership of the

paraphernal property.

Art. 137 of the Civil Code The wife shall have the administration

of the paraphernal property, unless she delivers the same to the

husband by means of a public instrument empowering him to

administer it.

The mere use of the surname of the husband in the tax declaration

of the subject property is not sufficient proof that said property was

acquired during the marriage and is therefore conjugal. It is

undisputed that the subject property was declared solely in the

wifes name, but the house built thereon was declared in the name

of the spouses. Under such circumstances, coupled with a careful

scrutiny of the records of the present case, the lot in question is

paraphernal.

The party who invokes the presumption of Art. 160 of the Civil Code

which provides that all property of the marriage is presumed to

belong to the conjugal partnership must first prove that the

property in controversy was acquired during the marriage.

In the determination of the nature of a property acquired by a

person during marriage, the controlling factor is the source of the

money utilized in the purchase.

The presumption of the conjugal nature of the properties subsists in

the absence of clear, satisfactory and convincing evidence to

overcome said presumption or to prove that the properties are

exclusively owned by the spouse.

In the present case, it is unclear where Romanico obtained the

money to pay his loan to his officemate. Thus, the presumption is

that it is from the conjugal property.

The conjugal properties cannot answer for Katrinas obligations as

she exclusively incurred the latter without the consent of her

husband nor they did redound to the benefit of the family. There

was also no evidence submitted that the administration of the

partnership had been transferred to Katrina by Romarico before

said obligations were incurred.

The presumption of conjugality of property is overturned only by

22. De La Pea vs. Avila

23. Quiao vs. Quiao*

24, Villanueva vs. CA

25. Mendoza vs. Reyes

26. Aguete vs. PNB

proper evidence. Even after having classified a property as

conjugal, it does not necessarily follow that it may automatically be

levied upon in an execution to answer for debts, obligations, fines,

or indemnities of one of the spouses. Before debts and obligations

may be charged against the conjugal partnership, it must be shown

that the same were contracted for, or the debts and obligations

should have redounded to, the benefit of the conjugal partnership.

Pursuant to Article 160 of the Civil Code, all property of the

marriage is presumed to belong to the conjugal partnership, unless

it be proved that it pertains exclusively to the husband or to the

wife. Although it is not necessary to prove that the property was

acquired with funds of the partnership, proof of acquisition during

the marriage is an essential condition for the operation of the

presumption in favor of the conjugal partnership.

This presumption of conjugality is rebuttable, but only with strong,

clear and convincing evidence; there must be a strict proof of

exclusive ownership of one of the spouses.

When a couple enters into a regime of conjugal partnership of

gains under Article 142 of the Civil Code, the husband and the wife

place in common fund the fruits of their separate property and

income from their work or industry, and divide equally, upon the

dissolution of the marriage or of the partnership, the net gains or

benefits obtained indiscriminately by either spouse during the

marriage.

Thus, each couple has his or her own property and debts.

Mixture or merger of separate debts or property between the

spouses is not contemplated in CPG; thus, it established complete

separation of capitals.

Art. 116 of the Family Code.The tax declarations are not

sufficient proof to overcome the presumption under Art. 116 of the

Family Code. All property acquired by the spouses during the

marriage, regardless in whose name the property is registered, is

presumed conjugal unless proved otherwise. The presumption is

not rebutted by the mere fact that the certificate of title of the

property or the tax declaration is in the name of one of the spouses

only. Article 116 of the Family Code expressly provides that the

presumption remains even if the property is registered in the name

of one or both of the spouses.

Conjugal nature of property not destroyed even if property

registered in the name of only one of the spouses; Reason.

Property acquired during a marriage is presumed to be conjugal

and the fact that the land is later registered in the name of only one

of the spouses does not destroy its conjugal nature. Property

acquired during marriage was registered in the name of the

husband alone does not affect its conjugal nature, neither does

registration in the name of the wife. Any person who buys land

registered in the married name of the wife is put on notice about its

conjugal nature.

In the present case, the theory that the property bought from the

personal funds of the wife was negated by the fact that the funds

were also invested by husband and wife in their other business.

Art. 153. The following are conjugal partnership property:

(1) That which is acquired by onerous title during the marriage at

the expense of the common fund, whether the acquisition be for the

27. Jovellanos vs. CA

28. Munoz Jr. vs. Ramirez

29. Padilla vs. Padilla

30. Padilla vs. Paterno

31. Coingco vs. Flores

partnership, or for only one of the spouses.

(2) That which is obtained by the industry, or work, or as salary of

the spouses, or of either of them.

(3) The fruits, rents or interests received or due during the

marriage, coming from the common property or from the exclusive

property of each spouse.

Art. 160. All property of the marriage is presumed to belong to the

conjugal partnership, unless it be proved that it pertains exclusively

to the husband or to the wife.

Generally, ownership is transferred upon delivery, but even if

delivered, the ownership may still be with the seller until full

payment is made, if there is stipulation to this effect in the terms of

sale. This stipulation is known as puctum reservati dominii, or

contractual reservation of title. Compliance with the stipulated

payments is a suspensive condition, meaning that failure to comply

prevents the vendors obligation to convey title from acquiring

binding force.

When the cost of the improvement and any resulting increase in the

value are more than the value of the property at the time of the

improvement, the entire property shall belong to the conjugal

partnership, subject to reimbursement; otherwise, the property shall

be retained in ownership by the owner-spouse, likewise subject to

reimbursement for the cost of improvement.

Mere construction of a building from common funds does not

automatically convey the ownership of the wife's land to the

conjugal partnership. Before the payment of the value of the land is

made from common funds, all the increases or decreases in its

value must be for her benefit or loss and she can only demand

payment after the conjugal partnership is liquidated.

The Supreme Court maintains that however small the value of the

buildings at the time of the demolition, considering the principles of

justice and equity, it still should be reimbursed to the wife.

In the present case, ownership of the land is retained by the wife

until she is paid the value of the lot, as result of the liquidation of

conjugal partnership.

Where the acquisition by the partnership of certain properties was

subject to the suspensive condition that their values would be

reimbursed to the widow on the liquidation of the conjugal

partnership, once paid, the effects of the fulfillment of the condition

should be deemed to retroact to the date of the obligation was

constituted. Consequently, all the fruits of these properties, after the

dissolution of the partnership by the death of the husband, until

final partition, logically belonged to the universal heir of said

husband and to the surviving widow in co-ownership, share and

share alike.

If there were buildings erected on the lands which were

paraphernal personal property of the appellee during the latters

marriage with the appellant, and such buildings were destroyed by

reason of the recent war, before the liquidation of the conjugal

partnership of both spouses, it is obvious that the conjugal

partnership did not ipso facto acquire the land from the time of the

construction of the buildings, so as to make afterwards the land

without any buildings a conjugal property irrespective of the result

of the liquidation of the conjugal partnership.

32. Mariano vs. CA

33. Ayala Investment vs.

CA

34. Ching vs. CA

35. Homeowners vs. Dailo

36. Ando vs. Campo

The husband of the judgment debtor cannot be deemed a stranger

to the case prosecuted and adjudged against his wife. Considering

that the wife had engaged in business with her husbands consent,

and the income derived therefrom had been expended, in part at

least, for the support of her family, the liability of the conjugal

assets to respond for the wifes obligations in the premises cannot

be disputed.

The loan obtained by the husband from AIDC was for the benefit of

PBM and not for the benefit of the conjugal partnership of Ching.

If the money or services are given to another person or entity, and

the husband acted only as a surety or guarantor, that contract

cannot, by itself, alone be categorized as falling within the context

of obligations for the benefit of the conjugal partnership.

In the present case, the contract of loan or services is clearly for

the benefit of the principal debtor and not for the surety or his

family. No presumption can be inferred that, when a husband

enters into a contract of surety or accommodation agreement, it is

for the benefit of the conjugal partnership. Proof must be

presented to establish benefit redounding to the conjugal

partnership.

All the properties acquired during the marriage are presumed to

belong to the conjugal partnership, unless it be proved that it

pertains exclusively to the husband, or to the wifeas long as the

properties were acquired by the parties during the marriage, they

are presumed to be conjugal in nature.

To make a conjugal partnership responsible for a liability that

should appertain alone to one of the spouses is to frustrate the

objective of the Family Code to show the utmost concern for the

solidarity and well-being of the family as a unit. The husband is

denied the power to assume unnecessary and unwarranted risks to

the financial stability of the conjugal partnership; No presumption

can be inferred from the fact that when the husband enters into an

accommodation agreement or a contract of surety, the conjugal

partnership would thereby be benefited.

Art. 121 (3) of the Family Code, the conjugal partnership shall be

liable for:

(3) Debts and obligations contracted by either spouse without the

consent of the other to the extent that the family may have

benefited.

In Conjugal Partnership of Gains, the spouses must have

knowledge and consent of the sale of property.

The burden of proof that the debt was contracted for the benefit of

the conjugal partnership of gains lies with the creditor-party litigant

claiming as such. Ei incumbit probatio qui dicit, non qui negat (he

who asserts, not he who denies, must prove).

Where the property belongs to petitioner and his wife, and not to

the corporation of which the petitioner is president, it can be said

that the property belongs to the conjugal partnership, a third party,

or, at the very least, the Court can consider that petitioners wife is

a third party within the contemplation of the law.

The husband being the agent of the corporation, is therefore is not

a stranger to the case such that the provision on third-party claims

will not apply to him, the property was registered not only in the

name of petitioner but also of his wife. She stands to lose the

37. G-Tractors vs. CA

38. Ong vs. CA*

39. Ayala Investment vs.

CA*

40. Security Bank vs. Mar

Tiera Corp.

property subject of execution without ever being a party to the

case. This will be tantamount to deprivation of property without due

process.

The power of the NLRC, or the courts, to execute its judgment

extends only to properties unquestionably belonging to the

judgment debtor alone. A sheriff, therefore, has no authority to

attach the property of any person except that of the judgment

debtor. Likewise, there is no showing that the sheriff ever tried to

execute on the properties of the corporation.

The conjugal partnership must equally bear the indebtedness of the

husband in pursuit of his career or profession and his losses from a

legitimate business.

The husband is the administrator of the conjugal partnership and as

long as he believes he is doing right to his family, he should not be

made to suffer and answer alone. So that, if he incurs an

indebtedness in the legitimate pursuit of his career or profession or

suffers losses in a legitimate business, the conjugal partnership

must equally bear the indebtedness and the losses, unless he

deliberately acted to the prejudice of his family.

There is no rule or law requiring that in a suit against the husband

to enforce an obligation, either pertaining to him alone or one

chargeable against the conjugal partnership, the defendant

husband must be joined by his wife.

There is no presumption that the family benefited when the

spouses are in fact separated.

The loan obtained by the husband from AIDC was for the benefit of

PBM and not for the benefit of the conjugal partnership of Ching.

If the money or services are given to another person or entity, and

the husband acted only as a surety or guarantor, that contract

cannot, by itself, alone be categorized as falling within the context

of obligations for the benefit of the conjugal partnership.

In the present case, the contract of loan or services is clearly for

the benefit of the principal debtor and not for the surety or his

family. No presumption can be inferred that, when a husband

enters into a contract of surety or accommodation agreement, it is

for the benefit of the conjugal partnership. Proof must be

presented to establish benefit redounding to the conjugal

partnership.

Art. 161(1) of the Civil Code - the conjugal partnership is liable for

all debts and obligations contracted by the husband for the benefit

of the conjugal partnership.

In acting as a guarantor or surety for another, the husband does not

act for the benefit of the conjugal partnership as the benefit is

clearly intended for a third party.

If the husband himself is the principal obligor in the contract, i.e.,

the direct recipient of the money and services to be used in or for

his own business or profession, the transaction falls within the term

obligations for the benefit of the conjugal partnership. In other

words, where the husband contracts an obligation on behalf of the

family business, there is a legal presumption that such obligation

redounds to the benefit of the conjugal partnership.

On the other hand, if the money or services are given to another

person or entity and the husband acted only as a surety or

guarantor, the transaction cannot by itself be deemed an obligation

41. Aguete vs. PNB*

42. Costuna vs. Domondon

43. Carlos vs. Abelardo

for the benefit of the conjugal partnership. It is for the benefit of the

principal debtor and not for the surety or his family.

Debts contracted by a spouse for and in the exercise of the industry

or profession by which he contributes to the support of the family

cannot be deemed to be his exclusive private debts. Hence, the

debt is chargeable to the conjugal partnership.

As a general rule, the sale of conjugal property by one spouse

without the consent of the other is invalid as the other spouses

consent is necessary.

However, in this case, the consent of Estela was unreasonably

withheld by her. The Court is constrained to relax the application of

the law, and consider the sale falling within the legal exceptions to

the general rule.

The conjugal partnership shall be liable for all debts and obligations

contracted by the husband for the benefit of the conjugal

partnership, and those contracted by the wife, also for the same

purpose, in the cases where she may legally bind the partnership.

A loan obtained to purchase the conjugal dwelling can be charged

against the conjugal partnership if it has redounded to the

benefit of the family.

44. Villanueva vs. Chiong

45. Ravina vs. Villa-Abrille

46. Fuentes vs. Roca

Where the husband contracts obligations in behalf of the family

business the law presumes and rightly that such obligation will

redound to the benefit of the conjugal partnership

Where the cnjugal property was sold by the husband without the

consent of the wife, even if they were separated in fact prior to the

selling, the deed of sale should be annulled as the wife had not

given her consent to it. (Sale was done before FC)

Art. 166 of the Civil Code - that the husband cannot alienate or

encumber the property without the wifes consent.

Art. 167 of the Civil Code - if a property was indeed encumbered by

the husband absent the wifes consent, the wife may file for

annulment of the contract, during the marriage, within 10 years

from the transaction.

The deed of sale covering the conjugal property is void due to the

absence of the consent of the wife. Since the sale was concluded

after the effectivity of the Family Code, what applies then is Art. 124

of the Family Code.

Art. 124 of the Family Code disposition of conjugal property is

void if it is done without:

(a) the consent of both the husband and the wife, or

(b) in case of one of the spouses inability, the authority of the court.

Additionally, the Court stated that Art 124 only contemplated that it

is only in the administration and enjoyment of the conjugal

partnership where the husbands decision shall prevail, if in case of

disagreement

Disposition of conjugal property made without the consent of the

other spouse is void.The death of the other spouse does not

prevent the heirs to question the validity of such disposition.

In a case where consent of the other spouse was obtained through

forgery, the disposition of the conjugal property is not void by virtue

of the forgery, but rather because of the absence of the consent of

the other spouse.

The action or defense for the declaration of the inexistence of the

contract does not prescribe.

47. People vs. Lagrimas

48. Pana vs. Heirs of

Juanite

49. Guiang vs. CA

50. Roxas vs. CA

51. Docena v Lapesura

52. Alinas vs. Alinas

53. Aggabao vs. Parulan

Fines and indemnities upon either husband or wife may be

enforced against the partnership assets after the responsibilities

enumerated in Art. 161 of the Civil Code have been covered, if the

spouse who is bound should have no exclusive property or if it

should be sufficient.

The civil indemnity that the decision in the murder case imposed on

the wife may be enforced against their conjugal assets after the

responsibilities enumerated in Art. 121 of the Family Code have

been covered. Art. 121 allows payment of the criminal indemnities

imposed on the wife out of the partnership assets even before

these are liquidated. It states that such indemnities may be

enforced against the partnership assets after the responsibilities

enumerated in the preceding article have been covered. No prior

liquidation of those assets is required. This is not altogether unfair

since Art. 122 states that at the time of the liquidation of the

partnership, such offending spouse shall be charged for what has

been paid for the purposes above-mentioned.

The sale of the conjugal property requires the consent of both the

husband and the wife. The absence of the consent of one renders

the sale null and void, while the vitiation thereof makes it merely

voidable. Only in the latter case can ratification cure the defect.

Even if the husband is administrator of the conjugal partnership,

administration does not include acts of ownership. For while the

husband can administer the conjugal assets unhampered, he

cannot alienate or encumber the conjugal realty. Thus, the joinder

of the wife, although unnecessary for an oral lease of conjugal

realty which does not exceed one year in duration, is required in a

lease of conjugal realty for a period of more than one year. In case

the wife's consent is not secured by the husband as required by

law, the wife has the remedy of filing an action for the annulment of

the contract.

Under the Family Code, the administration of the conjugal property

belongs to the husband and the wife jointly. However, unlike an act

of alienation or encumbrance where the consent of both spouses is

required, joint management or administration does not require that

the husband and wife always act together. Each spouse may validly

exercise full power of management alone, subject to the

intervention of the court in proper cases.

In the event that one spouse is incapacitated or otherwise unable to

participate in the administration of the conjugal properties, the other

spouse may assume sole powers of administration. These powers

do not include the powers of disposition or encumbrance which

must have the authority of the court or the written consent of the

other spouse. In the absence of such authority or consent the

disposition or encumbrance shall be void.

Art. 124 of the Family Code - the administration and enjoyment of

the conjugal partnership property shall belong to both spouses

jointly.

Art. 124 of the Family Code categorically requires the consent of

both spouses before the conjugal property may be disposed of by

sale, mortgage, or other modes of disposition.

Standard to determine the good faith of the buyers dealing with a

seller who had title to and possession of the land but whose

capacity to sell was restricted: that the consent of the other spouse

54. Uy vs. CA

55. Sabalones vs. CA

56. Cheeseman vs. IAC

57. Frenzel vs. Catito

was required before the conveyance, declaring that in order to

prove good faith in such a situation, the buyers must show that they

inquired not only into the title of the seller but also into the sellers

capacity to sell.

Thus, the buyers of conjugal property must observe two kinds of

requisite diligence, namely:

(a) the diligence in verifying the validity of the title covering the

property;

(b) the diligence in inquiring into the authority of the transacting

spouse to sell conjugal property in behalf of the other spouse.

The procedural rules on summary proceedings in relation to Article

124 of the Family Code are not applicable when the nonconsenting spouse is incapacitated to give consent. Hence, the

proper remedy was the appointment of a judicial guardian of the

person or estate or both of such incompetent.

The law provides that the wife who assumes sole powers of

administration has the same powers and duties as a guardian. In

this case, the wife who desires to sell real property as administrator

of the conjugal property must observe the procedure for the sale of

the wards estate required of judicial guardians under Rule 95 of the

1964 Revised Rules of Court and not the summary judicial

proceedings under the Family Code.

Furthermore, the Court held that absent an opportunity to be heard,

the decision rendered by the trial court is void for lack of due

process and may be assailed or impugned at any time either

directly or collaterally.

While spouses have joint administration over the conjugal

properties, Art. 61 of the Family Code also states that after a

petition for legal separation has been filed, the trial court shall, in

the absence of a written agreement between the couple, appoint

either one of the spouses or a third person to act as the

administrator.

In the case at bar, no formal designation of the administrator has

been made, such designation was implicit in the decision of the trial

court denying the husband any share in the conjugal properties

which also provides that he is disqualified to act as the

administrator. The designation was in effect approved by the CA

when it issued in favor of the respondent wife.

The foreigner husband has no capacity or personality to question

the sale of the property because it would be an indirect

contraversion of the constitutional prohibition. Aliens are prohibited

from acquiring lands of the public domain. Hence, Cheesemans

defense that he is merely exercising his right as a husband in

respect to the conjugal property is unmeritorious. If the property

were to be declared conjugal, this would accord to the alien

husband not insubstantial interest and right over land, as he would

then have a decisive vote as to its transfer or disposition. Even if

the wife did use conjugal funds to make the acquisition, his

recovering and holding the property cannot be warranted as it is

against the constitution.

A contract that violates the Constitution and the law is null and void

and vests no rights and creates no obligations. It produces no legal

effect at all. The petitioner, being a party to an illegal contract,

cannot come into a court of law and ask to have his illegal objective

58. Ravina vs. Villa-Abrille

59. Siochi vs. Gozon

60. Fuentes vs. Roca*

61. Aguete vs. PNB*

62. Flores vs. Lindo

63. Novares vs. Novares

64. Partosa-Jo vs. CA

carried out. One who loses his money or property by knowingly

engaging in a contract or transaction which involves his own moral

turpitude may not maintain an action for his losses.

Art 124 only contemplated that it is only in the administration and

enjoyment of the conjugal partnership where the husbands

decision shall prevail, if in case of disagreement, which is still

subject to recourse to the court by the wife to be availed within five

years from the date of the decision, this however, as the Court

stated does not apply to the disposition or encumbrance of the

property, which, as previously mentioned, requires :

(a) the consent of both the husband and the wife, or

(b) in case of one of the spouses inability, the authority of the court.

Disposition of conjugal property made without the consent of the

other spouse is void.The death of the other spouse does not

prevent the heirs to question the validity of such disposition.

In a case where consent of the other spouse was obtained through

forgery, the disposition of the conjugal property is not void by virtue

of the forgery, but rather because of the absence of the consent of

the other spouse.

The action or defense for the declaration of the inexistence of the

contract does not prescribe.

A spouse cannot alienate or encumber any conjugal real property

without the consent, express or implied, of his spouse. Should one

party do so, then the contract is voidable. Annulment will be

declared only upon a finding that the other party did not provide

consent.

Separation in fact for one year as a ground to grant a judicial

separation of property was not tackled in the trial courts decision

because, the trial court erroneously treated the petition as

liquidation of the absolute community of properties.

Having established that Leticia and David had actually separated

for at least one year, the petition for judicial separation of absolute

community of property should be granted.

The grant of the judicial separation of the absolute community

property automatically dissolves the absolute community regime,

as stated in the 4th paragraph of Article 99 of the Family Code.

A spouse is deemed to have abandoned the other when he or she

has left the conjugal dwelling without any intention of returning. The

spouse who has left the conjugal dwelling for a period of three

months or has failed within the same period to give any information

as to his or her whereabouts shall be prima facie presumed to have

no intention of returning to the conjugal dwelling. (Art. 128 of FC)

Abandonment implies a departure by one spouse with the avowed

intent never to return, followed by prolonged absence without just

cause, and without in the meantime providing in the least for one's

family although able to do so. There must be absolute cessation of

marital relations, duties and rights, with the intention of perpetual

separation. This idea is clearly expressed in the above-quoted

provision, which states that a spouse is deemed to have

abandoned the other when he or she has left the conjugal dwelling

without any intention of returning.

The physical separation of the parties, coupled with the refusal by

65. Novares vs. Novares*

66. Heirs of Go vs.

Servacio

67. Ugalde vs Ysasi

68. Lavadia vs. Heirs of

Luna

69. Noveras vs. Noveras*

70. Tarrosa vs. De Leon

the private respondent to give support to the petitioner, sufficed to

constitute abandonment as a ground for the judicial separation of

their conjugal property.

There was no abandonment in this case to necessitate judicial

separation of properties under Article 135 (4) of the Family Code.

Abandonment, under Art. 101 of the Family Code must be for a

valid cause and the spouse is deemed to have abandoned the

other when he/she has left the conjugal dwelling without intention of

returning.

The intention of not returning is prima facie presumed if the

allegedly abandoning spouse failed to give any information as to

his or her whereabouts within the period of three months from such

abandonment.

Art. 126 (1) of the Family Code -The conjugal partnership

terminates: (1) Upon the death of either spouse.

Art. 130 of the Family Code - Upon the termination of the marriage

by death, the conjugal partnership property shall be liquidated in

the same proceeding for the settlement of the estate of the

deceased.

If no judicial settlement proceeding is instituted the surviving

spouse shall liquidate the conjugal partnership property either

judicially or extra-judicially within one year from the death of the

deceased spouse. Is upon the lapse of the six month period no

liquidation is made, any disposition or encumbrance involving the

conjugal partnership property of the terminated marriage shall be

void.

Should the surviving spouse contract a subsequent marriage

without compliance with the foregoing requirements, a mandatory

regime of complete separation of properties shall govern the

property relations of the subsequent marriage.

A co-owner could sell his undivided share.

Under Article 175 of the Civil Code, the judicial separation of

property results in the termination of the conjugal partnership of

gains. Hence, the finality of the Amicable Settlement approving the

parties' separation of property resulted in the termination of the

conjugal partnership of gains.

Petitioner who is the second wife of deceased cannot claim death

benefits as it was a bigamous marriage entered. Art. 148 of the FC

governs their property relations (co-ownership through actual joint

contribution.)

However, Art 147 governs the property relations belonging to the

first wife (co-ownership in equal shares) despite the marriage being

void for lack of marriage license.

Having established that Leticia and David had actually separated

for at least one year, the petition for judicial separation of absolute

community of property should be granted.

The grant of the judicial separation of the absolute community

property automatically dissolves the absolute community regime,

as stated in the 4th paragraph of Art. 99 of the Family Code.

Art. 99 (4) of the Family Code - the absolute community terminates:

(4) In case of judicial separation of property during the marriage

under Articles 134 to 138.

The sale of one-half of the conjugal property without liquidation of

the partnership is void. Prior to the liquidation of the conjugal

71. Cabreza vs. Cabreza

72. Quiao vs. Quiao*

partnership, the interest of each spouse in the conjugal assets is

inchoate, a mere expectancy, which constitutes neither a legal nor

an equitable estate, and does not ripen into a title until it appears

that there are assets in the community as a result of the liquidation

and settlement. The interest of each spouse is limited to the net

remainder resulting from the liquidation of the affairs of the

partnership after its dissolution.

Art. 129 (9) of the Family Code - Upon the dissolution of the

conjugal partnership regime, the following procedure shall apply:

(9) In the partition of the properties, the conjugal dwelling and the

lot on which it is situated shall, unless otherwise agreed upon by

the parties, be adjudicated to the spouse with whom the majority of

the common children choose to remain. Children below the age of

seven years are deemed to have chosen the mother, unless the

court has decided otherwise. In case there is no such majority, the

court shall decide taking into consideration the best interests of

said children.

In Art 129 of the Family Code, it presupposes the husband and wife

has more than one property aside from the conjugal dwelling. In

case spouses have more properties, these properties are liquidated

and divided but the conjugal dwelling will be given to the spouse

whom majority of the children will reside. However, if there is only

one conjugal property, the property will be sold and liquidated.

Procedures for dissolution provided by Family Code shall be

applied when marriage was dissolved, separated, or annulled

during the effectivity of the Family Code even though the marriage

was contracted under the Civil Code.

Since at the time of the dissolution of the petitioner and the

respondents marriage the operative law is already the Family

Code, the same applies in the instant case and the applicable law

in so far as the liquidation of the conjugal partnership assets and

liabilities is concerned is Art. 129 of the Family Code in relation to

Art. 63 (2) of the Family Code.

73. Barrido vs. Nonato

74. Noveras vs. Noveras*

Liquidation follows the dissolution of the absolute

community regime, following the procedure in Art.

102 of the Family Code.

75. Santero vs. CFI

Since the provision of the Civil Code, a substantive law, gives the

surviving spouse and to the children the right to receive support

during the liquidation of the estate of the deceased, such right

cannot be impaired by Rule 83 Sec. 3 of the Rules of Court which

is a procedural rule. Note however that with respect to "spouse,"

the same must be the "legitimate spouse" and not common-law

spouses who are the mothers of the children here.

Вам также может понравиться

- Ching v. GoyankoДокумент2 страницыChing v. GoyankoNicole KalingkingОценок пока нет

- (08.F.11.d.01) Ugalde vs. YsasiДокумент2 страницы(08.F.11.d.01) Ugalde vs. YsasiDar CoronelОценок пока нет

- Spouses Medina Vs Dr. Venancia L. Makabali (1969)Документ2 страницыSpouses Medina Vs Dr. Venancia L. Makabali (1969)Uc ItlawОценок пока нет

- Gotardo v. BulingДокумент3 страницыGotardo v. BulingJosef MacanasОценок пока нет

- Case Digest - Jarillio v. PeopleДокумент2 страницыCase Digest - Jarillio v. PeopleMiguel Joshua Gange AguirreОценок пока нет

- 29.1 Seguisabal Vs Cabrera DigestДокумент2 страницы29.1 Seguisabal Vs Cabrera DigestEstel TabumfamaОценок пока нет

- Jocson V RoblesДокумент2 страницыJocson V RoblesArgel CosmeОценок пока нет

- 052.bankers Association of The Phils. v. COMELECДокумент3 страницы052.bankers Association of The Phils. v. COMELECKarla BeeОценок пока нет

- G02 Persons Digest Sept 7, 2018Документ136 страницG02 Persons Digest Sept 7, 2018Jappy AlonОценок пока нет

- Moe Vs DinkinsДокумент1 страницаMoe Vs DinkinsJerich HorrillenoОценок пока нет

- Digests For PFRДокумент62 страницыDigests For PFRJanine CastroОценок пока нет

- Constitution Construction MethodsДокумент4 страницыConstitution Construction MethodsJohn WeeklyОценок пока нет

- People vs. ZapataДокумент5 страницPeople vs. ZapataDani McstОценок пока нет

- Fr. Rene Ronulo Marriage RulingДокумент2 страницыFr. Rene Ronulo Marriage RulingCarl AngeloОценок пока нет

- PERSONS AND FAMILY RELATIONS QUESTIONNAIREДокумент5 страницPERSONS AND FAMILY RELATIONS QUESTIONNAIRECamille Angelica GonzalesОценок пока нет

- 28 People V TirolДокумент19 страниц28 People V TirolJimbo ManiriОценок пока нет

- What constitutes benefit to family in conjugal partnership loansДокумент2 страницыWhat constitutes benefit to family in conjugal partnership loansGC EleccionОценок пока нет

- Lupo Atienza V Judge BrillantesДокумент2 страницыLupo Atienza V Judge BrillantesAlexandraSoledadОценок пока нет

- Midterm Exam: Skip To ContentДокумент11 страницMidterm Exam: Skip To ContentAllen SoОценок пока нет

- Legal Separation Defenses-When To FileДокумент2 страницыLegal Separation Defenses-When To Filecmv mendozaОценок пока нет

- Court Clarifies Omission in Decision on Separation of Conjugal PropertyДокумент11 страницCourt Clarifies Omission in Decision on Separation of Conjugal Propertyyannie11Оценок пока нет

- Persons Reviewer PDFДокумент25 страницPersons Reviewer PDFFroilan Richard RamosОценок пока нет

- 10 Gotardo Vs Buling, G.R. No. 165166, August 15, 2012Документ2 страницы10 Gotardo Vs Buling, G.R. No. 165166, August 15, 2012Perry YapОценок пока нет

- Marriages: Valid, Void, Voidable and Legal SeparationДокумент11 страницMarriages: Valid, Void, Voidable and Legal SeparationMaria Katrinna IglesiasОценок пока нет

- Civil Code - Annotated by ParasДокумент36 страницCivil Code - Annotated by ParasPam MiraflorОценок пока нет

- Crimpro Cases 1Документ35 страницCrimpro Cases 1Kim Angelie TapicОценок пока нет

- 149.1 Matute vs. Macadaeg DigestДокумент1 страница149.1 Matute vs. Macadaeg DigestEstel TabumfamaОценок пока нет

- CASE DIGEST FOR Manuel VДокумент1 страницаCASE DIGEST FOR Manuel VDivineDionneОценок пока нет

- PFR Reviewer (Midterms)Документ37 страницPFR Reviewer (Midterms)Jewelito de GuzmanОценок пока нет

- Case DigestДокумент3 страницыCase DigestMikee RañolaОценок пока нет

- Ong v. Ong (Art. 56)Документ2 страницыOng v. Ong (Art. 56)CareenОценок пока нет

- Quiao Vs QuiaoДокумент1 страницаQuiao Vs QuiaoJoseMarellaОценок пока нет

- Madridejo V de LeonДокумент7 страницMadridejo V de LeonHowieking15Оценок пока нет

- Abrenica Vs AbrenicaДокумент1 страницаAbrenica Vs AbrenicaThereseSunicoОценок пока нет

- Block 4 2015 PFR Midterms Reviewer PDFДокумент28 страницBlock 4 2015 PFR Midterms Reviewer PDFDenise GordonОценок пока нет

- People of The Philippines, Appellee, vs. Victoriano DELA CRUZ y LORENZO, AppellantДокумент1 страницаPeople of The Philippines, Appellee, vs. Victoriano DELA CRUZ y LORENZO, AppellantRamon Carlo GuicoОценок пока нет

- Villanueva Vs Villanueva - G.R. No. 29959. December 3, 1929Документ2 страницыVillanueva Vs Villanueva - G.R. No. 29959. December 3, 1929Ebbe Dy0% (1)

- PFR CasesДокумент15 страницPFR CasesMarie CruzОценок пока нет

- 3 DM Consunji vs. CAДокумент1 страница3 DM Consunji vs. CAJoshua Alexander CalaguasОценок пока нет

- SC upholds death penalty for Muslim man who stabbed wife due to her infidelityДокумент2 страницыSC upholds death penalty for Muslim man who stabbed wife due to her infidelityZoe VelascoОценок пока нет

- G-Tractors vs. CAДокумент1 страницаG-Tractors vs. CAM Grazielle EgeniasОценок пока нет

- People v. de JesusДокумент3 страницыPeople v. de JesusSnep MediaОценок пока нет

- Persons HW # 6Документ19 страницPersons HW # 6Pouǝllǝ ɐlʎssɐОценок пока нет

- Mariano v. Court of Appeals, Which Was Later Adopted in Spouses Ching v. Court of Appeals, This Court Held That The Husband ofДокумент1 страницаMariano v. Court of Appeals, Which Was Later Adopted in Spouses Ching v. Court of Appeals, This Court Held That The Husband ofJoana Arilyn CastroОценок пока нет

- 182 People vs. LagrimasДокумент2 страницы182 People vs. LagrimasDanielle Sophia GardunoОценок пока нет

- (A2) LAW 121 - Endencia and Jugo vs. David, Etc. (G.R. No. 6355-56)Документ2 страницы(A2) LAW 121 - Endencia and Jugo vs. David, Etc. (G.R. No. 6355-56)mОценок пока нет

- Zulueta V. Pan-Am (January 8, 1973) : Digest By: Jedd Hernandez D 2015 Persons and Family Relations Prof. K. LegardaДокумент2 страницыZulueta V. Pan-Am (January 8, 1973) : Digest By: Jedd Hernandez D 2015 Persons and Family Relations Prof. K. LegardalabellejolieОценок пока нет

- Navarro v. DomagtoyДокумент1 страницаNavarro v. DomagtoyAlcala SofiaОценок пока нет

- Costuna vs. Domondon Deed of Sale UpheldДокумент2 страницыCostuna vs. Domondon Deed of Sale UpheldRiva Mae CometaОценок пока нет

- Mercado V Mercado (Tan)Документ3 страницыMercado V Mercado (Tan)DAblue Rey100% (2)

- Persons Doctrine: Separation of Property Title: Abing Vs Waeyan G.R. No. 146294Документ2 страницыPersons Doctrine: Separation of Property Title: Abing Vs Waeyan G.R. No. 146294nikol crisangОценок пока нет

- NERISSA Z. PEREZ, Petitioner, vs. THE COURT OF APPEALS (Ninth Division) and RAY C. PEREZ, RespondentsДокумент4 страницыNERISSA Z. PEREZ, Petitioner, vs. THE COURT OF APPEALS (Ninth Division) and RAY C. PEREZ, Respondentsmaan leyvaОценок пока нет

- CSC Chairman membership in GOCC boardsДокумент1 страницаCSC Chairman membership in GOCC boardsRein GallardoОценок пока нет

- 204 Moe v. Dinkins SeneresДокумент2 страницы204 Moe v. Dinkins SeneresChescaSeñeresОценок пока нет

- Effect and Application of Laws in the PhilippinesДокумент18 страницEffect and Application of Laws in the PhilippinesRad IsnaniОценок пока нет

- People Vs AlburquerqueДокумент2 страницыPeople Vs AlburquerqueKJPL_1987Оценок пока нет

- Santos Sr vs CA custody dispute over minor sonДокумент2 страницыSantos Sr vs CA custody dispute over minor sonFoo BarОценок пока нет

- Uy Vs CA, GR #109557, November 29, 2000Документ3 страницыUy Vs CA, GR #109557, November 29, 2000Loren Delos SantosОценок пока нет

- PFR FinalsДокумент13 страницPFR FinalsYza Cruz0% (1)

- Mathews Vs TaylorДокумент4 страницыMathews Vs TaylorStephen JacoboОценок пока нет

- Marfil Case Doctrines PDFДокумент17 страницMarfil Case Doctrines PDFKit CruzОценок пока нет

- Deed of DonationДокумент2 страницыDeed of DonationChaОценок пока нет

- Tax 2 QAДокумент15 страницTax 2 QAChaОценок пока нет

- Promoting Environmental Protection and Future Generations' RightsДокумент4 страницыPromoting Environmental Protection and Future Generations' RightsChaОценок пока нет

- Individual Block Enlistment Sheet (Ibes) SUBMIT BY 2359, JUNE 18, 2019, TUESDAYДокумент3 страницыIndividual Block Enlistment Sheet (Ibes) SUBMIT BY 2359, JUNE 18, 2019, TUESDAYChaОценок пока нет

- Case#27 - Testate Estate of Felicidad Esguerra Alto-Yap DeceasedДокумент2 страницыCase#27 - Testate Estate of Felicidad Esguerra Alto-Yap DeceasedChaОценок пока нет

- Digest Compilation (43-80)Документ45 страницDigest Compilation (43-80)ChaОценок пока нет

- LRTA Vs Venus Case DigestДокумент5 страницLRTA Vs Venus Case DigestJonaz EnriquezОценок пока нет

- Property Ampil Accession Charts C 1 1Документ3 страницыProperty Ampil Accession Charts C 1 1ChaОценок пока нет

- Labor RRRRR Kinds of EmployeesДокумент6 страницLabor RRRRR Kinds of EmployeesChaОценок пока нет

- 13 - MT. Carmel College, Bishop Labayen and Salud vs. NLRC and BaezДокумент1 страница13 - MT. Carmel College, Bishop Labayen and Salud vs. NLRC and BaezChaОценок пока нет

- Proxy Appointment for GLACE, Inc. Shareholders' MeetingДокумент1 страницаProxy Appointment for GLACE, Inc. Shareholders' MeetingChaОценок пока нет

- Marbury v. Madison establishes judicial reviewДокумент42 страницыMarbury v. Madison establishes judicial reviewChaОценок пока нет

- Case#27 - Testate Estate of Felicidad Esguerra Alto-Yap DeceasedДокумент2 страницыCase#27 - Testate Estate of Felicidad Esguerra Alto-Yap DeceasedChaОценок пока нет

- Escheat proceedings require proper notice and publicationДокумент57 страницEscheat proceedings require proper notice and publicationChaОценок пока нет

- Legend International Resorts Limited V. Kilusang Manggagawa NG Legenda (Kml-Independent)Документ11 страницLegend International Resorts Limited V. Kilusang Manggagawa NG Legenda (Kml-Independent)ChaОценок пока нет

- No writs of amparo or habeas data for property disputeДокумент10 страницNo writs of amparo or habeas data for property disputeChaОценок пока нет

- Proxy Appointment for GLACE, Inc. Shareholders' MeetingДокумент1 страницаProxy Appointment for GLACE, Inc. Shareholders' MeetingChaОценок пока нет

- IP Legal BasisДокумент4 страницыIP Legal BasisChaОценок пока нет

- No writs of amparo or habeas data for property disputeДокумент10 страницNo writs of amparo or habeas data for property disputeChaОценок пока нет

- Done - Deed of Assignment of SharesДокумент2 страницыDone - Deed of Assignment of SharesChaОценок пока нет

- Proxy Appointment for GLACE, Inc. Shareholders' MeetingДокумент1 страницаProxy Appointment for GLACE, Inc. Shareholders' MeetingChaОценок пока нет

- 29 - Maya Farms Employees Org v. NLRC - BacinaДокумент2 страницы29 - Maya Farms Employees Org v. NLRC - BacinaChaОценок пока нет

- Labor Legal BasisДокумент10 страницLabor Legal BasisChaОценок пока нет

- (Labor 2 - Atty. Nolasco) : G.R. No. 130866. September 16, 1998 Ponente: Digest By: BACINAДокумент1 страница(Labor 2 - Atty. Nolasco) : G.R. No. 130866. September 16, 1998 Ponente: Digest By: BACINAChaОценок пока нет

- Samahan NG Manggagawa Sa Hanjin Shipyard v. Bureau of Labor RelationsДокумент8 страницSamahan NG Manggagawa Sa Hanjin Shipyard v. Bureau of Labor RelationsChaОценок пока нет

- 16 - Lazatin v. Hon. Campos, JR., Nora L. de LeonДокумент2 страницы16 - Lazatin v. Hon. Campos, JR., Nora L. de LeonCha100% (1)

- Tax RemediesДокумент14 страницTax RemediesCha100% (3)

- 06 - Holcim Phils. v. ObraДокумент3 страницы06 - Holcim Phils. v. ObraChaОценок пока нет

- Labor Trending 2017 PDFДокумент15 страницLabor Trending 2017 PDFChaОценок пока нет

- CASE #1 Firestone v. CAДокумент2 страницыCASE #1 Firestone v. CApistekayawaОценок пока нет

- GST RETURN GUIDEДокумент9 страницGST RETURN GUIDESanthosh K SОценок пока нет

- Constitution of GermanyДокумент9 страницConstitution of GermanyAamir Hussain100% (1)

- Portfolio On Philippine Politics and Governance: 1 Quarter, 1 SemesterДокумент18 страницPortfolio On Philippine Politics and Governance: 1 Quarter, 1 SemesterDexter SaladinoОценок пока нет

- University study explores ethics case against lawyerДокумент3 страницыUniversity study explores ethics case against lawyerParitosh Rachna GargОценок пока нет

- Lanuza V de Leon in REДокумент3 страницыLanuza V de Leon in REIna VillaricaОценок пока нет

- Powell Conditions of ReleaseДокумент3 страницыPowell Conditions of ReleasegramabozoОценок пока нет

- Checklist of Bid Documents (Goods)Документ2 страницыChecklist of Bid Documents (Goods)Julius Caesar Panganiban100% (1)

- BED 3 - Monthly Disbursement ProgramДокумент4 страницыBED 3 - Monthly Disbursement ProgramMark Joseph BajaОценок пока нет

- Presentation of Financial Statements Standard for Philippine Public SectorДокумент18 страницPresentation of Financial Statements Standard for Philippine Public SectorAnonymous bEDr3JhGОценок пока нет

- Analysis of India's Juvenile Justice SystemДокумент7 страницAnalysis of India's Juvenile Justice SystemMike WalterОценок пока нет

- Effect of Persons in Possession of Real Estate Other Than The Owner/Vendor On A Buyer's Status As A Bona Fide Purchaser - Arizona State Court CasesДокумент32 страницыEffect of Persons in Possession of Real Estate Other Than The Owner/Vendor On A Buyer's Status As A Bona Fide Purchaser - Arizona State Court Casesrichdebt100% (1)

- Williams v. Mayor of Baltimore, 289 U.S. 36 (1933)Документ9 страницWilliams v. Mayor of Baltimore, 289 U.S. 36 (1933)Scribd Government DocsОценок пока нет

- Federalism and Friction in Centre State Relation: A Crtical AnalysisДокумент23 страницыFederalism and Friction in Centre State Relation: A Crtical AnalysisPrashantKumar100% (1)

- TESDA DPA Manual ApprovedДокумент3 страницыTESDA DPA Manual ApprovedBimbo GilleraОценок пока нет

- Robin Hood in Reverse: The Case Against Taking Private Property For Economic Development Cato Policy Analysis No. 535Документ24 страницыRobin Hood in Reverse: The Case Against Taking Private Property For Economic Development Cato Policy Analysis No. 535Cato InstituteОценок пока нет

- SK AgarwalДокумент14 страницSK AgarwalAmit WaskelОценок пока нет

- ComplaintДокумент44 страницыComplaintAnne Schindler100% (1)

- Access Control To GMP AreaДокумент4 страницыAccess Control To GMP AreaNishit SuvaОценок пока нет

- PDF Upload 370898Документ51 страницаPDF Upload 370898VimleshОценок пока нет

- COMELEC upholds disqualification of Laguna governor over campaign violationsДокумент89 страницCOMELEC upholds disqualification of Laguna governor over campaign violationsrichardgomez100% (1)

- PNB v. PasimioДокумент16 страницPNB v. PasimioJan Veah CaabayОценок пока нет

- CA Short Form Deed of TrustДокумент3 страницыCA Short Form Deed of TrustAxisvipОценок пока нет

- Bid - IДокумент313 страницBid - Isandip royОценок пока нет

- Phil Refining Company V NG SamДокумент68 страницPhil Refining Company V NG SamAliw del RosarioОценок пока нет

- Delpher Trades Corp. v. IAC ruling on alter ego statusДокумент2 страницыDelpher Trades Corp. v. IAC ruling on alter ego statusBingoheartОценок пока нет

- Islamic Law Position in MalaysiaДокумент2 страницыIslamic Law Position in MalaysiaLoh Jia JinОценок пока нет

- Age of Metternich and Revolution of 1848Документ28 страницAge of Metternich and Revolution of 1848api-316940023Оценок пока нет

- Presentation Custom ProcedureДокумент30 страницPresentation Custom ProcedureSohail Saahil0% (1)

- Larry Waldie v. County of Los Angeles - First Amended ComplaintДокумент14 страницLarry Waldie v. County of Los Angeles - First Amended ComplaintAlan RomeroОценок пока нет