Академический Документы

Профессиональный Документы

Культура Документы

17.) John Dy v. People

Загружено:

RubyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

17.) John Dy v. People

Загружено:

RubyАвторское право:

Доступные форматы

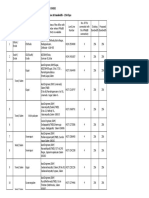

Case Name: John Dy v.

People of the Philipines

GR No. 158312

Date: November 14, 2008

Facts:

By: Ruby U. Santillana

Topic: Completion of Blanks

Since 1990, John Dy under the business name Dyna Marketing, has been the distributor of W.L. Food Products (WL Foods). Dy would pay

WL Foods in either cash or check upon pick up of stocks of snack foods.

At times, he would entrust the payment to one of his drivers.

Dys driver went to the branch office of WL Foods to pick up stocks of snack foods.

He introduced himself to the checker, Mary Maraca, who upon confirming Dys credit with the main office, gave him merchandise worth

P106,579.60

In return, the driver handed her a blank Far Ester Bank and Trust Compay (FEBTC) Check postdated July 31, 1992.

July 1, 1992: the driver obtained snack foods worth P226,794.36 in exchange for a blank FEBTC Check postdated July 31, 1992.

In both instances, the driver was issued an unsigned delivery receipt.

When presented for payment, FEBTC dishonored the checks for insufficiency of funds.

Later, Gonzales (FEBTC manager), sent Atty. Jimeno (counsel of WL Foods) a letter advising her that FEBTC Check for P106,579.60 was

returned to the drawee bank for the reasons stop payment order and drawn against uncollected deposit (DAUD), and not because it was

drawn against insufficient funds as stated in the first letter.

Dys savings deposit account ledger reflected a balance of P160,659.39 as of July 22, 1992. This, however, included a regional clearing

check for P55,000 which he deposited on July 20, 1992, and which took 5 banking days to clear.

When William Lim, owner of WL Foods, phoned Dy about the matter, the latter explained that he could not pay since he had no funds yet.

This prompted the former to send a demand letter, which the latter ignored.

Lim charged Dy with 2 counts of estafa under Art. 315, par. 2(d) and 2 counts of violation of BP Blg. 22

RTC: convicted Dy on 2 counts each of estafa and violation of BP Blg. 22

CA affirmed.

Dy contends that the checks were ineffectively issued and WL Foods accountant had no authority to fill the amounts.

Issue/s: W/N Dy is liable for estafa and in violation of BP Blg. 22.

Ruling: YES. But only for the second check. Dy is acquitted for the criminal cases in relation to the first check.

Elements of Estafa: 1. Postdating or issuance of a check in payment of an obligation contracted at the time the check was issued; 2.

Insufficiency of funds to cover the check; and 3. damage to the payee.

Sec. 191 of NIL defines issue as the first delivery of an instrument, complete in form, to a person who takes it as a holder.

Delivery is the final act essential to the negotiability of an instrument. It denotes physical transfer of the instrument by the maker or drawer

coupled with an intention to convey title to the payee and recognize him as a holder.

Even if the checks were given to WL Foods in blank, this alone did not make its issuance invalid.

When the checks were delivered to Lim, through his employee, he became a holder with prima facie authority to fill the blanks.

See Doctrine. (Sec. 14. Blanks; when may be filled.)

The law merely requires that the instrument be in the possession of a person other than the drawer or maker. From such possession, together

with the fact that the instrument is wanting in a material particular, the law presumes agency to fill up the blanks.

The burden of proving want of authority or that the authority granted was exceeded, is placed on the person questioning such authority. Dy

failed to fulfill this.

Elements of BP Blg. 22 (malum prohibitum): 1. the making, drawing and issuance of any check to apply to account or for value; 2. the

knowledge of the maker, drawer or issuer that at the time of issue he does not have sufficient funds in or credit with the drawee bank for the

payment of such check in full upon it presentment; 3. subsequent dishonor of the check by the drawee bank for insufficiency of funds or

credit or dishonor for the same reason had not the drawer, without any valid cause, ordered the bank to stop payment.

Dy admitted that he issued the checks, and that the signatures appearing on them were his.

Under Sec. 2 of BP Blg. 22: petitioner was prima facie presumed to know of the inadequacy of his funds with the bank when he did not pay

the value of the goods or make arrangements for their payment in full within 5 banking days upon notice.

Under Sec. 1, BP Blg. 22: Even though the first check became good only 5 days later, Dy was considered by the bank to retroactively have

had P160,659.39 in his account on July 20, 1992 which was more than enough to cover the first check. Hence, Dy had issued the check

with full ability to abide by his commitment to pay his purchases.

Doctrine:

Notes:

SEC. 14. Blanks; when may be filled. -Where the instrument is wanting in any

material particular, the person in possession thereof has a prima facie authority

to complete it by filling up the blanks therein. And a signature on a blank paper

delivered by the person making the signature in order that the paper may be

converted into a negotiable instrument operates as a prima facie authority to fill it

up as such for any amount.

Blue Font Color: Issuance and Delivery

Green Font Color: Completion of Blanks

Вам также может понравиться

- 11 Genson Vs AdarleДокумент10 страниц11 Genson Vs AdarleJorela TipanОценок пока нет

- B11 Allied Banking Corporation V Lim Sio WanДокумент3 страницыB11 Allied Banking Corporation V Lim Sio WanJ CaparasОценок пока нет

- Civ 2 DigestДокумент20 страницCiv 2 DigestGabrielAblolaОценок пока нет

- 10 Alfonso vs. Court of AppealsДокумент2 страницы10 Alfonso vs. Court of AppealsJemОценок пока нет

- Ocampo-Paule vs. CAДокумент2 страницыOcampo-Paule vs. CARemelyn SeldaОценок пока нет

- Lagon Vs CAДокумент2 страницыLagon Vs CAGwenBañariaОценок пока нет

- Abella Vs BarriosДокумент6 страницAbella Vs BarriosAronAbadillaОценок пока нет

- 46 RecitДокумент2 страницы46 RecitSara Andrea SantiagoОценок пока нет

- 232 - Katigbak v. CAДокумент2 страницы232 - Katigbak v. CABea Charisse MaravillaОценок пока нет

- Zamora v. CaДокумент7 страницZamora v. CaCervus Augustiniana LexОценок пока нет

- Paramount Insurance Corporation v. Maximo JapzonДокумент2 страницыParamount Insurance Corporation v. Maximo JapzonSJ San JuanОценок пока нет

- Filinvest Credit Corp. vs. MendezДокумент6 страницFilinvest Credit Corp. vs. MendezPrince CayabyabОценок пока нет

- 7 - Delfin Tan vs. Erlinda C. Benolirao Et AlДокумент2 страницы7 - Delfin Tan vs. Erlinda C. Benolirao Et Almark anthony mansuetoОценок пока нет

- NFF Industrial Corporation vs. G&L Associated BrokerageДокумент13 страницNFF Industrial Corporation vs. G&L Associated BrokerageCrisDBОценок пока нет

- Banco Atlantico v. Auditor General and Santos v. Reyes - NegoLawДокумент2 страницыBanco Atlantico v. Auditor General and Santos v. Reyes - NegoLawlchieS100% (1)

- PLDT Vs CA GR No 57079, September 29, 1989Документ5 страницPLDT Vs CA GR No 57079, September 29, 1989Marienyl Joan Lopez VergaraОценок пока нет

- Maulini (Final)Документ2 страницыMaulini (Final)Mark Pelobello MalhabourОценок пока нет

- Arrieta Vs Llosa DigestДокумент2 страницыArrieta Vs Llosa DigestMichael Parreño VillagraciaОценок пока нет

- Penalosa v. SantosДокумент4 страницыPenalosa v. Santoschappy_leigh118Оценок пока нет

- Espino Vs PresquitoДокумент1 страницаEspino Vs PresquitoKatharina CantaОценок пока нет

- PENALBER V RAMOSДокумент6 страницPENALBER V RAMOSjaneldeveraturdaОценок пока нет

- People vs. DarilayДокумент16 страницPeople vs. Darilayvince005Оценок пока нет

- Cruz vs. Atty. Jacinto DigestДокумент3 страницыCruz vs. Atty. Jacinto DigestMaricor VelascoОценок пока нет

- 095 Bacaling v. Muya (Mozo)Документ3 страницы095 Bacaling v. Muya (Mozo)JUAN MIGUEL MOZOОценок пока нет

- 6 Sps Golez Vs NemenoДокумент1 страница6 Sps Golez Vs NemenoNicole YastoОценок пока нет

- De Ocampo and Co V GatchalianДокумент3 страницыDe Ocampo and Co V GatchalianJazem AnsamaОценок пока нет

- Vintola V Insular Bank of Asia and AmericaДокумент2 страницыVintola V Insular Bank of Asia and AmericaErika Mariz CunananОценок пока нет

- GO vs. THE ESTATE OF T BUENA VENTURAДокумент3 страницыGO vs. THE ESTATE OF T BUENA VENTURAShella Hannah SalihОценок пока нет

- Rosendo C. Carticiano and Zacarias A. Carticiano vs. Mario NuvalДокумент2 страницыRosendo C. Carticiano and Zacarias A. Carticiano vs. Mario NuvalKalliah Cassandra CruzОценок пока нет

- Philippine Bank of Commerce VsДокумент1 страницаPhilippine Bank of Commerce VsJan Aldrin AfosОценок пока нет

- 123567-1999-Pacheco v. Court of AppealsДокумент10 страниц123567-1999-Pacheco v. Court of AppealsMa. Hazel Joy FacoОценок пока нет

- 015 Safeguard Security Agency vs. TangcoДокумент3 страницы015 Safeguard Security Agency vs. Tangcokeith105Оценок пока нет

- 26 Henson vs. Intermediate Appellate CourtДокумент2 страницы26 Henson vs. Intermediate Appellate CourtJemОценок пока нет

- PEOPLE Vs YATARДокумент1 страницаPEOPLE Vs YATARbenjaminteeОценок пока нет

- Torts Digest HRДокумент5 страницTorts Digest HRErika Mariz CunananОценок пока нет

- People v. Darilay: 421 SCRA 45Документ1 страницаPeople v. Darilay: 421 SCRA 45Kim LaguardiaОценок пока нет

- 1306 Dacsin vs. DacsinДокумент2 страницы1306 Dacsin vs. DacsinJerraemie Nikka Cipres Patulot100% (1)

- Patrimonio vs. GutierrezДокумент1 страницаPatrimonio vs. GutierrezPatrice ThiamОценок пока нет

- Ochoa Vs G.S. TransportДокумент5 страницOchoa Vs G.S. Transportkatherine magbanuaОценок пока нет

- De Leon V. Ong G.R. No. 170405 February 2, 2010Документ1 страницаDe Leon V. Ong G.R. No. 170405 February 2, 2010Paula TorobaОценок пока нет

- Maranan v. Perez, G.R. No. L-22272, 26 June 1967, (20 SCRA 412)Документ3 страницыMaranan v. Perez, G.R. No. L-22272, 26 June 1967, (20 SCRA 412)Jerica MercadoОценок пока нет

- Frederico Geminiano vs. Court of AppealsДокумент7 страницFrederico Geminiano vs. Court of AppealsCyrusОценок пока нет

- Development Bank of The Philippines vs. Guariña Agricultural and Realty Development Corporation G.R. No. 160758. January 15, 2014 FactsДокумент5 страницDevelopment Bank of The Philippines vs. Guariña Agricultural and Realty Development Corporation G.R. No. 160758. January 15, 2014 FactsPatricia Anne SorianoОценок пока нет

- Estacion Vs BernardoДокумент20 страницEstacion Vs BernardoMelissa AdajarОценок пока нет

- Manuel Serrano V Central Bank of The PhilippinesДокумент1 страницаManuel Serrano V Central Bank of The PhilippinesElieann QuinajonОценок пока нет

- Kapalaran Bus Line Vs CoronadoДокумент1 страницаKapalaran Bus Line Vs CoronadoDarby MarОценок пока нет

- First Integrated Bonding& Insurance Co., Inc. v. CA, GR 119577, Aug. 28, 1996, 261 SCRA 203Документ1 страницаFirst Integrated Bonding& Insurance Co., Inc. v. CA, GR 119577, Aug. 28, 1996, 261 SCRA 203Gia DimayugaОценок пока нет

- Cuara Vs Monfort - Vicarious LiabilityДокумент1 страницаCuara Vs Monfort - Vicarious LiabilityJulioОценок пока нет

- Case DigestsДокумент9 страницCase DigestsTubal ClemencioОценок пока нет

- 23 Fige vs. Court of AppealsДокумент1 страница23 Fige vs. Court of AppealsJemОценок пока нет

- Case ComplexДокумент219 страницCase ComplexpulithepogiОценок пока нет

- 2-People vs. Ong L37908Документ6 страниц2-People vs. Ong L37908Nomer HiguitОценок пока нет

- Succession Cases IIДокумент2 страницыSuccession Cases IIRed HoodОценок пока нет

- Credit - Cuyco vs. CuycoДокумент1 страницаCredit - Cuyco vs. CuycoisangbedistaОценок пока нет

- Sanchez v. FEBTC DigestДокумент2 страницыSanchez v. FEBTC DigestErika-Anne ThereseОценок пока нет

- Chattel MortgageДокумент9 страницChattel MortgageAlpha BetaОценок пока нет

- (Soriano v. BSP)Документ2 страницы(Soriano v. BSP)Patrick ManaloОценок пока нет

- Juno Batistis vs. People of The Philippines, G.R. No. 181571 December 16, 2009Документ2 страницыJuno Batistis vs. People of The Philippines, G.R. No. 181571 December 16, 2009Diane UyОценок пока нет

- MELVIN COLINARES Vs CAДокумент2 страницыMELVIN COLINARES Vs CAchaОценок пока нет

- Case Name: John Dy v. People of The Philipines GR No. 158312 Date: November 14, 2008 By: Ruby U. Santillana Topic: Completion of BlanksДокумент2 страницыCase Name: John Dy v. People of The Philipines GR No. 158312 Date: November 14, 2008 By: Ruby U. Santillana Topic: Completion of BlanksgiovanniОценок пока нет

- Francisco Vs Atty. PortugalДокумент7 страницFrancisco Vs Atty. PortugalRomОценок пока нет

- Sulpicio v. CAДокумент1 страницаSulpicio v. CARubyОценок пока нет

- New Code of Judicial Code - Canon 2 DigestДокумент7 страницNew Code of Judicial Code - Canon 2 DigestRubyОценок пока нет

- Compiled Digests HW 4 PDFДокумент13 страницCompiled Digests HW 4 PDFRubyОценок пока нет

- Alumbres v. CaoibesДокумент2 страницыAlumbres v. CaoibesdondzОценок пока нет

- People - v. - Taneo - y - Ca - Ada20161109-672-Cc321hДокумент12 страницPeople - v. - Taneo - y - Ca - Ada20161109-672-Cc321hRubyОценок пока нет

- Universal Mills Corp. v. Universal TextileДокумент3 страницыUniversal Mills Corp. v. Universal TextileRubyОценок пока нет

- Sulo NG Bayan Inc. v. Gregorio Araneta Inc.20160209-8795-Ee2d8uДокумент7 страницSulo NG Bayan Inc. v. Gregorio Araneta Inc.20160209-8795-Ee2d8uRubyОценок пока нет

- Stockholders of Guanzon v. Register of DeedsДокумент3 страницыStockholders of Guanzon v. Register of DeedsRubyОценок пока нет

- Lyceum - of - The - Philippines - Inc. - v. - Court - of PDFДокумент8 страницLyceum - of - The - Philippines - Inc. - v. - Court - of PDFRubyОценок пока нет

- Plaintiff-Appellant Vs Vs Defendants-Appellees Bausa, Ampil & Suarez Nicasio E. MartinДокумент12 страницPlaintiff-Appellant Vs Vs Defendants-Appellees Bausa, Ampil & Suarez Nicasio E. MartinRubyОценок пока нет

- Spouses - Yu - v. - Ngo - Yet - Te20160214-374-8nbcl6Документ11 страницSpouses - Yu - v. - Ngo - Yet - Te20160214-374-8nbcl6RubyОценок пока нет

- Gallagher V GermaniaДокумент2 страницыGallagher V GermaniaRubyОценок пока нет

- Philips Export B.V. v. Court of AppealsДокумент8 страницPhilips Export B.V. v. Court of AppealsRubyОценок пока нет

- Buyco - v. - BaraquiaДокумент4 страницыBuyco - v. - BaraquiaRubyОценок пока нет

- Torio V FontanillaДокумент2 страницыTorio V FontanillaRubyОценок пока нет

- Red Line Transportation Co. v. Rural TransitДокумент4 страницыRed Line Transportation Co. v. Rural TransitRubyОценок пока нет

- Brocka - v. - EnrileДокумент6 страницBrocka - v. - EnrileRubyОценок пока нет

- Medina v. Greenfield Development Corp.Документ7 страницMedina v. Greenfield Development Corp.RubyОценок пока нет

- Angat v. RepublicДокумент10 страницAngat v. RepublicRubyОценок пока нет

- Spouses Estares v. Court of AppealsДокумент10 страницSpouses Estares v. Court of AppealsRubyОценок пока нет

- China Banking Corp. v. CoДокумент6 страницChina Banking Corp. v. CoRubyОценок пока нет

- Bacolod City Water District v. Labayen20160321-9941-1e4wsqДокумент9 страницBacolod City Water District v. Labayen20160321-9941-1e4wsqRubyОценок пока нет

- Torio v. FontanillaДокумент13 страницTorio v. FontanillaRubyОценок пока нет

- Heirs of Reyes v. Court of Appeals20160322-9941-4vl8a8Документ14 страницHeirs of Reyes v. Court of Appeals20160322-9941-4vl8a8RubyОценок пока нет

- Sievert v. Court of AppealsДокумент5 страницSievert v. Court of AppealsRubyОценок пока нет

- Carlos v. SandovalДокумент22 страницыCarlos v. SandovalRubyОценок пока нет

- Republic v. FlorendoДокумент8 страницRepublic v. FlorendoRubyОценок пока нет

- Davao Light Power Co. Inc. v. Court Of20160308-3896-1jpub5qДокумент12 страницDavao Light Power Co. Inc. v. Court Of20160308-3896-1jpub5qRubyОценок пока нет

- O - Ate - v. - AbrogarДокумент10 страницO - Ate - v. - AbrogarRubyОценок пока нет

- Mil STD 3013Документ127 страницMil STD 3013Mirza Muneeb AhsanОценок пока нет

- SQE1 - Dispute Resolution (FLK1)Документ41 страницаSQE1 - Dispute Resolution (FLK1)Elizabeth FengОценок пока нет

- Insurance Code". Commissioner". Chanrobles Virtual LawДокумент9 страницInsurance Code". Commissioner". Chanrobles Virtual LawDairen CanlasОценок пока нет

- Second Sex - de Beauvoir, SimoneДокумент20 страницSecond Sex - de Beauvoir, SimoneKWins_1825903550% (1)

- 3rd Class Drill Badge Criteria 2014Документ2 страницы3rd Class Drill Badge Criteria 2014api-2539652580% (1)

- Bh. GitaДокумент20 страницBh. GitaAkshat SinghОценок пока нет

- Advance Paper Corp V ArmaДокумент3 страницыAdvance Paper Corp V ArmaInnah Agito-RamosОценок пока нет

- Petition For Expungement of Records (Alabama)Документ6 страницPetition For Expungement of Records (Alabama)ShamaОценок пока нет

- Anne Frank Was A Teenage Jewish Girl Who Kept A Diary While Her Family Was in Hiding From The Nazis During World War IIДокумент6 страницAnne Frank Was A Teenage Jewish Girl Who Kept A Diary While Her Family Was in Hiding From The Nazis During World War IILuz María RamírezОценок пока нет

- Banco Espanol V Palanca DigestДокумент26 страницBanco Espanol V Palanca DigestIvan Montealegre ConchasОценок пока нет

- ProstisДокумент82 страницыProstisVeneranda AtriaОценок пока нет

- Hamlet AnДокумент171 страницаHamlet AnhellooneoneОценок пока нет

- Reading Test b2Документ3 страницыReading Test b2unutulmaz100% (1)

- Trump IndictmentДокумент45 страницTrump IndictmentStefan Becket91% (129)

- Dillena vs. CAДокумент9 страницDillena vs. CALeizl A. VillapandoОценок пока нет

- Panhandle Co. v. Michigan Comm'n., 341 U.S. 329 (1951)Документ9 страницPanhandle Co. v. Michigan Comm'n., 341 U.S. 329 (1951)Scribd Government DocsОценок пока нет

- Special Power of Attorney (Representation)Документ2 страницыSpecial Power of Attorney (Representation)Samantha ReyesОценок пока нет

- Attempts at Appropriation - FrontlineДокумент3 страницыAttempts at Appropriation - FrontlineselvamuthukumarОценок пока нет

- Phil Suburban VS Auditor Gen DigestДокумент2 страницыPhil Suburban VS Auditor Gen DigestMJ Dela CruzОценок пока нет

- List of Shipping CompaniesДокумент3 страницыList of Shipping Companiestauseefmaqbool100% (1)

- R V Rogers - Implications For PractitionersДокумент5 страницR V Rogers - Implications For Practitionersdesh deepak shekhawatОценок пока нет

- EX Broker Carrier - PacketДокумент17 страницEX Broker Carrier - PacketJor JisОценок пока нет

- Animal Farm SummaryДокумент1 страницаAnimal Farm SummaryPI CubingОценок пока нет

- 21st Cent Lesson 3Документ77 страниц21st Cent Lesson 3Sheryl FaelnarОценок пока нет

- ErodeДокумент26 страницErodeRamesh SakthyОценок пока нет

- 5th Merit List BS Physics Self Supportinhg IIДокумент1 страница5th Merit List BS Physics Self Supportinhg IIRafay FarooqОценок пока нет

- Praise and Worship Oct 10 2020Документ22 страницыPraise and Worship Oct 10 2020CrisDBОценок пока нет

- CasestudyДокумент2 страницыCasestudyAjmal AhammedОценок пока нет

- MKII Hordes Forces Trollbloods PDFДокумент115 страницMKII Hordes Forces Trollbloods PDFleotardnimoyОценок пока нет

- The Unquiet Grave - Short Stories: M. R. JamesДокумент4 страницыThe Unquiet Grave - Short Stories: M. R. JamesJorgeAlcauzarLopezОценок пока нет