Академический Документы

Профессиональный Документы

Культура Документы

Intermediate Examination: Suggested Answers To Questions

Загружено:

durgeshИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Intermediate Examination: Suggested Answers To Questions

Загружено:

durgeshАвторское право:

Доступные форматы

Suggested Answers to Question AIT

INTERMEDIATE EXAMINATION

GROUP II

(SYLLABUS 2008)

SUGGESTED ANSWERS TO QUESTIONS

JUNE 2013

Paper- 10 : APPLIED INDIRECT TAXATION

Time Allowed : 3 Hours

Full Marks : 100

The figures in the margin on the right side indicate full marks.

Answer Question No. 1 which is compulsory and any five from the rest.

Wherever required, the candidate may make suitable assumptions and

state them clearly in the answers.

All questions relate to the assessment year 2013-14 unless stated otherwise in the question.

1. (a) Fill in the blanks :

(i)

(ii)

(iii)

(iv)

(v)

(vi)

(vii)

(viii)

(ix)

(x)

(xi)

(xii)

(xiii)

(xiv)

(xv)

1 x 15=15

For non-corporate assessees, e-filing of service tax return is ________.

Yellow Bill of Entry is required for

.

The effective rate of Service Tax at present is __________.

SSI units are required to submit __________ return in Form No. ER-3.

In Customs and Excise law, the commitment of offence beyond reasonable

doubt has to be proved by _________.

The time limit for filing appeal to CESTAT is ______________.

The Central Sales Tax applicable to goods exempt from State Sales Tax is _____.

Assessable Value in case of Captive Consumption is the Cost of Production plus

_________.

The Fifteen Digit PAN based registration number is Called __________ Under the

Indirect Tax.

The Finance Act, 2012 introduced _____Number of Services on which no tax has

been levied.

Exclusive Economic Zone extends to Nautical Miles from the base line of the

coast.

MRP Provisions are not applicable for packaged commodities meant for

______________.

Post Shipment Charges ____________considered for Assessable Value under the

Customs Act.

VAT

be imposed on the value of Service.

The unutilized Cenvat Credit can be carried forward up to

number of years.

(b) State with reasons, whether the following are True or False:

2x5=10

(i) Stock transfer is to be treated as Inter State Sale under the CST Act, 1956.

(ii) Transfer by way of mortgage are liable to CST.

(iii) "Service provider providing taxable service under brand name of others"-liable to

pay service tax.

(iv) Captive consumption goods need certification.

(v) Buying Commission is always includible in Customs Value.

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 1

Suggested Answers to Question AIT

Answer: 1. (a)

i.

ii.

iii.

iv.

v.

vi.

vii.

viii.

ix.

x.

xi.

xii.

xiii.

xiv.

xv.

b.

i.

Mandatory

Warehousing

12.36%

Quarterly.

Department.

3 Months/90 days.

Zero/ Nil

10%

ECC/STC

17

200

Industrial or institutional Consumers.

Will not be.

Cannot

Any.

False . Stock transfer from head office to branch office will not amount to interstate

sale as basic elements of sale i.e. presence of buyer & seller, consideration & transfer

of ownership are missing in this type of transaction.

ii.

False. Sec. 2 (g) of CST Act, 1956 deals with the definition of sale. It specifically

excluded mortgage, hypothecation, charge or pledge on goods. So CST cannot be

charged in case there is transfer by way of mortgage.

iii.

True. Service provider providing taxable services under the Brand name of other is not

eligible for claiming exemption limit of ` 10 Lakh & hence liable to pay service tax

irrespective of the turnover.

iv.

True. In case of captively consumed goods valuation will be done as per CAS-4(Cost

of Production +10%). This cost of production is definitely certified by the Cost

Accountant.

v.

False. Commission & Brokerage except Buying Commission is includable. Buying

Commission means fees paid by the importer to his agent for the service of

representing him abroad in purchase of goods.

2. (a) Explain briefly how the valuation of an excisable goods will be done when the same is

sold to both related and unrelated buyers?

5

(b) Briefly explain "Prohibited Goods" under the Customs Act, 1962. What is the purpose

of the interpretation rules regarding Custom Tariff?

3+2=5

(c) Write a brief note on the deficiencies of the VAT system.

5

Answer 2.

(a) If sale is made solely through 'related person', price relevant for valuation will be normal

transaction value at which the related buyer sales to unrelated buyer, as per rules 9 and

10 of valuation Rules.

Rules 9 and 10 of central excise valuations Rules make it clear that these rules apply only

in cases where assessee sales goods exclusively to or through related person. Thus, there

is no provision in rules when assessee partly sales to related persons and partly to

unrelated persons.

Even if negligible quantity is sold to unrelated buyer, Rules 9 and 10 become

inapplicable. Valuation can not be done on the basis of transaction value of assessee

to buyer as that is prohibited u/s 4 (i) (a).

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 2

Suggested Answers to Question AIT

In such case, the only alternative seems to be residual method, i.e. rule 11 of

Valuation Rules, which states that if value can not be determined under any of the

applicable rules, value shall be determined using reasonable means consistent with

the principles and general provisions of Sec 4 and Valuation Rules.

(b) As per Section 2(33) of the Custom Act, 1962, prohibited goods means any goods

the import or export of which is subject to any prohibition under the Customs Act or

any other law for the time being in force but doesn't include any such goods in

respect of which the conditions subject to which the goods are permitted to be

imported or exported have been complied with.

In some cases, conditions are to be fulfilled after importation of goods. Unless those

conditions are fulfilled, the goods continue to be prohibited goods.

The purpose of Interpretation Rules of Customs Tariff is:

(i) to give clear direction as to how the nomenclature in the schedule is to be

interpreted and

(ii) to give statutory force to the Interpretation Rules and the general explanatory

notes.

(c) Deficiencies of the VAT System :

1. Differential Rites of Tax: The merits accrue in full measure only under a situation

where there is only one rate of VAT and VAT applies to all commodities without

any question of exemptions whatsoever. Concessions like differential rates of VAT,

composition schemes, exemptions schemes, exempted category of goods, etc.

distort the systems.

2. Disintegration: If Central VAT is not integrated with the State VAT, it will be difficult

to put the Purchases from other States at par with the State Purchases. Hence,

advantage of neutrality will be confined only for purchases within State.

3. Accounting Costs (RTP): Compliance with the VAT provisions required better

accounting and records maintenance which will cost more. Such incremental

cost may not reflect any incremental benefits to small traders.

4. Increasing Working Capital Requirements: Since the tax is to be imposed or paid

at various stages and not on last stage, it would increase the working capital

requirements and the interest burden on the same.

5. Inequality of Taxation: VAT is a form of Consumption Tax. Since, the proportion of

income spent on consumption is larger for the poor than for the rich, VAT tends to

be regressive.

6. Increase in Administration Costs (RTP): As a result of introduction of VAT, the

administration cost to the State can increase significantly as the number of

Dealers to be administered will also go up significantly.

7. Non-Coverage of both goods and services: State VAT is characterized by noninclusion of services which reduces its effectiveness as a comprehensive system.

8. Higher Base Rate: The Base Rate of 12.5% is considered as relatively high. This rare

is fixed so as to ensure collection of equal revenues under the VAT system as

compared to Sales Tax System. However, as the rate is uniform in all the States,

revenue neutrality may be difficult to achieve.

9. Floor Rate: Floor Rates refer to the rates which have to be uniformly applied by all

States. However there is no flexibility available for States to tinker with Floor Rates.

This is contrary to the actual concept of Floor Rates.

10. Treatment of Exempted Goods: A major deficiency is observed with regard to

treatment of exempted category of goods. No VAT is leviable on such goods, but

no credit will be provided for taxes paid on their purchase.

11. Huge Volume of Exemptions: The basic structure of VAT does not allow many

exemptions, and it is to be fairly comprehensive, which has to lead to periodic

elimination of exemptions. However, in practice, due to continuous pressure from

industrial and social sectors, exemptions are on the rise, which can lead to

administrative problems.

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 3

Suggested Answers to Question AIT

12. Need for Extensive definitions: As there is scope for interpretations, there is a need

for defining even a simple term to avoid any confusion as to the rate and also the

category in which it falls, i.e., whether capital or revenue.

13. Arbitrary classification of goods: The basis adopted for classification of goods

under capital and revenue category seems to be arbitrary, which can lead to

confusion and inequity with regard to application of taxes on goods.

14. Concessional Rates based on End Usage: VAT system is based on the principle

that the customers end use (industrial use or exports or domestic use) should not

affect the levy of taxes on goods except under special circumstances. However,

several concessions being given for industrial inputs which contravenes this

principle.

15. Revenue loss: Due to concessional rates, revenue losses from undeclared sales of

finished goods increase.

3. (a) Discuss about the eligibility of cenvat credit in each of the following situations :

(i) 2.0 Metric Tonnes of Raw Materials on which Central Excise Duty paid was

`20,000.00 which were destroyed by accidental fire after the same are issued to

the shop floor for production of Finished Goods.

(ii) 1.0 metric Tonne of Raw materials on which Central Excise Duty paid was

`10,000.00 were used in manufacture of the Finished Goods for which Central

Excise Duty was payable `8,000.00.

(iii) The original copy of the Central Excise Invoice for 1000 units of Raw Materials

purchased was missing; however, duplicate for transporter copy of the same

Invoice is available, which also shows that the Central Excise Duty of `10,000.00

had been paid on Raw Materials.

2+1+2=5

(b) A Trader supplied to consignments of goods in a single carriage to his two different

buyers, (i) Reserve Bank of India and (ii) a unit located within Special Economic Zone. The

amounts of freights were `3,000.00 and `4,000.00 respectively. In the first case, the freight was

paid by the consignee and in the second case the freight by the consignor. Assess the

Service Tax liabilities of the freight payers. Discuss whether exemption from payment of

Service Tax is available in these cases or not.

1+2+2=5

(c) Illustrate with an example, whether inter-state purchases liable to Central Sales Tax are

eligible for Input Tax Credit or not.

5

Answer 3.

(a)

i. Goods must be used within factory of production and must have some relation with

manufacture so as to qualify as input under Rule 2(k). Since input had been issued

for production, hence, they may be regarded as used within factory and handling

losses are a part of manufacturing process. Hence credit can not be denied. [CCEX

vs. Indchem Electronics (SC)]

ii. Full Cenvat credit is available even though duty on the Finished Goods is less. Such

excess credit can be adjusted against duty payable on the Finished Goods.

iii. The Cenvat Credit Rule states that credit can be availed on the basis of invoice

issued by the manufacturer. Duplicate for Transporter copy of Invoice is also an

invoice issued by the manufacturer. Hence, credit is available on the basis of such

document.

(b) In both these two cases exemption from payment of service Tax for the freight payers

shall be available. In the first case, the amount of freight of `3000.00 was paid by the Reserve

Bank of India, the consignee. Against the item Sr. No. b) of the Negative List declared by the

Government of India under Section 66 D of the Finance Act, 1994, the Reserve Bank of India

have been granted exemption from payment of Service Tax both- as a Service Provider as

well as a Service Recipient.

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 4

Suggested Answers to Question AIT

In the second case, the freight was paid by the consignor, the trader. Supply of goods to a

unit located within Special Economic Zone is considered as export. Therefore, if the consignor

supplies the goods to a unit in Special Economic Zone by observing the provisions laid down

under Notification No. 31/2012 ST. dated 20.06.2012, he can enjoy exemption from payment

of Service Tax on the amount of freight he paid.

(c) The inter-state purchases liable to Central Sales Tax are not eligible for Input Tax Credit.

As an example it is stated that if a dealer from the State of West Bengal purchases goods

from another dealer in the State of Karnataka, the dealer from the state of Karnataka

charges CST @ 2% in his invoice against Form 'C issued on him by the dealer from the State of

West Bengal. The tax is deposited in the state of Karnataka and the Central Government

does not get any share of this since it is considered as revenue of the selling state. The dealer

from the state of West Bengal sells the said goods within West Bengal on payment of

appropriate amount of VAT and is not eligible for set off of the amount of CST he paid at

purchase point. West Bengal would not allow set off of a tax paid in Karnataka against the

tax levied by it, as it would result in revenue loss for West Bengal. This is the reason why CST is

not vatable.

4. (a) A manufacturer having Central Excise Registration Certificate imports an equipment

from abroad. Compute the duty payable under Customs Act, 1962 for such import on the

following information :

(i) Assessable Value of the imported equipment is US$ 15,500.

(ii) Date of Bill of Entry is 19.03.2012. Basic Custom Duty on this date was 12% and exchange

rate notified by the Central Board of Excise and Customs is US $1 = `55.00.

(iii) Date of Entry inwards is 14.03.2012. Basic Custom Duty on that was 10% and exchange

rate notified by the Central Board of Excise and Customs is US $1 = `58.00.

(iv) Additional Duty payable@ 12% under Section 3(1) & (2) of the Custom Tariff Act, 1975.

(v) Additional Duty under Section 3(5) of the Custom Tariff Act, 1975@ 4%.

(vi) Education Cess and Secondary and Higher Education Cess @ 2% and 1% respectively.

State which exchange rate and the rate of Custom Duty shall be the applicable rates in this

case.

Which amount shall be eligible for availment of Cenvat Credit for the manufacturer

(Importer)?

5+1+1=7

(b) (i) Explain briefly the Compulsory Registration and Voluntary Registration under the VAT

Act.

(ii) Mr. W, a manufacturer sells goods to Mr. X a distributor for `5,000.00 (excluding of VAT).

Mr. X, sells the goods to Mr. Y, a wholesale dealer for `6,000.00. Mr. Y, the wholesale dealer

sells the goods to a retailer for `7,500.00, who ultimately sells to the consumers for `9,200.00.

Compute the tax liability, Input Tax credit availed and tax payable by the manufacturer,

distributor, wholesale dealer and retailer under Invoice method assuming the rate of VAT as

13.5%.

2+2+4=8

Answer: 4.

(a)

Computation of Custom Duty payable

Amount (`)

Particulars

Assessable Value (15,500 x ` 55.00)

8,52,500.00

1,02,300.00

Add: Basic Custom Duty 12%

9,54,800.00

Total

1,14,576.00

Add: Countervailing Duty u/s 3(1) @ 12% (excluding EC

& SHEC due to exemption)

10,69,376.00

Total

Add: Education Cess (` 1,02,300 + 1,14,576) @3%

6,506.28

10,75,882.28

Total

43,035.29

Additional Duty under Section 3(5)@ 4%

Total Custom Duty payable (1,02,300 + 1,14,576 +

2,66,417.57

6,506.28 +43,035.29)

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 5

Suggested Answers to Question AIT

Exchange rate declared by CBEC and the rate of Custom Duty prevalent on the date of

filing of Bill of Entry i.e. 19th March, 2012 shall be applicable in this case.

The manufacture (importer) is eligible to avail cenvat credit of ` 1,14,576.00 + 43,035.29 =

1,57,611.29

i) Compulsory Registration:

If an assess fails to obtain registration under the applicable VAT act, he may be registered

compulsorily by the commissioner. The Commissioner may assess the tax due from such

person on the basis of evidence available with him and thereafter the concerned assessee is

bound to pay such amount of tax. Further, failure to get registered shall result in attracting

default penalty and forfeiture of eligibility to set of all Input Tax Credit related to the period

prior to the compulsory registration.

Voluntary registration:

A dealer who is not eligible for registration under VAT may also obtain registration if the

commissioner is satisfied that the business of the applicant requires registration under VAT. At

the time of granting voluntary registration, the Commissioner may impose certain terms or

conditions if he thinks it necessary to do so.

ii)

Particulars

Invoice value

5000.00

Output

VAT

675.00

Input tax

Credit

Net pay-able

(VAT)

675.00

Sale by W To X

(Distributor)

Sale by X to Y

(whole sale dealer)

Sale by Y to Z

(Retailer)

Sale by Z to

Consumers

6000.00

810.00

675.00

135.00

7500.00

1013.00

810.00

203.00

9200.00

1242.00

1013.00

229.00

5. (a) X Ltd. imported goods from Switzerland 400 units@ 110. Following further information is

also needs to be considered:

(i) Freight (Vessel) -$ 5000

(ii) Demurrage (Part & Parcel) -$ 1000

(iii) Insurance-$ 50

(iv) Landing Charges- `1,50,000

(v) Royalty for use of Patent -$ 10

(vi) Royalty as a condition of Sale-$ 20000

The Rate of Duty is10.3%. Assuming exchange rate is ` 30.00. Find the duty payable.

6

(b) "Brand owners are not liable to pay excise duty". Is there any exception in this regard?

Explain.

4

(c) Mr. Madhukar an "Interior Designer" received ` 2,00,000.00 as advance towards an

account payee cheque while signing a contract. He received ` 4,00,000.00 through credit

card while providing service and another ` 5,00,000.00 by a pay order after completion of

service. All transactions took place during the Financial Year 2012-2013. Compute the value

of taxable service and tax payable thereon.

5

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 6

Suggested Answers to Question AIT

Answer: 5 (a)

Particulars

Price

Add: Royalty for use the patent

Total

Total Price of units imported (400 x120)

Add: Royalty as a condition of sale

Add: Freight & Demurrage Charges

Add: Insurance

Total Cost of Goods imported

Cost of Goods in Indian Rupees

(74,050 x 30 = ` 22,21,500)

Landing Charges @ 1% (`)

Assessable value (`)

Duty Liability @ 10.30% (`)

$

110

10

120

48,000

20,000

6,000

50

74,050

22,21,500

22,215

22,43,715

2,31,102.64

(b) Generally Brand name Owner is not manufacturer. But there is an exception in this. In

case of ready- made garments and made up articles of textiles manufactured on job work

basis, liability to pay excise duty and comply with the provisions of the Act and rules lies on

the merchant manufacturer or the raw material supplier on whose behalf the goods are

manufactured by job workers.

(c) Computation of Taxable service of Mr. Madhukar for financial year 2012-2013.

`

Particulars

Advance received by an account payee cheque

2,00,000.00

Amount Received through credit Card

4,00,000.00

Amount received by pay order

5,00,000.00

Value of taxable service

11,00,000.00

Service tax Payable: (11,00,000.00 x 12.36%)

1,35,960.00

Notes : Money includes any Cheque, Promissory note, letter of Credit, draft, pay order

money order, postal remittance or other similar instruments.

Alternative Solution : It is assumed that the payments are inclusive of Service Tax

Particulars

Payments

Service

received (`)

Tax (`)

Advance received by an account payee

cheque

Amount Received through credit Card

Amount received by pay order

Value of taxable service

Service Tax payable : ` 1,21,000

6.

2,00,000.00

4,00,000.00

5,00,000.00

22,000

44,000

55,000

Value of

Taxable

Service (`)

1,78,000

3,56,000

4,45,000

11,00,000.00

1,21,000

9,79,000

(a) Explain the validity of the Statements with reference to the provision of the Customs

Act, 1962 with suitable reasons.

(i) Can warehouse goods be transferred from one warehouse to another warehouse

under the Customs Act,1962?

(ii) "Duty is required to paid on pilfered goods"-explain.

2+2=4

(b) Explain the validity of the Statements with reference to the provision of the Central Excise

Act, 1944 with suitable reasons.

(i) Cenvat Credit of service tax paid can be claimed in a case where a manufacturer

does not have registration under Service Tax Act.

(ii) Specific duty is payable by the assessee on excisable goods based on the value of

goods.

2+2=4

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 7

Suggested Answers to Question AIT

(c) Explain the validity of the Statements with reference to the provision of the Finance Act,

1994 with suitable reasons.

(i) Statutory services are also taxable service.

(ii) Speed Post Services provided by the Post Office are liable to service tax.

2+2=4

(d) Discuss the role of a Cost Accountant in the context of VAT.

Answer 6.

(a) i) As per the section 67 of the Customs Act, the owner of any warehoused goods may,

remove them from one warehouse to another, with the permission of the proper officer,

subject to such conditions as may be prescribed for the arrival of the warehoused goods at

the warehouse to which removal is permitted.

ii)

Section 13 - Duty on pilfered goods. If any imported goods are pilfered after the

unloading thereof and before the proper officer has made an order for clearance for home

consumption or deposit in a warehouse, the importer shall not be liable to pay the

duty leviable on such goods except where such goods are restored to the importer after

pilferage.

(b) i)

Yes this statement is absolutely valid. Input Service Tax Credit can be allowed to a

manufacturer against duty payable on finished goods, even though he may not have

register as per the Service Tax provisions.

ii) The Statement is not valid. Specific duty is payable by the assessee on excisable goods

based on the length or weight of the products not on value of goods.

(c) i) No this is not correct. Statutory services are when public Government Agencies use to

perform the duties which are statutory in nature, it cannot be said under any circumstances

that Government Agencies providing any service to any Individual for Consideration.

ii) This statement is absolutely correct. Speed post service rendered by the department of

Indian Post is not covered in the negative list. Hence this service is fully taxable.

(d)

Cost Accountants have the following key role to play in implementing the VAT.

Helps in proper record keeping and accounting.

Is competent person to properly analyze and helps in Tax Planning.

Vat credit alters the cost structure, thus Cost Accountant will ensure the benefit of cost

reduction.

He should properly ensure about the proper record keeping and satisfy the

departmental office.

He should properly ensure tax compliance by doing the audit.

7. (a) Determine the assessable value for purpose of Excise Duty under the Central Excise

Act, 1944 in the following cases:

(i) An assessee sells his excisable goods for ` 120 per piece and does not charge any duty

of excise in his invoice. Subsequently, it was found that the goods were not exempted

from excise duty, but were liable at 20% ad valorem.

(ii) Certain excisable goods were sold for ` 120 per piece and 20% ad valorem is the rate of

excise duty. Subsequently, it was found that the price cum duty was in fact ` 140 per

piece as the assessee had collected ` 20 per piece separately.

(iii) The cum duty price per piece120 and the assessee had paid duty at 20% ad valorem.

Subsequently, it was found that the rate of duty was 30% ad valorem and the assessee

had not collected anything over and above120 per piece.

6

(b) Mrs. & Mr. Kapoor visited Germany and brought following goods while returning to India:

(i) The personal effects like clothes, etc., valued at `35,000.

(ii) A personal computer bought for `46,000.

(iii) A laptop computer bought for `95,000.

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 8

Suggested Answers to Question AIT

(iv) Two litres of liquor bought for `1600.

(v) A new camera bought for `47,400.

What is the amount of customs duty payable ?

(c) Compute the invoice value to be charged and amount of tax payable under VAT by a

dealer who had purchased goods for `1,20,000 and after adding for expenses of `10,000

and of profit `15,000 had sold out the same. The rate of VAT on purchases and sales is

125%.

4

Answer 7.

a)

120

Price cumduty

=

= `100

Assessable Value

1 Rate of Excise duty 1.2

100

120 20

Price cumduty

ii)

=

=`116.67

Assessable Value

1 Rate of Excise duty

1.2

100

[Note: additional consideration has to be added to price.]

i)

iii)

120

Price cumduty

=

= `92.30

1 Rate of Excise duty 1.3

100

Assessable value

b) Computation of Customs Duty payable :

Personal effects like clothes etc.

A Personal Computer

A Laptop Computer

2 liters of liquor

A new camera

Total Value

Less : General Free Allowance for 2 persons (35,000 x 2)

Duty payable on

Customs Duty @ 36.05%

Exempt

46,000

Exempt

1,600

47,400

95,000

70,000

25,000

9,012.50

c)

Particulars

Purchase price of goods

Add: Expenses

Add: Profit margin

Amount to be billed

Invoice value to be changed

1,20,000

10,000

15,000

1,45,000

Add: VAT @12.5%

Total invoice value

18,125

1,63,125

VAT to be paid

VAT charged in the invoice

Less: VAT credit on input 12.5% of Total `1,20,000

Balance VAT payable

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

18,125

15,000

3,125

Page 9

Suggested Answers to Question AIT

Alternative Solution : It is assumed that the purchase price is inclusive of VAT :

Purchase Price

1,20,000

Less : VAT included in the above (1,20,000 x 12.50/112.50)

13,300

Purchase price exclusive of VAT

1,06,667

Add: Expenses

10,000

Add: Profit margin

15,000

Amount to be billed

1,31,667

Add: VAT @12.5%

16,458

Total invoice value

1,48,125

VAT to be paid

VAT charged in the invoice

Less: VAT credit on input `1,20,000

Balance VAT payable

16,458

13,333

3,125

8. (a) Discuss with a brief note the distinction between the functioning of Inland Container

Depots (lCD) and Container Freight Stations (CFS).

3

(b) Compute the VAT amount payble by R, who purchased goods from a manufacturer on

payment of ` 6,30,000 (including VAT) and earned 20% profit on sale price. VAT rates both on

purchase and sales is 5%.

4

(c) Explain briefly whether 'assembly' would tantamount to 'manufacture' under the Central

Excise Act, 1944.

3

(d)

Bharath Institute, a partnership firm, is running a coaching centre and has been

paying service tax of more than `10,00,000 in the past several years. The details pertaining

to the quarter ended 30.09.2012 are as under.

Particulars

Value of free coaching rendered

Coaching fees collected from students (service Tax collected

separately) on 16.08.2012

Advance received on 30.09.2012 from another coaching centre for

coaching their students, on 30.09.2012

Amount (`)

3,90,000

54,00,000

12,00,000

i) One student was refunded the total fee ` 40,000 plus service tax on 15.01.2013.

ii) Another student was refunded ` 10,000 (including Service tax) on 16.04.2013 due to

deficient service.

Determine the service tax liability for the quarter and indicate the date by which the service

tax has to be remitted by the assessee.

5

Answer 8.

a) The difference between the functioning of inland container depot (ICD) and container

Freight station (CFS) are:

i) Meaning: an ICD is a place where containers are aggregated for onward movement

to or from the ports whereas CFS is a place where containers are stuffed, unstuffed and

segregation/aggregation of cargo takes place.

ii) Location: ICDs are normally located outside the port towns whereas no site

restrictions apply to CFS.

iii) Attachment/ Extension: An ICD may have a CFS attached to it and CFS is treated as

an extension of a port/ICD/air cargo complex.

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 10

Suggested Answers to Question AIT

b) Computation of sale price and VAT liability

Particulars

Purchase Value of Goods exclusive of VAT (6,30,000 1.05)

Add: Profit 25% (see notes)

Sale value

VAT @ 5%

Total

VAT Payable

Less: Input VAT credit(`6,00,000 x5%)

Net VAT payable

Note: Suppose sale price

Profit @ 20% on sale price

Cost Price is

`

6,00,000

1,50,000

7,50,000

37,500

7,87,500

37,500

30,000

7,500

`100

`20

`80

Hence profits on cost shall 20/80 x 100= 25%

c) Assembly is a process of putting together a number of items or their parts to make a

product. All cases of assembly may not amount to manufacture as an already

manufactured item may also be assembled to put it in a readily usable form.

However, assembly of various parts and component may tantamount to manufacture if a

new product which is movable and marketable emerges out of such assembly. Therefore, if

an immovable property emerges such assembly, it will not be considered as manufacture.

The Apex court in the case of name Tulaman manufactures Pvt. Ltd. Vs CCS 1988 (38) E.L.T.

566 (S.C) held that if the assembly results in new commercial to manufacture.

d) Value of Taxable service

Particulars

i) Free coaching rendered

(Note : if the value of consideration is nil, then no service tax is levied)

ii) Coaching fee collected on 16.08.2012

(Note : It is taxable Service)

iii) Advance received from college for coaching their students (`

12,00,000 x 100 / 112.36) it is assumed that ` 12,00,000 which is

received in advance is inclusive of Service tax .

Note : Service Tax is payable on amount received

in advance

Total value of taxable service

Service Tax

Add: EC & SHEC @3%

Service tax liability

`

NIL

54,00,000

10,67,996

64,67,996

7,76,159

23,284

7,99,443

The amount of service tax is to be remitted to the credit of government after the quarter

ending September on or before 6.10.2012 as it has to be paid electronically because the

service tax liability exceeded ` 10,00,000 is the last year.

i) ` 4,944 service tax refunded along with ` 40,000 can be adjusted while making the

payment of service tax for the quarter ending 31.03.2013.

ii) ` 1100 (10,000 x 12.36/112.36) included in the refund of ` 10,000 can be adjusted while

making the payment of service tax for the quarter ending 30.06.2013.

INSTITUTE OF COST ACCOUNTANTS OF INDIA (Statutory Body under an Act of Parliament)

Page 11

Вам также может понравиться

- "VAT, VAT Audit and Statutory Role of Cost Accountant": Name - Richard D'silva Roll No - 09Документ12 страниц"VAT, VAT Audit and Statutory Role of Cost Accountant": Name - Richard D'silva Roll No - 09Richard DsilvaОценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- Acma Recommendations On Vat: Annexure IДокумент7 страницAcma Recommendations On Vat: Annexure IAkshay TanejaОценок пока нет

- GVAT Article by Pradip ShahДокумент5 страницGVAT Article by Pradip ShahLe Bharath RoiОценок пока нет

- Why VATДокумент10 страницWhy VATapi-3822396Оценок пока нет

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchОт EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchРейтинг: 5 из 5 звезд5/5 (1)

- GST 2018 Full Solved PaperДокумент15 страницGST 2018 Full Solved PaperKomala100% (1)

- Taxation Law Assignment by Sushali Shruti 18FLICDDN01144Документ10 страницTaxation Law Assignment by Sushali Shruti 18FLICDDN01144Shreya VermaОценок пока нет

- GST Project PDFДокумент47 страницGST Project PDFjassi7nishadОценок пока нет

- Value Added TaxДокумент11 страницValue Added TaxPreethi RajasekaranОценок пока нет

- Service Tax Need For Service TaxДокумент4 страницыService Tax Need For Service TaxAnonymous KJ1oUYCK8nОценок пока нет

- Types of Supply GSTДокумент46 страницTypes of Supply GSTRajatKumarОценок пока нет

- Taxation: (A) Ad-Valorem Tax:-Under This Tax System, Tax Is Imposed On The Basis of The Value ofДокумент7 страницTaxation: (A) Ad-Valorem Tax:-Under This Tax System, Tax Is Imposed On The Basis of The Value ofAmbalika SmitiОценок пока нет

- Taxation: Concept, Nature and Characteristics of Taxation and TaxesДокумент11 страницTaxation: Concept, Nature and Characteristics of Taxation and TaxesMohammad FaizanОценок пока нет

- 28548vol3stvatcp14 PDFДокумент5 страниц28548vol3stvatcp14 PDFNaveed AnsariОценок пока нет

- Vat Faqs: Q1. What Is Difference Between VAT and Sales Tax?Документ20 страницVat Faqs: Q1. What Is Difference Between VAT and Sales Tax?Syed Muhammad Ali SadiqОценок пока нет

- Executive Supplement GSTДокумент84 страницыExecutive Supplement GSThkakani1Оценок пока нет

- Value Added Tax: Master Minds - Quality Education Beyond Your ImaginationДокумент14 страницValue Added Tax: Master Minds - Quality Education Beyond Your ImaginationJishu Twaddler D'CruxОценок пока нет

- Vat Audit by Chetan SarafДокумент33 страницыVat Audit by Chetan Sarafchetan saraf100% (1)

- VatДокумент41 страницаVatRAM67% (3)

- What Is GST? Definition of Goods & Services TaxДокумент9 страницWhat Is GST? Definition of Goods & Services Taxzarfarie aron100% (1)

- Intermediate Examination: Suggested Answers To QuestionsДокумент13 страницIntermediate Examination: Suggested Answers To Questionsnarendra225Оценок пока нет

- FOURTH SEMESTER GSTДокумент6 страницFOURTH SEMESTER GSTKenny PhilipsОценок пока нет

- Unit 3 GSTДокумент51 страницаUnit 3 GSTMichael WellsОценок пока нет

- Chapter 1 Introduction To GSTДокумент5 страницChapter 1 Introduction To GSTabhay javiyaОценок пока нет

- Introduction of GSTДокумент9 страницIntroduction of GSTdevika7575Оценок пока нет

- Confirm Vat Audit ProjectДокумент33 страницыConfirm Vat Audit ProjectkennyajayОценок пока нет

- Anomalies in The New VAT LawДокумент3 страницыAnomalies in The New VAT LawMohammad Shahjahan SiddiquiОценок пока нет

- India Localization With Respect To INDIA: Modus Operandi Session IДокумент31 страницаIndia Localization With Respect To INDIA: Modus Operandi Session IpsroyalОценок пока нет

- Dr. LimДокумент152 страницыDr. LimJoan BaltazarОценок пока нет

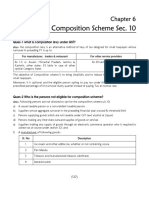

- Composition Scheme Sec. 10: Ques-1 What Is Composition Levy Under GST?Документ12 страницComposition Scheme Sec. 10: Ques-1 What Is Composition Levy Under GST?Tapan BarikОценок пока нет

- Suggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate ExaminationДокумент14 страницSuggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate Examinationseenu pОценок пока нет

- A Overview of Maharashtra Value Added Tax: IndexДокумент10 страницA Overview of Maharashtra Value Added Tax: IndexAdnan ParkarОценок пока нет

- Solution Review QuestionsДокумент41 страницаSolution Review Questionsying huiОценок пока нет

- GST Questions and ConceptsДокумент52 страницыGST Questions and ConceptsShefali TailorОценок пока нет

- Assignment On: Public Finance For Bangladesh PerspectiveДокумент6 страницAssignment On: Public Finance For Bangladesh PerspectiveNazib UllahОценок пока нет

- Business Law OverviewДокумент25 страницBusiness Law Overviewapce501Оценок пока нет

- Article On Reverse Charge 28jul2017Документ6 страницArticle On Reverse Charge 28jul2017Venkataramana NippaniОценок пока нет

- Goods and Services Tax (GST) in India: Ca R.K.BhallaДокумент27 страницGoods and Services Tax (GST) in India: Ca R.K.BhallaAditya V v s r kОценок пока нет

- ACC212 Student Notes 2019Документ62 страницыACC212 Student Notes 2019preciousgomorОценок пока нет

- VAT Road To GSTДокумент19 страницVAT Road To GSTVarun PuriОценок пока нет

- Topic 2 Value Added TaxДокумент22 страницыTopic 2 Value Added TaxSam ClassicОценок пока нет

- GST - Answer 2Документ9 страницGST - Answer 2Tarun SolankiОценок пока нет

- 6mmmmm: M M M MДокумент12 страниц6mmmmm: M M M MUtsav PoddarОценок пока нет

- Latest Updates in Indirect Tax Law For May 2015 Exams A. Central ExciseДокумент21 страницаLatest Updates in Indirect Tax Law For May 2015 Exams A. Central Excisesivanpillai ganesanОценок пока нет

- Project Report On Value Added Tax (VAT)Документ77 страницProject Report On Value Added Tax (VAT)Royal Projects100% (6)

- VAT Taxpayer Guide - VAT Return FilingДокумент16 страницVAT Taxpayer Guide - VAT Return FilingNeeyum Njaanum0021Оценок пока нет

- Goods and Service Tax NoДокумент5 страницGoods and Service Tax NonitinОценок пока нет

- Taxation of Cross-Border Mergers and Acquisitions: February 2022Документ14 страницTaxation of Cross-Border Mergers and Acquisitions: February 2022Đinh Ngọc BiếtОценок пока нет

- Acct Chapter 15BДокумент20 страницAcct Chapter 15BEibra Allicra100% (1)

- St. Mary'S Technical Campus, Kolkata Mba 3 Semester: Q1 Write Short Notes On (Any Five)Документ22 страницыSt. Mary'S Technical Campus, Kolkata Mba 3 Semester: Q1 Write Short Notes On (Any Five)Barkha LohaniОценок пока нет

- Indirect and Customs ActДокумент95 страницIndirect and Customs ActAyushi TiwariОценок пока нет

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleДокумент10 страницCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaОценок пока нет

- Paper 11 - Indirect Taxation - Syl2012Документ43 страницыPaper 11 - Indirect Taxation - Syl2012sumit4up6rОценок пока нет

- Basic Concepts of VATДокумент20 страницBasic Concepts of VATspchheda4996Оценок пока нет

- Value Added Tax in Maharashtra - Project Report MbaДокумент72 страницыValue Added Tax in Maharashtra - Project Report Mbakamdica100% (12)

- Developing The Business Idea: True-False QuestionsДокумент12 страницDeveloping The Business Idea: True-False QuestionsjenovaОценок пока нет

- Lesson 6 - ProductДокумент7 страницLesson 6 - ProductShanley Del RosarioОценок пока нет

- Week 1 LabДокумент3 страницыWeek 1 LabSara ThompsonОценок пока нет

- Kel691 XLS EngДокумент10 страницKel691 XLS EngSuyash DeepОценок пока нет

- Agreement For Liquidation Auction ServicesДокумент3 страницыAgreement For Liquidation Auction ServicesNeelamgaОценок пока нет

- Rishikesh Mokashi: Mobile: 9049058262/8999895336 E-Mail: Job ObjectiveДокумент3 страницыRishikesh Mokashi: Mobile: 9049058262/8999895336 E-Mail: Job ObjectivekarlОценок пока нет

- 10D 2Документ20 страниц10D 2Hidalgo, John Christian MunarОценок пока нет

- Introduction To FinTechДокумент34 страницыIntroduction To FinTechvarun022084100% (4)

- Coca-Cola Co.: Liquidity RatiosДокумент8 страницCoca-Cola Co.: Liquidity RatiosDBОценок пока нет

- 23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncДокумент2 страницы23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncPamelaОценок пока нет

- Carlos Hilado Memorial State College: College of Business, Management and Accountancy Fortune Towne Campus, Bacolod CityДокумент11 страницCarlos Hilado Memorial State College: College of Business, Management and Accountancy Fortune Towne Campus, Bacolod CityJoshua de JesusОценок пока нет

- Problems 123Документ52 страницыProblems 123Dharani RiteshОценок пока нет

- Economics PDFДокумент44 страницыEconomics PDFyesuОценок пока нет

- Item Master TemplateДокумент6 страницItem Master TemplatenrupenvarthyОценок пока нет

- ImsДокумент74 страницыImstextile028Оценок пока нет

- Economics For Today 5Th Asia Pacific Edition by Layton Full ChapterДокумент41 страницаEconomics For Today 5Th Asia Pacific Edition by Layton Full Chapterphilip.prentice386100% (24)

- Class Discussion QuestionsДокумент2 страницыClass Discussion Questionshank hillОценок пока нет

- Axiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Документ5 страницAxiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Rhb InvestОценок пока нет

- Cash Basis Accounting Vs Accrual SystemДокумент3 страницыCash Basis Accounting Vs Accrual SystemAllen Jade PateñaОценок пока нет

- Taxation Law CIA 1 (B) Salary AnalysisДокумент3 страницыTaxation Law CIA 1 (B) Salary Analysisawinash reddyОценок пока нет

- Account StatementДокумент10 страницAccount StatementVinod KumarОценок пока нет

- 4a - Long Term Sources of FinanceДокумент12 страниц4a - Long Term Sources of FinanceSudha AgarwalОценок пока нет

- SolutionManual (Project Managment)Документ9 страницSolutionManual (Project Managment)Ayan Ahmed0% (1)

- The Credit Manager of Montour Fuel Has Gathered The FollowingДокумент1 страницаThe Credit Manager of Montour Fuel Has Gathered The Followingamit raajОценок пока нет

- Media Economics: Presented by Majid Heidari PHD Student Media MangementДокумент43 страницыMedia Economics: Presented by Majid Heidari PHD Student Media MangementangenthОценок пока нет

- Introduction To Accounting - Principles of AccountingДокумент178 страницIntroduction To Accounting - Principles of AccountingAbdulla MaseehОценок пока нет

- Feasib ScriptДокумент3 страницыFeasib ScriptJeremy James AlbayОценок пока нет

- Ind Nifty FMCG PDFДокумент2 страницыInd Nifty FMCG PDFArvind AceОценок пока нет

- Causes of Industrial Backward NessДокумент2 страницыCauses of Industrial Backward NessFawad Abbasi100% (1)

- Buy Verified Revolut AccountsДокумент8 страницBuy Verified Revolut Accountskezjana dardhaОценок пока нет

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProОт EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProРейтинг: 4.5 из 5 звезд4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Tax Savvy for Small Business: A Complete Tax Strategy GuideОт EverandTax Savvy for Small Business: A Complete Tax Strategy GuideРейтинг: 5 из 5 звезд5/5 (1)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОт EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОценок пока нет

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОт EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОценок пока нет

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyОт EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyРейтинг: 4 из 5 звезд4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessОт EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessРейтинг: 5 из 5 звезд5/5 (5)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОт EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОценок пока нет

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012От EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Оценок пока нет

- Estrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoОт EverandEstrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoОценок пока нет

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОт EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОценок пока нет

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОт EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОценок пока нет

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)От EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Рейтинг: 4.5 из 5 звезд4.5/5 (43)

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesОт EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesОценок пока нет

- S Corporation ESOP Traps for the UnwaryОт EverandS Corporation ESOP Traps for the UnwaryОценок пока нет

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsРейтинг: 3.5 из 5 звезд3.5/5 (9)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionРейтинг: 5 из 5 звезд5/5 (27)

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)