Академический Документы

Профессиональный Документы

Культура Документы

Short Notes On Income Tax

Загружено:

sk sharmaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Short Notes On Income Tax

Загружено:

sk sharmaАвторское право:

Доступные форматы

Tax Year 2012

Short Notes

On

INCOME TAX

Topics Covered:

1. Salary

2. Employee share scheme

3. Income from property

4. Capital Gains

5. Final Tax Regime

6. Tax Credit

7. Income From Business

8. Tax on Tax

9. Losses

10. Minimum Tax

11. AOP

BY : Kashif Nawaz Jakhar

Contact No# 0331-4791167

INCOME TAX (Tax Year 2012)

PREFACE

Al-Hamd-O-Lillah, the 2nd addition of Short Notes on Income Tax

has been completed. These notes have been prepared under the

senior guidance of my dearest teacher Mr. Imran Shehzad (ACA) sb,

who guided me through the way in the preparation of such quality

notes for the students of Module-C.

In these note, I covered almost all the material areas covering upto

50 to 60 marks in the paper including numerical calculations and

fair presentations of the conceptual queries frequently asked by the

ICAP-Examiner.

These notes include:

a) Salary

b) Income from property

c) Income from business

d) Capital Gain (37 & 37A)

e) Income from other sources

f) Final Tax Regime

I try to retain the focus of the ICAP-examiner in paper construction

relative to the marks allocation as:

Topics

Individual or AOP

Conceptual queries

Marks

20-25

30-35

I recommend to study these notes with reference to

INCOME TAX & SALES TAX Khalid Petiwalas Notes.

I hope my efforts will help you to retain maximum marks in your

examination.

Utmost efforts have been made to make these notes free from

errors, yet there is always a room for improvement. Any suggestion

from you will highly be appreciated.

Kashif Nawaz

By : Kashif Nawaz Jakhar

Page 2

INCOME TAX (Tax Year 2012)

TABLE OF CONTENTS

Sr. no. Topics

Page no. Sr. no. Topics

Page no.

Basic concepts

12

Bad Debts

36

Salary

13

SPV

37

Provident Fund

11

14

Methods of

Accounting

39

Employee Share

Scheme

12

15

Minimum Tax

40

Capital Gain

13

16

Losses

( concepts )

43

Final Tax

Regime

15

17

Losses

45

Tax Credit

19

18

Group Taxation 49

& Group Relief

Income From

Business

22

19

AOP

53

In-admissible

Expenses

25

20

Tax on Tax

57

10

Depreciation

27

21

Share from

AOP

59

11

Amortization

35

22

By : Kashif Nawaz Jakhar

Page 3

INCOME TAX (Tax Year 2012)

COMPUTATION OF TAX LIABILITY (Under NTR)

Part A

Profile of Assessee

Part B

Computation of Income

Rs.

Name:

Salary ( U/S 12 )

xxx

NTN :

Income From Business

a) Speculative

Xxx

(1) Personal Status

I.

II.

Salaried

Non-Salaried

III.

AOP

IV.

Company

II.

Resident

Non-Resident

III.

Pakistan source

IV.

Foreign Source

(3) Tax Year

I. Normal tax Year

Tax on Tax Able Income

xxx

Tax on person

Add :

Income Prom Property

Capital Gain ( U/S ) 37A

Capital Gain ( U/S 37 )

xxx

Tax Credits:

Income From Other Sources

xxx

Less: Allowances

Less:

Senior Citizen Allowances

(xxx) Full time Teacher Allowances

(xxx) Foreign Tax credit

(xxx)

(xxx) Less : Average Relief

(xxx)

(xxx)

(xxx)

xxx

xxx

(xxx)

(xxx)

(xxx)

(xxx)

b) Non-Speculative

WWF

WWPF

Zakat

Donations U/S 61

(2) Residential Status

I.

Part C

Computation of Tax Liability Rs.

Add:

Income from property

Capital gain ( U/S ) 37 A

Total Income

( excluding share from AOP )

xxx

Investment in shares

Contribution to PF

Donation

Profit On debt

xxx

xxx

xxx

Less; Advance Tax

Add:

Share from AOP

xxx

Total Taxable Income

XXX

II. Special Tax Year

Collection of Tax

Deduction of Tax

Advance Tax ( u/s 147 )

Tax Payable /Refundable

III. Transitional Tax Year

By : Kashif Nawaz Jakhar

Page 4

(xxx)

(xxx)

(xxx)

XXX

INCOME TAX (Tax Year 2012)

INCOME TAX ( Tax year 2012)

TAX LAWS

Income Tax Ordinance

Ordinance

Income Tax rules

Explanation

Schedule

STATUS

Personal Status

Individual

Salaried

Residential Status

AOP ( 25%)

Company ( 35%)

Resident

Non Resident

Non Salaried

Salaried Person :

Total Salary Income . X 100=If answer is >50%,then salaried person.

Total Taxable Income

AOP ( Association of person ) 25%

Resident when control and management of affairs is

situated wholly or partially in Pakistan.

AOP may be a * firm * joint venture * Hindu undivided

family * but does not include a company.

By : Kashif Nawaz Jakhar

Page 5

INCOME TAX (Tax Year 2012)

Company : 35%

(1)

private (2) Public (3) Banking

Company incorporated in Pakistan , provincial govt. , and local

govt. are resident

Other companies are resident if control and management

affairs are situated wholly in Pakistan.

Resident :

183 or more days

Half day consider full day

NOTE: Only transit days are excluded.

Computation of Taxable income

Income is classified as by law

Geographical Source of Income

1) Pakistan source Income

2) Foreign source income

Heads of income

Regimes

1) Normal

2) Final

SCOPE OF TAXABLE INCOME

1. Resident

Both incomes are taxable

2. Non resident

Only Pakistan source income is taxable

By : Kashif Nawaz Jakhar

Page 6

INCOME TAX (Tax Year 2012)

3. Foreign source income of a short term resident

Pakistan source income is taxable

Foreign source income exempt which is not

brought / received in Pakistan

He is in Pakistan only for employment not for

business

Present in Pakistan for not exceeding 3 years

4. Foreign source income of a Returning Expatriate

non resident for last 4 years

National of Pakistan

An individual

Income ( current & next year exempt )

TAX YEAR

Normal Tax Year

Special Tax Year

1july 02------30june 03

A period of 12 months

ending on 30th June

1-10-2008-to 30-09-2009

A period of 12 months

ending on any date

other than 30th June

By : Kashif Nawaz Jakhar

Transitional Tax Year

Whenever there is a change in

tax year the period in between

the normal tax year and special

tax year is treat as transitional

tax year

Page 7

INCOME TAX (Tax Year 2012)

HEADS OF INCOME

1.

2.

3.

4.

5.

Salary

Income from property

income from Business

capital gain

income from other sources

SALARY : ( taxed on receipt basis )

relationship of employee and employer

Cash basis

Income From property : ( taxed on accrual basis )

Rent from immoveable property ( Land & building )

Forfeited deposit against sale of immovable Property

Only for that year in which Forfeited

Advance unadjusted Rent

{Unadjusted amount X 1/10} in that year

Signing amount

Note :

I. Mod of payment is irrelevant

II. Any benefit given by tenant to his landlord is rent

Income from business

Trade , manufacturing . any profession

Capital Gain ( gain from disposal of capital assets )

Shares , coins , postage stamp, jewelry

Income from other sources

If any income does not fall under any other heads . then it

will be under the head of income from other sources.

e.g.,

Dividend

By : Kashif Nawaz Jakhar

Page 8

INCOME TAX (Tax Year 2012)

SALARY

Any kind of benefit transfer or

given by employer to employee will be taxed and it will be add in the

salary income of the employee.

Components of salary

Basic Salary

T.T

Perquisites

Allowances

Accommodation

Conveyance

Medical facility

Others benefits

H.R.Allowance ( T.T )

Conveyance allowance

( T.T )

Medical allowance

(exempt upto 10% of B.S)

Loans

U. bills

Comp. shares

TA / DA

Terminal benefits

Gratuity

Provident fund

Pension

Golden hand

Shake

Perquisites

1) ACCOMMODATION :

45% of BS or Actual Expense of employer(rent)

( whichever is higher = add in salary )

2) Conveyance:

Only for office use

Owned ( cost )

I. Personal

II. Personal + Business use

Leased ( FMV )

I. Personal

II. Personal + Business use

( T.E )

( 10% )

( 5% )

( 10% )

( 5% )

3) Medical Facility :

a) Facility Given

i.

ii.

Under the contract

Not Under the Contract

( T.E )

(T.T )

b) Re-imbursement

c) Insurance

Amount contributed by employer will be added in

salary

By : Kashif Nawaz Jakhar

Page 9

INCOME TAX (Tax Year 2012)

4) Medical facility & medical Allowance both given

i.

ii.

Under the contract

a. Facility

( T.E )

b. Allowance

( T.T )

Not Under the contract

a. Facility

( T.T )

b. Allowance

(Exempt upto 10% of BS )

5) Asset is given to employee Permanently

FMV of Asset payment by employee = add in salary

6) Marginal cost:

Nothing will be added in salary, if no additional cost incurred

by the employer

Other Benefits :

Loan provided by employer

Loan X 14% X time = XXX add in salary

Note : if any interest paid by employee then that amount

will be deduct from above answer . and the remaining will be

added in salary.

Terminal Benefits

1. Pension ( Exempt )

a. In case of 2 or more than 2 pensions

( higher will be exempt)

b. In case of re-employment with same employer or group

No amount will be exempt

2. Gratuity

a. Approved

I. Government

II. Fund

III. Scheme

b. Unapproved

( T.E )

( T.E )

(exempt upto Rs.200,000 )

Rs. 75000 or 50% of gratuity amount

( lower will be exempt)

Note : unapproved conditions or exemptions will

be not applied on the following Cases.

i.

ii.

iii.

iv.

By : Kashif Nawaz Jakhar

Non employee

Non resident

Not received in Pakistan

Re-employment

Page 10

INCOME TAX (Tax Year 2012)

3. Provident Fund.

= Employer + employee contribution

Unrecognized PF

Annual

X

Withdrawal Employer Contribution + interest = add in salary

Recognized PF

Note

X

Note:

Rs.

Rs.

Employer contribution (p.a)

10% X ( BS + DA )

Whichever

Or 100,000

is lower

Interest on Acc. Balance (p.a )

1/3 X ( BS + DA )

Whichever

Or 16% X Acc.Balance

is lower

XXX

(xxx)

XXX

add in salary

XXX

add in salary

XXX

(XXX)

Note :

Acc. Balance = Employee cont. + Employer Cont. + interest

Formula ::: ( For calculate missing figure )

Interest = Acc. Balance X Rate

If any figure missing we can calculate with the help of above

formula .

By : Kashif Nawaz Jakhar

Page 11

INCOME TAX (Tax Year 2012)

EMPLYEES SHARE SCHEME

60

Capital Gain

Rs.20

Benefit given by Market

40

Salary

Rs.10

Benefit given by employer or company

30

Example :

Persons

Kashif

Rameez

Farhan

2010

2011

2012

Option sale = Rs.5000

Option sale of 200 shares

@ sale price Rs. 3000

Acquisition of shares

Balance(300) Acquisition

Sale Rs.60/ share

Sale = Rs. 70

On march 2010.

FMV = Rs. 50/share

Offer value = Rs. 30/share

No. of share = 500 shares

Advance = 2 per share

On march 2011

FMV= Rs.40/ share

SOLUTON:

Persons

Kashif

Rameez

Salary

Capital Gain

Salary

2010

4000

X

X

2011

X

X

5000

(500 X 10 )

Capital Gain

500 X 30 = 15000

X

Farhan

Salary

2600

{3000-(200 X 2 )

Capital Gain

2012

X

X

X

X

3000

(300 X 10 )

6000

{300 X (60-40)}

SP-FMV=70-40=30

X

X

Here Rs. 10 = FMV Offer Value

By : Kashif Nawaz Jakhar

Page 12

INCOME TAX (Tax Year 2012)

CAPITAL GAINS

Definition : The Gain from Disposal of Capital Assets.

C

A

B

Explanation:

a) Gain

b) Disposal

Sale price/FMV --- cost of

disposal

I. Sale with in one year ,100%

add in taxable income

II. Disposal after one year ,75%

add in salary

c) Capital Assets

Disposal

Means

Sale

Transfer

Destroyed

Gift

Relinquished

Capital Assets :

These

o

o

o

o

o

So,

are not capital assets

Immovable

Intangible

Depreciable

Stock-in-trade

Other movables ( cars )

These are Capital Assets

o Shares

o Debentures

o Shares of Private company

o Shares of AOP

o Membership cards of stock

exchange

After one year 25% of gain

is Exempt. & 75% of gain is

taxable

Capital Gains

37

Gain/Loss

37 A

Gain

Taxable income in case of Gain

I. Disposal within year, 100% add

in taxable income.

II. Disposal after one year , 75%

add in taxable income.

By : Kashif Nawaz Jakhar

Shares of public limited company

Redeemable debentures

Modaraba certificates

PTC vouchers

Derivatives

If these assets sold

With in 6 months = 10% of gain is taxable

With in one year = 7.5% of gain is taxable

After one year

= No tax

Page 13

INCOME TAX (Tax Year 2012)

Non recognition rule:

under the following conditions income is not taxed.

1) Inheritance

2) Gift

3) To transfer to a spouse

4) In case of dissolution of a company

ASSETS whose Gain is Taxable But no treatment of loss

1)

2)

3)

4)

5)

Jewelry

Coins

Medallions

Postage stamp

Sculpture

By : Kashif Nawaz Jakhar

etc

Page 14

INCOME TAX (Tax Year 2012)

Final Tax Regimes

Regime: Traditions

1. NTR ( normal Tax Regime )

2. FTR ( Final Tax Regime )

1. NTR :

Just add the income on the basis of persons and applied tax.

PERSONS

I. Individual

Salaried

Non Salaried

II. AOP

25%

III. Company

35%

Incomes should be under there related head of incomes

Revenue Expense = Income

Sale price purchase price = income

Return file in case of NTR.

2. FTR :

No expenses are allowed

e.g.

Revenue = income

No heads of incomes

Tax rates are independents for persons

No loss

Income is Tax on gross basis

Statement file in case of FTR.

Note

i.

Dividend for

o Individual

o AOP

Shall be considered under FTR

ii.

Dividend for

o Company

Shall be considered under NTR.

So for companies the dividend shall be recorded

under the head of Income from business in case

of banking business.

By : Kashif Nawaz Jakhar

Page 15

INCOME TAX (Tax Year 2012)

Dividend Income :

Dividend income shall be deducted @10% of gross

dividend which shall be considered full and final tax for the other than a

corporate shareholder .

e.g.

Net dividend after deducting Tax and Zakat is Rs. 875

Calculate gross dividend .

Solution :

Formula :

875 .

X 100 = 1000

87.5

By : Kashif Nawaz Jakhar

Page 16

INCOME TAX (Tax Year 2012)

Important Terms

Deduction Of Tax

Collection Of Tax

Advance Tax

Final Tax

1. Deduction Of Tax:

Deduct from Income

Payer will deduct the Tax in case of deducting authority

Income over which Deduction of Tax Applied

Supply of Goods , Dividend , Services , Price

winning , Salary , Export

2. Collection Of Tax :

Formula to Remember

Collect from expense

Services provider will collect the tax

Expenses over which Collection of tax applied

Cell phone payment , imports

D

I

C

E

=

=

=

=

Deduction from

Income

Collection from

Expense

3. Advance Tax : ( NTR )

The items which fall under NTR ( according to law ).

So the tax deduct or collect on such items is Advance tax

4. Final Tax :

( FTR )

The items which fall under FTR ( according to law ). So

the tax deduct or collect on such items is Final tax.

Withholding TAX

Aisa tax jo kisi bhi source say collect ya

deduct hova hoo.

By : Kashif Nawaz Jakhar

Page 17

INCOME TAX (Tax Year 2012)

Table For understanding

Persons

Supply

Trading

Manufacturing

Contracts

Individual/ AOP

Unlisted companies

listed companies

FTR

FTR

FTR

FTR

NTR

FTR

NTR

NTR

NTR

Retailers ( sale goods for final consumptions )

Individual / AOP

Turnover < 5 million

Turnover > 5 millions

Option to pay tax @ 1% of Sale

as Final Tax.

Compulsory to pay as

final tax

Condition

Turnover > 5 m but < 10 m

Turnover > 10 m

By : Kashif Nawaz Jakhar

Rate of Tax

Rs.25000 + 0.5% of Turnover > 5 m

Rs.25000 + 0.75% of Turnover > 10 m

Page 18

INCOME TAX (Tax Year 2012)

TAX CREDIT

Rs.

XXXX

(xxx)

(xxx)

(xxx)

. A .

Tax liability

Less: Senior citizen allowance

Less: Full time teacher allowance

Less: Foreign Tax Credit

Less:

Less:

Less:

Less:

Investment in shares

Pension fund

Donation

Profit on debt

(xxx)

(xxx)

(xxx)

(xxx)

XXXX

(xxx)

Less: Advance Tax

or

Tax Payable

XXXX

Tax Refundable (f negative figure)

(XXXX)

Note( Related to Tax Credit )

Lower

Invest. In shares

Pension Fund

Donation

Actual Amount

Actual Amount

Actual Amount

15 %

20 %

500,000

------

Profit on debt

Actual Amount

30 %

------

50 %

% of taxable income

750,000

FORMULA :

A

X Lower = Tax credit

Taxable Income

.

By : Kashif Nawaz Jakhar

Page 19

INCOME TAX (Tax Year 2012)

Rules Of Tax Credit :

Conditions

Senior citizen allowance

Full time teacher allowance

Foreign tax credit

Eligibility amount

Age 60 years or more

Taxable income does

exceed Rs. 10,00,000

A full time teacher ; or

A researcher of a recognized

non-profit

educational

or

research institution including

government

training

and

research institution .

Then his tax payable

shall be reduce by

75%.

If the foreign source income of a

resident person is taxable in

Pakistan

then the taxpayer shall

be allowed tax credit in

respect

of

foreign

income tax paid by him

as lower of:

not

Then his tax liability

shall be reduced by

50%.

Investment in shares

Foreign income tax

paid; and

Pakistan tax payable

in respect of foreign

source income at

average rate of tax.

o

o

Shares must be of listed

Comp.

Must be original allottee

Did not dispose in one year

o

o

o

actual

15 % of T.I

Rs.500,000

Approves Institution

Govt. hospital

Not trough CASH

May be direct or by cheque.

actual

20% of T.I

Donation

Eligible person (u/s 19A )

PF must be approved

Actual

30% of T.I

Lower

Profit on debt

Loan for house build.

Loan from bank or financial

institution

Actual

50% of T.I

Rs.750,000

Lower

Contribution

fund

to

pension

See illustration no. 2.9 & 2.10 of K.petiwala

By : Kashif Nawaz Jakhar

Page 20

Lower

Lower

INCOME TAX (Tax Year 2012)

Full Time Teacher Allowance :

Formula :

Taxable salary(as F.T.T) X Tax payable X 75% = XXX

Taxable Income

Where :

F.T.T means = Full time Teacher

After deducting senior

citizen allowance

Foreign Tax Credit :

Formula :

Tax payable(Note 1) X Foreign source income = xxxx

Taxable Income

Tax paid in foreign Country

= xxxx

Note 1 :

Tax Payable

xxxxx

Less: Senior citizen allowance

(xxxxx)

Less: Full time Teacher allowance (xxxxx)

Tax Payable ( Note 1 )

xxxxxx

By : Kashif Nawaz Jakhar

Lower will be deducted

from tax payable

Page 21

INCOME TAX (Tax Year 2012)

INCOME FROM BUSINESS

Taxable

Income

(Income Deduction = T.Income)

Deduction

( 5 % discussion)

( 95 % Discussion )

Exempt

Non speculative

Speculative

WE discuss about it:

1: Definition

2: Losses

Special

(Separate Calculation)

Depreciation

Allowed (20% discussion)

Or ( Admissible )

Amortization

Without any condition

e.g.

* Tax

* Personal expenditure

By : Kashif Nawaz Jakhar

Pre-commencement

Dis-Allowed (80% discussion)

Or ( inadmissible )

Research

&

Development

Conditionally

e.g.

* salary in certain condition

paid through cash

* Tax is deducted

Page 22

INCOME TAX (Tax Year 2012)

Example : ( of allowed and disallowed expenses )

!!!!!!!! Income statement according to IAS !!!!!!

Particulars

Rs.

Particulars

Purchase

Opening Stock

Factory Salary (10)

Depreciation (70)

Income Tax

Admin salary

300

100

50

50

40

30

Profit

500

Rs.

Sales

Closing Stock

Dividend

1000

50

20

1070

1070

!! Income statement according to Income Tax Ordinance 2001 !!

Particulars

Rs.

Particulars

Rs.

Purchase

Opening Stock

Factory Salary

Depreciation

Admin salary

300

100

40

70

30

Sales

Closing Stock

1000

50

Profit

510

1050

1050

Solution :

Computation OF Taxable Income :

Rs.

Accounting Profit

Rs.

500

Add: Disallowed Expenses

Salary

Depreciation

Income tax

10

50

40

100

Less: Allowed Expenses:

Dividend Income

Depreciation

20

70

(90)

Taxable Income

By : Kashif Nawaz Jakhar

510

Page 23

INCOME TAX (Tax Year 2012)

SECTION. 20.

ALLOWED EXPENSES

All expenses incurred for business.

Apportionment of Expenses :

e.g.

FTR

Common Expenses

500,000

NTR

400,000

Expenses

Expenses

333333

27778

16667

266667

22222

13333

=900,000 (turnover)

Expenses

600,000

50,000

30,000

purchases

salary

depreciation

Income under FTR ( no expenses allowed ) = Rs. 500,000

Income under NTR ( expenses are allowed ) = Rs. 337,778

Formula for calculate Expense:

Sale(under NTR)

Total Turnover

By : Kashif Nawaz Jakhar

X Expense = xxxx

Page 24

INCOME TAX (Tax Year 2012)

Section . 21:

In-Admissible Expenses

Not Allowed Expenses:

Following expenses are not allowed

TAX :

Income Tax

Sales Tax

Advance Tax

Violation Of Law ( Penalty )

Allowed

(For Business)

Disallowed

(Against Law)

AOP

Salary or other benefit by AOP to its members are not

allowed.

Salary Paid

Notes :

o Salary , commission

o Deducting the authority but did not deduct tax

o Then the tax expense not allowed.

TRADING LIABILITY

Those liabilities which effect the P & L A/C

e.g.

a. Cash

To Loan

XXX

b. Salary

XXX

To Salary Payable

c. Purchases

To Mr. Z

By : Kashif Nawaz Jakhar

XXX

( Capital Liability )

.

XXX

( Trading Liability )

.

XXX

XXX

( Trading Liability )

.

Page 25

INCOME TAX (Tax Year 2012)

DONATION

INCOME

TAX

U/S 61 of 2nd Schedule

Less: ( as Zakat )

Rate:

Donation to approved institution.

e.g. Govt. hospital

( Chapter #2)

Rate: 30 %

30 %

Conditions:

o Pay in cash

o By cheque

o In any kind

Conditions:

o Do not pay in cash

o By cheque

o In any kind

Preliminary Expenses:

are disallowed upto commercial production

( pre-commencement expense )

Trading Liability:

Not paid with in 3 years.

By : Kashif Nawaz Jakhar

Page 26

INCOME TAX (Tax Year 2012)

Chapter # 12

DEPRECIATION

The Rules and Regulation For Depreciation

Rules:

Depreciation shall be charged on depreciable assets.

Depreciation shall be charged after deducting initial

allowance .

FORMULA :

( cost initial allowance ) X Rate of depreciation

e.g.

( 100 50 ) X 10% = 5

INITIAL ALLOWANCE

( Rate 50% )

All depreciable assets are also eligible

depreciable assets except the following :

1. Furniture and Fixture

2. Transport vehicle not plying(use) for hire

e.g. business or rent a car

3. Second time used plant and machinery

Note:

In Pakistan one asset is :

Depreciable + eligible depreciable asset

Only for 1st user . For all other users that asset will be only a

depreciable asset.

INITIAL ALLOWANCE ON VEHICLE

CASES

Rent a car + Daewoo

( eligible depreciable asset )

By : Kashif Nawaz Jakhar

Directors car + company car

( not plying for hire )

Page 27

INCOME TAX (Tax Year 2012)

Eligible depreciable Assets:

Life more than one year

Subject to wear and tear

For business use

IMPORTANT NOTES

Initial allowance @ 50% shall be charged on the

eligible depreciable assets in the 1st year only.

Depreciation shall be charged on reducing balance

method.

Depreciation Rates

Depreciation rates are as follows.

Rates

10 %

Assets

Building

30 %

Computer and related equipment

15 %

All other assets

HINT

Try to compute depreciation in the examination /

prepare the depreciation schedule on written down

value bases.

By : Kashif Nawaz Jakhar

Page 28

INCOME TAX (Tax Year 2012)

Assets use partially for Business:

If an asset , use partially

for business and partially for other objectives , we will charge

deprecation proportionally

BUT initial allowance fully

Example:

Business use ( 60 % ) & for other objectives ( 40 % )

Full yearly

Cost

Initial

allowance

Depreciation

10,00,000

(5,00,000)

5,00,000

(50,000)

4,50,000

60 %

5,00,000

5,00,000

50,000 (60%)

. 30,000.

5,30,000

NOTE

Full year depreciation charge in the year of

purchase.

No depreciation is charged in the year of disposal.

By : Kashif Nawaz Jakhar

Page 29

INCOME TAX (Tax Year 2012)

GAIN or LOSS in disposal of Depreciable Asset:

The gain

or loss on disposal of depreciable assets charged to income from

business.

COMPUTATION OF GAIN or LOSS

Gain or Loss = Sale price/FMV ( higher) - Tax WDV

WHERE:

Tax written down value = Cost Tax depreciation

WHERE:

Tax Depreciation = Depreciation + Initial allowance

NOTE

Full year depreciation charge in the year of

purchase.

No depreciation is charged in the year of disposal.

By : Kashif Nawaz Jakhar

Page 30

INCOME TAX (Tax Year 2012)

Examples :

a(I)

Computation of Depreciation

e.g. numerical example

Year

2007

cost

Initial

allowance(50%)

Depreciation(15%)

Furniture &

Fixture

Plant

500,000

10,00,000

Tax

allowance

500,000

500,000

(75000)

425,000

(500,000)

500,000

(75000)

425,000

150,000

650,000

2008

Depreciation(15%)

(63750)

361250

(63750)

361250

127500

2009

Depreciation(15%)

(54188)

307062

(54188)

307062

108376

b(II)

Computation of Gain or Loss

Assume the plant sold for Rs.500,000 in 2009. now compute the

gain or loss.

= sale price tax WDV

= 500,000 361250

Gain = 138750

its the income from business in 2009.

now less depreciation Rs. 54188 of this year from

this income .

By : Kashif Nawaz Jakhar

Page 31

INCOME TAX (Tax Year 2012)

a(II)

Asset Partially Used For Business

(assume 60% for business use )

Year

2007

Plant

Cost

Initial allowance

Depreciation(15%)

2008

Depreciation(15%)

2009

Depreciation(15%)

10,00,000

(500,000)

500,000

(75000)

425,000

(63750)

361,250

(54188)

307,062

Tax Allowance/ dep.

allowance

500,000

45000

545,000

38250

583,250

NOTE: the depreciation column must be draw and calculate

depreciation.

b(II)

!!!! Calculation of Profit or Loss !!!!!!!!!

when

!!!!!Asset partially used for business !!!!!

Assume the plant sold for Rs.500,000 .

= sale price Tax WDV

= Sale price - ( cost depreciation allowances )

= Sale price [ cost ( initial allowance + depreciation)]

= 500,000 [ 10,00,000 583250 ]

= 83250

income from business

By : Kashif Nawaz Jakhar

Page 32

INCOME TAX (Tax Year 2012)

Cases for Gain or Loss

( three cases )

Exceptions:

Building

( Case 1 )

Export of use asset

( Case 2 )

= sale price Tax WDV

= Sale Price ( cost tax Depreciation )

NOTE:

= sale price Tax WDV

= Sale Price ( cost tax Depreciation )

NOTE:

If sale price is above the cost price

If a used asset sold, out of Pakistan ,

then the cost shall be consider as sale price sale price will be consider as cost.

So,

So,

=Sale Price ( sale price tax Depreciation )

= cost ( cost tax Depreciation )

=Sale Price - sale price + tax Depreciation

= cost cost + tax Depreciation

= Tax depreciation

= Tax depreciation

It means that the INCOME will be equal

to the TAX DEPRECIATION .

e.g.

Tax depreciation = Gain

500,000

= 500,000

Case 3:

NOTE:

It is assume that the asset , sold at

price , at which that was purchased.

CAR

its not about vehicle . because all

cars are vehicle but all vehicles are not cars.

Maximum cost of car is Rs. 1500,000

NOTE

Even it is purchased above the Rs. 1500,000 , we will

consider Rs. 1500,000 and the depreciation will be calculated on

this amount.

e.g.

Year

2010

X car

Cost

Depreciation ( 15 % )

20,00,000

( 225,000 )

1500,000 X 15 %

Written Down Value

*1275,000

*Where 1500,000 225,000 = 1275,000

By : Kashif Nawaz Jakhar

Y car

1200,000

( 180,000 )

1200,000 X 15 %

1020,000

Page 33

INCOME TAX (Tax Year 2012)

ASSUME

Both cars were sold for Rs. 1500,000 each

NOTE:

sale price ki amount utni laini hai , jitni cost ki %age allow ki

gai thi

FORMULA :

n=

1500,000 X 100

cost

only for those assets whose cost id above Rs.1500,000

So,

= sale price Tax WDV

and ,

sale price = 1500,000 X 75% = 1125,000

X car

1500,000 . X 100

20,00,000

Y car

= ( sale price x n ) Tax WDV

= 1125,000 1275,000

Loss = ( 150,000 )

By : Kashif Nawaz Jakhar

= sale price Tax WDV

= 1500,000 10,20,000

Gain = 480,000

Page 34

INCOME TAX (Tax Year 2012)

AMORTIZATION

NOTE

amortization is allowed on intangible assets.

intangible asset--------definition .

amortization shall be charged on per day used method.

no amortization in the year of disposal

the maximum life of a intangible asset is 10 years.

if life exceeds 10 years or unknown , in this case,

10 years will be consider as the life of intangible

asset.

e.g.

Year Copy Right

Purchase price= Rs. 200,000

Life

= 7 years

Date of purchase . 1-1-2011

Year end = 30 June, 2011

Solution,

cost

2011 = useful life

Solution,

.

x days used

cost

.

useful life

= 200,000 . x 181

= 300,000 .

= 14168

= 14876

7 X 365

2012

Patent

Purchase price= Rs. 300,000

Life

= 15 years

Date of purchase . 1-1-2011

Year end = 30 June, 2011

= 200,000

. x 365

7 X 365

= 28571

x days used

x 181

10 X 365

= 300,000 .

x 365

10 X 365

= 30,000

NOTE: use full life in days

By : Kashif Nawaz Jakhar

Page 35

INCOME TAX (Tax Year 2012)

BAD DEBTS

Sale to Mr. A for Rs. 100,000 on credit in 2009. it will the income

for 2009 under NTR.

2010 :

Mr. A didnt pay back. we claim Rs. 100,000 in Tax`

Department for allowing us expense.( bad debts ). but tax

department allow expense to us Rs. 50,000.

2011:

No.

A

B

C

Situations. (Receipts)

Actual Bad Debts

Tax Treatment

100,000

50,000

Nothing

nil

50,000

100,000

80,0000

20,000

50,000 ---Income

No treatment

50,000 --- expense

allowed

30,000 ---income

Ways of asking question about Bad Debts in exam.

1) Conditions of Bad Debts :

how to claim bad debts in the

department.

2) Recovery of Bad Debts :

Tax treatment .

Formula :

Allowed Actual = + or

NOTE

If answer is + then = add in income from business

If answer is - then = less from income from business

By : Kashif Nawaz Jakhar

Page 36

INCOME TAX (Tax Year 2012)

!!!!!!! Perquisites for claiming Bad Debts !!!!

The amount must be declared as income before.(pahly)

Entry of bad debts has been passed in the books of

accounts.

NOTE :

it is not necessary that the department will allow the

whole amount as expanse which we claimed in the department.

!!!!!!! ACCOUNTING TREATMENT OF LEASE !!!!

amount paid for lease.

Amount of Lease ( Rs.50,000 )

Depreciation

( 10,000 )

Capital

Interest

( 1000 )

Insurance

( 500 )

Expense claim in accounting :

depreciation

Interest

Insurance

10,000

1,000

500

11,500

Expense claim in Tax :

The amount which paid against lease that

amount will be allowed. ( Rs. 50,000 )

By : Kashif Nawaz Jakhar

Page 37

INCOME TAX (Tax Year 2012)

!!!!!!!!!

PROFIT ON DEBT !!!!!!!!

( Interest )

We borrow the amount .

So interest is our expense

ALLOWED EXPENSE

debt is utilized for business .its not the part of cost.

SALE OF DEBTOR

SPV

Special purpose vehicle

A person or Organization which used for

special purpose.

e.g. SPV:

Originator

SPV

.5 interest

Itefaq

Itefaq ( IT )

(Sugar)

Investment

.5 interest

5 m loan

single company = loan 5 million

Group

= loan 20 million

NOTE

NOTE

loan from subsidiary is not allowed

.

BANK

Loan & lease are both allowed to

SPV.

NOTE

If any Income earned by SPV . That income will be exempt

because income earning is not its objective.

SPV

Originator

6 million

By : Kashif Nawaz Jakhar

1 m --income(exempt)

5 m loan return

Bank

Page 38

INCOME TAX (Tax Year 2012)

METHODS OF ACCOUNTING

Accrual Basis ( Absorptional Costing )

Company

Cash basis ( Marginal Costing )

Individual / AOP

Option

Closing Stock Valuation

Absorptional Costing

( Add all kinds of Costs )

Marginal Costing

( Fixed FOH will be excluded )

e.g.

Factor of

Production

Absorptional

Costing

Factor of

Production

Marginal

Costing

Material

Labour

FOH

Variable

Fixed

50

10

Material

Labour

FOH

Variable

50

10

20

10

90

Define Small company .

By : Kashif Nawaz Jakhar

20

80

Rate : 25 %

Page 39

INCOME TAX (Tax Year 2012)

MINIMUM TAX

Rate :

1 % of Turnover

Higher

Or

Actual Tax Liability

income is exempt .

Who will pay Tax :

Resident Company

Individual having Turnover 50 million or Above.

AOP having 50 million or Above.

Turnover :

means,

Sale

Excludes

sales tax , excise duty

Services

Share from AOP

Provisions :

1st Year

2nd Year

forward

Excess of actual Tax Liability shall be carry

for subsequent 3 years.

Advance Tax = Actual Tax Liability 1 % of Turn Over

Advance Tax =Remaining Actual Tax Liability 1 % of Turn Over

HINT

Excess of 1 % of T.O from Actual Tax Liability will be advance tax and

that excess amount will be deduct in the next year from actual tax

liability. And then the remaining of actual tax liability will be compare

with 1 % of turn over.

Higher of :

Actual Tax liability

&

1 % of Turnover

will be payable.

By : Kashif Nawaz Jakhar

Page 40

INCOME TAX (Tax Year 2012)

EXCEPTIONS:

Minimum tax not apply , if business entity declare

gross loss before depreciation and other inadmissible

expenses.

Commissioner has the power to re-asses the income.

Minimum tax not apply on certain cases.

e.g. Modaraba , non-profit organization.

Employee Training and Facilities :

allowed expenditures other than capital expenditures

.

o

o

o

Hospital or educational institution for the benefit of

employees.

For the training of industrial workers run by federal

or Provincial Government

Training of citizen of Pakistan . e.g. PHD

TAX paid on import Stage :

Tax collected by collector of

custom on import of,

edible oil

&

packing material

TAX deduct from services as minimum Tax :

6 % at source from gross income.

no adjustment or refund shall be allowed.

NOTE :

HINT

Services provided to a person , who is not Tax deducting

authority then the said services income is not subject to minimum

Tax.

This provision of minimum tax is not applicable for a company , receiving income

from services.

By : Kashif Nawaz Jakhar

Page 41

INCOME TAX (Tax Year 2012)

Advance Tax on Electricity Bill As minimum Tax :

advance tax is payable on

1. Commercial

&

2. Industrial Bills

RANGE :

TAX

Amount

From Rs.80 to Rs. 1500

Monthly bill exceeds Rs.400 but does not exceeds Rs.

2000

If monthly bill exceeds Rs. 20,000

Users

Rate

Commercial

Industrial

10 %

5%

Electricity bill for person other than Company :

Bill upto Rs. 30,000 per month shall be treated

as minimum tax.

No refund or adjustment shall be allowed.

Scientific Research Expenditure :

Deduction allowed , if expenditure incurred in

Pakistan

For business purpose

!!!!!! Scientific Research !!!!!

Any activity in the

field of natural (mining, oil refinery) or Applied Science (new

technology) for the development of human knowledge.

By : Kashif Nawaz Jakhar

Page 42

INCOME TAX (Tax Year 2012)

CH # 15 :

LOSSES

General concepts :

ENGINE 1

in urdu

Categories of tickets :

A type ticket

B type ticket

C type ticket

Usage of tickets :

explanation in Urdu.

A type ticket:

A type ticket say ap train k box 1 & 2 main

baith sakty hain. ager in boxes main jaga na hoo tu ap next any wali

6 ( six ) trains main bhe ap un k box no. 1 & 2 main baith sakty hain.

laiken in boxes k elawa ap kisi bhi aor box main nai baith sakty.

B type ticket:

B type ticket say ap mojoda train k kisi bhi box

main baith sakty hain. aor ager is train main jaga nai hai tu ap any

wali kisi bhi train main nai baith sakty.

By : Kashif Nawaz Jakhar

Page 43

INCOME TAX (Tax Year 2012)

C type ticket:

C type ticket ki madad say ap mojoda train k to

kisi bhi box main baith sakty hain laiken ager mojoda train main

jaga na hoo to ap next any wali 6 ( six ) trains main un k box no. 3

main hii baith sakain gay.

HINT

for understanding

mojoda train main bathny say morad hai ====

next train main bathny say morad hai

By : Kashif Nawaz Jakhar

set off

==== carry forward.

Page 44

INCOME TAX (Tax Year 2012)

Ch # 15.

LOSSES

under NTR. because under FTR losses

and expenses are not allowed.

HEADS OF INCOMES UNDER NTR

salary

income from property

NO Loss

separate block of income

income from business

non-speculative

speculative

capital gain

37

37-A

other losses.

No Loss

C type

A type

A type

Losses can be set off only against the

incomes from other items U/S 37 A.

B type

EXPLANATION:

A type:

can be carry forward but they can by set off only

against the incomes of their heads.

B type:

can be set off only

C type:

can be carry forward and set off. but they can

be set off only in 1st year.

Set off :

adjustment of one income or loss in

other head .

Inter head adjustment: adjustment in the same head.

Carry forward:

Transfer to next year.

By : Kashif Nawaz Jakhar

Page 45

INCOME TAX (Tax Year 2012)

Example : 1

Case 1

Rs.(000)

Salary

Non-speculative business

Speculative

Capital gain

Other Losses

500

(800)

(400)

700

(300)

Case 2

Rs.(000)

500

(900)

(400)

700

(300)

Total Income

1200

1200

Requirement :

I. Compute taxable income

II. amount of loss to be carry forward

Solution:

I.

Case 1

Rs.(000)

Total Income

Other losses

Non-speculative business

Total Income

II. Losses to be c/f.

non-speculative

By : Kashif Nawaz Jakhar

Case 2

Rs.(000)

1200

(300)

900

(800)

1200

(300)

900

(900)

100

------

( 400 )

( 400 )

Page 46

INCOME TAX (Tax Year 2012)

Example : 2

Case 1

Rs.(000)

Salary

Non-speculative business

Speculative

Capital gain

Other Losses or Gain

500

(1000)

(400)

700

(300)

Case 2

Rs.(000)

500

(1000)

(400)

700

300

Total Income

1200

1500

Requirement :

III. Compute taxable income

IV. amount of loss to be carry forward

Solution:

I.

Case 1

Rs.(000)

Total Income

Other losses

Case 2

Rs.(000)

1500

Non-speculative business

1200

(300)

900

(900)

Total Income

-------

500 .

(1000)

II. Losses to be c/f.

non-speculative (1000-900) ( 100 )

Speculative

( 400 )

By : Kashif Nawaz Jakhar

------( 400 )

Page 47

INCOME TAX (Tax Year 2012)

HINT

A: In case set off losses.

1st set off other losses

2nd set off non-speculative business losses.

B: In case of carry forward losses.

year wise.

2009

2010

2011

( 100 )

( 200 )

( 500 )

If there is gain in 2012 , then use FIFO method of adjustment of

losses.

2012

2009

2010

2011

By : Kashif Nawaz Jakhar

10000

( 100 )

( 200 )

( 500 )

200 .

Page 48

INCOME TAX (Tax Year 2012)

GROUP TAXATION

as a single fiscal unit.

Features of group taxation:

Note

100% owned group of companies locally incorporated under

companies ordinance 1984.

Loss of any group will be set-off against income of any other

group.

consolidated group accounts as required under companies

ordinance , 1984 will form.

I. Basis of computation of income

II. tax payable by the person

GT relief will not be available to losses prior to the

formation of the group.

Inter corporate dividend income with in the group companies

entitled to group taxation shall be exempt .

GROUP RELIEF

{ surrender of tax loss by a subsidiary company }

Note

a subsidiary company may surrender its assessed loss

( excluding b/f loss and capital loss ) for the tax year in favor

of its holding company or any subsidiary of the holding

company.

The holding company shall directly hold , share capital of the

subsidiary company as under,

55% or more

75% or more

NOTE

in case of listed companies.

in case of non-listed companies.

The loss surrender by 1 subsidiary company may be adjusted by the holding company

or subsidiary company against its business income in the tax year and the following

two tax year.

Any un-adjusted loss shall be revert back to the subsidiary company and shall be

carry forward in the normal manner.

By : Kashif Nawaz Jakhar

Page 49

INCOME TAX (Tax Year 2012)

Example :

S

H

stands for

stands for

1st year = 30

subsidiary company

holding company

2nd year = 40

S-2

H

LOSS = 100

(surrender)

Listed Company

S-1

Assume :

loss incurred in 2006 (adjusted in next 6 tax years)

2012.

the losses were surrender for two years.

So,

2007----- 2008

S-2

losses = 30+40= 70

By : Kashif Nawaz Jakhar

2009, 2010, 2011, 2012

S-1

Remaining 30 were adjusted by

original subsidiary company.

Page 50

INCOME TAX (Tax Year 2012)

Conditions of Group Relief

1. Ownership of share capital shall be continued for 5 years to the

extent of 75% or 55%.

2. Trading company with in the group shall be entitled to avail

group relief.

3. If the holding company is a private company, it is required to

be listed with in 3 years from the year in which loss is claimed.

4. group companies are locally incorporated companies under

companies ordinance 1984.

5. board of directors approval of both the companies is required.

6. Subsidiary company , continuous the same business during the

said period of 3 years.

7. all the companies in the group shall comply with specific

corporate governance requirement.

8. Inter corporate dividend with in the group companies entitled

to group taxation shall be exempt.

9. The subsidiary company cannot surrender its assessed losses for

more than the 3 tax years.

10. The tax relief availed would be reversed if holding companys

equity interest falls below 75% or 55%. As a consequences of

disposal of shares during the stipulated period of 5 years .

11. Loss claiming company , may , with the approval of Board of

directors , transfer cash to loss surrendering company , equal to

the amount of tax saving in this respect.

This transfer shall would not be allowed tax

expense for the loss claiming company or taxable income for the

loss surrendering company.

By : Kashif Nawaz Jakhar

Page 51

INCOME TAX (Tax Year 2012)

Some Important Concepts

S

H

stands for

stands for

1st year = 30

subsidiary company

holding company

2nd year = 40

Benefit

= Rs15

S-2

H

LOSS = 100

(surrender)

Cash Rs.10

S-1

This Cash of RS.10 received by Loss surrendering

company will be not treated as income of this company.

Transfer of shares between the companies and the

shareholder , in one direction , would not be taxable capital

gain provided the transfer is , to acquire share capital for the

formation of the SECP or STATE BANK has been obtained in

this effect.

By : Kashif Nawaz Jakhar

Page 52

INCOME TAX (Tax Year 2012)

CH # 6

ASSOCIATION OF PERSONS ( AOP )

Important Notes

1. In Case of Loss ( Loss of AOP ):

Loss shall not be distributed among the

partners .

2. In case of income:

Income shall be distributed among the

partners .

3. If any partner have no income other than the share from

AOP ( income from AOP ) then his , this income ( share

from AOP ) shall be exempt.

4. if any partner have income other than the share from

AOP ( income from AOP ) then his , this income ( share

from AOP ) shall be included only for tax purpose.

5. For checking individual status share from AOP shall

be excluded.

6. For calculating full time teacher allowance share from

AOP shall be excluded.

7. For average relief share from AOP shall be included.

Rules For

1. Investment in shares 2. Donations 3. Contribution in

pension fund 4. profit on debt

Assume for Investment in shares :

10% of Taxable income

300,0000

Actual

Excluding Share from

AOP

Lower

And :

Tax liability

X Lower

Taxable income (Including share from AOP )

.

By : Kashif Nawaz Jakhar

Page 53

INCOME TAX (Tax Year 2012)

Example :

Total taxable business income = Rs. 10,00,000

Tax ( 25% )

= Rs ( 2,50,000 )

Distributable Income

7,50,000 .

Income After Tax

Not Distributable Income

Assume there are 3 partners of AOP.

Partners

Rate of share

Share from AOP

Business Income

A ( Individual )

B ( Individual )

C ( Ltd Company )

20%

30%

50%

150,000

225,000

375,000

500,000

------------500,000

Requirement :

compute taxable income of AOP and its members.

Also compute tax payable .

Solution :

(i) Mr. A

Rs.

business income

Add: share from AOP

Total Taxable Income

Tax Liability

Tax on Rs. 650,000 @ 10%

Less:

500,000

150,000

650,000

65000

Tax ( individual)

. X share form AOP

Taxable Income ( individual )

65000

.

650,000 X 150,000

Tax Payable

By : Kashif Nawaz Jakhar

( 15000 )

50,000 .

Page 54

INCOME TAX (Tax Year 2012)

(ii) Mr. B;

Mr. Bs income shall be exempt because he

has no income other than share from AOP.

(iii) C ltd Company :

Rs.

Business income

Add: share from AOP

Total Taxable Income

Tax Liability

Tax on Rs. 875,000@ 35%

Less:

Tax ( of AOP)

Taxable Income ( AOP )

306250

X share form AOP

250,000

.

X

10,00,000 375,000

Tax payable

By : Kashif Nawaz Jakhar

500,000

375,000

875,000

( 93750)

212500

Page 55

INCOME TAX (Tax Year 2012)

General Format of

( Income tax numerical ):

Compute Taxable Income

Salary Income

Capital Gain

Business Income

Other source income

Zakat

Donation

Add : share from AOP

Taxable Income

Computation of tax liability .

Tax liability

Property

37-A

:

:

:

:

Investment in shares

Donation

Contribution

Profit on debt

Less : Advance Tax

Tax Payable

By : Kashif Nawaz Jakhar

XXXX

XXXX

XXXX

XXXX

XXXX

( XXX )

( XXX )

XXXXX

( XXXX )

XXXX .

RS

XXXXX

Tax Liability

Less : Senior citizen Allowance

Less : Full time Teacher Allowance

Less : Foreign Tax Credit

Less

Less

Less

Less

RS

XXXXX

XXXXX

XXXXX

(XXXX)

(XXXX)

(XXXX)

XXXXX

(XXXX)

(XXXX)

(XXXX)

(XXXX)

XXXXX

(XXXX)

XXXXX

Page 56

INCOME TAX (Tax Year 2012)

TAX ON TAX

Tax of employee paid by the employer.

Impacts:

Tax Born by Employer

1. Income

Tax in Salary.

2. Advance Tax

Less from tax liability.

How to Compute:

Mostly in exam this amount will be given.

Compute:

Cases

1. Fully paid by employer

2. Partially paid by employer and

partially paid by employee

Example

Case 1:

Total salary

= 500,000

Tax employee paid by employer = 10,000

Explanation :

According to Tax department the tax paid by the

employer , will be income of the employee because , it was

basically the expense of employee . So now the Total salary of the

employee will be Rs.510,000 instead of Rs.500,000.

Assume Tax on Rs. 510,000 is Rs. 12,000. and paid by the employer.

so now

Total salary

= 500,000

Tax employee paid by employer = 12,000

According to Tax department the tax paid by the employer , will be

income of the employee because , it was basically the expense of

employee . So now the Total salary of the employee will be

Rs.512,000 instead of Rs.500,000.

By : Kashif Nawaz Jakhar

Page 57

INCOME TAX (Tax Year 2012)

NOTE

The Tax calculation will be same as we calculte in other questions.

Means :

Tax on Rs. XXX @XXX % is

= XXX

1

Marginal Relief

Rs. XXXX @ XXX % = XXX

Marginal amount

{difference between total taxable income and Marginal relief @

XXX% }

= XXX

2

= XXX

Lower of 1 & 2 will be Tax liability = XXXX

NOTE

the same calculation should be repeated for

minimum 3 times

Maximum 5 times

After the repeated calculations now the individual will calculate tax

as below.

The following figures are assumed figures.

Taxable Income

= 500,000

Tax paid by employer = 13050

Total taxable Income

Tax on Rs. 513050 @ 2.544%

Advance Tax ( paid by employer )

By : Kashif Nawaz Jakhar

513050

13050

13050

------

Page 58

INCOME TAX (Tax Year 2012)

SHARE FROM AOP

Computation of taxable income

Taxation of members

Computation of taxable income :

Assume share fro AOP is equally distributed among the members of

AOP.

EXAPMLE :

Salary

Electricity Bills

Share from AOP

Mr. X ( 50% )

Mr. Y ( 50% )

Total

50

------200

10

40

200

60

40

400

250

250

500

This amount will be

added in the income

from other sources of

the Mr. X only for

Rate purpose

If we assume

that Mr. Y have

no any source of

income other

than share from

AOP.

So in this

condition the

share from AOP

for Mr. Y will be

exempt

Rs.400 is balancing

figure

Distributable Income

Calculation of distributable income

taxable Income ( AOP )

Less: Tax liability

Distributable income

1200

(700)

500

THE END

By : Kashif Nawaz Jakhar

Page 59

Вам также может понравиться

- AA Examiner's Report M20Документ11 страницAA Examiner's Report M20Ngọc MaiОценок пока нет

- Foundation in Financial ManagementДокумент5 страницFoundation in Financial ManagementSiti Rahmah YahyaОценок пока нет

- CTP BooksДокумент3 страницыCTP BooksuzernaamОценок пока нет

- Cambodia Tax Booklet January 2016Документ44 страницыCambodia Tax Booklet January 2016David MОценок пока нет

- Acca Afm s18 NotesДокумент9 страницAcca Afm s18 NotesUsman MaqsoodОценок пока нет

- L2 Management AccountingДокумент23 страницыL2 Management Accountingvidisha sharmaОценок пока нет

- Advanced Accounting and Financial Reporting (PDFDrive)Документ1 015 страницAdvanced Accounting and Financial Reporting (PDFDrive)Tafadzwanashe MaringireОценок пока нет

- MSC Finance Programme Handbook 2023.24Документ53 страницыMSC Finance Programme Handbook 2023.24Sam SungОценок пока нет

- CimaДокумент174 страницыCimaroman marian89100% (1)

- Chapter 1 - Updated-1 PDFДокумент29 страницChapter 1 - Updated-1 PDFj000diОценок пока нет

- Introduction To Accounting: ContentsДокумент251 страницаIntroduction To Accounting: ContentsJaya Bala ChandranОценок пока нет

- Foundation of Financial Management Bbs 3rd YearДокумент1 страницаFoundation of Financial Management Bbs 3rd YearSamrat ShresthaОценок пока нет

- Contingency Framework of Management AccoДокумент19 страницContingency Framework of Management AccoKhoyyimahОценок пока нет

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKДокумент206 страницICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderОценок пока нет

- Gold Alp Application Pack ACCAДокумент13 страницGold Alp Application Pack ACCAACCA ClassesОценок пока нет

- Marginal Costing & Absorption CostingДокумент56 страницMarginal Costing & Absorption CostingHoàng Phương ThảoОценок пока нет

- Financial Accounting 1Документ306 страницFinancial Accounting 1Dimpal RabadiaОценок пока нет

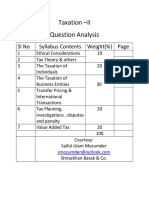

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Документ68 страницQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionОценок пока нет

- Financial AccountingДокумент159 страницFinancial AccountingTRINI100% (2)

- Journal List For AccountingДокумент5 страницJournal List For AccountingNikhil Chandra ShilОценок пока нет

- Going Concern Concept: Accounting ConceptsДокумент4 страницыGoing Concern Concept: Accounting ConceptsDalton McleanОценок пока нет

- Mathematics For Business: Chapter 7: MatricesДокумент23 страницыMathematics For Business: Chapter 7: MatricesoverkilledОценок пока нет

- Direct Taxation - WorkBook - Question and Answers - CMA IntermediateДокумент187 страницDirect Taxation - WorkBook - Question and Answers - CMA IntermediateUdaya VelagapudiОценок пока нет

- F20-AAUD Questions Dec08Документ3 страницыF20-AAUD Questions Dec08irfanki0% (1)

- ACCA 1 DIPAC Framework - Presentation - Revenue - Change in Acc Policies - Income TaxДокумент178 страницACCA 1 DIPAC Framework - Presentation - Revenue - Change in Acc Policies - Income Taxgavin henningОценок пока нет

- 2 Sem - Bcom - Advanced Financial AccountingДокумент39 страниц2 Sem - Bcom - Advanced Financial AccountingpradeepОценок пока нет

- Acca p2 j18 NotesДокумент161 страницаAcca p2 j18 NotesMaha M. Al-Masri100% (2)

- Financial Reporting First Take - Ron KingДокумент340 страницFinancial Reporting First Take - Ron KingYuan Fu100% (1)

- Case Study ExamnationДокумент4 страницыCase Study ExamnationEduardo GreatОценок пока нет

- PO QuestionДокумент6 страницPO QuestionthomaspoliceОценок пока нет

- First Intuition - MA - PM Q&A - Final PDFДокумент552 страницыFirst Intuition - MA - PM Q&A - Final PDFRasul ShabanОценок пока нет

- Fac 3703Документ99 страницFac 3703Nozipho MpofuОценок пока нет

- Auditing and Assurance Notes 1Документ237 страницAuditing and Assurance Notes 1Sam Mac'ObonyoОценок пока нет

- Cost of Capital Optimization ModelingДокумент71 страницаCost of Capital Optimization ModelingAhmed Mostafa ElmowafyОценок пока нет

- Financial Reporting Important QuestionsДокумент155 страницFinancial Reporting Important QuestionsJuhi vohraОценок пока нет

- 1.B.Com.Документ49 страниц1.B.Com.deepakОценок пока нет

- 2023 UPSA Level 400 Ecommerce Week 3 and 4Документ96 страниц2023 UPSA Level 400 Ecommerce Week 3 and 4Daniel MontesОценок пока нет

- Mutual Funds in BangladeshДокумент6 страницMutual Funds in BangladeshSakib ÂhmedОценок пока нет

- ATX Summary Notes Tax Year 2022 23Документ45 страницATX Summary Notes Tax Year 2022 23sheharyar.kgsОценок пока нет

- Best PDFДокумент569 страницBest PDFnidamahОценок пока нет

- Accounting Standards - E-Notes - Udesh Regular - Group 1Документ135 страницAccounting Standards - E-Notes - Udesh Regular - Group 1Uday TomarОценок пока нет

- Management AccountingДокумент358 страницManagement AccountingLeojelaineIgcoy100% (1)

- Depreciation Chart 11-12 (FY)Документ4 страницыDepreciation Chart 11-12 (FY)specky123100% (1)

- Paper 11 NEW GST PDFДокумент399 страницPaper 11 NEW GST PDFsomaanvithaОценок пока нет

- FR-S23-Notes FY 2023-2024Документ180 страницFR-S23-Notes FY 2023-2024UPENDRA PATELОценок пока нет

- TL Indirect Taxes NS June 2021Документ15 страницTL Indirect Taxes NS June 2021SP CONTRACTORОценок пока нет

- UntitledДокумент482 страницыUntitlednanu miglaniОценок пока нет

- 602 Management Accounting v2Документ4 страницы602 Management Accounting v2Vandoir GoncalvesОценок пока нет

- KPMG Analysis of The Finance Act 2021 - FinalДокумент47 страницKPMG Analysis of The Finance Act 2021 - FinalNirvan MaudhooОценок пока нет

- Business and Finance Sample PaperДокумент21 страницаBusiness and Finance Sample PaperTariqul IslamОценок пока нет

- Financial ManagementДокумент254 страницыFinancial Managementkimringine50% (2)

- Ca Firm Exam Question AnswerДокумент17 страницCa Firm Exam Question AnswerSihinta AzraaОценок пока нет

- Acca p4 Notes From EmilyДокумент139 страницAcca p4 Notes From EmilyCường Lê TựОценок пока нет

- Audit 1100 - MCQs by CA Nitin Gupta SirДокумент182 страницыAudit 1100 - MCQs by CA Nitin Gupta SirPak CareerОценок пока нет

- Notes On Income TaxДокумент59 страницNotes On Income TaxTuqeer Ali80% (35)

- Rsm324 Week 1Документ18 страницRsm324 Week 1Rudy GuОценок пока нет

- IPCC - FAST TRACK MATERIAL - 35e PDFДокумент69 страницIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarОценок пока нет

- Tax Planning and ManagementДокумент4 страницыTax Planning and ManagementPravina SantoshОценок пока нет

- Fiber Optic Patch Panel DWGДокумент2 страницыFiber Optic Patch Panel DWGsk sharmaОценок пока нет

- Vol IДокумент208 страницVol Isk sharmaОценок пока нет

- PagesДокумент1 страницаPagessk sharmaОценок пока нет

- Calculation For Earth Resistance of Buried StripДокумент1 страницаCalculation For Earth Resistance of Buried Stripsk sharmaОценок пока нет

- Binder 1Документ30 страницBinder 1sk sharmaОценок пока нет

- Data Centers in Nepal - Location, Types & Cloud Services Provided - TechSansarДокумент14 страницData Centers in Nepal - Location, Types & Cloud Services Provided - TechSansarsk sharmaОценок пока нет

- Bussiness Law, EthcsДокумент102 страницыBussiness Law, Ethcssk sharmaОценок пока нет

- Suggested Answer CAP II Dec 2011Документ98 страницSuggested Answer CAP II Dec 2011Sankalpa NeupaneОценок пока нет

- Chap 001Документ19 страницChap 001WilliamОценок пока нет

- 05 01 Interview Question ModelДокумент3 страницы05 01 Interview Question ModelXintongHuangОценок пока нет

- The Conceptual Framework and Accounting Policies: Learning Objectives ReferenceДокумент26 страницThe Conceptual Framework and Accounting Policies: Learning Objectives ReferenceAsi Cas JavОценок пока нет

- Company Financial StatementsДокумент3 страницыCompany Financial StatementsNarasimha Jammigumpula0% (1)

- Q1. Journalize The Following Transactions in The Books of BaluДокумент12 страницQ1. Journalize The Following Transactions in The Books of Balumreenal kalitaОценок пока нет

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsДокумент38 страницSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyОценок пока нет

- Dusters Total Solutions Services PVT - LTD.: Amount Deductions Earned AllowanceДокумент52 страницыDusters Total Solutions Services PVT - LTD.: Amount Deductions Earned Allowancerishichauhan25Оценок пока нет

- Paper 2newДокумент328 страницPaper 2newAnonymous 1ClGHbiT0JОценок пока нет

- Psak 15 Investment in AssociateДокумент8 страницPsak 15 Investment in Associatevrizkal ferlyОценок пока нет

- Group 4 - Assessing A New Venture's Financial Strength and ViabilityДокумент34 страницыGroup 4 - Assessing A New Venture's Financial Strength and ViabilityBuraq KhanОценок пока нет

- Revision Test Paper: Cap Ii (June 2017)Документ12 страницRevision Test Paper: Cap Ii (June 2017)binuОценок пока нет

- Restaurant Business Plan TemplateДокумент15 страницRestaurant Business Plan TemplateZubair Ahmad LashariОценок пока нет

- LM Business Finance Q3 WK 3 4 Module 5Документ32 страницыLM Business Finance Q3 WK 3 4 Module 5Minimi LovelyОценок пока нет

- Audit Questionnaire Part 2Документ7 страницAudit Questionnaire Part 2Mendoza Ron NixonОценок пока нет

- Sesi 13 & 14Документ10 страницSesi 13 & 14Dian Permata SariОценок пока нет

- Financial Statement Analysis: Project Report ON "Motherson Sumi Systems LTD"Документ27 страницFinancial Statement Analysis: Project Report ON "Motherson Sumi Systems LTD"writik saha0% (1)

- LAtihan CH 18Документ19 страницLAtihan CH 18laurentinus fikaОценок пока нет

- Internship Report On ZTBLДокумент87 страницInternship Report On ZTBLShabnam Naz100% (3)

- Foundations of Financial Management 14th Edition Block Solutions ManualДокумент25 страницFoundations of Financial Management 14th Edition Block Solutions ManualMaryMurphyatqb100% (51)

- Accounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of Your Choice inДокумент5 страницAccounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of Your Choice inDiane MagnayeОценок пока нет

- ch20 (改)Документ21 страницаch20 (改)林義哲Оценок пока нет

- VAS To IFRSДокумент17 страницVAS To IFRSHồng NguyễnОценок пока нет

- BM Las q1 w5 8 FinalДокумент35 страницBM Las q1 w5 8 FinalKatrina BinayОценок пока нет

- All Figures in - 000Документ4 страницыAll Figures in - 000Karthikeyan RamamoorthyОценок пока нет

- 1.1 Financial PerformanceДокумент132 страницы1.1 Financial PerformanceGary AОценок пока нет

- Introduction To Management AccountingДокумент71 страницаIntroduction To Management AccountingAnonymous kwi5IqtWJОценок пока нет

- CHAPTER 5 ChurrositeaДокумент21 страницаCHAPTER 5 ChurrositeademiОценок пока нет

- CH 05Документ87 страницCH 05Ismadth2918388Оценок пока нет

- Annual Report PDFДокумент237 страницAnnual Report PDFnahid hasanОценок пока нет