Академический Документы

Профессиональный Документы

Культура Документы

Financial Results For Dec 31, 2012 (Result)

Загружено:

Shyam SunderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Results For Dec 31, 2012 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

Pretto Leather Industries Limited

Head & Corp. Office: C-78, First Fioor, Sector-63, Noida-201301 (U.P.) INDIA

Phone: +91-120 - 4731567 E-mail: info@prettoleather.com

Website: www.prettoleather.com

Regd. Office: 149-A, Civil Lines, Bareilly (U.P.) INDIA -2430Q.1

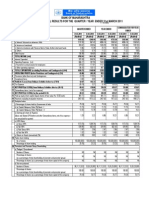

Quarterly

Particulars

I.

months

3

ended

(31/12/2012)

Net SaleslIncome

Operations

/

Operating Income

from

Other

2. Expenditure

a. Increase/decrease in stock in

trade and work in progress

b.

Consumption

raw

of

materials

c. Purchase of traded goods

d. Employees cost

e. Depreciation

f. Other expenditure

g. Total

(Any item exceeding 10% of

the total expenditure to be

shown separately)

.

3.

Financial Results for quarter

Previoll,s

3

months

~<red

(30/09/2012)

Corresponding

3 months ended

in the previous

year

(31/12/2011 )

Unaudited*

ended 31/12/2012

(Rs. in lakhs)

Year to date

figures

for

current

period ended

(31112/20lZ)

Unaudite

d

Year to date

figures

for

the previous

year

ended

(31/12/2011)

Unaudited

Previous

accounting

year ended

(31/03/2011)

Unaudited

Unaudite

d

20.00

5.00

40.00

20.00

40.00

150.81

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL'

NIL

NIL

NIL

NIL

17.00

1.25

NIL

1.25

19.50

4.00

.30

NIL

.50

4.80

34.00

2.50

NIL

2.50

39.00

17.00

1.25

NIL

1.25

19.50

34.00

2.50

NIL

2.50

39.00

125.88

9.10

.21

11.88

147.07

NIL

NIL

NIL

NIL

NIL

NIL

.50

.20

1.00

.50

1.00

3.74

NIL

.50

NIL

NIL

1.00

NIL

.50

NIL

1.00

NIL

3.74

NIL

1.00

NIL

.50

NIL

1.00

NIL

3.74

NIL

1.00

NIL

.50

NIL

1.00

NIL

3.74

.30

.70

.15

.35

.30

.70

.94

2.80

Audited

Profit

from Operations

before

Income,

Other

Interest

& EXQeptional

Items (1-2)

4. Other Income

5. Profit before Interest &

Exceptional Items (3+4)

6. Interest

7. Profit after Interest but

before Exceptional Items

(5-6)

8. Exceptional Items

9. Profit (+)/ Loss (-) from

Ordinary Activities before

tax (7+8)

10. Tax expense

I I. Net Profit (+)/Loss( -) from

NIL

.50

.20

NIL

.20

NIL

.50

NIL

.15

.35

.06

.14

.20

Ordinary Activities after

tax (9-10)

12. Extraordinary Item (net of

tax expense Rs ....... )

13. Net Profit U/Loss(-)

for

the period (11-12)

14. Paid-up equity share capital

(Face Value of the Share shall

be indicated)

15.

Reserve

excluding

Revaluation

Reserves as

per

balance

sheet

of

previous accounting year

16. Earnings Per Share (EPS)

(a) Basic and diluted EPS

before Extraordinary items

for the period, for the year

to date and for the previous

year (not to be annualized)

(b) Basic and diluted EPS after

Extraordinary items for the

period, for the year to date

and for the previous year

(not to be annualized)

17. Public shareholding

- Number of shares

- Percentage of shareholding

18. Promoters and Promoter Group

Shareholding **

a) Pledged / Encumbered

Number of shares

- Percentage of shares (as a % of

shareholding

of

the total

promoter and promoter group)

Percentage of shares (as a % of

the total share capital of the

company)

b) Non - encumbered

- Number of shares

- Percentage of shares (as a % of

of the

the total shareholding

Promoter and Promoter group)

.Uiii.

of shares (as a % of

the total share capital of the

company)

NIL

NIL

NIL

NIL

NIL

NIL

.35

.14

.70

.35

.70

2.80

780

10/-

780

10/-

780

10/-

780

10/-

780

10/-

780

10/-

-41.35

-41.6ti

41.66

-41.35

41.66

(-)41.25

.,;

/'

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

36.18

20.28

20.28

20.28

20.28

20.28

46.39%

41.82

53.61%

26%

57.72

74%

26%

57.72

74%

26%

57.72

74%

26%

57.72

74%

26%

57.72

74%

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

Note:1. The Company has complied with all relevant accounting standards issued by lCAl as

applicable to the Company.

2. The above results were reviewed by an Audit Committee and thereafter taken on record by

the Board of Directors in their Meeting held on 11/02/2013.

':\~d~>~

J~~)

"'-,IJ '/.{ijj'/l

. we,.

'.'.

, ?J-'' '5/1

~:-,."'..:,.

3. A limited reviews of the above results has been done by the auditors

the Company.

4. There were no investor Complaints known to the Company outstanding at the beginning of

the quarter.

5. Previous period figures have been regrouped/restated as per new format.

"

Вам также может понравиться

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- Financial Results For March 31, 2013 (Audited) (Result)Документ3 страницыFinancial Results For March 31, 2013 (Audited) (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2013 (Result)Документ2 страницыFinancial Results For June 30, 2013 (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2014 (Standalone) (Result)Документ2 страницыFinancial Results For June 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For December 31, 2015 (Result)Документ2 страницыFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results For March 31, 2013 (Result)Документ3 страницыFinancial Results For March 31, 2013 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- 30 SeptДокумент2 страницы30 SeptMausam CutyОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results For March 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results For March 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Ref: Code No. 530427: Encl: As AboveДокумент3 страницыRef: Code No. 530427: Encl: As AboveShyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Документ1 страницаPDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaОценок пока нет

- Sebi Million Q3 1213 PDFДокумент2 страницыSebi Million Q3 1213 PDFGino SunnyОценок пока нет

- Financial Results & Limited Review For June 30, 2015 (Company Update)Документ7 страницFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderОценок пока нет

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Документ1 страницаAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisОценок пока нет

- Financial Results For Sept 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ8 страницFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results For Sept 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Jaihind Synthetics Limited: S BusДокумент4 страницыJaihind Synthetics Limited: S BusShyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- Audited Result 2010 11Документ2 страницыAudited Result 2010 11Priya SharmaОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- India BullsДокумент2 страницыIndia Bullsrajesh_d84Оценок пока нет

- Financial Results For Sept 30, 2015 (Standalone) (Result)Документ6 страницFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Extract of Annual Return MGT 9 Word Format Unprotected2Документ8 страницExtract of Annual Return MGT 9 Word Format Unprotected2Roney Raju Philip0% (1)

- Revised Financial Results For June 30, 2015 (Result)Документ2 страницыRevised Financial Results For June 30, 2015 (Result)Shyam SunderОценок пока нет

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarДокумент9 страницForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaОценок пока нет

- Financial Results For June 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Mgt-9 Extract of Annual ReturnДокумент10 страницMgt-9 Extract of Annual ReturnAnonymous zvVGv6Оценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results For Sept 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedДокумент5 страницParticulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDhanya R KarthaОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- 31 DecДокумент2 страницы31 DecMausam CutyОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- 30 June 2010Документ2 страницы30 June 2010Mausam CutyОценок пока нет

- Sebi MillionsДокумент3 страницыSebi MillionsShubham TrivediОценок пока нет

- Audited Financial 2011Документ1 страницаAudited Financial 2011gayatri9324814475Оценок пока нет

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Документ4 страницыMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750Оценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results Sep 2011Документ1 страницаFinancial Results Sep 2011Shankar GargОценок пока нет

- Financial Results For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- FY11 - Investor PresentationДокумент11 страницFY11 - Investor Presentationcooladi$Оценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ5 страницFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Money Management: Nominal and Effective Interest RateДокумент14 страницMoney Management: Nominal and Effective Interest RateJane Erestain BuenaobraОценок пока нет

- Final Report On Mutual Fund - Fm1vimal14Документ71 страницаFinal Report On Mutual Fund - Fm1vimal14Raksha ThakurОценок пока нет

- Washington Mutual (WMI) - Project Fillmore (Decapitalization of WMB FSB)Документ50 страницWashington Mutual (WMI) - Project Fillmore (Decapitalization of WMB FSB)meischer100% (1)

- Sunnix Memo To BoardДокумент4 страницыSunnix Memo To BoardDennie IdeaОценок пока нет

- IT - Y10 - Y11 - Ver - 7 - With Form 10 EДокумент30 страницIT - Y10 - Y11 - Ver - 7 - With Form 10 EKirit J Patel100% (1)

- Reading 71.2 Guidance For Standards I (C) and I (D)Документ11 страницReading 71.2 Guidance For Standards I (C) and I (D)AmineОценок пока нет

- Accounts List (Detail) : Account # Account Type DR/CR Header/Detail Level ChequeДокумент4 страницыAccounts List (Detail) : Account # Account Type DR/CR Header/Detail Level ChequeEka RatihОценок пока нет

- Insead Consulting Club Handbook 2011 PDFДокумент108 страницInsead Consulting Club Handbook 2011 PDFJasjivan Ahluwalia100% (1)

- Presentation - Sources - of - Finance - BST SEMINARДокумент16 страницPresentation - Sources - of - Finance - BST SEMINARManav MohantyОценок пока нет

- BBM 5th Sem Syllabus 2015 PDFДокумент44 страницыBBM 5th Sem Syllabus 2015 PDFBhuwanОценок пока нет

- Tendering & Estimating IДокумент72 страницыTendering & Estimating Ivihangimadu100% (3)

- PDS SMART Mortgage Flexi TawarruqДокумент8 страницPDS SMART Mortgage Flexi TawarruqNUR AQILAH NUBAHARIОценок пока нет

- Handbook For Consultants Selection-GoPДокумент75 страницHandbook For Consultants Selection-GoPzulfikarmoin001Оценок пока нет

- Deduction in Respect of Expenditure On Specified BusinessДокумент5 страницDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniОценок пока нет

- CE Board Problems in Engineering EconomyДокумент6 страницCE Board Problems in Engineering EconomyFritz Fatiga100% (3)

- Val Quiz 1 ReviewДокумент20 страницVal Quiz 1 Reviewshafkat rezaОценок пока нет

- Shipping Invoice: Kentex CargoДокумент3 страницыShipping Invoice: Kentex Cargomaurice gituaraОценок пока нет

- EconomicsДокумент50 страницEconomicshiteshrao810Оценок пока нет

- Europass CV 110625 IanaДокумент3 страницыEuropass CV 110625 IanaDorina BalanОценок пока нет

- Diaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Документ3 страницыDiaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)EvangerylОценок пока нет

- ch07 - Intermediate Acc IFRS (Cash and Receivable)Документ104 страницыch07 - Intermediate Acc IFRS (Cash and Receivable)irma cahyani kawiОценок пока нет

- Nikl Metals WeeklyДокумент7 страницNikl Metals WeeklybodaiОценок пока нет

- Tutorial 4 QAsДокумент6 страницTutorial 4 QAsJin HueyОценок пока нет

- 407 - 1e LTN20170420808 PDFДокумент196 страниц407 - 1e LTN20170420808 PDFTony ZhangОценок пока нет

- Chapter 2 The Sale of Goods Act 1930Документ59 страницChapter 2 The Sale of Goods Act 1930taufeequeОценок пока нет

- Wade CatalogueДокумент10 страницWade CatalogueMohamed IbrahimОценок пока нет

- Class NotesДокумент5 страницClass NotesAcads LangОценок пока нет

- Haris Mumtaz - Roll No 09 - Financial AccountingДокумент7 страницHaris Mumtaz - Roll No 09 - Financial Accountinghafeez ahmedОценок пока нет

- Sources of Output VATДокумент2 страницыSources of Output VATNadine SantiagoОценок пока нет

- Chapter 1Документ37 страницChapter 1bhawesh agОценок пока нет