Академический Документы

Профессиональный Документы

Культура Документы

BIR Ruling No. 206-90

Загружено:

Raiya Angela100%(2)100% нашли этот документ полезным (2 голоса)

312 просмотров2 страницыBIR Ruling

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBIR Ruling

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

100%(2)100% нашли этот документ полезным (2 голоса)

312 просмотров2 страницыBIR Ruling No. 206-90

Загружено:

Raiya AngelaBIR Ruling

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

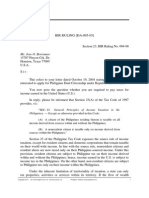

October 30, 1990

BIR RULING NO. 206-90

29 (d) 144-85 206-90

Gentlemen :

This refers to your letter dated June 25, 1990 requesting in behalf of your

client, Porcelana Mariwasa, Inc. (PMI), a ruling confirming your opinion that the

foreign exchange loss incurred by PMI is a deductible loss in 1990.

aisadc

It is represented that PMI is a corporation established and organized under

Philippine laws; that it has existing US dollar loans from Noritake Company,

Limited (Noritake) and Toyota Tsusho Corporation (Toyota) in the aggregate

amounts of US $7,636,679.17 and US $3,054,671.27, respectively, that in 1989,

the parties agreed to convert the said dollar denominated loans into pesos at the

exchange rate prevailing on June 30, 1989; that in December 1989, both

agreements were approved by the Central Bank subject to the submission of a copy

each of the signed agreements incorporating the conversion; that thereafter, drafts

of the amended agreements were submitted to the Central Bank for pre-approval;

that on January 29, 1990, the Central Bank advised your office on their findings

and comments on the said drafts which were considered and incorporated in the

final amended agreements; that in June 1990, the parties submitted to the Central

Bank the signed agreements; that you are of the opinion that in the case of your

client, the resultant loss on conversion of US dollar denominated loans to peso is

more than a shrinkage in value of money; that the approval by the Central Bank

and the signing by the parties of the agreements covering the said conversion

established the loss, after which, the loss became final and irrevocable, so that

recoupment is reasonably impossible; and that having been fixed and determinable,

the loss is no longer susceptible to change, hence, it could fairly be stated that such

has been sustained in a closed and completed transaction.

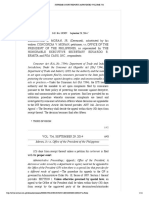

In reply, please be informed that the annual increase in value of an asset is

not taxable income because such increase has not yet been realized. The increase

in value i.e., the gain, could only be taxed when a disposition of the property

occurred which was of such a nature as to constitute a realization of such gain, that

is, a severance of the gain from the original capital invested in the property. The

same conclusion obtains as to losses. The annual decline in the value of property is

Copyright 2014

CD Technologies Asia, Inc. and Accesslaw, Inc.

Philippine Taxation Encyclopedia First Release 2014

not normally allowable as a deduction. Hence, to be allowable the loss must be

realized. (Surre Warren, Federal Income Taxation (1950, pp. 422-4)

When foreign currency acquired in connection with a transaction in the

regular course of business is disposed ordinary gain or loss results from the

fluctuations. (Pr Hall Federal Taxes, Vol. 1, par. 6261) The loss is deductible only

for the year it is actually sustained. It is sustained during the year in which the loss

occurs as evidenced by the completed transaction and as fixed by identifiable

occurring in that year. (par, 6570, 34 Am. Jur. 2d, 1976 closed transaction is a

taxable event which has been consummated (p. 231 Black Law's Dictionary, Fifth

Editions) No taxation event has as yet been consummated prior to the remittance

of the scheduled amortization. Accordingly, your request for confirmation of your

aforesaid opinion is hereby denied considering that foreign exchange losses

sustained as a result of conversion or devaluation of the peso vis-a-vis the foreign

currency or US dollar and vice versa but which remittance of scheduled

amortization consisting of principal and interests payment on a foreign loan has

not actually been made are not deductible from gross income for income tax

purposes.

cdtai

Very truly yours,

(SGD.) JOSE U. ONG

Commissioner

Copyright 2014

CD Technologies Asia, Inc. and Accesslaw, Inc.

Philippine Taxation Encyclopedia First Release 2014

Вам также может понравиться

- Bir Ruling No. 144-85Документ1 страницаBir Ruling No. 144-85matinikkiОценок пока нет

- BIR Ruling No. 006-00Документ2 страницыBIR Ruling No. 006-00glg-phОценок пока нет

- Rmo 38-83Документ1 страницаRmo 38-83saintkarriОценок пока нет

- RMC 27-2011Документ0 страницRMC 27-2011Peggy SalazarОценок пока нет

- 3M PhilippinesДокумент2 страницы3M PhilippinesKarl Vincent Raso100% (1)

- BIR Ruling 19-01 May 10, 2001Документ3 страницыBIR Ruling 19-01 May 10, 2001Raiya AngelaОценок пока нет

- Philamlife V Cta Case DigestДокумент2 страницыPhilamlife V Cta Case DigestAnonymous BvmMuBSwОценок пока нет

- ITAD Ruling No 018-09Документ11 страницITAD Ruling No 018-09Peggy SalazarОценок пока нет

- Bir Ruling No. 322-87Документ1 страницаBir Ruling No. 322-87matinikkiОценок пока нет

- BIR Ruling (DA-287-07) May 8, 2007Документ3 страницыBIR Ruling (DA-287-07) May 8, 2007Raiya AngelaОценок пока нет

- ITAD Ruling 102-2002 May 28, 2002Документ5 страницITAD Ruling 102-2002 May 28, 2002Aine Mamle TeeОценок пока нет

- BIR Ruling No 274-87Документ3 страницыBIR Ruling No 274-87Peggy SalazarОценок пока нет

- Benaglia V CIR PDFДокумент4 страницыBenaglia V CIR PDFGlenn caraigОценок пока нет

- Bir Ruling Da 095 05Документ2 страницыBir Ruling Da 095 05RB BalanayОценок пока нет

- 49 CIR V Glenshaw GlassДокумент2 страницы49 CIR V Glenshaw GlassMiguel AlonzoОценок пока нет

- RR 10-98Документ2 страницыRR 10-98matinikkiОценок пока нет

- BIR Ruling (DA-145-07) March 8, 2007Документ3 страницыBIR Ruling (DA-145-07) March 8, 2007Raiya AngelaОценок пока нет

- G.R. No. L-53961Документ1 страницаG.R. No. L-53961Jannie Ann DayandayanОценок пока нет

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Документ1 страницаCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoОценок пока нет

- SMI-ED Vs CIRДокумент2 страницыSMI-ED Vs CIRVel June50% (2)

- Javier v. AnchetaДокумент1 страницаJavier v. AnchetaGSSОценок пока нет

- Kuenzle v. CIRДокумент2 страницыKuenzle v. CIRTippy Dos Santos100% (2)

- Commissioner of Internal Revenue Vs Isabela Cultural CorporationДокумент2 страницыCommissioner of Internal Revenue Vs Isabela Cultural CorporationKim Lorenzo Calatrava100% (2)

- CIR vs. CTA (And Smith Kline & French Overseas Co.)Документ1 страницаCIR vs. CTA (And Smith Kline & French Overseas Co.)scartoneros_1Оценок пока нет

- CIR Vs MeralcoДокумент2 страницыCIR Vs MeralcoSherry Mae Malabago100% (1)

- Cir V. Philippine Airlines, Inc. (2009) : PartiesДокумент3 страницыCir V. Philippine Airlines, Inc. (2009) : PartiesAila AmpОценок пока нет

- Garrison v. CAДокумент5 страницGarrison v. CAMuslimeenSalamОценок пока нет

- 13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestДокумент1 страница13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestHarleneОценок пока нет

- CD - 81. Allied Banking v. Quezon CityДокумент2 страницыCD - 81. Allied Banking v. Quezon CityCzarina CidОценок пока нет

- China Banking Corporation Vs CAДокумент2 страницыChina Banking Corporation Vs CARahl SulitОценок пока нет

- Phil Refining Co Vs CA - Fernandez Hermanos Inc Vs CIRДокумент2 страницыPhil Refining Co Vs CA - Fernandez Hermanos Inc Vs CIRPatrick RamosОценок пока нет

- RR 1-79Документ9 страницRR 1-79matinikkiОценок пока нет

- CIR v. Isabela Cultural Corp.Документ4 страницыCIR v. Isabela Cultural Corp.kathrynmaydevezaОценок пока нет

- Tang Ho V Board of Tax AppealsДокумент1 страницаTang Ho V Board of Tax AppealsKara Aglibo100% (1)

- Pansacola v. CIRДокумент3 страницыPansacola v. CIRSean GalvezОценок пока нет

- 1 - Conwi vs. CTA DigestДокумент2 страницы1 - Conwi vs. CTA Digestcmv mendozaОценок пока нет

- Bir 123-13Документ1 страницаBir 123-13Lizzette Dela PenaОценок пока нет

- Revenue Regulations No. 01-79: Regulations Governing The Taxation of Non-Resident CitizensДокумент3 страницыRevenue Regulations No. 01-79: Regulations Governing The Taxation of Non-Resident Citizenssaintkarri100% (1)

- CIR Vs Batangas Transpo CompanyДокумент2 страницыCIR Vs Batangas Transpo CompanyBam BathanОценок пока нет

- CIR vs. Filinvest Development Corp.Документ2 страницыCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- Contex Corp vs. CIRДокумент3 страницыContex Corp vs. CIRKayelyn LatОценок пока нет

- 40 Nippon Life V CIRДокумент2 страницы40 Nippon Life V CIRMae SampangОценок пока нет

- ALEXANDER HOWDEN & CO., LTD Vs CIRДокумент2 страницыALEXANDER HOWDEN & CO., LTD Vs CIRMariz GalangОценок пока нет

- CIR vs. Lednicky (1964)Документ1 страницаCIR vs. Lednicky (1964)Emil BautistaОценок пока нет

- Nippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002Документ21 страницаNippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002EnzoGarcia100% (1)

- Madrigal Vs RaffertyДокумент2 страницыMadrigal Vs RaffertyKirs Tie100% (1)

- RR 13-00Документ2 страницыRR 13-00saintkarri100% (2)

- BIR Ruling 27-02Документ2 страницыBIR Ruling 27-02erikagcv100% (1)

- Case 59 CS Garments Vs CirДокумент3 страницыCase 59 CS Garments Vs CirJulian Guevarra0% (1)

- Old Colony Trust Co vs. CommissionerДокумент1 страницаOld Colony Trust Co vs. CommissionerPretzel TsangОценок пока нет

- Atlas Vs CIRДокумент2 страницыAtlas Vs CIRRoyalhighness18Оценок пока нет

- BIR Ruling 274-1987 September 9, 1987Документ4 страницыBIR Ruling 274-1987 September 9, 1987Raiya Angela100% (1)

- Howden Vs CollectorДокумент2 страницыHowden Vs CollectorLouise Bolivar DadivasОценок пока нет

- 005 - Collector v. YusecoДокумент2 страницы005 - Collector v. YusecoJaerelle HernandezОценок пока нет

- BIR Ruling No. 522-2017Документ7 страницBIR Ruling No. 522-2017liz kawiОценок пока нет

- CIR V SolidbankДокумент14 страницCIR V Solidbankrj_guzmanОценок пока нет

- 11 NDC V CIRДокумент3 страницы11 NDC V CIRTricia MontoyaОценок пока нет

- Kuenzle Vs CIRДокумент2 страницыKuenzle Vs CIRHaroldDeLeon100% (1)

- BIR Ruling No. 206-90Документ1 страницаBIR Ruling No. 206-90Peggy SalazarОценок пока нет

- Bir Ruling No. 144-85Документ1 страницаBir Ruling No. 144-85saintkarriОценок пока нет

- Agoncillo & Ilustre, C. H. Gest,: 184 Philippine Reports AnnotatedДокумент7 страницAgoncillo & Ilustre, C. H. Gest,: 184 Philippine Reports AnnotatedRaiya AngelaОценок пока нет

- 03 Viking Industrial Corp V CAДокумент13 страниц03 Viking Industrial Corp V CARaiya Angela100% (1)

- Bayot Vs CAДокумент18 страницBayot Vs CARaiya AngelaОценок пока нет

- 09 Alfarero V SevillaДокумент11 страниц09 Alfarero V SevillaRaiya AngelaОценок пока нет

- San Luis Vs San LuisДокумент20 страницSan Luis Vs San LuisRaiya AngelaОценок пока нет

- Roehr Vs RodriguezДокумент10 страницRoehr Vs RodriguezRaiya AngelaОценок пока нет

- Corpuz Vs Sto. TomasДокумент18 страницCorpuz Vs Sto. TomasRaiya AngelaОценок пока нет

- Catalan Vs CatalanДокумент10 страницCatalan Vs CatalanRaiya AngelaОценок пока нет

- Dacasin Vs DacasinДокумент15 страницDacasin Vs DacasinRaiya AngelaОценок пока нет

- The Case: Llorente vs. Court of AppealsДокумент12 страницThe Case: Llorente vs. Court of AppealsRaiya AngelaОценок пока нет

- Moran V Office of The PresidentДокумент11 страницMoran V Office of The PresidentRaiya AngelaОценок пока нет

- Power Homes Unlimited CorporationДокумент20 страницPower Homes Unlimited CorporationRaiya AngelaОценок пока нет

- 11 Pepsi Cola Bottling Company vs. Municipality of TanauanДокумент5 страниц11 Pepsi Cola Bottling Company vs. Municipality of TanauanRaiya AngelaОценок пока нет

- 04 Mactan Cebu International Airport Authority vs. MarcosДокумент16 страниц04 Mactan Cebu International Airport Authority vs. MarcosRaiya AngelaОценок пока нет

- Certificate of Residence (For Tax Treaty Relief)Документ3 страницыCertificate of Residence (For Tax Treaty Relief)Nancy VelascoОценок пока нет

- GSTR1 Excel Workbook Template-V1.0Документ39 страницGSTR1 Excel Workbook Template-V1.0palanisathiyaОценок пока нет

- LLB GST Notes-Unit-3-Part-2 - Final PDFДокумент2 страницыLLB GST Notes-Unit-3-Part-2 - Final PDFravi kumarОценок пока нет

- Taxation Bar Examination 2013 Q&AДокумент11 страницTaxation Bar Examination 2013 Q&ADianne Esidera RosalesОценок пока нет

- Capital Allowances Lecture Slides (2 Per Page)Документ11 страницCapital Allowances Lecture Slides (2 Per Page)NicolasОценок пока нет

- Indian Direct Tax Structure - An Analytical StudyДокумент10 страницIndian Direct Tax Structure - An Analytical StudyPremier PublishersОценок пока нет

- Deduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToДокумент169 страницDeduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToRajОценок пока нет

- Social Responsibility Terhadap Tax Avoidance Di Perusahaan PerbankanДокумент18 страницSocial Responsibility Terhadap Tax Avoidance Di Perusahaan PerbankanfahranyОценок пока нет

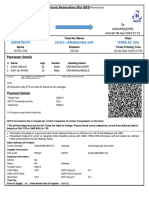

- Statement of Salary As of 2019-08-2: Earnings DeductionsДокумент1 страницаStatement of Salary As of 2019-08-2: Earnings DeductionsHenry CagaОценок пока нет

- (Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaДокумент8 страниц(Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaSujan SanjayОценок пока нет

- SSI FAQs Updated 2021Документ2 страницыSSI FAQs Updated 2021Indiana Family to FamilyОценок пока нет

- Mcq-Income TaxesДокумент7 страницMcq-Income TaxesRandy Manzano100% (1)

- Ga55 PDFДокумент1 страницаGa55 PDFuttamdhabasОценок пока нет

- Bamford V FCT On Trust DeedsДокумент2 страницыBamford V FCT On Trust DeedsKaren HeafeyОценок пока нет

- Assignment On Income Tax Authorities in BangladeshДокумент22 страницыAssignment On Income Tax Authorities in BangladeshZakia Elham33% (6)

- Minimum Alternate Tax Section 115JbДокумент17 страницMinimum Alternate Tax Section 115JbEmeline SoroОценок пока нет

- 18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestДокумент15 страниц18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestKeith BalbinОценок пока нет

- Vivek 15 BlackДокумент1 страницаVivek 15 BlackSurya KОценок пока нет

- Impact of Sales Tax Value Added Tax and GST On Profitability of Organisations Shashank DhondДокумент280 страницImpact of Sales Tax Value Added Tax and GST On Profitability of Organisations Shashank DhondpriyanshuОценок пока нет

- 1013201695227122Документ67 страниц1013201695227122polbisente100% (1)

- BIR-Form-No.-0619E SampleДокумент3 страницыBIR-Form-No.-0619E SampleJermone MuaripОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sonu alamОценок пока нет

- Tez Ticket PrintДокумент1 страницаTez Ticket Printosama amjad.hy8ggОценок пока нет

- Northern CPAR: Taxation - Fringe Benefit Taxation: Rex B. Banggawan, Cpa, MbaДокумент7 страницNorthern CPAR: Taxation - Fringe Benefit Taxation: Rex B. Banggawan, Cpa, MbaLouiseОценок пока нет

- Po-1922003499-15 07 2022Документ2 страницыPo-1922003499-15 07 2022kartikОценок пока нет

- Taxation Handbook 4th Edition 2022 - 10.02.2022Документ170 страницTaxation Handbook 4th Edition 2022 - 10.02.2022Mercy Akello100% (1)

- Lecture 1 - Introduction To Statutory ValuationДокумент11 страницLecture 1 - Introduction To Statutory ValuationQayyumОценок пока нет

- Percentage & Ratio and Proportion Past Paper QuestionsДокумент39 страницPercentage & Ratio and Proportion Past Paper QuestionsinternationalmakkhayarОценок пока нет

- Microeconomics Group Assignment (Report Writing)Документ9 страницMicroeconomics Group Assignment (Report Writing)Abdirizak AhmedОценок пока нет

- Caltex Philippines Vs COA, 208 SCRA 726, 05 - 08 - 1992Документ2 страницыCaltex Philippines Vs COA, 208 SCRA 726, 05 - 08 - 1992I took her to my penthouse and i freaked itОценок пока нет