Академический Документы

Профессиональный Документы

Культура Документы

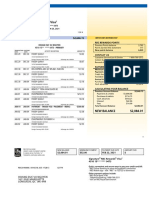

Asad Bank Statement

Загружено:

api-344873207Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asad Bank Statement

Загружено:

api-344873207Авторское право:

Доступные форматы

Statement Period Mar 13, 2015 - Apr 14, 2015

Statement date

Apr 14, 2015

Account #

3792 400239 17011

Page

1 of 5

Scotiabank American

Express Card

#32 - 850 SADDLETOWNE CIRCLE NE

CALGARY, ALBERTA T3J 0H5

If you have any questions about this

statement, call us at:

1-888-861-5443 / 416-701-7820

TTY Service 1-800-645-0288

SBAXEP_20100_D15104_A E S 81349

MR ASAD CHEEMA

75 MARTHAS HEAVEN PL NE

CALGARY, AB T3J 3W2

Payment due date

Total minimum payment

Current minimum payment

Borrowers on this account;

New balance

This statement covers transactions posted to your account during the Statement Period.

Scotia Rewards Summary

Based on your eligible purchases, please find below the Scotia

Rewards points you have earned on your Scotiabank American

Express Card for this Statement PeriodI:

SBAXEP_20100_D15104_A - 0003022

HRI - - 3 - 1 - 23 - -

012271

Beginning points balance

3,030

Points earned (1x earn rate**)

720

Bonus points earned

5,000

Points redeemed / transferred

7,000

Ending points balance

2,250

Scotia Rewards points earned, including any bonus points earned,

points adjustments or points redeemed on the Statement Date may

not be reflected.

I

For more information on your Scotia Rewards points, and to

sign-up for email offers, visit www.scotiarewards.com or call

1-800-665-2582.

Transactions since your last statement

AMOUNT($)

001

Apr 11

Apr 13

002

Apr 14

Apr 14

CREDIT VOUCHER/RETURN SCOTIAREWARDSBYOTE MISSISSAUGA ON

ANNUAL FEE

003

Apr 14

Apr 14

SCOTIA SCCP PREMIUM

$0.00

$0.00

$1,114.00

$2,425.38

$1,311.38

$2,000.00

$688.00

Annual interest rates as of statement date:

Cash advances

21.99%

Purchases

19.99%

**When you use your Scotiabank American Express Card, you earn 2

points for each dollar spent on eligible purchases at Gas Stations,

Grocery Stores, Dining and Entertainment establishments and 1

point for each dollar spent on all other eligible purchases.

DETAILS

Credit limit

Credit available

Interest Information

500

Points earned (2x earn rate**)

TRANS. POST

REF.# DATE DATE

$10.00

Previous balance, Mar 12/15

Interest

+

Payments/credits

Purchases/charges

+

MR ASAD CHEEMA

May 5, 2015

$10.00

70.0039.00

9.81

Continued on page 3

Statement Period Mar 13, 2015 - Apr 14, 2015

Statement date

Apr 14, 2015

Account #

3792 400239 17011

Page

2 of 5

1. PAYMENTS: The TOTAL MINIMUM PAYMENT includes your minimum payment and

any amount(s) shown as overdue or overlimit. Amounts shown as overdue or

overlimit must be paid in full. We must receive your payment by the PAYMENT DUE

DATE shown on your statement. Your payment options are shown in section 8.

Please refer to your Credit Agreement, Disclosure Statement or disclosure letter, or

any subsequent notice that we have sent you for information about the minimum

payment.

If your account goes into default and we demand the balance in full, we will no

longer send monthly statements. However, we will continue to charge interest on

your account.

We reserve the right to hold funds until your payment has cleared. This may

temporarily affect your available credit.

Please refer to your Credit Agreement or Personal Credit Agreement Companion

Booklet for information on how your payments are allocated or applied to your

account.

2. INTEREST CHARGES: We calculate interest on the portion of your balance to which

interest applies using the annual percentage rate(s) which is shown on the front of

your statement, or which we have notified you of separately.

For Scotiabank American Express Cards, we will not charge interest on any purchases

or interest-bearing services charges (dishonoured payment fee and the overlimit fee)

if you pay, by the PAYMENT DUE DATE, the entire balance of the monthly statement

on which they first appear. If your current balance is not paid in full, we will charge

interest on all purchases and interest-bearing service charges from their transaction

date to the date they are paid in full. Interest is payable on each cash advance,

balance transfer and Scotia Credit Card Cheque from the transaction date indicated

on the statement to the date it is repaid in full. There is no interest-free grace period

for cash advances, balance transfers and Scotia Credit Card Cheques. Cash advances

include "quasi cash advances" which are monetary transactions posted to your

account which are not "purchase" transactions and include, but are not limited to,

wire transfers, foreign currency, travelers cheques, money orders and remote stored

value. American Express Cards are not presently accepted for the purchase of bets,

lottery tickets or casino gaming chips.

We calculate interest on your debt daily but we only add it to your debt once a

month on each statement. We calculate the amount of daily interest by adding any

new advances and subtracting any payments and then multiplying the unpaid balance

of the debt on which interest is payable by the annual interest rate then dividing by

365 or 366 in a leap year. Interest is charged on a leap day in a leap year. Interest is

charged at the rate applicable under the agreement both before and after the final

payment date, maturity, default and judgment, until the credit account has been paid

off in full.

Interest appearing on this statement is calculated only to the statement date. We will

continue to charge interest on the amounts you owe until we receive payment in full.

This interest will be reflected on your next statement. To pay off the full amount you

owe and stop interest accumulation, ask your branch for your payout balance and pay

that amount at the branch the same day. (This figure may not include insurance

premiums and/or transactions not posted to your account).

3. INTEREST RATE CHANGES: We will tell you the applicable interest rates. We may

change these rates from time to time in our sole discretion and in accordance with

applicable law even if you repay your credit account in accordance with its terms. For

variable interest rate accounts, interest is composed of two factors: our prime rate

and an adjustment factor. We will change our prime rate from time to time and will

post a notice of this in our branches. We may also change the adjustment factor, but

we will give you prior written notice of this, stating the effective date of the change.

4. TRANSACTION DATE & POSTING DATE: These dates are shown next to each

transaction on your statement; "TRANS DATE" is the date on which the transaction

occurred; and "POST DATE" is the date on which the transaction is applied to your

account.

5. CREDIT BALANCE: If you pay more than the total amount owing on your account,

your credit balance will be shown with a minus sign next to your account balance. We

will apply the credit to any future charges on your account, unless you ask us in

writing to return the credit amount to you.

6. TRANSACTIONS IN FOREIGN CURRENCY/ CROSS BORDER:

All transactions made in a foreign currency are converted and posted to your account

in Canadian dollars. For card transactions in a foreign currency other than U.S.

dollars, the amount is converted to U.S. dollars and then to Canadian dollars.

For a transaction with your Scotiabank American Express Card, the exchange rate is

determined by American Express on the date the transaction is processed by American

Express. This exchange rate may be different from the exchange rate in effect on the

transaction date. A commission of 2.50% will be added to all charges in foreign

currency after being converted to Canadian dollars,1.0% of which will be retained by

American Express. For any reversal of a transaction the exchange rate that is used to

process the credit may not be the same exchange rate as the one used to convert the

original charge (and will include an amount equal to 2.50% of the Canadian dollar

amount).

For Scotiabank American Express Card account payments and Scotia Credit Card

Cheques, the exchange rate will be the posted rate charged to customers at any

branch of The Bank of Nova Scotia on the date the transaction occurs. For any reversal

of these transactions, the exchange rate will be determined in the same manner as of

the date the transaction is reversed.

For cash withdrawals made from ABMs outside of Canada using a ScotiaCard debit

card to obtain a cash advance on the Scotiabank American Express Card account the

exchange rate is determined by the appropriate network on

our behalf on the date that the transaction is settled with that

network. This exchange rate may be different from the

exchange rate in effect on the transaction date. This rate

includes an amount equal to 2.50% of the Canadian dollar

converted amount.

For a transaction with your Scotiabank American Express Card

in Canadian dollars with a merchant located outside of

Canada, a Cross Border Transaction Fee will be charged, equal

to 2.50% of the Canadian dollar amount of the transaction,

1% of which will be retained by American Express.

7. HOW TO CONTACT US: If your Scotiabank American Express

Card or Scotia Credit Card cheque is LOST OR STOLEN, please

contact us IMMEDIATELY at one of the following numbers:

U Toronto area

416-288-1440

U All other area codes within Canada

1-800-387-6466

U Outside Canada (Collect)

416-288-1440

If you believe there are errors on your statement, please

contact your branch or call us at one of the numbers listed

above within 15 days of your statement date.

If you wish to apply for a higher credit limit or additional

cards, please contact your Scotiabank servicing branch.

If you have general questions about your statement, you can

write to us at:

Scotiabank Contact Centres

P. O. Box 4100

Postal Station "A"

Toronto, Ontario M5W 1T1

8. PAYMENT OPTIONS:

Pay your Scotiabank American Express card at any of

Scotiabank's self-service banking channels:

U Scotia OnLine Financial Services:

www.scotiaonline.scotiabank.com

U Scotiabank ABM in Canada

U TeleScotia automated telephone banking at 1-800-267-1234

U By mail. Complete and return the slip attached to your

statement (if applicable) along with your payment. Make

cheque or money order payable to Scotiabank. If your

statement did not include a payment slip and return

envelope, please ensure that your account number is written

on your cheque and mail it to address shown above:

U At any Scotiabank branch in Canada.

PLEASE WRITE YOUR ACCOUNT NUMBER ON ALL

CORRESPONDENCE AS WELL AS ON THE FRONT OF YOUR

CHEQUE OR MONEY ORDER (payable to Scotiabank).

9. *** ESTIMATE OF THE TIME IT WILL TAKE TO PAY THE

OUTSTANDING BALANCE ON SCOTIABANK AMERICAN

EXPRESS CARD ACCOUNTS: This mathematical calculation is

approximate and is for information purposes only. The

calculation assumes: (i) the outstanding balance on this

statement is rounded up to the nearest $100; (ii) the first

minimum payment is the amount shown in the TOTAL

MINIMUM PAYMENT box, including any overlimit or overdue

amount(s); (iii) each subsequent minimum payment is based on

a declining balance and a declining minimum payment; (iv)

each minimum payment will be made on its corresponding

due date; (v) a final minimum payment equal to the

outstanding balance of the account will be due by the 80th

year of the calculation, if applicable; (vi) monthly interest is

added to the account using a constant interest rate equal to

the current Preferred Rate for purchases, except that the

higher Standard Rate for purchases is used if that rate is

currently applicable to your account; and (vii) monthly interest

is calculated by multiplying the entire projected outstanding

balance for each statement period by the annual interest rate,

then dividing by 360, and then multiplying by 30. The actual

time to pay your outstanding balance will depend on various

factors including the prevailing interest rate(s) and the

amounts, timing and application of any payments made, the

nature of any card transactions and any applicable grace

periods.

American Express is a trademark of American Express. American

Express/Lic. user. The Bank of Nova Scotia. Registered trademark

of The Bank of Nova Scotia. TM Trademarks of The Bank of Nova

Scotia. This credit card program is issued and administered by

The Bank of Nova Scotia.

Date revised November 2012.

SBAXEP_20100_D15104_A - 0003022

INFORMATION ABOUT YOUR SCOTIABANK STATEMENT

012272

Scotiabank American Express Card

Statement Period Mar 13, 2015 - Apr 14, 2015

Statement date

Apr 14, 2015

Account #

3792 400239 17011

Page

3 of 5

Scotiabank American

Express Card

Transactions - continued

TRANS. POST

REF.# DATE DATE

DETAILS

AMOUNT($)

SUB-TOTAL CREDITS

SUB-TOTAL DEBITS

$70.00$48.81

SBAXEP_20100_D15104_A - 0003022

HRI - - 3 - 2 - 24 - -

012273

MR ASAD CHEEMA - 3792 400239 17011

004 Mar 11 Mar 13 CALGARY -CALGARY TRA CALGARY AB

3.15

005

Mar 11 Mar 16 Shell Canada C00188 CALGARY AB

1.91

006

Mar 11 Mar 16 CALGARY -CALGARY TRA CALGARY AB

3.15

007

Mar 11 Mar 16 Shell Canada C00188 CALGARY AB

20.01

008

Mar 11 Mar 16 Shell Canada C00188 CALGARY AB

50.00

009

Mar 12 Mar 17 Shell Canada C00188 CALGARY AB

20.00

010

Mar 12 Mar 17 Shell Canada C00188 CALGARY AB

20.02

011

Mar 13 Mar 16 CALGARY -CALGARY TRA CALGARY AB

012

Mar 13 Mar 16 SHOPPERSDRUGMART2403 CALGARY AB

37.27

013

100.00-

014

Mar 13 Mar 13 MB-CREDIT CARD/LOC PAY. FROM 81349045 5385

Mar 15 Mar 16 CALGARY -CALGARY TRA CALGARY AB

015

Mar 15 Mar 16 CALGARY -CALGARY TRA CALGARY AB

016

Mar 15 Mar 17 Shell Canada C00188 CALGARY AB

30.02

017

Mar 15 Mar 17 Shell Canada C00188 CALGARY AB

30.12

018

Mar 15 Mar 17 Shell Canada C00188 CALGARY AB

30.50

019

Mar 15 Mar 18 Shell Canada C00188 CALGARY AB

020

Mar 16 Mar 18 THE BODY SHOP TORONTO ON

021

Mar 17 Mar 19 SHOPPERSDRUGMARTPO24 CALGARY AB

1.25

022

Mar 17 Mar 19 CALGARY -CALGARY TRA CALGARY AB

6.30

023

Mar 17 Mar 19 PASSPORT/PASSEPORT,CAL 14 CALGARY AB

024

Mar 17 Mar 23 SHOPPERSDRUGMART2403 CALGARY AB

27.05

025

Mar 18 Mar 23 Shell Canada C00188 CALGARY AB

10.00

026

Mar 18 Mar 23 Shell Canada C00188 CALGARY AB

20.00

027

Mar 18 Mar 23 Shell Canada C00188 CALGARY AB

20.01

028

Mar 18 Mar 23 Shell Canada C00188 CALGARY AB

40.01

029

Mar 18 Mar 23 Shell Canada C00188 CALGARY AB

40.01

030

Mar 18 Mar 23 Shell Canada C00188 CALGARY AB

54.20

031

032

Mar 18 Mar 23 KOODO AIRTIME KOODO AIRTI SCARBOROUGH

ON

Mar 19 Mar 23 CALGARY -CALGARY TRA CALGARY AB

033

Mar 19 Mar 23 CALGARY -CALGARY TRA CALGARY AB

034

Mar 19 Mar 23 PAYPAL *2YK COM*2YK COM BRAMPTON

11.99

035

Mar 19 Mar 24 Shell Canada C00188 CALGARY AB

20.00

036

Mar 19 Mar 24 Shell Canada C00188 CALGARY AB

20.00

037

Mar 19 Mar 24 Shell Canada C00188 CALGARY AB

40.52

038

Mar 20 Mar 24 Shell Canada C00323 CALGARY AB

2.78

039

Mar 21 Mar 24 Shell Canada C00188 CALGARY AB

20.00

040

Mar 21 Mar 24 Shell Canada C00188 CALGARY AB

24.69

041

Mar 21 Mar 24 Shell Canada C00188 CALGARY AB

45.40

042

Mar 21 Mar 24 Shell Canada C00188 CALGARY AB

60.01

3.15

3.15

3.15

3.25

81.86

160.00

113.37

3.15

3.15

Continued on next page

Statement Period Mar 13, 2015 - Apr 14, 2015

Statement date

Apr 14, 2015

Account #

3792 400239 17011

Page

4 of 5

Scotiabank American Express Card

Transactions - continued

DETAILS

AMOUNT($)

043

Mar 22 Mar 24 Shell Canada C00188 CALGARY AB

40.00

044

Mar 22 Mar 24 Shell Canada C00188 CALGARY AB

70.05

045

Mar 25 Mar 27 CALGARY -CALGARY TRA CALGARY AB

046

Mar 25 Mar 30 Shell Canada C00188 CALGARY AB

30.01

047

Mar 25 Mar 30 Shell Canada C00188 CALGARY AB

30.01

048

Mar 25 Mar 30 Shell Canada C00188 CALGARY AB

049

050

Mar 25 Mar 25 MB-CREDIT CARD/LOC PAY. FROM 81349045 5385

Mar 26 Mar 31 Shell Canada C00188 CALGARY AB

051

Mar 28 Mar 31 Shell Canada C00188 CALGARY AB

40.00

052

Mar 28 Mar 31 Shell Canada C00188 CALGARY AB

50.00

053

Mar 29 Mar 30 TIM HORTONS #3565# QPCALC CALGARY AB

054

Mar 29 Mar 31 CHATTERS CALGARY AB

055

Mar 29 Apr 2

SHOPPERSDRUGMART2403 CALGARY AB

056

Mar 30 Apr 1

CHATTERS CALGARY AB

057

Apr 1

Apr 6

TIM HORTONS #3565# QPCALC CALGARY AB

058

Apr 1

Apr 6

STARBUCKS #04403# CALGARY AB

10.00

059

Apr 1

Apr 7

Shell Canada C00188 CALGARY AB

20.01

060

Apr 1

Apr 7

Shell Canada C00188 CALGARY AB

30.00

061

Apr 1

Apr 7

Shell Canada C00188 CALGARY AB

40.15

062

Apr 1

Apr 7

Shell Canada C00188 CALGARY AB

42.00

063

Apr 1

Apr 7

Shell Canada C00188 CALGARY AB

064

Apr 1

Apr 2

065

Apr 2

Apr 6

MB-CREDIT CARD/LOC PAY. FROM 81349045 5385

CALGARY -CALGARY TRA CALGARY AB

066

Apr 2

Apr 7

Shell Canada C00188 CALGARY AB

20.00

067

Apr 2

Apr 7

Shell Canada C00188 CALGARY AB

20.00

068

Apr 2

Apr 7

Shell Canada C00188 CALGARY AB

24.03

069

Apr 2

Apr 7

Shell Canada C00188 CALGARY AB

24.70

070

Apr 2

Apr 7

Shell Canada C00188 CALGARY AB

29.99

071

Apr 3

Apr 7

Shell Canada C00188 CALGARY AB

25.00

072

Apr 3

Apr 7

Shell Canada C00188 CALGARY AB

40.00

073

Apr 3

Apr 7

Shell Canada C00188 CALGARY AB

40.03

074

Apr 5

Apr 7

Shell Canada C00188 CALGARY AB

20.00

075

Apr 6

Apr 8

CALGARY -CALGARY TRA CALGARY AB

076

Apr 6

Apr 9

FRITOU FRIED CHICKEN CALGARY AB

34.09

077

Apr 6

Apr 9

AIR CANADA AIR CANADA WINNIPEG

70.00

078

Apr 7

Apr 9

SAFEWAY #8909 CALGARY AB

3.99

079

Apr 7

Apr 10

CALGARY -CALGARY TRA CALGARY AB

3.15

080

Apr 7

Apr 10

Shell Canada C00142 CALGARY AB

4.99

081

Apr 7

Apr 7

082

Apr 8

Apr 10

MB-CREDIT CARD/LOC PAY. FROM 81349045 5385

CALGARY -CALGARY TRA CALGARY AB

083

Apr 8

Apr 13

Shell Canada C00188 CALGARY AB

30.00

084

Apr 9

Apr 14

Shell Canada C00188 CALGARY AB

20.01

085

Apr 9

Apr 14

Shell Canada C00188 CALGARY AB

23.69

086

Apr 10

Apr 13

CALGARY -CALGARY TRA CALGARY AB

3.15

60.01

500.0050.00

3.14

25.20

109.82

47.00

3.14

91.90

244.00-

3.15

200.003.15

3.15

Continued on next page

012274

3.15

SBAXEP_20100_D15104_A - 0003022

TRANS. POST

REF.# DATE DATE

Statement Period Mar 13, 2015 - Apr 14, 2015

Statement date

Apr 14, 2015

Account #

3792 400239 17011

Page

5 of 5

Scotiabank American

Express Card

Transactions - continued

TRANS. POST

REF.# DATE DATE

DETAILS

087

Apr 10

Apr 13

SAFEWAY #8909 CALGARY AB

10.00

088

Apr 12

Apr 14

Shell Canada C00188 CALGARY AB

40.11

AMOUNT($)

SUB-TOTAL CREDITS - 3792 400239 17011

SUB-TOTAL DEBITS - 3792 400239 17011

$1,044.00$2,376.57

Interest charges

Cash advances/cheques

$0.00

Special rate offers

$0.00

Purchases

$0.00

SBAXEP_20100_D15104_A - 0003022

HRI - - 3 - 3 - 25 - -

012275

Estimate of the time it will take to pay the "New Balance"

shown on this statement, through minimum payments***:

11 Years and 08 Months.

SBAXEP_20100_D15104_A - 0003022

012276

Вам также может понравиться

- 09-28-2018 PDFДокумент12 страниц09-28-2018 PDFAnonymous haqBJBY100% (2)

- TD Cash Back Card: MR JOHN DOE 1234 1234 1234 1234Документ5 страницTD Cash Back Card: MR JOHN DOE 1234 1234 1234 1234Nadiia Avetisian100% (3)

- 01 0129 0295268 46 - Statement - 2016 02 11 PDFДокумент2 страницы01 0129 0295268 46 - Statement - 2016 02 11 PDFAnonymous 6jgkW0uOMv100% (1)

- Mustafa Bank StatementДокумент15 страницMustafa Bank StatementHatim MoiyadiОценок пока нет

- Scotiabank StatementДокумент3 страницыScotiabank StatementЮлия П100% (2)

- STMNT 112013 9773Документ3 страницыSTMNT 112013 9773redbird77100% (1)

- CIBC Bank StatementДокумент5 страницCIBC Bank StatementJordan Grey100% (2)

- BMO Preferred Rate Mastercard: Period Covered by This StatementДокумент4 страницыBMO Preferred Rate Mastercard: Period Covered by This StatementBubba Johns100% (1)

- Statement Apr 2012Документ14 страницStatement Apr 2012ksj5368100% (2)

- November 07, 2016 PDFДокумент8 страницNovember 07, 2016 PDFChristine HogueОценок пока нет

- TD All-Inclusive Banking Plan 315-6461249 Aug 31-Sep 30 2016Документ1 страницаTD All-Inclusive Banking Plan 315-6461249 Aug 31-Sep 30 2016Imran7878Оценок пока нет

- Tangerine-eStatement Jul19 PDFДокумент2 страницыTangerine-eStatement Jul19 PDFRudyard Martin Cardozo33% (6)

- Statement Jan, 2021Документ4 страницыStatement Jan, 2021Marco Antonio Martinez Estrada0% (2)

- Bmo 8.1.13 PDFДокумент7 страницBmo 8.1.13 PDFChad Thayer VОценок пока нет

- 2012sep15 2012oct15Документ3 страницы2012sep15 2012oct15nancy1358Оценок пока нет

- Online StatementДокумент6 страницOnline StatementЮлия П100% (2)

- Your Rewards: Bmo Cashback MastercardДокумент5 страницYour Rewards: Bmo Cashback Mastercardhananahmad114Оценок пока нет

- 4600 20180824 StatementДокумент4 страницы4600 20180824 StatementAnanda WijayaratnaОценок пока нет

- Credit One 2Документ2 страницыCredit One 2BryanОценок пока нет

- Statement Jun 2015Документ3 страницыStatement Jun 2015TheCanadianPress100% (2)

- Your Consolidated Statement: Contact UsДокумент5 страницYour Consolidated Statement: Contact UsSAM50% (2)

- CIBC U.S. Dollar Aventura Gold Visa Card: Your Account at A GlanceДокумент6 страницCIBC U.S. Dollar Aventura Gold Visa Card: Your Account at A GlanceM A KhanОценок пока нет

- Scotiabank Bank Statement BankStatementsДокумент5 страницScotiabank Bank Statement BankStatementsLao TruongОценок пока нет

- June 14 PDFДокумент4 страницыJune 14 PDFSusan Romdenne100% (1)

- Goldman Future of Finance - Payment EcosystemsДокумент87 страницGoldman Future of Finance - Payment Ecosystemsnirav kakariyaОценок пока нет

- RBC Visa Classic: Low Rate OptionДокумент4 страницыRBC Visa Classic: Low Rate OptionThe VaultОценок пока нет

- Statement: WWW - Tangerine.caДокумент2 страницыStatement: WWW - Tangerine.cahanh dao0% (1)

- MEDINA - Homework 2 (Midterm)Документ9 страницMEDINA - Homework 2 (Midterm)Von Andrei MedinaОценок пока нет

- 2020-06-05 PDFДокумент6 страниц2020-06-05 PDFAli west NabОценок пока нет

- Signature RBC Rewards Visa: Previous Account Balance $2,646.15Документ5 страницSignature RBC Rewards Visa: Previous Account Balance $2,646.15Hoang DucОценок пока нет

- 4520 34XX XXXX 9045: Statement DateДокумент3 страницы4520 34XX XXXX 9045: Statement DateЮлия ПОценок пока нет

- VISAPlatinum 4601843780399869 17sep2009Документ3 страницыVISAPlatinum 4601843780399869 17sep2009Fabian Pazmino100% (1)

- Financial Support Evidence PDFДокумент23 страницыFinancial Support Evidence PDFmcolmОценок пока нет

- For The Period Ending October 05, 2020: Summary of Your AccountДокумент1 страницаFor The Period Ending October 05, 2020: Summary of Your AccountKrista SchlosserОценок пока нет

- EstatementДокумент2 страницыEstatementjosealex134Оценок пока нет

- Payment Information Summary of Account Activity: SeptemberДокумент3 страницыPayment Information Summary of Account Activity: SeptemberSarah BledsoeОценок пока нет

- Statement - 2014 06 05Документ4 страницыStatement - 2014 06 05Sebastian WatersОценок пока нет

- Savings (00) : Periodic Account StatementДокумент4 страницыSavings (00) : Periodic Account Statementalan100% (1)

- Statement September 2019Документ6 страницStatement September 2019Mike Schmoronoff100% (1)

- TransactionSummary PDFДокумент6 страницTransactionSummary PDFandresОценок пока нет

- Westpac Feb4Документ2 страницыWestpac Feb4რაქსშ საჰა100% (1)

- Avalanche Bank Statement 26.02.2021Документ2 страницыAvalanche Bank Statement 26.02.2021HerbertОценок пока нет

- Deposit Account StatementДокумент3 страницыDeposit Account Statementsaid Obnika100% (1)

- 06492XXX6915 2016apr08 2016may10Документ6 страниц06492XXX6915 2016apr08 2016may10Anonymous q4ORY5Оценок пока нет

- 01/01/2021 - 27/01/2021 Statement: Contact Tel +44 (0) 207 930 4450Документ1 страница01/01/2021 - 27/01/2021 Statement: Contact Tel +44 (0) 207 930 4450RanaОценок пока нет

- PDFДокумент21 страницаPDFAnonymous hiCyxqsNОценок пока нет

- Statement Dec 2011Документ2 страницыStatement Dec 2011Iris KhanashatОценок пока нет

- 2011dec07 2012jan06Документ2 страницы2011dec07 2012jan06Cowdrey Ilan100% (1)

- Sam StatementДокумент11 страницSam StatementAmrinder Setia100% (1)

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredДокумент6 страницNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- Your Gold Credit Card Statement: 10 December 2012Документ3 страницыYour Gold Credit Card Statement: 10 December 2012usernam1976Оценок пока нет

- IDfC FD CertificateДокумент3 страницыIDfC FD Certificatenisha bhardwaj100% (1)

- 2014sep11 2014oct10Документ3 страницы2014sep11 2014oct10Karen JoyОценок пока нет

- 2010jun03 2010jul02Документ2 страницы2010jun03 2010jul02karmelita0672100% (1)

- Card Statement: Statement Date Last Payment DateДокумент2 страницыCard Statement: Statement Date Last Payment DateS.M. Shamsuzzaman SalimОценок пока нет

- Statement 20140508Документ2 страницыStatement 20140508franraizerОценок пока нет

- Payoneer Account Statement: Amazon Registered Seller DetailsДокумент1 страницаPayoneer Account Statement: Amazon Registered Seller DetailsĐào Văn CườngОценок пока нет

- NationwideДокумент1 страницаNationwideЮлия ПОценок пока нет

- VISA Classic: Getting Yourself StartedДокумент3 страницыVISA Classic: Getting Yourself Startedkarely jackson lopez100% (1)

- Credit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchДокумент6 страницCredit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchAkhbar-ul- AkhyarОценок пока нет

- Asad M Cheema - Chat History in FullДокумент77 страницAsad M Cheema - Chat History in Fullapi-344873207Оценок пока нет

- 11-13-2015 PDFДокумент4 страницы11-13-2015 PDFAnonymous ZgROrLNLCjОценок пока нет

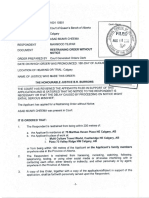

- Asad C Restraining OrderДокумент2 страницыAsad C Restraining Orderapi-344873207Оценок пока нет

- HSBC Gold Visa: Kenneth C DuncanДокумент6 страницHSBC Gold Visa: Kenneth C DuncanKenny Diego ChenОценок пока нет

- Halifax - Print Friendly Statement PDFДокумент2 страницыHalifax - Print Friendly Statement PDFAnonymous 2FybjkA50% (1)

- Statement Nov 2011Документ3 страницыStatement Nov 2011HarikadurgaОценок пока нет

- Patel 2Документ2 страницыPatel 2api-344873207Оценок пока нет

- Asad PromisesДокумент4 страницыAsad Promisesapi-344873207Оценок пока нет

- Asad PromisesДокумент4 страницыAsad Promisesapi-344873207Оценок пока нет

- Asad PassportДокумент1 страницаAsad Passportapi-344873207Оценок пока нет

- General Power of AttorneyДокумент2 страницыGeneral Power of Attorneyapi-344873207Оценок пока нет

- Asad C R OrderДокумент3 страницыAsad C R Orderapi-344873207Оценок пока нет

- Asad C R Order 2Документ2 страницыAsad C R Order 2api-344873207Оценок пока нет

- Sister Chat - Sir I Am Mrs Goraya AsadДокумент2 страницыSister Chat - Sir I Am Mrs Goraya Asadapi-344873207Оценок пока нет

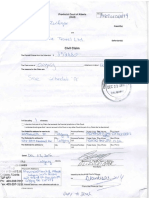

- P Court of Alberta Civil 1924Документ2 страницыP Court of Alberta Civil 1924api-344873207Оценок пока нет

- Third-Party-Notice - This-Form-Includes-The-Affidavit-Of-Service-Cts2776Документ3 страницыThird-Party-Notice - This-Form-Includes-The-Affidavit-Of-Service-Cts2776api-344873207Оценок пока нет

- Ali Zulfiqar - 2Документ1 страницаAli Zulfiqar - 2api-344873207Оценок пока нет

- Ali ZulfiqarДокумент1 страницаAli Zulfiqarapi-344873207Оценок пока нет

- Ali Zulfiqar - 3Документ2 страницыAli Zulfiqar - 3api-344873207Оценок пока нет

- Commercial Bank Management Sem IIIДокумент11 страницCommercial Bank Management Sem IIIJanvi MhatreОценок пока нет

- GPF Part Final Appendix oДокумент3 страницыGPF Part Final Appendix oteja ptoОценок пока нет

- Lesson 7 Mergers and AcquisitionsДокумент11 страницLesson 7 Mergers and AcquisitionsfloryvicliwacatОценок пока нет

- Icici FinalДокумент3 страницыIcici FinalYashika AsraniОценок пока нет

- ApkaiДокумент20 страницApkaiAhmadОценок пока нет

- Investment Has Different Meanings in Finance and EconomicsДокумент15 страницInvestment Has Different Meanings in Finance and EconomicsArun IssacОценок пока нет

- Fundamentals of Corporate Finance 12th Edition Ross Solutions ManualДокумент15 страницFundamentals of Corporate Finance 12th Edition Ross Solutions Manuallovellmil51wg1100% (32)

- No Akun Nama Akun N Type AkunДокумент5 страницNo Akun Nama Akun N Type AkunDanishОценок пока нет

- 201FIN Tutorial 3 Financial Statements Analysis and RatiosДокумент3 страницы201FIN Tutorial 3 Financial Statements Analysis and RatiosAbdulaziz HОценок пока нет

- Insurance Team Sent You An Amazon Pay Gift Card! UpdatedДокумент3 страницыInsurance Team Sent You An Amazon Pay Gift Card! UpdateddeepakkumaarrОценок пока нет

- Overview of Functions and Operations BSPДокумент2 страницыOverview of Functions and Operations BSPKarla GalvezОценок пока нет

- IGCSE-OL - Bus - CH - 22 - Answers To CB ActivitiesДокумент2 страницыIGCSE-OL - Bus - CH - 22 - Answers To CB ActivitiesOscar WilliamsОценок пока нет

- The Philippine Financial SystemДокумент2 страницыThe Philippine Financial SystemElizabeth CanadaОценок пока нет

- Assignment of Resource Mobilisation and Portfolio Management in HDFC BankДокумент13 страницAssignment of Resource Mobilisation and Portfolio Management in HDFC Bankashish bansalОценок пока нет

- Sep-22 302020Документ6 страницSep-22 302020itsyour vinESОценок пока нет

- Bookkeeping ProposalДокумент8 страницBookkeeping ProposalOwolabi CorneliusОценок пока нет

- Pro Forma Balance Sheet - FinalДокумент18 страницPro Forma Balance Sheet - FinalsssssОценок пока нет

- Testing Ingine KaliДокумент30 страницTesting Ingine KaliIngiaОценок пока нет

- FAQ On Cordros Money Market FundДокумент3 страницыFAQ On Cordros Money Market FundOnaderu Oluwagbenga EnochОценок пока нет

- Respon Code Edc Miniatm-1Документ1 страницаRespon Code Edc Miniatm-1hasibuanОценок пока нет

- Workshop 2 Qs As Introduction To A FДокумент18 страницWorkshop 2 Qs As Introduction To A FYeoh Tze ShinОценок пока нет

- Financial Accounting: Foundation LevelДокумент569 страницFinancial Accounting: Foundation LevelHadija Nondo100% (1)

- CA Inter FM ECO Suggested Answer May2023Документ35 страницCA Inter FM ECO Suggested Answer May2023sreeramireddigari abhishekreddyОценок пока нет

- Nefas Silk Poly Technic College: Learning GuideДокумент39 страницNefas Silk Poly Technic College: Learning GuideNigussie BerhanuОценок пока нет

- Solution:: January 1 0.16 May 1 0.18 July 1 0.20 October 1 0.21 December 31 0.22 Average For The Year 0.19Документ19 страницSolution:: January 1 0.16 May 1 0.18 July 1 0.20 October 1 0.21 December 31 0.22 Average For The Year 0.19Germayne GaluraОценок пока нет

- Worksheet: Date Nama Akun Debit KreditДокумент3 страницыWorksheet: Date Nama Akun Debit KreditAlche MistОценок пока нет