Академический Документы

Профессиональный Документы

Культура Документы

RMC No 70-2016

Загружено:

Freznel B. Sta. Ana0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров2 страницыSuspension of all audits

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSuspension of all audits

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров2 страницыRMC No 70-2016

Загружено:

Freznel B. Sta. AnaSuspension of all audits

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

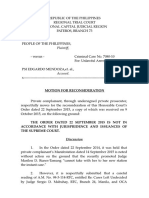

BI-lRilJ 0F INTEITNAL RE""tsNU-E

l-,siotuts IUG'r' Di\rysI(}N

---l:)f

REPUBLIC OF THE PHiLIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

JUL tt

F'/"t'

I 2U16 /+

LrUbqrt

[TECE,TfE&

July L,20LG

REVENUE MEMORANDUM CTRCULAR

NO. TC - VDtb

Suspension of Audit of the Bureau of Internal

Reven ue Effective J u ly L , 20L6 a nd Su bm ission of

Inventory of Pend ing Letters of Authority/Letter

Notices as of June 30, 2016

SUBJECT

All Internal Revenue Officers and Others Concerned

TO

it a nd other field operations of the Bu rea u of Interna

relative

Revenue

to examinations and verifications of taxpayers' books

of accou nts, records a nd other tra nsactions a re hereby ordered

suspended until further notice.

,.j

All field

a ud

As such, oo field audit, field operations, or any form of business

visitation in execution of Letters of Authority/Audit Notices (LAs), Letter

Notices , or Mission Orders should be conducted.

Further, no written orders to audit an d/or investigate taxpayers'internal

revenue tax liabilities shall be issued and/or served except in the

following cases:

Investigation of cases prescribing on or before October 31, 2016;

Processing a nd verification of estate tax retu rns, donor's tax

returns, capital gains tax returns and withholding tax returns on

the sale of real properties or shares of stocks together with the

documentary stamp tax returns related thereto;

Examination and/or verification of internal revenue tax liabilities

of taxpayers retiring from business;

Audit of National Government Agencies (NGAs),

Local

Government Units (tGUs) and Government Owned and Controlled

Corporations (GOCCs) including subsidiaries and affiliates; and

Other matters/concerns where deadlines have been imposed or

under the orders of the Commissioner of Internal Revenue.

However, service of Assessment Notices, WErrants and Seizure Notices

should still be effected. Also, taxpayers may voluntarily pay their known

deficiency taxes without the need to secure authority from concerned

Revenue Officials.

In this regard, inventory of all outstanding Letters of Authority/Audit

Notices, and Letter Notices as of June 30, 2AL6, shall be submitted to

the Office of the Commissioner in Excel format, both in softcopy in

CD/DVD and hardcopy, on or before July 16,2016. The template of the

inventory is hereby attached as Annex A.

All internal revenue officers and others concerned are enjoined to give

this Circular as wide a publicity as possible'

This Order shall take effect immediately.

rs

CAESAR R. DULAY

Commissioner of lnternal Revenue

,,;

I]IINTAU OF NNEHNAT REVENUE

{{':ICOR.IIS

]\4;T. DIV-ISION

t: { F.t1 ,

JUL u I ,Orr,Llir^

?

IdECEHVE#

000003

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Information Asset Classification Framework: All Information Used in COMPANYДокумент2 страницыInformation Asset Classification Framework: All Information Used in COMPANYFreznel B. Sta. AnaОценок пока нет

- Customer Due Diligence TemplatesДокумент25 страницCustomer Due Diligence TemplatesFreznel B. Sta. Ana100% (1)

- ManifestationДокумент5 страницManifestationFreznel B. Sta. AnaОценок пока нет

- Jeff Gutcheon - Low Down BoogieДокумент1 страницаJeff Gutcheon - Low Down BoogieFreznel B. Sta. AnaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Ctolibas Ac550 Assignment1 Unit1Документ4 страницыCtolibas Ac550 Assignment1 Unit1May-AnnJoyRedoñaОценок пока нет

- Relationship Between Internal Shariah Audit Characteristics and Its EffectivenessДокумент22 страницыRelationship Between Internal Shariah Audit Characteristics and Its EffectivenessMonika IndahОценок пока нет

- CG & Corp Failure-ScidirectДокумент8 страницCG & Corp Failure-ScidirectindahmuliasariОценок пока нет

- Chapter 5 (Audit)Документ2 страницыChapter 5 (Audit)arnel gallarteОценок пока нет

- Acct557 w1 HomeworkДокумент5 страницAcct557 w1 HomeworkDaMaterial Gyrl MbaОценок пока нет

- ETR - Genius Training CentreДокумент57 страницETR - Genius Training CentrejojotheripperОценок пока нет

- Securities LawДокумент41 страницаSecurities LawVimal SinghОценок пока нет

- Opening of Business End of Year 2Документ10 страницOpening of Business End of Year 2Mhd RahmanОценок пока нет

- OPM in English 20200604135452 20200623172516Документ422 страницыOPM in English 20200604135452 20200623172516Robin Kumar YadavОценок пока нет

- Netrika Corporate Forensic Investigation Deck DTD 28th April, 2023Документ41 страницаNetrika Corporate Forensic Investigation Deck DTD 28th April, 2023Himanshu BishtОценок пока нет

- Performing Substatntive TestsДокумент18 страницPerforming Substatntive TestsAlex OngОценок пока нет

- Hinigaran2017 Audit ReportДокумент146 страницHinigaran2017 Audit ReportChito BarsabalОценок пока нет

- Credit Audit FormatДокумент14 страницCredit Audit FormatRAGAVIОценок пока нет

- Bactng1 Syllabus UbДокумент19 страницBactng1 Syllabus UbvicenteferrerОценок пока нет

- 102 - Anti-Money Laundering Questionnaire - V2017 Risk DepartmentДокумент7 страниц102 - Anti-Money Laundering Questionnaire - V2017 Risk DepartmentShaq JordanОценок пока нет

- Planet Payment Inc.Документ50 страницPlanet Payment Inc.ArvinLedesmaChiongОценок пока нет

- Job SheetДокумент6 страницJob SheetRoy Sumugat100% (1)

- CH 7Документ6 страницCH 7Mendoza KlariseОценок пока нет

- Latihan Arus KasДокумент8 страницLatihan Arus KasEka Junita HartonoОценок пока нет

- Perwaja SteelДокумент7 страницPerwaja SteelThiripura Sundhari100% (1)

- AaДокумент5 страницAaMjhayeОценок пока нет

- Vat Audit Check ListДокумент1 страницаVat Audit Check Listmehtayash90Оценок пока нет

- All Commerce Colleges Pune 2019Документ117 страницAll Commerce Colleges Pune 2019Madhurie Singh100% (1)

- Management Control Systems of BritanniaДокумент19 страницManagement Control Systems of BritanniaJonathan Smith100% (2)

- Christ The King College of Science and TechnologyДокумент10 страницChrist The King College of Science and TechnologyHanna ColinaresОценок пока нет

- PBL Task IV - Audit II - Group 4Документ3 страницыPBL Task IV - Audit II - Group 4Diva GunawanОценок пока нет

- Project Management & Economics: Sessions 14 & 15 ExerciseДокумент4 страницыProject Management & Economics: Sessions 14 & 15 ExerciseTown Obio EteteОценок пока нет

- Chapter 16 Advanced Accounting Solution ManualДокумент94 страницыChapter 16 Advanced Accounting Solution ManualVanessa DozonОценок пока нет

- 7 Depreciation, Deplbtion, Amortization, and Cash FlowДокумент52 страницы7 Depreciation, Deplbtion, Amortization, and Cash FlowRiswan Riswan100% (1)

- EO EncounterДокумент12 страницEO EncounterMJ YaconОценок пока нет