Академический Документы

Профессиональный Документы

Культура Документы

Opportunity Cost

Загружено:

vaibhavОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Opportunity Cost

Загружено:

vaibhavАвторское право:

Доступные форматы

TUTORIAL 2

OPPORTUNITY COST

1. Marshall runs a small pottery firm. He hires one helper at $ 12,000 per year, pays

monthly rent of $ 420 for his shop and spends $ 20,000 per year on materials. He

has $ 40,000 of his own funds invested in equipment (pottery wheels, kilns and so

forth) that could earn him $ 4000 per year if alternatively invested. He has been

offered $ 15,000 per year to work as a potter for a competitor. He estimates his

entrepreneurial talents are worth $ 3000 per year. Total annual revenue from

pottery sales is $ 72,000. Calculate the accounting and economic profit for

Marshalls pottery firm. (AP = 34,960, EP = 12,960)

2. Mr. Mehra operates small shop specializing in party favors. He owns the building

and supplies all his own labor and Rs 120,000 money which was kept in a bank

earning 5% monthly rate of interest. Before starting his own business, he earned

Rs 12,000 p.m. by renting out the store and earned Rs 25,000 p.m. as a store

manager for a large departmental store. His monthly revenue from operating his

shop are Rs 1,00,000 and his total monthly expenses for labor and supplies

amounted to Rs 60,000.Calculate his accounting and economic profit. (AP =

40,000, EP = -3,000)

3. Smith quit his job as an auto mechanic earning $ 50,000 per year to start his own

business. To save money, he operates his garage out of a small building he owns

which, until he started his own business had rented out for $ 10,000 per year. He

also owns an apartment which he has rented out for $15,000 per year. He has also

invested his $20,000 savings (earning 5% per year) into his business. For first year

of his operations total revenue is $ 1, 20,000, employee wages $ 40,000, material

cost $15,000 and rental of equipment $5000. Calculate accounting cost, economic

cost & economic profit.

4. After working for one year with a company, Deepak decided to start up his own

venture for which he took loan of Rs. 25 lakhs @12 p.a. Along with this; he

invested his own money Rs 50 lakhs, which was earning 10% p.a. in a bank. His

other expenses were: employee salary Rs. 30,000 per month, raw material Rs

45,000 per month, other expenses Rs. 5,000 per month. Further he had to pay

taxes which were 20% of the economic profit of the first year. The first year

revenue was Rs 30 Lakhs. Earlier Deepak was getting a salary of Rs 10 lakhs.

Calculate total explicit cost, implicit cost, accounting profit, and economic profit. Is

the business profitable for the first year?

5. Tillys Trilbies has estimated the following revenues and expenditures for the next

fiscal year:

Revenues $6,800,000

Cost of goods sold 5,000,000

Cost of labor 1,000,000

Advertising 100,000

Insurance 50,000

Rent 350,000

Miscellaneous expenses 100,000

a) Calculate Tillys accounting profit.

b) Suppose that to open her trilby business, Tilly gave up a $250,000 per year job

as a buyer at the exclusive Hammocker Shlumper department store. Calculate

Tillys economic profit.

Вам также может понравиться

- ME-Tut 4Документ2 страницыME-Tut 4Shekhar SinghОценок пока нет

- Opportunity CostДокумент11 страницOpportunity Costcarolsaviapeters100% (1)

- Unit 1 Opportunity CostДокумент10 страницUnit 1 Opportunity CostSUSHANTH E REVANKARОценок пока нет

- Role of Stakeholders in CGДокумент17 страницRole of Stakeholders in CGalvita100% (1)

- 33.saiyadain - Cases in Organizational Behaviour and Human Resource Management (2010)Документ163 страницы33.saiyadain - Cases in Organizational Behaviour and Human Resource Management (2010)Chan Myae MoeОценок пока нет

- Opportunity CostДокумент7 страницOpportunity CostMayankJhaОценок пока нет

- Managerial Economics:: According To Spencer and SiegelmanДокумент10 страницManagerial Economics:: According To Spencer and SiegelmankwyncleОценок пока нет

- Prepared By: Priyanka KumariДокумент40 страницPrepared By: Priyanka KumariSanjeet PandeyОценок пока нет

- Economies of Scale and Diseconomies of ScaleДокумент22 страницыEconomies of Scale and Diseconomies of ScaleHafizul RahmanОценок пока нет

- Time Value of Money Practice ProblemsДокумент5 страницTime Value of Money Practice ProblemsMarkAntonyA.RosalesОценок пока нет

- MNCs PDFДокумент13 страницMNCs PDFOmkar MohiteОценок пока нет

- Opportunity CostДокумент9 страницOpportunity CostHÂN LÊ THỊ XUÂNОценок пока нет

- Shri. K.M. Savjani & Smt. K.K. Savjani B.B.A./B.C.A College, VeravalДокумент26 страницShri. K.M. Savjani & Smt. K.K. Savjani B.B.A./B.C.A College, VeravalKaran DalkiОценок пока нет

- Comparative Analysis of Reliance Communications and Market LeadersДокумент15 страницComparative Analysis of Reliance Communications and Market Leadersarka85Оценок пока нет

- Critical Appraisal On Project Management Approaches in E-GovernmentДокумент6 страницCritical Appraisal On Project Management Approaches in E-GovernmentPaulo AndradeОценок пока нет

- Values and ethics in project management proceedingsДокумент11 страницValues and ethics in project management proceedingssami saeedОценок пока нет

- Managerial Economics - NotesДокумент69 страницManagerial Economics - NotesR.T.IndujiОценок пока нет

- 3 Corporate Social Responsibility - The Concept CHP 7 (Jan 22)Документ27 страниц3 Corporate Social Responsibility - The Concept CHP 7 (Jan 22)fidansekiz100% (1)

- Analysis of The Macro EnvironmentДокумент24 страницыAnalysis of The Macro Environmentabhasa100% (1)

- Micro Economics QuestionsДокумент51 страницаMicro Economics QuestionsKai Pac100% (1)

- Break Even AnalysisДокумент6 страницBreak Even AnalysisNafi AhmedОценок пока нет

- ECP5702 MBA ManagerialEconomics ROMANO SPR 16Документ4 страницыECP5702 MBA ManagerialEconomics ROMANO SPR 16OmerОценок пока нет

- Cost AllocationДокумент216 страницCost AllocationbhheartОценок пока нет

- Types of Corporate Social ResponsibilityДокумент10 страницTypes of Corporate Social Responsibilityrinky_trivedi100% (1)

- Ethics in Business GuideДокумент25 страницEthics in Business Guidebhatiachetan2075Оценок пока нет

- Mergers and AcquisitionsДокумент12 страницMergers and AcquisitionsSaurav NishantОценок пока нет

- Entrepreneurship NOTESДокумент34 страницыEntrepreneurship NOTESIndronil Mukherjee100% (1)

- Gropu 10 Assignment 1Документ12 страницGropu 10 Assignment 1Brian ZunguОценок пока нет

- Retailing Managemen T: Text and CasesДокумент16 страницRetailing Managemen T: Text and Casesbiotech_savvyОценок пока нет

- Opportunity CostДокумент4 страницыOpportunity Costmeetwithsanjay50% (2)

- DevaluationДокумент46 страницDevaluationPriya ChaudhryОценок пока нет

- Finance Case StudyДокумент8 страницFinance Case StudyEvans MettoОценок пока нет

- TERM PAPER Corporate Social ResponsibilityДокумент24 страницыTERM PAPER Corporate Social ResponsibilityJennifer UmaliОценок пока нет

- NABARD BrochureДокумент3 страницыNABARD BrochureptdineshaОценок пока нет

- Ethics and Truths in Indian Advertising PDFДокумент2 страницыEthics and Truths in Indian Advertising PDFTrevorОценок пока нет

- An Overview of Indian Financial SystemДокумент11 страницAn Overview of Indian Financial SystemParul NigamОценок пока нет

- Syllabus Business Ethics & CSRДокумент2 страницыSyllabus Business Ethics & CSRRahul BarnwalОценок пока нет

- Gandhian Approach to Rural DevelopmentДокумент4 страницыGandhian Approach to Rural Developmentdipon sakibОценок пока нет

- HRM: Performance Related PayДокумент12 страницHRM: Performance Related Payseowsheng100% (6)

- Avarage Cost and Marginal CostДокумент26 страницAvarage Cost and Marginal CostJaideep GargОценок пока нет

- Rule of MultiplicationДокумент23 страницыRule of MultiplicationbheakantiОценок пока нет

- Lecture 01Документ43 страницыLecture 01SABAJAMSHAID100% (1)

- Annamalai Univ MBA AssignmentsДокумент11 страницAnnamalai Univ MBA AssignmentssnraviОценок пока нет

- Balance of Payment ConceptsДокумент39 страницBalance of Payment ConceptsVikku Agarwal100% (1)

- Reporte Anual 2019 - IkeaДокумент54 страницыReporte Anual 2019 - IkeaLeodan ZapataОценок пока нет

- sm01 Solution Manual Operations and Supply Chain ManagementДокумент11 страницsm01 Solution Manual Operations and Supply Chain ManagementomkarОценок пока нет

- Customer Is The KingДокумент4 страницыCustomer Is The KingHiratek InternationalОценок пока нет

- Demand Forecasting MEДокумент26 страницDemand Forecasting MEmanslikeОценок пока нет

- Opportunity CostДокумент6 страницOpportunity Costsweetpoojasingh1989Оценок пока нет

- Unit VДокумент17 страницUnit VHapp NoОценок пока нет

- The Making of Chik ShampooДокумент3 страницыThe Making of Chik ShampooGaurav AroraОценок пока нет

- 6310 S2 - 20 Tutorial 7 AnswersДокумент5 страниц6310 S2 - 20 Tutorial 7 AnswersThuraga LikhithОценок пока нет

- Cost and Management Accounting TechniquesДокумент5 страницCost and Management Accounting TechniquesRupal Rohan DalalОценок пока нет

- Production And Operations Management A Complete Guide - 2020 EditionОт EverandProduction And Operations Management A Complete Guide - 2020 EditionОценок пока нет

- Business Leadership in Turbulent Times: Decision-Making for Value CreationОт EverandBusiness Leadership in Turbulent Times: Decision-Making for Value CreationОценок пока нет

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- Project Production Management A Complete Guide - 2020 EditionОт EverandProject Production Management A Complete Guide - 2020 EditionОценок пока нет

- Exercise (Disk&File)Документ22 страницыExercise (Disk&File)vaibhavОценок пока нет

- Unix Files Rev 2 4Документ33 страницыUnix Files Rev 2 4vaibhavОценок пока нет

- Tut-6 With SolutionДокумент9 страницTut-6 With SolutionvaibhavОценок пока нет

- IPO AssignmentДокумент1 страницаIPO AssignmentvaibhavОценок пока нет

- IPO AssignmentДокумент1 страницаIPO AssignmentvaibhavОценок пока нет

- Car Monitoring System T1Q1 Oddsem2011Документ8 страницCar Monitoring System T1Q1 Oddsem2011vaibhavОценок пока нет

- ElasticityДокумент1 страницаElasticityvaibhavОценок пока нет

- Facebook IPOДокумент4 страницыFacebook IPOvaibhavОценок пока нет

- Importance of EcoДокумент2 страницыImportance of EcovaibhavОценок пока нет

- T-2 Project Stock Analysis Project - Fundamental and Technical AnalysisДокумент2 страницыT-2 Project Stock Analysis Project - Fundamental and Technical AnalysisvaibhavОценок пока нет

- Fiscal and Monetary PolicyДокумент7 страницFiscal and Monetary PolicyvaibhavОценок пока нет

- Credit CreationДокумент2 страницыCredit CreationvaibhavОценок пока нет

- Growth Strategy Types for FirmsДокумент3 страницыGrowth Strategy Types for FirmsvaibhavОценок пока нет

- Growth Strategy Types for FirmsДокумент3 страницыGrowth Strategy Types for FirmsvaibhavОценок пока нет

- RBI MoneyKumar ComicДокумент24 страницыRBI MoneyKumar Comicbhoopathy100% (1)

- Industrial SociologyДокумент5 страницIndustrial SociologyvaibhavОценок пока нет

- T-2 Project Stock Analysis Project - Fundamental and Technical AnalysisДокумент2 страницыT-2 Project Stock Analysis Project - Fundamental and Technical AnalysisvaibhavОценок пока нет

- Case Study 2Документ2 страницыCase Study 2vaibhavОценок пока нет

- Development Economics 3: Subject Code 14B1NHS831 Semester Even Semester VIII Session 2013 - 2014Документ3 страницыDevelopment Economics 3: Subject Code 14B1NHS831 Semester Even Semester VIII Session 2013 - 2014vaibhavОценок пока нет

- Evolution of HRДокумент10 страницEvolution of HRvaibhavОценок пока нет

- Extra Class For Batch B7-13 Is Scheduled On Thursday: DATE: 11 FEB TIME: 9-10 Am Venue: Lt5Документ1 страницаExtra Class For Batch B7-13 Is Scheduled On Thursday: DATE: 11 FEB TIME: 9-10 Am Venue: Lt5vaibhavОценок пока нет

- Lec 2Документ30 страницLec 2vaibhavОценок пока нет

- Lec 4Документ47 страницLec 4vaibhavОценок пока нет

- Quality Issues in EngineeringДокумент14 страницQuality Issues in EngineeringvaibhavОценок пока нет

- Effective Tools For Career Management and DevelopmentДокумент8 страницEffective Tools For Career Management and DevelopmentvaibhavОценок пока нет

- Software Engg ManualДокумент7 страницSoftware Engg ManualvaibhavОценок пока нет

- International Studies: JIIT University, NoidaДокумент3 страницыInternational Studies: JIIT University, NoidavaibhavОценок пока нет

- Lecture-1 TO Object Oriented Programming System (Oops)Документ35 страницLecture-1 TO Object Oriented Programming System (Oops)vaibhavОценок пока нет

- Const DestДокумент29 страницConst DestvaibhavОценок пока нет

- Mullane vs. Central Hanover Bank & Trust Co., Trustee, Et AlДокумент20 страницMullane vs. Central Hanover Bank & Trust Co., Trustee, Et AlAngelica LeonorОценок пока нет

- BMW Immo EmulatorДокумент12 страницBMW Immo EmulatorAnonymous wpUyixsjОценок пока нет

- Case Digests - Simple LoanДокумент14 страницCase Digests - Simple LoanDeb BieОценок пока нет

- Kerala rules on dangerous and offensive trade licensesДокумент3 страницыKerala rules on dangerous and offensive trade licensesPranav Narayan GovindОценок пока нет

- Lea2 Comparative Models in Policing Syllabus Ok Converted 1Документ6 страницLea2 Comparative Models in Policing Syllabus Ok Converted 1Red Buttrerfly RC100% (2)

- Dr. M. Kochar vs. Ispita SealДокумент2 страницыDr. M. Kochar vs. Ispita SealSipun SahooОценок пока нет

- 1.18 Research Ethics GlossaryДокумент8 страниц1.18 Research Ethics GlossaryF-z ImaneОценок пока нет

- LCSD Use of Force PolicyДокумент4 страницыLCSD Use of Force PolicyWIS Digital News StaffОценок пока нет

- Bmu AssignmnetДокумент18 страницBmu AssignmnetMaizaRidzuanОценок пока нет

- Cod 2023Документ1 страницаCod 2023honhon maeОценок пока нет

- Bihar High Court Relaxation Tet Case JudgementДокумент4 страницыBihar High Court Relaxation Tet Case JudgementVIJAY KUMAR HEERОценок пока нет

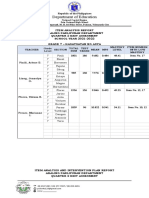

- Item Analysis Repost Sy2022Документ4 страницыItem Analysis Repost Sy2022mjeduriaОценок пока нет

- CA 101 Lecture 8Документ22 страницыCA 101 Lecture 8Johnpatrick DejesusОценок пока нет

- Torts For Digest LISTДокумент12 страницTorts For Digest LISTJim ParedesОценок пока нет

- Major League Baseball v. CristДокумент1 страницаMajor League Baseball v. CristReid MurtaughОценок пока нет

- Paper On Society1 Modernity PDFДокумент13 страницPaper On Society1 Modernity PDFferiha goharОценок пока нет

- What Is Leave Travel Allowance or LTAДокумент3 страницыWhat Is Leave Travel Allowance or LTAMukesh UpadhyeОценок пока нет

- Faculty - Business Management - 2023 - Session 1 - Pra-Diploma Dan Diploma - Eco211Документ16 страницFaculty - Business Management - 2023 - Session 1 - Pra-Diploma Dan Diploma - Eco2112021202082Оценок пока нет

- Barangay Hearing NoticeДокумент2 страницыBarangay Hearing NoticeSto Niño PagadianОценок пока нет

- Managerial Accounting CASE Solves Missing Data Income StatementДокумент3 страницыManagerial Accounting CASE Solves Missing Data Income StatementAlphaОценок пока нет

- Au Dit TinhДокумент75 страницAu Dit TinhTRINH DUC DIEPОценок пока нет

- AДокумент109 страницALefa Doctormann RalethohlaneОценок пока нет

- Gorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockДокумент1 страницаGorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockLorena Sanchez 3Оценок пока нет

- Moran V Office of The PresidentДокумент5 страницMoran V Office of The PresidentnazhОценок пока нет

- Canada Application SummaryДокумент6 страницCanada Application SummaryCarlos FdezОценок пока нет

- Blank Speedy Trial MotionДокумент2 страницыBlank Speedy Trial MotionMichael Kovach100% (1)

- Assignment No 1. Pak 301Документ3 страницыAssignment No 1. Pak 301Muhammad KashifОценок пока нет

- F2800-11 Standard Specification For Recirculating Hood System For Cooking AppliancesДокумент4 страницыF2800-11 Standard Specification For Recirculating Hood System For Cooking AppliancesjohnnyОценок пока нет

- Project Management of World Bank ProjectsДокумент25 страницProject Management of World Bank ProjectsDenisa PopescuОценок пока нет

- BIZ ADMIN INDUSTRIAL TRAINING REPORTДокумент14 страницBIZ ADMIN INDUSTRIAL TRAINING REPORTghostbirdОценок пока нет