Академический Документы

Профессиональный Документы

Культура Документы

DTTL Tax Kazakhstanhighlights 2016

Загружено:

Máté Bence TóthИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DTTL Tax Kazakhstanhighlights 2016

Загружено:

Máté Bence TóthАвторское право:

Доступные форматы

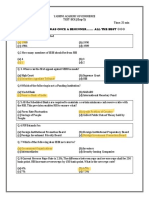

International tax

Kazakhstan Highlights 2016

Currency Kazakhstan Tenge (KZT)

Foreign exchange control Payments between residents and

nonresidents may be made in any currency. Certain transactions may

be subject to the national banks notification or registration regime.

Accounting principles/financial statements Large entities and

public companies in Kazakhstan must use IFRS, while small and

medium-size enterprises, branches and representative offices of

foreign entities may use IFRS or national financial reporting

standards.

Principal business entities Principal forms of business include the

joint stock company, limited liability company, partnership, branch

and representative office of a foreign corporation.

Alternative minimum tax No

Foreign tax credit A credit generally is available for foreign taxes

paid on foreign-source income, based on documentation confirming

the foreign income tax payment.

Participation exemption No

Holding company regime No

Incentives Certain incentives are available in the form of

accelerated tax deductions for capital expenditure, provided certain

requirements are met. There also are incentives for investments in

priority economic sectors relating to business in special economic

zones, and investments in qualifying investment priority projects. In

addition, special tax regimes/incentives are available for qualifying

nonprofit organizations and organizations operating in social spheres.

Corporate taxation:

Withholding tax:

Residence A company is considered to be a Kazakh tax resident if

it is established under the laws of Kazakhstan or if its governing

body/place of actual management and control is located in

Kazakhstan.

Basis Resident companies are taxed on worldwide income.

Nonresidents generally are taxed only on Kazakhstan-source income.

Taxable income Entities are subject to corporate income tax on

trading profits and other taxable income. Expenses that are wholly

and exclusively incurred for business-related purposes and that are

supported by appropriate documentation may be deducted against

income.

Taxation of dividends Dividends received (other than from risk

investment funds, which are exempt if certain criteria are satisfied)

are effectively exempt from income taxation.

Capital gains Capital gains are treated as normal income and

taxed at the standard tax rate. Certain categories of capital gains

(including gains derived from the sale of shares that principally do not

derive their value from subsurface use property) are exempt if certain

conditions are satisfied.

Losses Operating losses generally may be carried forward for up to

10 years following the year in which the loss is incurred. The

carryback of losses is not permitted.

Rate The main corporate income tax rate of 20% applies to

domestic and foreign companies.

Surtax A surtax exists in the form of an excess profit tax levied on

subsurface users.

Dividends A withholding tax of 15% is levied on dividends paid to

nonresidents without a permanent establishment (PE) in Kazakhstan.

A 20% tax rate applies to dividends paid to nonresidents registered in

a tax haven jurisdiction. The tax rate may be reduced in line with the

corresponding provisions of an applicable tax treaty in force with

Kazakhstan.

Interest A 15% withholding tax is levied on interest paid to

nonresidents without a PE in Kazakhstan. Interest paid to

nonresidents registered in a tax haven jurisdiction is subject to a 20%

rate. The tax rate may be reduced in line with the corresponding

provisions of an applicable tax treaty in force with Kazakhstan.

Royalties Royalties paid to nonresidents without a PE in

Kazakhstan are subject to a 15% withholding tax. A 20% rate applies

to royalties paid to nonresidents registered in a tax haven. The tax

rate may be reduced in line with the corresponding provisions of an

applicable tax treaty in force with Kazakhstan.

Technical service fees Technical service fees paid to nonresidents

without a PE in Kazakhstan are subject to withholding tax. In the

event that the services in question are classified as royalties, a 15%

tax rate would apply, as stated above. If fees paid are classified as

income of a nonresident from the provision of general technical

services, a 20% rate applies under domestic tax law. A 20% rate

applies to technical service fees paid to a nonresident registered in a

tax haven, regardless of the nature of services provided.

Branch remittance tax A net profit tax applies. A PE of a

nonresident foreign company is subject to a net profits tax of 15% on

net after-tax income (unless the rate is reduced under a tax treaty), in

Investment basics:

addition to corporate income tax. The net profit tax is payable

regardless of whether net profits are remitted to the parent

company.

Other taxes on corporations:

Capital duty No

Payroll tax An employer is required to remit social tax at a flat rate

of 11%, applied to an employees gross salary (both local and

foreign), at its own expense.

As tax agents, employers are required to withhold and remit a 10%

individual income tax and obligatory pension fund contributions on

behalf of employees. Contributions to private pension accounts are

equal to 10% of the monthly salary, up to a maximum of KZT

171,442.50 per month. See also under Social security, below.

Real property tax Property tax is levied on immovable property

located in Kazakhstan at progressive rates ranging from 0.1% to

1.5%, depending on a taxpayers activities.

Social security The employer must pay social security

contributions to the State Social Security Fund at an effective rate of

5% (with an income cap of KZT 228,590), in addition to local

employees salaries. Any social contributions paid ultimately reduce

the amounts of social tax due (see under Payroll tax, above).

Stamp duty No standalone stamp duty regime exists. However, the

authorities may impose a levy on various legal actions, such as the

issuance of documents by state bodies.

Transfer tax No

Other Corporate taxpayers undertaking licensed activity to extract

mineral resources in Kazakhstan are subject to a specific subsurface

user taxation regime, which includes the excess profit tax (see under

Surtax, above), mineral extraction tax and rent tax on exports, in

addition to bonuses payable upon signature of license agreements

and upon confirmation of commercial discoveries.

Tax also is levied on transportation activities.

Anti-avoidance rules:

Transfer pricing The Kazakh transfer pricing regime adopts the

arms length standard and includes reporting requirements. A

framework for advance pricing agreements is included in the

domestic legislation.

Thin capitalization The deduction of interest generally is limited by

reference to either the lower of the market rate or a specific debt-toequity formula provided by the tax authorities. Excess interest paid is

not recharacterized as a deemed dividend.

Controlled foreign companies CFC rules apply to residents with

at least a 10% shareholding in a tax haven entity. The government

has issued a list of tax haven jurisdictions. Kazakh residents holding

shares in CFCs are required to include their proportionate shares of

CFC profits in aggregate annual income.

Disclosure requirements No

Compliance for corporations:

Tax year Calendar year

Consolidated returns Consolidated returns are not permitted;

each company must file a separate return. However, nonresidents

with several PEs in Kazakhstan may opt to file a consolidated tax

return.

Filing requirements The corporate income tax return is due by 31

March of the year following the reporting tax year. A one-month

extension may be obtained for electronically filed tax returns.

Penalties Penalties are assessed at 2.5 times the official

refinancing rate established by the national bank for each day of

delay in paying the tax due.

Rulings The tax authorities generally issue nonbinding rulings of an

explanatory nature. Advance pricing agreements also are possible.

Personal taxation:

Basis Resident individuals are taxed on worldwide income.

Nonresidents are taxed only on their Kazakh-source income.

Residence Tax residence is based on whether an individual is

permanently residing in or has his/her center of vital interests in

Kazakhstan. The permanent residence test is based on the number of

days of presence in Kazakhstan: a foreign individual is deemed to be

a resident if he/she is present in Kazakhstan no less than 183 days in

any consecutive 12-month period ending in the reporting tax year.

The center of vital interests test is based on whether an individual is a

citizen or a holder of a Kazakh residence permit and has family and a

place of abode in Kazakhstan.

Filing status Joint filing is not permitted; each individual must file

his/her own return, if required.

Taxable income Kazakh-source income includes income from

employment and other activities in Kazakhstan and any other benefits

received in this respect, regardless of where payment is made.

Taxable income is comprised of employment income (including

benefits in kind), income from a business and passive income.

Capital gains Income derived from the sale of property is treated

as capital gains subject to taxation unless the individual has held the

property for more than one year. Subject to certain exceptions,

income derived from the sale of shares of participations and

securities is treated as capital gains subject to taxation. Income in the

form of capital gains is taxed at the rate generally applicable to the

individual.

Deductions and allowances Standard monthly deductions are

allowed for tax residents, such as a minimum monthly salary

deduction (KZT 22,859 per month) and deductions for obligatory

pension fund contributions, medical costs, etc., with certain

limitations.

Rates Employment income is taxed at a flat rate of 10% for both

residents and nonresidents. Dividends are taxed at 5% for residents.

Dividends and capital gains are taxed at 15% for nonresidents. Other

income is taxed at 10% for residents and 20% for nonresidents.

Other taxes on individuals:

Capital duty No

Stamp duty See under Other taxes on corporations, above.

Capital acquisitions tax No

Real property tax Property tax is levied on immovable property

located in Kazakhstan at progressive rates, depending on the value of

the property. The applicable rate of taxation varies from 0.05% to KZT

2,946,600 + 2% of (property value minus KZT 450 million).

Inheritance/estate tax No

Net wealth/net worth tax No

Social security See under Other taxes on corporations, above.

Compliance for individuals:

Tax year Calendar year

Filing and payment Individual income tax on employment income

is subject to withholding, payment and reporting by the employer.

Payment is due by the 25th day of the month following the month in

which the income was paid. Income and tax should be reported on a

quarterly basis by the 15th day of the second month following the

reporting quarter.

If an individual receives income not subject to taxation at source, a

tax return must be filed by 31 March of the year following the

reporting year, with the payment of final tax due by 10 April.

Penalties Penalties apply for late payment of taxes, and

administrative fines are imposed for noncompliance.

Value added tax:

Taxable transactions VAT is levied on the supply of goods and

services and on imports. A reverse charge applies in certain cases.

Rates The standard rate is 12%. Certain exemptions exist for

exports and for financial and other transactions.

Registration Registration is compulsory for companies whose

turnover exceeds KZT 63,630,000 in a calendar-year period.

Otherwise, registration is optional.

Filing and payment Payment is due by the 25th day of the second

month following the reporting quarter. VAT and related turnover

should be reported on a quarterly basis, by the 15th day of the

second month following the reporting quarter.

Source of tax law: Code of the Republic of Kazakhstan on taxes

and other mandatory payments to the budget

Tax treaties: Kazakhstan has concluded 49 international tax

treaties.

Tax authorities: State Revenue Committee of the Ministry of

Finance of the Republic of Kazakhstan; state revenue departments at

the regional level and for the cities of Almaty and Astana; state

revenue agencies at the district and town levels

Deloitte contact

Vladimir Kononenko

E-mail: vkononenko@deloitte.kz

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee

(DTTL), its network of member firms, and their related entities. DTTL and each of its member firms are legally

separate and independent entities. DTTL (also referred to as Deloitte Global) does not provide services to

clients. Please see http://www.deloitte.com/about for a more detailed description of DTTL and its member

firms.

Deloitte provides audit, consulting, financial advisory, risk management, tax and related services to public and

private clients spanning multiple industries. With a globally connected network of member firms in more than

150 countries and territories, Deloitte brings world-class capabilities and high-quality service to clients,

delivering the insights they need to address their most complex business challenges. Deloittes more than

225,000 professionals are committed to making an impact that matters.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its

member firms, or their related entities (collectively, the Deloitte Network) is, by means of this communication,

rendering professional advice or services. Before making any decision or taking any action that may affect your

finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network

shall be responsible for any loss whatsoever sustained by any person who relies on this communication.

2016. For information, contact Deloitte Touche Tohmatsu Limited.

Вам также может понравиться

- DTTL Tax Pakistanhighlights 2018 PDFДокумент5 страницDTTL Tax Pakistanhighlights 2018 PDFAhsan IqbalОценок пока нет

- DTTL Tax Luxembourghighlights 2014Документ3 страницыDTTL Tax Luxembourghighlights 2014pldevОценок пока нет

- DTTL Tax Hungaryhighlights 2017Документ4 страницыDTTL Tax Hungaryhighlights 2017zinveliu_vasile_florinОценок пока нет

- DTTL Tax Croatiahighlights 2020 PDFДокумент8 страницDTTL Tax Croatiahighlights 2020 PDFРосен Атанасов-ЕжкоОценок пока нет

- DTTL Tax Bangladeshhighlights 2016Документ3 страницыDTTL Tax Bangladeshhighlights 2016অরণ্য আহমেদОценок пока нет

- DTTL Tax Serbiahighlights 2018Документ4 страницыDTTL Tax Serbiahighlights 2018BbaPbaОценок пока нет

- Business Tax Laws (Phils)Документ15 страницBusiness Tax Laws (Phils)Jean TanОценок пока нет

- Business Tax Laws in The PhilippinesДокумент12 страницBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaОценок пока нет

- International Tax: Hungary Highlights 2020Документ7 страницInternational Tax: Hungary Highlights 2020Swastik GroverОценок пока нет

- Investing in Africa Angola: Page - 1Документ9 страницInvesting in Africa Angola: Page - 1odongochrisОценок пока нет

- International Tax: Bangladesh Highlights 2020Документ8 страницInternational Tax: Bangladesh Highlights 2020Mehadi HasanОценок пока нет

- Cambodian 2018 Tax Booklet: A Summary of Cambodian TaxationДокумент26 страницCambodian 2018 Tax Booklet: A Summary of Cambodian TaxationLee XingОценок пока нет

- Indonesia Deloitte PDFДокумент5 страницIndonesia Deloitte PDFYlaine Gonzales-PanisОценок пока нет

- Related Tax LawДокумент7 страницRelated Tax LawNishad VTОценок пока нет

- DTTL Tax Peruhighlights 2019 PDFДокумент4 страницыDTTL Tax Peruhighlights 2019 PDFCalMustoОценок пока нет

- DTTL Tax Bangladeshhighlights 2023Документ10 страницDTTL Tax Bangladeshhighlights 2023steveОценок пока нет

- Lecture 1: Moldovan Versus International Tax Payment OptimizationДокумент13 страницLecture 1: Moldovan Versus International Tax Payment OptimizationIon CaraОценок пока нет

- DTTL Tax Spainhighlights 2020Документ9 страницDTTL Tax Spainhighlights 2020Росен Атанасов-ЕжкоОценок пока нет

- Income Tax - Chap 01Документ8 страницIncome Tax - Chap 01ZainioОценок пока нет

- View in Online Reader: Text Size +-RecommendДокумент7 страницView in Online Reader: Text Size +-RecommendRhea Mae AmitОценок пока нет

- DTTL Tax Philippineshighlights 2019Документ4 страницыDTTL Tax Philippineshighlights 2019Ivy BuentiempoОценок пока нет

- DTTL Tax Romaniahighlights 2017Документ6 страницDTTL Tax Romaniahighlights 2017FLORIN VIOREL MARGELATUОценок пока нет

- KPMG - Indonesian TaxДокумент13 страницKPMG - Indonesian Taxbang bebetОценок пока нет

- DTTL Tax Unitedarabemirateshighlights 2021Документ6 страницDTTL Tax Unitedarabemirateshighlights 2021nbОценок пока нет

- DTTL Tax Sloveniahighlights 2017 PDFДокумент4 страницыDTTL Tax Sloveniahighlights 2017 PDFzinveliu_vasile_florinОценок пока нет

- International Tax: Guatemala Highlights 2017Документ3 страницыInternational Tax: Guatemala Highlights 2017daggoОценок пока нет

- Who Are Required To Pay Income Tax in The Philippines? (Section 23 of The National Internal Revenue Code (NIRC) of 1997)Документ3 страницыWho Are Required To Pay Income Tax in The Philippines? (Section 23 of The National Internal Revenue Code (NIRC) of 1997)Kristine Ann CarandangОценок пока нет

- Tax StructureДокумент23 страницыTax StructureAsif Rasool ChannaОценок пока нет

- Liechtenstein's New Tax LawДокумент8 страницLiechtenstein's New Tax LawMaksim DyachukОценок пока нет

- Taxation ProjectДокумент14 страницTaxation ProjectrahulkoduvanОценок пока нет

- DTTL Tax Costaricahighlights 2015Документ3 страницыDTTL Tax Costaricahighlights 2015MikailOpintoОценок пока нет

- Income TaxДокумент10 страницIncome TaxSojan MaharjanОценок пока нет

- Malta Income Tax For An IndividualДокумент4 страницыMalta Income Tax For An IndividualCristina PopescuОценок пока нет

- TaxДокумент6 страницTaxBirs BirsОценок пока нет

- International Tax: Philippines Highlights 2017Документ4 страницыInternational Tax: Philippines Highlights 2017Tony MorganОценок пока нет

- DTTL Tax Argentinahighlights 2019 PDFДокумент7 страницDTTL Tax Argentinahighlights 2019 PDFadripilitaОценок пока нет

- Guinea Tax 2Документ6 страницGuinea Tax 2Onur KopanОценок пока нет

- Taxes Egypt - DeloitteДокумент10 страницTaxes Egypt - Deloittehur hussainОценок пока нет

- Nature and Concept: OF IncomeДокумент193 страницыNature and Concept: OF IncomeFranchise AlienОценок пока нет

- Corporate Taxation in TurkeyДокумент6 страницCorporate Taxation in TurkeyВладимир СуворовОценок пока нет

- International Tax: India Highlights 2018Документ7 страницInternational Tax: India Highlights 2018Prince VamsiОценок пока нет

- International Tax Vietnam Highlights 2017Документ4 страницыInternational Tax Vietnam Highlights 2017Thanh TrucОценок пока нет

- Pakistan Taxation SystemДокумент4 страницыPakistan Taxation SystemAli MustafaОценок пока нет

- Turkish Tax SystemДокумент3 страницыTurkish Tax Systemapi-3835399Оценок пока нет

- Notes To Business Taxation: Corporate Income Tax Tax BaseДокумент7 страницNotes To Business Taxation: Corporate Income Tax Tax BaseAngela AralarОценок пока нет

- 3 Income Tax ConceptsДокумент37 страниц3 Income Tax ConceptsRommel Espinocilla Jr.Оценок пока нет

- Doing Business Brazil Deloitte Corporate Taxation Indirect TaxesДокумент18 страницDoing Business Brazil Deloitte Corporate Taxation Indirect TaxesGiulia CamposОценок пока нет

- Indonesia Tax HighlightsДокумент10 страницIndonesia Tax HighlightsMatus JakubikОценок пока нет

- Fiscal Regime For A Business Set UpДокумент13 страницFiscal Regime For A Business Set Upmurfa0019Оценок пока нет

- International Tax: India Highlights 2019Документ8 страницInternational Tax: India Highlights 2019AbcdОценок пока нет

- Pratical Tax Guide 2022Документ19 страницPratical Tax Guide 2022levis BilossiОценок пока нет

- 61a38d5c7b74a - INcome Tax and ETA HandwrittenДокумент15 страниц61a38d5c7b74a - INcome Tax and ETA HandwrittenAnuska ThapaОценок пока нет

- DTTL Tax Boliviahighlights 2018Документ3 страницыDTTL Tax Boliviahighlights 2018MikailOpintoОценок пока нет

- Direct Tax Code: Kunal Vora Bhavik BhanderiДокумент11 страницDirect Tax Code: Kunal Vora Bhavik BhanderiBhavik BhanderiОценок пока нет

- Transferring Capital and Profit Out of VietnamДокумент2 страницыTransferring Capital and Profit Out of VietnamNguyễn Thu VânОценок пока нет

- Net of TaxДокумент32 страницыNet of TaxAli GulzarОценок пока нет

- Capital Gains Tax - Wikipedia, The Free EncyclopediaДокумент18 страницCapital Gains Tax - Wikipedia, The Free Encyclopediatsar_philip2010Оценок пока нет

- Tax Assignment 1Документ16 страницTax Assignment 1Tunvir Islam Faisal100% (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- Middle East Airlines Analysis: March - May 2017Документ58 страницMiddle East Airlines Analysis: March - May 2017Máté Bence TóthОценок пока нет

- Trade Policy Forum On Central Asia and The Multilateral Trading SystemДокумент8 страницTrade Policy Forum On Central Asia and The Multilateral Trading SystemMáté Bence TóthОценок пока нет

- SABRE GDS Booking Instructions For Transavia PDFДокумент51 страницаSABRE GDS Booking Instructions For Transavia PDFMáté Bence TóthОценок пока нет

- TM01 V6 0 PDFДокумент2 страницыTM01 V6 0 PDFMáté Bence TóthОценок пока нет

- Caucasus and Central Asia: Moderating Growth, Rising UncertaintyДокумент6 страницCaucasus and Central Asia: Moderating Growth, Rising UncertaintyMáté Bence TóthОценок пока нет

- Just War Theory NotesДокумент1 страницаJust War Theory NotesMáté Bence TóthОценок пока нет

- Turkmenistan: Asian Development Bank Member Fact SheetДокумент4 страницыTurkmenistan: Asian Development Bank Member Fact SheetMáté Bence TóthОценок пока нет

- Case Study 05 PDFДокумент5 страницCase Study 05 PDFSaltNPepa SaltNPepaОценок пока нет

- SchlumbergerДокумент29 страницSchlumbergerAitazaz Ahsan100% (5)

- TrustworthinessДокумент24 страницыTrustworthinessJamsheed Raza100% (1)

- BCK Test Ans (Neha)Документ3 страницыBCK Test Ans (Neha)Neha GargОценок пока нет

- Project SummaryДокумент59 страницProject SummarynaseebОценок пока нет

- Slope Stability Analysis Using FlacДокумент17 страницSlope Stability Analysis Using FlacSudarshan Barole100% (1)

- Ruggedbackbone Rx1500 Rx1501Документ13 страницRuggedbackbone Rx1500 Rx1501esilva2021Оценок пока нет

- ISA 265 Standalone 2009 HandbookДокумент16 страницISA 265 Standalone 2009 HandbookAbraham ChinОценок пока нет

- DRPL Data Record Output SDP Version 4.17Документ143 страницыDRPL Data Record Output SDP Version 4.17rickebvОценок пока нет

- Leadership and Decision Making PDFДокумент34 страницыLeadership and Decision Making PDFNhi PhamОценок пока нет

- Fixed Plug-In Motor A2Fe: Series 6Документ24 страницыFixed Plug-In Motor A2Fe: Series 6Michail ArmitageОценок пока нет

- Exercises Service CostingДокумент2 страницыExercises Service Costingashikin dzulОценок пока нет

- Determination of The Amount of Hardness in Water Using Soap SolutionДокумент3 страницыDetermination of The Amount of Hardness in Water Using Soap SolutionlokeshjoshimjОценок пока нет

- UNIT 2 - ConnectivityДокумент41 страницаUNIT 2 - ConnectivityZain BuhariОценок пока нет

- Válvula DireccionalДокумент30 страницVálvula DireccionalDiego DuranОценок пока нет

- Marc-André Ter Stegen PES 2021 StatsДокумент1 страницаMarc-André Ter Stegen PES 2021 StatsSom VasnaОценок пока нет

- Taiwan Petroleum Facilities (1945)Документ85 страницTaiwan Petroleum Facilities (1945)CAP History LibraryОценок пока нет

- Feeding Pipe 2'' L 20m: General Plan Al-Sabaeen Pv-Diesel SystemДокумент3 страницыFeeding Pipe 2'' L 20m: General Plan Al-Sabaeen Pv-Diesel Systemمحمد الحديОценок пока нет

- BACS2042 Research Methods: Chapter 1 Introduction andДокумент36 страницBACS2042 Research Methods: Chapter 1 Introduction andblood unityОценок пока нет

- A Job InterviewДокумент8 страницA Job Interviewa.rodriguezmarcoОценок пока нет

- Torque Converter Lock-Up FunctionДокумент2 страницыTorque Converter Lock-Up Functioncorie132100% (1)

- S No. Store Type Parent ID Partner IDДокумент8 страницS No. Store Type Parent ID Partner IDabhishek palОценок пока нет

- Pay Policy and Salary ScalesДокумент22 страницыPay Policy and Salary ScalesGodwin MendezОценок пока нет

- KR 10 Scara: The Compact Robot For Low PayloadsДокумент4 страницыKR 10 Scara: The Compact Robot For Low PayloadsBogdan123Оценок пока нет

- AДокумент2 страницыAẄâQâŗÂlïОценок пока нет

- MAC120 PartsДокумент23 страницыMAC120 PartspRAMOD g pATOLEОценок пока нет

- Ch-3 BUFFETДокумент9 страницCh-3 BUFFETJanith prakash567Оценок пока нет

- Application For Leave - EOДокумент1 страницаApplication For Leave - EOcomelec carmenОценок пока нет

- Objectives in DraftingДокумент1 страницаObjectives in Draftingshannejanoras03Оценок пока нет

- Account Statement From 1 Oct 2018 To 15 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент8 страницAccount Statement From 1 Oct 2018 To 15 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancerohantОценок пока нет