Академический Документы

Профессиональный Документы

Культура Документы

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Загружено:

Shyam SunderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

A

i.

il

ENTERPRISE INTERNATIONAL LTD.

,[

Ph. No, : 03340447872

: 033 40448394

Fax: 03340448615

e-mail: contact@eilgroup.com

info@eilgroup,com

REGD. OFFICE: "MALAYALAY", UNIT No.2A (S)

2ND FLOOR, 3, WOODBURN PARK, KOLKA TA . 700020

CIN NO. : L27104WB 1989PLC047832

30.01.2017

Rei. :

Date:

Phiroze jeejeebboy To\vers.

Dalal Street,

Mumbai - 40000 I

Dear Sir,

th

The Meeting of the Board of the Directors held on Today i.e 30 January 2017. approved

Un- Audited Financial Results lor the quarter ended 31 5t December 2016.

Pursuant to Regulation

of the SCSI (Listing Obligations and Disclosure Requirements)

Regulations, 2015. \ve enclose the 1()llowing. duly approved by the Board:

1. Un- Audited Financial Results for the Quarter ended 3 ISl Decem bcr 2016

2.

Limited Review Report tor the Quarter ended 3 i sC Decelll bel' 2016.

Yours faithfully.

For Enterprise lntemational Ltd

~<

Compliance Officer

Encl : As above/

A EN~~!!F~~:~!~~E~~~)LTD.

Ph. No. : 03340447872

: 033 40448394

Fax: 03340448615

e-mail: contact@eilgroup.com

2ND FLOOR. 3, WOODBURN PARK, KOLKATA - 700020

elN No.: L271 04WB 1989PLC047832

Date:

Ref. :

The Secretary,

Date: 30-01-2017

The Stock Exchange, Mum\1ai,

Phiroze Jeejeebhoy Towers, Dalal Street,

Mumbai - 400 001

Dear Sir.

Ref: Un-audited Financial Results for the nine months ended 31st December. 2016

This is to inform you that a Meeting of the Board of Directors of the Company was held today and Un-audited Financial Results

of the Company as detailed below were taken on record.

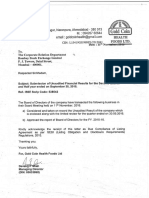

STATEMENT OF UN-AUDITED FINANCIAL RESULTS FOR THE QUARTER 8. NINE MONTHS ENDED 31ST DECEMBER 2016

IRS In Lacs)

I

51

No.

b) Other Operating ilqcome

Total income from operations (Net)

Previous

year ended

31-12-2015

31-03-2016

31-12-2016

30-09-2016

31-12-2015

31-12-2016

(Unaudited)

(Unaudited) (Unaudited)

1,009.35

1,477.11

(Audited)

c) Employee benefits expenses

~Depreciation

and amortisation expenses

e) Other Expenses

1,009.35

1,477.11

1,025.18

1,529.03

(48.63)

2,242.90

-

2,752.36

490.96

3,450.15

2,242.90

2,752.36

350.88

120.71 ;

3,604.67 '

(61.92)

2,032.59

142.93

2,554.86

132.87

7.06

9.32

8.92

26.66

36.86

1.61

1.67

1.57

4.93

4.64

6.28

8.96

11.36

12.08

31.97

39.13

48.47

9.68

7.80

11.31

23.66

13.74

24.95

3,484.23

2,293.03

2,837.27

f) Exchange Difference

g) Travelling Expenses

0.92

1.29

6.70

995.10

1,490.75

506.17

Ih)

3,450.15

b) Change in inventories of finished goods, work in progress and stock in trade

d)

490.96

expenses

a) Cost of materials consumed

Bank Charges

;Total Expenses

Nine

Months

ended

(Unaudited) (Unaudited)

Quarter ended

Income from opertions

a) Net Sales/Income from Operations (Net of excise duty)

Quarter

ended

Particulars

Nine

Months

ended

Quarter

ended

(194.36)

25_71

5.31

Profit / (loss) from operations before other income, financial costs and exceptional Items (1-2)

14.25

(13.64)

(15.21)

(34.08)

(50.13)

Other Income

11.18

36.59

21.53

62.50

69.41

Profit / (Loss) from ordinary activities before financial costs and exceptional Items (3+4)

25.43

22.95

6.32

Financial Costs

3.21

6.44

1.55

28.42

15.50 '

19.28

6

7

22.22 ;

16.51

4.77

12.92

14.91

Profit from ordinary activities after financial costs but before exceptional Items (5-6)

8 Exceptional Items

9 Profit from Ordinary Activities before Tax {7+8l

10 Tax Expenses (including Deferred Tax)

11 Net Profit from Ordinary Activities after Tax (9-10)

12 Extraordinary Items (net of tax expenses)

13 Net Profit for the peWod (11-12)

14 Share of Profit / (loss) of associates

25.18

(84.91)1

101.19

16.28\

4.37

6.17 ;

10.11

16.51

4.77

12.92

14.91

10.11

(6.74)

3.45

(1.37)

(3.67)

(4.32)

(2.96):

15.48

19.96

3.40

9.25

10.59

7.15

15.48

19.96

3.40

9.25

10.59

15 Minority Interest

7.15 ;

16 Net Profit / (Loss) after taxes, minority interest and share of Profit/{loss) of associates (13+14+15)

17 Paid up Equity Share Capital (Face Value of Rs. 10/- each)

15.48

19.96

3.40

9_25

10.59

7.15

298.46

298.46

298.46

298.46

298.46

298.46

18 Reserves excluding revalUation reserves

464.82

449.34

459.01

464.82

459.01

455.57

'(a) Basic

0.52

0.67

0.11

0.31 .

0.35

;(b) Diluted

0.52

0.67

0.11

0.31 :

0.35

0.24

(a) Basic

0.52

0.67

0.11

0.24

0.52

0.67

0.11

0_31

D.31

0.35

(b) Diluted

0.35

0.24

19(i) Earning per Share (before extra ordinary items) (of Rs. 10/- each)

0.24

19(1i) Earning per Share (after extra ordinary items) (of Rs. 10/- each)

Notes:

1. The Company operates in Textile Segment which is primary reportable segment. Therefore segment reporting is not applicable.

2. Previous period's figure have been regrouped whereever necessary to ccmform to current period's classification.

3. The Statitory auditors have been carried out a limited Review of the above Financial results.

Thanking you.

Yours faithfully,

For Entmprite 19ternationaJ Ltd.

lY'"

Sl

DIrector

~ ENT~~~~~:~~!!~~!~~~~)LTD.

Ph. No. : 03340447872

: 033 40448394

Fax: 033 40448615

e-mail: contact@eilgroup.com

2ND FLOOR. 3, WOODBURN PARK, KOLKATA 700020

CIN No.: L27104WB1989PLC047832

Date:

Ref. :

STATEMENT OF ASSETS AND LIABILITIES

SL

Particulars

NO.

(Rs In Lacs)

As at Current

Period ended

As at Previous

Year ended

31-12-2016

31-03-2016

(Un-audited)

(Audited)

A EQUITY AND LIABILITIES

1 Shareholders' Funds

(a) Share Capital

-Fully paid up shares

-Forfeited shares

(b) Reserves & Surplus

Sub Total: Shareholders' funds

2 Non-Current Liabilities

(a) Long Term Borrowings

(b) Other Long Term Liabilities

(c) Deferred Tax Liabilities

Sub Total: Non-Current Liabilities

3 Current Liabilities

(a) Short Term Borrowings

(b) Trade Payables

((lather Current Liabilities

(d) Short Term Provisions

Sub-Total: Current Liabilities

TOTAL - EQUITY AND LIABILITIES

298.46

0.96

464.82

764.24

298.46

0.96

455.57

754.99

2.94

2.00

5.90

10.84

4.97

2.00

5.29

12.26

114.85

539.32

140.88

795.05

306.89

108.24

245.04

1.29

661.46

1,570.13

1,428.71

110.43

349.51

5.99

465.93

119.23

179.51

9.81

308.55

B ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Non-Current Investments

(c) Long-Term Loans & Advances

Sub-Total: Non-Current Assets

2 Current Assets

(e) Other Current Assets

Sub-Total: Current Assets

223.98

65.86

412.89

118.39

283.08

1,104.20

29.62

85.55

621.30

122.93.

260.76

1,120.16

TOTAL - ASSETS

1,570.13

1,428.71

(a) Inventories

(ti) Trade Receivables

(c) Cash & Bank Balances

(d) Short Term Loans & Advances

For Entfzrpriae International Ltd.

~~

Director

I M TAPURIAH & CO

jK

Chartered Accountants

4,SYNAGOGUE STREET,

8th FLOOR,

KOLKATA -700001

INDEPENDENT A!JD,ITORS' REVIEVV REPORT ON REVIEW OF INTERIM FINANCIAL RESULTS

TO THE BOARD OF DIRECTORS OF ENTERPRISE INTERNATIONAL LIMITED

1. We have reviewed the accompanying Statement of Unaudited Financial Results of ENTERPRISE

st

INTERNATIONAL LIMITED (the Company) for the Quarter ended 31 December/2016 (the

Statement), being submitted by the Company pursuant to the requirement of Regulation 33 of the

Securities Exchange Board of India (Listing Obligations and Disclosure Requirements)

Regulations,2015. This Statement which is the responsibility of the Company's Management and

approved by the Board of Directors, has been prepared in accordance with the recognition and

measurement principles laid down in Accounting Standard 25 on 'Interim Financial Repotting',

prescribed under Section 133 of the Companies Act, 2013 read with relevant rules issued there

under and other accounting principles generally accepted in India. Our responsibility is to issue a

report on the Statement based on our review.

2. We conducted our review of the Statement in accordance with the Standard on Review

Engagements 2410 on 'Review of Interim Financial Information Performed by the Independent

Auditor of the Entity', issued by the Institute of Chartered Accountants of India. This Standard

requires that we plan and perform the review to obtain moderate assurance as to whether the

Statement is free of material misstatement. A review is limited primarily to inquiries of Company

personnel and analytical procedures applied to financial data and t~us provides less assurance than

an audit. We have not performed an audit and accordingly, we do not express an audit opinion.

3. Based on our review conducted as stated above, nothing has come to our attention that causes us to

believe that the accompanying Statement, prepared in accordance with the applicable Accounting

Standards specified in Section 133 of the Companies Act,2013, and other accounting principles

generally accepted in India, has not disclosed the information required to be disclosed in terms of

Regulation 33 of the Securities Exchange Board of India (Listing Obligations and Disclosure

Requirements) Regulations ,2015, including the manner in which it is to be disclosed, or that it

contains any material misstatement.

For K M TAPURIAH & CO

(Chartered Accountants)

FRN : 314043E

Place: Kolkata

Date: 20.01.2017

K MTAPURIAH

(Partner)

Membership No: 051509

Вам также может понравиться

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Документ8 страницFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Документ9 страницStandalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ8 страницFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ7 страницFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ5 страницFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ5 страницFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ6 страницFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- PayslipДокумент1 страницаPayslipVenu GudlaОценок пока нет

- Overview of The Sonali BankДокумент18 страницOverview of The Sonali BankMoumita Rahman100% (1)

- CHAPTER 7 - Competition and Policies Toward Monopolies and Oligopolies Privatization and DeregulationДокумент30 страницCHAPTER 7 - Competition and Policies Toward Monopolies and Oligopolies Privatization and DeregulationCharlie Magne G. Santiaguel90% (10)

- MLA Vs Vera Tabios DigestДокумент2 страницыMLA Vs Vera Tabios DigestKeith BalbinОценок пока нет

- CH 04Документ23 страницыCH 04kmarisseeОценок пока нет

- NRI TaxationДокумент14 страницNRI TaxationSanjay SinghОценок пока нет

- Disposal of SubsidiaryДокумент9 страницDisposal of SubsidiaryCourage KanyonganiseОценок пока нет

- Annual Report 2010 BaosteelДокумент160 страницAnnual Report 2010 Baosteelnalini1501_187919552Оценок пока нет

- Decision Making 36 Practice Questions & SolutionsДокумент33 страницыDecision Making 36 Practice Questions & SolutionsAbdullah Naeem57% (7)

- Kansai Nerolac Software TDSДокумент17 страницKansai Nerolac Software TDSkumargaurav21281Оценок пока нет

- Algebra Question Paper 2010-2011Документ10 страницAlgebra Question Paper 2010-2011AMIN BUHARI ABDUL KHADERОценок пока нет

- Stock Market Quiz - Stock Market Quiz Questions With AnswersДокумент3 страницыStock Market Quiz - Stock Market Quiz Questions With AnswersRootujaОценок пока нет

- 14 Bbma3203 T10 PDFДокумент27 страниц14 Bbma3203 T10 PDFHarianti HattaОценок пока нет

- Nigeria Property Tax in Federal Capital TerritoryДокумент3 страницыNigeria Property Tax in Federal Capital TerritoryMark allenОценок пока нет

- Sapm Unit 1Документ49 страницSapm Unit 1Alavudeen ShajahanОценок пока нет

- Patent Infringement Damages - A Brief Summary - Articles - FinneganДокумент14 страницPatent Infringement Damages - A Brief Summary - Articles - FinneganneelgalaОценок пока нет

- BBA Viva Final Year PDFДокумент70 страницBBA Viva Final Year PDFPratikBhowmickОценок пока нет

- Audit of Banks With The Help of FinacleДокумент8 страницAudit of Banks With The Help of FinacleKartikey RanaОценок пока нет

- Vegetron ExcelДокумент21 страницаVegetron Excelanirudh03467% (3)

- Managing Political RiskДокумент12 страницManaging Political RiskVy NguyenОценок пока нет

- Byte Company Case StudyДокумент9 страницByte Company Case StudyMariaОценок пока нет

- Report Singue Revised4Документ11 страницReport Singue Revised4EDINPETROL ESPINOZAОценок пока нет

- Third Degree Price DiscriminationДокумент34 страницыThird Degree Price DiscriminationMarie Adriano BadilloОценок пока нет

- Entrepreneurs Recognize OpportunitiesДокумент41 страницаEntrepreneurs Recognize OpportunitiesnikowawaОценок пока нет

- Bloomberg ReferenceДокумент112 страницBloomberg Referencephitoeng100% (1)

- Acctng 1 pt1 NmarasignaДокумент3 страницыAcctng 1 pt1 NmarasignaMarielle Red AlmarioОценок пока нет

- LiabilitiesДокумент5 страницLiabilitiesmalaya negadОценок пока нет

- Solved David A Cpa For A Large Accounting Firm Often WorksДокумент1 страницаSolved David A Cpa For A Large Accounting Firm Often WorksAnbu jaromiaОценок пока нет

- TX10 - Other Percentage TaxДокумент15 страницTX10 - Other Percentage TaxKatzkie Montemayor GodinezОценок пока нет

- Managerial and Cost Accounting Exercises IДокумент20 страницManagerial and Cost Accounting Exercises IRithik VisuОценок пока нет