Академический Документы

Профессиональный Документы

Культура Документы

MAPAX1

Загружено:

CunCunAlAndra0 оценок0% нашли этот документ полезным (0 голосов)

3 просмотров2 страницыInformation about Financial Analysis

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документInformation about Financial Analysis

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

3 просмотров2 страницыMAPAX1

Загружено:

CunCunAlAndraInformation about Financial Analysis

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

meaning, The identical principles and calculations apply to compa

nies of any size—very small businesses as well as larger companies.

MAPAX Manufacturing Corp. manufactures two product lines,

stoves and furnaces, both sold to the residential and commercial mar.

kets, The company also stocks a variety of resale accessories, some of

which must be slightly modified to meet customer specifications, The

stove and furnace business is a stable but growing industry. Although

susceptible to both economic and industry cycles, its historical swings

have been shallow, seldom more than 5 percent in either direction,

FIGURES 311 and 3.2 show MAPAXS balance sheets and income

statements (respectively) for the years Year 1, Year 2, and Year 3.

FIGURE3.1_ MAPAX Manufacturing Corp. Balance Sheet

As of December 31, Year 1, Year 2, Year 3 (in dollars)

Cash 622,852

‘Accounts receivable 1,364,344 | 1.392.188| 1.406.250

inventory 2,721,250 | 3.125.000 | 3,696,263

Propaid expenses 5,000 5.000 5,000

Total curont assets 4713-446 | 4643873] 5.048513

Buildings 2,000,000 2,000,000

Machinery & equipment 6,000,000 8,000,000

Delivery tucks 50,000 50,000,

‘Total ined assets 8,050,000 | 91 10050,000

Less: Accumulated depreciation (2,200,000) _(2.668,000)| (3,200,000)

Net fixed assets §,850,000 | 6,482,000 | 6,850,000

Other assats 100,000 | 100,000 100,000

Total Assets 10.665.406) 11.225,678| 11908519

Bank nate payable 500,000 | 250,000 200,000

‘Accounts payable 500.140 [666.559 775.814

‘Accrued expenses 200,000,| 200.000 200,000

Other current liabilities 50,000 50,000) 80,000,

Total current liabilities 1,300.440 [7.166.650] 7.228.614

Long-term debt 4,400,000} 4,200,000| 4,000,000

Mortgage loan 1,150,000 | 7.075.000 1,000,000

Total Liabilities 6,980,440 6441559 / 6,225,614

Common stock 100,000 100,000 100,000

Retained earings—beginning 270119 | 3,683,006 | 4684,320

Profits) 981,567 [1.001313 968,579

Aetained earnings—ending 3,683,008 | 4684320| 6.672.899

‘Total Net Worth 3,783,008 | 4,784,320] 6,772,890

‘Total Liabilities and Net Worth 10,663,448 | 11,225.79 11,990,613,

en as rvmnyenny rmancra! Statements

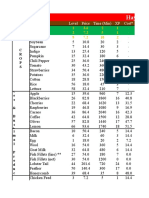

NGURE 3.2 MAPAX Manufacturing Corp. Statement of Income

For the Years Ended December 31, Year 1, Year 2, Year 3(in dollars)

10914750 11137500 11,250,009

5.588.952 5702400 5,760,009

849430866785 B75. 579

Overhead 70373 708877 _747347

Total cost of sales 710960 7294081 7382-967

Gross profit 377379 3903409 apse

Porcent of sales 346% 5% 34.4%

Operating expenses

Seling expenses 584768 $9672 608.909

‘Administrative expense 520297 530.915.541.759

Other expenses 20,000 20,000 20,000

Depreciation 468,000 32000 _s85.009

Total operating expenses 1593084 1679837 755,659

NNetincome before interest andtaxes 2180705 2.163.772 211,48

Percent of sales 200% 19.4% 18.8%

Interest 548,750 517,000

[Net income before taxes 1618022 1,594,493

Taxes 613708 605.904

Netincome 1001313“ 988.57g

Percent of sales 90% 88%

Profitability Ratios

Profitability ratios indicate a company’s ability to earn a satisfac.

tory return on sales, total assets, and invested capital. Of course, you

must define “satisfactory” to meet your objectives, Every company ig

different, and it would be wrong to assume that a company that earns

a 10 percent return on sales is outperforming one thal earns a 5 per.

cent return, or that a company with an 80 percent gross profit rar.

gin is run more efficiently than one turning a 30 percent gross profit

‘Comparison with industry standards or with companies of similar

size in similar businesses is the only reasonable way to interpret the

values derived from profitability ratios.

Ed

‘Two profitability ratios common

company’s earnings potential are

ly used to measure the trend of,

3 Gross profit margin as.a percent of sales

Net income as a percent of sales

These ratios can normall i

« ly be read direct!

ments without additional analysis. Obviously

cate improvements in operating expense cont

reverse condition indicate:

Percent and 9 percent, respectively

percent, ly, are very respectal

turing companies in stable, mature industes Hea a

‘ot so good and indicates that something negative may Le heen

'© MAPAX' cost structure or market position: ”

Gross profit to sales 345% 345%

Netinonersaes “ggg tag

be happening

Three other fit

ler profitability ratios measure the

income) a company earns on invested capital aa

+ Return on owner's equity

* Return on investment

* Return on total assets

In the MAPAX example, these ratios were

Return on owners’ equity

mono 259%

Beuunenivesman idee wasoninwen) fea SS TR

Am on investment (unadjusted for taxes on interest) 179% n

tur an tl assets (austed or tares on intrest) 120% bi nn

mon total asses unadjusted for taxes ninterest) 16.2% 141% 139.

Financ ni

nancial analysts will probably argue for the next two hundred

years about which of thes of

2 rat

ye ios yields the most accurate picture of

ly from financial state

increasing ratios indi-

: : ol pricing, product

Iso competitive advantage—all pstivesigns wean ee

« follows:

The arguments ran

1+ Hor returit on owners’ equity: "The only true measure of a company

{show much it returns to its owners.

'* For return on investment: The true measure of a company is how

inuch it returns to all investors, both debt holders and equity

investors.

* For return on assets: The true measure of a company is the effi-

ciency of its management, which can be measured only by the

returns generated on assets employed.

argument has merit, and which ratio is appropriate in a

given situation is related to the capital structure of a company and the

purpose of the analysis.

‘Although the return on owners’ equity ratio is straightforward,

the return on investment ratios and return on assets ratios war-

rant an explanation. The theory behind return on investment is that

long-term debt represents as valid an investment as common shares.

Therefore, by definition, the term investment as used in these ratios

represents the sum of the average outstanding balances of long-term

debt and the average stockholder investment.

Furthermore, since debt is included in the ratio’s denominator,

interest expense must be added back to net income to arrive at the

numerator. Arguments pérsist about the merits of adding back inter-

est expense adjusted for the tax effect or total interest. The answer

can only be a matter of personal choite. The final point to clarify is

that practically speaking, only interest on long-term debt should be

used. Theoretically, short-term interest should be included; however,

since it is virtually impossible to obtain average interest expense for

short-term debt, most calculations ignore the minor distortion caused

by excluding it.

The return on assets ratio, sometimes referred to as the asset

utilization ratio or assets employed ratio, uses average total assets as a

denominator, on the theory that assets must be employed during the

entire period to generate the income for the period. In addition, the

same argument over using interest that has or has not been adjusted

for the tax effect for the numerator applies here as in the return on

investment calculation

Вам также может понравиться

- Process Plant Layout - Seán Moran 1-2Документ2 страницыProcess Plant Layout - Seán Moran 1-2CunCunAlAndra100% (1)

- Process Plant Layout - Seán Moran 3-4Документ2 страницыProcess Plant Layout - Seán Moran 3-4CunCunAlAndraОценок пока нет

- DA38 Safety Data Shett FAME (Fatty Acid Methyl Ester) V4 - en - DEДокумент14 страницDA38 Safety Data Shett FAME (Fatty Acid Methyl Ester) V4 - en - DECunCunAlAndraОценок пока нет

- Management Gathering 0718 - Distribution - v5 CoverДокумент1 страницаManagement Gathering 0718 - Distribution - v5 CoverCunCunAlAndraОценок пока нет

- Early Liver TransplantationДокумент11 страницEarly Liver TransplantationCunCunAlAndraОценок пока нет

- GF Signet 515 2536 Manual01Документ1 страницаGF Signet 515 2536 Manual01CunCunAlAndraОценок пока нет

- Problem 5 Git: Ivan MichaelДокумент68 страницProblem 5 Git: Ivan MichaelCunCunAlAndraОценок пока нет

- Hay Day Price Profit AnalysisДокумент112 страницHay Day Price Profit AnalysisCunCunAlAndraОценок пока нет

- RicoДокумент62 страницыRicoCunCunAlAndraОценок пока нет

- Pitri - GI.Pemicu 4. GE+ Tifus AbdominalisДокумент154 страницыPitri - GI.Pemicu 4. GE+ Tifus AbdominalisCunCunAlAndraОценок пока нет

- Breather Valve - Pressure-Vaccuem Relief ValveДокумент2 страницыBreather Valve - Pressure-Vaccuem Relief Valvevphor85Оценок пока нет

- Hay Day Price Profit AnalysisДокумент112 страницHay Day Price Profit AnalysisCunCunAlAndraОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)