Академический Документы

Профессиональный Документы

Культура Документы

Discussion Questions:: No. Account Yes/ No Discussion

Загружено:

Misu NguyenОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Discussion Questions:: No. Account Yes/ No Discussion

Загружено:

Misu NguyenАвторское право:

Доступные форматы

1 Solutions to homework

Discussion Questions:

5.2

(a)

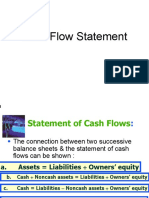

Similarities:

- They both represent flow (for the period) statements.

(b)

Differences:

- The cash flow statement is based on cash transactions whereas the

statement of financial performance is based on accrual transactions.

- The cash flow statement incorporates changes in all accounts types while

the statement of financial performance includes only revenue and

expense transactions.

5.5

The accrual profit exceeds the cash flow from operating activities where:

(a) The accrual revenues exceed the cash revenues (eg. increase in debtors;

increase in other receivables) and/or

(b) The accrual expenses are less than the cash expenses (eg increase in

inventories; increase in prepayments; decrease in accounts payable;

decrease in accruals; decrease in provision for taxation; decrease in

interest payable).

5.6

(i) For operating activities it should be an inflow in each period.

(ii) For investing activities the expectation would be for outflows in most

periods.

(iii) For financing activities it will change from year to year but should

balance out over time.

5.8

People and organisations will not normally accept other than cash in settlement

of their claims against the business. If a business wants to employ people it must

pay them in cash. If it wants to buy a new non-current asset to exploit a business

opportunity, the seller of the asset will normally insist on being paid in cash,

usually after a short period of credit. When businesses fail, it is their inability to

find the cash to pay claimants that actually drives them under. These factors

lead to cash being the pre-eminent business asset and, therefore, the one which

analysts and others watch carefully in trying to assess the ability of the business

to survive and/or to take advantage of commercial opportunities as they arise.

5.9

Classification as cash or cash equivalent:

No. Account Yes/ Discussion

No

A Bank overdraft Yes Part of cash

B Accounts receivable No Related to operating activities

C Debentures payable No Related to financing activities

D Deposits at call Yes Part of cash equivalent

E Shares No Related to investing activities

RMIT University Vietnam | Chapter 5 Cash Flow Statements 1

2 Solutions to homework

F Bills receivable No Related to either operating or financing

activities

G Unused bank No Related to non-cash disclosures

overdraft

H Cash advances to No Related to investment activities

staff

5.11

Bad and doubtful debts represent non-cash expenses and are incorporated into

the cash flow statement through the following adjustments

(a) Direct Method:

Cash received from sales

= sales

+/- change in debtors (+ Cr [decreases]; - Dr [increases])

+/- change in allowance for doubtful debts (+ Cr [decreases]; - Dr

[increases])

- bad and doubtful debts expense

(b) Indirect Method:

As part of the reconciliation by adding the credit change in accounts receivable

(decrease)* or deducting the debit change in accounts receivable*(increase).

*will include the allowance for doubtful debts

5.15

Depreciation is a non-cash expense. In terms of the cash flow statement it

represents an add back to net profit after tax in computing the cash flow from

operating activities.

RMIT University Vietnam | Chapter 5 Cash Flow Statements 2

3 Solutions to homework

Application Exercise:

5.1

No. Particulars Activity Cash flow

Eg. Cash received from customers Operating Inflow

(a) Dividends received Financing Inflow

(b) Taxation paid Operating Outflow

(c) Payments to suppliers and Operating Outflow

employees

(d) Interest paid Operating Outflow

(e) Purchase of property, plant and Investing Outflow

equipment

(f) Bonus issue of shares Non-cash

(g) Dividends paid Financing Outflow

(h) Proceeds on sale of investments Investing Inflow

(i) Interest received Financing Inflow

(j) Long term borrowing Financing Inflow

(k) Write-down goodwill Non-cash

(l) Profit on sale of equipment Non-cash

RMIT University Vietnam | Chapter 5 Cash Flow Statements 3

Вам также может понравиться

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОт EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОценок пока нет

- SM ch05Документ41 страницаSM ch05Akash JainОценок пока нет

- E4 Cashflow StatementДокумент4 страницыE4 Cashflow StatementSean H2OОценок пока нет

- Cfas Cash Flow Theories and ProblemsДокумент30 страницCfas Cash Flow Theories and ProblemsIris MnemosyneОценок пока нет

- FABM2 Module 5. Statement of Cash FlowsДокумент7 страницFABM2 Module 5. Statement of Cash FlowsSITTIE RAYMAH ABDULLAHОценок пока нет

- Cash Flow Statement FormatsДокумент7 страницCash Flow Statement FormatsSenelwa AnayaОценок пока нет

- Statement of Cash FlowsДокумент24 страницыStatement of Cash FlowsShimimana MayenjeОценок пока нет

- FIN305 FA12 Ch04Документ39 страницFIN305 FA12 Ch04banmaiixoОценок пока нет

- Cash Flow StatementsДокумент4 страницыCash Flow StatementsUnbeatable 9503Оценок пока нет

- Chapter 5 HW SolutionsДокумент39 страницChapter 5 HW SolutionsemailericОценок пока нет

- Cash Flow Statement-Short1Документ27 страницCash Flow Statement-Short1saqlain aliОценок пока нет

- Quiz 2Документ3 страницыQuiz 2Kenneth Jules GarolОценок пока нет

- Cash FlowДокумент28 страницCash Flowleen mercado100% (1)

- Cash Flow Statement: Vishesh SinghДокумент20 страницCash Flow Statement: Vishesh SinghVishesh SinghОценок пока нет

- IND AS 7 Cash Flow StatementДокумент10 страницIND AS 7 Cash Flow StatementCharu JagetiaОценок пока нет

- IAS 7 Statement of Cash flows-1Документ27 страницIAS 7 Statement of Cash flows-1machabelanosiphoОценок пока нет

- CFAS Unit 1 - Module 4Документ12 страницCFAS Unit 1 - Module 4Ralph Lefrancis DomingoОценок пока нет

- CIPFA PPT Template NEW IPFM PSFR Session 9Документ24 страницыCIPFA PPT Template NEW IPFM PSFR Session 9SabОценок пока нет

- Cash Flow Statement ExplainedДокумент22 страницыCash Flow Statement ExplainedShivati Singh KahlonОценок пока нет

- Chapter 4 Statement of Cash Flows Part AДокумент23 страницыChapter 4 Statement of Cash Flows Part AKwan Kwok AsОценок пока нет

- Investing Cash Flows - InvestingДокумент2 страницыInvesting Cash Flows - InvestingPaula De RuedaОценок пока нет

- Chapter 17-Statement of Cash FlowsДокумент4 страницыChapter 17-Statement of Cash Flowselizabeth angel100% (1)

- V CoS S&D Exp Admin & Other and Fin ExpДокумент18 страницV CoS S&D Exp Admin & Other and Fin ExpsahnojОценок пока нет

- AMD Topic 5Документ30 страницAMD Topic 5Anjeena ShresthaОценок пока нет

- Concept of Cash Flows StatementДокумент4 страницыConcept of Cash Flows StatementA B M MoshiuddullahОценок пока нет

- Error Correction & Statement of Cash Flows - OUTLINEДокумент6 страницError Correction & Statement of Cash Flows - OUTLINESophia Marie VerdeflorОценок пока нет

- Cash FlowДокумент81 страницаCash FlowRoy Van de SimanjuntakОценок пока нет

- Ias7 170901160535Документ18 страницIas7 170901160535ashanthisarangaaОценок пока нет

- Classroom Notes 6396Документ2 страницыClassroom Notes 6396Mary Grace Galleon-Yang Omac100% (1)

- Erica Lamsen - Modified Module 5Документ13 страницErica Lamsen - Modified Module 5erica lamsenОценок пока нет

- FABM2 Module 5 Cash Flow StatementДокумент12 страницFABM2 Module 5 Cash Flow StatementLoriely De GuzmanОценок пока нет

- IAS 7: Statement of Cash Flow: Single CompanyДокумент27 страницIAS 7: Statement of Cash Flow: Single CompanyAfsanaОценок пока нет

- Chapter 11 Lecture 2018Документ62 страницыChapter 11 Lecture 2018Johnny Sins100% (1)

- Act Module4 Cashflow Fabm 2 5.Документ11 страницAct Module4 Cashflow Fabm 2 5.DOMDOM, NORIEL O.Оценок пока нет

- AFA Week 3 SolutionДокумент25 страницAFA Week 3 SolutionElaine TeoОценок пока нет

- 9 CMA Rev. Cash Flow StatementДокумент15 страниц9 CMA Rev. Cash Flow StatementSakshiОценок пока нет

- Topic V - Statement of Cash FlowsДокумент8 страницTopic V - Statement of Cash FlowsSean William CareyОценок пока нет

- Cash Flows Chap-13Документ52 страницыCash Flows Chap-13nina0301100% (1)

- Financial Reporting: Statement of Cash Flows Hkas 7Документ12 страницFinancial Reporting: Statement of Cash Flows Hkas 7clancychengОценок пока нет

- Statement of Changes in Financial PositionДокумент17 страницStatement of Changes in Financial PositionAbdul MoinОценок пока нет

- Kotler SummaryДокумент27 страницKotler Summaryshriya2413Оценок пока нет

- IAS 7 CASH FLOWДокумент7 страницIAS 7 CASH FLOWRechelleОценок пока нет

- Statement of Cash Flows (IAS7)Документ16 страницStatement of Cash Flows (IAS7)Mîñåk ŞhïïОценок пока нет

- Cash Flow Analysis GuideДокумент2 страницыCash Flow Analysis GuideJoey WassigОценок пока нет

- Financial Statements & Analysis 2024 SPCCДокумент29 страницFinancial Statements & Analysis 2024 SPCCSaturo GojoОценок пока нет

- QuestionsДокумент7 страницQuestionsPangitkaОценок пока нет

- Fund Flow StatementДокумент16 страницFund Flow StatementRavi RajputОценок пока нет

- CH 05Документ38 страницCH 05Abdulelah AlhamayaniОценок пока нет

- IND AS 7 Cash Flow ClassificationДокумент1 страницаIND AS 7 Cash Flow Classificationchandrakumar k pОценок пока нет

- Funds Flow StatementДокумент11 страницFunds Flow Statementkulife50% (4)

- Ind AS 7 PDFДокумент23 страницыInd AS 7 PDFnavinsurana1987Оценок пока нет

- Introduction to Financial Reporting and Accounting ConceptsДокумент7 страницIntroduction to Financial Reporting and Accounting ConceptsKothari InvestmentsОценок пока нет

- Fundamentals of Accountancy Business and Management II Module 4Документ4 страницыFundamentals of Accountancy Business and Management II Module 4Rafael RetubisОценок пока нет

- Cash Flow From Financing Activities - CFF Definition - InvestopediaДокумент5 страницCash Flow From Financing Activities - CFF Definition - InvestopediaBob KaneОценок пока нет

- Pas 7 PDFДокумент8 страницPas 7 PDFraien gaayonОценок пока нет

- Generate Cash Flow ReportsДокумент15 страницGenerate Cash Flow ReportsSoumendra RoyОценок пока нет

- SEx 9Документ24 страницыSEx 9Amir Madani100% (1)

- CashFlow - A Short NoteДокумент7 страницCashFlow - A Short NoteRamana DvОценок пока нет

- Lesson 4: Statement of Cash FlowsДокумент7 страницLesson 4: Statement of Cash FlowsReymark TalaveraОценок пока нет

- The Cashflow StatementДокумент17 страницThe Cashflow StatementNdumiso MsizaОценок пока нет

- Audio Equipment and Software Products ListingДокумент1 страницаAudio Equipment and Software Products ListingMisu NguyenОценок пока нет

- Notes - Chapter 4Документ5 страницNotes - Chapter 4Misu NguyenОценок пока нет

- Drums Test NotesДокумент3 страницыDrums Test NotesMisu NguyenОценок пока нет

- Era of MunДокумент1 страницаEra of MunMisu NguyenОценок пока нет

- Unit 4 - Measuring and Reporting Financial Performance (Continued) Non Current Tangible AssetsДокумент4 страницыUnit 4 - Measuring and Reporting Financial Performance (Continued) Non Current Tangible AssetsMisu NguyenОценок пока нет

- Depreciation Methods ComparisonДокумент5 страницDepreciation Methods ComparisonMisu NguyenОценок пока нет

- Document For MorningДокумент4 страницыDocument For MorningMisu NguyenОценок пока нет

- Elements of EraДокумент1 страницаElements of EraMisu NguyenОценок пока нет

- Elements of EraДокумент1 страницаElements of EraMisu NguyenОценок пока нет

- Chap 4 (Fix)Документ11 страницChap 4 (Fix)Misu NguyenОценок пока нет

- Document For NightДокумент2 страницыDocument For NightMisu NguyenОценок пока нет

- Chapter 4 Income Statement GuideДокумент78 страницChapter 4 Income Statement GuideMisu NguyenОценок пока нет

- Chap 5 (Fix)Документ6 страницChap 5 (Fix)Misu NguyenОценок пока нет

- Depreciation Methods ComparisonДокумент5 страницDepreciation Methods ComparisonMisu NguyenОценок пока нет

- Chap 4 (Fix)Документ11 страницChap 4 (Fix)Misu NguyenОценок пока нет

- Chap 4 (Fix)Документ11 страницChap 4 (Fix)Misu NguyenОценок пока нет

- 03 Balance SheetДокумент9 страниц03 Balance SheetMisu NguyenОценок пока нет

- XYZ Trading Exercise: Balance Sheet Class Notes Business TransactionsДокумент3 страницыXYZ Trading Exercise: Balance Sheet Class Notes Business TransactionsMisu NguyenОценок пока нет

- Lecture 4 Lecture Notes 2011Документ27 страницLecture 4 Lecture Notes 2011Misu NguyenОценок пока нет

- Lecture Notes Unit 3 2011Документ27 страницLecture Notes Unit 3 2011Misu NguyenОценок пока нет

- Unit 3 Financial PositionДокумент31 страницаUnit 3 Financial PositionMisu NguyenОценок пока нет

- ACCT 2105 - Different Accounting EntitiesДокумент9 страницACCT 2105 - Different Accounting EntitiesMisu NguyenОценок пока нет

- Tutorial Preparation Questions Unit 2Документ1 страницаTutorial Preparation Questions Unit 2Misu NguyenОценок пока нет

- Accounting Entities Forms Business StructuresДокумент2 страницыAccounting Entities Forms Business StructuresMisu NguyenОценок пока нет

- BPI Vs PosadasДокумент2 страницыBPI Vs PosadasCarlota Nicolas VillaromanОценок пока нет

- Diploma, Anna University-UG, PG., HSC & SSLC: Ba5008 Banking Financial Services ManagementДокумент2 страницыDiploma, Anna University-UG, PG., HSC & SSLC: Ba5008 Banking Financial Services ManagementSruthi KunnasseryОценок пока нет

- DWSD Lifeline Plan - June 2022Документ12 страницDWSD Lifeline Plan - June 2022Malachi BarrettОценок пока нет

- Pacific Oxygen Vs Central BankДокумент3 страницыPacific Oxygen Vs Central BankAmmie AsturiasОценок пока нет

- Human Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofДокумент44 страницыHuman Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofDHARMENDER YADAVОценок пока нет

- Presentation Flow: Public © 2023 SAP SE or An SAP Affiliate Company. All Rights Reserved. ǀДокумент31 страницаPresentation Flow: Public © 2023 SAP SE or An SAP Affiliate Company. All Rights Reserved. ǀAbhijeet PawarОценок пока нет

- IGI Insurance CompanyДокумент26 страницIGI Insurance Companymach!50% (2)

- Investment and Portfolio AnalysisДокумент6 страницInvestment and Portfolio AnalysisMuhammad HaiderОценок пока нет

- ISM - PrimarkДокумент17 страницISM - PrimarkRatri Ika PratiwiОценок пока нет

- The Optimal Choice of Index-Linked Gics: Some Canadian EvidenceДокумент14 страницThe Optimal Choice of Index-Linked Gics: Some Canadian EvidenceKevin DiebaОценок пока нет

- Retailing: by Shraddha KocharДокумент45 страницRetailing: by Shraddha KocharShraddha KocharОценок пока нет

- Review of Related LiteratureДокумент3 страницыReview of Related LiteratureEaster Joy PatuladaОценок пока нет

- 1 CombinedДокумент405 страниц1 CombinedMansi aggarwal 171050Оценок пока нет

- RPM Course Overview Mining For Non Miners Advanced Underground Coal.v1Документ1 страницаRPM Course Overview Mining For Non Miners Advanced Underground Coal.v1Prakash RajakОценок пока нет

- IKEA PresentationДокумент20 страницIKEA PresentationAvinash2458Оценок пока нет

- CPED Policy Brief Series 2021 No.2Документ7 страницCPED Policy Brief Series 2021 No.2Job EronmhonseleОценок пока нет

- Benefits of MYOB Accounting SoftwareДокумент13 страницBenefits of MYOB Accounting SoftwareTuba MirzaОценок пока нет

- Profits and Gains of Business or ProfessionДокумент13 страницProfits and Gains of Business or Professionajaykumar0011100% (2)

- Organigrama Ypfb 20180208Документ1 страницаOrganigrama Ypfb 20180208Ana PGОценок пока нет

- Report On Non Performing Assets of BankДокумент53 страницыReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- BOI - New LetterДокумент5 страницBOI - New Lettersandip_banerjeeОценок пока нет

- Emkay LEAD PMS - JULY 2019Документ17 страницEmkay LEAD PMS - JULY 2019speedenquiryОценок пока нет

- Swifttrip Analysis - Investor'S MouДокумент3 страницыSwifttrip Analysis - Investor'S Mounnaemeka ObowuОценок пока нет

- Ae Sce Presentation Group 14Документ11 страницAe Sce Presentation Group 14Kisan KhuleОценок пока нет

- Acceptance of Presentment for Value Discharges DebtДокумент2 страницыAcceptance of Presentment for Value Discharges Debtali100% (17)

- AutoДокумент11 страницAutorocky700inrОценок пока нет

- My India in 2047Документ3 страницыMy India in 2047Karttikeya Mangalam NemaniОценок пока нет

- 7C'S of Effective CommunicationДокумент2 страницы7C'S of Effective CommunicationOsama AhmedОценок пока нет

- Wakalah Bi Al Istithmar A Case Study of Wafiyah Investment Account Bank Islam Malaysia Berhad BimbДокумент25 страницWakalah Bi Al Istithmar A Case Study of Wafiyah Investment Account Bank Islam Malaysia Berhad BimbMuhammed UsmanОценок пока нет

- MCQs Financial AccountingДокумент12 страницMCQs Financial AccountingPervaiz ShahidОценок пока нет