Академический Документы

Профессиональный Документы

Культура Документы

1

Загружено:

Your Materials0 оценок0% нашли этот документ полезным (0 голосов)

421 просмотров2 страницыThe document provides data on multiple production problems involving work in process inventory for different companies. Problem A involves calculating the cost of ending work in process inventory using average costing. Problem D provides extensive data on a two-department production process and requires calculating equivalent units, costs of normal lost units, and costs of transfers using FIFO costing. Problem G involves a watch assembly process and calculating total cost of units completed and transferred.

Исходное описание:

1

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document provides data on multiple production problems involving work in process inventory for different companies. Problem A involves calculating the cost of ending work in process inventory using average costing. Problem D provides extensive data on a two-department production process and requires calculating equivalent units, costs of normal lost units, and costs of transfers using FIFO costing. Problem G involves a watch assembly process and calculating total cost of units completed and transferred.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

421 просмотров2 страницы1

Загружено:

Your MaterialsThe document provides data on multiple production problems involving work in process inventory for different companies. Problem A involves calculating the cost of ending work in process inventory using average costing. Problem D provides extensive data on a two-department production process and requires calculating equivalent units, costs of normal lost units, and costs of transfers using FIFO costing. Problem G involves a watch assembly process and calculating total cost of units completed and transferred.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

6.

Cost of abnormal lost units

PROBLEM A = ABC CO. Products reports the following data 7. Cost of the units completed and transferred

for the first department in its production process: 8. Cost of the Ending Work in Process

Units in process at beginning of period

(all materials; 3/4 labor and factory PROBLEM D = Miami Corporation manufactures Heat Energy

overhead) 5,000 Drink process using two departments, Mixing Department and

Units started in process 35,000 Refining Department.

Units transferred out 33,000

Units still in process (all materials; In the Mixing Department, material A is added 30% at the

labor and factory overhead) 5,000 start, plus 30% when the products are 50% completed as to

Units completed but not yet transferred labor and the remaining 40% is added only when the products

to Finished Goods. 2,000 are 90% completed as to labor. In this department labor and

Related data were: overhead are incurred evenly throughout the process.

Beginning Cost added

In Refining Department units received from preceding

Materials 100,000 304,000

department will further process, and at 50% completion

Labor 125,400 407,100

Material B is added, which approximately increases the

Factory Overhead 173,500 407,750

production by 50%. The processing in this department

Required: Using the average costing method: Determine the requires the use of two different skills in which applicable

1. Cost of the Work in process ending inventory rates are P1,500 for SKILL X (which is also the required labor

in Mixing department) and P2,000 for SKILL Y per Direct Labor

PROBLEM B = BCD CO. Products is asking help from you to Hour. The processing in the Refining Department will start

complete the cost reports for this department. Below are the the use of Skill Y only after completing the application of Skill

data and the company is aware that the information provided X that is after the addition of materials.

to you might not be sufficient. Overhead is applied at P800 per direct labor hour for the two

Units in process January 1 (all materials; 3/4 departments.

labor and factory overhead) 5,000

Units started in process 35,000 For the month of December the following data were made

Units transferred out 36,000 available:

Units still in process January 31 (all Unit of Production Mixin WD Refinin WD

materials; labor and factory overhead) 4,000 g g

Beginning Units in beginning 20,000 80% 20,000 30%

Materials 100,000 inventory - December

Labor 125,400 1

Factory Overhead 173,500 Units started in process 100,00 ?

Related data were: this period 0

Total cost of beginning inventories Units transferred from

completed and transferred. P 430,150 Mixing to Refining

Total materials requested during the period P 306,250 this period ?

Required: Using the FIFO costing method: Determine the ff: Units transferred from

2. Total cost of completed and transferred Refining to Finished

3. Cost of the Work in process ending inventory Goods this period 150,000

Lost Units (Normal

Problem C = The Mongol Company uses the weighted Loss should not

average costing method in its there processing department. exceed 2% of the

Direct materials are added in Department 1 and Department units started this

2. Direct materials in Department 2 are placed immediately period) 5,000 10,000

on each unit as it is transferred in. Units in Ending 90%

Below is a portion of Octobers cost of production report for inventory December

Department 2. 31 ? 20,000 75%

Work in process inventory ending: 8,900 units

Cost from preceding department 203,000 Mixing Refining

Direct materials 26,700 Cost in beginning inventory

Conversion cost 60%, completed 20,470 Cost from preceding 647,000

During November the following activity occurred in department

Department 2. Materials

Units transferred in 30,100 Materials A P100,000

Units added 3,000 Materials B 0

Cost transferred in 926,800 Labor

Cost incurred Skill X P750,000 90,000

Direct materials 653,700 Skill Y 0

Conversion cost 483,215 Factory overhead ? ?

Units transferred out 37,800 Cost added during the current

Ending work in process inventory 75% period

completed Transferred In Cost ?

Materials

Required: Calculate the following unit costs for the month of Materials A P1,200,000

November: Materials B 2,250,000

4. Total cost of Units Transferred out Labor

5. Total cost of Ending Work in Process Skill X 783,750 1,215,000

Skill Y ?

PROBLEM C = The following data pertain to the December,

Factory Overhead ? 1,048,000

2011 production of Department B in a manufacturing

company. Materials are added at 50% completion.

Required:

(Subsequent Department)

Using FIFO method and assuming the inspection point for

Quantity Schedule

mixing department is at 70% completion while loss in refining

In process, December 1 (40% completed) 5,000 department are discover before the addition of materials

Units Added 5,000 which is at 50% completion, determined the following for the

Transferred in from preceding department 90,000 two departments:

Lost Units Abnormal (40% completed) 10,000 9. Equivalent production (Materials, Labors and

In process, December 31 (75% completed) 10,000 Overhead)30 points

Cost Data: 10. Total cost of Normal lost units

In process, December 1 60,500 11. Total cost of ending work in process

Manufacturing cost, December: 12. Total cost of units transferred out.

Materials 360,000

Labor 179,000 Problem G = The Wilson Company manufactures the

Factory overhead 179,000 Ticktock watch on a assembly-line basis. January 1 work-in-

Received from preceding department 997,500 process consisted of 5,000 units partially completed. During

Equivalent Units: FIFO Costing the month an additional 110,000 units were started and

105,000 units were completed. The ending work-in-process 20. Total cost of units completed and transferred

was 3/5 complete as to conversion costs. Conversion costs 21. Total cost of units is still in process

are added evenly throughout the process. The following

conversion costs were incurred: Theories:

1. When should process costing techniques be used in

Beginning costs for work-in-process. 1,500 assigning costs to products?

Total current conversion costs 273,920 a. If the product is manufactured on the basis of each

order received

The conversion costs assigned to ending work-in-process b. When production is only partially completed during the

totaled 15,360 using the FIFO method of process costing. accounting period

13. What was the percentage of completion as to c. If the product is composed of mass-produced

conversion costs on the 5,000 units in BWIP? homogeneous units

d. Whenever standard costing technique should not be

Problem L = Information concerning Department B of the used

Loren Company is as follows: 2. Which of the following is a characteristic of a process

Units Costs costing system?

Beginning work in process 5,000 6,300 a. Work-in-process inventory is restated in terms of

Units transferred 35,000 58,000 completed units

Total 40,000 64,300 b. Cost are accumulated by job order

Units completed 37,000 c. It is used by manufacturing custom machinery

Ending work in process 3,000 company.

d. Standard costs are not applicable.

3. From the industries listed below, which one is most

Costs likely to use process costing in accounting for production

Transferre Material Conversio Total cost?

d s n costs a. Road Builder

Beginning 2,900 3,400 6,300 b. Electrical Contractor

work in c. Newspaper Publisher

process d. Automobile Repair Shop

4. An equivalent unit of material or conversion cost is

Units 17,500 25,500 15,000 58,00

equal to

transferred 0

a. The amount of material or conversion cost necessary

in

to complete one unit of production

20,400 25,500 18,400

64,30

b. A unit of work-in-process inventory

0

c. The amount of material or conversion cost necessary to

Conversion costs were 20% complete as to the beginning

start a unit of production in work-in-process

work in process and 40% complete as to the ending work in

d. Fifty percent of material or conversion cost of a unit of

process. All materials are added at the end of the process.

finished goods inventory (assuming a linear production

Loren uses the weighted-average method.

pattern)

14. The portion of the total cost of ending work in

5. The percentage of completion of the beginning work-in-

process attributable to transferred in cost is

process inventory should be considered in the

computation of the equivalent units of production for

Problem M = Information for the month of May concerning

which of the following methods of process costing

Department A, the first stage of Leo Corporations production

FIFO Weighted Average

cycle, is as follows:

a Yes No

Materials Conversion

b Yes Yes

Costs

c No Yes

Work in process, beginning 4,000 3,000

d. No No

Current costs 20,000 16,000

Total Costs 24,000 19,000

6. The units transferred in from the first department to the

Equivalent units based on

second department should be included in the computation of

weighted-average method 100,000 95,000

the equivalent units for the second department under which

Average unit costs 0.24 0.20

of the following method of process costing?

Goods completed 90,000 units

FIFO Weighted Average

Work in process, end 10,000 units

a Yes Yes

Materials costs are added at the beginning of the process. The

b Yes No

ending work in process is 50% complete as to conversion

c No Yes

costs. How would the total cost account for the distributed,

d. No No

using the weighted-average method?

15. Total cost of Goods Completed. 7. In a given process costing system, the equivalent units of

16. Total cost of Work in Process End production are computed using the weighted average method.

With respect to conversion costs, the percentage of

Problem N = Under FIFO METHOD completion for the current period is included the calculation of

Quantity Actual Materials Labor Overhead the

Schedule Units WD EUP WD EUP WD EUP Beginning Work in Ending Work-in

In process ? ? ? ? Process Inventory Process Inventory

beginning a No No

Started this 14,000 b No Yes

period c Yes No

Total ?

d. Yes Yes

Completed and 8. In a process costing system, how is the unit cost affected in

transferred a production cost report when materials are added in a

In process ? ? ? 75% 1,500 45% ? department subsequent to the first department and the added

beginning materials result in additional units?

Started this ? ? ? ? a. The first department unit cost is increased which

period necessitates an adjustment of the transferred in unit cost

In process end 1,500 ? ? ? ? 20% ? b. The first department unit cost is decreased which

Total ? 14,750 ? necessitates an adjustment of the transferred in unit cost

Materials is added 30% at the start, plus 30% when 50% c. The first department unit cost is increased but it does not

complete as to labor and the remaining 40% is added only necessitates an adjustment of the transferred in unit cost

when the products are 90& completed as to labor. d. The first department unit cost is decreased but it does not

necessitates an adjustment of the transferred in unit cost

Assuming the IP beg cost is P5,000, current cost per units for

Materials is P5.50, Labor is P8.25, and overhead is P6.25. Notes:

a. If the problem does not specify the inspection point, it is

Determine the following: assumed that the loss discovered at the beginning

17. EUP Materials b. If the problem does not specify if it is normal loss or

18. EUP Materials of In Process - Ending abnormal loss, it should be consider as normal loss.

19. EUP Overhead

Вам также может понравиться

- Chapter 11: Allocation of Joint Costs and Accounting For By-ProductsДокумент100 страницChapter 11: Allocation of Joint Costs and Accounting For By-Productsmoncarla lagonОценок пока нет

- QUIZ REVIEW Homework Tutorial Chapter 5Документ5 страницQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoОценок пока нет

- DocДокумент3 страницыDocWansy Ferrer BallesterosОценок пока нет

- Practice Set 2 (Cost Segregation and CVP)Документ2 страницыPractice Set 2 (Cost Segregation and CVP)Jessica Aningat0% (1)

- Midterms 201 NotesДокумент6 страницMidterms 201 NotesLyn AbudaОценок пока нет

- Activity 1 Cost Concepts and Cost BehaviorДокумент2 страницыActivity 1 Cost Concepts and Cost BehaviorLacie Hohenheim (Doraemon)Оценок пока нет

- PPE Government Grant Borrowing Cost Intangible AssetsДокумент7 страницPPE Government Grant Borrowing Cost Intangible AssetsLian Garl100% (4)

- Name: - : Problem 1Документ2 страницыName: - : Problem 1Samuel FerolinoОценок пока нет

- CEL 1 PRAC 1 Answer KeyДокумент12 страницCEL 1 PRAC 1 Answer KeyRichel ArmayanОценок пока нет

- Orn 31 PDFДокумент82 страницыOrn 31 PDFRaghavОценок пока нет

- Cost Accounting - Q15Документ1 страницаCost Accounting - Q15rowilson reyОценок пока нет

- Process1 Process2 Process3Документ2 страницыProcess1 Process2 Process3Darwin Competente LagranОценок пока нет

- ReviewerДокумент5 страницReviewermaricielaОценок пока нет

- ProblemsДокумент9 страницProblemsMark Angelo AlvarezОценок пока нет

- Standard Costing PSBA ManilaДокумент11 страницStandard Costing PSBA ManilaXXXXXXXXXXXXXXXXXXОценок пока нет

- D12Документ12 страницD12neo14Оценок пока нет

- Intermediate Accounting Exercise 2 FinalsДокумент2 страницыIntermediate Accounting Exercise 2 FinalsJune Maylyn MarzoОценок пока нет

- D15Документ12 страницD15neo14Оценок пока нет

- Process Costing SWДокумент2 страницыProcess Costing SWChristine AltamarinoОценок пока нет

- Chapter 12-14Документ18 страницChapter 12-14Serena Van Der WoodsenОценок пока нет

- Bsa 2202 SCM PrelimДокумент17 страницBsa 2202 SCM PrelimKezia SantosidadОценок пока нет

- Answer Value 800000Документ1 страницаAnswer Value 800000Kath LeynesОценок пока нет

- ReviewerДокумент6 страницReviewerSamuel FerolinoОценок пока нет

- Activity Based Costing ReviewerДокумент1 страницаActivity Based Costing ReviewerJonna LynneОценок пока нет

- Review 105 - Day 15 P1Документ12 страницReview 105 - Day 15 P1John De Guzman100% (1)

- Drill#1Документ5 страницDrill#1Leslie BustanteОценок пока нет

- Assignment 4 - CVPДокумент12 страницAssignment 4 - CVPAlyssa BasilioОценок пока нет

- MA CUP PracticeДокумент9 страницMA CUP PracticeFlor Danielle Querubin100% (1)

- Job OrderДокумент9 страницJob OrderMaybelleОценок пока нет

- Cgu ProblemsДокумент2 страницыCgu ProblemsAlizeyyОценок пока нет

- Leslie Company Manufacturing Department Cost of Production Report For January Materials Conversion CostДокумент8 страницLeslie Company Manufacturing Department Cost of Production Report For January Materials Conversion Costmaica G.Оценок пока нет

- Identify The Choice That Best Completes The Statement or Answers The QuestionДокумент5 страницIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoОценок пока нет

- Pre-Test 5Документ3 страницыPre-Test 5BLACKPINKLisaRoseJisooJennieОценок пока нет

- MAS 3 - Standard Costing For UploadДокумент9 страницMAS 3 - Standard Costing For UploadJD SolañaОценок пока нет

- Additional Problems DepnRevaluation and ImpairmentДокумент2 страницыAdditional Problems DepnRevaluation and Impairmentfinn heartОценок пока нет

- Problem 17-1, ContinuedДокумент6 страницProblem 17-1, ContinuedJohn Carlo D MedallaОценок пока нет

- Finals Q3 - PPE Problems PDFДокумент8 страницFinals Q3 - PPE Problems PDFCzerielle Queens0% (1)

- Receivable Practice Problem 1Документ2 страницыReceivable Practice Problem 1ayeeeОценок пока нет

- Costacc HWДокумент2 страницыCostacc HWRikka Takanashi100% (1)

- Practical Accounting 2Документ4 страницыPractical Accounting 2RajkumariОценок пока нет

- Saint Joseph College of Sindangan Incorporated College of AccountancyДокумент18 страницSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- Quiz No. 1 Part 3 Multiple Choice Problems Attempt ReviewДокумент1 страницаQuiz No. 1 Part 3 Multiple Choice Problems Attempt ReviewEly RiveraОценок пока нет

- On January 1Документ3 страницыOn January 1Jude Santos0% (1)

- 2009-09-06 125024 MmmmekaДокумент24 страницы2009-09-06 125024 MmmmekathenikkitrОценок пока нет

- Interim Financial Reporting: Problem 45-1: True or FalseДокумент7 страницInterim Financial Reporting: Problem 45-1: True or FalseMarjorieОценок пока нет

- Finals Quiz 2 Buscom Version 2Документ3 страницыFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesОценок пока нет

- Cost AccountingДокумент6 страницCost AccountingValierry VelascoОценок пока нет

- Seatwork # 1Документ2 страницыSeatwork # 1Joyce Anne GarduqueОценок пока нет

- Acctg201 PCLossesLectureNotesДокумент17 страницAcctg201 PCLossesLectureNotesSophia Marie Eredia FerolinoОценок пока нет

- D. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Документ14 страницD. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Ferb CruzadaОценок пока нет

- Exercise 1: Assignment: Accounitng For Materials (Adapted)Документ2 страницыExercise 1: Assignment: Accounitng For Materials (Adapted)Charles TuazonОценок пока нет

- Cost Acctg. - HO#9Документ5 страницCost Acctg. - HO#9JOSE COTONER0% (1)

- ABC ProblemsДокумент2 страницыABC Problemsxenon cloudОценок пока нет

- Cost Accounting Chapter1Документ6 страницCost Accounting Chapter1Jhon Ariel JulatonОценок пока нет

- 12Документ2 страницы12Carlo ParasОценок пока нет

- Job Order CostingДокумент51 страницаJob Order CostingKenneth TallmanОценок пока нет

- Pract 1 - Exam2Документ2 страницыPract 1 - Exam2Sharmaine Rivera MiguelОценок пока нет

- 1398236Документ3 страницы1398236mohitgaba19Оценок пока нет

- Docxdocx 53 PDF FreeДокумент61 страницаDocxdocx 53 PDF FreeJamaica DavidОценок пока нет

- Exercise 7 Process Costing ProblemsДокумент5 страницExercise 7 Process Costing ProblemsKimОценок пока нет

- AFAR Self Test - 9004Документ4 страницыAFAR Self Test - 9004King MercadoОценок пока нет

- Living Things Cells Genes: Transfer of Genetic InformationДокумент1 страницаLiving Things Cells Genes: Transfer of Genetic InformationYour MaterialsОценок пока нет

- Name: Martinez, Jeffrey G. Date: July 1, 2017: Clara Lim-SyliancoДокумент10 страницName: Martinez, Jeffrey G. Date: July 1, 2017: Clara Lim-SyliancoYour MaterialsОценок пока нет

- Training Schedule & Duties/Training PlanДокумент1 страницаTraining Schedule & Duties/Training PlanYour MaterialsОценок пока нет

- Solutions Manual Internal Auditing2015Документ3 страницыSolutions Manual Internal Auditing2015Your Materials75% (8)

- DocДокумент5 страницDocYour Materials33% (3)

- Employment LetterДокумент1 страницаEmployment LetterYour MaterialsОценок пока нет

- VA and HAДокумент9 страницVA and HAYour MaterialsОценок пока нет

- Morning in Nagrebcan: Systems Plus College FoundationДокумент8 страницMorning in Nagrebcan: Systems Plus College FoundationYour Materials100% (1)

- Group 4 Pandan LeavesДокумент1 страницаGroup 4 Pandan LeavesYour MaterialsОценок пока нет

- For The Period - November 01-15, 2016Документ3 страницыFor The Period - November 01-15, 2016Your MaterialsОценок пока нет

- ProblsДокумент3 страницыProblsYour MaterialsОценок пока нет

- Brief History - General Information: D Japan in 1590, andДокумент8 страницBrief History - General Information: D Japan in 1590, andYour MaterialsОценок пока нет

- Tourism: Activity in Finals (2 Semester)Документ2 страницыTourism: Activity in Finals (2 Semester)Your MaterialsОценок пока нет

- Footnote To YouthДокумент28 страницFootnote To YouthYour MaterialsОценок пока нет

- Take Home Quiz 1Документ9 страницTake Home Quiz 1Your MaterialsОценок пока нет

- Systems Plus College FoundationДокумент3 страницыSystems Plus College FoundationYour MaterialsОценок пока нет

- Directly Chargeable Overhead Cost Building Depreciation Janitorial Cost Materials Receiving Cost Power Total Allocated Overhead CostДокумент9 страницDirectly Chargeable Overhead Cost Building Depreciation Janitorial Cost Materials Receiving Cost Power Total Allocated Overhead CostYour MaterialsОценок пока нет

- Book 1Документ6 страницBook 1Your MaterialsОценок пока нет

- EGYPTДокумент2 страницыEGYPTYour MaterialsОценок пока нет

- Other People and Especially Myself by Learning About Aspects of Human Behavior That Will Help Me in Daily LifeДокумент1 страницаOther People and Especially Myself by Learning About Aspects of Human Behavior That Will Help Me in Daily LifeYour MaterialsОценок пока нет

- Brain Imaging Techniques and HemisphereДокумент4 страницыBrain Imaging Techniques and HemisphereYour MaterialsОценок пока нет

- TB CH 4Документ44 страницыTB CH 4Your MaterialsОценок пока нет

- Takehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionДокумент3 страницыTakehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionYour MaterialsОценок пока нет

- Manual HPOD 100 KДокумент86 страницManual HPOD 100 KLuis Guillermo SandovalОценок пока нет

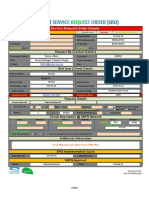

- Service Request Order DetailsДокумент4 страницыService Request Order DetailsKashif NaeemОценок пока нет

- Kleyn Successful (2012) G1 MaterialДокумент9 страницKleyn Successful (2012) G1 MaterialcarlmarxОценок пока нет

- 10.1 Quantum Mechanics in CrystalsДокумент16 страниц10.1 Quantum Mechanics in CrystalsHarrier AlphaОценок пока нет

- ProblemsДокумент1 страницаProblemsBeesam Ramesh KumarОценок пока нет

- Web Application TORДокумент3 страницыWeb Application TORFaxikko FazyОценок пока нет

- Mathematics Research Paper SampleДокумент7 страницMathematics Research Paper Samplexwrcmecnd100% (1)

- Kohler 50 PDFДокумент4 страницыKohler 50 PDFĐại DươngОценок пока нет

- HDM-4 VOC Configuration For NigeriaДокумент120 страницHDM-4 VOC Configuration For NigeriaOladunni AfolabiОценок пока нет

- Fetal Pig Dissection Lab Aol RubricДокумент3 страницыFetal Pig Dissection Lab Aol Rubricapi-337244272Оценок пока нет

- Termination and Resumptive ModelДокумент2 страницыTermination and Resumptive ModelOnline ClassesОценок пока нет

- ACCT 434 Midterm Exam (Updated)Документ4 страницыACCT 434 Midterm Exam (Updated)DeVryHelpОценок пока нет

- Unit No-01: Ashok Institute of Engineering & Technology, PolytechnicДокумент4 страницыUnit No-01: Ashok Institute of Engineering & Technology, PolytechnicPrathmesh BadheОценок пока нет

- Sudan University of Science and Technology College of Graduate Studies Department of Electrical EngineeringДокумент85 страницSudan University of Science and Technology College of Graduate Studies Department of Electrical EngineeringAbdel-Rahman Saifedin Arandas100% (1)

- ExponentsДокумент5 страницExponentsarmailgm100% (1)

- Pad or 9118Документ56 страницPad or 9118cooltechsolutionsОценок пока нет

- Conventional ToolingДокумент108 страницConventional Toolingreginaldo joseОценок пока нет

- Matlab Fundamental 1Документ5 страницMatlab Fundamental 1duc anhОценок пока нет

- XAM IDEA Mathematics Sample Papers Class 10 2023Документ238 страницXAM IDEA Mathematics Sample Papers Class 10 2023anonymousОценок пока нет

- Parameters For IPG-X4-WQДокумент6 страницParameters For IPG-X4-WQMaksim MaksimovicОценок пока нет

- CD - CH2 - Lexical AnalysisДокумент67 страницCD - CH2 - Lexical AnalysisfanОценок пока нет

- Us8801359 PDFДокумент49 страницUs8801359 PDFfermeskopОценок пока нет

- Nverse Gas ChromatographyДокумент5 страницNverse Gas ChromatographySenthil KumarОценок пока нет

- Unit 5 Digital MetersДокумент9 страницUnit 5 Digital Metersazhar3303Оценок пока нет

- 6-Design of Vertical Drains-30-Aug-2019Material I 30-Aug-2019 Preloading TechniqueДокумент29 страниц6-Design of Vertical Drains-30-Aug-2019Material I 30-Aug-2019 Preloading TechniquesadacdszdcОценок пока нет

- Design of Rocker-Bogie Mechanism (Major 2)Документ40 страницDesign of Rocker-Bogie Mechanism (Major 2)saurabh rajakОценок пока нет

- 10 1 1 1025 6490Документ8 страниц10 1 1 1025 6490Pach PachecoОценок пока нет

- Sentence Correction Flash CardsДокумент20 страницSentence Correction Flash CardsPradebban RajaОценок пока нет

- Seasonal Variation of Phytoplankton in Mahanadi EsДокумент8 страницSeasonal Variation of Phytoplankton in Mahanadi EsFor NewslettersОценок пока нет