Академический Документы

Профессиональный Документы

Культура Документы

Part B Exit and Withdrawal

Загружено:

malaynvАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Part B Exit and Withdrawal

Загружено:

malaynvАвторское право:

Доступные форматы

PART B : INFORMATION ON EXIT & WITHDRAWAL

Withdrawal & Exit: The Exit & Withdrawal under NPS shall entire accumulated pension wealth without purchasing any d) Treatment for prescribed illnesses suffered by

be in accordance with PFRDA(Exit & Withdrawals under NPS) annuity . subscriber, his legally wedded spouse, children including a

Regulation 2015. It is advised that one should go through said (iii) If the accumulated pension wealth of the subscriber is legally adopted child and dependent parents.

regulation thoroughly for the proper understanding of the more than one lakh rupees but the age of the subscriber is The above withdrawal shall be subject to the condition that:

same and these regulation are available on our website at less than the minimum age required for purchasing any a) The subscriber should have been in NPS for at least ten

www.pfrda.org.in. However, for the sake of clarity the salient annuity from any of the empanelled annuity service providers years from the date of his or her joining.

feature of the said regulation are provided below for enabling as chosen by such subscriber, such subscriber shall continue b) Subscriber shall be allowed to withdraw a maximum of

subscriber to understand implication: to subscribe to the National Pension System, until he or she three (3) times from the scheme and not less than a period

A. On attaining the age of superannuation (retirement): attains the age of eligibility for purchase of any annuity of 5 years should have elapsed from the last date of such

C. Death before superannuation: withdrawal. However, the mandatory requirement of 5 years

(i) Upon attaining the age of superannuation as

(i) The subscriber who, before attaining the age of having elapsed between two withdrawals shall not apply in

prescribed by the service rules applicable to him or her,

superannuation, dies, then at least 80% out of the case of treatment for prescribed illnesses or in case of

retires, then at least 40% out of the accumulated pension

accumulated pension wealth of the subscriber shall be Withdrawal arising out of exit from National Pension System

wealth of such subscriber shall be mandatorily utilized for

mandatorily utilized for purchase of annuity similar to default due to the death of the subscriber. Detailed guidelines on

purchase of annuity providing for a monthly or any other

annuity and balance pension wealth shall be paid as lump the partial withdrawal has been issued vide circular no-

periodical pension and the balance of the accumulated

sum to the nominee or nominees or legal heirs, as the case PFRDA/20016/7/exit /2 dated 21-03-2016 :

pension wealth, after such utilization, shall be paid to the

may be, of such subscriber

subscriber in lump sum. The Subscriber may choose to Online Exit withdrawal- In order to simplify and streamline

purchase an annuity for an amount greater than 40 percent (ii) Corpus <= Rs. 2.00 Lakh : If amount in the PRAN of the

the exit and withdrawal claims, PFRDA has introduced the

also. subscriber at the time of his death is equal to or less than two

online faclity for withdrawal process. The circular dated

lakh rupees, the nominee or legal heirs as the case may be,

(ii) Deferment of lump sum: The lump sum can be deferred 12.11.2015 in relation to the same is uploaded on PFRDAs

shall have the option to withdraw the entire accumulated

which can be withdrawn at any time between superannuation website.

pension wealth without requiring to purchase any annuity and

and 70 or every year till age of 70 years, subscriber has to

upon such exercise of this option the right of the family Annuity: Annuity provides for monthly pay-outs to the

give in writing in the specified form at least fifteen days

members to receive any pension or other amounts under the individual in lieu of the lump sum amount paid to the Annuity

before the attainment of age of superannuation ,provided the

National Pension System shall extinguish. Service Provider (ASP) from NPS scheme as per percentage

subscriber agrees to bear the maintenance charges like CRA ,

(iii) If the subscriber or the family members of the deceased specified by the subscriber at the time of exit.

PFM etc.

subscriber, upon his death, avails the option of additional relief

(iii) Deferment of annuity: Annuity purchase can also be on death or disability provided by the Government, the Default Annuity: If subscriber is not able to decide the type of

deferred for maximum period of 3 years. Subscriber has to Government shall have right to adjust or seek transfer of the annuity , an option of default annuity has been provided. In

give in writing in the specified form at least fifteen days before entire accumulated pension wealth of the subscriber to itself. this annuity, annuity is paid to subscriber, spouse, mother &

the attainment of age of superannuation. If the death of the The subscriber or family members of the subscriber availing father of the subscriber in this sequence with provision for

subscriber occurs before such due date of purchase of an such benefit shall specifically and unconditionally agree and return of purchase price of the annuity to the nominee in case

annuity after the deferment, the annuity shall mandatorily be undertake to transfer the entire accumulated pension wealth of death of all above.

purchased by the spouse. to the Government. There are following other variants of annuity, if subscriber is

(iv) Corpus <= Rs. 2.00 Lakh: Option to withdraw complete not opting for default annuity:

pension wealth (Only in superannuation cases). D. Partial Withdrawals from NPS before Exit : A subscriber (i) Annuity for life no return of purchase price.

B. Exit before attaining the superannuation age or shall be permitted to withdraw not exceeding twenty-five (ii) Annuity guaranteed for 5, 10, 15 or 20 years and for life

percent (25%) of the contribution made by him individual thereafter

voluntary retirement :

pension account (PRAN) for any of the following purposes (iii) Annuity for life with return of purchase price on death

(i) Before attaining the age of superannuation or voluntary

only: (iv) Annuity for life increasing at simple rate of 3% p.a.--

retirement , 80% out of the accumulated pension wealth of

a) For Higher education of his/her children including a payment of annuity ceases on death.

such subscriber shall be mandatorily utilized for purchase of

legally adopted child. (v) Annuity for life with a provision for 50% of the annuity to

default annuity providing for a monthly or any other periodical

b) For the marriage of his/her children, including a legally the spouse of the annuitant for life on death of the annuitant.

pension and the balance of the accumulated pension wealth,

adopted child.

after such utilization, shall be paid to the subscriber in lump Annuity Service Provider and Annuity Scheme shall be

c) For the purchase/construction of residential house or flat.

sum. provided strictly in accordance by choice made by the

In case, the subscriber already owns either individually or in

(ii) Corpus <= Rs. 1.00 Lakh : If the accumulated pension subscriber at the time of exit from NPS. The details of the

the joint name a residential house or flat, other than

wealth of the subscriber is equal to or less than one lakh empanelled ASPs, types of annuity offered and annuity

ancestral property, no withdrawal under these regulations

rupees, such subscriber shall have the option to withdraw the calculators are available at web link on CRA website.

shall be permitted.

Вам также может понравиться

- LeafletДокумент4 страницыLeafletmalaynvОценок пока нет

- Effectiveness in SupervisionДокумент3 страницыEffectiveness in SupervisionmalaynvОценок пока нет

- Jeep Compass BrochureДокумент53 страницыJeep Compass BrochuremalaynvОценок пока нет

- Crane Operation Manual PDFДокумент23 страницыCrane Operation Manual PDFcippolippo123100% (1)

- Website:: Amundi)Документ64 страницыWebsite:: Amundi)malaynvОценок пока нет

- App For IAP Immunization Timetable 2013Документ13 страницApp For IAP Immunization Timetable 2013malaynvОценок пока нет

- Part A Govt Brochure PDFДокумент2 страницыPart A Govt Brochure PDFmalaynvОценок пока нет

- D3300 SG (En) 02Документ144 страницыD3300 SG (En) 02Christer John UyОценок пока нет

- Mutual Fund:: Asset Management CompanyДокумент43 страницыMutual Fund:: Asset Management CompanymalaynvОценок пока нет

- Kindergarten Class List 2016-2017 - St. Mary's School (I.c.s.eДокумент4 страницыKindergarten Class List 2016-2017 - St. Mary's School (I.c.s.emalaynvОценок пока нет

- Meaning of NameДокумент129 страницMeaning of NamemalaynvОценок пока нет

- Affordable CatalogueДокумент16 страницAffordable Cataloguebinod8860Оценок пока нет

- Linear ProgrammingДокумент66 страницLinear ProgrammingKarthikeyan Tamilselvam0% (1)

- Mahindra Thar BrochureДокумент5 страницMahindra Thar BrochuremalaynvОценок пока нет

- FinanceДокумент4 страницыFinancemalaynvОценок пока нет

- Change LogДокумент10 страницChange LogmalaynvОценок пока нет

- Crane Operation Manual PDFДокумент23 страницыCrane Operation Manual PDFcippolippo123100% (1)

- Renault Duster BrochureДокумент16 страницRenault Duster Brochureyajax12Оценок пока нет

- 15-Yr-Old Overslept, Missed School. Is Now Only Survivor From Class IXДокумент1 страница15-Yr-Old Overslept, Missed School. Is Now Only Survivor From Class IXmalaynvОценок пока нет

- Flashproxy Reg Url.1Документ2 страницыFlashproxy Reg Url.1Govind ManglaniОценок пока нет

- RBIДокумент84 страницыRBISathish KumarОценок пока нет

- 2011 Salary Survey All SectorsДокумент15 страниц2011 Salary Survey All SectorsmalaynvОценок пока нет

- Financial Ratios TutorialДокумент54 страницыFinancial Ratios Tutorialapi-27605522Оценок пока нет

- Ecosport Brochure PDFДокумент9 страницEcosport Brochure PDFManojj NatarrajanОценок пока нет

- GMAT Og 11th Edition - CRДокумент166 страницGMAT Og 11th Edition - CRmalaynv100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Double Entry SystemДокумент17 страницDouble Entry SystemDastaan Ali100% (1)

- Car InsuranceДокумент13 страницCar InsuranceDipayan SatpathyОценок пока нет

- Auditing Icwai Group I Objective Type Questions and Answers: Narayan@icwahelpn - Co.inДокумент11 страницAuditing Icwai Group I Objective Type Questions and Answers: Narayan@icwahelpn - Co.inHaider ShoaibОценок пока нет

- Analysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabraДокумент59 страницAnalysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabravishalbehereОценок пока нет

- Heuristic Analysis of "Growth of PayTM"Документ10 страницHeuristic Analysis of "Growth of PayTM"Sumit BasantrayОценок пока нет

- Govacctg New PDFДокумент190 страницGovacctg New PDFJasmine Lim100% (1)

- Technology in BankingДокумент92 страницыTechnology in BankingJason Amaral100% (2)

- Development Bank of The Philippines vs. Prudential BankДокумент2 страницыDevelopment Bank of The Philippines vs. Prudential BankKaye Miranda LaurenteОценок пока нет

- Clean Energy Handbook For Financial Service InstitutionДокумент227 страницClean Energy Handbook For Financial Service Institutionhannyjberchmans-1Оценок пока нет

- FIRS's Circular On The Tax Implications of The Adoption of The IFRSДокумент19 страницFIRS's Circular On The Tax Implications of The Adoption of The IFRSOnaderu Oluwagbenga EnochОценок пока нет

- Mandate PDFДокумент3 страницыMandate PDFM AzeemОценок пока нет

- Fee Decleration FormДокумент2 страницыFee Decleration FormMohit MohanОценок пока нет

- BCOM V Sem - Principles of Insurance Business - Unit II NotesДокумент3 страницыBCOM V Sem - Principles of Insurance Business - Unit II NotesMona Sharma DudhaleОценок пока нет

- Articles of AgreementДокумент2 страницыArticles of AgreementMd Rajikul IslamОценок пока нет

- SSSForm Retirement ClaimДокумент3 страницыSSSForm Retirement ClaimMark JosephОценок пока нет

- Bankers' Books Evidence Act 1879Документ7 страницBankers' Books Evidence Act 1879Jo JoОценок пока нет

- Premium Paid Acknowledgement PDFДокумент1 страницаPremium Paid Acknowledgement PDFPragna NachikethaОценок пока нет

- PDFДокумент14 страницPDFBeboy Paylangco EvardoОценок пока нет

- Bhamasha SheetsДокумент1 130 страницBhamasha SheetsGaming GurujiОценок пока нет

- Dec 2021. VattamДокумент11 страницDec 2021. VattamsadaSivaОценок пока нет

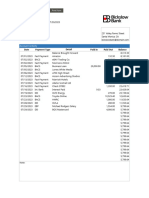

- Bank Statement TemplateДокумент1 страницаBank Statement TemplateChristina MaierОценок пока нет

- BUSANA1 Chapter 4: Sinking FundДокумент17 страницBUSANA1 Chapter 4: Sinking Fund7 bitОценок пока нет

- Batch 17 1st Preboard (P1) No AnswerДокумент6 страницBatch 17 1st Preboard (P1) No AnswerAngelica manaoisОценок пока нет

- FTI Consulting ReportДокумент98 страницFTI Consulting ReportJohn E. Mudd100% (1)

- Harnden v. State Farm Mut. Auto. Ins. Co., CUMcv-09-289 (Cumberland Super. CT., 2010)Документ9 страницHarnden v. State Farm Mut. Auto. Ins. Co., CUMcv-09-289 (Cumberland Super. CT., 2010)Chris BuckОценок пока нет

- Comp. LetterДокумент1 страницаComp. LettersuyogsangoleОценок пока нет

- Visa Prepaid - Myanma Apex BankДокумент2 страницыVisa Prepaid - Myanma Apex BankMyo NaingОценок пока нет

- Account Statement From 1 Jul 2021 To 31 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент6 страницAccount Statement From 1 Jul 2021 To 31 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAJОценок пока нет

- Attach File Bbs BBS 4 3-2 ProjectLoan N EquipmentLoanДокумент4 страницыAttach File Bbs BBS 4 3-2 ProjectLoan N EquipmentLoanRovita TriyambudiОценок пока нет

- 5 Mercantile Law Bar Questions and Answers (2007-2017) PDFДокумент146 страниц5 Mercantile Law Bar Questions and Answers (2007-2017) PDFAngelica Fojas Rañola100% (6)