Академический Документы

Профессиональный Документы

Культура Документы

ISSN: 0975-833X Recent Trends in Banking Sector - Challenges and Opportunities Binija George Challenges and Opportunities

Загружено:

jothiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ISSN: 0975-833X Recent Trends in Banking Sector - Challenges and Opportunities Binija George Challenges and Opportunities

Загружено:

jothiАвторское право:

Доступные форматы

z

Available online at http://www.journalcra.com

INTERNATIONAL JOURNAL

OF CURRENT RESEARCH

International Journal of Current Research

Vol. 7, Issue, 10, pp.21913-21915, October, 2015

ISSN: 0975-833X

REVIEW ARTICLE

RECENT TRENDS IN BANKING SECTOR ---- CHALLENGES AND OPPORTUNITIES

*Binija George

Department of Commerce, Mar Thoma College, Chungathara, Nilambur, Affiliated to University of Calicut

ARTICLE INFO ABSTRACT

Article History: The banking industry in India has a huge canvas of history, which covers the traditional banking

Received 20th July, 2015 practices from the time of Britishers to the reforms period. Therefore, banking in India has been

Received in revised form through a long journey. Today banking is known as innovative banking. The use of technology has

29th August, 2015 brought a revolution in the working style of the banks. Information Technology has had a positive

Accepted 25th September, 2015 impact

mpact on substitutes for traditional funds movement services. With networking and interconnection

Published online 31st October, 2015 new challenges are arising related to security privacy and confidentiality to transactions. In this paper,

an attempt is made to explain the changing banking scenario. The study also identifies the challenges

Key words: and opportunities for the Indian banking sector in changing banking scenario.

Networking, IT,

Internet Security,

Global Banking, NPA.

Copyright 2015 Binija George. This is an open access article distributed under the Creative Commons Attribution

Attribution License, which permits unrestricted use,

distribution, and reproduction in any medium, provided the original work is properly cited.

Recent trends in banking sector ---- challenges and opportunities, International Journal of Current

Citation: Binija George, 2015. Recent

Research, 7, (10), 21913-21915.

INTRODUCTION Methodology Used

The traditional functions of banking are limited to accept

deposit and to give loans and advances. Today banking is The study is based on secondary data. The sources of

known as innovative banking. Current banking sector has come secondary data include banking books, annual reports of RBI,

up with a lot of initiatives that oriented to provide a better Internet (websites) and research papers etc.

customer services with the help of new technologies. Indian

banking sector today has the same sense of excitement and Structure of Indian banking sector

opportunity that is evidence in the Indian economy. In the

competitive banking world improvement day by day in Today, role of banking industry is very im

important as one of the

customer services is the most useful tool for their better leading and mostly essential service sector. Banking Industry

growth. Bank offers so many changes to access their banking in India functions under the sunshade of Reserve Bank of India

and other services. Banks play an important role in the - the regulatory central bank. Banking industry mainly consists

economic development

lopment of developing countries. Economic of

development involves investment in various sectors of the

economy. In normal banking, the banks perform agency ---------- Commercial banks

services for their customers and helps economic development ---------- Co-operative banks

of the country. Bank arranges foreign exchange

nge for the business

transactions with other countries. Banking sectors are not The commercial banking structure in India consists of

simply collecting funds but also serve as a guide to the

customer about the investment of their money. ----- Scheduled commercial banks

----- Unscheduled bank

Objectives of study

Scheduled commercial banks constitute those banks which

To explain the changing banking scenario have been included in the second schedule of Reserve Bank of

To identify

y the challenges for the Indian banking sector India (RBI) Act, 1934. For the purpose of assessment of

To study the opportunities for the Indian banking sector performance of banks, the RBI categorise them as public sector

banks, old private sector banks, new private sector banks and

*Corresponding author: Binija George, foreign banks.

Dept. of Commerce, Mar Thoma College, Chungathara, Nilambur,

Affiliated to University of Calicut, India.

21914 Binija George, Recent trends in banking sector ---- Challenges and opportunities

The Commercial banking structure in India

Present Scenario Competition in banking sector brings various challenges before

the banks such as product positioning, innovative ideas and

The present banking scenario provides a lot of opportunities as channels and new market trends. Banks are restricting their

well as facing lot of challenges also. India is being administrative folio by converting manpower into machine

fundamentally strong supported by concrete economic policies, power.ie, banks are decreasing manual powers and getting

decisions and implementations by the Indian Government. maximum work done through machine power. Skilled and

Today in India, the service sector is contributing half of the specialised manpower is to be utilised and result oriented

Indian GDP and the banking is most popular service sector in targeted staff will be appointed.

India. The significant role of banking industry is essential to

speed up the social economic development. To improve major Global Banking

areas of banking sector, Government of India, RBI and

It is practically and fundamentally impossible for any nation to

Ministry of finance have made several notable efforts. Many of

exclude itself from world economy. Therefore, for sustainable

leading banks operating in market have made use of the

development, one has to adopt integration process in the form

changed rules and regulations such as CRR, interest rate,

of liberalization and globalization as India spread the red

special offers to the customers such as to open account in Zero

carpet for foreign firms in 1991. The impact of globalization

balance. In addition to this, now a days banks are entered in

becomes challenges for the domestic enterprises as they are

non-banking products such as insurance in which area there are

bound to compete with global players. The foreign banks

tremendous opportunities.

operating in India, becomes a major challenge for nationalised

Challenges faced by the banking sector and private sector banks. These banks are large in size,

technically advanced and having presence in global market,

Customer satisfaction which gives more and better options and services to Indian

traders.

Today, in banking sector customers are more value oriented in

their services because they have alternative choices in it. So Growth of Banking

that each and every bank have to take care about fulfilling Zhao, Casu and Ferrari (2008) used a balanced panel data set

customers satisfaction. covering the period of 1992-2004 and employing a Data

Envelopment Analysis (DEA) based Total Factor Productivity

To provide several personnel services (TFP) index. The empirical study indicated that after an initial

Today, it is demanded that banks are to provide several adjustment phase, the Indian Banking Industry experienced

services for which they have to expand their service, social sustained productivity growth, which was driven mainly by

banking with financial possibilities, computerisation and technological progress. Foreign banks appear to have acted as

innovative mechanization, better customer services, internal technological innovators when competition increased, which

supervision and control, adequate profitability, strong added to the competitive pressure in the banking market. It was

organisation culture etc. Therefore banks must be able to found in the study of Goyal and Joshi (2011) that small and

provide complete personal service to the customers who comes local banks face difficulty in bearing the impact of global

with expectations. economy. Therefore, they need support and it is one of the

reasons for merger. ICICI Bank Ltd has used mergers as their

Competition expansion strategy in rural market. They are successful in

making their presence in rural India. It strengthens their

The nationalized banks and commercial banks have the network across geographical boundary improves customer base

competition from foreign and new private sector banks. and market share.

21915 International Journal of Current Research, Vol. 7, Issue, 10, pp.21913-21915, October, 2015

Managing Technology

Offering various channels

Developing or acquiring the right technology, deploying it

optimally and then leveraging it to the maximum extent is Banks can offer so many channels to access their banking and

essential to achieve and maintain high service and efficiency other services such as ATM, Local branches,

standards while remaining cost effective and delivering Telephone/Mobile banking, Video banking etc. to increase the

sustainable return to shareholders. Early adopters of banking business.

technology acquire significant competitive advantages.

Managing technology is therefore, a key challenge for the Product Differentiation

Indian Banking Sector.

Apart from traditional banking services, Indian Banks must

Market Discipline and Transparency adopt some product innovation so that they can compete in

gamut of competition

According to Fernando (2011) transparency and disclosure

norms as part of internationally accepted corporate governance Expansion

practices are assuming greater importance in the emerging

Expansion of branch size in order to increase market share is

environment. Banks are expected to be more responsive and

another opportunity to combat competitors. Therefore Indian

accountable to the investors. Banks have to disclose in their

nationalised and commercial banks must spread their wings

Balance sheets a plethora of information on the maturity

towards global markets as some of them have already done it.

profiles of assets and liabilities, movements in NPAs, capital,

shareholdings of the government, value of investment in India Conclusion

and abroad, the total investment made in the equity share,

bonds, debentures, aggregate advances against shares and so Indian banks are trust worthy brands in Indian market,

on. therefore these banks must utilise their brand equity as it is a

valuable asset for them. The paper discusses the various

Other Challenges challenges and opportunities like transparency, growth in

banking sector, global banking, managing technology etc.

Development of skill of bank personnel Banks are striving to combat the competition. The competition

Customer awareness and satisfaction from global banks and technological innovation has compelled

Changing needs of customers the banks to rethink their policies and strategies. Finally the

Lack of common technology standards for mobile banking banking sector will need to master a new business model by

Manpower planning etc. building management and customer services. Banks should

contribute intensive efforts to render better services to their

Opportunities customer. Nationalized and commercial banks should

overcome the challenges and to get advantage of opportunities

Where there are challenges, there must be opportunities. in changing banking scenario.

Following are the opportunities for the banking sector.

REFERENCES

Rural area customers

Levesque, T. and Mcdougall, 1996. Determinants of customer

Contributing to 70% of the total population in India is a largely satisfaction in retail banking International journal of Bank

untapped market for banking sector. In all urban areas, banking Marketing pp 12-20

services entered but only few big villages have the banks Uppal, R.K. 2007. Banking services and IT New century

entered. So that the banks must reach in remaining all villages publications, New Delhi

because majority of Indian still living in rural areas. Niti Bhasin, 2007. Banking development in India 1947

to2007, Century publication, Delhi 110005

Good customer services

Zhao, T, Casu, B. and Ferrari, A. 2008. Deregulation and

Good customer services are the best brand ambassador for any Productivity Growth: A study of the Indian commercial

bank for growing its business. Every engagement with banking industry, International journal of Business

customer is an opportunity to develop a customer faith in the Performance Management pp318-343

bank. While increasing competition, customer services has Goyal, K.A. and Joshi, V. 2011. Mergers in banking industry

become the backbone for judging the performance of banks. of India: some emerging issues, Asian journal of Business

and Management Sciences pp157-165

Internet Banking Fernando, A.C 2011. Business Environment Noida: Dorling

Kindersley(India) Pvt. Ltd pp549-553

It is clear that online finance will pick up and there will be WWW.indiatoday.com

increasing convergence in terms of product offerings, banking WWW.wikiepedia.com

services, share trading, insurance, loans based on the data WWW.moneyindia.com

warehousing and data mining technologies. Anytime anywhere

banking will become common and will have to upscale. Such

upscaleing could include banks launching separate internet

banking services apart from traditional banking services.

*******

Вам также может понравиться

- Challenges and Opportunities Indian BanksДокумент4 страницыChallenges and Opportunities Indian BanksNitin NagpureОценок пока нет

- Banking RPДокумент4 страницыBanking RPPalak SharmaОценок пока нет

- Ijmra 13869Документ13 страницIjmra 13869kapa123Оценок пока нет

- Ibank 3 PDFДокумент6 страницIbank 3 PDFsomprakash giriОценок пока нет

- Chapter - 4 Developments IN Banking After PrivatizationДокумент16 страницChapter - 4 Developments IN Banking After PrivatizationAbhinav G PandeyОценок пока нет

- 10 Nishith Devraj Paper For Jbfsir 1 PDFДокумент10 страниц10 Nishith Devraj Paper For Jbfsir 1 PDFpareek gopalОценок пока нет

- Black BookДокумент41 страницаBlack BookMoazza QureshiОценок пока нет

- Impact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanДокумент5 страницImpact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanthОценок пока нет

- Macauro: Emerging Trends in Banking - Challenges and OpportunitiesДокумент4 страницыMacauro: Emerging Trends in Banking - Challenges and Opportunitiesrk_rkaushikОценок пока нет

- A Comparative Study of Banking Services and Custom PDFДокумент13 страницA Comparative Study of Banking Services and Custom PDF19TPMB112 PAVITHRA.JОценок пока нет

- A Study On Performance Appraisal of Idbi Bank in IndiaДокумент43 страницыA Study On Performance Appraisal of Idbi Bank in Indiasj computersОценок пока нет

- UTI BankДокумент69 страницUTI BankSnehal RunwalОценок пока нет

- Research Paper On Banking Sector in IndiaДокумент5 страницResearch Paper On Banking Sector in Indiafzhw508n100% (1)

- Innovative Practices in Banking Sectors: D. Sivasubramanian M.Phil Scholar ST - Xavier's College (Autonomous) PalayamkottaiДокумент6 страницInnovative Practices in Banking Sectors: D. Sivasubramanian M.Phil Scholar ST - Xavier's College (Autonomous) PalayamkottaiRani Sinha KОценок пока нет

- Prof. Adv. Sonal JainДокумент6 страницProf. Adv. Sonal JainChhaya ChaurasiaОценок пока нет

- Project Report: Executive SummaryДокумент32 страницыProject Report: Executive SummaryAbhijit PhoenixОценок пока нет

- Fundamental Analysis of Banking SectorsДокумент56 страницFundamental Analysis of Banking SectorsRajesh BathulaОценок пока нет

- Universal Banking LatestДокумент189 страницUniversal Banking LatestSony Bhagchandani50% (2)

- A Project On Banking SectorДокумент81 страницаA Project On Banking SectorAkbar SinghОценок пока нет

- Marketing Practices of Public Sector Banks - 2Документ4 страницыMarketing Practices of Public Sector Banks - 2nitinsule64Оценок пока нет

- Fundamental Analysis of Banking SectorsДокумент54 страницыFundamental Analysis of Banking SectorsRajesh BathulaОценок пока нет

- Emerging Trends of Banking SystemДокумент12 страницEmerging Trends of Banking SystemChoden ChdnОценок пока нет

- Universal BKG IndiaДокумент28 страницUniversal BKG IndiarajrnairОценок пока нет

- Study On HSBC BankДокумент48 страницStudy On HSBC Bankvarun_new87Оценок пока нет

- Retail Banking (Final 100mks)Документ69 страницRetail Banking (Final 100mks)ashish07031988Оценок пока нет

- Challenges Faced by Indian BaksДокумент2 страницыChallenges Faced by Indian BaksAlex FrancisОценок пока нет

- Fundamental Analysis of Banking SectorsДокумент63 страницыFundamental Analysis of Banking SectorsDeepak Kashyap75% (4)

- " A Study On " IDBI Bank's Performance" Submitted ToДокумент40 страниц" A Study On " IDBI Bank's Performance" Submitted TosalmaОценок пока нет

- Banking System 1Документ52 страницыBanking System 1Banshul KumarОценок пока нет

- Customer Satisfaction Regarding Consumer Loan With Specialreference To PUNJAB AND SIND BANKДокумент60 страницCustomer Satisfaction Regarding Consumer Loan With Specialreference To PUNJAB AND SIND BANKSaurabh Mehta0% (1)

- Banking SectorДокумент77 страницBanking Sectormhdtariq22544100% (1)

- CCI SynopsisДокумент11 страницCCI SynopsisAshish SinghОценок пока нет

- Comparative Study of Private Sector and Public Sector BanksДокумент14 страницComparative Study of Private Sector and Public Sector Banksparthiban.26061979Оценок пока нет

- 2.10 Retail BankingДокумент14 страниц2.10 Retail BankingSrinivas RaoОценок пока нет

- Tamilnadu Based Private Sector BanksДокумент15 страницTamilnadu Based Private Sector BanksAbi NeshОценок пока нет

- Devendra Tiwari Mba MRPДокумент26 страницDevendra Tiwari Mba MRPambrishgpt9360% (1)

- Emerging Role of Technology in Indian Banking Sector: A Phase of Digitalization in The SectorДокумент18 страницEmerging Role of Technology in Indian Banking Sector: A Phase of Digitalization in The Sectorsamriddhi sinhaОценок пока нет

- Indian Banking IndustryДокумент25 страницIndian Banking IndustryAsim MahatoОценок пока нет

- A Project Report ON: "Customer Satisfaction Towards Icici Bank With Special Reference To Gondia Branch"Документ72 страницыA Project Report ON: "Customer Satisfaction Towards Icici Bank With Special Reference To Gondia Branch"ravijoshi1010Оценок пока нет

- Management Term PaperДокумент20 страницManagement Term PaperSH RaihanОценок пока нет

- Chapter 1,2,3 PDFДокумент36 страницChapter 1,2,3 PDFprapoorna chintaОценок пока нет

- Indian Banking Industry: An AnalysisДокумент18 страницIndian Banking Industry: An Analysismishra29swati1913Оценок пока нет

- The Indian Banking IndustryДокумент33 страницыThe Indian Banking IndustryArvind KumarОценок пока нет

- Comparison of Retail Loans of J&K Bank With Other Banks and Deposit SchemesДокумент111 страницComparison of Retail Loans of J&K Bank With Other Banks and Deposit SchemesAnmol GuptaОценок пока нет

- Ndian Banking Industry: An Analysis 1.1industry DefinitionДокумент29 страницNdian Banking Industry: An Analysis 1.1industry DefinitionRiyas ThelakkadanОценок пока нет

- Comparative Analysis of Private Sector BankДокумент66 страницComparative Analysis of Private Sector BankRashmita Bhatt50% (4)

- ShivamДокумент40 страницShivamNitesh TiwariОценок пока нет

- Banking IndustryДокумент4 страницыBanking Industrygurjeetkaur1991Оценок пока нет

- Challenges To Retail Banking in IndiaДокумент2 страницыChallenges To Retail Banking in IndiapadmajammulaОценок пока нет

- The Impact of Human Resource Management On Sustainability of Employee's PerformanceДокумент134 страницыThe Impact of Human Resource Management On Sustainability of Employee's PerformanceNandini SinghОценок пока нет

- Comparative Analysis of Public & Private Bank (Icici &sbi) - 1Документ108 страницComparative Analysis of Public & Private Bank (Icici &sbi) - 1Sami Zama100% (1)

- Mergers Indian Banking Sector AluminiДокумент72 страницыMergers Indian Banking Sector AluminiAvinash Pal SuryavanshiОценок пока нет

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesОт EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesОценок пока нет

- Banking India: Accepting Deposits for the Purpose of LendingОт EverandBanking India: Accepting Deposits for the Purpose of LendingОценок пока нет

- World Bank Group Support for Innovation and Entrepreneurship: An Independent EvaluationОт EverandWorld Bank Group Support for Innovation and Entrepreneurship: An Independent EvaluationОценок пока нет

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesОт EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesОценок пока нет

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeОт EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeОценок пока нет

- Toward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyОт EverandToward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyОценок пока нет

- Consumer Behaviour Towards Two-Wheeler Users in Rayalaseema Region, A.PДокумент6 страницConsumer Behaviour Towards Two-Wheeler Users in Rayalaseema Region, A.PjothiОценок пока нет

- Intercontinental Journal of Marketing Research Review: Volume 1, Issue 8 (October, 2013)Документ8 страницIntercontinental Journal of Marketing Research Review: Volume 1, Issue 8 (October, 2013)jothiОценок пока нет

- JounalismДокумент30 страницJounalismjothiОценок пока нет

- I Wonder Science Magazine PDFДокумент116 страницI Wonder Science Magazine PDFjothiОценок пока нет

- 13 - Conclusion and SuggestionsДокумент4 страницы13 - Conclusion and SuggestionsjothiОценок пока нет

- Cb1consumer BehaviourДокумент10 страницCb1consumer Behaviourismail_99Оценок пока нет

- Customer Satisfaction Towards HondaДокумент9 страницCustomer Satisfaction Towards Hondafarhan okОценок пока нет

- Financial Inclusion: Presented byДокумент20 страницFinancial Inclusion: Presented byjothiОценок пока нет

- Final ThesisДокумент284 страницыFinal ThesisjothiОценок пока нет

- Start-Up India: An Analysis of The Indian Entrepreneurial LandscapeДокумент4 страницыStart-Up India: An Analysis of The Indian Entrepreneurial LandscapeYash VermaОценок пока нет

- FI 1: Display Chart of AccountsДокумент17 страницFI 1: Display Chart of AccountsMirela MemicОценок пока нет

- Message Specification V1.3 BДокумент41 страницаMessage Specification V1.3 Bsuy uy100% (1)

- Case of ICICI and Bank of Madura MergerДокумент6 страницCase of ICICI and Bank of Madura MergerAkash SinghОценок пока нет

- AOF Asaan Account (English)Документ4 страницыAOF Asaan Account (English)Rana UsmanОценок пока нет

- Bank of Baroda: (Head Office, Mandvi, Baroda) Particulats To Be Supplied by The Applicant/Guarantor For AdvanceДокумент3 страницыBank of Baroda: (Head Office, Mandvi, Baroda) Particulats To Be Supplied by The Applicant/Guarantor For AdvanceShiv DwivediОценок пока нет

- Revised Corporation Code - Books Merger and Appraisal RightДокумент29 страницRevised Corporation Code - Books Merger and Appraisal RightVenziel PedrosaОценок пока нет

- Flytxt Banking Intelligent Decisioning Solution 120522Документ14 страницFlytxt Banking Intelligent Decisioning Solution 120522Mauricio Fayad OspinaОценок пока нет

- SatishДокумент24 страницыSatishashwaniОценок пока нет

- Payment 380 490413BДокумент2 страницыPayment 380 490413BJohanny SantosОценок пока нет

- Factors Affecting Money SupplyДокумент3 страницыFactors Affecting Money Supplyananya50% (2)

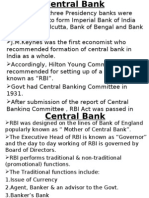

- Central BankДокумент24 страницыCentral BankShailesh RathodОценок пока нет

- Digital Securities and Blockchain TechnologypvsupawichДокумент90 страницDigital Securities and Blockchain TechnologypvsupawichxombakaОценок пока нет

- Actuary India April 2015Документ28 страницActuary India April 2015rahulrajeshanandОценок пока нет

- MBA Finance Project Report On Micro FinancingДокумент65 страницMBA Finance Project Report On Micro FinancingNisha Patel100% (2)

- Commerce Lesson PlanДокумент6 страницCommerce Lesson PlanPrince Victor0% (1)

- Know About Swiss Bank AccountДокумент3 страницыKnow About Swiss Bank AccountJain DanendraОценок пока нет

- RBI Vs Government of IndiaДокумент4 страницыRBI Vs Government of IndiaYash HenrageОценок пока нет

- Rajib Sarker VivaДокумент2 страницыRajib Sarker VivaMd. Golam KibriaОценок пока нет

- CSA Compliance ChecklistДокумент2 страницыCSA Compliance ChecklistAmenu AdagneОценок пока нет

- Where To Invest in Africa 2020Документ365 страницWhere To Invest in Africa 2020lindiОценок пока нет

- Strategic Management Plan (Bpi)Документ93 страницыStrategic Management Plan (Bpi)Sido Angel Mae BarbonОценок пока нет

- Banking Interview QuestionДокумент8 страницBanking Interview QuestionTushar SharmaОценок пока нет

- BSP First Home Ownership Fhol ChecklistДокумент3 страницыBSP First Home Ownership Fhol ChecklistChuck AnsphilОценок пока нет

- Lesson - Sources of FundsДокумент14 страницLesson - Sources of FundsJohn Paul GonzalesОценок пока нет

- Material 2008 BДокумент227 страницMaterial 2008 BshikumamaОценок пока нет

- AFM NotesДокумент55 страницAFM NotesrenesanitaОценок пока нет

- Share NumerologyДокумент24 страницыShare NumerologyDeepak SolankiОценок пока нет

- Customer Data Sheet - Revised 1 2Документ2 страницыCustomer Data Sheet - Revised 1 2Billy Maravillas Dela CruzОценок пока нет

- Ponente: Carpio-Morales, JДокумент15 страницPonente: Carpio-Morales, JCristelle Elaine ColleraОценок пока нет