Академический Документы

Профессиональный Документы

Культура Документы

Reviewer Corpo Jhez Notes Up To Finals

Загружено:

MylscheОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Reviewer Corpo Jhez Notes Up To Finals

Загружено:

MylscheАвторское право:

Доступные форматы

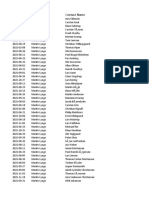

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

ATTY. RUBEN C. LADIA

Saturday 1:00PM-4:00PM Voting Requirements in the Election of

Sunday 1:00PM-3:00PM Directors/Trustees

Majority of the outstanding capital stock

MIDTERM EXAMS LAST MINUTE TIPS (in person or proxy)

Viva voce; otherwise, by ballot, upon

Corporation by Estoppel;

1

Ostensible request by any voting stockholder

5

Corporation Cumulative voting for stock

corporations (not available in non-stock

corporations unless allowed by the

Section 21. Corporation by estoppel. All

articles of incorporation or by-laws

persons who assume to act as a corporation

knowing it to be without authority to do so shall

President must be a Director

be liable as general partners for all debts,

Treasurer may or may not be a Director

liabilities and damages incurred or arising as a

Secretary a resident and citizen of the

result thereof: Provided, however, That when

Philippines

any such ostensible corporation is sued on any

transaction entered by it as a corporation or on

Not Allowed:

any tort committed by it as such, it shall not be

allowed to use as a defense its lack of corporate President and Secretary

personality. President and Treasurer

On who assumes an obligation to an ostensible Reason for Cumulative Voting: to allow

corporation as such, cannot resist performance minority to have a rightful representation

thereof on the ground that there was in fact no

corporation.

Cash, Property, Stock dividends re Total

N.B. Assets;

The doctrine of corporation by estoppel applies

against a third party only when he tries to Section 43. Power to declare dividends. - The

escape liability on a contract from which he has board of directors of a stock corporation may

benefitted on the irrelevant ground of defective declare dividends out of the unrestricted

incorporation.

2 retained earnings which shall be payable in

cash, in property, or in stock to all stockholders

on the basis of outstanding stock held by them:

3 4 Provided, That any cash dividends due on

Common Shares v. Founders Shares

delinquent stock shall first be applied to the

unpaid balance on the subscription plus costs

Common Shares Founders Shares

and expenses, while stock dividends shall be

One which entitle its May exercise exclusive

withheld from the delinquent stockholder until his

owner to an equal pro- right to vote and be

unpaid subscription is fully paid: Provided,

rata division of profits voted for in the election

without preference or of directors within a

further, That no stock dividend shall be issued

advantage over any limited period (not to without the approval of stockholders

other stockholder; May exceed five years) to representing not less than two-thirds (2/3) of the

be denied the right to the exclusion of the outstanding capital stock at a regular or special

vote in favor of others. meeting duly called for the purpose.

Founders shares

1

Ladia, The Corporation Code of the Philippines

(Annotated), Revised (2007) Edition, p.74

2

Supra, p.75

3 5

Supra, p.53 Total No. of Votes = [No. of Shares] x [No. of

4

Supra, p.58 Directors]; may be given to only one Director

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 1

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

Stock corporations are prohibited from retaining

surplus profits in excess of one hundred (100%) Nationality v. Residency requirements, as to

percent of their paid-in capital stock, except: incorporation

(1) when justified by definite corporate

expansion projects or programs Nationality Residency

approved by the board of directors; or Relevant in determining Relevant in determining

(2) when the corporation is prohibited under the compliance with the qualification of

any loan agreement with any financial Constitution and incorporators (a majority

institution or creditor, whether local or nationality laws as to of whom are residents of

foreign, from declaring dividends without minimum Filipino the Philippines)

its/his consent, and such consent has ownership

not yet been secured; or

(3) when it can be clearly shown that such

retention is necessary under special Minimum Authorized Capital Stock

circumstances obtaining in the

corporation, such as when there is need Section 12. Minimum capital stock required

for special reserve for probable of stock corporations. Stock corporations

contingencies. incorporated under this Code shall not be

required to have any minimum authorized capital

stock except as otherwise specifically provided

Subscribed Capital Stock v. Subscribers for by special law, and subject to the provisions

Subscription of the following section.

Section 13. Amount of capital stock to be

subscribed and paid for the purposes of Minimum Paid-up Capital

incorporation. At least twenty-five percent

(25%) of the authorized capital stock as stated in Section 13. x x x Provided, however, That in no

the articles of incorporation must be subscribed case shall the paid-up capital be less than five

at the time of incorporation, and at least twenty- Thousand (P5,000.00) pesos.

five (25%) per cent of the total subscription must

be paid upon subscription, the balance to be

payable on a date or dates fixed in the contract

Quorum

of subscription without need of call, or in the

absence of a fixed date or dates, upon call for

Section 25. Corporate officers, quorum. xxx

payment by the board of directors: Provided,

however, That in no case shall the paid-up

The directors or trustees and officers to be

capital be less than five Thousand (P5,000.00)

elected shall perform the duties enjoined on

pesos.

them by law and the by-laws of the corporation.

Unless the articles of incorporation or the by-

laws provide for a greater majority, a majority of

Section 61. Pre-incorporation subscription.

the number of directors or trustees as fixed in

A subscription for shares of stock of a

the articles of incorporation shall constitute a

corporation still to be formed shall be irrevocable

quorum for the transaction of corporate

for a period of at least six (6) months from the

business, and every decision of at least a

date of subscription, unless all of the other

majority of the directors or trustees present at a

subscribers consent to the revocation, or unless

meeting at which there is a quorum shall be

the incorporation of said corporation fails to

valid as a corporate act, except for the election

materialize within said period or within a longer

of officers which shall require the vote of a

period as may be stipulated in the contract of

majority of all the members of the board.

subscription: Provided, That no pre-

incorporation subscription may be revoked after

Directors or trustees cannot attend or vote by

the submission of the articles of incorporation to

proxy at board meetings.

the Securities and Exchange Commission.

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 2

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

Section 52. Quorum in meetings. Unless corporation which is not a close corporation

otherwise provided for in this Code or in the by- within the meaning of this Code.

laws, a quorum shall consist of the stockholders

representing a majority of the outstanding Any corporation may be incorporated as a close

capital stock or a majority of the members in corporation, except mining or oil companies,

the case of non-stock corporations. (n) stock exchanges, banks, insurance

companies, public utilities, educational

institutions and corporations declared to be

Section 97. Articles of incorporation. The vested with public interest in accordance with

articles of incorporation of a close corporation the provisions of this Code.

may provide:

xxx The provisions of this Title shall

3. For a greater quorum or voting primarily govern close corporations: Provided,

requirements in meetings of That the provisions of other Titles of this Code

stockholders or directors than those shall apply suppletorily except insofar as this

provided in this Code. Title otherwise provides.

Redeemable Shares Four (4) Liabilities of BOD, personally and

solidarily

Section 8. Redeemable shares. Redeemable

shares may be issued by the corporation when willfully and knowingly vote for patently

expressly so provided in the articles of unlawful acts of the corporation

incorporation. They may be purchased or taken willfully and knowingly assent to patently

up by the corporation upon the expiration of a unlawful acts of the corporation

fixed period, regardless of the existence of gross negligence or bad faith in directing

unrestricted retained earnings in the books the affairs of the corporation

of the corporation, and upon such other terms acquire any personal or pecuniary

and conditions as may be stated in the articles interest in conflict with their duty as such

of incorporation, which terms and conditions directors or trustees

must also be stated in the certificate of stock

representing said shares.

Section 31. Liability of directors, trustees or

officers. x x x

Close Corporation

When a director, trustee or officer attempts to

Section 96. Definition and applicability of acquire or acquire, in violation of his duty, any

Title. - A close corporation, within the meaning interest adverse to the corporation in respect of

of this Code, is one whose articles of any matter which has been reposed in him in

incorporation provide that: (1) All the confidence, as to which equity imposes a

corporations issued stock of all classes, disability upon him to deal in his own behalf, he

exclusive of treasury shares, shall be held of shall be liable as a trustee for the corporation

record by not more than a specified number of and must account for the profits which otherwise

persons, not exceeding twenty (20); (2) all the would have accrued to the corporation.

issued stock of all classes shall be subject to

one or more specified restrictions on transfer

permitted by this Title; and (3) The corporation Doctrine of Piercing the Veil of Corporate

shall not list in any stock exchange or make any Fiction

public offering of any of its stock of any class.

Notwithstanding the foregoing, a corporation When the notion of legal entity is used to defeat

shall not be deemed a close corporation when at public convenience, justify wrong, protect fraud

least two-thirds (2/3) of its voting stock or voting or defend crime, the law will regard the

rights is owned or controlled by another corporation as mere association of persons, or

in the case of two corporations, merge them into

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 3

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

one, the one being mere dummy and serves no policy and business practice in respect to the transaction

business purpose and is intended only as a attacked so that the corporate entity as to this transaction

had at the time no separate mind, will or existence of its

blind, or an alter ego or business conduit for the own;

6

sole benefit of the stockholders. 2. Such control must have been used by the defendant

to commit fraud or wrong, to perpetuate the violation of a

statutory or other positive legal duty, or dishonest and

Concept Builders v. NLRC unjust act in contravention of plaintiffs legal rights; and

3. The aforesaid control and breach of duty must

257 SCRA 149 proximately cause the injury or unjust loss complained of.

It is a fundamental principle of corporation law that a The absence of any one of these elements prevents

corporation is an entity separate and distinct from its piercing the corporate veil. in applying the

stockholders and from other corporations to which it may instrumentality or alter ego doctrine, the courts are

be connected. But, this separate and distinct personality concerned with reality and not form, with how the

of a corporation is merely a fiction created by law for corporation operated and the individual defendants

convenience and to promote justice. So, when the notion relationship to that operation.

of separate juridical personality is used to defeat public

convenience, justify wrong, protect fraud or defend crime, Thus, the question of whether a corporation is a mere

or is used as a device to defeat the labor laws, this alter ego, a mere sheet or paper corporation, a sham or a

separate personality of the corporation may be subterfuge is purely one of fact.

disregarded or the veil of corporate fiction pierced. This is

true likewise when the corporation is merely an adjunct, a

business conduit or an alter ego of another corporation.

Transferability of Shares

The conditions under which the juridical entity may be

disregarded vary according to the peculiar facts and

circumstances of each case. No hard and fast rule can Advantage Disadvantage

be accurately laid down, but certainly, there are some Shares of stocks may Transfers of the shares

probative factors of identity that will justify the application be transferred by the may result to uniting

of the doctrine of piercing the corporate veil, to wit: owner without consent incompatible and

of the other conflicting interests

1. Stock ownership by one or common ownership of both stockholders

corporations.

2. Identity of directors and officers.

3. The manner of keeping corporate books and records.

4. Methods of conducting the business. Compensation of Directors

The SEC en banc explained the instrumentality rule Section 30. Compensation of directors. In

which the courts have applied in disregarding the

the absence of any provision in the by-laws

separate juridical personality of corporations as follows:

fixing their compensation, the directors shall not

Where one corporation is so organized and controlled receive any compensation, as such directors,

and its affairs are conducted so that it is, in fact, a mere except for reasonable per diems: Provided,

instrumentality or adjunct of the other, the fiction of the however, That any such compensation other

corporate entity of the instrumentality may be than per diems may be granted to directors by

disregarded. The control necessary to invoke the rule is

not majority or even complete stock control but such

the vote of the stockholders representing at least

domination of finances, policies and practices that the a majority of the outstanding capital stock at a

controlled corporation has, so to speak, no separate regular or special stockholders meeting. In no

mind, will or existence of its own, and is but a conduit for case shall the total yearly compensation of

its principal. It must be kept in mind that the control must directors, as such directors, exceed ten (10%)

be shown to have been exercised at the time the acts percent of the net income before income tax of

complained of took place. Moreover, the control and

breach of duty must proximately cause the injury or

the corporation during the preceding year.

unjust loss for which the complaint is made.

The test in determining the applicability of the doctrine of Western Institute v. Salas

piercing the veil of corporate fiction is as follows: 278 SCRA 216

1. Control, not mere majority or complete stock control, There is no argument that directors or trustees, as the

but complete domination, not only of finances but of case may be, are not entitled to salary or other

compensation when they perform nothing more than the

usual and ordinary duties of their office. This rule is

6 founded upon a presumption that directors /trustees

Supra, p.101

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 4

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

render service gratuitously and that the return upon their deceptive" or "patently confusing" or "contrary to existing

shares adequately furnishes the motives for service, laws," is the avoidance of fraud upon the public which

without compensation Under the foregoing section, there would have occasion to deal with the entity concerned,

are only two (2) ways by which members of the board the evasion of legal obligations and duties, and the

can be granted compensation apart from reasonable per reduction of difficulties of administration and supervision

diems: (1) when there is a provision in the by-laws fixing over corporations. We do not consider that the corporate

their compensation; and (2) when the stockholders names of private respondent institutions are "identical

representing a majority of the outstanding capital stock at with, or deceptively or confusingly similar" to that of the

a regular or special stockholders meeting agree to give it petitioner institution. True enough, the corporate names

to them. of private respondent entities all carry the word "Lyceum"

but confusion and deception are effectively precluded by

This proscription, however, against granting the appending of geographic names to the word

compensation to directors/trustees of a corporation is not "Lyceum." Thus, we do not believe that the "Lyceum of

a sweeping rule. Worthy of note is the clear phraseology Aparri" can be mistaken by the general public for the

of Section 30 which states: xxx [T]he directors shall not Lyceum of the Philippines, or that the "Lyceum of

receive any compensation, as such directors, xxx. The Camalaniugan" would be confused with the Lyceum of

phrase as such directors is not without significance for it the Philippines.

delimits the scope of the prohibition to compensation

given to them for services performed purely in their DOCTRINE OF SECONDARY MEANING; USE OF

capacity as directors or trustees. The unambiguous WORD "LYCEUM," NOT ATTENDED WITH

implication is that members of the board may receive EXCLUSIVITY. It is claimed, however, by petitioner

compensation, in addition to reasonable per diems, when that the word "Lyceum" has acquired a secondary

they render services to the corporation in a capacity meaning in relation to petitioner with the result that word,

other than as directors/trustees In the case at bench, although originally a generic, has become appropriable

Resolution No. 48, s. 1986 granted monthly by petitioner to the exclusion of other institutions like

compensation to private respondents not in their capacity private respondents herein. The doctrine of secondary

as members of the board, but rather as officers of the meaning originated in the field of trademark law. Its

corporation, more particularly as Chairman, Vice- application has, however, been extended to corporate

Chairman, Treasurer and Secretary of Western Institute names sine the right to use a corporate name to the

of Technology. exclusion of others is based upon the same principle

which underlies the right to use a particular trademark or

xxx

trade name. In Philippine Nut Industry, Inc. v. Standard

Clearly, therefore , the prohibition with respect to Brands, Inc., the doctrine of secondary meaning was

granting compensation to corporate elaborated in the following terms: " . . . a word or phrase

directors/trustees as such under Section 30 is not originally incapable of exclusive appropriation with

violated in this particular case. reference to an article on the market, because

geographically or otherwise descriptive, might

nevertheless have been used so long and so exclusively

by one producer with reference to his article that, in that

Lyceum of the Philippines v. C.A. trade and to that branch of the purchasing public, the

219 SCRA 610 word or phrase has come to mean that the article was his

product." The question which arises, therefore, is

REGISTRATION OF PROPOSED NAME WHICH IS whether or not the use by petitioner of "Lyceum" in its

IDENTICAL OR CONFUSINGLY SIMILAR TO THAT OF corporate name has been for such length of time and

with such exclusivity as to have become associated or

ANY EXISTING CORPORATION, PROHIBITED;

CONFUSION AND DECEPTION EFFECTIVELY identified with the petitioner institution in the mind of the

PRECLUDED BY THE APPENDING OF GEOGRAPHIC general public (or at least that portion of the general

public which has to do with schools). The Court of

NAMES TO THE WORD "LYCEUM". The Articles of

Incorporation of a corporation must, among other things, Appeals recognized this issue and answered it in the

set out the name of the corporation. Section 18 of the negative: "Under the doctrine of secondary meaning, a

Corporation Code establishes a restrictive rule insofar as word or phrase originally incapable of exclusive

appropriation with reference to an article in the market,

corporate names are concerned: "Section 18. Corporate

name. No corporate name may be allowed by the because geographical or otherwise descriptive might

Securities an Exchange Commission if the proposed nevertheless have been used so long and so exclusively

name is identical or deceptively or confusingly similar to by one producer with reference to this article that, in that

trade and to that group of the purchasing public, the word

that of any existing corporation or to any other name

already protected by law or is patently deceptive, or phrase has come to mean that the article was his

confusing or contrary to existing laws. When a change in produce (Ana Ang vs. Toribio Teodoro, 74 Phil. 56). This

circumstance has been referred to as the distinctiveness

the corporate name is approved, the Commission shall

issue an amended certificate of incorporation under the into which the name or phrase has evolved through the

amended name." The policy underlying the prohibition in substantial and exclusive use of the same for a

Section 18 against the registration of a corporate name considerable period of time. . . . No evidence was ever

presented in the hearing before the Commission which

which is "identical or deceptively or confusingly similar" to

that of any existing corporation or which is "patently sufficiently proved that the word 'Lyceum' has indeed

acquired secondary meaning in favor of the appellant. If

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 5

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

there was any of this kind, the same tend to prove only outstanding capital stock, in exchange for

that the appellant had been using the disputed word for a property needed for corporate purposes or in

long period of time. . . . In other words, while the

appellant may have proved that it had been using the

payment of a previously contracted debt.

word 'Lyceum' for a long period of time, this fact alone

did not amount to mean that the said word had acquired Section 102. Pre-emptive right in close

secondary meaning in its favor because the appellant corporations. The pre-emptive right of

failed to prove that it had been using the same word all stockholders in close corporations shall extend

by itself to the exclusion of others. More so, there was no to all stock to be issued, including reissuance of

evidence presented to prove that confusion will surely

arise if the same word were to be used by other

treasury shares, whether for money, property or

educational institutions. Consequently, the allegations of personal services, or in payment of corporate

the appellant in its first two assigned errors must debts, unless the articles of incorporation

necessarily fail." We agree with the Court of Appeals. provide otherwise.

The number alone of the private respondents in the case

at bar suggests strongly that petitioner's use of the word

"Lyceum" has not been attended with the exclusivity

essential for applicability of the doctrine of secondary Cumulative Shares in Favor of 1 Candidate

meaning. Petitioner's use of the word "Lyceum" was not (See Footnote 5)

exclusive but was in truth shared with the Western

Pangasinan Lyceum and a little later with other private

respondent institutions which registered with the SEC Issuance of Stocks

using "Lyceum" as part of their corporation names. There

may well be other schools using Lyceum or Liceo in their Section 62. Consideration for stocks.

names, but not registered with the SEC because they Stocks shall not be issued for a consideration

have not adopted the corporate form of organization.

less than the par or issued price thereof.

CORPORATE NAMES MUST BE EVALUATED IN Consideration for the issuance of stock may be

THEIR ENTIRETY TO DETERMINE WHETHER THEY any or a combination of any two or more of the

ARE CONFUSINGLY OR DECEPTIVELY SIMILAR TO following:

ANOTHER CORPORATE ENTITY'S NAME. 1. Actual cash paid to the corporation;

petitioner institution is not entitled to a legally enforceable 2. Property, tangible or intangible, actually

exclusive right to use the word "Lyceum" in its corporate

name and that other institutions may use "Lyceum" as

received by the corporation and

part of their corporate names. To determine whether a necessary or convenient for its use and

given corporate name is "identical" or "confusingly or lawful purposes at a fair valuation equal

deceptively similar" with another entity's corporate name, to the par or issued value of the stock

it is not enough to ascertain the presence of "Lyceum" or issued;

"Liceo" in both names. One must evaluate corporate 3. Labor performed for or services

names in their entirety and when the name of petitioner is

juxtaposed with the names of private respondents, they actually rendered to the corporation;

are not reasonably regarded as "identical" or "confusingly 4. Previously incurred indebtedness of

or deceptively similar" with each other. the corporation;

5. Amounts transferred from unrestricted

retained earnings to stated capital; and

6. Outstanding shares exchanged for

Pre-emptive Rights stocks in the event of reclassification or

conversion.

Section 39. Power to deny pre-emptive

right. All stockholders of a stock corporation Where the consideration is other than actual

shall enjoy pre-emptive right to subscribe to all cash, or consists of intangible property such as

issues or disposition of shares of any class, in patents of copyrights, the valuation thereof shall

proportion to their respective shareholdings, initially be determined by the incorporators or

unless such right is denied by the articles of the board of directors, subject to approval by the

incorporation or an amendment thereto: Securities and Exchange Commission.

Provided, That such pre-emptive right shall not

extend to shares to be issued in compliance with Shares of stock shall not be issued in exchange

laws requiring stock offerings or minimum stock for promissory notes or future service.

ownership by the public; or to shares to be

issued in good faith with the approval of the The same considerations provided for in this

stockholders representing two-thirds (2/3) of the section, insofar as they may be applicable, may

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 6

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

be used for the issuance of bonds by the of the certificate or certificates and the number

corporation. of shares transferred.

The issued price of no-par value shares may be No shares of stock against which the corporation

fixed in the articles of incorporation or by the holds any unpaid claim shall be transferable in

board of directors pursuant to authority the books of the corporation.

conferred upon it by the articles of incorporation

or the by-laws, or in the absence thereof, by the

Section 86. Notation on certificates; rights of

stockholders representing at least a majority of

transferee. Within ten (10) days after

the outstanding capital stock at a meeting duly

demanding payment for his shares, a dissenting

called for the purpose.

stockholder shall submit the certificates of stock

representing his shares to the corporation for

Section 64. Issuance of stock certificates.

notation thereon that such shares are dissenting

No certificate of stock shall be issued to a

shares. His failure to do so shall, at the option of

subscriber until the full amount of his

the corporation, terminate his rights under this

subscription together with interest and expenses

Title. If shares represented by the certificates

(in case of delinquent shares), if any is due, has

bearing such notation are transferred, and the

been paid.

certificates consequently cancelled, the rights of

the transferor as a dissenting stockholder under

Section 65. Liability of directors for watered

this Title shall cease and the transferee shall

stocks. Any director or officer of a corporation

have all the rights of a regular stockholder; and

consenting to the issuance of stocks for a

all dividend distributions which would have

consideration less than its par or issued value or

accrued on such shares shall be paid to the

for a consideration in any form other than cash,

transferee.

valued in excess of its fair value, or who, having

knowledge thereof, does not forthwith express

his objection in writing and file the same with the

corporate secretary, shall be solidarily, liable Removal of Directors/Trustees

with the stockholder concerned to the

corporation and its creditors for the difference Section 28. Removal of directors or

between the fair value received at the time of trustees. Any director or trustee of a

issuance of the stock and the par or issued corporation may be removed from office by a

value of the same. vote of the stockholders holding or representing

at least two-thirds (2/3) of the outstanding capital

Better right Re Dividend at the time of stock, or if the corporation be a non-stock

corporation, by a vote of at least two-thirds (2/3)

declaration

of the members entitled to vote: Provided, That

such removal shall take place either at a regular

Section 63. Certificate of stock and transfer meeting of the corporation or at a special

of shares. The capital stock of stock

meeting called for the purpose, and in either

corporations shall be divided into shares for

case, after previous notice to stockholders or

which certificates signed by the president or vice

members of the corporation of the intention to

president, countersigned by the secretary or

propose such removal at the meeting. A special

assistant secretary, and sealed with the seal of

meeting of the stockholders or members of a

the corporation shall be issued in accordance

corporation for the purpose of removal of

with the by-laws. Shares of stock so issued are

directors or trustees, or any of them, must be

personal property and may be transferred by

called by the secretary on order of the president

delivery of the certificate or certificates indorsed

or on the written demand of the stockholders

by the owner or his attorney-in-fact or other

representing or holding at least a majority of the

person legally authorized to make the transfer.

outstanding capital stock, or, if it be a non-stock

No transfer, however, shall be valid, except as

corporation, on the written demand of a majority

between the parties, until the transfer is

of the members entitled to vote. Should the

recorded in the books of the corporation

secretary fail or refuse to call the special

showing the names of the parties to the

meeting upon such demand or fail or refuse to

transaction, the date of the transfer, the number

give the notice, or if there is no secretary, the

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 7

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

call for the meeting may be addressed directly to After such authorization or approval by the

the stockholders or members by any stockholder stockholders or members, the board of directors

or member of the corporation signing the or trustees may, nevertheless, in its discretion,

demand. Notice of the time and place of such abandon such sale, lease, exchange, mortgage,

meeting, as well as of the intention to propose pledge or other disposition of property and

such removal, must be given by publication or assets, subject to the rights of third parties under

by written notice prescribed in this Code. any contract relating thereto, without further

Removal may be with or without cause: action or approval by the stockholders or

Provided, That removal without cause may not members.

be used to deprive minority stockholders or

members of the right of representation to which Nothing in this section is intended to restrict the

they may be entitled under Section 24 of this power of any corporation, without the

Code. authorization by the stockholders or members,

to sell, lease, exchange, mortgage, pledge or

otherwise dispose of any of its property and

Power to Dispose Property and Assets assets if the same is necessary in the usual and

Requirement of Stockholders regular course of business of said corporation or

if the proceeds of the sale or other disposition of

Section 40. Sale or other disposition of such property and assets be appropriated for the

assets. Subject to the provisions of existing conduct of its remaining business.

laws on illegal combinations and monopolies, a

corporation may, by a majority vote of its board In non-stock corporations where there are no

of directors or trustees, sell, lease, exchange, members with voting rights, the vote of at least a

mortgage, pledge or otherwise dispose of all or majority of the trustees in office will be sufficient

substantially all of its property and assets, authorization for the corporation to enter into any

including its goodwill, upon such terms and transaction authorized by this section.

conditions and for such consideration, which

may be money, stocks, bonds or other

instruments for the payment of money or other Power to Acquire own Shares

property or consideration, as its board of

directors or trustees may deem expedient, when Section 41. Power to acquire own shares. A

authorized by the vote of the stockholders stock corporation shall have the power to

representing at least two-thirds (2/3) of the purchase or acquire its own shares for a

outstanding capital stock, or in case of non-stock legitimate corporate purpose or purposes,

corporation, by the vote of at least to two-thirds including but not limited to the following cases:

(2/3) of the members, in a stockholders or Provided, That the corporation has unrestricted

members meeting duly called for the purpose. retained earnings in its books to cover the

Written notice of the proposed action and of the shares to be purchased or acquired:

time and place of the meeting shall be

addressed to each stockholder or member at his 1. To eliminate fractional shares arising out

place of residence as shown on the books of the of stock dividends;

corporation and deposited to the addressee in 2. To collect or compromise an

the post office with postage prepaid, or served indebtedness to the corporation, arising

personally: Provided, That any dissenting out of unpaid subscription, in a

stockholder may exercise his appraisal right delinquency sale, and to purchase

under the conditions provided in this Code. delinquent shares sold during said sale;

and

A sale or other disposition shall be deemed to 3. To pay dissenting or withdrawing

cover substantially all the corporate property and stockholders entitled to payment for

assets if thereby the corporation would be their shares under the provisions of this

rendered incapable of continuing the business or Code.

accomplishing the purpose for which it was

incorporated. GOOD LUCK ON THE MIDTERM EXAMS!

(As of 30 March 2015)

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 8

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

FINAL EXAMS LAST MINUTE TIPS priest, minister, rabbi or presiding elder

acting as corporation sole, and may be

opposed by any member of the religious

Foreign corporations capacity to sue

denomination, sect or church represented by

the corporation sole: Provided, That in cases

General Rule:

where the rules, regulations and discipline of

Foreign corporations capacity to sue must

the religious denomination, sect or church,

be affirmatively pleaded in order that it may

religious society or order concerned

proceed and effectively institute a case in a

represented by such corporation sole

case in Philippine courts. But if the case will

regulate the method of acquiring, holding,

be dismissed with prejudice on the ground of

selling and mortgaging real estate and

non-averment of foreign capacity to sue,

personal property, such rules, regulations

there will be no bar for re-institution of the

and discipline shall control, and the

same case.7

intervention of the courts shall not be

necessary.9

Exception:

Averment of capacity to sue is not necessary

Trustees vote by proxy

if the action involves a complaint for

violation of Revised Penal.8

The voting trustee or trustees may vote by

proxy unless the agreement provides

Corporation Sole to own and alienate

otherwise.10

real property

Educational corporation / institution

Acquisition and alienation of property.

Any corporation sole may purchase and hold

Educational institutions, other than those

real estate and personal property for its

established by religious groups and mission

church, charitable, benevolent or educational

boards, shall be owned solely by citizens of

purposes, and may receive bequests or gifts

the Philippines or corporations or

for such purposes. Such corporation may

associations at least sixty per centum of the

sell or mortgage real property held by it by

capital of which is owned by such citizens.

obtaining an order for that purpose from

The Congress may, however, require

the Court of First Instance of the province

increased Filipino equity participation in all

where the property is situated upon proof

educational institutions. The control and

made to the satisfaction of the court that

administration of educational institutions

notice of the application for leave to sell or

shall be vested in citizens of the

mortgage has been given by publication or

Philippines.11

otherwise in such manner and for such

time as said court may have directed, and

A director who has been declared

that it is to the interest of the corporation

delinquent

that leave to sell or mortgage should be

granted. The application for leave to sell or

The Corporation Code requires that the

mortgage must be made by petition, duly

director must own at least one (1) share

verified, by the chief archbishop, bishop,

7 9

Supra Note 1, p.573. B.P. Blg. 68, Section 113.

8 10

Le Chemise Lacoste, S.A. v. Fernandez, 129 SCRA B.P. Blg. 68, Section 59 (last paragraph).

11

377, 21 May 21 1984. Constitution (1987), Article XIV, Section 4(2).

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 9

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

which shall stand in his name in the books over to another. The term implies a

of the corporation.12 Delinquency does not continuity of commercial dealings and

deprive the director of ownership of shares. arrangements and contemplates, to the

The effects of delinquency are provided in extent, the performance of acts or works or

Section 71 of the Corporation Code. the exercise of some functions normally

incident to and in progressive prosecution

By-Laws of a stock corporation of, the purpose and objects of its

organization.15

By-laws are rules and ordinances made by a

corporation for its own government; to Doing Business, appointment of an

regulate the conduct and define the duties of exclusive dealer

the stockholders or members towards the

corporation and among themselves. Doing business does not include mere

appointing a representative or distributor

Corporate Opportunity Doctrine domiciled in the Philippines which transacts

business in its own name and for its own

Corporate officers are not permitted to use account. 16

their position of trust and confidence to

further their private interests. The doctrine Dissolved corporation in a merger

recognizes that the fiduciary standards could

not be upheld where the fiduciary was acting Although there is dissolution of the absorbed

for two entities with competing interests.13 corporation, there is no winding up of their

affairs or liquidation of their assets,

Religious Society because the surviving corporation

automatically acquires all their rights,

Religious society is not mandated by law to privileges and powers, as well as their

register as a corporation but it may do so to liabilities.17

acquire juridical personality for the purpose

of administration of its temporalities and Non-Filing of by-laws in period

properties and even to acquire properties of provided for (suspension)

its own.

Non-filing of by-laws will not result in

Like a corporation sole, the articles of automatic dissolution of the corporation.

incorporation of a religious society need not The SEC is empowered only to suspend or

contain a term of its existence as it is revoke, after proper notice and hearing, the

supposed to exist in perpetuity.14 franchise or certificate of registration of

corporation on the ground inter alia of

Doing business failure to file by-laws within the required

period.18

is continuing the body or substance of

business or enterprise for which it has 15

Ladia, p. 537.

substantially retired from it and turned it 16

Ladia, p. 538.

17

Associated bank v. CA, G.R. No. 123793, June 29,

1998 (also see Ladia, p.427)

12 18

B.P. Blg. 68, Section 23. Loyola Grand Villas Homeowners (South)

13

Gokongwei, Jr. v. SEC, 89 SCRA 336 Association, Inc. v. CA, 276 SCRA 681, (also see

14

Ladia, p. 481. Ladia, p.305)

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 10

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

corporation is substituted by the receiver

Effects of delinquency (to vote, who may sue or be sued beyond the 3 year

receive cash and stock) period.

No delinquent stock shall be voted.19 General requirements for a valid

stockholders meeting

No delinquent stock shall be voted for or be

entitled to vote or to representation at any (1) It must be held on the date fixed in

stockholders meeting, nor shall the holder the by-laws or in accordance with

thereof be entitled to any of the rights of a law.

stockholder except the right to dividends in (2) Prior notice must be given.

accordance with the provisions of this Code, (3) It must be held at the proper place.

until and unless he pays the amount due on (4) It must be called by the proper party.

his subscription with accrued interest, and (5) Quorum and voting requirements

the costs and expenses of advertisement, if must be met.

any.20

Rights of stockholders to compel

Three (3) methods of liquidation and corporation to pay value of his shares

their effects is broader in a close corporation than

in ordinary stock

(1) By the Corporation itself through

the Board of Directors the Board will only A stockholder of a close corporation, may,

have 3 yrs to finish its task of liquidation, for any reason compel the corporation to

claims for or against the corporation not purchase his shares at their fair value, which

filed within the 3 year period will become shall not be less than their par or issued

unenforceable as there exists no corporate value, with the limitation only that the

entity against which they can be enforced. corporation has sufficient assets to cover its

Actions pending for or against the liabilities exclusive of capital stock.21

corporation when the 3 year period expires

are abated since after that period the In an ordinary stock corporation, unless a

corporation ceases for all intents and stockholder sells his shares, a stockholder

purposes and is no longer capable of suing cannot get back his investment nor compel

or being sued after that period. the corporation to buy his shares, except in

the exercise of his appraisal right.22

(2) By a Trustee appointed by the

corporation the 3 year period will not In case of deadlock in close

apply provided the designation of a trustee is corporation the courts can interfere

made within the 3 year period.

The SEC is granted a wide discretion in

(3) By appointment of a receiver on respect to the management of a close

petition or motu proprio upon the corporation in the event of a deadlock. This

dissolution of the corporation the 3 year jurisdiction of the SEC has been transferred

period will not apply because the dissolved

19 21

B.P. Blg. 68, Section 24. B.P. Blg. 68, Section 105.

20 22

B.P. Blg. 68, Section 71. B.P. Blg. 68, Section 81.

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 11

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

to the regular courts under RA 8799 or the a license which bars a foreign corporation

Securities and Regulation Code.23 form access to our courts.

Cumulative voting in non-stock No foreign corporation transacting business

corporation in the Philippines without a license, or its

successors or assigns, shall be permitted to

General Rule: Not allowed. maintain or intervene in any action, suit or

Exception: proceeding in any court or administrative

The right of the members of any class or agency of the Philippines; but such

classes to vote may be limited, broadened or corporation may be sued or proceeded

denied to the extent specified in the articles against before Philippine courts or

of incorporation or the by-laws. Unless so administrative tribunals on any valid cause

limited, broadened or denied, each member, of action recognized under Philippine

regardless of class, shall be entitled to one laws.25

vote.24

Dissolved corporation may undertake

Voting by proxy in non-stock any of the ways of liquidation:

corporations

(1) By the corporation itself though

General Rule: Allowed. Board of Directors;

Exception: (2) By a trustee/assignee appointed by

Unless otherwise provided in the articles of the corporation;

incorporation or the by-laws, a member (3) By appointment of a

may vote by proxy in accordance with the receiver/liquidator;

provisions of this Code.

In a corporate controversy, service of

Voting by mail or any other means in summons

non-stock corporations

Service upon domestic private juridical

Voting by mail or other similar means by entity. When the defendant is a

members of non-stock corporations may be corporation, partnership or association

authorized by the by-laws of non-stock organized under the laws of the Philippines

corporations with the approval of, and with a juridical personality, service may be

under such conditions which may be made on the president, managing partner,

prescribed by, the Securities and Exchange general manager, corporate secretary,

Commission. treasurer, or in-house counsel.26

Lack of requisite license, doing In an intra-corporate controversy,

business service of summons

The general rule is that it is not the lack of Service upon domestic private juridical

required license but doing business without entities. If the defendant is a domestic

corporation, service shall be deemed

23 25

B.P. Blg. 68, Section 104. B.P. Blg. 68, Section 133.

24 26

B.P. Blg. 68, Section 89. Rules of Court, Rule 14, Section 11

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 12

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

adequate is made upon any of the statutory the rights and defenses which the true and

or corporate officers as fixed by the by-laws lawful owner may have except in so far as

or their respective secretaries. If the the principles governing estoppel may

defendant is a partnership, service shall be apply.30

deemed adequate if made upon any of the

managing or general partners or upon Wash Sale

their respective secretaries. If the defendant

is an association service shall be deemed By effecting any transaction in such security

adequate if made upon any of its officers or which involves no change in the beneficial

their respective secretaries.27 ownership thereof.31

Issuance of certificate of stock Matched Order

The capital stock of stock corporations shall By entering an order or orders for the

be divided into shares for which certificates purchase or sale of such security with the

signed by the president or vice president, knowledge that a simultaneous order or

countersigned by the secretary or assistant orders of substantially the same size, time

secretary, and sealed with the seal of the and price, for the sale or purchase of any

corporation shall be issued in accordance such security, has or will be entered by or

with the by-laws.28 for the same or different parties;32

Subscriptions of Shares of Stock Short Sale

(indivisible)

Refers to any sale of a security which the

No certificate of stock shall be issued to a seller does not own or any sale which is

subscriber until the full amount of his consummated by the delivery of a security

subscription together with interest and borrowed by, or for the account of the seller.

expenses (in case of delinquent shares), if This is not illegal per se.

any is due, has been paid.29

No person shall use or employ, in

certificate of stock merely quasi- connection with the purchase or sale of any

negotiable security any manipulative or deceptive

device or contrivance. Neither shall any

A certificate of stock is not regarded as short sale be effected nor any stop-loss

negotiable in the same sense that a bill or a order be executed in connection with the

note is negotiable, even if it is endorsed in purchase or sale of any security except in

blank. Thus, while it may be transferred by accordance with such rules and regulations

endorsement coupled with delivery thereof, as the Commission may prescribe as

and therefore merely quasi-negotiable, it is necessary or appropriate in the public

nonetheless non-negotiable in that the interest for the protection of investors.33

transferee takes it without prejudice to all

27

Interim Rules of Procedure Governing Intra-

30

Corporate Controversies under R.A. No. 8799, Ladia, p. 347.

31

Rule 2, Section 5 R.A. No. 8799, Section 24.1(a)(i)

28 32

B.P. Blg. 68, Section 63. R.A. No. 8799, Section 24.1(a)(ii)

29 33

B.P. Blg. 68, Section 64. R.A. No. 8799, Section 24.2

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 13

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

Instances when a foreign corporation otherwise is also in possession of the

with no license to do business can sue information.xxx38

in the country

Averment of a foreign corporations Material nonpublic information

capacity to sue is not necessary:34

Information is "material nonpublic" if:

if the action involves a complaint for

violation of the Revised Penal (a) It has not been generally disclosed to the

Code;35 public and would likely affect the market

if not suing or maintaining a suit but price of the security after being disseminated

is merely defending itself from one to the public and the lapse of a reasonable

filed against it.36 time for the market to absorb the

information; or

Inspection of corporate books

(b) would be considered by a reasonable

The records of all business transactions of person important under the circumstances in

the corporation and the minutes of any determining his course of action whether to

meetings shall be open to inspection by any buy, sell or hold a security.39

director, trustee, stockholder or member of

the corporation at reasonable hours on Dissolution of Corporation

business days and he may demand, in

writing, for a copy of excerpts from said (1) by expiration of its term;

records or minutes, at his expense.37

(2) by voluntary surrender of its primary

Insider Trading franchise (voluntary dissolution);

It shall be unlawful for an insider to sell or Modes :

buy a security of the issuer, while in (a) voluntary dissolution when there

possession of material information with are creditors affected;

respect to the issuer or the security that is (b) voluntary dissolution where

not generally available to the public, unless: creditors are affected;

(a) The insider proves that the information (c) shortening of corporate term;

was not gained from such relationship; or

(b) If the other party selling to or buying (3) by revocation of its corporate

from the insider (or his agent) is identified, franchise (involuntary dissolution)

the insider proves: (I) that he disclosed the

information to the other party, or (ii) that he Exercise of appraisal rights

had reason to believe that the other party

(1) In case amendment of the articles of

incorporation has the effect of

changing or restricting the rights of

34

Ladia, p.573 any stockholder, or class of shares,

35

Le Chemise Lacoste, S.A. v. Fernandez, 129

SCRA 377, 21 May 21 1984.

36 38

Times, Inc. v. Reyes, 39 SCRA 303 R.A No. 8799, Section 27.1

37 39

B.P. Blg. 68, Section 74, par.2 R.A No. 8799, Section 27.2

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 14

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

or of authorizing preferences in

respect superior to those outstanding (1) By contract of subscription

shares of any class, or extending or (2) Purchase of treasury shares

shortening of the term of corporate (3) Purchase or acquisition of shares

existence; from existing stockholders

(2) In case of sale, lease, exchange , N.B. Acquisition of unissued shares of

mortgage, pledge or other disposition stocks is always a subscription contract

of all or substantially all of corporate notwithstanding the fact that parties refer to

property and assets; it as purchase or some other contract.42

(3) In case of merger or consolidation; Meaning of Transfer

Improperly held or called As used in the Code, refers to absolute and

stockholders meeting unconditional transfer to warrant registration

in the books of the corporation in order to

All proceedings had and any business bind the latter and other third persons.43

transacted at any meeting of the

stockholders or members, if within the Interests on unpaid subscription

powers or authority of the corporation, shall

be valid even if the meeting be improperly General Rule: No interest

held or called, provided all the stockholders Exception: If stated the by-laws.

or members of the corporation are present or

duly represented at the meeting.40 Important effect of merger or

consolidation

Attending directors meeting by proxy

The surviving or the consolidated

corporation shall thereupon and thereafter

A director or trustee cannot attend or vote

possess all the rights, privileges, immunities

by proxy at any board or meeting since he

and franchises of each of the constituent

was supposedly elected because of his

corporations; and all property, real or

expertise in the management or his business

personal, and all receivables due on

acumen such that he is expected to

whatever account, including subscriptions to

personally attend and vote on matters

shares and other choses in action, and all

brought before the meeting.41

and every other interest of, or belonging to,

or due to each constituent corporation, shall

Requisites of voting trusts

be deemed transferred to and vested in

(1) In writing

such surviving or consolidated corporation

(2) Notarized

without further act or deed;44

(3) Specified terms/conditions

(4) Certified copy filed with the

corporation and SEC

3-ways of becoming stockholder

42

B.P. Blg. 68, Section 60

40 43

B.P. Blg. 68, Section 51, par. 3 Ladia, p. 350

41 44

Ladia, p.326 B.P. Blg. 68, Section 80(4)

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 15

JHEZ NOTES ON CORPORATION LAW

2015 ARELLANO UNIVERSITY SCHOOL OF LAW

Grounds for dissolution of closed [4] Continuous inoperation for a period of at

corporation least five (5) years;

[A]ny stockholder of a close corporation [5] Failure to file by-laws within the

may, by written petition to the Securities and required period;

Exchange Commission, compel the

dissolution of such corporation whenever [6] Failure to file required reports in

any of acts of the directors, officers appropriate forms as determined by the

or those in control of the corporation Commission within the prescribed period;

is illegal, or fraudulent, or dishonest,

or oppressive or unfairly prejudicial Appointment of Management

to the corporation or any Committee

stockholder, or

whenever corporate assets are being A reading of the aforecited legal provision

misapplied or wasted.45 reveals that for a minority stockholder to

obtain the appointment of an interim

Dissolution of corporation sole management committee, he must do more

A corporation sole may be dissolved and its than merely make a prima facie showing of

affairs settled voluntarily by submitting to a denial of his right to share in the concerns

the Securities and Exchange Commission a of the corporation;

verified declaration of dissolution.xxx46 he must show that the corporate

property is in danger of being wasted

Grounds for involuntary dissolution and destroyed; that the business of

the corporation is being diverted

To suspend, or revoke, after proper notice from the purpose for which it has

and hearing, the franchise or certificate of been organized; and

registration of corporations, partnerships or that there is serious paralyzation of

associations, upon any of the grounds operations all to his detriment.47

provided by law, including the following:

Marking the close

[1] Fraud in procuring its certificate of

The placing of purchase or sale order, at or near

registration; the close of the trading period. The person

making the order would thus post a higher or

[2] Serious misrepresentation as to what the lower price for the security just barely before the

corporation can do or is doing to the great close of the market.

prejudice of or damage to the general public;

Painting the tape

[3] Refusal to comply or defiance of any Akin to marking the close but the activity is

lawful order of the Commission restraining made during normal trading hours.

commission of acts which would amount to

a grave violation of its franchise; GOOD LUCK ON THE FINAL EXAMS!

(26 May 2015)

ENJOY THE MID-YEAR VACATION!

45

B.P. Blg. 68, Section 105

46 47

B.P. Blg. 68, Section 115 Sy Chim vs. Sy Siy Ho & Sons (480 SCRA 2006)

Notes By: ENGR. JESSIE A. SALVADOR, MPICE | http://wordpress.com/engrjhez Page 16

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Iiqe Paper 1 Pastpaper 20200518Документ42 страницыIiqe Paper 1 Pastpaper 20200518Tsz Ngong Ko100% (3)

- Obligations and Contracts Jurado Reviewer PDFДокумент70 страницObligations and Contracts Jurado Reviewer PDFRaymond Ruther87% (15)

- Shareholder Protection From Unfairly Prejudicial Conduct: Case and Statute CitatorДокумент19 страницShareholder Protection From Unfairly Prejudicial Conduct: Case and Statute CitatorJerry TingОценок пока нет

- 1245-Bussiness LawДокумент14 страниц1245-Bussiness LawJan ryanОценок пока нет

- Definition and Attributes of A CorporationДокумент6 страницDefinition and Attributes of A Corporationkeith105Оценок пока нет

- Ramaiya Guide To The Companies Act, 18th Edition EditedДокумент20 страницRamaiya Guide To The Companies Act, 18th Edition EditedJai Verma50% (2)

- Islamic Directorate of The Phils V CA DigestДокумент2 страницыIslamic Directorate of The Phils V CA Digestmaanyag6685Оценок пока нет

- Mark Osbeck - WHAT IS GOOD LEGAL WRITING PDFДокумент51 страницаMark Osbeck - WHAT IS GOOD LEGAL WRITING PDFRalph Sembrano CatipayОценок пока нет

- Comparative Accounting: EuropeДокумент20 страницComparative Accounting: EuropeSylvia Al-a'maОценок пока нет

- PDFДокумент6 страницPDFDigvijay PrasharОценок пока нет

- ModelsДокумент24 страницыModelsakhil100% (1)

- Jclinpath00189 0119dДокумент1 страницаJclinpath00189 0119dMylscheОценок пока нет

- Pathfinder On Legal Medicine PDFДокумент5 страницPathfinder On Legal Medicine PDFMylscheОценок пока нет

- Kwang in Kim: PublicationsДокумент3 страницыKwang in Kim: PublicationsMylscheОценок пока нет

- V 3Документ15 страницV 3MylscheОценок пока нет

- The Constitution of The Law Student Government: Name, Office and SealДокумент12 страницThe Constitution of The Law Student Government: Name, Office and SealMylscheОценок пока нет

- Cost Accounting 1 QUIZ - Allocation of Service Department Costs Overhead Variance AnalysisДокумент1 страницаCost Accounting 1 QUIZ - Allocation of Service Department Costs Overhead Variance AnalysisMylscheОценок пока нет

- Adv3 FinalsДокумент7 страницAdv3 FinalsMylscheОценок пока нет

- Interview With Sole Trader With Questions and AnswersДокумент5 страницInterview With Sole Trader With Questions and AnswersAbegail OlayvarОценок пока нет

- Part D - Disclosure and TransparencyДокумент21 страницаPart D - Disclosure and TransparencyMuhammadYudithEddwinaОценок пока нет

- DLF Ar +2009 10Документ195 страницDLF Ar +2009 10Muthamil Selvan DОценок пока нет

- Corporation Law NotesДокумент17 страницCorporation Law NotesDaniОценок пока нет

- Study of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementДокумент45 страницStudy of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementmaheshОценок пока нет

- Nifty OPtion Chain 30-4-2020Документ17 страницNifty OPtion Chain 30-4-2020Sushobhan DasОценок пока нет

- Network Excel DataДокумент40 страницNetwork Excel DataAnuj JoshiОценок пока нет

- College of Accountancy & FinanceДокумент5 страницCollege of Accountancy & FinanceCecille GuillermoОценок пока нет

- Deposit For Future SubscriptionДокумент3 страницыDeposit For Future SubscriptionKatrinaОценок пока нет

- Group 1 Final TPДокумент9 страницGroup 1 Final TPRagib ShahriarОценок пока нет

- FinApp Company Law Quick Revision Charts PDFДокумент13 страницFinApp Company Law Quick Revision Charts PDFAkram KhanОценок пока нет

- Corporate Governance (Law 506) Models of Corporate Governance: Japanese Model and German ModelДокумент18 страницCorporate Governance (Law 506) Models of Corporate Governance: Japanese Model and German Modelprabhat chaudharyОценок пока нет

- APC Ch10solДокумент10 страницAPC Ch10solkeith niduelanОценок пока нет

- Jong Min CheowДокумент5 страницJong Min Cheowdenesh11Оценок пока нет

- Lifting The Corporate VeilДокумент7 страницLifting The Corporate Veilgaurav singh100% (1)

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesДокумент23 страницыConsolidation Theories, Push-Down Accounting, and Corporate Joint Venturesmd salehinОценок пока нет

- P.P Rep 287 A P.P Rep 293 A: Former Liquidator Sole LiquidatorДокумент41 страницаP.P Rep 287 A P.P Rep 293 A: Former Liquidator Sole Liquidatormisc miscОценок пока нет

- Stock Eligibility ReportДокумент4 страницыStock Eligibility ReportMurali KanakamedalaОценок пока нет

- Duties of Executors in Insolvent EstatesДокумент5 страницDuties of Executors in Insolvent EstatesIsa MajОценок пока нет

- Limited Liability Partnership LLP in India and Other CountriesДокумент2 страницыLimited Liability Partnership LLP in India and Other CountriesGagan NarangОценок пока нет

- Problem Set 2 - IFMPS2 (19SP) BKCДокумент17 страницProblem Set 2 - IFMPS2 (19SP) BKCLaurenОценок пока нет