Академический Документы

Профессиональный Документы

Культура Документы

Report

Загружено:

arun_algoИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Report

Загружено:

arun_algoАвторское право:

Доступные форматы

07 Jan 2017

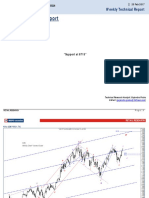

RETAIL RESEARCH

Weekly Technical Report

Weekly Technical Report

A chart speaks one thousand words

Bulls Horn Hits and Tears the First Target

Technical Research Analyst: Gajendra Prabu

E-Mail: (gajendra.prabu@hdfcsec.com)

RETAIL RESEARCH P age |1

RETAIL RESEARCH

Nifty [CMP-8243.80]

RETAIL RESEARCH P age |2

RETAIL RESEARCH

Observations: [Earlier Indications are in Italics & All levels are in Nifty Spot/Cash]

Weeks action formed a spinning top candle which indicates tug of war between bulls and bears to lead their direction. On daily charts index has formed a Dark Cloud

Cover candle pattern which is bearish reversal pattern; so index could slide in the first half of the week. This Dark Cloud Cover candle pattern is not clear by its

visibility but price character is meeting the requirement (see page no 5).

In line with our expectations index has attained our 1st extended target of 8300 - high made was 8307. Now index is showing some minor weakness on daily charts; so

book partial profit and buy again in the dips for our second and third target of 8450 8550 levels. In simple terms buy the dips as more upside room is left for bulls.

[Index has started to retrace (upward) the last fall started from 8978 to 7983, the golden retracement levels of 38.2%, 50% and 61.8% levels are placed at 8300

8450 - 8550 levels respectively. Traders can maintain positive bias for the upside targets of 8300 8450 - 8550 levels in next couple of weeks.]

Two weeks back we had mentioned about this rise to 8275 - 8350 when market was falling; we also clearly stated that At this point this view it may seem doubtful but

wave wise it has few good validations to rely on it. As we said index is moving in line with our expectations.

Index has formed a higher top formation which is beginning bullish continuation structure; next fall will halt above 7893; so that index could form a higher bottom

which is clear Bullish Dow formation.

As discussed earlier the truncated (failure) wave c has pushed the index sharply up and provided a faster upward retracement (Faster retracements could occur in

first and last moves, here first move up) which means the fall from 8275 to 7893 has taken 11 days but the same fall has retraced 100% upward in 8 days. This indicates

next fall will halt above 7893 and i.e. will be a retracement fall before the next rise.

The 200 day EMA is resisting the bulls so we may see some selloff in the first half of the week (see page no 5).

The rise from 7893 to 8307 has completed five wave advance which is an impulse; so next fall could halt above 8051 which is 61.8% retracement levels.We are

expecting index is forming zigzag pattern (a-b-c). In zigzag wave b should not retrace more than 61.8% level; if it is does then it is not wave b but wave ii. Why we

are highly relying on wave b instead of wave ii? Answer in coming weeks.

Overall traders can maintain mildly negative till 8150 8100 levels in near term and turn positive from there for the upside targets of 8450 - 8550 levels in

forthcoming weeks. Key support, trend reversal and stoploss for the larger bullish view is placed at 8000 levels.

As per our preferred wave count: Decline from the high of 9119 to 7940 is marked as major wave a .The three wave upward rise from 7940 to 8655 is marked as

major wave b and the major wave c has started from 8655 ended at 7539. This a-b-c is 1st corrective and the rise from 7539 to 8336 is marked as wave x. Then

the 2nd corrective has started from 8336. In this wave a has started from 8336 to 7714. The rise from 7714 to 7979 is wave b. The last falling leg wave c has

started from 7979 ended at 6825 with minor wave i & iv overlap. And now we are in progress of wave x which has started from 6825 level. The wave x is a rising

wedge pattern. As per our preferred count Cycle degree wave iii/C has ended at 238.2% projection level of wave i/A & wave ii/B. The cycle degree wave i/A

started from 4531 level and ended at 6229 and wave ii/B started from 6229 and ended at 5118. The dynamic wave iii/C started from 5118 and ended at 9119 with

a couple of extensions. And now index is in progress of cycle degree wave iv/X down.

RETAIL RESEARCH P age |3

RETAIL RESEARCH

Nifty Internals

The daily chart of Nifty shows how

failure c has pushed an index.

From the low of 7893 index has been

forming a zigzag pattern which is a

three wave pattern i.e. a-b-c.

A five wave advance has ended at

8306. The rise from 7983 to 8306 is

an impulse marked as wave a.

Now index is set for minor correction

towards 8150 8100 which could be

wave b and it may not move below

8051 which is 61.8% retracement

levels. Technically index is in

retracement fall before the next rise.

Technically we have two triggers to

validate that index has started wave

b down.

First, index facing resistance from the

falling channel setup.

Index kissed 38.2% retracement level

and is showing weakness; so it is clear

that index has stared wave b down.

RETAIL RESEARCH P age |4

RETAIL RESEARCH

Nifty Dark Cloud Cover Candle pattern Nifty 200 Day EMA

The above chart shows the dark cloud cover (DC) pattern formed on daily The above chart shows that 200 Day EMA is resisting the bulls around 8300

chart which is a bearish reversal. levels.

Just by seeing it may not looks like DC pattern but the price requirement i.e. a Few weeks back the same has been witnessed around 8274 levels.

bear candle should open above and cover and close below the previous bull

candles more than 61.8% of it.

Here this requirement is meeting perfectly.

RETAIL RESEARCH P age |5

RETAIL RESEARCH

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website:

www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475."

Disclosure:

We /I, (Gajendra Prabu), (MBA), authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also

certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its Associate may have beneficial ownership of

1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any

material conflict of interest. Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended

to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other jurisdiction

where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement within such

jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or published

for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this mail

and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any

other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such

company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or other

deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage

service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match

or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.

RETAIL RESEARCH P age |6

Вам также может понравиться

- Etoro Forex Trading Course - First LessonДокумент19 страницEtoro Forex Trading Course - First LessonTrading Guru100% (4)

- التأمين ٢٠٢٢-٢٠٢٣Документ2 страницыالتأمين ٢٠٢٢-٢٠٢٣lafamfatamОценок пока нет

- Valuation Certificate Subject: Valuation of Fixed Assets: Dear Sir/madamДокумент4 страницыValuation Certificate Subject: Valuation of Fixed Assets: Dear Sir/madamArjun BaralОценок пока нет

- AC15 Quiz 2Документ6 страницAC15 Quiz 2Kristine Esplana Toralde100% (1)

- Hart Venture CapitalДокумент5 страницHart Venture Capitalrubinsch86% (7)

- Daily Technical Report: Sensex (21120) / Nifty (6277)Документ4 страницыDaily Technical Report: Sensex (21120) / Nifty (6277)Raya Durai100% (1)

- GTB Statement For The Month of May 2013Документ3 страницыGTB Statement For The Month of May 2013shomama100% (2)

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Weekly Technical Report: Retail ResearchДокумент7 страницWeekly Technical Report: Retail ResearchGauriGanОценок пока нет

- Different Kinds of Obligations: ©2016 Atty. Raphael James Dizon Photo byДокумент24 страницыDifferent Kinds of Obligations: ©2016 Atty. Raphael James Dizon Photo byJimmy Boy DiazОценок пока нет

- The Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCДокумент25 страницThe Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCHulu LuluОценок пока нет

- The Illustrated Guide to Technical Analysis Signals and PhrasesОт EverandThe Illustrated Guide to Technical Analysis Signals and PhrasesОценок пока нет

- ReportДокумент5 страницReportumaganОценок пока нет

- ReportДокумент5 страницReportDinesh ChoudharyОценок пока нет

- ReportДокумент5 страницReportDinesh ChoudharyОценок пока нет

- ReportДокумент6 страницReportarun_algoОценок пока нет

- ReportДокумент7 страницReportarun_algoОценок пока нет

- Weekly Technical Report: Retail ResearchДокумент4 страницыWeekly Technical Report: Retail ResearchGauriGanОценок пока нет

- Weekly Technical Report: Retail ResearchДокумент3 страницыWeekly Technical Report: Retail ResearchGauriGanОценок пока нет

- Weekly Technical Report: Retail ResearchДокумент7 страницWeekly Technical Report: Retail ResearchGauriGanОценок пока нет

- ReportДокумент6 страницReportshobhaОценок пока нет

- HDFC WeeklyTech 04may15Документ3 страницыHDFC WeeklyTech 04may15VijayОценок пока нет

- ReportДокумент6 страницReportumaganОценок пока нет

- Weekly Technical Report: Retail ResearchДокумент3 страницыWeekly Technical Report: Retail ResearchGauriGanОценок пока нет

- ReportДокумент6 страницReportumaganОценок пока нет

- Weekly Technical Report: Retail ResearchДокумент6 страницWeekly Technical Report: Retail ResearchGauriGanОценок пока нет

- Weekly Technical ReportДокумент5 страницWeekly Technical ReportumaganОценок пока нет

- Market Commentary 11mar12Документ7 страницMarket Commentary 11mar12AndysTechnicalsОценок пока нет

- Daily Technical Report: Sensex (25318) / Nifty (7688)Документ4 страницыDaily Technical Report: Sensex (25318) / Nifty (7688)PrashantKumarОценок пока нет

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail ResearchjaimaaganОценок пока нет

- Daily Technical Report: Sensex (27275) / Nifty (8235)Документ4 страницыDaily Technical Report: Sensex (27275) / Nifty (8235)Tirthajit SinhaОценок пока нет

- Daily Technical Report, 12.08.2013Документ4 страницыDaily Technical Report, 12.08.2013Angel BrokingОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail ResearchDinesh ChoudharyОценок пока нет

- NIFTY SPOT: 8541.20: Daily Technical OutlookДокумент3 страницыNIFTY SPOT: 8541.20: Daily Technical Outlookram sahuОценок пока нет

- Market Commentary 27NOV11Документ5 страницMarket Commentary 27NOV11AndysTechnicalsОценок пока нет

- The Commodity Edge Short Term Update 20111010Документ7 страницThe Commodity Edge Short Term Update 20111010jaiswaniОценок пока нет

- Technical Format With Stock 07.12.2012Документ4 страницыTechnical Format With Stock 07.12.2012Angel BrokingОценок пока нет

- Market Commentary 18mar12Документ8 страницMarket Commentary 18mar12AndysTechnicalsОценок пока нет

- Weekly Technical Analysis 15th July 2013Документ27 страницWeekly Technical Analysis 15th July 2013Kaushaljm PatelОценок пока нет

- Market Commentary 1JUL12Документ8 страницMarket Commentary 1JUL12AndysTechnicalsОценок пока нет

- Market Commentary 20NOV11Документ7 страницMarket Commentary 20NOV11AndysTechnicalsОценок пока нет

- Daily Technical Report: Sensex (25779) / Nifty (7843)Документ4 страницыDaily Technical Report: Sensex (25779) / Nifty (7843)Kumar GauravОценок пока нет

- Technical Format With Stock 03.12.2012Документ4 страницыTechnical Format With Stock 03.12.2012Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19765) / NIFTY (6010)Документ4 страницыDaily Technical Report: Sensex (19765) / NIFTY (6010)Angel BrokingОценок пока нет

- Daily Technical Report, 17.04.2013Документ4 страницыDaily Technical Report, 17.04.2013Angel BrokingОценок пока нет

- Index 29062013Документ8 страницIndex 29062013Bhasker NiftyОценок пока нет

- Market Outlook For FY 2011 - REPORT Released in Month of April 2010 - RAJESH PALVIYAДокумент4 страницыMarket Outlook For FY 2011 - REPORT Released in Month of April 2010 - RAJESH PALVIYARajesh Palviya JainОценок пока нет

- Technical and DerivativesДокумент5 страницTechnical and DerivativesSarvesh BhagatОценок пока нет

- Daily Technical Report: Sensex (18620) / NIFTY (5472)Документ4 страницыDaily Technical Report: Sensex (18620) / NIFTY (5472)Angel BrokingОценок пока нет

- Technical Format With Stock 01.10Документ4 страницыTechnical Format With Stock 01.10Angel BrokingОценок пока нет

- NIFTY SPOT: 8510.10: Daily Technical OutlookДокумент3 страницыNIFTY SPOT: 8510.10: Daily Technical Outlookram sahuОценок пока нет

- CPR BY KGS Newsletter Issue 02Документ5 страницCPR BY KGS Newsletter Issue 02Bhupesh SinghОценок пока нет

- Daily Technical Report, 08.08.2013Документ4 страницыDaily Technical Report, 08.08.2013Angel BrokingОценок пока нет

- Technical Format With Stock 12.12.2012Документ4 страницыTechnical Format With Stock 12.12.2012Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19461) / NIFTY (5898)Документ4 страницыDaily Technical Report: Sensex (19461) / NIFTY (5898)Angel BrokingОценок пока нет

- Nifty News-27 July 2015Документ8 страницNifty News-27 July 2015NehaSharmaОценок пока нет

- Chapter 3 Lesson 1 - DepreciationДокумент13 страницChapter 3 Lesson 1 - DepreciationLeojhun PalisocОценок пока нет

- Weekly Update 26th Nov 2011Документ5 страницWeekly Update 26th Nov 2011Devang VisariaОценок пока нет

- Market Discussion 5 Dec 10Документ9 страницMarket Discussion 5 Dec 10AndysTechnicalsОценок пока нет

- Nifty Report Daily Out Look 28 June Equity Research LabДокумент8 страницNifty Report Daily Out Look 28 June Equity Research Labram sahuОценок пока нет

- Technical Format With Stock 04.12.2012Документ4 страницыTechnical Format With Stock 04.12.2012Angel BrokingОценок пока нет

- 21T3-ED-8641 Linear Models PART-2 (PDF)Документ7 страниц21T3-ED-8641 Linear Models PART-2 (PDF)The MegaHiveОценок пока нет

- Daily Technical Report, 01.07.2013Документ4 страницыDaily Technical Report, 01.07.2013Angel BrokingОценок пока нет

- Daily Technical Report, 01.08.2013Документ4 страницыDaily Technical Report, 01.08.2013Angel BrokingОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- 16find and Replace Text Using Regular Expressions - JetBrains RiderДокумент6 страниц16find and Replace Text Using Regular Expressions - JetBrains Riderarun_algoОценок пока нет

- HSL PCG "Currency Daily": 11 January, 2017Документ6 страницHSL PCG "Currency Daily": 11 January, 2017arun_algoОценок пока нет

- Indian Currency Market: Retail ResearchДокумент6 страницIndian Currency Market: Retail Researcharun_algoОценок пока нет

- En Bloc,: No.l 34IRGIDHC/2021Документ2 страницыEn Bloc,: No.l 34IRGIDHC/2021arun_algoОценок пока нет

- HSL PCG "Currency Daily": 10 January, 2017Документ6 страницHSL PCG "Currency Daily": 10 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Daily": 05 January, 2017Документ6 страницHSL PCG "Currency Daily": 05 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Документ16 страницHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Daily": 19 January, 2017Документ6 страницHSL PCG "Currency Daily": 19 January, 2017arun_algoОценок пока нет

- Indian Currency Market: Retail ResearchДокумент6 страницIndian Currency Market: Retail Researcharun_algoОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail Researcharun_algoОценок пока нет

- Suzlon Energy: Momentum Building UpДокумент9 страницSuzlon Energy: Momentum Building Uparun_algoОценок пока нет

- HSL PCG "Currency Daily": 06 January, 2017Документ6 страницHSL PCG "Currency Daily": 06 January, 2017arun_algoОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail Researcharun_algoОценок пока нет

- HSL PCG "Currency Daily": 31 January, 2017Документ6 страницHSL PCG "Currency Daily": 31 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Daily": 18 January, 2017Документ6 страницHSL PCG "Currency Daily": 18 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Daily": 20 January, 2017Документ6 страницHSL PCG "Currency Daily": 20 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Daily": 24 January, 2017Документ6 страницHSL PCG "Currency Daily": 24 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Daily": 17 January, 2017Документ6 страницHSL PCG "Currency Daily": 17 January, 2017arun_algoОценок пока нет

- HSL PCG "Currency Daily": 25 January, 2017Документ6 страницHSL PCG "Currency Daily": 25 January, 2017arun_algoОценок пока нет

- Techno Electric & Engineering: Expensive ValuationsДокумент9 страницTechno Electric & Engineering: Expensive Valuationsarun_algoОценок пока нет

- KNR Constructions: Outperformance Priced inДокумент8 страницKNR Constructions: Outperformance Priced inarun_algoОценок пока нет

- HSL PCG "Currency Insight"-Weekly: 21 January, 2017Документ16 страницHSL PCG "Currency Insight"-Weekly: 21 January, 2017arun_algoОценок пока нет

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Документ10 страницSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoОценок пока нет

- Sanghvi Movers: Compelling ValuationsДокумент9 страницSanghvi Movers: Compelling Valuationsarun_algoОценок пока нет

- Challenges To Continue: NeutralДокумент12 страницChallenges To Continue: Neutralarun_algoОценок пока нет

- Coal India: Back To Business As UsualДокумент9 страницCoal India: Back To Business As Usualarun_algoОценок пока нет

- Hindustan Zinc: Strong TailwindsДокумент8 страницHindustan Zinc: Strong Tailwindsarun_algoОценок пока нет

- Solved Will and Sandra Emmet Were Divorced This Year As PartДокумент1 страницаSolved Will and Sandra Emmet Were Divorced This Year As PartAnbu jaromiaОценок пока нет

- Singur and Nandigram and The Untold Story OF Capitalised MarxismДокумент145 страницSingur and Nandigram and The Untold Story OF Capitalised MarxismChandan BasuОценок пока нет

- Solved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonДокумент1 страницаSolved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonAnbu jaromiaОценок пока нет

- Discussion Problems: FAR Ocampo/Ocampo FAR.2902-InventoriesДокумент8 страницDiscussion Problems: FAR Ocampo/Ocampo FAR.2902-InventoriesCV CVОценок пока нет

- Brochure PGDM Exe PDFДокумент39 страницBrochure PGDM Exe PDFtrishajainmanyajainОценок пока нет

- Industry Spectra Volume 1 Series 1Документ82 страницыIndustry Spectra Volume 1 Series 1Vinay KhandelwalОценок пока нет

- Session 1 - Describing The AOM and Its Linkages To ISSAI and The IARДокумент44 страницыSession 1 - Describing The AOM and Its Linkages To ISSAI and The IARmadalangin.coaОценок пока нет

- Accounting For Governmental & Nonprofit 16e Solution Manual Chapter 17Документ24 страницыAccounting For Governmental & Nonprofit 16e Solution Manual Chapter 17sellertbsm2014Оценок пока нет

- DP Classes CA Final IDT May 2021 Module 3Документ235 страницDP Classes CA Final IDT May 2021 Module 3Sathwika DevarapalliОценок пока нет

- Customer Demographics and Sales Lab5Документ41 страницаCustomer Demographics and Sales Lab5nat lamОценок пока нет

- Daftar Akun Rumah Cantik HanaДокумент4 страницыDaftar Akun Rumah Cantik HanaLSP SMKN 1 BanjarmasinОценок пока нет

- Attendee List As of 4-22-19.Документ7 страницAttendee List As of 4-22-19.karthik83.v209Оценок пока нет

- Advacc 3 Question Set A 150 CopiesДокумент6 страницAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasОценок пока нет

- Finance and Accounts - Business Management IBДокумент6 страницFinance and Accounts - Business Management IBJUNIORОценок пока нет

- Economy India EnglishДокумент76 страницEconomy India EnglishSudama Kumar BarailyОценок пока нет

- Exide Life Sampoorna Jeevan1599746534637 PDFДокумент7 страницExide Life Sampoorna Jeevan1599746534637 PDFDarshan HN100% (1)

- InstaBIZ 1Документ14 страницInstaBIZ 1Sacjin mandalОценок пока нет

- Wallex HomepageДокумент1 страницаWallex HomepageRadius KhorОценок пока нет

- How A Bank Statement Looks LikeДокумент12 страницHow A Bank Statement Looks LikeAnil KumarОценок пока нет

- 5 AppraisalProcess MBC2015 PDFДокумент70 страниц5 AppraisalProcess MBC2015 PDFRoy John MalaluanОценок пока нет

- Nirma Lafarge AquistionДокумент9 страницNirma Lafarge Aquistionmilind goswamiОценок пока нет

- MFiN HkustДокумент26 страницMFiN Hkustjackson510024Оценок пока нет

- st2112040843 deДокумент31 страницаst2112040843 desujaydas00123Оценок пока нет

- Internship Report: Department of CommerceДокумент23 страницыInternship Report: Department of CommerceSriram SriramОценок пока нет