Академический Документы

Профессиональный Документы

Культура Документы

Insurance Double Policy Ruled Void

Загружено:

N.Santos0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров1 страницаОригинальное название

50_Pioneer-Insurance-vs.-Olivia-Yap.docx

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров1 страницаInsurance Double Policy Ruled Void

Загружено:

N.SantosАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

Insurance Double Insurance

Title GR No. L-36232

50_Pioneer Insurance vs. Olivia Yap Date: December 19, 1974

Ponente: FERNANDEZ, J.

PIONEER INSURANCE AND SURETY OLIVA YAP, represented by her attorney-in-fact, CHUA

CORPORATION, petitioner-appellant SOON POON respondent-appellee

Case Doctrine: Where a policy contains a clause providing that the policy shall be void if insured has or shall

procure any other insurance on the property, the procurement of additional insurance without the consent of the

insurer avoids the policy. The obvious purpose of the aforesaid requirement in the policy is to prevent over-

insurance and thus avert the perpetration of fraud. The public, as well as the insurer, is interested in preventing

the situation in which a fire would be profitable to the insured. According to Justice Story: "The insured has no right

to complain, for he assents to comply with all the stipulation on his side, in order to entitle himself to the benefit of

the contract, which, upon reason or principle, he has no right to ask the court to dispense with the performance of

his own part of the agreement, and yet to bind the other party to obligations, which, but for those stipulation

would not have been entered into."

FACTS

1. Respondent Oliva Yap was the owner of a store in a two-storey building, where in 1962 she sold

shopping bags and footwear, such as shoes, sandals and step-ins. Chua Soon Poon Oliva Yap's son-in-

law, was in charge of the store.

2. On April 19, 1962, respondent Yap took out Fire Insurance Policy No. 4219 from petitioner Pioneer

Insurance & Surety Corporation with a face value of P25,000.00 covering her stocks, office furniture,

fixtures and fittings of every kind and description. It is understood that, except as may be stated on

the face of the policy there is no other insurance on the property covered and no other insurance is

allowed except by the consent of the petitioner. Any false declaration or breach or this condition will

render the policy null and void.

3. At the time of the insurance on April 19, 1962 of Policy No. 4219 in favor of respondent Yap, an

insurance policy for P20,000.00 issued by the Great American Insurance Company covering the same

properties was noted on said policy as co-insurance. Later, on August 29, 1962, the parties executed

Exhibit "1-K", as an endorsement on Policy No. 4219, stating: It is hereby declared and agreed that

the co-insurance existing at present under this policy is as follows: P20,000.00 Northwest Ins., and

not as originally stated.

4. Still later, or on September 26, 1962, respondent Oliva Yap took out another fire insurance policy for

P20,000.00 covering the same properties, this time from the Federal Insurance Company, Inc., which

new policy was, however, procured without notice to and the written consent of petitioner Pioneer

Insurance & Surety Corporation and, therefore, was not noted as a co-insurance in Policy No. 4219.

5. At dawn on December 19, 1962, a fire broke out in the building housing respondent Yap's above-

mentioned store, and the said store was burned. Respondent Yap filed an insurance claim, but the

same was denied by petitioner, on the ground of "breach and/or violation of any and/or all terms and

conditions" of Policy No. 4219.

6. Trial court decided for plaintiff. Appellate court affirmed in full.

ISSUE/S

W/N petitioner should be absolved from liability on Fire Insurance Policy No. 4219 on account of any violation

by respondent Yap of the co-insurance clause therein. YES.

RESOLUTION

The Court of Appeals would consider petitioner to have waived the formal requirement of endorsing the

policy of co-insurance "since there was absolutely no showing that it was not aware of said substitution and

preferred to continue the policy." The fallacy of this argument is that, contrary to Section 1, Rule 131 of the

Revised Rules of Court, which requires each party to prove his own allegations, it would shift to petitioner,

respondent's burden of proving her proposition that petitioner was aware of the alleged substitution, and

with such knowledge preferred to continue the policy. A waiver must be express. If it is to be implied from

conduct mainly, said conduct must be clearly indicative of a clear intent to waive such right. Especially in the

case at bar where petitioner is assumed to have waived a valuable right, nothing less than a clear, positive

waiver, made with full knowledge of the circumstances, must be required.

By the plain terms of the policy, other insurance without the consent of petitioner would ipso facto avoid

the contract. It required no affirmative act of election on the part of the company to make operative the

clause avoiding the contract, wherever the specified conditions should occur. Its obligations ceased, unless,

being informed of the fact, it consented to the additional insurance.

RULING

WHEREFORE, the appealed judgment of the Court of Appeals is reversed and set aside, and the petitioner absolved from

all liability under the policy. Costs against private respondent.

2S 2016-17 (ALFARO)

Вам также может понравиться

- 128 Pioneer V YapДокумент1 страница128 Pioneer V YapJovelan V. EscañoОценок пока нет

- Pioneer Insurance v. YapДокумент1 страницаPioneer Insurance v. YapAiza OrdoñoОценок пока нет

- Insurance - Week 4Документ8 страницInsurance - Week 4Stephanie GriarОценок пока нет

- 09 Roa, Jr. Vs CAДокумент17 страниц09 Roa, Jr. Vs CAJanine RegaladoОценок пока нет

- APL v. KlepperДокумент3 страницыAPL v. KlepperJen T. TuazonОценок пока нет

- CONFLICTSДокумент7 страницCONFLICTSIrish PrecionОценок пока нет

- (C. Insurable Interest) Tai Tong Chuache & Co. vs. Insurance Commission, 158 SCRA 366, No. L-55397 February 29, 1988Документ8 страниц(C. Insurable Interest) Tai Tong Chuache & Co. vs. Insurance Commission, 158 SCRA 366, No. L-55397 February 29, 1988Alexiss Mace JuradoОценок пока нет

- Heirs of Ildelfonso CoscolluelaДокумент1 страницаHeirs of Ildelfonso CoscolluelaMaricar Corina CanayaОценок пока нет

- Ago vs. CAДокумент3 страницыAgo vs. CAJan Carlo SanchezОценок пока нет

- Verendia vs. CA & Fidelity Surety CoДокумент1 страницаVerendia vs. CA & Fidelity Surety CoJessie Albert CatapangОценок пока нет

- Gonzalez Lao V YEk Tong LinДокумент1 страницаGonzalez Lao V YEk Tong LinAllen OlayvarОценок пока нет

- Sun Insurance Office, Ltd. vs. Court of AppealsДокумент6 страницSun Insurance Office, Ltd. vs. Court of AppealsJaja Ordinario Quiachon-AbarcaОценок пока нет

- Ty Vs Filipinas Compania de SegurosДокумент3 страницыTy Vs Filipinas Compania de SegurosGigiRuizTicar100% (1)

- Union Manufacturing vs. Philippine GuarantyДокумент3 страницыUnion Manufacturing vs. Philippine GuarantyAnonymous 33LIOv6LОценок пока нет

- 48 Philippine American Life Insurance Co. v. PinedaДокумент3 страницы48 Philippine American Life Insurance Co. v. PinedaKaryl Eric BardelasОценок пока нет

- Cases in PremiumДокумент8 страницCases in PremiumChristine Jane Amancio RodriguezОценок пока нет

- Manila Mahogany v. CA, 1987Документ2 страницыManila Mahogany v. CA, 1987Randy SiosonОценок пока нет

- Tax Review Specific ItemsДокумент2 страницыTax Review Specific ItemsAllana NacinoОценок пока нет

- The Wildlife Protection ActДокумент8 страницThe Wildlife Protection Actadvravi_008Оценок пока нет

- 10 Geagonia V CA G.R. No. 114427 February 6, 1995Документ10 страниц10 Geagonia V CA G.R. No. 114427 February 6, 1995ZydalgLadyz NeadОценок пока нет

- Rem Rev Cases Full TextДокумент20 страницRem Rev Cases Full TextaaronjerardОценок пока нет

- 10) Rizal Surety & Insurance Co. vs. Manila Railroad Company, 23 SCRA 205, No. L-24043 April 25, 1968Документ4 страницы10) Rizal Surety & Insurance Co. vs. Manila Railroad Company, 23 SCRA 205, No. L-24043 April 25, 1968Alexiss Mace JuradoОценок пока нет

- IP Feist Publication Vs Rural TelephoneДокумент3 страницыIP Feist Publication Vs Rural TelephoneMi-young SunОценок пока нет

- Insurance DigestsДокумент4 страницыInsurance DigestsLesly BriesОценок пока нет

- Insular Life v. EbradoДокумент3 страницыInsular Life v. EbradoFrancis PunoОценок пока нет

- Medical Malpractice Claims ExplainedДокумент10 страницMedical Malpractice Claims ExplainedAlyssa AquinoОценок пока нет

- No Privity of Contract Between Repairmen and Insurer in Insured's AccidentДокумент6 страницNo Privity of Contract Between Repairmen and Insurer in Insured's AccidentADОценок пока нет

- Philippine Phoenix Surety & Insurance v. Woodworks on Unpaid Insurance PremiumsДокумент1 страницаPhilippine Phoenix Surety & Insurance v. Woodworks on Unpaid Insurance PremiumsAlyk Tumayan CalionОценок пока нет

- Life vs. Property Insurance; Assignments and Total LossesДокумент3 страницыLife vs. Property Insurance; Assignments and Total LossesFelix C. JAGOLINO IIIОценок пока нет

- Labrel Case Digests (Set 1)Документ21 страницаLabrel Case Digests (Set 1)jamilove20100% (1)

- ANTONINA LAMPANOvДокумент5 страницANTONINA LAMPANOvYour Public ProfileОценок пока нет

- 2nd Half Cases-Rulings OnlyДокумент39 страниц2nd Half Cases-Rulings OnlyalyssamaesanaОценок пока нет

- G.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerДокумент13 страницG.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerChatОценок пока нет

- Case DigestsДокумент33 страницыCase DigestsMark Voltaire LazaroОценок пока нет

- Case No. 21 Qua Chee Gan Vs Law Union and Rock Insurance CoДокумент2 страницыCase No. 21 Qua Chee Gan Vs Law Union and Rock Insurance CoA Paula Cruz FranciscoОценок пока нет

- Insurance 2 - Ong - RCBC V CAДокумент2 страницыInsurance 2 - Ong - RCBC V CADaniel OngОценок пока нет

- Insurance Dispute Over Unpaid PremiumДокумент3 страницыInsurance Dispute Over Unpaid PremiummansikiaboОценок пока нет

- Insurance Premium PaymentДокумент2 страницыInsurance Premium Paymentangelo doceoОценок пока нет

- Gargantos Vs YanonДокумент1 страницаGargantos Vs YanonjneОценок пока нет

- Saudia Airlines V Rebesencio (Conflict)Документ3 страницыSaudia Airlines V Rebesencio (Conflict)Yeye Farin PinzonОценок пока нет

- 5) San Miguel v. Law UnionДокумент1 страница5) San Miguel v. Law UnionRod Ralph ZantuaОценок пока нет

- G.R. No. 194328, July 01, 2015: Nroblesvirtualawlibra RyДокумент2 страницыG.R. No. 194328, July 01, 2015: Nroblesvirtualawlibra RymiyamiОценок пока нет

- Perez v. CA, 323 SCRA 613 (2000)Документ5 страницPerez v. CA, 323 SCRA 613 (2000)KristineSherikaChyОценок пока нет

- Fisherfolk challenge ECC for Mindoro power facilityДокумент14 страницFisherfolk challenge ECC for Mindoro power facilitycncrned_ctzenОценок пока нет

- Eternal Gardens Memorial Park Corporation vs. The Philippine American Life Insurance Company G.R. No. 166245 April 9, 2008Документ7 страницEternal Gardens Memorial Park Corporation vs. The Philippine American Life Insurance Company G.R. No. 166245 April 9, 2008Claudine Christine A VicenteОценок пока нет

- Cases in Insurance Law (Part I)Документ71 страницаCases in Insurance Law (Part I)kingofhearts006Оценок пока нет

- Negado Vs MakabentaДокумент2 страницыNegado Vs MakabentaZahraMinaОценок пока нет

- Understanding the Principles of InsuranceДокумент20 страницUnderstanding the Principles of Insurancegilberthufana446877Оценок пока нет

- Revenue Memorandum Circular No 48-90Документ2 страницыRevenue Memorandum Circular No 48-90UGHNESSОценок пока нет

- SECUYA v. VDA. DE SELMA Quieting of Title CaseДокумент2 страницыSECUYA v. VDA. DE SELMA Quieting of Title CaseXing Keet LuОценок пока нет

- Bachrach v. British American InsuranceДокумент3 страницыBachrach v. British American InsuranceDominique PobeОценок пока нет

- DOUBLE INSURANCE POLICIESДокумент3 страницыDOUBLE INSURANCE POLICIESLuigiMangayaОценок пока нет

- 4 Ty v. Filipinas Compañia de Seguros - Insurance PolicyДокумент3 страницы4 Ty v. Filipinas Compañia de Seguros - Insurance PolicyZydalgLadyz NeadОценок пока нет

- Insurance DigestДокумент2 страницыInsurance DigestMorphuesОценок пока нет

- 01 FORTUNATA LUCERO VIUDA DE SINDAYEN V THE INSULAR LIFE ASSURANCE CO., LTD., PDFДокумент2 страницы01 FORTUNATA LUCERO VIUDA DE SINDAYEN V THE INSULAR LIFE ASSURANCE CO., LTD., PDFCheska VergaraОценок пока нет

- Godinez Vs CAДокумент7 страницGodinez Vs CAJamie VodОценок пока нет

- TortsДокумент12 страницTortsMonice RiveraОценок пока нет

- Soncuya Vs de LunaДокумент1 страницаSoncuya Vs de LunaVikki Mae AmorioОценок пока нет

- HSBC V Jack Robert ShermanДокумент1 страницаHSBC V Jack Robert ShermanFrancise Mae Montilla MordenoОценок пока нет

- The Young Adult Starter Kit: 12 Steps To Being A Better Person: YA Self-HelpОт EverandThe Young Adult Starter Kit: 12 Steps To Being A Better Person: YA Self-HelpОценок пока нет

- Legal Counselling Reviewer MAMBAДокумент3 страницыLegal Counselling Reviewer MAMBAN.SantosОценок пока нет

- Bagong Filipinas VsДокумент2 страницыBagong Filipinas VsN.SantosОценок пока нет

- Particularly The Modern Concept of Law Practice, and Taking IntoДокумент10 страницParticularly The Modern Concept of Law Practice, and Taking IntoN.SantosОценок пока нет

- Bataan Shipyard Vs PCGGДокумент2 страницыBataan Shipyard Vs PCGGN.Santos100% (1)

- This Is For Free Scribd Download. Help Me Graduate. Please Please HuhuДокумент1 страницаThis Is For Free Scribd Download. Help Me Graduate. Please Please HuhuN.SantosОценок пока нет

- Legal Counselling Reviewer MAMBAДокумент10 страницLegal Counselling Reviewer MAMBAN.SantosОценок пока нет

- Tax 2 - Batch 1Документ14 страницTax 2 - Batch 1N.SantosОценок пока нет

- Can a father's visitation rights be denied if he is a negative influenceДокумент1 страницаCan a father's visitation rights be denied if he is a negative influenceN.SantosОценок пока нет

- Apb Corp Viewer LTДокумент162 страницыApb Corp Viewer LTN.SantosОценок пока нет

- Class Notes 11-17-2018Документ4 страницыClass Notes 11-17-2018N.SantosОценок пока нет

- RULE 130 Maliksi v. COMELEC PDFДокумент34 страницыRULE 130 Maliksi v. COMELEC PDFN.SantosОценок пока нет

- Rule 130 Scra FullДокумент187 страницRule 130 Scra FullN.SantosОценок пока нет

- Property Case DigestДокумент106 страницProperty Case DigestJim Mateo100% (6)

- 51 - Republic Bank vs. Phil Guaranty CoДокумент1 страница51 - Republic Bank vs. Phil Guaranty CoN.SantosОценок пока нет

- 37 - First Integrated Bonding Insurance Co vs. HernandoДокумент1 страница37 - First Integrated Bonding Insurance Co vs. HernandoN.SantosОценок пока нет

- Case 4 Republic Vs MarcopperДокумент2 страницыCase 4 Republic Vs MarcopperJanlucifer Rahl100% (2)

- In Re Application For Land Titles Fieldman Vs RepublicДокумент10 страницIn Re Application For Land Titles Fieldman Vs RepublicN.SantosОценок пока нет

- Insurance Policy Holders Can Implead Insurer in Criminal CaseДокумент1 страницаInsurance Policy Holders Can Implead Insurer in Criminal CaseN.Santos100% (1)

- Eagle Realty Corp Vs RepublicДокумент1 страницаEagle Realty Corp Vs RepublicN.SantosОценок пока нет

- 33 Insular Life Assurance Co. vs. FelicianoДокумент1 страница33 Insular Life Assurance Co. vs. FelicianoN.SantosОценок пока нет

- Supreme Court rules on land registration caseДокумент10 страницSupreme Court rules on land registration caseN.SantosОценок пока нет

- Supreme Court: Estanislao L. Cesa, Jr. For Petitioner. Benjamin I. Fernandez For Private RespondentДокумент9 страницSupreme Court: Estanislao L. Cesa, Jr. For Petitioner. Benjamin I. Fernandez For Private RespondentJackie CanlasОценок пока нет

- Title Issue Doctrine: 1 Atok Big-Wedge Company V. IacДокумент22 страницыTitle Issue Doctrine: 1 Atok Big-Wedge Company V. IacN.SantosОценок пока нет

- Sanchez vs. CAДокумент28 страницSanchez vs. CAArlando G. ArlandoОценок пока нет

- Bank Draft Dispute Leads to HumiliationДокумент7 страницBank Draft Dispute Leads to HumiliationN.SantosОценок пока нет

- Iglesia Vs CFI Nueva EcijaДокумент6 страницIglesia Vs CFI Nueva EcijaN.SantosОценок пока нет

- Can A Father Be Denied Visitation Rights? The Supreme Court in Its Silva Ruling Stated ThatДокумент1 страницаCan A Father Be Denied Visitation Rights? The Supreme Court in Its Silva Ruling Stated ThatN.SantosОценок пока нет

- Natres Full CasesДокумент260 страницNatres Full CasesN.SantosОценок пока нет

- Definition of Terms Under Natres LawsДокумент17 страницDefinition of Terms Under Natres LawsN.SantosОценок пока нет

- 2009 IBP ElectionsДокумент77 страниц2009 IBP ElectionsBaldovino VenturesОценок пока нет

- p240 MemristorДокумент5 страницp240 MemristorGopi ChannagiriОценок пока нет

- Awareness Training On Filipino Sign Language (FSL) PDFДокумент3 страницыAwareness Training On Filipino Sign Language (FSL) PDFEmerito PerezОценок пока нет

- De Broglie's Hypothesis: Wave-Particle DualityДокумент4 страницыDe Broglie's Hypothesis: Wave-Particle DualityAvinash Singh PatelОценок пока нет

- Understanding EndogeneityДокумент25 страницUnderstanding EndogeneityagustinusОценок пока нет

- GUIA REPASO 8° BÁSICO INGLÉS (Unidades 1-2)Документ4 страницыGUIA REPASO 8° BÁSICO INGLÉS (Unidades 1-2)Anonymous lBA5lD100% (1)

- Audience AnalysisДокумент7 страницAudience AnalysisSHAHKOT GRIDОценок пока нет

- A Study of Outdoor Interactional Spaces in High-Rise HousingДокумент13 страницA Study of Outdoor Interactional Spaces in High-Rise HousingRekha TanpureОценок пока нет

- ReportДокумент7 страницReportapi-482961632Оценок пока нет

- Problems of Education in The 21st Century, Vol. 78, No. 4, 2020Документ199 страницProblems of Education in The 21st Century, Vol. 78, No. 4, 2020Scientia Socialis, Ltd.Оценок пока нет

- New Manual of Fiber Science Revised (Tet)Документ43 страницыNew Manual of Fiber Science Revised (Tet)RAZA Khn100% (1)

- Pengaruh Implementasi Sistem Irigasi Big Gun Sprinkler Dan Bahan Organik Terhadap Kelengasan Tanah Dan Produksi Jagung Di Lahan KeringДокумент10 страницPengaruh Implementasi Sistem Irigasi Big Gun Sprinkler Dan Bahan Organik Terhadap Kelengasan Tanah Dan Produksi Jagung Di Lahan KeringDonny Nugroho KalbuadiОценок пока нет

- 1000 Electronic Devices & Circuits MCQsДокумент467 страниц1000 Electronic Devices & Circuits MCQskibrom atsbha67% (3)

- SampleДокумент4 страницыSampleParrallathanОценок пока нет

- Republic v. EncelanДокумент2 страницыRepublic v. EncelanKyla ReyesОценок пока нет

- Evidence Law PDFДокумент15 страницEvidence Law PDFwanborОценок пока нет

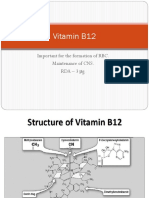

- Vitamin B12: Essential for RBC Formation and CNS MaintenanceДокумент19 страницVitamin B12: Essential for RBC Formation and CNS MaintenanceHari PrasathОценок пока нет

- Chapter 2Документ26 страницChapter 2Dinindu Siriwardene100% (1)

- Hi Scan Pro ManualДокумент231 страницаHi Scan Pro ManualFaridhul IkhsanОценок пока нет

- Second Periodic Test - 2018-2019Документ21 страницаSecond Periodic Test - 2018-2019JUVELYN BELLITAОценок пока нет

- Duah'sДокумент3 страницыDuah'sZareefОценок пока нет

- Family Health Nursing Process Part 2Документ23 страницыFamily Health Nursing Process Part 2Fatima Ysabelle Marie RuizОценок пока нет

- Guidelines For TV Broadcast Script Writing and News CastingДокумент3 страницыGuidelines For TV Broadcast Script Writing and News CastingAngel D. Liwanag0% (1)

- Operations Management Success FactorsДокумент147 страницOperations Management Success Factorsabishakekoul100% (1)

- John R. Van Wazer's concise overview of phosphorus compound nomenclatureДокумент7 страницJohn R. Van Wazer's concise overview of phosphorus compound nomenclatureFernanda Stuani PereiraОценок пока нет

- Community Action and Core Values and Principles of Community-Action InitiativesДокумент5 страницCommunity Action and Core Values and Principles of Community-Action Initiativeskimberson alacyangОценок пока нет

- 02 Cost of Capital QBДокумент26 страниц02 Cost of Capital QBAbhi JayakumarОценок пока нет

- Ashforth & Mael 1989 Social Identity Theory and The OrganizationДокумент21 страницаAshforth & Mael 1989 Social Identity Theory and The Organizationhoorie100% (1)

- Asian Paints Research ProposalДокумент1 страницаAsian Paints Research ProposalYASH JOHRI-DM 21DM222Оценок пока нет

- Germ TheoryДокумент15 страницGerm TheoryjackjugОценок пока нет