Академический Документы

Профессиональный Документы

Культура Документы

BWRR3043 2015/2016 A152

Загружено:

Cyrilraincream0 оценок0% нашли этот документ полезным (0 голосов)

81 просмотров7 страницPastyear BWRR3043

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPastyear BWRR3043

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

81 просмотров7 страницBWRR3043 2015/2016 A152

Загружено:

CyrilraincreamPastyear BWRR3043

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

BWRR3043 CONFIDENTIAL

@UUM

UNIVERSITI UTARA MALAYSIA

FINAL EXAMINATION

FIRST SEMESTER SESSION 2015/2016

COURSE CODE/NAME : BWRR3043 EMPLOYEE BENEFITS MANAGEMENT

DATE : 22 DECEMBER 2015 (TUESDAY)

TIME 2 9,00- 11.30 AM (2 % HOURS)

: BTA 13-18

INSTRUCTIONS:

1. This examination paper contains SIX (6) questions in SIX (6) printed pages

excluding the cover page.

Die craciine er aracl fed ie ontver All’ suedione n becmaper ered cree

3. Candidates are NOT ALLOWED to take both examination question and the

answer booklet out of the examination hall.

4. Candidates are bound by the UUM’s RULES AND PROCEDURES ON

ACADEMIC FRAUD.

DO NOT OPEN THIS EXAMINATION PAPER

UNTIL INSTRUCTED

CONFIDENTIAL

BWRR3043 EMPLOYEE BENEFITS MANAGEMENT

“MATRIC NO.

QUESTION ONE (10 MARKS)

a)

b)

Give definition of employee benefits.

(1 mark)

Name THREE (3) types of employee benefits offers under the following

categories. (Example: “Paid time off benefits”: the answers are Sick leave,

Maternity leave, Vacation and Sabbatical leave]

i) _ Extra cash payment to employees

(marks)

ii) Cost of services to employees

@B marks)

List any THREE (3) refevants acts to the employee benefits practices in

Malaysia.

Q marks)

QUESTION TWO (10 MARKS)

a)

by

4)

There is a misconception related to the matter of “who is paying for the cost of

employee benefits”. This misconception indicates that the paying, for employee

benefits is “free add-ons” concept while the reality is not true as being practice

in organizations. Explain the tradeoff involved in this concept.

@ marks)

Revise the Top-Down approach under the Strategic Planning of employee

benefits plan in the organization.

(2 marks)

Based on the life cycle stage, the likely preferred type of employee benefits is

align with the employee demographic and live event. What is then the TWO (2)

most desired employee benefit preferred by “young and unmarried” employees?

@ marks)

Compose TWO (2) objectives of communicating of employee benefits plan to

employees?

(4 marks)

BWRRGO43 EMPLOYEE BENEFITS MANAGEMENT

MATRIC NO.

QUESTION THREE (20 MARKS)

a) Answer the following questions related to the characteristics of the group

insurance contract:

i) Examine any FOUR (4) general underwriting principles of the group

insurance?

(8 marks)

ii) Analyse the Accelerated Benefit in the group contract provisions?

Q marks)

b) Analyse your ideas by answering the following questions related to disability

benefit

i) Differientiate the definitions between short term disability (STD) and long-

term disability (LTD).

(2 marks)

ii) “An employee had a heart attack while lifting some heavy materials at

work”. Based on that situation, analyse whether he is entitle or not to claim

under the workmen’s compensation laws?

(2 marks)

iii) Differentiate between permanent partial disability with temporary partial

disability. Give example for each type of disability.

(4 marks)

iv) Debate the meaning of workmen applied in the Malaysian Workmen’s

Compensation Laws.

(2 marks)

‘BWRB3043 EMPLOYEE BENEFITS MANAGEMENT

MATRIC XO,

QUESTION FOUR (20 MARKS)

2) Apply your health benefits knowledge in the following questions:

i) Give THREE (3) reasons why does the healtheare cost so much?

G marks)

ii) Explain the meaning of government daily cash allowance included in the

hospital and surgical insurance.

(2 marks)

iii) Briefly differientiate between Basic Medical Coverage and Major Medical

Coverage in medical expenses benefits.

(4 marks)

iv) Describe the defect in the fee-for-service systems and how to solve it?

(3 marks)

b) Ong is analyzing two options of group health insurance plans offered by her

employer as follows.

Option 1: The first group health insurance pian consists of a medical plan plus a

supplemental major medical plan, The annual limit for basic medical plan is

RM10,000 meanwhile the annual limit for supplemental major medicat plan is,

RMS50,000. The insured will be subject to a deductible of RM1,500 before the

benefits under the supplemental major medical plan are payable. The

supplemental major medical plan is a plan with 70 percent coinsurance.

Option 2: The second group health insurance plan is a comprehensive major

medical plan. The comprehensive major medical plan has an annual limit of

RM60,000. The insured will be subject to a deductible of RM1,500 which can

be accumulated from any illnesses or accidents giving rise to eligible claimable

medical expenses. The comprehensive major medical plan is a 70 percent

coinsurance plan.

BWRR3043 EMPLOYEE BENEFITS MANAGEMENT

MATRIC NO,

Based on the information given, calculate the claim amount payable to Ong on.

the following medical plans for a covered medical expense of RM25,000:

i) Basic medical plan plus supplemental major medical plan,

(3 marks)

ii) Comprehensive major medical plan.

G marks)

iii) Based on the calculations above, which plan would Ong prefer? Justify your

answer.

(2 marks)

QUESTION FIVE (20 MARKS)

a) What is an unemployment insurance? Is there any current Jaw provision that

impose this unemployment insurance in the Malaysian workforce?

(2 marks)

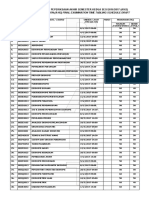

b) Complete the table below on the differences between Social insurance and Private

insurance: You have to copy the table into the answer booklet.

ii) ? Larger amount available, depending on

individual desires and ability to pay

iii) ? Benefits establish by legal contract

(contractual right)

iv) ? Competition

y) ? ‘Must operate on fully funded basis

©) Categorise FOUR (4) types of workers who are exempted from SOCSO coverage.

(4 marks)

BWRR30413 EMPLOYEE BENEFITS MANAGEMENT

MATRIC NO.

4) The employer pays 1.75% for Employment Injury Insurance Scheme and

Invalidity Pension Scheme under the SOCSO schemes. What is the employee’s

share of contribution of his or her wages should be paid for coverage under the

Invalidity Pension Scheme?

(1 mark)

e) List FOUR (4) major cost controls applied in the dental insurance.

(4 marks)

f) You have been asked to do two presentations on other (discretionary) types of

employee benefits practices in Malaysia. What is the name of your TWO (2)

selected benefits in your presentations? Briefly explain them.

(4 marks)

QUESTION SIX (20 MARKS)

a) Compose your understanding on the Malaysian retirement systems by answering

the followings:

i) Beside Social Security, Defined Benefits (DB) and Defined Contribution

(DC) Plans, provide THREE (3) other sources of retirement income for an

individual.

marks)

ii) Give areal example of the Defined Contribution (DC) Plans in Malaysia

(1 mark)

iii) Which Plan (DB or DC) that best fit the nature of today’s workforce which

have frequent job changing nature?

(1 mark)

iv) Analyse THREE (3) conditions where pension payment for government

retiree will cease even though she/he is still alive

(3 marks)

»

‘BW RR3043 EMPLOYEE BENEFITS MANAGEMENT

MATRIC NO,

¥) Provide the formula to calculate the benefit amount on gratuity payment to

government pensioners.

(2 marks)

vi) What is the percentage of a guaranteed minimum annual dividend promised

to be paid out by Employees Provident Fund (EPF) in Malaysia?

(1 mark)

vii) What is the percentage (portion) of Account 1 in the EPF? When can you

make withdrawal from Account 1?

(2 marks)

viii) Compare the protection provided by an insurance and by an annuity?

(2 marks)

You are given the following informations related to Loh’s house and her EPF

saving account:

* Cost of house = RM200,000

* Balance in EPF Account II = RM38,000

* Loan amount = 90% of the house price

Compute the amount that Loh could withdraw under the housing-withdrawal

scheme of her EPF account.

(S marks)

END OF QUESTIONS

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- HR IN PUBLIC SECTOR Past YearДокумент4 страницыHR IN PUBLIC SECTOR Past YearCyrilraincreamОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Knowledge Base Representing Porter's Five Forces ModelДокумент6 страницA Knowledge Base Representing Porter's Five Forces ModelhinirobОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Resistance To ChangeДокумент8 страницResistance To ChangeCyrilraincreamОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Effect of Sickness On WorkplaceДокумент6 страницEffect of Sickness On WorkplaceCyrilraincreamОценок пока нет

- Open Systems TheoryДокумент10 страницOpen Systems TheoryCyrilraincream100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Appreciative InquiryДокумент19 страницAppreciative InquiryCyrilraincreamОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- 1 PB PDFДокумент12 страниц1 PB PDFAknaf Ismed GanieОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Analyzing Open Source Business With Porter's FiveДокумент4 страницыAnalyzing Open Source Business With Porter's FiveCyrilraincreamОценок пока нет

- Strategic Management and Strategic Competitiveness: Student VersionДокумент16 страницStrategic Management and Strategic Competitiveness: Student VersionCyrilraincreamОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- How To Increase Learning TransferДокумент2 страницыHow To Increase Learning TransferCyrilraincreamОценок пока нет

- Chapter 5 Diagnosis of ChangeДокумент5 страницChapter 5 Diagnosis of ChangeCyrilraincreamОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Influence of Business Ethics Judgments of Malaysiaa AccountantsДокумент16 страницInfluence of Business Ethics Judgments of Malaysiaa AccountantsCyrilraincreamОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Boeings High-Flying Approach To HR Planning RecruitmentДокумент1 страницаBoeings High-Flying Approach To HR Planning RecruitmentCyrilraincream50% (2)

- Factors Influencing Consumer Ethical Decision MakingДокумент11 страницFactors Influencing Consumer Ethical Decision MakingCyrilraincreamОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sims 4 CheatДокумент1 страницаThe Sims 4 CheatCyrilraincreamОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- A Peek Into Goodyears Ergonomic SandboxДокумент3 страницыA Peek Into Goodyears Ergonomic SandboxCyrilraincreamОценок пока нет

- BSMH 3103 - PPT 3Документ24 страницыBSMH 3103 - PPT 3Cyrilraincream0% (1)

- JWP Draf A162 UumДокумент18 страницJWP Draf A162 UumCyrilraincreamОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- How To Create An Effective Training Program 8 Steps To SuccessДокумент32 страницыHow To Create An Effective Training Program 8 Steps To SuccessCyrilraincreamОценок пока нет

- Ethics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFДокумент13 страницEthics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFCyrilraincreamОценок пока нет

- How To Write A Review ArticleДокумент16 страницHow To Write A Review ArticleZama MakhathiniОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Ethics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFДокумент13 страницEthics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFCyrilraincreamОценок пока нет

- Impact of Reward On Job Satisfaction and Employee RetentionДокумент8 страницImpact of Reward On Job Satisfaction and Employee RetentionCyrilraincreamОценок пока нет

- CorruptionДокумент3 страницыCorruptionCyrilraincreamОценок пока нет

- Topic 5 BEEB1013Документ20 страницTopic 5 BEEB1013CyrilraincreamОценок пока нет

- Citing Secondary Sources (Using APA 6TH Edition)Документ1 страницаCiting Secondary Sources (Using APA 6TH Edition)CyrilraincreamОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- SQQS1013 Chapter 5Документ23 страницыSQQS1013 Chapter 5Cyrilraincream100% (1)

- Labour Law LegislationДокумент12 страницLabour Law LegislationCyrilraincreamОценок пока нет

- CalendarДокумент2 страницыCalendarSaya FarezОценок пока нет