Академический Документы

Профессиональный Документы

Культура Документы

Evolucion en El Sistema Bancario

Загружено:

4gen_30 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров5 страницАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

TXT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате TXT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров5 страницEvolucion en El Sistema Bancario

Загружено:

4gen_3Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате TXT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

DEVELOPMENTS IN LOCAL CURRENCY BANKING SYSTEM AS A RESULT OF THE IMPLEMENTATION

OF THE ITF, THE widening gap FINDINGS AND EXCHANGE OF BOLIVIA

MONTERO NUÑEZ DEL PRADO MARCELO

La Paz, October 12, 2006

DEVELOPMENTS IN LOCAL CURRENCY BANKING SYSTEM AS A RESULT OF THE IMPLEMENTATION

OF THE ITF, THE widening gap FINDINGS AND EXCHANGE OF BOLIVIA. An issue always i

n vogue among the public, government and international agencies is the high degr

ee of dollarization of the economy, weaknesses that introduces the monetary poli

cy management and vulnerability created in the financial system. The authorities

in turn implemented various measures that directly or indirectly had a major im

pact on this situation, we intend to measure them through the impact on deposits

, portfolio and operations in local currency checks as well as monetary issue, a

s explained below . In the 26 months running from the implementation of the ITF

in July 2004, which, for purposes of this analysis, concede that she set as a ta

rget for bolivianización of the economy and not simply fundraising effort led to

its implementation by the government of that time, the Central Bank of Bolivia,

from the second year of operation of such tax, start a clear incentive to use p

olicy of the national currency through the exchange widening gap that begins in

July 2005, with a widening gap between the purchase price and the sale of 4 cent

s per U.S. dollar, ending with a gap of ten cents in March 2006, stock assessmen

ts of the Bolivian reinforced since July 2005 to date, which led to an appreciat

ion of 13 cents. This article attempts to answer some questions such as "Measure

s to bolivianizar the economy have had any meaningful results? What instruments

have played a central role in the process? "Assuming that the ITF was used as an

instrument of incentive to use the national currency, was effective and what si

de effects created? Does the behavior reported to date continue in the future?.

It attempts to answer the first, third and fourth questions through an analysis

of the figures between the two extremes of the period mentioned, in what we call

global impact and the second in what I call analysis by periods of application

of the instruments. The overall impact of this set of provisions on the variable

s chosen for analysis, throughout the period of 26 months can be summarized as f

ollows:

EVOLUTION OPERATIONS JUNE 04 - SEPTEMBER 06 In Millions of $ us

MN DATE Jun-04 Part.% Sep-06 Part. VarAbs% Chg% 10% 243 701 23% 288% 458 90% DEP

OSIT ME 2.155 2.317 162 77% 108% 100% 3.018 2.398 TOTAL 100% 126% 620 69 3 MN %

383 14% 558% 314 ME PORTFOLIO 2.345 2.396 97% 86% 98% -50% TOTAL 2.464 100 2.728

100% 111% 39% 264 MN 298 323 58% 108% 25 CAMARA ME 235 459 61% 42% 51% - TOTAL

224 757 100% 558 100% 74% 199 218% 457 845

ISSUE *

388 Amount

* Issue for August 2006 Source: BCB SBEF-Figures from 2005 include Banco Los And

es includes UFV's MN = ME = Includes MNMV

1

•

Deposits in national currency banking system spent the equivalent of U.S. $ 243

million in June 2004 to U.S. $ 701 million, an increase of 188% equivalent to U.

S. $ 458 million. Foreign currency deposits, on the other hand, continue to grow

at a slower pace than 8%, thus determining the importance of local currency dep

osits in total pass 10% to 23%. • The national currency portfolio of the bank, h

aving captured the national currency resources, also recorded a significant incr

ease of U.S. $ 314 million, equivalent to a growth of 455%, rising from U.S. $ 6

9 million in June 2004 to $ us 383 million in September 2006. The foreign curren

cy bank during this period experienced a contraction of 2%. The behavior of the

portfolio determined that the local currency bank pass a share on the total port

folio in June 2004 from 3% to 14% in September 2006. • financial disintermediati

on, as measured by the operations of Cheques Clearing House during the first yea

r amounted to 36% due to lower trading volumes in U.S. $ 272 million, of which U

.S. $ 82 million corresponded to a disintermediation national currency. During t

he remainder of the period, there is a gradual and modest recovery of operations

, reducing the disintermediation to 26%, mainly due to further deterioration of

foreign exchange transactions reaching a 15% growth compared to transactions in

national currency reached 52%.• The monetary issue, it could not be otherwise,

with increased use of the national currency, is increasing the equivalent of U.S

. $ 457 million, ie 118%, from U.S. $ 388 million in June 2004 U.S. $ 845 millio

n in September 2006, growth similar to that recorded by deposits in local curren

cy in the banking system. The behavior of the analyzed variables allows some con

clusions that are detailed below, within the limits considered exclusively respo

nsible for introducing this process only the measures taken by the Government, t

he Central Bank of Bolivia and the ongoing action of the Bank through interest r

ates more attractive and profitable for deposits in national currency for foreig

n currency. • The ITF, the enlargements of the exchange rate gap and the appreci

ation of Bolivia, has led to a growing process bolivianización the operations of

the financial system and hence the economy. Progress has been made, but much re

mains to be done and this depends largely on the margins of stability and econom

ic growth, social stability and legal certainty, without which they always prior

itize safety over the return on savings. Given that the conditions which determi

ned the behavior described, they remain in greater magnitude, because the exchan

ge rate gap is 10 cents, the ITF only applies to foreign currency and would not

be surprising some additional findings Boliviano, as a result of the behavior fo

reign trade and virtually no demand for dollars in the Bolsín, you can expect th

is process to continue more rapidly. As a result of growth in local currency ope

rations, foreign exchange risk in the banking system has declined, reducing thei

r vulnerability, yet she remains at the low significance of the process yet. The

ITF despite being an adjunct to bolivianización element of the economy had a pe

rnicious effect on the degree of financial intermediation, since despite some

•

• •

2

•

•

recovery in financial intermediation, at the time of House operations and the us

e of the financial system are at levels below those registered before the enactm

ent of the measure. Continued bolivianización process with a consequent increase

of the monetary issue involved, not only will continue to provide more effectiv

e monetary policy, but will give the Central Bank of Bolivia increasing responsi

bilities in controlling inflation and, hence the economic stability. Undoubtedly

the combination of these measures are removing a habit acquired in the country

as a result of dollarization and hyperinflation experienced in the past, they di

d prioritize the security rather than profitability and that meant that income i

n Bolivianos, the dollar deposit and withdraw partial sums in Bolivia to meet ho

usehold expenses as the cost of this exchange was minimal gymnastics.

To try to answer the question concerning the greater or lesser effectiveness of

the tools used to encourage the use of the national currency, saving the fact th

at the measures can not be judged independently in their effects because they re

inforce each other and heighten the effects, analysis of the figures are done in

three periods, the first year of the ITF in which there is no other measure, th

e second between June and March 2006, characterized by enlargement of the gap fo

ur and five assessments exchange currency national and, finally, the third betwe

en April and September 2006, characterized by only two findings of the national

currency.

EVOLUTION OPERATIONS JUNE 04 - SEPTEMBER 06 In Millions of $ us

MEASURE DATE MN DEPOSITS Jun-July 4 Jun-05 ITF implementation Jul-05 Aug-05 Sep-

5 October to 5 February-06 Mar-06 Apr-06 Aug-06

Findings of the Bolivian 3-point-wide the gap is 4 points (8.05-8.09) Bolivian A

preciaciión the two points, the gap widens to 6 points (8.03-8.09) Bolivian Find

ings of a point (8.02-8.08) Findings the Bolivian two points - by widening the g

ap to 8 points (8.00-8.08) Bolivian Findings of a point (7.99-8.07) Findings of

the Bolivian-2 points the gap widens to 10 points (7.97-8.07) Findings of Bolivi

an 1 point (7.96-8.06) Bolivian Findings of a point (7.95-8.05)

PORTFOLIO ME MN 69 144 2.396 2.412

CAMARA ME MN 298 213 459 272

Amount 388 501 ISSUE

2.328 2.155 ME

243 348

376 406 425 484 522 545 558 680 701

2.346 2.414 2.416 2.443 2.348 2.344 2.337 2.280 2.317

149 154 179 190 234 235 245 359 383

2.419 2.412 2.401 2.405 2.346 2.356 2.377 2.348 2.345

217 259 246 235 203 253 222 311 323

223 267 256 251 192 273 244 221 235

517 544 571 596 709 690 728 845 845

Sep-06 *

Figures from 2005 include Banco Los Andes Includes UFV's MN = ME = Includes MNMV

3

DEVELOPMENTS IN OPERATIONS MN

900 800 700 600 500 400 300 200 100 0

Jun-4 June to 5 July-05 Aug-05 Sep-5 October to 5 February-06 Mar-06 Apr-06 Aug-

06 Sep-06

Deposits MN

Portfolio MN

NM House Operations

Monetary Issue

* Issue for August 2006 Source: SBEF-BCB

•

First year of the ITF (July 2004 - June 2005). or public deposits in national cu

rrency increased by 43%, reaching U.S. $ 348 million representing 13% of total d

eposits, compared with 10% representing June 2004. o The national currency portf

olio increased by 110% to U.S. $ 144 million, or 6% of the total portfolio, comp

ared to 3% in June 2004 depicting. or direct financial disintermediation as the

amount of operations in Check Clearing for both currencies, shows a reduction of

such operations was 36%, falling from U.S. $ U.S. $ 757 million to 485 million,

corresponding to 28% ($ U.S. 85 million) in local currency and 41% (U.S. $ 187

million) in foreign currency. Consistent with this behavior or the money supply

grows by 29% from U.S. $ 388 million to U.S. $ 501 million. Second period of enl

argement of the breach by 10 cents and appreciation of the Boliviano at 11 cents

(July 2005 - March 2006). During this period the exchange rate goes from 8.08 B

s buying and selling Bs 8.10 Bs 7.97 Bs 8.05 buying and selling the U.S. dollar.

or public deposits in national currency in each of the extensions of the breach

, reinforced by findings from Bolivia, are increased by 81% from the equivalent

of U.S. $ 438 million to U.S. $ 545 million. In the same period foreign currency

deposits only grow at USD 16 million, translating this into the national curren

cy deposits go to represent 19% of total deposits, compared to 13% which represe

nted the end of first year ITF. o The national currency portfolio increases by t

he equivalent of U.S. $ 91 million, reaching U.S. $ 235 million, while the portf

olio in foreign currency decreases in U.S. $ 56 million. This behavior determine

s the portfolio in domestic currency pass for a share of the total portfolio of

6% recorded at the end of the first year of the ITF to 9%.

•

4

In this period the financial disintermediation is reversed slightly surpassing H

ouse operations to those recorded at the end of the first year of the ITF at USD

42 million, mainly due to growth in local currency operations by 19% and the ma

intenance of standards of foreign exchange transactions. Despite this slight rec

overy of the Clearing House operations were 30% below those registered before th

e enactment of the ITF. Unsurprisingly or monetary issue continues to grow and d

o these nine months at USD 189 million. or • In the third selected period (April

-September 2006), characterized by only two findings of Bolivia in April and Aug

ust, the exchange rate stands at 7.95 Bs 8.05 Bs buying and selling the U.S. dol

lar. o The national currency deposits increased by the equivalent of U.S. $ 156

million, representing an increase of 29%, while foreign currency deposits grow a

t USD 129 million, equivalent to 4%. The behavior described determines that depo

sits in domestic currency deposits in this period to move from a share of the to

tal deposits from 19% to 23%. o The bank national currency increased by U.S. $ 1

48 million, ie 63% growth compared to growth of the portfolio in foreign currenc

y of U.S. $ 137 million, equivalent to 5%. This situation determines that began

corresponding national currency represents 14% of the total portfolio, compared

with 9% which represented the beginning of this period. o In this period there i

s a revival of financial intermediation, measured by the increase in House opera

tions in national currency in U.S. $ 70 million, while foreign currency transact

ions fall at USD 38 million, remaining operations Chamber is 26% below what they

were before the implementation of the ITF.

The three periods analyzed, with the limitation of assuming that just bolivianiz

ación due to stimuli given through the ITF, the widening gap and exchange rate a

ppreciation of Boliviancan be concluded: • • • • • In the economic bolivianizac

ión played a greater role expanding the exchange gap and the appreciation of the

ITF Boliviano. The appreciation of the Boliviano, keeping the gap change repres

ented a greater impact on the ITF bolivianización. The greatest impetus to the u

se of the national currency occurred when combined gap measures and the apprecia

tion of exchange Boliviano. Undoubtedly the various measures under consideration

were an effect of empowerment over time, increasing the impact generated by the

successive enlargements of the gap and exchange rate appreciation of the Bolivi

ano. The fact that the new grave ITF only foreign currency operations, which int

roduces a bias against the use of foreign currency is expected to strengthen bol

ivianización trend that has been registered.

5

While the analysis, it is far from complete, but allows for an assessment of the

impact of measures taken by the government in more than two years since the imp

lementation of the ITF, making it possible to quantify their impact and the degr

ee of utility of the instruments used. Marcelo Montero Nuñez del Prado La Paz, O

ctober 12, 2006

6

Вам также может понравиться

- Working Methodology in The School of Football. Author: Emanuele Aquilani Att Cisco Calcio RomaДокумент4 страницыWorking Methodology in The School of Football. Author: Emanuele Aquilani Att Cisco Calcio Roma4gen_3Оценок пока нет

- CCB - Suggested Methods For MusiciansДокумент2 страницыCCB - Suggested Methods For Musicians4gen_3Оценок пока нет

- Model CurriculumДокумент1 страницаModel Curriculum4gen_3Оценок пока нет

- Disclosure of Information Technology For SchoolsДокумент4 страницыDisclosure of Information Technology For Schools4gen_3Оценок пока нет

- UntitledДокумент6 страницUntitled4gen_3Оценок пока нет

- OSegredoДокумент14 страницOSegredo4gen_3Оценок пока нет

- What Should Be A Written GFS?Документ3 страницыWhat Should Be A Written GFS?4gen_3Оценок пока нет

- JazzAscona Official Flyer - Programme 2010Документ15 страницJazzAscona Official Flyer - Programme 20104gen_3Оценок пока нет

- All About BPM - Step by Step Process To Begin WithДокумент8 страницAll About BPM - Step by Step Process To Begin With4gen_3Оценок пока нет

- Conference PackagesДокумент17 страницConference Packages4gen_3Оценок пока нет

- SociologyДокумент9 страницSociology4gen_3Оценок пока нет

- Guides Clinical Protocols Revisionists Were SystematicallyДокумент5 страницGuides Clinical Protocols Revisionists Were Systematically4gen_3Оценок пока нет

- Educaparty ScribbДокумент5 страницEducaparty Scribb4gen_3Оценок пока нет

- Do Neurons Play?Документ2 страницыDo Neurons Play?4gen_3Оценок пока нет

- Windows OriginalДокумент1 страницаWindows Original4gen_3Оценок пока нет

- ItineraryДокумент4 страницыItinerary4gen_3Оценок пока нет

- Apostila - FiberglassДокумент9 страницApostila - Fiberglass4gen_3Оценок пока нет

- The Journal of FreetownДокумент9 страницThe Journal of Freetown4gen_3Оценок пока нет

- The Guide Ablution and Prayer of The Muslim From (MC ISLAM SUNNA)Документ4 страницыThe Guide Ablution and Prayer of The Muslim From (MC ISLAM SUNNA)4gen_3Оценок пока нет

- Tuscany Exclusive Program 2010Документ8 страницTuscany Exclusive Program 20104gen_3Оценок пока нет

- No Secret Mouth 26Документ17 страницNo Secret Mouth 264gen_3Оценок пока нет

- Pensions: The Government's Guidance Document (May 16, 2010)Документ10 страницPensions: The Government's Guidance Document (May 16, 2010)4gen_3Оценок пока нет

- Museum NightДокумент13 страницMuseum Night4gen_3Оценок пока нет

- Lemon TherapyДокумент1 страницаLemon Therapy4gen_3Оценок пока нет

- Products Filling of Wrinkles - Afssaps Recommendations For The ConsumerДокумент1 страницаProducts Filling of Wrinkles - Afssaps Recommendations For The Consumer4gen_3Оценок пока нет

- Systems of Equations ExercisesДокумент2 страницыSystems of Equations Exercises4gen_3Оценок пока нет

- Whitepaper Facebook Privatsphaere 05 2010Документ16 страницWhitepaper Facebook Privatsphaere 05 20104gen_3Оценок пока нет

- 080 525 in The WombДокумент2 страницы080 525 in The Womb4gen_3Оценок пока нет

- General OphthalmologyДокумент24 страницыGeneral Ophthalmology4gen_3Оценок пока нет

- Multi OrgasmusДокумент29 страницMulti Orgasmus4gen_30% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- ERGO PolicyДокумент2 страницыERGO Policyranju93Оценок пока нет

- Unicredit CEE Quarterly 4Q2019Документ76 страницUnicredit CEE Quarterly 4Q2019Sorin DinuОценок пока нет

- Grihawas Prospectus DrawДокумент31 страницаGrihawas Prospectus Drawbyteb0xОценок пока нет

- Indian Black Money in Swiss BankДокумент2 страницыIndian Black Money in Swiss BankLogesh SaravananОценок пока нет

- AP Econ Practice Prob 22-29Документ8 страницAP Econ Practice Prob 22-29Nastassja LopezОценок пока нет

- DATA INTERPRETATION - OdtДокумент6 страницDATA INTERPRETATION - OdtAbhay DabhadeОценок пока нет

- BSP Primer - Exchange RateДокумент14 страницBSP Primer - Exchange RateCarlo Bryan CortezОценок пока нет

- Currency War - Reasons and RepercussionsДокумент15 страницCurrency War - Reasons and RepercussionsRaja Raja91% (11)

- Blanchard (2006) PDFДокумент8 страницBlanchard (2006) PDFbilly jimenezОценок пока нет

- Demo Quiz - Key Macroeconomic ConceptsДокумент10 страницDemo Quiz - Key Macroeconomic ConceptsRohit GuptaОценок пока нет

- Continue Operations or Shut DownДокумент2 страницыContinue Operations or Shut DownDivina Secretario0% (1)

- Cir vs. Toshiba Information Equipment (Phils.), Inc.Документ2 страницыCir vs. Toshiba Information Equipment (Phils.), Inc.brendamanganaan100% (2)

- Exchange Rate Overshooting Model in International MacroeconomicsДокумент12 страницExchange Rate Overshooting Model in International MacroeconomicseljosetobarОценок пока нет

- Alternative Centres of PowerДокумент12 страницAlternative Centres of PowerSameena SirajОценок пока нет

- Lesson 1 Simple InterestДокумент2 страницыLesson 1 Simple InterestKarla BangFerОценок пока нет

- Choosing The Executor or TrusteeДокумент22 страницыChoosing The Executor or TrusteeSeasoned_Sol100% (1)

- Calculation MacroДокумент19 страницCalculation Macromolla mengeshaОценок пока нет

- Mgea06 Final 2011wДокумент12 страницMgea06 Final 2011wexamkillerОценок пока нет

- Regional Economic Integration: Mcgraw-Hill/IrwinДокумент34 страницыRegional Economic Integration: Mcgraw-Hill/IrwinJulia NopsОценок пока нет

- Define Public Policy (5marks)Документ1 страницаDefine Public Policy (5marks)Syafika Masrom-4FОценок пока нет

- Fair Trade For All Stiglitz PDFДокумент2 страницыFair Trade For All Stiglitz PDFMaryОценок пока нет

- An Empirical Analysis of Balance of Payment in Ghana Using The Monetary ApproachДокумент11 страницAn Empirical Analysis of Balance of Payment in Ghana Using The Monetary ApproachAlexander DeckerОценок пока нет

- ECON+2105+exam +3+study+guide Chapters+6-8 Exam+date+04152015Документ56 страницECON+2105+exam +3+study+guide Chapters+6-8 Exam+date+04152015Likhit NayakОценок пока нет

- San Jose Civic AuditoriumДокумент11 страницSan Jose Civic AuditoriumSachin RadhakrishnanОценок пока нет

- Macroeconomics 11e Arnold Ch9 Classical Macroeconomics Attempt 4Документ5 страницMacroeconomics 11e Arnold Ch9 Classical Macroeconomics Attempt 4Pat100% (1)

- CFA Level 1 - Economics Flashcards - QuizletДокумент20 страницCFA Level 1 - Economics Flashcards - QuizletSilviu Trebuian100% (3)

- Chart of AccountsДокумент4 страницыChart of AccountsNaveed 205100% (1)

- 03 Principles of Macroeconomics I B.AДокумент2 страницы03 Principles of Macroeconomics I B.AAnish DasОценок пока нет

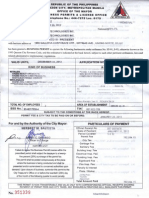

- City Business Permit 2012Документ1 страницаCity Business Permit 2012Claire BarnesОценок пока нет