Академический Документы

Профессиональный Документы

Культура Документы

Report PDF

Загружено:

Dinesh ChoudharyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Report PDF

Загружено:

Dinesh ChoudharyАвторское право:

Доступные форматы

MUTUAL FUNDS 23 Sep 2016

RETAIL RESEARCH

Monthly Report Sep 2016

Prologue: The month end Assets Under Management (AUM) of Indian Mutual Fund industry witnessed a M-o-M rise during August by 2.97% or Rs. 45,080 crore to Rs. 15,63,177 crore

against Rs. 15,18,097 crore as seen in the previous month (Source: AMFI Monthly data).

The maximum growth among MF categories during the month was seen in the AUM of Balanced Funds category by 7.77%, while the minimum growth was witnessed in the AUM of FoF

overseas category by -4.76%.

The total mutual fund industry saw net inflows of Rs. 25,332 crore while the equity categories saw net inflows of Rs. 6,103 crore during last month.

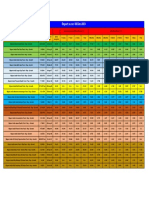

Net Flow during the month of August 2016 - Category wise AUM as on Changes in AUM

Sales on Existing Redemptions / Net Inflow / Aug 31, 2016 July 31, 2016 Including flows Including flows Excluding flows Excluding flows

Segment NFO Sales

Schemes Repurchases Outflow (Crs) (Crs) (Crs) (%) (Crs)* (%)*

Income 1,812 75,990 49,345 28,457 7,04,240 6,69,933 34,307 5.12 5,850 0.87

Infrastructure Debt Fund 0 1,795 1,782 13 0.73 13 0.73

Equity 20,501 14,398 6,103 4,16,814 4,01,469 15,345 3.82 9,242 2.30

Balanced 3,878 1,146 2,732 53,881 49,994 3,887 7.77 1,155 2.31

Liquid 13,24,461 13,37,643 -13,182 2,89,707 3,00,995 -11,288 -3.75 1,894 0.63

Gilt 1,126 1,095 31 16,149 15,875 274 1.73 243 1.53

ELSS - Equity 812 410 402 50,604 49,064 1,540 3.14 1,138 2.32

Gold ETFs 18 69 -51 6,349 6,499 -150 -2.31 -99 -1.52

Other ETFs 2,085 1,193 892 21,698 20,449 1,249 6.11 357 1.75

FOF Overseas 34 86 -52 1,940 2,037 -97 -4.76 -45 -2.21

Total 1,812 14,28,905 14,05,385 25,332 15,63,177 15,18,097 45,080 2.97 19,748 1.30

* Mainly represents approximate MTM gain / loss over the month.

Equity Markets: In the month of August 2016, the S&P BSE Sensex and CNX Nifty gained 1.4% and 1.7% respectively. The BSE Sensex jumped to a 13-month high in line with the

global markets as automakers and consumer companies rose amid speculation payment of past dues to government staff soon will stoke sales of cars and appliances. Gains in

emerging-market stocks, following a rally in US equities to near a record, aided sentiment and put the Sensex on course for its sixth monthly increase. Even the RBIs growth projection

lifted domestic investor sentiments. The Sensex has risen about 28% from the low in February as capital flows accelerated amidst a wave of global policy easing and the forecast of a

good monsoon promised a spurt in rural incomes after a two-year drought.

Debt Markets: The yields of the domestic bonds inched down significantly during the month of Aug 2016. The benchmark, 7.59% GS 2026 bond yield closed at 7.11%, down by 5 bps

over the last month. Some of the factors that influenced the market sentiments negatively during the month included Profit booking, caution ahead of RBIs monetary policy meeting,

ahead of the Jul retail inflation data, weekly auctions, caution ahead of the U.S. Federal Reserve chairs speech at the annual central bankers meeting, favourable comment from the

Federal Reserve chief on hiking rates, etc. Major factors that influenced the market sentiments positively during the month included hopes that the GST Bill would be approved in the

Parliament, approval from Rajya Sabha for GST bill, announcement of Open Market Operation by the RBI, RBIs move to ensure surplus cash in the system, strong response for weekly

auctions, strong demand from foreign investors, g announcement of auction for a new 10-year paper, etc.

Liquidity conditions improved significantly in last 3 months and have been positive during the last 2 months. As against ~Rs 12,297 crs of average liquidity net surplus placed with RBI

during the month of July through various sources (Liquidity Adjustment Facility, export refinance, marginal standing facility and term repos/reverse repos), ~Rs. 28,251 crs of liquidity

was net surplus placed with RBI during the month of August. Wholesale inflation came in at 3.55% (provisional) for the month of July, 2016.

RETAIL RESEARCH Page |1

RETAIL RESEARCH

Categories Month-end Corpus Detailed: Liquidity Provided by the RBI (Rs. Mn):

The AUM for equity category rose during Aug month by 3.82% MoM to Rs.4,16,814 crore mainly

on the back of notable inflows. In the month of August 2016, the S&P BSE Sensex and CNX Nifty

gained 1.4% and 1.7% respectively. Gains in emerging-market stocks, following a rally in US

equities to near a record, aided sentiment and put the Sensex on course for its sixth monthly

increase. Even the RBIs growth projection lifted domestic investor sentiments. The Equity

category saw net inflows of Rs. 6,103 crore during the month. The category accounts for 27% of

the overall assets of the Indian MF industry.

The AUM of Other ETFs category rose during the month by 6.11% to Rs. 21,698 crore. The

category witnessed net inflows of Rs. 892 crore. It is worth noting that EPFO has started

investing in the stock market through ETFs to invest 5-15% of its incremental corpus. It is

estimated that EPFO will invest a minimum Rs. 400-500 crore every month in the mentioned

ETF. As on June 30, the EPFO invested Rs 7,468 crore (Rs 74.68 billion) in two index-linked ETFs.

Relationship between Net flows in Equity category Vs. Nifty Index:

The AUM of Balanced category rose the most during last month. The category witnessed net

inflows of Rs. 2,732 crore during last month. The recent volatility seen in the domestic equity

markets induced the investors to shift to moderate risk bearing instruments such as Balanced

funds. The AUM of the category rose by 7.77% to Rs. 53,881 crore.

The AUM of the ELSS category witnessed a rise by 3.14% to Rs. 50,604 crore during the month.

The category saw net inflows of Rs. 402 crore during the month.

The AUM of FOF Overseas category fell the most during the month by 4.76% and stood at Rs.

1,940 crore. The category saw net outflows of Rs. 52 crore.

The AUM of Gilt category rose during last month by 1.73% to Rs. 16,149 crore. The category saw

net outflows of Rs. 31 crore during the last month. Trend in mutual Funds folios (Crs in numbers):

The AUM of liquid funds fell during last month by 3.75%. The category witnessed net outflows of

Rs. 13,182 crore. The AUM of the category stood at Rs. 2,89,707 crore.

The corpus of the Gold ETF category fell during last month by Rs. 150 crore or 2.31% to Rs. 6,349

crore. The category saw net outflows of Rs. 51 crore during the month. Gold Prices fell to its

two-month low as concerns over the possibility of an interest-rate increase drove nervous

investors to close out bets on the precious metal. Gold in INR term fell 0.5% during the last

month.

Funds mobilized by 20 newly launched schemes (All FMPs) in Aug stood at Rs. 1,812 crore.

RETAIL RESEARCH Page |2

RETAIL RESEARCH

Overall MF folios saw an increase for the 27th consecutive month. As of Aug 2016, the total Average Quarter end AUM:

number of equity folios (Equity + ELSS) stood at 3.72 crore while the overall folios of the MF

industry stood at 4.98 crore. During the month, the overall MF folios saw increase in numbers by

5.6 lakh while the equity folios saw an increase of 3.1 lakh folios.

FII & MF Activity:

On the equity side, Mutual funds were net buyers during Aug by buying net equities of Rs. 2,717

crore. They were the net sellers of Rs. 33.5 crore in July 2016. The net outflows during last

month was a result of gross purchases Rs. 29,723 crore and gross sales Rs. 27,006 crore.

On the debt side, mutual funds were net buyers in Aug by buying debt net of Rs. 4,093 crore.

They were the net buyers in July as they bought the debt securities to the tune of Rs 19,653

crore. The net inflow during the month was a result of gross purchases of Rs. 1,27,545 crore and

gross sales of Rs. 1,23,452 crore. MFs net investment in Equity and Debt during Aug 2016 (Rs in Crs):

FIIs were net buyers in equity market as they bought securities to the tune of Rs. 9,786 crore in

Aug 2016 after being net buyers of Rs. 11,339 crore in July 2016.

FIIs turned net sellers in the debt side as they sold to the tune of Rs. 2,949 crore during the

month of Aug 2016. The net inflow during the last month was a result of gross purchases Rs.

25,151 crore and gross sales Rs 28,000 crore. They were net buyers in the month of July 2016

bought debt securities for Rs. 6,965 crore.

Bulk Deals:

Company Name Date Exchge MF Price VOLUME DEAL

Health.Global 8/22/2016 BSE Reliance MF 210.00 1260104 BUY

VOLTAMP TRAN 9/01/2016 BSE Reliance MF 775.00 659200 BUY

VOLTAMP TRAN 9/01/2016 BSE ICICI Pru MF 775.00 659537 SELL

Triveni Turbine 9/02/2016 BSE FT MF 125.00 2096339 BUY

Advance. Enzyme. 8/01/2016 NSE Reliance MF 1229.43 200000 BUY

Astra Microwave 8/01/2016 NSE Reliance MF 120.05 700000 BUY

Atul 8/01/2016 NSE HDFC MF 1925.00 400000 BUY

Health.Global 8/22/2016 NSE Reliance MF 210.00 1296901 BUY

Agro Tech Foods. 8/23/2016 NSE Reliance MF 525.00 309000 SELL

GHCL 9/01/2016 NSE FT MF 257.40 1174893 BUY

Nava Bharat Vent 9/15/2016 NSE Reliance MF 112.00 443420 BUY

PRICOL LTD. 9/09/2016 NSE UTI MF 120.00 1269050 BUY

RETAIL RESEARCH Page |3

RETAIL RESEARCH

Indices & asset class returns (%) across the globe for the month of Aug 2016:

MF Categories returns (%) during the month of Aug 2016:

RETAIL RESEARCH Page |4

RETAIL RESEARCH

Toppers and Laggards for the month based on simple average basis:

Category:

Most of Mutual Fund categories posted positive returns during last month (barring Equity Infotech, Pharma and Gold ETF). On the equity oriented categories side, the Equity

Diversified sub categories such as Large-cap, Mid-cap and Multi-cap categories outperformed the key indices Sensex and Nifty. They posted returns of +2.59%, +2.71% and 3.13%

respectively. In the month of August 2016, the S&P BSE Sensex and CNX Nifty gained 1.4% and 1.7% respectively. Equity Infotech category was the bottom performer during last

month posting -2.50% return. Equity - banking category was the top performer during last month as the category posted 4.19% of returns during last month. Among Debt categories,

Gilt LT Funds outperformed other by posting returns of 1.34%.

Schemes:

Baroda Pioneer PSU Equity Fund (G), Mirae Asset China Advantage (G) and DSP BR Natural Resources & New Energy Fund (G) were the top performing schemes during the month. They

posted 7.3%, 6.8% and 6.3% of absolute returns respectively. Kotak World Gold Fund, DSP BR World Gold Fund and DSP BR World Mining Fund were least performers as they registered

returns of -14.4%, -13.2% and -7.8% respectively.

Top 3 & Bottom 3 performers from MF categories during the month (based on Simple average returns):

The following charts depict the top three (Sky blue) and the bottom three (Orange) performers in each category in Aug 2016.

Large-cap: Multi-cap:

Mid-cap: ELSS:

RETAIL RESEARCH Page |5

RETAIL RESEARCH

Equity Banking:

Equity Infrastructure:

Hybrid - Equity: MIP - LT:

Liquid: Income:

Short term Income:

Gilt:

RETAIL RESEARCH Page |6

RETAIL RESEARCH

Asset Weighted average returns (%) (Trailing) for MF categories over periods:

Category Name 1 Month Absolute 3 Months Absolute 6 Months Absolute 1 Year CAGR 3 Years CAGR 5 Years CAGR

Arbitrage Funds 0.65 1.85 3.50 6.38 6.98 7.38

Balanced - Debt Oriented 0.82 3.22 7.36 4.02 1.67 0.79

Balanced - Equity Oriented 2.16 9.08 24.47 12.53 22.94 14.60

Equity - Auto 4.05 12.82 32.69 11.12 50.68 30.68

Equity - Banking 4.72 18.69 49.78 24.15 27.63 14.66

Equity - Diversified - Dividend Yield 3.25 10.91 28.71 9.46 20.71 11.50

Equity - Diversified - Infrastructure 2.54 13.45 35.79 10.23 30.61 11.33

Equity - Diversified - LARGE 2.73 11.14 30.51 11.52 16.17 9.67

Equity - Diversified - MID 3.35 13.50 32.79 14.43 28.70 16.63

Equity - Diversified - MNC 0.07 7.05 20.51 4.36 34.93 23.19

Equity - Diversified - MULTI 3.04 12.01 30.50 12.54 21.70 13.87

Equity - Diversified - SMALL 3.25 13.62 37.19 19.98 46.54 24.66

Equity - FMCG 1.81 11.54 27.80 16.64 19.54 9.63

Equity - Infotech -2.42 -5.98 5.11 -4.00 13.78 15.26

Equity - Pharma 0.12 7.44 8.82 -4.67 26.49 22.41

Equity - Tax Planning 2.09 10.36 26.14 9.09 24.47 15.40

ETFs - Gold ETFs -1.50 7.86 3.59 17.17 -2.65 2.09

Floating Rate Income Funds 0.73 2.34 4.85 8.69 9.26 9.12

Fund of Funds - FOF - Debt 1.04 4.15 8.63 9.41 10.87 9.24

Fund of Funds - FOF - Equity 1.66 6.73 16.57 11.23 7.74 5.14

Fund of Funds - FOF - Gold -0.28 7.48 5.78 14.74 -2.05 0.48

Gilt Funds - Medium & Long Term 1.23 5.01 8.73 10.41 9.64 7.92

Gilt Funds - Short Term 1.29 5.10 9.05 12.53 11.83 9.93

Global Funds -0.20 7.04 17.57 15.32 8.77 4.86

Income Funds 1.14 4.09 7.56 10.20 9.66 7.87

Liquid Funds 0.44 1.29 2.78 5.53 6.12 6.10

Monthly Income Plans 1.45 6.28 13.22 11.28 14.74 10.98

Short Term Income Funds 0.89 3.05 5.95 9.49 9.40 8.57

Ultra Short Term Funds 0.73 2.34 4.82 8.55 8.62 8.45

Note: NAV value as of Aug 31, 2016.

RETAIL RESEARCH Page |7

RETAIL RESEARCH

Micro Analysis (period between July 2016 and Aug 2016):

New stocks bought in from primary/secondary market by at least three mutual funds during Aug 2016:

Mutual Fund Stock Mutual Fund Stock

BNP Paribas Mutual Fund HSBC Mutual Fund

DHFL Pramerica Mutual Fund Invesco Mutual Fund Muthoot Finance Ltd

Cadila Healthcare Ltd

Invesco Mutual Fund Union KBC Mutual Fund

L&T Mutual Fund Edelweiss Mutual Fund

HSBC Mutual Fund IDFC Mutual Fund NHPC Ltd

Invesco Mutual Fund Exide Industries Ltd Invesco Mutual Fund

LIC Mutual Fund Edelweiss Mutual Fund

DSP BlackRock Mutual Fund Invesco Mutual Fund

PTC India Ltd

JM Financial Mutual Fund L&T Mutual Fund

GAIL (India) Ltd

L&T Mutual Fund LIC Mutual Fund

Mirae Asset Mutual Fund Canara Robeco Mutual Fund

IDFC Mutual Fund Edelweiss Mutual Fund Tata Chemicals Ltd

Invesco Mutual Fund Godrej Consumer Products Ltd Invesco Mutual Fund

JM Financial Mutual Fund Canara Robeco Mutual Fund

Birla Sun Life Mutual Fund HDFC Mutual Fund

TCI Express Ltd

ICICI Prudential Mutual Fund Housing Development & Infrastructure Ltd IDFC Mutual Fund

IDFC Mutual Fund PRINCIPAL Mutual Fund

Stocks exited totally by at least three Mutual Funds during Aug 2016:

Mutual Fund Stock Mutual Fund Stock

BOI AXA Mutual Fund Advanced Enzyme Technologies Ltd Baroda Pioneer Mutual Fund Max India Ltd

Edelweiss Mutual Fund Motilal Oswal Mutual Fund

Kotak Mahindra Mutual Fund Sundaram Mutual Fund

Escorts Mutual Fund Ajanta Pharma Ltd JP Morgan Mutual Fund MBL Infrastructures Ltd

JM Financial Mutual Fund L&T Mutual Fund

L&T Mutual Fund Reliance Mutual Fund

BNP Paribas Mutual Fund Bata India Ltd Birla Sun Life Mutual Fund MphasiS Ltd

Tata Mutual Fund Escorts Mutual Fund

UTI Mutual Fund Taurus Mutual Fund

Baroda Pioneer Mutual Fund Bharat Financial Inclusion Ltd Baroda Pioneer Mutual Fund Muthoot Finance Ltd

Canara Robeco Mutual Fund Canara Robeco Mutual Fund

DSP BlackRock Mutual Fund SBI Mutual Fund

AXIS Mutual Fund Castrol India Ltd Baroda Pioneer Mutual Fund Persistent Systems Ltd

Escorts Mutual Fund DSP BlackRock Mutual Fund

HDFC Mutual Fund Escorts Mutual Fund

RETAIL RESEARCH Page |8

RETAIL RESEARCH

JM Financial Mutual Fund Birla Sun Life Mutual Fund Power Finance Corporation Ltd

Escorts Mutual Fund Crompton Greaves Consumer Electrical Ltd Edelweiss Mutual Fund

LIC Mutual Fund Escorts Mutual Fund

SBI Mutual Fund DSP BlackRock Mutual Fund Rural Electrification Corporation Ltd

Escorts Mutual Fund Gulf Oil Lubricants India Ltd Invesco Mutual Fund

ICICI Prudential Mutual Fund L&T Mutual Fund

Sundaram Mutual Fund PRINCIPAL Mutual Fund

Baroda Pioneer Mutual Fund HCL Technologies Ltd Tata Mutual Fund

Canara Robeco Mutual Fund UTI Mutual Fund

Escorts Mutual Fund Birla Sun Life Mutual Fund Torrent Power Ltd

Indiabulls Mutual Fund Edelweiss Mutual Fund

Edelweiss Mutual Fund Hexaware Technologies Ltd Escorts Mutual Fund

Escorts Mutual Fund BNP Paribas Mutual Fund Welspun India Ltd

LIC Mutual Fund Edelweiss Mutual Fund

Edelweiss Mutual Fund Mahindra & Mahindra Financial Services Ltd L&T Mutual Fund

IDFC Mutual Fund PRINCIPAL Mutual Fund

JM Financial Mutual Fund

Comments on Fund activities:

Funds have bought some stocks belonging to sectors like Pharma, Power Generation, Finance, Personal care to name a few.

Funds have sold some stocks belonging to Chemicals, Leather, Textiles, Finance, Pharma to name a few.

Among top AMCs having larger AUM, IDFC, Reliance and DSP BR Mutual Funds did the maximum additions and exit of stocks during the month. These funds have made fresh additions

and total exits in 29, 18 & 16 stocks respectively.

Motilal, Mirae and HSBC Mutual Funds did the least churning in terms of making fresh additions and total exits. These funds made fresh additions and total exits from 3, 4 & 4 stocks

respectively during the period.

Most common stock among Top 5 holdings in the portfolio of All 221 Equity Diversified Schemes (in terms of corpus) HDFC Bank, Infosys, ICICI Bank, SBI & ITC Ltd.

Most common stock among Top 10 holdings in the portfolio of All 221 Equity Diversified Schemes (in terms of corpus) In addition to the above, IndusInd Bank, L&T, RIL, Maruti

Suzuki Ind and Yes Bank Ltd.

RETAIL RESEARCH Page |9

RETAIL RESEARCH

NEWS:

Mahendra Kumar Jajoo appointed as Head - Fixed Income of Mirae Asset MF: Mirae Asset Mutual Fund has appointed Mr. Mahendra Kumar Jajoo as Head - Fixed Income & Key

Personnel with effect from August 22, 2016. Mr. Jajoo is ACA, ACS, CFA and has over 25 years of experience in the field of financial services including 11 years of experience in Fixed

Income funds management.

NSE to move to web-based system for MF trade from January 2017: NSE has decided to shift its mutual fund services platform to web-based system from January 2 next year. Currently,

the bourse is operating the mutual fund platform through its fully automated screen trading system - National Exchange for Automated Trading (NEAT).

Merger of Reliance MF and Goldman Sachs MF schemes: Goldman Sachs MF has 12 schemes in operation and are transferred to Reliance MF. Taking forward its deal to acquire

Goldman Sachs mutual fund business in India, Reliance Capital Asset Management has begun the process of merging the schemes of global giant with itself.

Analyst: DhuraivelGunasekaran (dhuraivel.gunasekaran@hdfcsec.com) Source: NAVIndia.com& ACEMF

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email:

hdfcsecretailresearch@hdfcsec.com.

Disclaimer: Mutual Funds investments are subject to risk. Past performance is no guarantee for future performance.This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or

copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and i t should not be relied upon as

such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional

Clients.

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams

(Institutional, PCG) of HDFC Securities Ltd. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

RETAIL RESEARCH P a g e | 10

Вам также может понравиться

- Triangle Trading MethodДокумент14 страницTriangle Trading Methodxagus100% (1)

- Court Document SummaryДокумент15 страницCourt Document SummaryAkAsh prAkhAr vErmA100% (1)

- Mutual Fund Holding Report - March 23 - 14042023Документ57 страницMutual Fund Holding Report - March 23 - 14042023Bansi Shah100% (1)

- 04peter Steidlmayer Kevin Koy-Markets and Market Logic-EnДокумент171 страница04peter Steidlmayer Kevin Koy-Markets and Market Logic-EnDinesh Choudhary100% (1)

- Aprils Detox GuideДокумент20 страницAprils Detox GuideKwasi BempongОценок пока нет

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementОт EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementОценок пока нет

- Alesco User GuideДокумент20 страницAlesco User GuideXHo D. King Jr.90% (10)

- Fathers House MansionsДокумент3 страницыFathers House Mansionswilf12100% (1)

- Monthly Report - Nov 2016: Retail ResearchДокумент10 страницMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyОценок пока нет

- Company Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PriceДокумент23 страницыCompany Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PricenkmpatnaОценок пока нет

- Name of The company-JSW STEEL LTD Financial Analysis Financial Statements 1) Income StatementДокумент6 страницName of The company-JSW STEEL LTD Financial Analysis Financial Statements 1) Income StatementzaniОценок пока нет

- MF wrap: Equity fund folio addition boosted as SIP inflows decline 61% in April-DecemberДокумент6 страницMF wrap: Equity fund folio addition boosted as SIP inflows decline 61% in April-Decemberravindra singh ratnuОценок пока нет

- Monthly report highlights top performing fundsДокумент2 страницыMonthly report highlights top performing fundsPraful ThakreОценок пока нет

- Ratio Analysis Memo and Presentation: ACCA 500Документ8 страницRatio Analysis Memo and Presentation: ACCA 500Awrangzeb AwrangОценок пока нет

- Types of Mutual Fund 1Документ14 страницTypes of Mutual Fund 1Sneha BhuwalkaОценок пока нет

- D489 Abhishek JSWphase 2Документ44 страницыD489 Abhishek JSWphase 2Yash KalaОценок пока нет

- Hindustan Uniliver - FMДокумент9 страницHindustan Uniliver - FMrachitaОценок пока нет

- Analysis of Risk & Return of 2 Companies Under 2 Portfolios (Minimum Variance Portfolio)Документ56 страницAnalysis of Risk & Return of 2 Companies Under 2 Portfolios (Minimum Variance Portfolio)Sonali Namdeo DaineОценок пока нет

- Amtek Ratios 1Документ18 страницAmtek Ratios 1Dr Sakshi SharmaОценок пока нет

- Weekly Report - 3 Aug 2007Документ5 страницWeekly Report - 3 Aug 2007api-3840085Оценок пока нет

- Avenue Supermarts Limited: (D-MART)Документ15 страницAvenue Supermarts Limited: (D-MART)Mayur0% (1)

- Avenue Supermarts Limited: (D-MART)Документ15 страницAvenue Supermarts Limited: (D-MART)Parth prajapatiОценок пока нет

- StatementДокумент12 страницStatementsupertraderОценок пока нет

- We Are Not Above Nature, We Are A Part of NatureДокумент216 страницWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVОценок пока нет

- 20051600013463voltas Result UpdateДокумент6 страниц20051600013463voltas Result UpdatennsriniОценок пока нет

- Mutual Fund Report IDBIДокумент54 страницыMutual Fund Report IDBINiruОценок пока нет

- SL& C Study 9Документ37 страницSL& C Study 9abhibth151Оценок пока нет

- Equity and Debt Fund Performance UpdateДокумент8 страницEquity and Debt Fund Performance Updatesamuel debebeОценок пока нет

- Sbi Analyst PPT Fy16Документ49 страницSbi Analyst PPT Fy16tamirisaarОценок пока нет

- Consolidated Statements of Comprehensive Income SummaryДокумент15 страницConsolidated Statements of Comprehensive Income SummaryComedy Royal PhilippinesОценок пока нет

- Aum/ Aaum Report For The Quarter Ended 31-Mar-2018 Asset Class Wise Disclosure of AUM & AAUMДокумент1 страницаAum/ Aaum Report For The Quarter Ended 31-Mar-2018 Asset Class Wise Disclosure of AUM & AAUMSandip KunduОценок пока нет

- IDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Документ28 страницIDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Essantio DeniraОценок пока нет

- Stock Marketing February Minor Project: - Piyush KaramchandaniДокумент18 страницStock Marketing February Minor Project: - Piyush KaramchandaniAyush KumarОценок пока нет

- Financial Section 2017: For The Year Ended March 31, 2017Документ104 страницыFinancial Section 2017: For The Year Ended March 31, 2017Car Și PolicarОценок пока нет

- IFS ValidationДокумент9 страницIFS ValidationcherylmanapolОценок пока нет

- Nifty Daily Movement and Stocks Technical AnalysisДокумент5 страницNifty Daily Movement and Stocks Technical AnalysisNiraj KumarОценок пока нет

- Report As On: 08-Dec-2021Документ1 страницаReport As On: 08-Dec-2021Aryan MehrotraОценок пока нет

- SOAL UTS MK 2020-2021 HarmonoДокумент5 страницSOAL UTS MK 2020-2021 HarmonoAulia Khoirun NisaОценок пока нет

- Monetary Aggregates: M1, M2 and M3: Monetary Statistics Division, Statistics & DWH DepartmentДокумент1 страницаMonetary Aggregates: M1, M2 and M3: Monetary Statistics Division, Statistics & DWH Departmentsherman ullahОценок пока нет

- SWP MAF - Jun'22Документ6 страницSWP MAF - Jun'22Deepak GoyalОценок пока нет

- Balance SheetДокумент2 страницыBalance SheetUDAYTRSОценок пока нет

- Wright Quality RatingДокумент14 страницWright Quality RatingSweetyg GuptaОценок пока нет

- Markets Stay Steady: BSE Auto Index - Motor Still RunningДокумент28 страницMarkets Stay Steady: BSE Auto Index - Motor Still RunningshanmugammaithiliОценок пока нет

- Fundcard: Invesco India Contra FundДокумент4 страницыFundcard: Invesco India Contra FundChittaОценок пока нет

- Bajaj Auto Apr 2023Документ10 страницBajaj Auto Apr 2023dhruv.bhandari.0301Оценок пока нет

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BДокумент7 страницBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniОценок пока нет

- Chapter 5b Financial (Page 1-2)Документ2 страницыChapter 5b Financial (Page 1-2)Anne XxОценок пока нет

- Oil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)Документ16 страницOil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)ravi198522Оценок пока нет

- Csmo Project ReportДокумент14 страницCsmo Project ReportAnirudh BhardwajОценок пока нет

- Fundamental Analysis Case Study of ICICI BankДокумент61 страницаFundamental Analysis Case Study of ICICI BankNirojini Bhat BhanОценок пока нет

- BST PROJECT FileДокумент5 страницBST PROJECT FileAR MASTERRОценок пока нет

- HDFC MF Mip Swap Leaflet June 2015Документ6 страницHDFC MF Mip Swap Leaflet June 2015Darkness DarknessОценок пока нет

- fm2 Project Phase 1Документ7 страницfm2 Project Phase 1SACHIN THOMAS GEORGE MBA19-21Оценок пока нет

- Pacific Grove Spice CompanyДокумент3 страницыPacific Grove Spice CompanyLaura JavelaОценок пока нет

- Financial ReportДокумент441 страницаFinancial ReportJosé Manuel EstebanОценок пока нет

- Performance Analysis of Public Sector Banks in IndiaДокумент10 страницPerformance Analysis of Public Sector Banks in IndiaSajna NadigaddaОценок пока нет

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesДокумент2 страницыData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesKIranОценок пока нет

- JETIR2002031Документ5 страницJETIR2002031adilsk1019Оценок пока нет

- 6-Month Price Earnings Trend 6-Month Price Earnings Trend 6-Month Price Earnings TrendДокумент1 страница6-Month Price Earnings Trend 6-Month Price Earnings Trend 6-Month Price Earnings Trendalroy dcruzОценок пока нет

- Muthoot FinДокумент12 страницMuthoot FinMahesh Karande (KOEL)Оценок пока нет

- BFM ASSIGNMENT 2 ANALYSISДокумент14 страницBFM ASSIGNMENT 2 ANALYSISTabrej AlamОценок пока нет

- CSB Bank LTD - IPO Note - Nov'19Документ10 страницCSB Bank LTD - IPO Note - Nov'19puchooОценок пока нет

- Annex A - Cagayan State University 2023 Financial PlanДокумент4 страницыAnnex A - Cagayan State University 2023 Financial PlanWhenng LopezОценок пока нет

- Lucky Cement ReportДокумент8 страницLucky Cement ReportmoazzamkamranОценок пока нет

- Uptempo Shareholder Update Letter June 12th 2020Документ7 страницUptempo Shareholder Update Letter June 12th 2020Steve LiОценок пока нет

- Balance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Документ22 страницыBalance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Santhiya ArivazhaganОценок пока нет

- Methodology Document of NIFTY Sectoral Index Series: January 2020Документ16 страницMethodology Document of NIFTY Sectoral Index Series: January 2020Sumit KhatanaОценок пока нет

- Forensic Review Under IBC 1711 PDFДокумент22 страницыForensic Review Under IBC 1711 PDFaaryan0001Оценок пока нет

- David Windover-The Triangle Trading Method-EnДокумент156 страницDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- MotiveWave Volume AnalysisДокумент49 страницMotiveWave Volume AnalysisDinesh ChoudharyОценок пока нет

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationДокумент2 страницыFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyОценок пока нет

- Safe Software FME Desktop/Server v2018 Data TransformationДокумент1 страницаSafe Software FME Desktop/Server v2018 Data TransformationDinesh ChoudharyОценок пока нет

- WIPRO - Pick of The Week-280119Документ15 страницWIPRO - Pick of The Week-280119Dinesh ChoudharyОценок пока нет

- All About Forensic AuditДокумент8 страницAll About Forensic AuditDinesh ChoudharyОценок пока нет

- AZB Capital Markets Update ICDR 2018 PDFДокумент120 страницAZB Capital Markets Update ICDR 2018 PDFpalo_909961085Оценок пока нет

- HSL PCG Pick-Of-The-Week - Reliance Industries - 040219Документ17 страницHSL PCG Pick-Of-The-Week - Reliance Industries - 040219Dinesh ChoudharyОценок пока нет

- ApplicationForm (GH FLATS)Документ15 страницApplicationForm (GH FLATS)Dinesh ChoudharyОценок пока нет

- Membership FormДокумент3 страницыMembership FormDinesh ChoudharyОценок пока нет

- Equity Linked Savings Schemes (ELSS) : Retail ResearchДокумент4 страницыEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyОценок пока нет

- Retail Research: Franklin India Prima Plus FundДокумент3 страницыRetail Research: Franklin India Prima Plus FundDinesh ChoudharyОценок пока нет

- Equity MF SIP Baskets For 2017: Retail ResearchДокумент2 страницыEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyОценок пока нет

- ApplicationForm (GH FLATS)Документ7 страницApplicationForm (GH FLATS)gauravghaiОценок пока нет

- ReportДокумент9 страницReportDinesh ChoudharyОценок пока нет

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterДокумент8 страницRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyОценок пока нет

- Retail Research: MF Ready ReckonerДокумент3 страницыRetail Research: MF Ready ReckonerDinesh ChoudharyОценок пока нет

- ReportДокумент3 страницыReportDinesh ChoudharyОценок пока нет

- ReportДокумент8 страницReportDinesh ChoudharyОценок пока нет

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchДокумент1 страницаShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyОценок пока нет

- ReportДокумент15 страницReportDinesh ChoudharyОценок пока нет

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesДокумент4 страницыRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyОценок пока нет

- ReportДокумент8 страницReportDinesh ChoudharyОценок пока нет

- Report PDFДокумент3 страницыReport PDFDinesh ChoudharyОценок пока нет

- Thank You LetterДокумент2 страницыThank You LetterFathina57% (7)

- English Proficiency Test (EPT) Reviewer With Answers - Part 1 - Online E LearnДокумент4 страницыEnglish Proficiency Test (EPT) Reviewer With Answers - Part 1 - Online E LearnMary Joy OlitoquitОценок пока нет

- Sugar Cane White FlyДокумент13 страницSugar Cane White Flyvishnu0751Оценок пока нет

- B1 Mod 01 MathsДокумент152 страницыB1 Mod 01 MathsTharrmaselan VmanimaranОценок пока нет

- MT 06Документ2 страницыMT 06Glen Rey BrunОценок пока нет

- 'Relentless' Poems by Jeff BezosДокумент32 страницы'Relentless' Poems by Jeff BezosromanlujanОценок пока нет

- United States v. Calvin Antonio Spencer, 68 F.3d 462, 4th Cir. (1995)Документ4 страницыUnited States v. Calvin Antonio Spencer, 68 F.3d 462, 4th Cir. (1995)Scribd Government DocsОценок пока нет

- English - Method BobathДокумент4 страницыEnglish - Method Bobathje_corektОценок пока нет

- Biology-A Complete Solution For - V. Educational ServicesДокумент2 088 страницBiology-A Complete Solution For - V. Educational Servicesteamindian gamersОценок пока нет

- Yu-Gi-Oh Nightmare Troubadour InfoДокумент12 страницYu-Gi-Oh Nightmare Troubadour InfoBrandon Bradley0% (1)

- TQM 2 MARKSДокумент12 страницTQM 2 MARKSMARIYAPPANОценок пока нет

- GATE Instrumentation Engineering Solved 2013Документ22 страницыGATE Instrumentation Engineering Solved 2013Meghraj ChiniyaОценок пока нет

- Bolomeya Model For Normal Concrete Mix DesignДокумент6 страницBolomeya Model For Normal Concrete Mix DesignprincessrandotaОценок пока нет

- 9851 BCG Vaccine Professional HCWДокумент4 страницы9851 BCG Vaccine Professional HCWIuliana PanaitОценок пока нет

- Sample Thesis Title in Business ManagementДокумент6 страницSample Thesis Title in Business Managementlisabrownomaha100% (2)

- Management Review, 32: 794-816.: Daftar PustakaДокумент8 страницManagement Review, 32: 794-816.: Daftar PustakaNurulsalamah28Оценок пока нет

- AthletesДокумент494 страницыAthletesLuis CarlosОценок пока нет

- Rock and Roll and The American Dream: Essential QuestionДокумент7 страницRock and Roll and The American Dream: Essential QuestionChad HorsleyОценок пока нет

- Function Point and Cocomo ModelДокумент31 страницаFunction Point and Cocomo ModelParinyas SinghОценок пока нет

- Rehotrical AnalysisДокумент3 страницыRehotrical AnalysisShahid MumtazОценок пока нет

- Property Management Agreement TemplateДокумент2 страницыProperty Management Agreement TemplatemarcelОценок пока нет

- One, Two and Three PerspectiveДокумент10 страницOne, Two and Three PerspectiveNikko Bait-itОценок пока нет

- BBFH107 - Business Statistics II Assignment IIДокумент2 страницыBBFH107 - Business Statistics II Assignment IIPeter TomboОценок пока нет

- An ISO 9001Документ3 страницыAn ISO 9001Prasad IngoleОценок пока нет

- EDMU 520 Phonics Lesson ObservationДокумент6 страницEDMU 520 Phonics Lesson ObservationElisa FloresОценок пока нет