Академический Документы

Профессиональный Документы

Культура Документы

Taxation Mid 2 Solution NUB

Загружено:

NiizamUddinBhuiyanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Taxation Mid 2 Solution NUB

Загружено:

NiizamUddinBhuiyanАвторское право:

Доступные форматы

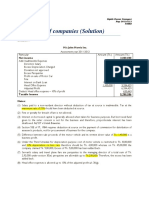

Problem

Rupon Glass Manufacturing Ltd. is a publicly traded company enlisted with the stock

exchanges of Bangladesh having a paid up share capital of Tk. 50,00,000. Its Profit and Loss

Account for the last income year was as follows:

Taka Taka

To Opening stock 12,00,000By Sales 90,00,000

Purchase of jute 40,00,000 Closing stock 11,00,000

Purchase of coal 10,00,000 Share transfer fees 11,500

Wages 5,00,000 Sale proceed of old machine 11,00,000

Salaries and allowances 6,00,000 Rental income from office

General expenses 3,00,000 space let out 8,500

Income tax 1,00,000 Dividends 93,500

Fess for technical services 60,000

Interest on loan 50,000

Directors remuneration 1,25,000

Stock damaged in fire 2,65,000

Bonus to employees 3,00,000

Depreciation on fixed 5,00,000

assets 23,13,50

Net profit 0

1,13,13, 1,13,13,

500 500

On examination of the books of account of the company, the following additional

information was revealed:

(1) The company has valued the closing stock of Tk. 11,00,000 at cost price and

opening stock would have been Tk. 10,00,000, if valued at cost price.

(2) Dividend received from a public limited company having its registered office in

Bangladesh, and which had paid a dividend distribution tax (DDT) u/s 16D.

(3) General expenses include: Tk.

Employee club building construction 50,000

Opening of night school for the workers 10,000

Legal fees related to other taxes 15,000

Embezzlement of cash by cashier 5,000

Distribution of free sample 1,50,000

Repair and maintenance expenses for office space let out 4,250

(4) The cost price of the machine sold was Tk. 10,00,000 whereas its written down

value was Tk. 3,70,740. The machine was bought 6 years back.

(5) Interest on loan was paid to a non-resident, the company did not deduct tax at

source while making the payment thereon.

(6) Depreciation on fixed assets granted as per Third Schedule Tk. 4,50,000.

(7) The company disclosed total income in its return Tk. 23,13,500 and paid Tk.

6,66,000 as tax on the basis of return (including the income tax shown in the

Profit & Loss A/C) as follows:

Source of income Amount (Taka) Tax (Taka)

Dividend income 93,500 Exempted under para 22, Part A, Sixth nil

Sch.

Other income 22,20,000 @ 30% 6,66,000

Total income 23,13,500 Total tax payable u/s 74 6,66,000

Tax paid on the basis of return 6,66,000

(8) The company paid dividend @ 10% during the last income year. Its accumulated

profit and free reserve up to the end of the last income year were Tk. 2,51,278

and Tk. 37,00,000 respectively.

Solution

Rupon Glass Manufacturing Ltd.

Income Year: 2003-04 Assessment Year: 2004-05

Particulars of Income Amount (Taka)

1. Income from House Property: u/s 24 (W-2 and Note-3) 5,950

2. Income from Business or Profession: u/s 28 (W-1) 22,02,047

3. Capital Gains: u/s 31 (W-3) nil

4. Income from Other Sources: u/s (W-4) 11,500

Total Income 22,19,497

Calculation of Tax Liability:

Amount (Taka)

1. On Dividend Income nil

2. On other income (22,19,497 @ 30%) 6,65,849

Gross tax on Total Income u/s 74 6,65,957

4. Additional tax @ 5% on undistributed profit Tk. 62,64,778 u/s 16B 3,13,239

(W-5)

Total tax 9,79,088

Less: Tax deducted at source Nil

Less: Advance tax paid (6,66,000)

Tax Liability before penalty 3,13,088

Workings:

W-1: Calculation of Income from Business or Profession:

Taka Taka

23,13,500

Net Profit as per Profit and Loss Account

Add: Items of deductions disallowed/allowed for other income-

head: 2,00,000

opening stock (12,00,000 10,00,000) 50,000

Employee club building construction

Interest to non-resident, tax not deducted at source u/s 30(aa) 50,000

Income tax (shown in P. & L. A/C) 1,00,000

Repair & maintenance expenses (for office space let out) 4,250 4,04,250

Add: Items of deductions to be considered as per ITO:

1,50,00

Cost of distribution of free sample 0

5,00,000

Depreciation on fixed asset (as per accounts)

60,000 7,10,000

Fees for technical services

Less: Income to be shown under other heads:

93,500

Dividend received DDT paid u/s 16D

11,00,00

Sale proceeds of old machine 0

Share transfer fees 11,500

(12,13,500

Rent received 8,500 )

Add: Income not yet included:

6,29,26 6,29,260

Revenue profit from sale of old machine (10,00,000

0

3,70,740)

Less: Deductions allowed as per ITO:

4,50,000

Depreciation as per Third schedule

Cost of distribution of free sample u/s 30(f)(iv) and u/r 65C (up to 1,35,000 (5,85,000)

turnover Tk. 5 crore @ 1.5%, i.e., 1.5% of Tk. 90,00,000)

Profit before charging the above expense 22,58,510

Less: Deductions allowed as per ITO:

(56,463)

Fees for technical services u/s 30(h) [up to 2.5% of above profit]

Income from Business or Profession: u/s 28 22,02,047

N.B.: Following three expenses are not to exceed the limit specified in this behalf. The

calculation of the limit will be based on the profit before charging the expenses.

(i) Entertainment expenses u/s 30(f)(i) and u/r 65: On first Tk 10 lakh @ 4% and on balance

@ 2%.

(ii) Head Office expenses for branch company u/s 30(g): up to 10% [Effective from 1-7-

2003].

(iii) Payment by way of royalty, technical services fee, technical know how fee or technical

assistance fee u/s 30(h): up to 2.5% [Effective from 1-7-2003].

W-2: Calculation of Income from House Property:

Annual value (Rental income from office space let out) Tk. 8,500

Less: Repair & maintenance Actual Tk. 4,250

Allowed equal to 30% of annual value u/s 25(1)(h) 2,550

Income from House Property Tk. 5,950

W-3: Calculation of Capital Gains:

Sale proceeds of old machine Tk.

11,00,000

Less: Cost of acquisition of the machine 10,00,000

Capital Gains (long-term), non-assessable u/s 32(5) & para 1,00,000

31A, Part A, 6th Sch.

W-4: Calculation of Income from Other Sources:

Share transfer fees Tk. 11,500

Dividends DDT paid u/s 16D Tk. 1,10,000 [non-assessable under para 22, Part A, nil

6thSch.]

Income from Other Sources 11,500

W-5: Calculation of Undistributed Profit u/s 16B:

Disclosed income Tk. 23,13,500

Accumulated profit 2,51,278

Free reserve 37,00,000

Undistributed profit Tk. 62,64,778

Md. Foysal Hossain Sohag

www.foysal.info

Вам также может понравиться

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- Af 314 Corporate Accounting FLEXI-SCHOOL: 2022 Individual AssignmentДокумент6 страницAf 314 Corporate Accounting FLEXI-SCHOOL: 2022 Individual AssignmentShiv AchariОценок пока нет

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- Reconciliation Statement MathДокумент6 страницReconciliation Statement MathRajibОценок пока нет

- Business Examples 2021Документ12 страницBusiness Examples 2021Faizan HyderОценок пока нет

- Profits Tax Computation QuestionДокумент2 страницыProfits Tax Computation Question何健珩Оценок пока нет

- Illustration 1Документ9 страницIllustration 1Thanos The titanОценок пока нет

- Notes To AccountsДокумент2 страницыNotes To Accountsnahangar113Оценок пока нет

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncДокумент8 страницAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALОценок пока нет

- 8447809Документ11 страниц8447809blackghostОценок пока нет

- Topic 3 Tutorial Questions PDFДокумент15 страницTopic 3 Tutorial Questions PDFKim FloresОценок пока нет

- Mba ZC415 Ec-3r First Sem 2022-2023Документ4 страницыMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviОценок пока нет

- ANS-1 Balance Sheet of Om Ltd. As at 31 March, 2023Документ20 страницANS-1 Balance Sheet of Om Ltd. As at 31 March, 2023Kusuma MОценок пока нет

- SS Project January 2023Документ2 страницыSS Project January 2023NUR AFFIDAH LEEОценок пока нет

- Gujarat Technological UniversityДокумент6 страницGujarat Technological UniversitymansiОценок пока нет

- Is and BS For FinalsДокумент5 страницIs and BS For FinalsRehan FarhatОценок пока нет

- Taxation Review Dec2016Документ6 страницTaxation Review Dec2016Shaiful Alam FCAОценок пока нет

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Документ5 страницLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainОценок пока нет

- AF314 RevisionДокумент7 страницAF314 RevisionShiv AchariОценок пока нет

- MOJAKOE AK1 UTS 2012 GasalДокумент15 страницMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudОценок пока нет

- 01 Audit of Income Tax Exercise SetДокумент2 страницы01 Audit of Income Tax Exercise SetBecky GonzagaОценок пока нет

- Paper - 1: Financial Reporting Questions Ind AS 103Документ30 страницPaper - 1: Financial Reporting Questions Ind AS 103sam kapoorОценок пока нет

- Income Tax Revision QuestionsДокумент13 страницIncome Tax Revision QuestionsMbeiza MariamОценок пока нет

- Illustrative Example Income TaxesДокумент4 страницыIllustrative Example Income Taxes22700021maaeОценок пока нет

- Test 3 Tax SolutionsДокумент17 страницTest 3 Tax SolutionsManjulaОценок пока нет

- Case - Chemlite (B)Документ7 страницCase - Chemlite (B)Vibhusha SinghОценок пока нет

- Chapter Five PrintДокумент18 страницChapter Five PrintGedionОценок пока нет

- WordДокумент2 страницыWordalaamabood6Оценок пока нет

- Direct Tax Solution PDFДокумент8 страницDirect Tax Solution PDFGaurav SoniОценок пока нет

- Ce Quiz II (A+b+c)Документ3 страницыCe Quiz II (A+b+c)Mohaiminur ArponОценок пока нет

- Accounts Home Test 2Документ7 страницAccounts Home Test 2Ashish RaiОценок пока нет

- Solution Test 1Документ3 страницыSolution Test 1anis izzatiОценок пока нет

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Документ23 страницыAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiОценок пока нет

- Tax ProblemsДокумент14 страницTax Problemsrav dano100% (1)

- Profits Tax Computation Illustration 2023S - Suggested Answers Ver2Документ2 страницыProfits Tax Computation Illustration 2023S - Suggested Answers Ver2何健珩Оценок пока нет

- Guideline Answers For Accounting Group - IДокумент14 страницGuideline Answers For Accounting Group - ITrisha IyerОценок пока нет

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingДокумент12 страницTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287Оценок пока нет

- Cash Flow StatementДокумент9 страницCash Flow StatementPiyush MalaniОценок пока нет

- Class 1 HomeworkДокумент10 страницClass 1 HomeworkAngel MéndezОценок пока нет

- Section A - CASE QUESTIONS (Total: 50 Marks) : Module A (December 2010 Session)Документ13 страницSection A - CASE QUESTIONS (Total: 50 Marks) : Module A (December 2010 Session)Vong Yu Kwan EdwinОценок пока нет

- Session 1 Activity 3 Cob LTDДокумент6 страницSession 1 Activity 3 Cob LTDSze ChristienyОценок пока нет

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBДокумент13 страницCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreОценок пока нет

- Laboratory Exercise 2 - Intermediate Accounting 3Документ2 страницыLaboratory Exercise 2 - Intermediate Accounting 3Zeniah LouiseОценок пока нет

- Application Level Taxation II Nov Dec 2013Документ3 страницыApplication Level Taxation II Nov Dec 2013MahediОценок пока нет

- P18 Syl2012 Set1Документ22 страницыP18 Syl2012 Set1Aswin KumarОценок пока нет

- IFRS Week 6Документ4 страницыIFRS Week 6AleksandraОценок пока нет

- Accounting MTP Question Series I 1676966561047406Документ9 страницAccounting MTP Question Series I 1676966561047406Tushar MittalОценок пока нет

- CH 4 and 5 Sanjay Ind Sol Finacman 6th EdДокумент8 страницCH 4 and 5 Sanjay Ind Sol Finacman 6th EdAnshika100% (2)

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Документ24 страницы(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaОценок пока нет

- CashFlowStatement AssignmentДокумент15 страницCashFlowStatement AssignmentAnanta Vishain0% (1)

- 5 6336743075766863237 PDFДокумент75 страниц5 6336743075766863237 PDFshagufta afrin100% (1)

- Project Information Project 1Документ8 страницProject Information Project 1biniamОценок пока нет

- Practice Solution 2Документ4 страницыPractice Solution 2Luigi NocitaОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент25 страниц© The Institute of Chartered Accountants of IndiaShobhit JalanОценок пока нет

- Excercise ProblemsДокумент7 страницExcercise ProblemsKatherine EderosasОценок пока нет

- UntitledДокумент13 страницUntitledTejasree SaiОценок пока нет

- Review For Quiz 3 Part 2Документ18 страницReview For Quiz 3 Part 2Mariah ValizadoОценок пока нет

- Statement of Comprehensive IncomeДокумент4 страницыStatement of Comprehensive Incomebobo tangaОценок пока нет

- Assignment1 - Profit and Loss Exercise E FinanceДокумент8 страницAssignment1 - Profit and Loss Exercise E Financees.eldeebОценок пока нет

- 10Документ1 страница10Bryan KenОценок пока нет

- Research ProposalДокумент14 страницResearch ProposalNiizamUddinBhuiyanОценок пока нет

- AP End of Chapter 3 QuestionsДокумент18 страницAP End of Chapter 3 QuestionsNiizamUddinBhuiyanОценок пока нет

- Importance:: Running FollowsДокумент4 страницыImportance:: Running FollowsNiizamUddinBhuiyanОценок пока нет

- Application Format For TeacherДокумент2 страницыApplication Format For TeacherNiizamUddinBhuiyanОценок пока нет

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFДокумент139 страницAccounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFNiizamUddinBhuiyanОценок пока нет

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 4 and 5Документ14 страницAccounting Principles 10th Edition Weygandt Kimmel Chapter 4 and 5NiizamUddinBhuiyan100% (1)

- Act301 AssignmentДокумент2 страницыAct301 AssignmentNiizamUddinBhuiyanОценок пока нет

- Taxation Mid 2 Solution NUBДокумент4 страницыTaxation Mid 2 Solution NUBNiizamUddinBhuiyanОценок пока нет

- Assignment On: Submitted ToДокумент1 страницаAssignment On: Submitted ToNiizamUddinBhuiyanОценок пока нет

- Class Activity 2Документ1 страницаClass Activity 2NiizamUddinBhuiyanОценок пока нет

- Hca14 - PPT - CH06 Master Budgeting and Responsibility AccountingДокумент20 страницHca14 - PPT - CH06 Master Budgeting and Responsibility AccountingNiizamUddinBhuiyan100% (1)

- Buying Any StockДокумент1 страницаBuying Any StockNiizamUddinBhuiyanОценок пока нет

- Class Activity 1Документ1 страницаClass Activity 1NiizamUddinBhuiyanОценок пока нет

- Opportunity For Luxury Brands in ChinaДокумент12 страницOpportunity For Luxury Brands in ChinaNiizamUddinBhuiyanОценок пока нет

- Taxation Income MCQДокумент59 страницTaxation Income MCQMary Therese Gabrielle Estioko33% (3)

- Chapter 15 Taxincentives Group3Документ15 страницChapter 15 Taxincentives Group3Rhenzo ManayanОценок пока нет

- Dimaampao Tax NotesДокумент69 страницDimaampao Tax NotestinctОценок пока нет

- Analysis of Case Sarla Verma Others V S DTCДокумент11 страницAnalysis of Case Sarla Verma Others V S DTCJayalakshmi RajendranОценок пока нет

- Hamza Final S.documentДокумент16 страницHamza Final S.documentWallpaper HouseОценок пока нет

- Payroll Statement InsentifДокумент3 страницыPayroll Statement Insentifdhika agustyaОценок пока нет

- Tax 1 FinalsДокумент16 страницTax 1 FinalsDenise DuriasОценок пока нет

- Answer Key HandoutsДокумент5 страницAnswer Key HandoutsRichard de Leon100% (1)

- CpaДокумент37 страницCparav danoОценок пока нет

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualДокумент6 страницFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (61)

- House PropertyДокумент33 страницыHouse PropertypriyaОценок пока нет

- SolutionДокумент57 страницSolutionJeremiah NcubeОценок пока нет

- Concepts in Federal Taxation 2013 Murphy 20th Edition Solutions ManualДокумент24 страницыConcepts in Federal Taxation 2013 Murphy 20th Edition Solutions ManualBrendaMooredxse100% (40)

- Tax 1 Outline LastДокумент5 страницTax 1 Outline LastAlyanna BarreОценок пока нет

- Chapter 5: Tax Avoidance and EvasionДокумент11 страницChapter 5: Tax Avoidance and EvasionHay JirenyaaОценок пока нет

- Flexible Clause Refer To The Power of The President Upon Recommendation ofДокумент11 страницFlexible Clause Refer To The Power of The President Upon Recommendation ofjharik23Оценок пока нет

- AABS - 2019 Al-Abbas Sugar Mills Limited - OpenDoors - PKДокумент100 страницAABS - 2019 Al-Abbas Sugar Mills Limited - OpenDoors - PKZIA UL REHMANОценок пока нет

- Chapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Документ75 страницChapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Anonymous lfw4mfCmОценок пока нет

- Sample Estate Tax ProblemДокумент14 страницSample Estate Tax ProblemAiza MadumОценок пока нет

- CGT Slides 2018 - 4th YearДокумент58 страницCGT Slides 2018 - 4th YearLemon SherbertОценок пока нет

- Conversion Into Limited Liability PartnershipДокумент34 страницыConversion Into Limited Liability Partnershipgayathris111Оценок пока нет

- Tax Credits and Calculation of Tax: What Is Income Tax?Документ59 страницTax Credits and Calculation of Tax: What Is Income Tax?Moilah MuringisiОценок пока нет

- 1ST Tax Review Questionnaires With AnswersДокумент15 страниц1ST Tax Review Questionnaires With Answersmitakumo uwu50% (6)

- BUFIN ITDeclarationFormДокумент2 страницыBUFIN ITDeclarationFormdpfsopfopsfhopОценок пока нет

- Taxable Income: Credit", As FollowsДокумент13 страницTaxable Income: Credit", As FollowsSuzette VillalinoОценок пока нет

- Income Tax Study PackДокумент68 страницIncome Tax Study PackKempton MurimiОценок пока нет

- Chapter 18 Test BankДокумент47 страницChapter 18 Test BankBrandon Lee100% (2)

- Form16.pdf HIRA PDFДокумент2 страницыForm16.pdf HIRA PDFSuchitra BakulyОценок пока нет

- Tax Newsletter January 2019 PDFДокумент9 страницTax Newsletter January 2019 PDFinobestconsultingОценок пока нет

- Draft Loan Guarantee Agreement GPC January 2012Документ188 страницDraft Loan Guarantee Agreement GPC January 2012Southern Alliance for Clean EnergyОценок пока нет