Академический Документы

Профессиональный Документы

Культура Документы

Aadhaar Seeding Circular

Загружено:

Bavya MohanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Aadhaar Seeding Circular

Загружено:

Bavya MohanАвторское право:

Доступные форматы

12.03.

2015

TO ALL OFFICES

FINANCIAL INCLUSION DIVISION CIRCULAR NO.05/2015

Reg.: Seeding of Aadhaar Number in Bank Account

1. Background

1.1. The Unique Identification Authority of India (UIDAI) has been created with an

objective is to issue a unique identification number (UIDAI) to each and every resident

of India that can be verified and authenticated in an online, cost-effective manner, which

is robust enough to eliminate duplicate and fake identities.

1.2. Aadhaar has been identified as a potent tool to facilitate various services based

on biometric authentication of the person/citizen having Aadhaar number from UIDAI

data base. However, from banks perspective transaction of customer in bank account is

one of the pivotal uses of Aadhaar.

1.3. Aadhaar Payment Bridge System (APBS) and Aadhaar Enable Payment System

(AEPS) are two products currently available for credit and basic transaction in aadhaar

enabled bank accounts. Aadhaar platform facilitate all types of transactions e.g. credit,

debit and transfer as individual credit or in bulk mode also. As per procedural guidelines

released by NPCI/IBA related to Aadhaar enabled Payment System (AEPS) will be

used to empower the customer to use Aadhaar number to access his/her account and

perform banking transactions i.e. Balance Enquiry, Cash Deposit, Cash Withdrawal and

Fund Transfer within and in between the banks.The objective of the said payment

system is to promote electronification of retail paymentand will also support

disbursement of payments by way of credit through APBS related to various

government schemes like MGNREGA, Social Security Pension and Handicapped Old

Age Pension, DBT schemes etc.

1.4. Govt. of India has approved various schemes and subsidy has to be credited to

the beneficiary accounts using Aadhaar number through Aadhaar Payment Bridge

System. Also, our bank has recently made e- life certificate (JeevanPraman) live using

Aadhaar number through all the bank branches. Therefore, Aadhaar offer a list of facility

in day to day basis.

2. Need for Aadhaar Seeding

To avail financial services through AEPS channel and to receive various

DBT/DBTL subsidies, customer should have the Aadhaar number and same should

also be available in our CBS system. Hence, it is decided to start capturing the UIDAI

number of the customer in their bank account.

3. Process of Aadhaar Seeding

3.1. Aadhaar seeding is a process of linking Aadhaar number with primary bank

account number. In view of implementation of Prime Minister Jan DhanYojana

(PMJDY), Aadhaar seeding has become more important and is a part of account

opening process for customers having Aadhaar Numbers so as to enable them to

operate their accounts through Aadhaar Enabled Payment System (AEPS).Besides

direct credit of various types of Govt. subsidies including LPG Subsidy,Department of

Financial Services (DFS), Ministry of Finance is monitoring the status of Aadhaar

seeding under PMJDY, on daily basis.

3.2. HO: ITD has issued various circular vide circular no. ITD/CBS/23/2012,

ITD/CBS/44/2012, ITD/CBS/08/2013 on Aadhaar seeding vide which it was

communicated that to capture the Aadhaar number and link customer account number,

a new menu option named as UIDNUM has been customized in the CBS system.

Subsequently, HO: ITD issued another Circular no.: ITD/CBS/56/2013 dated 05/08/2013

vides which operational guidelines on Addition of new functionalities in UIDNUM and

UIDUPL menu options have been communicated to the field. These circulars may be

referred for operational purpose.

3.3. Govt. Department/agencies may contact our bank branches/circle offices for bulk

seeding of Aadhaar numbers. In that case UIDUPL menu option is used for bulk

seeding. Tool for bulk seeding is available as Download Aadhaar Code at CBS

Homepage under Form Download.

4. Channels for receiving request of the customer for Aadhaar Seeding

4.1. Initially Bank had provided the facility for linking of Aadhaar number with account

number in CBS through branches. Now this facility has been extended through other

alternate delivery channels also: i.e. through ATM, IBS and SMS Banking. Using these

channels our Bank customer can link his account number with Aadhaar number as

under:

4.1.1. Registration through Branches

Customer has to approach branch along with his/her Aadhaar number along with

request letter so that Aadhaar number could be seeded to his account number. Request

received at branches are seeded in the bank account using UIDNUM/UIDUPL menu

option under maker checker mode.

4.1.2. Registration through ATM

Customer can enter his/her Aadhaar number through link provided at ATMs.

4.1.3. Registration through IBS

A new option is provided to customer to link his Aadhaar number with the operative

account number by entering his Aadhaar number through IBS channel.

4.1.4. Registration through the SMS Banking

Customer can send SMS to 5607640 with the key word AADHAR<space><Aadhar

Number>

The genuineness of request for Aadhaar seeding received at branches is verified by

branch officials. In order to verify the genuineness of demographic details the Aadhaar

number captured through all the alternate delivery channels are sent to UIDAI for

demographic authorization. UIDAI sends back success and failure files. These success

and failure files are uploaded automatically in Finacle. For success files, Aadhaar

number is seeded with the account number and linking of Aadhaar number is confirmed

to the customer through SMS. For failure files, system triggers SMS to customers that

their request for registration of Aadhaar number has been declined due to data

mismatch. In case of failure of Aadhaar seeding due to name mismatch the customer

may approach the branch with his Aadhaar card. The branch may then seed his/her

Aadhaar number through maker checker mode provided he/she satisfies other matches

like photo etc. and the mismatch of name is of acceptable nature.

Also, bank is in the process to extend the service of Aadhaar seeding from BC

locations.

5. Benefits associated with Aadhaar Seeding:

5.1. Source of non-interest income on DBT/DBTL credit

5.2. No need to bank own database of biometric

5.3. Interoperability

5.4. More scope for float in DBT/DBTL accounts

6. All concerned are requested to ensure seeding of Aadhaar Numbers while

opening of accounts under PMJDY. While issuing RuPay cards to customers,

mandate for seeding of Aadhaar number be taken from customers and seeding be

done on daily basis.

(V P Jain)

General Manager

Вам также может понравиться

- Underwriting GuidelinesДокумент6 страницUnderwriting GuidelinesHitkaran Singh RanawatОценок пока нет

- Investment BankingДокумент27 страницInvestment BankingAkshatha UpadhyayОценок пока нет

- Bard NoteДокумент20 страницBard NoteAmulya Kumar SahuОценок пока нет

- Aadhar Case StudyДокумент7 страницAadhar Case StudySAHIL RAJPALОценок пока нет

- Demat Request Form RetailДокумент11 страницDemat Request Form RetailHarsh YadavОценок пока нет

- Bank Financial Statements: Format of Bank Balance SheetДокумент10 страницBank Financial Statements: Format of Bank Balance SheetMannavan ThiruОценок пока нет

- Tcs India Faqs - Food CardДокумент9 страницTcs India Faqs - Food CardkolisachintОценок пока нет

- Typical Questions & AnswersДокумент82 страницыTypical Questions & AnswersSudip PaulОценок пока нет

- New Virtual Bank Account Opening Process Ver4Документ6 страницNew Virtual Bank Account Opening Process Ver4Vijay VenkatОценок пока нет

- Loan Disbursement and Recovery Procedures of BKBДокумент10 страницLoan Disbursement and Recovery Procedures of BKBFarhanChowdhuryMehdiОценок пока нет

- PGC FINACLEДокумент95 страницPGC FINACLEBavya MohanОценок пока нет

- Manual 1044 31mar19 Revised PDFДокумент232 страницыManual 1044 31mar19 Revised PDFRanjeet kumarОценок пока нет

- Shared Services India 2011Документ30 страницShared Services India 2011marcirobiОценок пока нет

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОт EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОценок пока нет

- Development Bank of The Philippines vs. Prudential BankДокумент2 страницыDevelopment Bank of The Philippines vs. Prudential BankKaye Miranda LaurenteОценок пока нет

- Discussion Paper On Aadhaar Based Financial InclusionДокумент24 страницыDiscussion Paper On Aadhaar Based Financial Inclusionreddy1151Оценок пока нет

- Discussion Paper On Aadhaar Based Financial InclusionДокумент26 страницDiscussion Paper On Aadhaar Based Financial Inclusionharry04hОценок пока нет

- E KYC PDFДокумент4 страницыE KYC PDFCRGB PersonnelОценок пока нет

- Ekyc PDFДокумент4 страницыEkyc PDFSandeep KumarОценок пока нет

- Aadhaar in The Financial World 06032014Документ14 страницAadhaar in The Financial World 06032014ykbharti101Оценок пока нет

- Aadhaar Handbook For Registrars: Unique Identification Authority of India Planning Commission, Government of IndiaДокумент35 страницAadhaar Handbook For Registrars: Unique Identification Authority of India Planning Commission, Government of Indiaonc30187Оценок пока нет

- Subject: Aadhaar - Informed ConsentДокумент1 страницаSubject: Aadhaar - Informed ConsentPSPLОценок пока нет

- DownloadДокумент1 страницаDownloadjaiswal.prateekvnsОценок пока нет

- AADHAAR Consent Letter - Non Ind PDFДокумент1 страницаAADHAAR Consent Letter - Non Ind PDFJarnail SinghОценок пока нет

- Full Name Aadhaar NumberДокумент1 страницаFull Name Aadhaar NumberJarnail SinghОценок пока нет

- Uidai: Approach Document For Aadhaar Seeding in Service Delivery DatabasesДокумент24 страницыUidai: Approach Document For Aadhaar Seeding in Service Delivery DatabasesavinashadhikariОценок пока нет

- Non DBT Adhaar - NewДокумент1 страницаNon DBT Adhaar - NewDeepankar SinghОценок пока нет

- Aadhaar Aadhaar: Authentication Authentication Framework FrameworkДокумент14 страницAadhaar Aadhaar: Authentication Authentication Framework FrameworkShubham DwivediОценок пока нет

- Aadhaar Handbook For Registrars: Unique Identification Authority of India Planning Commission, Government of IndiaДокумент35 страницAadhaar Handbook For Registrars: Unique Identification Authority of India Planning Commission, Government of IndiaAshutosh Kumar SinghОценок пока нет

- Aadhaar Consent Version 26072019-202001061254115137999Документ1 страницаAadhaar Consent Version 26072019-202001061254115137999thiyagu_808Оценок пока нет

- Product BookletДокумент11 страницProduct Bookletnidhi kapОценок пока нет

- Procedural Guidelines1Документ69 страницProcedural Guidelines1sburugulaОценок пока нет

- Faqs Bhim Aadhaar SbiДокумент2 страницыFaqs Bhim Aadhaar SbibhavikОценок пока нет

- Shweta Anand - Aadhaar' Based Banking Services Growth and Financial InclusionДокумент7 страницShweta Anand - Aadhaar' Based Banking Services Growth and Financial InclusionsumandroОценок пока нет

- Aadhaar Based ProductsДокумент1 страницаAadhaar Based ProductsRam RОценок пока нет

- Project 6Документ12 страницProject 6Goku NarutoОценок пока нет

- Aadhaar Ekyc Api 2 5Документ16 страницAadhaar Ekyc Api 2 5Ramesh VeginatiОценок пока нет

- Direct Benefit TransferДокумент16 страницDirect Benefit TransfershanujssОценок пока нет

- Steps To Activate The Inactive AadhaarДокумент2 страницыSteps To Activate The Inactive AadhaarDR Røれît ༺ShⱥRmⱥ༻Оценок пока нет

- REport Bank LawДокумент3 страницыREport Bank LawVinayakram TSОценок пока нет

- Aadhaar and Financial InclusionДокумент2 страницыAadhaar and Financial InclusionCyril JosОценок пока нет

- Unit 3. Procedure For Opening & Operating of Deposit AccountДокумент11 страницUnit 3. Procedure For Opening & Operating of Deposit AccountBhagyesh ThakurОценок пока нет

- Unit 3 TybbaДокумент11 страницUnit 3 TybbaChaitanya FulariОценок пока нет

- Udyogaadhaar - Gov.in UA UAM RegistrationДокумент5 страницUdyogaadhaar - Gov.in UA UAM RegistrationPlant Head Prasad75% (4)

- ABOUT UID-Aadhaar Number-MANMOHAN SINGH CHANDOLIYAДокумент17 страницABOUT UID-Aadhaar Number-MANMOHAN SINGH CHANDOLIYAMANMOHAN SINGH CHANDOLIYAОценок пока нет

- FAQs Digital Instant Account Opening - HDFC BankДокумент4 страницыFAQs Digital Instant Account Opening - HDFC Banksom ghoshОценок пока нет

- RBI Circular E-KYCДокумент4 страницыRBI Circular E-KYCadmiralninjaОценок пока нет

- Aadhaar Myth Busters - Unique Identification Authority of India - Government of IndiaДокумент3 страницыAadhaar Myth Busters - Unique Identification Authority of India - Government of IndiabpbhattiОценок пока нет

- Project Plan AADHAR ProjectДокумент9 страницProject Plan AADHAR ProjectIndranath MitraОценок пока нет

- AEPSДокумент11 страницAEPSAmmuManmadhanОценок пока нет

- Insta Save All Variants TNCДокумент10 страницInsta Save All Variants TNCarman ahmadkhanОценок пока нет

- Know Your Client Requirements - Clarification On Voluntary Adaptation of Aadhaar Based e-KYC ProcessДокумент4 страницыKnow Your Client Requirements - Clarification On Voluntary Adaptation of Aadhaar Based e-KYC ProcessShyam SunderОценок пока нет

- Winter PRJCT SynopsisДокумент15 страницWinter PRJCT SynopsisNitu Saini100% (1)

- DD-Digital ProductsДокумент58 страницDD-Digital ProductsFaded JadedОценок пока нет

- Internet Banking ApplicationДокумент5 страницInternet Banking ApplicationBala Murugan ThangaveluОценок пока нет

- HDFCДокумент60 страницHDFCxpovimajjuОценок пока нет

- Payment and Settlement Systems in India-Major Developments: SAARC Payments Council MeetingДокумент14 страницPayment and Settlement Systems in India-Major Developments: SAARC Payments Council MeetingLalit ShahОценок пока нет

- Pcdagri TODINNOFRILLДокумент3 страницыPcdagri TODINNOFRILLANBUОценок пока нет

- E-Mandate 01102021Документ3 страницыE-Mandate 01102021Djxjfdu fjedjОценок пока нет

- Insta Save All Variants TNCДокумент17 страницInsta Save All Variants TNCArt PlatformОценок пока нет

- Bank Terms and ConditionДокумент5 страницBank Terms and ConditionLibin VargheseОценок пока нет

- Salary Account - Easy To AccessДокумент6 страницSalary Account - Easy To Accessritesh sinhaОценок пока нет

- Unified Payments Interface: Current QR Code-Based PaymentsДокумент5 страницUnified Payments Interface: Current QR Code-Based Paymentschaudhary harisОценок пока нет

- UIDAI Temporarily Suspends Airtel, Airtel Payments Bank's EKYC Licence - The HinduДокумент3 страницыUIDAI Temporarily Suspends Airtel, Airtel Payments Bank's EKYC Licence - The HinduAditya KoutharapuОценок пока нет

- HomeДокумент3 страницыHomeAishwarya Sharma DawarОценок пока нет

- Cyber Crime - RBI - July-Dec 22Документ4 страницыCyber Crime - RBI - July-Dec 22srinivasunnagiriОценок пока нет

- Business CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersОт EverandBusiness CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersОценок пока нет

- Java Traps - Java Interview QuestionsДокумент9 страницJava Traps - Java Interview QuestionsBavya MohanОценок пока нет

- CARAJACLASSДокумент22 страницыCARAJACLASSBavya MohanОценок пока нет

- SBI PO (Quantitative Aptitude) Memory Based Held On 04-06-17 (QUESTION PAPER) BankersaddaДокумент7 страницSBI PO (Quantitative Aptitude) Memory Based Held On 04-06-17 (QUESTION PAPER) BankersaddaBavya MohanОценок пока нет

- April 1st Week Current AffairsДокумент106 страницApril 1st Week Current AffairsBavya MohanОценок пока нет

- 100 Platinum Points of Ubion Budget 2016-17Документ6 страниц100 Platinum Points of Ubion Budget 2016-17Bavya MohanОценок пока нет

- 229kyc Aml CFT Pmla1Документ13 страниц229kyc Aml CFT Pmla1Bavya MohanОценок пока нет

- Insurance Chapter 2Документ69 страницInsurance Chapter 2Bavya Mohan100% (1)

- TestFunda Puzzles of The Week Vol - 2 PDFДокумент39 страницTestFunda Puzzles of The Week Vol - 2 PDFBavya MohanОценок пока нет

- PIB - 1st Feb To 7th Feb 2016Документ24 страницыPIB - 1st Feb To 7th Feb 2016Bavya MohanОценок пока нет

- Current Affairs CapsuleДокумент76 страницCurrent Affairs CapsuleRaviraj GhadiОценок пока нет

- Mobile Communication PDFДокумент13 страницMobile Communication PDFBavya MohanОценок пока нет

- SBI PO Prelims Mock Paper GSДокумент11 страницSBI PO Prelims Mock Paper GSBavya MohanОценок пока нет

- Cs-550 (M.Soneru) : Fault-Tolerance (Sas)Документ12 страницCs-550 (M.Soneru) : Fault-Tolerance (Sas)Bavya MohanОценок пока нет

- BSC Current AffairsДокумент7 страницBSC Current AffairsBavya MohanОценок пока нет

- SN P&P 2013 PDFДокумент188 страницSN P&P 2013 PDFMixxmixouОценок пока нет

- BSC Current Affairs MCQДокумент8 страницBSC Current Affairs MCQBavya Mohan100% (1)

- BSC Ca MCQДокумент6 страницBSC Ca MCQBavya MohanОценок пока нет

- BSC MCQ CaДокумент7 страницBSC MCQ CaBavya MohanОценок пока нет

- RTS Nptel MaterialДокумент30 страницRTS Nptel MaterialBavya MohanОценок пока нет

- RtsДокумент48 страницRtsBavya MohanОценок пока нет

- CS1252 - Operating Sysytem - (Unit-I)Документ5 страницCS1252 - Operating Sysytem - (Unit-I)Bavya Mohan100% (1)

- 20 C Programming Interview QuestionsДокумент13 страниц20 C Programming Interview QuestionsBavya MohanОценок пока нет

- Horse Riding N HidingДокумент9 страницHorse Riding N HidingBavya MohanОценок пока нет

- CS1253 2,16marksДокумент24 страницыCS1253 2,16marksRevathi RevaОценок пока нет

- Chapter 03Документ28 страницChapter 03Bavya MohanОценок пока нет

- Tata MotorsДокумент3 страницыTata MotorsSiddharth YadiyapurОценок пока нет

- 7110 w10 QP 01Документ12 страниц7110 w10 QP 01iisjafferОценок пока нет

- Allied Bank ReportДокумент53 страницыAllied Bank ReportAli HassanОценок пока нет

- Notice Inviting Tender (Nit) : (Bidding Document No. TP/068107C001/T/BS-IV/16)Документ9 страницNotice Inviting Tender (Nit) : (Bidding Document No. TP/068107C001/T/BS-IV/16)amitjustamitОценок пока нет

- Excel Skills - Cashbook & Bank Reconciliation TemplateДокумент17 страницExcel Skills - Cashbook & Bank Reconciliation TemplateLawrence MaretlwaОценок пока нет

- InsuranceДокумент7 страницInsurancesarvesh.bhartiОценок пока нет

- ReportДокумент1 страницаReportumaganОценок пока нет

- Nationwide Junior ISA Ts and CsДокумент4 страницыNationwide Junior ISA Ts and CsSpartacus UkinОценок пока нет

- KMC SAE '19 ChallanДокумент1 страницаKMC SAE '19 ChallanPartha DeyОценок пока нет

- PDFДокумент14 страницPDFBeboy Paylangco EvardoОценок пока нет

- Jose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiДокумент7 страницJose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiTrem GallenteОценок пока нет

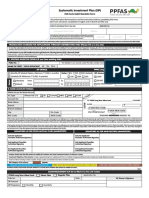

- Ppfas Sip FormДокумент2 страницыPpfas Sip FormAmol ChikhalkarОценок пока нет

- 34 Analysis of Demat Account and Online Trading HimanshuДокумент74 страницы34 Analysis of Demat Account and Online Trading HimanshuVasant Kumar VarmaОценок пока нет

- Welcome To Park Controls UpdatedДокумент6 страницWelcome To Park Controls UpdatedRitu DasОценок пока нет

- Religare Explore Insurance BrochureДокумент2 страницыReligare Explore Insurance BrochurearuvindhuОценок пока нет

- Final FormatingДокумент69 страницFinal FormatingSyed Munawar Abbas NaqviОценок пока нет

- Conversion Active LandlinesДокумент8 страницConversion Active LandlinesRitsheОценок пока нет

- Retirement Fees Lawsuit Filed Against Duke UniversityДокумент98 страницRetirement Fees Lawsuit Filed Against Duke UniversitythedukechronicleОценок пока нет

- Project Allotment SheetДокумент20 страницProject Allotment SheetRoushan RajОценок пока нет

- Articles of AgreementДокумент2 страницыArticles of AgreementMd Rajikul IslamОценок пока нет

- Philamcare Health Vs CA GR No. 125678Документ9 страницPhilamcare Health Vs CA GR No. 125678judy andradeОценок пока нет

- Presented by - Prachi Thapar - Trivikram Apte - Rohit GargДокумент18 страницPresented by - Prachi Thapar - Trivikram Apte - Rohit GargVikram ApteОценок пока нет