Академический Документы

Профессиональный Документы

Культура Документы

Accounts Payable Procedure

Загружено:

rameshИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounts Payable Procedure

Загружено:

rameshАвторское право:

Доступные форматы

PROCEDURE ACCOUNTS PAYABLE PROCEDURE

Approval Effective Next review

Version 2.0 14 July 2016 18 July 2016 July 2019

date date date

Procedure Statement

The purpose of this document is to outline the Accounts Payable process

Purpose

including payments that are applicable to UNSW.

This Procedure is University-wide and applies to all University staff

Scope

regardless of their level or seniority.

Are Local Documents on Yes Yes, subject to any areas specifically No

this subject permitted? restricted within this Document

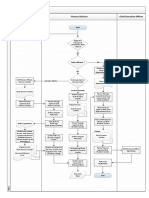

Procedure Processes and Actions

1. Accountabilities ................................................................................................................. 1

2. Vendor creation ................................................................................................................. 2

3. Invoice Processing ............................................................................................................ 2

3.1 Invoice Requirements ............................................................................................. 2

3.2 Payment Request Form (PR1) ............................................................................... 2

3.3 Invoice Processing Time ........................................................................................ 3

3.4 Advances ................................................................................................................ 3

3.4.1 Travel Cash Advances (TR3 Form) ........................................................... 3

3.4.2 Non-Travel Advances (NT1 Form) ............................................................ 3

3.5 Employee and Student Reimbursements ............................................................... 3

4. Other ................................................................................................................................. 4

4.1 Asset Instalments ................................................................................................... 4

5. Payment ............................................................................................................................ 4

5.1 Payment Terms ...................................................................................................... 4

5.2 Payment channels .................................................................................................. 4

5.3 Express Payments .................................................................................................. 5

5.4 Payment cycle ........................................................................................................ 5

1. Accountabilities

The roles and responsibilities under the Accounts Payable Procedure can be

submitted as follows:

Department Accountabilities

Finance Invoice processing and payment

Shared Services Maintain Vendor master data in NSF

University staff Purchase order creation and goods receipting

Prompt submission of invoices with correct

information to enable processing of invoices and

payments by Accounts Payable

Submit vendor creation request

Accounts Payable Procedure Page 1 of 6

Version: 2.0 Effective 18 July 2016

2. Vendor creation

University staff member completes the Online Vendor Request form by including

details below:

Type of request - create new vendor or change existing vendor

Location where the vendor will be processed Sydney or Canberra

University staff primary and secondary contact details

Secondary contact details are only required as an alternative contact, if the

primary contact is expecting to be on leave

Vendor/Supplier email address

The vendor will receive an email containing the vendor application form for

completion. Once the vendor completes the form, the UNSW requestor will review

the information provided by the vendor and then submit to Accounts Payable for

creation in NS Financials.

Note: If the vendor cannot complete the online form, you should contact

vendors@unsw.edu.au for assistance and guidance.

You can access the online vendor creation form at Accounts Payable Vendor

Creation

3. Invoice Processing

3.1 Invoice Requirements

The following criteria must be met before invoices can be processed:

Invoice must be addressed to UNSW.

Invoice should include Vendor/Supplier name, business address, amount and

description of goods and or services provided.

Australian Vendors must provide a Tax invoice. A Tax invoice must include the

price of sale, whether it includes GST and the vendors Australian Business

Number (ABN).

If goods and or services are ordered using a UNSW purchase order the

Vendors/Suppliers invoice must contain the relevant purchase order number.

Invoices with UNSW purchase orders must meet matching requirements.

Unsuccessful three-way or two-way matching in NS Financials will result in

exception errors. Invoices with exceptions are put on hold until the exceptions are

resolved. Accounts Payable coordinates with the relevant University staff member

to resolve these exceptions to enable posting and payment of invoices on hold.

Electronic PDF invoices are preferred and should be emailed to

invoiceap@unsw.edu.au. If paper invoices are received in Accounts Payable,

these will be returned to the relevant party for scanning.

When goods or services have been delivered and accepted they must be receipted

in NS Financials. You do not require a tax invoice to receipt the goods/services.

Receipting should be completed on the delivery of goods/services.

3.2 Payment Request Form (PR1)

UNSW Purchasing Policy supports the use of Purchase Orders accompanied by a

vendor invoice as the preferred method of purchasing. However, it is recognised

that there are certain approved payment types where a purchase order and invoice

are not appropriate. Then a Payment Request Form-PR1 needs to be used.

Accounts Payable Procedure Page 2 of 6

Version: 2.0 Effective 18 July 2016

3.3 Invoice Processing Time

Invoices and other requests received by Accounts Payable that meet all invoice

and purchasing requirements will be processed in NS Financials within 3 business

days. Payments will be made according to agreed terms and schedule listed in

point 5.

3.4 Advances

3.4.1 Travel Cash Advances (TR3 Form)

In exceptional circumstances, a travel cash advance may be required to

cover significant expenses of a business nature that are not covered by a

travel allowance (TR2). A travel cash advance must be approved by a

financial delegate and is paid before the date of travel. Acquitting the travel

cash advance (TR4) occurs when the employee submits all tax invoices and

receipts no more than 30 days after the returned date of travel.

TR2 Travel allowance for meals, accommodation and incidentals. Can

be paid in advance and is not required to be reconciled or acquitted.

TR3 Travel cash advance for business expenses. Must be reconciled

and acquitted upon return. Any unused funds to be repaid.

TR4 Travel cash advance settlement form.

A further travel allowance advance will not be issued to an employee until

their outstanding travel advance has been acquitted. Furthermore, there are

also FBT implications if a travel allowance advance is not acquitted in a

timely manner.

Please refer to the UNSW Travel Policy and Procedure.

3.4.2 Non-Travel Advances (NT1 Form)

Non-travel advances are paid to employees for other sorts of business

related advances where a UNSW credit card or other purchasing method are

not available (excludes travel). The requestor for non-travel advances must

seek approval from a financial delegate.

All non-travel advances must be acquitted within 6 months from the date of

the request to avoid FBT liability charges.

3.5 Employee and Student Reimbursements

The purpose of reimbursements is to refund employees or students when personal

funds are used to incur UNSW related expenditure.

Reimbursements can be completed in NS Financials by the employee who

incurred the expense or entered on behalf of a student or on behalf of another

employee. Approval of these claims must be submitted to a person with financial

delegation.

To ensure prompt and efficient payment, any changes to your personal details

must be updated via myUNSW.

The approver must ensure that the expenditure is appropriate and that receipts

and tax invoices are attached to the claim.

Accounts Payable Procedure Page 3 of 6

Version: 2.0 Effective 18 July 2016

Once a claim is approved payment will be made in the next payment run.

All enterers will receive a system generated report on a monthly basis to review

and action all aged expenses.

For further information please use this link.

Supporting documentation: Receipts and tax invoices must be obtained for all

transactions for advance acquittals and expense reimbursements. In the event of

lost or obtainable invoices/receipts a Transaction Declaration Form ( PCDT) must

be completed and submitted unless the transaction value is less than AUD$82.50 (

including GST). This is in accordance with the Credit Card Procedure.

4. Other

4.1 Asset Instalments

A multi-line purchase order indicating milestone payments is required for asset

instalments. Receipting should be completed according to payment due dates. A

copy of the invoice or pro-forma invoice marked as PREPAYMENT should be

sent to Accounts Payable for processing.

For further information please review Asset Instalment

5. Payment

5.1 Payment Terms

UNSW complies with agreed payment terms and endeavors to take advantage of

discounts offered for prompt payment.

UNSWs default payment terms are 30 days end of month from invoice date.

Where payment terms are less than 30 days, a higher payment term should be

negotiated wherever possible.

If no payment term is specified on the invoice, UNSW shall pay within 30 days of

the end of the month in which the vendors invoice is received. Any changes to the

standard payment terms must be channeled through the Accounts Payable Team

Leaders with an explanation so that the vendor master data information can be

amended.

5.2 Payment channels

UNSW maintains multiple payments methods as part of its commitment to

efficiently pay for goods and or services provided. The payments channels are to

be used appropriately to maintain payment efficiency and effectiveness for UNSW.

The payment channels are as follows:

i) Student and Employee Reimbursement - The expense module in NS

Financials must be used for employee and student reimbursements.

ii) Credit card - UNSW credit cards are intended to provide an efficient method

of purchasing travel, accommodation and low value goods and services where

no preferred supplier agreement is in place for UNSW business purposes. Use

of credit cards should strictly follow the Credit Card Policy and Procedure.

Accounts Payable Procedure Page 4 of 6

Version: 2.0 Effective 18 July 2016

iii) Supplier Payment method below:

Domestic Electronic Funds Transfers - this is the preferred payment method

Payments for all domestic payments.

Cheques - these should be used in exceptional circumstances

only (e.g. when the preferred payment method (EFT) is not

available, for instance for Student Prizes

Overseas WIRE payments - this is the preferred payment method for all

Payments international payments (including transfer if appropriate for

visiting academics).

Drafts - these should be used in exceptional circumstances only.

5.3 Express Payments

Express payments may only be requested from Accounts Payable if the following

criteria are met:

Significant penalty or late fees will be incurred or discount foregone.

Meeting UNSW statutory or compliance obligations (e.g. tax or payroll).

All express payments must be approved by the Associate Director Finance

Shared Services or nominated delegate.

The method of express payments is limited to electronic funds transfer (EFT) only.

5.4 Payment cycle

Payments are processed every Tuesday and Friday for local vendors including

employee and student reimbursements and overseas vendors. All payment

remittances are emailed electronically.

If the payment run fall on a public holiday, the payment run will be processed the

next business day.

Effective 18th July 2016, a $20 processing fee will be charged to business units

that have requested cheques or drafts. This fee will not be charged if the option to

pay electronically is not available.

Revision History

Approval Effective

Version Approved by Sections modified

date date

Acting Vice-President, 12 February 1 January This is a new

1.0

Finance and Operations 2015 2015 Procedure

Vice-President, Finance &

2.0 14 July 2016 18 July 2016 Full review

Operations

Accounts Payable Procedure Page 5 of 6

Version: 2.0 Effective 18 July 2016

Supporting Information

Parent Document Nil

Supporting Guidelines Nil

Credit Card Policy

Credit Card Procedure

Online forms | UNSW Finance

Related Documents Procurement Policy and Procurement Procedure

Procurement Guidelines

Travel Policy and Travel Procedure

Asset Guidelines

Superseded Documents Accounts Payable Procedure, v1.0, effective 1 January 2015

UNSW Statute and / or

Nil

Regulation

Relevant State / Federal

Nil

Legislation

Accountabilities

Responsible Officer Director of Finance

Contact Officer Associate Director, Finance Shared Services (Finance Help Desk)

Definitions and Acronyms

Accounts Payable UNSW department responsible for processing invoices and payments.

Milestone payments made in advance of receipt of equipment or similar

Asset Instalments

assets.

A payment process used by Accounts Payable if an urgent payment is

Express payment

required.

NS Financials (NSF) UNSWs finance system, which is a software application, provided by

Oracle/PeopleSoft. The system is referred to as NS Financials at UNSW. It

is the technology used for purchasing (and other) financial processes and

transactions.

Payment Terms Agreed number of days between delivery and payment.

Formal document issued by UNSW to vendors specifying goods and or

Purchase Order

service requirements.

Tax Invoice A document which shows the supplier charges for goods delivered or services

provided. It contains pricing, details of types of goods or services sold,

Australian Business Number, indicates whether it includes GST and the total

charged.

Three-way matching Matching the invoice price and quantity against the purchase order price and

quantity and matching receipts. If not 3 way matched the invoice will appear in

the matched exception report for resolution.

Two-way matching Matching the invoice price and quantity against the purchase order price and

quantity. If not 2-way matched the invoice will appear in the matched

exception report for resolution.

All employees of UNSW including fixed-term, casuals and persons who are

University Staff engaged to perform work as independent contractors authorised to undertake

purchasing on behalf of UNSW

The external party or entity providing goods and or services to UNSW. They

include Australian and non-Australian entities, sole-traders, firms,

incorporated and publicly listed companies, GST registered and non-

Vendor

registered entities. They can be manufacturers, distributors, franchisors,

retailers, resellers, merchants, agents and individuals. UNSW employees are

not considered vendors.

Accounts Payable Procedure Page 6 of 6

Version: 2.0 Effective 18 July 2016

Вам также может понравиться

- Sop - Invoice ProcessingДокумент3 страницыSop - Invoice Processingapi-29896722871% (17)

- Sop's On Accounts PayableДокумент3 страницыSop's On Accounts PayableJoy SelphaОценок пока нет

- Finance Procedures ManualДокумент35 страницFinance Procedures ManualMohamed100% (4)

- Cash and Bank Disbursement - SOP ExampleДокумент5 страницCash and Bank Disbursement - SOP ExampleMochammad IqbalОценок пока нет

- Fixed Assets Policy and Procedure ManualДокумент60 страницFixed Assets Policy and Procedure ManualArup DattaОценок пока нет

- AP Procedure Updated Oct 2010Документ4 страницыAP Procedure Updated Oct 2010maheshОценок пока нет

- (Company Name) Accounting Policies and Procedures ManualДокумент22 страницы(Company Name) Accounting Policies and Procedures ManualPhil Kgobe100% (1)

- Financial and Accounting Procedures ManualДокумент60 страницFinancial and Accounting Procedures ManualjewelmirОценок пока нет

- Accounting Receivables and PayablesДокумент14 страницAccounting Receivables and PayablesDiego EspinozaОценок пока нет

- 1 Payroll-SopДокумент12 страниц1 Payroll-SopbhanupalavarapuОценок пока нет

- E7 - TreasuryRCM TemplateДокумент30 страницE7 - TreasuryRCM Templatenazriya nasarОценок пока нет

- Actg GuideДокумент124 страницыActg GuideohohmaiaОценок пока нет

- Petty Cash /imprest Reimbursement Post Audit ChecklistДокумент2 страницыPetty Cash /imprest Reimbursement Post Audit ChecklistHenry Mapa100% (1)

- Accounting Policy Procedure ManualДокумент57 страницAccounting Policy Procedure ManualImee100% (3)

- Finance SopДокумент46 страницFinance SopOsman Zaheer100% (1)

- Accounting and Internal Control Procedures Manual Revised November 21Документ116 страницAccounting and Internal Control Procedures Manual Revised November 21Jose' YesoОценок пока нет

- SOP For Fixed Assets MainagementДокумент12 страницSOP For Fixed Assets MainagementJAK Group100% (1)

- APДокумент6 страницAPprasana devi babu raoОценок пока нет

- Accounts Receivable PolicyДокумент6 страницAccounts Receivable PolicyJS100% (1)

- Sop's On Accounts PayableДокумент3 страницыSop's On Accounts PayableJoy SelphaОценок пока нет

- Manual Accounts PayableДокумент134 страницыManual Accounts Payablesrinivas0731Оценок пока нет

- Combined SOP For Finance and Accounting Operations - Siddhi & Sarika Prachiti-BSCPLДокумент6 страницCombined SOP For Finance and Accounting Operations - Siddhi & Sarika Prachiti-BSCPLsamatajoilОценок пока нет

- Taxguru - in-SOP For Finance Accounts For Construction Infrastructure CompanyДокумент14 страницTaxguru - in-SOP For Finance Accounts For Construction Infrastructure CompanyChandan ChatterjeeОценок пока нет

- Purchasing Card Policy 07-08Документ9 страницPurchasing Card Policy 07-08Anonymous ZRsuuxNcCОценок пока нет

- ACCTG AP002 5-15 - Invoice ProcessingДокумент1 страницаACCTG AP002 5-15 - Invoice ProcessingDebbie Langolf100% (1)

- Proposed Disbursement ProcessДокумент4 страницыProposed Disbursement ProcessmarvinceledioОценок пока нет

- Statutory AuditДокумент2 страницыStatutory AuditKalyani PhadkeОценок пока нет

- Fixed Assets PolicyДокумент19 страницFixed Assets PolicyLouieОценок пока нет

- 1 SOP Petty Cash ManagementДокумент27 страниц1 SOP Petty Cash ManagementMuhammad Julianto FardanОценок пока нет

- UNIT 4 The Revenue Cycle Detailed Report BSA 2 1Документ45 страницUNIT 4 The Revenue Cycle Detailed Report BSA 2 1Harvey AguilarОценок пока нет

- A Cpas & Controllers Checklist For Closing Your Books at Year-End Part One: Closing The Books at Year-EndДокумент3 страницыA Cpas & Controllers Checklist For Closing Your Books at Year-End Part One: Closing The Books at Year-EndDurbanskiОценок пока нет

- Petty Cash Disbursements PolicyДокумент3 страницыPetty Cash Disbursements PolicyAngelo Andro SuanОценок пока нет

- Accounts Payable Policy and Procedures Manual: Galveston County Office of County AuditorДокумент18 страницAccounts Payable Policy and Procedures Manual: Galveston County Office of County AuditorNavs100% (2)

- Petty Cash ControlДокумент3 страницыPetty Cash ControlLeonard Roberts100% (1)

- Financial Procedures 2008Документ39 страницFinancial Procedures 2008lisaconnollyОценок пока нет

- Policies and Procedures Manual - Finance Department PDFДокумент49 страницPolicies and Procedures Manual - Finance Department PDFSyed Fawad Ahmad100% (1)

- Internal Control & ComplianceДокумент30 страницInternal Control & ComplianceAijaz Ali MughalОценок пока нет

- Policy On Disbursements 08Документ3 страницыPolicy On Disbursements 08Jeh EusebioОценок пока нет

- Audit Program For Accounts Receivable and Sales Client Name: Date of Financial Statements: Iii. Accounts Receivable and SalesДокумент6 страницAudit Program For Accounts Receivable and Sales Client Name: Date of Financial Statements: Iii. Accounts Receivable and SalesFatima MacОценок пока нет

- Fixed Asset Acquisition FormДокумент1 страницаFixed Asset Acquisition FormJack L. JohnsonОценок пока нет

- Contents of An Interim Financial Report: Unit OverviewДокумент5 страницContents of An Interim Financial Report: Unit OverviewRITZ BROWNОценок пока нет

- Audit CheclistДокумент34 страницыAudit CheclistYoga Guru100% (1)

- Sop Accounts Payables Axiom EasyДокумент16 страницSop Accounts Payables Axiom EasyRiskyKurniasih100% (1)

- Module1 Internal Control Checklist en 0Документ12 страницModule1 Internal Control Checklist en 0Mohammad Abd Alrahim ShaarОценок пока нет

- HCM 436 Internal Controls in Hospitality PDFДокумент110 страницHCM 436 Internal Controls in Hospitality PDFZaki josephineОценок пока нет

- Operating Equipment Policy & ProcedureДокумент5 страницOperating Equipment Policy & ProcedureRex UrciaОценок пока нет

- Sop Finance and Accounting DepartmentДокумент54 страницыSop Finance and Accounting DepartmentNurul Nadhilah RoslainiОценок пока нет

- WIP IA Manual - Audit Program - Sales and ReceivablesДокумент10 страницWIP IA Manual - Audit Program - Sales and ReceivablesMuhammad Faris Ammar Bin ZainuddinОценок пока нет

- Key Roles & Responsibilities of Accounts Receivable - Finance in Erp and CRMДокумент35 страницKey Roles & Responsibilities of Accounts Receivable - Finance in Erp and CRMABT SuppОценок пока нет

- Audit Manual 1Документ274 страницыAudit Manual 1Humayoun Ahmad Farooqi100% (2)

- Audit of Income and Expenditure Account 1.1Документ27 страницAudit of Income and Expenditure Account 1.1Akshata Masurkar100% (1)

- Travel Policy, Expense Claim & ReimbusementДокумент4 страницыTravel Policy, Expense Claim & ReimbusementTinsuОценок пока нет

- MDLF Financial ManualДокумент263 страницыMDLF Financial ManualAmalgated Capital Inc.Оценок пока нет

- Period End ClosingДокумент10 страницPeriod End ClosingailcpОценок пока нет

- Sop Billing ProcessДокумент9 страницSop Billing ProcessRony Lesbt0% (1)

- Accounting Procedures Manual 6-2020 DRAFTДокумент27 страницAccounting Procedures Manual 6-2020 DRAFTShahzad AslamОценок пока нет

- Accounts Payable ProcedureДокумент5 страницAccounts Payable ProceduremohamedОценок пока нет

- Finance Policy ManualДокумент16 страницFinance Policy ManualPearl DebbyОценок пока нет

- DigDarshika - Operations Related PoliciesДокумент139 страницDigDarshika - Operations Related PoliciesFaded JadedОценок пока нет

- Accenture Value Driven Business Process ManagementДокумент16 страницAccenture Value Driven Business Process ManagementGianella MatamorosОценок пока нет

- Business Research Assignment Misha (0808-MBA-21)Документ6 страницBusiness Research Assignment Misha (0808-MBA-21)Abcd EfuckОценок пока нет

- Reynolds CaseДокумент6 страницReynolds CaseTony JosephОценок пока нет

- Conept of RetailingДокумент13 страницConept of RetailingAniSh ThapaОценок пока нет

- A Vehicle Routing Problem Solution Considering Minimizing Fuel ConsumptionДокумент7 страницA Vehicle Routing Problem Solution Considering Minimizing Fuel ConsumptionAdrian SerranoОценок пока нет

- Chapter 8 MowenДокумент25 страницChapter 8 MowenRosamae PialaneОценок пока нет

- Environmental AnalysisДокумент11 страницEnvironmental AnalysisRupanshi GuptaОценок пока нет

- Pay Back Contracts For Coordinating Supply ChainДокумент29 страницPay Back Contracts For Coordinating Supply Chainhappiest1Оценок пока нет

- Rules of Debit and Credit EntriesДокумент2 страницыRules of Debit and Credit EntriesRuman MahmoodОценок пока нет

- Trends 1 Trends vs. FadsДокумент16 страницTrends 1 Trends vs. FadsjacilcadacОценок пока нет

- Segmentation, Targeting and Positioning: Assit. Prof. Nil Engizek Principles of MarketingДокумент24 страницыSegmentation, Targeting and Positioning: Assit. Prof. Nil Engizek Principles of MarketingDoğukan ÇorumluОценок пока нет

- Module 2 NotesДокумент8 страницModule 2 Notescriselyn agtingОценок пока нет

- Flow Chart - Production SystemДокумент30 страницFlow Chart - Production Systemmatthew mafaraОценок пока нет

- Valuation and Negotiation of Technology Step 2 - Create Value From Technologic InnovationДокумент10 страницValuation and Negotiation of Technology Step 2 - Create Value From Technologic InnovationPaola HernandezОценок пока нет

- Pelatihan Awareness Integrated Management System Qhse: Based OnДокумент77 страницPelatihan Awareness Integrated Management System Qhse: Based OnAchmad FiqriОценок пока нет

- Ovh Energy Ghana Limitedcls - ProfileДокумент5 страницOvh Energy Ghana Limitedcls - Profileaddo.terrenceОценок пока нет

- Chapter 4 Types of Business Organisation - Answers To ActivitiesДокумент1 страницаChapter 4 Types of Business Organisation - Answers To ActivitiesTooba SohailОценок пока нет

- CBM Lopez Moghadasi Moustahsine KrishnakumarДокумент21 страницаCBM Lopez Moghadasi Moustahsine KrishnakumarkhalidibrahimalsafadiОценок пока нет

- IIC - Schemes & ImplementationДокумент17 страницIIC - Schemes & Implementationelangoprt1Оценок пока нет

- Entrepreneurs: The Driving Force Behind Small BusinessДокумент33 страницыEntrepreneurs: The Driving Force Behind Small BusinessBibhu R. TuladharОценок пока нет

- 20220720-MODIG-Supply Chain Manager (ENG)Документ2 страницы20220720-MODIG-Supply Chain Manager (ENG)abhilОценок пока нет

- AnswerДокумент31 страницаAnswerJabeth IbarraОценок пока нет

- Old Spice AnalysisДокумент2 страницыOld Spice AnalysisMusic N StuffОценок пока нет

- Lecture 1Документ24 страницыLecture 1kaizen4apexОценок пока нет

- External Environment: Porter'S Five ForcesДокумент2 страницыExternal Environment: Porter'S Five Forcesanjineth lapulapuОценок пока нет

- LTHLAnnualReport2018 19Документ252 страницыLTHLAnnualReport2018 19Madhura SridharОценок пока нет

- Taixing Longyi Terminals Co. LTD.: ClarificationДокумент9 страницTaixing Longyi Terminals Co. LTD.: ClarificationMaria Nancy Vásquez LeónОценок пока нет

- Cat&Dog Toys Suppliers UpdateДокумент10 страницCat&Dog Toys Suppliers UpdateSameer KОценок пока нет

- Order Appealed Against 2Документ27 страницOrder Appealed Against 2Jyoti MeenaОценок пока нет

- About ASSETS AND EQUIPMENTS INC. Formed On January 2014 Is A Mumbai Based Sole ProprietorshipДокумент7 страницAbout ASSETS AND EQUIPMENTS INC. Formed On January 2014 Is A Mumbai Based Sole Proprietorshipgraceenggint8799Оценок пока нет