Академический Документы

Профессиональный Документы

Культура Документы

Il E&) Fflffiifif (I#,: Preparatori (JI, N-?IO

Загружено:

daniel_143_davidОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Il E&) Fflffiifif (I#,: Preparatori (JI, N-?IO

Загружено:

daniel_143_davidАвторское право:

Доступные форматы

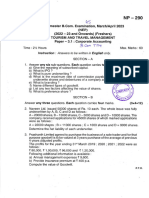

il P U C PREPARATORI[ E&)fflffiifif{I#, JI,N-?

IO, 6 @

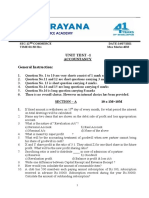

Time:3.15 Hours ACCOI.INTANCY - 30 Max. Marks: 100

Section - A

l. Answer any SEVEN questions. Each carrying Two marks. 7x2=14

1. What is depreciation?

2. What is fixed capital system?

3. What is Sacrifice ratio?

4. Write the Journal entry to close revaluation account. When there is profit.

5. What is Realization Account?

6. State any two types of Shares.

7. Write any two assets which are shown in fixed assets.

B. Write any two types of ratios.

9. What are non-profit organizations?

10. Give the meaning of data processing.

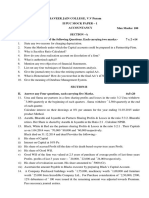

Section - B

ll.

Answer any four questions. Each carrying Five marks. 4x5=20

11. Hamsini and Vatsalya are partner sharing profits and iosses in the ratio of 3:2. On 1-4-2014 they had capitals

of Rs. 30,000 and Rs. 20,000 respectivety.

According to their parlnership deed they are entitled to the following :-

a) lnterest on capital al 6/" P.a.

b) lnterest on Drawings at 5% P.a.

c) Vastalya is allowed a salary ol Rs. 500 PM for lirst 6 months and for the remaining period Rs. 1000 P.M.

d) Theirdrawings during the year Hamsini Rs.8000 and Vatsalya Rs. 10,000. lnterest on the same Rs.400

and Rs. 500 respectively.

The Profit for the year before making the above adjustrnents-was Rs. 24,600.

Prepare P&L appropriation alc tor the year ending 31-3-2015.

12. X and Y are padners in a firm sharing Profits and losses in the ratio of 3:2. They admit Z into partnership. The

new profit sharing ratio is 4:3:3. calculate the sacrifice ratib of X and y.

13. A B and C are partners sharing profits and losses in the ratio of 2:2:1. Their capitals on 01-04-2015 were Rs,

50,000, Rs.30,000 and Rs. 25,000 respectivety

'A'died on 01-10-2015 and the partnership deed provided the tollowing:

a) Salary to'A'at Hs. 500 P.M.

b) lnterest on capital at 5% P.a.

c) His share of goodwilt. The Goodwill of the firm is valued at Rs. 2s,000.

d) His share in accrued profit upto the date of death amounted to Rs. 5,000

Prepare A's Capital Account.

14. Rajesh Company Ltd. issued 10,000, 10% debentures of Hs. '100 each at a discount of Rs.10 per debenture

payable as follows :-

a) Rs. 20 on application

b) Rs. 40 on allotment

c) Rs. 30 on first and final call.

All the debentures were subscribed and the money duly received upto the stage of allotment.

Pass the Journal Entries in the books of the company upto the stage allotment.

15. lndian Co. Ltd. had the following on 31-3-2015.

Current Assets { 4,B0,OOO

Current Liabilities < 1,20,000

Quick Assets < 2,4O,OOO

Calculate :- i) Current Batio ii) euick Ratio (p.T.o.)

Use e-papers for save trees-InyaTrust.com

16. From the folowing tedger balances prepare R";p1;"d Payments Account of Cauvery Charitable Trust.

Cash in hand < 12,000

Periodicals Cos { 1,200

Furniture bought { 40,000

Postage t 500

Subscriptions Received { 24,000

Bent Paid < 10,000

Salary paid < 8,000

Electricity Charges t 1,000

17. Explain five qualities of information.

Section - C

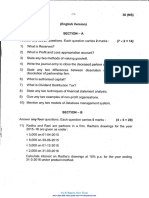

lll. Answer any FOUR questions. Each carrying Fourteen marks. 4x14=56

18. From the following information prepare Machinery Account and Depreciation Account for four years ending

31-3-2015 under Diminishing balance method. Depreciation is being 1O"/" per annum.

a) Machine X was purchased on 01-04-2011 for Rs. 1,00,000

b) Machine Y was purchased on 01-10-2013 for Rs. 1,50,000

c) Machine X was sold on 01-'10-2014 for Rs.70,000

1g. P.Q. and R are partners sharing prolits and losses in the ratio of 5:3:2. respectively. Their Balance Sheet as

on 31-3-2015 was as under

Balance Sheet as on 31-3-2015

Liabilities Rs. Assets Rs.

Creditors 15,000 Cash at Bank 16,000

Bills payable 9,000 Bills Receivable 5,000

Reserve Fund 20,000 Debtors 30,000

Capitals Less : PBD 1.000 29,000

P - 50,000 Stock 20,000

Q - 30,000 Machinery 50,000

R - 20,000 1,00,000 Motor Car 14,000

P and L A/c 10,000

1,44,000 1,44,000

Mr.Q retired. The following adjustments are to be made

a) Stock is revalued at Rs. 28,000

b) Provision for doubtful debts to be brought upto 10olo oo debtors.

'107" respectively.

c) Machinery and motor car depreciated by 5% and

d) Outstanding rent to be provided for Rs. 1,200

e) Goodwill of the firm was raised for Rs. 50,000 and it has to be retained in the book.

Prepare :- a) Revaluation Account b) Partners Capital Account c) New Balance Sheet of the firm

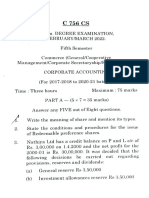

zo. Chirag and Chintan are partners sharing profits and losses in the ratio of 3:2. They dissolved their firm on 31-

03-2015.

Balance Sheet as on 31-3-2015

Liabilities Rs. Assets Rs.

Creditor 20,000 Bank 21,000

Bills payable 17,000 Debtors 25,000

Chirag's Loan 21,000 (-) PBD l ooo 24,O00

Reserve Fund 10,000 lnvestments 10,000

P&LA/c 12,000 Stock 14,000

Capitals : Furniture 16,000

Chirag 50,000 Motor Car 30,000

Chintan 40,000 90,000 Computer 25,000

Buildings 30,000.

1,70,000 1,70,OOO

Use e-papers for save trees-InyaTrust.com

-3-

The details available are :-

a) Assets reaiised as follows :-

Debtors T 22,000

Stock { 16,000

Furniture { 14,000

Motor Car { 25,000

Buildings { 40,000

b) lnvestment is taken over by Chirag at book value.

c) Computer is taken over by Chintan at 10% less.

d) All liabilities are paid in full.

e) Realisation Expenses T 3000

Prepare :- i) Realisation A/c ii) Partner Capital A/c iii) Bank A/c

21 . Prem Co. Ltd. issued 10,000 Equity shares at ( 100 each at a premium of Rs. 10 per share payable as follows:-

T 10 on Application

< 50 on Allotment (lncluding premium)

t 30 on First Call

t 20 on Final call

All the shares were subscribed and the money duly received except on final call f0f 500 shares. The

Directors forfeited these shares and re-issued at t 90 each fully paid.

Pass the necessary Journal Entries related to the above information.

22. From the following Trial balance of Ratna Trading Co. Ltd., Prepare the financial statements for the year

ending 31st March 2015.

Sl.No. Particulars Debit Credit

t t

1" Sale of goods 5,50,000

2. Office Rent 50,000

3. Opening inventories 35,000

A

.+. Purchase of goods 1 70,000

5. Furniture 1 85,000

6. Trade payable 85,000

7. Plant & Machinery 1 00,000

B. Trade Receivable 1 60,000

I Surplus (opening balance) 10,000

10 10% Debentures 1,00,000

11 lnterest on Debentures 10,000

12 Fixed Deposit (6 months term) 70,000

13 Staff welfare expenses 12,000

14 Equity share capital 40,000 Share of Rs 10 each 4,00,000

15 Cash in hand and at Bank 63,000

16 Buildings 90,000

17 Rates & taxes 25,000

1B Salaries 55,000

19 Goodwill 1,25,000

2. General Fleserve 5,000

11,50,000 11,50,000

Adjustments :- a) Closing inventories { 45,000

b) Create provision for taxation at 30%

c) Transfer to General Reserve ( 5,000

d) Directors proposed dividend ol 10/"

e) Provide depreciation on plant and mabhinery at 10% and Buildings at 5%

(P.r.o.)

Use e-papers for save trees-InyaTrust.com

23. From the following -4-

Balance Sheet prepare common size Balance Sheet of KSM Co. Ltd. as on 31st March 2014

and 2015.

Liabilities 31-03-14 < 31-3-15 t Assets 31-3-14 < 31-3-2015 {

Share capital 2,00,000 2,90,000 Land & Buildings 50,000 70,000

General Reserve 40,000 43,500 Plant & Machinery 1,00,000 1,00,000

P&L a/c 16,000 14,500 Furniture 30,000 62,000

Long term loan 18,000 20,000 Stock 7.000 8,000

Creditors 5,000 5,000 Debtors 40,000 58,000

Bills payable 2,000 2900 Bills Receivable 50,000 43,500

Bank overdraft 15,000 14,500 Cash 10,000 14,500

O/S expenses 2,000 1,600 Prepaid expenses 11,000 36,000

2,98,000 3,92,000 2,98,000 3,92,000

24. Following are the Balance Sheet and Receipts and payments Account of Mandya Sports club, manday.

Balance Sheet as on 31-03-20'14

Liabilities Rs. Assets Rs.

O/S Rent 3,600 Furniture 17,600

Capital Fund 1,22,700 Sports Materials 70,000

O/s Subscriptions 1.600

Cash in hand 1 7,1 00

Cash at Bank 20,000

1,26,300 1,26,300

Receip and payments A/c for the year endin 31-03-201s

Liabilities Rs. Assets Rs.

To Cash balance 17,100 By Salary 21,000

.17,800

To Bank balance 20,000 By Rent and Taxes

To entrance fee 10,900 By Legal Charges 1,700

To Donations 27,O00 By General expenses 3,500

To Subscriptions 46,000 By Sports materials 12,000

To lnterest 1,060 By Office expenses 8,600

To Sports fee 2,400 By lnvestments 30,000

By Cash Balance 13,860

By Bank Balance 16,000

,24,460 1,24,460

Adjustments :- a) O/s Subscriptions t 3,600

b) Ols Rent t 1800 and legal charges due { 300

c) Donations are to be capitalised.

d) Depreciate sports materials by { 8000 and Furniture by 1200

Prepare :- a) lncome and expenditure Account b) Balance Sheet

.

Section -D (Practical Oriented Questions)

lV.Answer any TWO questions, each carrying Five marks. 2x5=10

25. How do you treat the following in the absence of partnership deed?

a) lnterest on capital of partners

b) lnterest on Drawings of padners

c) lnterest on loan from partners

d) Distribution of profit or loss

e) Salary or commission to partners

26. Prepare Executors loan account with imaginary figures showing the repayment in two annual equal installments

along with interest.

27. Prepare the tree diagram of hierarchical data base model.

Use e-papers for save trees-InyaTrust.com

Вам также может понравиться

- BBA II Chapter 2 Sale of Partnership ProblemsДокумент14 страницBBA II Chapter 2 Sale of Partnership ProblemsSiddharth SalgaonkarОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Internship Reflective ReportДокумент26 страницInternship Reflective ReportTan C Chi0% (1)

- 45 Corporate Accounting March 2023 TTMДокумент4 страницы45 Corporate Accounting March 2023 TTMvenuv4269Оценок пока нет

- Corporate Accounting - I Semester ExaminationДокумент7 страницCorporate Accounting - I Semester ExaminationVijay KumarОценок пока нет

- Bcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Документ6 страницBcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Zakkiya ZakkuОценок пока нет

- XДокумент5 страницXSAI KISHOREОценок пока нет

- KseebДокумент12 страницKseebArif ShaikhОценок пока нет

- Accountancy 12th SPSДокумент4 страницыAccountancy 12th SPSMahesh TandonОценок пока нет

- Assignment: K12 PROFESSIONALS 98784-56023 Jassian Chowk, Haibowal Kalan, Ldh.141001Документ2 страницыAssignment: K12 PROFESSIONALS 98784-56023 Jassian Chowk, Haibowal Kalan, Ldh.141001Vidhi GoyalОценок пока нет

- Karnataka II PUC Accountancy Model Question Paper 17Документ6 страницKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreОценок пока нет

- II Puc Accountancy Mock Paper IIДокумент5 страницII Puc Accountancy Mock Paper IISAI KISHOREОценок пока нет

- Karnataka II PUC Accountancy Sample Question Paper 18Документ6 страницKarnataka II PUC Accountancy Sample Question Paper 18Kishu KishoreОценок пока нет

- Class 12 CBSE ISC Accountancy Assignment 10Документ15 страницClass 12 CBSE ISC Accountancy Assignment 10studentОценок пока нет

- Corporate Accounting Ii-1Документ4 страницыCorporate Accounting Ii-1ARAVIND V KОценок пока нет

- Advanced Corporate Accounting Jan - 2024 SupplementaryДокумент2 страницыAdvanced Corporate Accounting Jan - 2024 SupplementarysaradhachinnaboyinaОценок пока нет

- ACCOUNTANCY - II MID - Quastion PaperДокумент6 страницACCOUNTANCY - II MID - Quastion PaperveenaОценок пока нет

- Ajanta Public School: General InstructionsДокумент3 страницыAjanta Public School: General Instructionsbhumika aggarwalОценок пока нет

- FINANCIAL - 22UCOS304 - Corrected - 23N528Документ5 страницFINANCIAL - 22UCOS304 - Corrected - 23N528aswathvignessОценок пока нет

- Corporate Accounting II (T)Документ6 страницCorporate Accounting II (T)BISLY MARIAM BINSONОценок пока нет

- 12 C BK Mock Board PraveenaДокумент4 страницы12 C BK Mock Board PraveenaAdvanced AcademyОценок пока нет

- Ca QP ModelДокумент3 страницыCa QP Modelmahabalu123456789Оценок пока нет

- MQP Accountancy WMДокумент14 страницMQP Accountancy WMRithik PoojaryОценок пока нет

- Karnataka 2nd Puc Accountancy Board Exam Question Paper Eng Version-March 2017Документ8 страницKarnataka 2nd Puc Accountancy Board Exam Question Paper Eng Version-March 2017poornimaramshettyОценок пока нет

- Ca-Ii May 2022Документ6 страницCa-Ii May 2022Gayathri V GОценок пока нет

- Corporate Accounting Exam Questions PaperДокумент7 страницCorporate Accounting Exam Questions PaperAmmar Bin NasirОценок пока нет

- PT 06 (Partnership) (5 Dec)Документ8 страницPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Документ6 страницXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashОценок пока нет

- XI Accountancy Model Set 2078Документ38 страницXI Accountancy Model Set 2078kevin bhattaraiОценок пока нет

- Financial Accounting II MinДокумент4 страницыFinancial Accounting II MinAsna Rachal ShibuОценок пока нет

- Sale of PartnershipДокумент11 страницSale of PartnershipJoel VargheseОценок пока нет

- Unit 3 Admission of A Partner QuestionsДокумент4 страницыUnit 3 Admission of A Partner QuestionsMitesh SethiОценок пока нет

- Test29th AugustДокумент2 страницыTest29th Augustemraan_aazamОценок пока нет

- Corrporate ModelДокумент10 страницCorrporate Modelnithinjoseph562005Оценок пока нет

- II PU Accountancy QPДокумент13 страницII PU Accountancy QPLokesh RaoОценок пока нет

- Corporate Accounting Ii 2020Документ4 страницыCorporate Accounting Ii 2020joe josephОценок пока нет

- II Pu Acc 23 Dis Pre QprsДокумент92 страницыII Pu Acc 23 Dis Pre QprskrupithkОценок пока нет

- Accounts Mock Test May 2019Документ18 страницAccounts Mock Test May 2019poojitha reddyОценок пока нет

- FND Partnership QuestionДокумент3 страницыFND Partnership QuestionShweta BhadauriaОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceДокумент4 страницыLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorОценок пока нет

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFДокумент6 страницBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyОценок пока нет

- Adv Acc MTPO1 PDFДокумент18 страницAdv Acc MTPO1 PDFuma shankarОценок пока нет

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksДокумент3 страницыInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarОценок пока нет

- Corporate ACДокумент4 страницыCorporate ACElavarasan NОценок пока нет

- 12 Accountancy SQP 5Документ13 страниц12 Accountancy SQP 5KandaroliОценок пока нет

- Accountancy QP 3 (A) 2023Документ5 страницAccountancy QP 3 (A) 2023mohammedsubhan6651Оценок пока нет

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusДокумент5 страницDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditОценок пока нет

- 12 2006 Accountancy 2Документ5 страниц12 2006 Accountancy 2Akash TamuliОценок пока нет

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFДокумент3 страницы2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethОценок пока нет

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Документ5 страницSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuОценок пока нет

- Monthly Test - Acc. Aug 2020Документ5 страницMonthly Test - Acc. Aug 2020akash debbarmaОценок пока нет

- CA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutesДокумент7 страницCA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutespriyaОценок пока нет

- Accountancy Unit Test 2 - WorksheetДокумент12 страницAccountancy Unit Test 2 - WorksheetFawaz YoosefОценок пока нет

- 2BBL311 SEE IR Financial Accounting Dec 2017Документ3 страницы2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaОценок пока нет

- Accounts Parntership TestДокумент6 страницAccounts Parntership TestdhruvОценок пока нет

- Class 12 AccountsДокумент5 страницClass 12 AccountsVishal AgarwalОценок пока нет

- Accountancy - XII - QPДокумент5 страницAccountancy - XII - QPKulvirkuljitharmeet singhОценок пока нет

- SEM III - Advanced Accounting (EM)Документ4 страницыSEM III - Advanced Accounting (EM)Abdul MalikОценок пока нет

- Accountancy EngДокумент8 страницAccountancy EngBettappa Patil100% (1)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020От EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Оценок пока нет

- Slide of Chapter 1Документ29 страницSlide of Chapter 1Uyen ThuОценок пока нет

- BAB 7 Cash Flow AnalyisisДокумент19 страницBAB 7 Cash Flow AnalyisisMaun GovillianОценок пока нет

- Financial Accounting - IIДокумент4 страницыFinancial Accounting - IIPadmini VasanthОценок пока нет

- Global Strategic CFO Manufacturing in Burlington VT Resume Kent RosenthalДокумент3 страницыGlobal Strategic CFO Manufacturing in Burlington VT Resume Kent RosenthalKent RosenthalОценок пока нет

- Accounting ChangesДокумент5 страницAccounting ChangesShielle AzonОценок пока нет

- Advanced Cost & Management AccountingДокумент3 страницыAdvanced Cost & Management AccountingDawit DawitОценок пока нет

- OHUN CrossWalk 12 22 11Документ520 страницOHUN CrossWalk 12 22 11Robert AraujoОценок пока нет

- Cost Accounting and ControlДокумент14 страницCost Accounting and Controlkaye SagabaenОценок пока нет

- Unit VI Performing Substantive TestДокумент29 страницUnit VI Performing Substantive TestMark GerwinОценок пока нет

- Vallix QuestionnairesДокумент14 страницVallix QuestionnairesKathleen LucasОценок пока нет

- Theory Questions 5 PDF FreeДокумент5 страницTheory Questions 5 PDF FreeSamsung AccountОценок пока нет

- Social Responsibility Accounting: A Conceptual Framework For Universal AcceptanceДокумент7 страницSocial Responsibility Accounting: A Conceptual Framework For Universal AcceptancePritee SinghОценок пока нет

- Guide To The Assessment of IT Risk (GAIT) - Part 4Документ20 страницGuide To The Assessment of IT Risk (GAIT) - Part 4Ko ZawОценок пока нет

- Course Title: Audit Course ID: ACN403 Section: 02 Assignment OnДокумент12 страницCourse Title: Audit Course ID: ACN403 Section: 02 Assignment OnIbn ShuraimОценок пока нет

- Revised Syllabus of BS Commerce 2017Документ87 страницRevised Syllabus of BS Commerce 2017ahsan azizОценок пока нет

- Ichapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresДокумент14 страницIchapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresJessalyn DaneОценок пока нет

- 01 Configuration Phase I - Financial AccountingДокумент36 страниц01 Configuration Phase I - Financial Accountingsumber kocakОценок пока нет

- Ch03 - Cost-Volume-Profit Analysis OKДокумент48 страницCh03 - Cost-Volume-Profit Analysis OKDwidarОценок пока нет

- Cpa Review School of The Philippines: Related Psas: Psa 700, 710, 720, 560, 570, 600 and 620Документ49 страницCpa Review School of The Philippines: Related Psas: Psa 700, 710, 720, 560, 570, 600 and 620Jasmine LimОценок пока нет

- IFRS 16 Examples, Summary, & How To Transition From IAS 17Документ13 страницIFRS 16 Examples, Summary, & How To Transition From IAS 17Bruce ChengОценок пока нет

- PSA 100 Phil Framework For Assurance EngagementsДокумент4 страницыPSA 100 Phil Framework For Assurance EngagementsSkye LeeОценок пока нет

- P3 - Performance StrategyДокумент17 страницP3 - Performance StrategyWaqas BadshahОценок пока нет

- Mid Term Exam FIN 3-Aug 2013Документ20 страницMid Term Exam FIN 3-Aug 2013monzkymine57% (7)

- Pa 2Документ9 страницPa 2Aditya DzikirОценок пока нет

- Internal Audit Manual NewДокумент26 страницInternal Audit Manual NewhtakrouriОценок пока нет

- Book of Accounts Part 1. JournalДокумент12 страницBook of Accounts Part 1. JournalJace AbeОценок пока нет

- 6 Chapter7-2 InventoryДокумент59 страниц6 Chapter7-2 InventoryEvelyn WongОценок пока нет

- P2P & O2C (Entries)Документ9 страницP2P & O2C (Entries)hari koppalaОценок пока нет

- Catapang Hazel Ann E.Документ4 страницыCatapang Hazel Ann E.Johnlloyd BarretoОценок пока нет