Академический Документы

Профессиональный Документы

Культура Документы

Audited Financial Statement For 2015

Загружено:

lancekim210 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров9 страницPNB Life Insurance Audited Financial Report

Оригинальное название

Audited Financial Statement for 2015

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPNB Life Insurance Audited Financial Report

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров9 страницAudited Financial Statement For 2015

Загружено:

lancekim21PNB Life Insurance Audited Financial Report

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

COVER SHEET

for

AUDITED FINANCIAL STATEMENTS.

SEC Registration Number

Aji}9}9}9/1/5]9] 1] 0

COMPANY NAME

piniB] [frre] jrin{siulrialniclel,] [rinfc

PRINCIPAL OFFICE (No /Siee/Barengay/ Cty / Town /Provnca)

Foo Type Deparment requrng the reper ‘Secontary cans Type, I Applcable

AA[F|S sjg|c

COMPANY INFORMATION

‘Companys Ered Adress ‘rips Telephone Number Mabie Naber

818-5433 =

No.of Stxknobios Anal Meetng (Month/Day) Fiscal Year (Monthy)

n 32 1281

CONTACT PERSON INFORMATION

The designed contact parson MUST be an Offa of he Crporaon

Name of Contac Person mat Adress ‘Telephone Nurbeds Mobile uber

Caesar P, Altarejos, Jr, ‘eaetaraliareios@onblifecom -

‘CONTACT PERSON’s ADDRESS:

10* Floor, Allied Bank Center, 6754 Ayala Avenue, Makati City

NOTE Tin Gave of death, resgnaton or cesaton of oce of tha acer desbaled os corae pean, sur Reo shal Be raped fo te

Commision win tity (30) clencer dye tom the occurance ther! wah nfomasfen end complete contest dla o te new conic! person

dsirated

2: Al Boxes must bo propery ard conpltsy Ails.up. Falure to do so shal couse the delay in undetng the comport’ records wth

the Commission ander nonreslt of Note of Defiencis. Further, renee of Nolce of Defences shal nok excuse Oe corre fom

abit fs deficenc.

SGV SyCip Gore Velaye & Co. Tel (632) 801 0307 GONPRC Reg. No, 000%,

760 Ayes Avenue Fes (032)810.0072 December, 2026, valid unt# Decamber 31, 2018

1226 Maxat Cy excomiph ‘SEC Accreditation No. 0012-FR-4 (Group

Building a better Phitppines ‘November 10,2078, vad urti Never

‘working word i be 10,2076, valid unts Never

2038

INDEPENDENT AUDITORS’ REPORT

‘The Stockholders and the Board of Directors

PNB Life Insurance, Inc.

10th Floor, Allied Bank Center

6754 Ayala Avenue, Makati City

Report on the Financial Statements

We have audited the accompanying financial statements of PNB Life Insurance, Inc., which comprise

the statements of financial position as at December 31, 2015 and 2014, and the statements of income,

‘statements of comprehensive income, statements of changes in equity and statements of cash flows for

the years then ended, and a summary of significant accounting policies and other explanatory

information.

‘Management's Responsibility for the Financial Statements

‘Management is responsible for the preparation and the fair presentation of these financial statements in

accordance with Philippine Financial Reporting Standards, and for such internal control as

‘management determines is necessary to enable the preparation of financial statements that are free

from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibilty is to express an opinion on these financial statements based on our audits. We

conducted our audits in accordance with Philippine Standards on Auditing. Those standards require that

‘we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance

about whether the financial statements are free from material misstatement.

‘An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

the financial statements. The procedures selected depend on the auditor’s judgment, including the

assessment of the risks of material misstatement of the financial statements, whether due to fraud or

error. In making those risk assessments, the auditor considers internal control relevant to the entity's

preparation and fair presentation of the financial statements in order to design audit procedures that are

‘appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies

used and the reasonableness of accounting estimates made by management, as well as evaluating the

overall presentation of the financial statements,

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for

cour audit opinion.

Sate | APR 21 206 | TSIS

RECEIVED

WA, GRACIAAURORA Ly CASTILLO.

SGV

Bulging a etter

‘rorming won

Opinion

In our opinion, the financial statements present fairly, in all material respects, the financial position of

PNB Life Insurance, Inc. as at December 31, 2015 and 2014, and its financial performance and its

cash flows for the years then ended in accordance with Philippine Financial Reporting Standards

Report on the Supplementary Information Required Under Revenue Regulations 15-2010

Our audits were conducted for the purpose of forming an opinion on the basic financial statements

taken as a whole. The supplementary information required under Revenue Regulations 15-2010 in

‘Note 30 to the financial statements is presented for purposes of filing with the Bureau of Internal

Revenue and is not a required part of the basic financial statements. Such information is the

responsibility of the management of PNB Life Insurance, Inc. The information has been subjected to

the auditing procedures applied in our audit of the basic financial statements. In our opinion, the

information is fairly stated, in all material respects, in relation to the basic financial statements taken

as a whole,

SYCIP GORRES VELAYO & CO.

CPA Certificate No. 0097907

SEC Accreditation No. 1285-A (Group A),

February 25, 2013, valid until February 24, 2016

Tax Identification No. 201-960-347

BIR Accreditation No. 08-001998-102-2015,

‘November 25, 2015, valid until November 24, 2018

PTR No. 5321641, January 4, 2016, Makati City

February 3, 2016

©) APR 21 2016 | Tsis

RECEIVED

NA, GRACIAAURURA Ly CASTILLO

PNB

‘STATEMENT OF MANAGEMENT'S RESPONSIBILITY

FOR FINANCIAL STATEMENTS,

‘The management of PNB Life Insurance, Inc, is responsible for the preparation and

fair presentation of the financial statements for the years ended December 31, 2015

‘and 2014, including the additional components attached therein, in accordance with

accounting principles generally accepted in the Philippines. This responsibilty

ineludes designing and implementing internal controls relevant to the preparation and

fair presentation of the financial statements that are free from material misstatement,

whether due to fraud or error, selecting and applying appropriate accounting policies,

‘and making accounting estimiates that are reasonable in the circumstances.

‘The Board of Directors reviews and approves the financial statements and submits

the same to the stockholders.

‘SyCip Gorres Velayo & Co., the independent auditors appointed by the stockholders

has examined the financial statements of the company in accordance with Philippine

Standards on Auditing, and in its report to the stockholders has expressed its opinion

(on the fairness of the presentation upon completion of such examination.

REBECCA B. DELA CRUZ

President & CEO

AKESKRD_ALTARELOS. JR.

PNB LIFE INSURANCE, INC.

STATEMENTS OF FINANCIAL POSITION

December 31

2015 2014

ASSETS

Cash and Cash Equivalents (Notes 4, 27 and 28) 717,662,812 410,236,605

Insurance Receivables (Notes 5 and 28) 60,402,832 76,442,961

Financial Assets (Notes 6 and 28)

Available-for-sale financial assets 7,474,892,965 6,669,547,016

Held-to-maturity investments 982,619,353 974,746,864

Loans and receivables (Note 27) 353,388,854 304,339,805

Segregated Fund Assets (Notes 6, 9 and 28) 13,714,995,150 10,750,694,926

Prepayments and Deposits (Notes 7 and 29) 6,627,847 4,201,126

Reinsurance Assets (Note 11) 4,944,345 3,783,235

Property and Equipment - net (Note 8) 29,545,692 23,007,627

Other Assets (Note 10) 56,565,940 41,914,126

P23,401,645,790_P19,258,914,291

LIABILITIES AND EQUITY

Liabilities

Insurance provisions (Notes 11, 12 and 28) 76,837,144,498P5,857,020,754

Due to reinsurer 9,167,566 4,886,817

‘Segregated fund liabilities (Notes 9 and 28) 13,725,321,275 10,817,122,252

Premium deposit fund (Notes 13 and 28) 476,686,327 482,796,195

Accounts payable and accrued expenses (Notes 14 and 28) 382,479,022 416,717,560

Pension liability - net (Note 25) 21,822,321 24,381,638

Total Liabilities 21,452,621,009 _ 17,602,925,216

Equity

Capital stock (Note 15) 250,000,000 250,000,000

‘Additional paid-in capital 50,000,000 50,000,000

Contingency surplus 1,300,000,000 _1,300,000,000

Reserve for fluctuation on available-for-sale

financial assets (Note 6) 531,046,064 574,443,373

Deficit (182,021,283)__ (518,454,298)

Total Equity 1,949,024,781 _1,655,989,075

P23,401,645,790_P19,258,914,291

See accompanying Notes to Financial Statements

RECEIVED

vis, GRACIAMURURA L, CASTILLO

PNB LIFE INSURANCE, INC.

STATEMENTS OF INCOME

REVENUE

Gross premiums on insurance contracts

Years Ended December 31

2015 2014

B1,733,775,734 P1,614,556,907

Reinsurers’ share of gross premiums on insurance contracts (17,467,727) (10,057,249)

Net insurance premiums (Note 16) 1,716,308,007 _1,604,499,658

Investment income (Notes 4, 6 and 17) 470,838,194 423,015,319

Referral and trust fees (Note 18) 141,621,003 95,721,841

Gain on sale of available-for-sale financial assets - net (Note 6) 20,874,394 14,661,369

Miscellaneous income (Note 19) 10,268,758 4,303,657

Other revenue 643,602,349 537,702,186

Total revenue 2,359,910,356__2,142,201,844

BENEFITS, CLAIMS AND EXPENSES

Gross life insurance contract benefits and claims 444,367,487 432,839,766

Reinsurers’ share of life insurance contract benefits and claims (3,433,563) _ (3,010,042)

Gross change in life insurance contract liabilities 842,275,163 756,861,142

Reinsurers” share of change in life insurance contract liabilities (1,161,110) 4,666,564

Net insurance benefits and claims (Note 20 1,282,047,977__1,191,357,430

‘Commissions and agency related compensation (Note 21) 277,298,831 333,361,719

Salaries, wages and employee benefits (Note 24) 51,636,143 46,358,242

Taxes and licenses (Note 22) 29,437,756 28,061,891

Interest expense (Note 13) 9,239,766 8,191,464

Medical fees 1,813,984 1,426,502

Insurance expenses 369,426,480 417,399,818

General and administrative expenses (Note 23) 322,242,309 ___ 226,653,843

Total benefits and expenses 1,973,716,766 __1,835,411,091

INCOME BEFORE INCOME TAX 386,193,590 306,790,753

PROVISION FOR INCOME TAX (Note 26) 44,305,317 43,171,518

NET INCOME 341,988,273 P 263,619,235

‘See accompanying Notes to Financial Statements

EER

05S ANE Dio

APR 21 206 | Tsis

RECE

Was GRACIAAURORAL, CASTILLO

PNB LIFE INSURANCE, INC.

STATEMENTS OF COMPREHENSIVE INCOME.

Years Ended December 31

2015

NET INCOME. 341,888,273

OTHER COMPREHENSIVE INCOME (LOSS)

Other comprehensive income (1oss) that will be reclassified to

profit or loss in the subsequent periods:

Fair value gains (losses) on available-for-sale

financial assets (Note 6) (43,397,309)

Other comprehensive income (loss) that will not be reclassified

10 profit or loss in the subsequent periods:

2014

263,619,235

125,986,649

Re-measurement losses on defined benefit plan (Note 25) (5,455,258) (11,546,088)

Other comprehensive income (losses) for the year (48,852,567) 114,440,561

TOTAL COMPREHENSIVE INCOME. 293,035,706 __P378,059,796

‘See accompanying Notes to Financial Statements.

UE

SLOGSESS9 1d (BET HSY'SISH) ELE EbY ELSE 000%000'00E"id __000'000'0Se 000°000'0Sca loz ‘Te 9quI99q IV

96L°6S0'RLE pT ELOCST, CPF ORE STL = = = ‘BUTOOUT eATstaySIaCHOS [CO

“Tasos T1) OVI ORE STL = 7 TSF) OUTST SATSTOHSIAWOS OHIO

SEC6I9'EST - = - = ‘u0out JON

GLTOCOLLT lA SPV LES OLLA) PEL OSV'BVVE 000°000°00E"1e ~~ 000'000'0Se ‘000°000"0Sza prog T Aron ay

TE VEOOe TA CERT TLOTSI) pOTOFOTESA OOD OON OE Ta 000000 USE ‘oon 000" 0Sta ‘Siz Te 29qaC IV

‘OLSEN EST SIOESF OSE OE L6E EH) ia! = = (80]) SuTOOUT OAISUOyoICUIOS THIOL

(9s tS88b) (esvsst's) Oe Lor eh) ot = FA Wo] SAIsUays TAOS IIS

ELT BBS'EVE ELT RBS'TPE 7 in - - ‘M109u JON

SLOGRESSN Ta (ROTHSFBISA) ELE EPY'PLSA __OO0'OONODETA _000°000'0Sa (000° 000°0STa SToe T Ganuepay

THO, IU (20ND smjding rede (1 aN)

spssy fepaeuy —foweBupwo3 pong rence)

ayes-s05

-s1qeTeAy wo

wopenyonpt

40} 94195941

107 ONY ST0z ‘Te AAWAAC AAGNA SUVAA IHL YOL

ALINOA NI SHONVHD AO SINTWALVLS

“ONI “AONVUASNI FATT ANd

PNB LIFE INSURANCE, INC.

STATEMENTS OF CASH FLOWS

CASH FLOWS FROM OPERATING ACTIVITIES

Income before income tax

Adjustments for:

‘Years Ended December 31

2015

586,193,590

2014

306,790,753,

Increase in aggregate reserve for life policies (Note 11) 841,114,053 761,527,706

Impairment loss 36,470,366 -

Depreciation and amortization (Notes 8 and 23) 10,704,582 14,039,495

Write-off of property and equipment(Note 8) 37,327 -

Unrealized foreign exchange loss (gain) (4,820,379) 1,487,331

Gain on sale of available-for-sale financial assets (Note 6) (20,874,394) (14,661,369)

Dividend income (Note 17) (79,279,842) (59,629,432)

Interest income (Notes 4, 6 and 17) (368,126,622) __ (363,385,887)

‘Operating income before changes in working capital 901,418,681 646,168,597

‘Changes in operating assets and liabilities:

Decrease (increase) in:

Insurance receivables 16,040,130 (24,813,485)

Loans and receivables 35.641,846) (31,762,068)

Segregated fund assets (@,964,300,224) _(2,889,006,540)

Prepayments and deposits (@,426,721) 405,909

Reinsurance assets, 161,110) 4,666,564

Other assets (10,067,724) (4,513,433)

Increase (decrease) in:

Insurance provisions 139,009,691 73,688,365

Due to reinsurers 4,280,749 (1,707,857)

Segregated fund | 2,908,199,023 _2,905,327,630

Premium deposit fun (6,109,868) 272,227,387

‘Accounts payable and accrued expenses 64,238,538) 204,962,269

Net pension liability (8,014,575) (325,367)

Net cash generated from operations 806,987,668 _1,155,317.971

Dividend received 79,345,501 59,629,433

Interest received 373,143,740 372,669,837

Income tax paid (48,889,407) __(51,666,454)

‘Net cash from operating activites ¥,210,587,502____1,535,950,787

CASH FLOWS FROM INVESTING ACTIVITIES

Acquisitions of:

Available-for sale nancial assets (Note 6) (6,023,278,217) (6,424,047, 44)

Property and equipment (Note 8) (17,646,837) (6,207,556)

Proceeds from sale/maturity/tetirement of:

‘Available-for sale financial assets (Note 6) $,.214,214,627—_5,034,747,501

Held-to-maturity 11,037,500 -

Property and equipment

366,863,

(395,307,199)

‘Net cash used in investing activities (815,306,064)

EFFECT OF EXCHANGE RATE CHANGES ON

CASH AND CASH EQUIVALENTS (87.855231) 2,295,886)

NET INCREASE IN CASH AND CASH EQUIVALENTS 307,426,207 138,147,702

CASH AND CASH EQUIVALENTS

AT BEGINNING OF YEAR 410,236,605 __ 272,088,903,

‘CASH AND CASH EQUIVALENTS

ATEND OF YEAR

P717,662,812

410,23

‘See accompanying Notes to Financial Staiemend

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Activity 3 Interpret and TeachДокумент1 страницаActivity 3 Interpret and Teachlancekim21Оценок пока нет

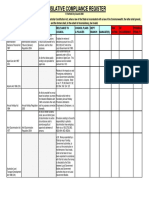

- Legislative Compliance RegisterДокумент26 страницLegislative Compliance Registerlancekim21Оценок пока нет

- Compliance Bulletin Data PrivacyДокумент1 страницаCompliance Bulletin Data Privacylancekim21Оценок пока нет

- Assessment of Compliance With Rules and Regulations On Bank ProtectionДокумент5 страницAssessment of Compliance With Rules and Regulations On Bank Protectionlancekim21100% (1)

- RPAC - 26 July 2019Документ21 страницаRPAC - 26 July 2019lancekim21Оценок пока нет

- 2019legislation - Revised Corporation Code Comparative Matrix PDFДокумент120 страниц2019legislation - Revised Corporation Code Comparative Matrix PDFlancekim21Оценок пока нет

- PNB Data Privacy Client Consent FormДокумент1 страницаPNB Data Privacy Client Consent Formlancekim21Оценок пока нет

- 5 Money Rules The Rich Have MasteredДокумент163 страницы5 Money Rules The Rich Have Masteredlancekim21100% (3)

- Raci GuideДокумент7 страницRaci Guidelancekim21Оценок пока нет

- Joint Ventures in The Philippines - Nicolas & de Vega Law OfficesДокумент5 страницJoint Ventures in The Philippines - Nicolas & de Vega Law Officeslancekim21Оценок пока нет

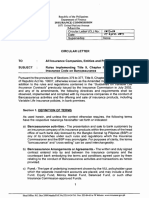

- CL2015 20 PDFДокумент24 страницыCL2015 20 PDFlancekim21Оценок пока нет

- Salesforce The Path Toward EqualityДокумент18 страницSalesforce The Path Toward Equalitylancekim21Оценок пока нет

- 10-Pay Velocity - Product PrimerДокумент1 страница10-Pay Velocity - Product Primerlancekim21Оценок пока нет

- Definition of Dread DiseasesДокумент4 страницыDefinition of Dread Diseaseslancekim21Оценок пока нет

- CL2013 33Документ25 страницCL2013 33lancekim21Оценок пока нет

- VULДокумент15 страницVULlancekim21Оценок пока нет

- VULДокумент15 страницVULlancekim21Оценок пока нет

- Basic Sales Training 2 Trainer GuideДокумент2 страницыBasic Sales Training 2 Trainer Guidelancekim21Оценок пока нет

- Upcoming Movies As of June 19Документ2 страницыUpcoming Movies As of June 19lancekim21Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)