Академический Документы

Профессиональный Документы

Культура Документы

Analisis de Fleet PDF

Загружено:

Daniel RicoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Analisis de Fleet PDF

Загружено:

Daniel RicoАвторское право:

Доступные форматы

Estrategias

aplicadas al

Sector

Bancario

4

A Survey of

Manufacturing Company CFOs

2004

Middle-Market Outlook

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 1

Estrategias

aplicadas al

About The Survey Sector

Bancario

This is the sixth annual survey of middle-market

manufacturer CFOs commissioned by Fleet Capital

Corporation.

During September 2003, an independent market research

firm completed phone interviews with 601 chief financial

officers drawn from a random sampling of manufacturing

companies (SIC codes 2000 to 3999) with annual revenues

between $25 million and $2 billion.

The purpose of this proprietary research project was to

determine how manufacturing company CFOs view the

U.S. economy, their outlook for revenue, financing, M&A

activity, and their involvement in foreign markets. The

statistical range of error for the total sample is plus or

minus 4%.

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 2

Estrategias

aplicadas al

About The Survey Sector

Bancario

Survey Demographics

Is your company public or private? _ 8% Chemicals

_ 81% Privately owned _ 8% Automotive parts

_ 18% Publicly owned _ 6% Miscellaneous manufacturing

_ 1% Refused or dont know _ 6% Fabricated metal products

What type or types of product does your _ 5% Printing/publishing

company manufacture? _ 5% Furniture

_ 12% Food products _ 5% Lumber & wood products

_ 4% Paper products

_ 11% Electric

equipment/electronics _ 4% Textiles & apparel

_ 3% Medical equipment

_ 10% Primary metal industries

_ 3% Rubber & plastics

_ 9% Industrial machinery & _ 1% Stone, clay & glass products

equipment

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 3

Estrategias

aplicadas al

About The Survey Sector

Bancario

Survey Demographics

Sales Region

_ 64% $25 million to $74,999,999 _ 37% Midwest

_ 26% $75 million to $199,999,999 _ 23% East

_ 6% $200 million to $499,999,999 _ 22% South

_ 4% $500 million to $2 billion _ 18% West

Gender

_ 80% Male

_ 20% Female

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 4

Estrategias

aplicadas al

1. Economic Outlook Sector

Bancario

1.1. Do you think the actions taken by the Federal Reserve

Board over the past year regarding interest rates have

helped or hurt the national economy?

1.2. Has the current state of the economy caused you to alter

your plans for growth or expansion?

1.3. What actions have the current economic conditions

caused you to take?

1.4.Looking ahead, do you think the U.S. economy will expand,

contract, or stay the same in 2004?

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 5

Estrategias

aplicadas al

1. Economic Outlook Sector

Bancario

1.5. On a scale ranging from 0 (extremely weak) to 100 (extremely

strong), how would you rate the current state of the

manufacturing sector?

1.6. Do you expect your companys revenues to grow, contract or

stay the same in 2004?

1.7. Do you expect your companys level of capital expenditures

over the next 12 months to increase, decrease or stay the same

as the past 12 months?

1.8.What are your most significant financial concerns?

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 6

Estrategias

aplicadas al

2. Financing Sector

Bancario

2.1. Will your companys financing requirements increase,

decrease or say the same in 2004 as compared to 2003?

2.2. Do you expect your financing cost of capital to increase,

decrease or stay the same in 2004 as compared to 2003?

2.3. Are you currently considering financing for any the

following

_ Acquisition

_ Debtor-in-Possession (DIP)/Exit Financing

_ Expansion

_ Leveraged Buyout (LBO)/Management Buyout (MBO)

_ Machinery & Equipment

_ Working Capital

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 7

Estrategias

aplicadas al

2. Financing Sector

Bancario

2.4. Which of the following types of financing does your

company plan to use in 2004?

2.5. Thinking about the credit availability from your current lender,

would you say that your lender has increased, maintained or

restricted credit availability compared to a year ago

2.6. Do you think that your relationship with your current lender

has improved, remained the same or deteriorated over the past

year?

2.7. How important is it that your lender have the ability to

provide your company with a wide range of financial

products and services?

2.8. Which of the following products and services do you

currently purchase from your lender?

2.9. Do you use the Internet to transact business with your

lender or financial institution

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 8

Estrategias

aplicadas al

3. Labor Costs and Product Pricing

Sector

Bancario

3.1. Do you expect your labor costs per unit to increase, decrease or

stay the same in 2004 as compared to 2003? What about product

pricing?

4.Mergers and Acquisitions

4.1. Will your company participate in any mergers or acquisitions in

2004?

4.2. Are there more businesses available at lower prices and attractive

multiples compared to a year ago?

4.3.Do you think that the purchase price for companies in your

industry as a multiple of EBITDA will increase, decrease or stay the

same in the year 2004 compared to 2003?

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 9

Estrategias

aplicadas al

5. International Outlook

Sector

Bancario

5.1. Regarding foreign markets, do you sell, import or have

operations in foreign countries?

5.2. Will your companys sales to foreign markets increase,

decrease or stay the same in 2004 as compared to 2003?

5.3. Where geographically will the increase in sales occur?

5.4. Do you hedge foreign currency risks?

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 10

Estrategias

aplicadas al

The Major Findings -Financing Sector

Bancario

_ The top three types of financing middle-market manufacturing companies

plan to use in 2004 are bank financing (74%), internal sources (64%)

and leasing (36%).

_ Less than one-third of CFOs surveyed expect their companys financing

requirements to increase in 2004, down from 46% in 2003. Ten percent

say they plan to borrow less.

_ Despite continued historically low interest rates and an optimistic view of

the outlook for the economy, only 41% of CFOs forecast an increase in

their cost of capital.

_ An overwhelming majority (93%) of CFOs surveyed say that they have

been able to find the financing needed to execute their business plans.

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 11

Estrategias

aplicadas al

The Major Findings -Financing Sector

Bancario

_ Most CFOs believe credit availability has not deteriorated over the

past year. Twenty seven percent of respondents say that credit

availability from their current lender has increased over the past 12

months. Six out of ten (60%) are experiencing no change incredit

availability.

_ Twenty-nine percent of CFOs reported that their relationship with

their current lender has improved, while only 8% report that their

lender relationship has deteriorated.

_ More then eight out of ten (84%) CFOs indicated that it is

important that their lender be able to provide them with a wide

range of products and services..

services

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 12

Estrategias

aplicadas al

The Major Findings -Financing Sector

Bancario

_ In addition to their credit facility, 89% of companies

surveyed purchase at least one additional product or

service from their lender.

_ More than four in ten (42%) CFOs use the Internet to

transact business with their lender.

_ Viewing balance information/on-line statements (90%)

and accessing bank services (82%) rose to the top of the

list when asked how they use the Internet to transact

business with their lender.

.

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 13

Estrategias

aplicadas al

Respuesta al 1.1. Sector

Bancario

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 14

Estrategias

aplicadas al

Respuesta al 1.8. Sector

Bancario

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 15

Estrategias

aplicadas al

Respuesta al 2.3. Sector

Bancario

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 16

Estrategias

aplicadas al

Respuesta al 2.4. Sector

Bancario

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 17

Estrategias

aplicadas al

Respuesta al 2.7. Sector

Bancario

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 18

Estrategias

aplicadas al

Respuesta al 2.8. Sector

Bancario

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 19

Estrategias

aplicadas al

Respuesta al 2.9. Sector

Bancario

Diploma en Economa y Gestin Bancaria

Departamento de Economa de la Facultadad de Ciencias Sociales

Universidad de la Repblica 20

Вам также может понравиться

- Basilea2 PDFДокумент11 страницBasilea2 PDFDaniel RicoОценок пока нет

- Core Principles For Effective Banking Supervision - September 1997Документ48 страницCore Principles For Effective Banking Supervision - September 1997glkbvОценок пока нет

- Política Anticiclica (Ponencia de J Saurina Banco de España) PDFДокумент38 страницPolítica Anticiclica (Ponencia de J Saurina Banco de España) PDFDaniel RicoОценок пока нет

- Cousin Risk (Correlación Entre Riesgo País y Moneda) PDFДокумент30 страницCousin Risk (Correlación Entre Riesgo País y Moneda) PDFDaniel RicoОценок пока нет

- What Market Segmentation Is and Isn-'T.Документ10 страницWhat Market Segmentation Is and Isn-'T.Daniel RicoОценок пока нет

- Market DefДокумент8 страницMarket DefDaniel RicoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Procedure For Election of The President of IndiaДокумент20 страницProcedure For Election of The President of IndiaAnanya Karan0% (1)

- Wiredusa 20201020Документ90 страницWiredusa 20201020Paulius JanciauskasОценок пока нет

- "Women in Islam" by Fatima Umar Naseef IMMA Editor Saleha Abedin Asst Editor, Huma AbedinДокумент22 страницы"Women in Islam" by Fatima Umar Naseef IMMA Editor Saleha Abedin Asst Editor, Huma AbedinTarek FatahОценок пока нет

- Comparative Rhetorical AnalysisДокумент7 страницComparative Rhetorical Analysisapi-308816815Оценок пока нет

- Pricing StrategyДокумент6 страницPricing StrategyTriyug Enterprises IndiaОценок пока нет

- 1930s Jazz Flyer Project Brings Bud's Era to LifeДокумент3 страницы1930s Jazz Flyer Project Brings Bud's Era to LifedawnmjohnsonОценок пока нет

- Carnival Traditions Around the WorldДокумент41 страницаCarnival Traditions Around the WorldArxhenta ÇupiОценок пока нет

- Dealing With The Tax Issues: Discount and Premium BondsДокумент4 страницыDealing With The Tax Issues: Discount and Premium BondsAntonio J FernósОценок пока нет

- Responsible Parenthood's Impact on OFW ChildrenДокумент92 страницыResponsible Parenthood's Impact on OFW ChildrenisabelОценок пока нет

- Entrance Examination Result of MBBS Program 2014Документ36 страницEntrance Examination Result of MBBS Program 2014Adina BatajuОценок пока нет

- UCSP Lesson 2 Handout On Culture and SocietyДокумент3 страницыUCSP Lesson 2 Handout On Culture and SocietyJoyce Orda100% (1)

- M136A1 AT4 Confined Space (AT4-CS)Документ23 страницыM136A1 AT4 Confined Space (AT4-CS)rectangleangleОценок пока нет

- The SUN 23.08Документ58 страницThe SUN 23.08Omid Habibinia50% (2)

- BS EN 1503-4 2002 Valves Materials For Bodies BonnetsДокумент10 страницBS EN 1503-4 2002 Valves Materials For Bodies BonnetsолегОценок пока нет

- Chinese Love-Erotic PoetryДокумент90 страницChinese Love-Erotic PoetrygamahucherОценок пока нет

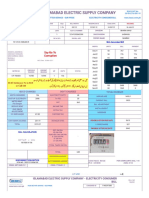

- IESCO GST No. bill provides Say No To Corruption detailsДокумент2 страницыIESCO GST No. bill provides Say No To Corruption detailsUmer SarfarazОценок пока нет

- Fire Risk AssessmentДокумент30 страницFire Risk AssessmentMufti Sinergi Solusi100% (1)

- Power Interuption ScheduleДокумент13 страницPower Interuption ScheduleAdaderana Online50% (2)

- Summer 2023 NewsletterДокумент6 страницSummer 2023 NewsletterChristine ParksОценок пока нет

- Government Innovation Through Social MedДокумент8 страницGovernment Innovation Through Social MedV AОценок пока нет

- Indian Stream Research JournalДокумент7 страницIndian Stream Research JournalShashidhar MahendrakumarОценок пока нет

- Paycheck 20211203 002360 Maurisha 202112231136Документ1 страницаPaycheck 20211203 002360 Maurisha 202112231136saraОценок пока нет

- Cdi 1 Fundamentals of Criminal Investigation & Intelligence - PowerpointДокумент22 страницыCdi 1 Fundamentals of Criminal Investigation & Intelligence - PowerpointJoey Figueroa94% (17)

- A Maori Reference GrammarДокумент9 страницA Maori Reference GrammarSengngeun0% (3)

- PAREDES After MidtermДокумент296 страницPAREDES After MidtermblimjucoОценок пока нет

- TOS Quiz 4Документ6 страницTOS Quiz 4maria ronoraОценок пока нет

- University of Oil and Gas,Ploieşti - British Cultural Studies - Samuel Beckett's Waiting for GodotДокумент8 страницUniversity of Oil and Gas,Ploieşti - British Cultural Studies - Samuel Beckett's Waiting for GodotmadalinaОценок пока нет

- Inflation DefinitionДокумент13 страницInflation DefinitionBrilliantОценок пока нет

- Trainspotting (Film) - WikipediaДокумент13 страницTrainspotting (Film) - WikipediaMartin KellyОценок пока нет

- March 2018 Highlights: Banco BICE Performance and Chilean EconomyДокумент27 страницMarch 2018 Highlights: Banco BICE Performance and Chilean EconomyDarío Guiñez ArenasОценок пока нет