Академический Документы

Профессиональный Документы

Культура Документы

Bim Assign

Загружено:

abhisekАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bim Assign

Загружено:

abhisekАвторское право:

Доступные форматы

The analysis of ratio of trips taken vs miles driven for hourly and daily users shows

that daily users are using vehicles for longer stretches (commuting between cities

perhaps) as compared to hourly users. Similarly, in terms of total hours used we can

see daily users data shows more hours as compared to hourly users. However,

when we see the respective billing pattern, it yields opposite in terms of revenue.

This seems to be underlying issue of the business model that Chase needs to

address. She should follow tiered pricing to reap maximum profit from the daily

users as well as the costs incurred do not vary for hourly and daily users.

(A) For daily trips, 94 miles used, instead of expected 125 miles, and 16 hours used

instead of expected 24 hours (it is assumed that billing for daily trips is fixed for 125

miles/24 hours thus saving 31 miles and 8 hours) (B) Hourly use is expected to be 4

hrs per trip however actual results show that 6.2 hrs per trip are used. As hourly

charge is variable, thus increased hours reflect increased earnings, while daily

charges are fixed, thus decreased miles reflect savings. Thus, business is in overall

positive direction.

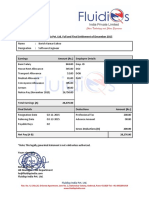

Revenue hourly (per Hour) $ 6.90

Revenue daily (per hour) $ 2.84

Miles driven (hourly) % 32.69%

Miles driven (daily) % 67.31%

Trips taken (hourly) % 65.07%

Trips taken (daily) % 34.93%

Hours used (hourly) % 41.92%

Hours used (daily) % 58.08%

Revenue per trip (daily

basis) $ 45.45

Revenue per trip (hourly

basis) $ 42.78

From the above table, we can see that revenue per trip for daily users is higher than

revenue per trip for hourly basis and miles driven and hours used for daily users is

greater than hourly users we should go for increasing the price and decreasing the

amount of free oil to be provided.

But if we consider the other side no of trips taken for hourly users are higher i.e.

65%, which means revenue by hourly basis should be increased more as it is a

variable cost.

Вам также может понравиться

- Statistics For Managers Using Microsoft Excel: 6 Global EditionДокумент70 страницStatistics For Managers Using Microsoft Excel: 6 Global EditionabhisekОценок пока нет

- JSW Steel Ratio AnalysisДокумент2 страницыJSW Steel Ratio AnalysisabhisekОценок пока нет

- Borish Kumar Sahoo - F&F StatementДокумент1 страницаBorish Kumar Sahoo - F&F StatementabhisekОценок пока нет

- SM Project Report - MayfairДокумент12 страницSM Project Report - Mayfairabhisek0% (1)

- Format of Transaction DataДокумент1 страницаFormat of Transaction DataabhisekОценок пока нет

- Swot AnalysisДокумент5 страницSwot AnalysisabhisekОценок пока нет

- Questions For End TermДокумент3 страницыQuestions For End TermabhisekОценок пока нет

- Cluster AnalysisДокумент3 страницыCluster AnalysisabhisekОценок пока нет

- Capital Structure AdaniДокумент4 страницыCapital Structure AdaniabhisekОценок пока нет

- Mountain 1Документ1 страницаMountain 1abhisekОценок пока нет

- WolfДокумент1 страницаWolfabhisekОценок пока нет

- AmazonДокумент3 страницыAmazonabhisekОценок пока нет

- Exploratory Factor Analysis With Small Sample SizesДокумент35 страницExploratory Factor Analysis With Small Sample SizesmedijumОценок пока нет

- MountainДокумент1 страницаMountainabhisekОценок пока нет

- IanДокумент2 страницыIanabhisekОценок пока нет

- Basel II Disclosures 31-03-2012Документ24 страницыBasel II Disclosures 31-03-2012abhisekОценок пока нет

- Assignment1 InstructionДокумент1 страницаAssignment1 InstructionabhisekОценок пока нет

- TQM ImplementationДокумент1 страницаTQM ImplementationabhisekОценок пока нет

- Missing ValueДокумент2 страницыMissing ValueabhisekОценок пока нет

- Crocodile Farming & Business: BackgroundДокумент1 страницаCrocodile Farming & Business: BackgroundabhisekОценок пока нет

- IanДокумент1 страницаIanabhisekОценок пока нет

- Zipcar: Redefining Its Business ModelДокумент11 страницZipcar: Redefining Its Business Modelshmuup10% (1)

- R Week1 Lecture Note1Документ5 страницR Week1 Lecture Note1abhisekОценок пока нет

- UkraineДокумент2 страницыUkraineabhisekОценок пока нет

- TudhafДокумент3 страницыTudhafabhisekОценок пока нет

- JordanДокумент1 страницаJordanabhisekОценок пока нет

- KievДокумент1 страницаKievabhisekОценок пока нет

- Del ToroДокумент2 страницыDel ToroabhisekОценок пока нет

- MerlДокумент1 страницаMerlabhisekОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)