Академический Документы

Профессиональный Документы

Культура Документы

Jyske Bank Jul 06 Eco Outlook Uk

Загружено:

Miir ViirАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Jyske Bank Jul 06 Eco Outlook Uk

Загружено:

Miir ViirАвторское право:

Доступные форматы

Economic Outlook, the UK

6 July 2010

Please direct inquiries, if any, to:

Tina Winther Frandsen, Senior Macroeconomic Analyst

+45 8989 7170

Tina.winther.frandsen@jyskebank.dk

Summary – the UK

• Strong downturn followed by moderate upturn

– The strong downturn is replaced by recovery, but the upturn is still fragile.

– So far, the upturn has been driven by substantial easing of the monetary and fiscal policies.

Th sentiment

The ti t iindicators

di t signal

i l th

thatt growth

th will

ill continue

ti and

d th

the h

housing

i and

d llabour

b markets

k t

are improving. However, the imminent significant tightening of the fiscal policy and the high

debt level of the households adversely affect the growth prospects.

– On the whole, we therefore expect relatively moderate growth at 1.2% this year and at 1.7%

in 2011

2011.

• Consumers and companies are still cautious, but things are looking up

for exports

– High indebtedness, an uncertain job situation and very low wage growth have made

consumers save more and be less inclined to consume. The labour market is improving, and

combined with low interest rates and increasing housing prices, the pressure on the consumers

has eased a bit. However, the fiscal-policy tightening measures are still preponderant.

– We therefore

f expect private consumption to grow at a moderate rate.

– Corporate investment has declined substantially, and the investment ratio is therefore very

low. We assess that investment activity will soon pick up, but growth will presumably be

moderate.

– Given the recovery of the global economy and the currency, which is still weak, things are

looking up for exports.

• The Bank of England will keep interest rates at record low

– We expect the Bank of England to keep interest rates at the record low 0.5% until Q1 2011

despite the dilemma of high inflation.

The upturn is moderate

• The strong downturn has been replaced by recovery, but the upturn is

still fragile.

• The business trend indicators signal that growth will continue and the housing and

labour markets are improving. However, the imminent significant tightening of the

fiscal policy and the high debt level of the households adversely affect growth.

• On the whole, we expect relatively moderate growth at 1.2% this year and at 1.7% in

2011.

2011

Business trend indicators signal

g

improvement

• The business trend indicators have signaled increasing activity for long.

Notably the manufacturing industry seems to be growing, while the service

sector has 'lost steam'.

The manufacturing industry in

progress

• In recent months, the industrial production has increased

significantly.

but it is a long way up to the old levels of production.

• We expect that the industrial production will continue to grow.

Consumers are still hesitant

• High indebtedness, an uncertain job situation and very low

wage growth have prompted households to save more and to

reduce private consumption.

• H

However, th

the llabour

b market

k t iis iimproving,

i and

d combined

bi d with

ith llow iinterest

t t rates

t

and the improvement in the housing market, the pressure on the consumers

has eased a bit. The need for fiscal-policy tightening is, however, still

preponderant.

• All in all, we expect private consumption to grow at a moderate rate.

Stabilisation in the labour market

• The labour market is showing signs of stabilisation. A significant

increase in employment is not just around the corner, because

the workforce has not been reduced nearly so sharply as production.

• As wage growth has fallen markedly at the same time, real wages are in

negative territory at the moment - the impact from the labour market is

therefore still acting as a damper on private consumption.

UK: Average Wages

Wage growth (ex. bonus), 3 month moving average

5,5

5,0

4,5

y/yy, 3 month moving avverage

mln.)

4,0

Number of employed (m

Unemployment in %

3,5

3,0

25

2,5

N

2,0

1,5

1,0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Source: Reuters Ecowin

Modest private-sector lending

• Lending growth has slowed sharply. This indicates that banks

are still reluctant to grant loans, but also that the demand for

loans is low.

• So long

l as aggregate llending

d remains this

h llow, private consumption and

d the

h

housing market will be impeded.

Improvement in the

housing market

• The stabilisation in the housing market happened faster and

was more convincing than predicted. However, progress cannot

continue unless mortgage lending rises also.

• We do not expect consumers to benefit from rising housing prices to the same

extent as in 2009.

Low investment activity

• Corporate investment has fallen sharply, and the investment

ratio is therefore low.

• We expect that investment activity will soon begin to increase

b growth

but h will

ll probably

b bl still

ll b

be moderate.

d

Things look up for exports

• In line with the improvement of the global economy, the

prospects for exports are gradually improving and the weakness

of the currency is helping too.

The currency y has appreciated

pp but

it is still weak

Interest rates remain at record

low

• The relatively high inflation rate is a dilemma for the Bank of England,

even though it is still temporary factors to a high extent that

have pushed inflation higher.

• We expect thath inflation

fl will

ll ffall

ll ffrom the

h current llevel,

l and

d combined

b d with

h

significant tightening of the fiscal policy, this will enable the BoE to be

hesitant. Therefore, we still assess that the BoE will keep interest rates at the

record-low

record low 0.5% until February 2011.

Strong consolidation of public

finances

fi

• The recession and the fiscal-policy rescue packages have made

budget

g deficits and the g government debt increase drastically.

y

• Therefore, the government has presented a comprehensive savings plan aimed

to bring the public finances back on a sustainable track. This will put a damper

on the UK growth prospects.

Disclaimer & Disclosure

Jyske Bank is supervised by the Danish Financial Supervisory Authority.

J k Bank's

Jyske B k' analysts

l are subject

bj to the

h recommendations

d i off The

Th Danish

D i h Securities

S i i Dealers

D l

Association on the handling of conflicts of interest within investment banks.

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank

does not assume any responsibility for the correctness of the material nor for transactions made

on the basis of the information or the estimates of the research report. The estimates and recommendations

off the

th research

h reportt may be

b changed

h d without

ith t notice.

ti Th research

The h reportt is

i ffor the

th personall use off Jyske

J k

Bank's customers and may not be copied. This report is an investment research report.

Conflicts of interest

Jyske Bank has prepared procedures to prevent and preclude conflicts of interest thus ensuring that analyses

are being

b i preparedd in

i an objective

bj ti manner. These

Th procedures

d h

have b

been i

incorporated

t d in

i th

the b

business

i

procedures covering the research activities of Jyske Markets, a business unit of Jyske Bank.

Read more about Jyske Bank's policy on conflicts of interest at www.jyskemarkets.com

Jyske Bank's analysts may not hold positions in the instruments for which they prepare research reports.

Jyske Bank may hold positions and/or have interests in the instruments for which such reports are prepared.

The analysts receive no payment from persons interested in individual research reports.

reports

The first publication date of the research report

See the front page. All prices stated are the latest closing prices before the release of the report, unless

otherwise stated.

Financial models

Jyske Bank uses one or more models based on traditional econometric and financial methods. The data used

are solely data available to the public.

Risk

Ri k

Investment may involve risk, so assessments and recommendations, if any, in this research report may

involve risk. See the research report for an assessment of risk, if any.

Good advice

The future and historical returns estimated in the research report are stated as returns before costs since

returns after costs depend on a number of factors relating to individual customer relations, custodian charges,

volume of trade as well as market-, currency- and product-specific factors.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- AUG-10 Mizuho Technical Analysis USD JPYДокумент1 страницаAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 DBS Daily Breakfast SpreadДокумент6 страницAUG 11 DBS Daily Breakfast SpreadMiir ViirОценок пока нет

- Westpack AUG 11 Mornng ReportДокумент1 страницаWestpack AUG 11 Mornng ReportMiir ViirОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- AUG 11 UOB Asian MarketsДокумент2 страницыAUG 11 UOB Asian MarketsMiir ViirОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- AUG-10 Mizuho Technical Analysis EUR USDДокумент1 страницаAUG-10 Mizuho Technical Analysis EUR USDMiir ViirОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- AUG 11 UOB Global MarketsДокумент3 страницыAUG 11 UOB Global MarketsMiir ViirОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Jyske Bank Aug 10 Equities DailyДокумент6 страницJyske Bank Aug 10 Equities DailyMiir ViirОценок пока нет

- AUG-10 - Mizuho - Start The DayДокумент2 страницыAUG-10 - Mizuho - Start The DayMiir ViirОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- AUG-10 Mizuho Technical Analysis EUR JPYДокумент1 страницаAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- AUG 10 UOB Asian MarketsДокумент2 страницыAUG 10 UOB Asian MarketsMiir ViirОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- AUG 10 UOB Global MarketsДокумент3 страницыAUG 10 UOB Global MarketsMiir ViirОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

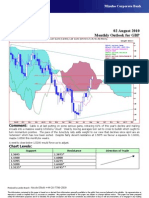

- AUG-02 Mizuho Monthly Outlook For GBP USDДокумент1 страницаAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirОценок пока нет

- AUG-10 Mizuho Technical Analysis GBP USDДокумент1 страницаAUG-10 Mizuho Technical Analysis GBP USDMiir ViirОценок пока нет

- AUG 10 DBS Daily Breakfast SpreadДокумент8 страницAUG 10 DBS Daily Breakfast SpreadMiir ViirОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- AUG 10 Danske EMEADailyДокумент3 страницыAUG 10 Danske EMEADailyMiir ViirОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- JYSKE Bank AUG 10 Corp Orates DailyДокумент2 страницыJYSKE Bank AUG 10 Corp Orates DailyMiir ViirОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDДокумент5 страницMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirОценок пока нет

- Danske Daily: Key NewsДокумент4 страницыDanske Daily: Key NewsMiir ViirОценок пока нет

- AUG 10 DanskeTechnicalUpdateДокумент1 страницаAUG 10 DanskeTechnicalUpdateMiir ViirОценок пока нет

- Jyske Bank Aug 10 Market Drivers CommoditiesДокумент3 страницыJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirОценок пока нет

- AUG 10 Danske FlashCommentFOMC PreviewДокумент7 страницAUG 10 Danske FlashCommentFOMC PreviewMiir ViirОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Westpack AUG 10 Mornng ReportДокумент1 страницаWestpack AUG 10 Mornng ReportMiir ViirОценок пока нет

- AUG-02 Mizuho Monthly Outlook For USD JPYДокумент1 страницаAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirОценок пока нет

- Jyske Bank Aug 10 em DailyДокумент5 страницJyske Bank Aug 10 em DailyMiir ViirОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- AUG 10 Danske Commodities DailyДокумент8 страницAUG 10 Danske Commodities DailyMiir ViirОценок пока нет

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDДокумент1 страницаAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirОценок пока нет

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYДокумент1 страницаAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirОценок пока нет

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYДокумент1 страницаAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURДокумент1 страницаAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirОценок пока нет

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPДокумент1 страницаAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirОценок пока нет

- Data Sheet BC 547Документ6 страницData Sheet BC 547rodmansupiitaОценок пока нет

- Globalization in The Asia Pacific and South AsiaДокумент3 страницыGlobalization in The Asia Pacific and South AsiaKaren Aniñon BarcelonОценок пока нет

- Project Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaДокумент3 страницыProject Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaSofiaLopezОценок пока нет

- Sample UploadДокумент14 страницSample Uploadparsley_ly100% (6)

- Airbnb CaseДокумент2 страницыAirbnb CaseVân Anh Phan0% (1)

- Assignment On Ratio Analysis: Presented byДокумент5 страницAssignment On Ratio Analysis: Presented bybhaskkarОценок пока нет

- Light DimmerДокумент4 страницыLight DimmerReen LeeОценок пока нет

- Aptitude Sample PaperДокумент6 страницAptitude Sample PaperShriram Nagarajan100% (2)

- UK Hotel Industry ReportДокумент10 страницUK Hotel Industry Reportagrawalnakul100% (1)

- Chapter 7: Game TheoryДокумент6 страницChapter 7: Game TheoryPrince DesperadoОценок пока нет

- Future Worth Analysis + Capitalized CostДокумент19 страницFuture Worth Analysis + Capitalized CostjefftboiОценок пока нет

- Rationing Device: Exists Because of Scarcity. If There Were Enough Resources To Satisfy All Our SeeminglyДокумент3 страницыRationing Device: Exists Because of Scarcity. If There Were Enough Resources To Satisfy All Our SeeminglyMd RifatОценок пока нет

- P&R Listsepoct09Документ16 страницP&R Listsepoct09307112402684Оценок пока нет

- DGDДокумент2 страницыDGDmarksahaОценок пока нет

- Magnit ValuationДокумент50 страницMagnit ValuationNikolay MalakhovОценок пока нет

- Pangasinan Coop Masterlist 2013 PDFДокумент43 страницыPangasinan Coop Masterlist 2013 PDFeslima5100% (2)

- Reservation ExerciseДокумент2 страницыReservation ExerciseMutia ChimoetОценок пока нет

- Gmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreДокумент3 страницыGmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreVishnu SamyОценок пока нет

- UN SMA 2015 Bahasa InggrisДокумент5 страницUN SMA 2015 Bahasa InggrisMohammad EfendiОценок пока нет

- QPMC Rate CardsДокумент9 страницQPMC Rate CardsTarek TarekОценок пока нет

- Financial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsДокумент7 страницFinancial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsnikunjОценок пока нет

- 3 How To Create The PartsДокумент47 страниц3 How To Create The PartsArief Noor RahmanОценок пока нет

- TANEO presentation 4-2011-ΧΑΡΙΤΑΚΗΣДокумент22 страницыTANEO presentation 4-2011-ΧΑΡΙΤΑΚΗΣhristinioОценок пока нет

- SheltaДокумент7 страницSheltaconfused597Оценок пока нет

- PZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabДокумент13 страницPZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabFarah DibaОценок пока нет

- Universiti Teknologi Mara Cawangan Kelantan, Bukit Ilmu, 18500 Machang, Kelantan. Macroeconomics (Eco211) Group Project - (Report) - 10%Документ9 страницUniversiti Teknologi Mara Cawangan Kelantan, Bukit Ilmu, 18500 Machang, Kelantan. Macroeconomics (Eco211) Group Project - (Report) - 10%robertОценок пока нет

- AFM Exam Report June 2020Документ6 страницAFM Exam Report June 2020Mohsin AijazОценок пока нет

- True or False in Financial ManagementДокумент7 страницTrue or False in Financial ManagementDaniel HunksОценок пока нет

- DTI Feasibility StudiesДокумент2 страницыDTI Feasibility StudiesAyobami OdewoleОценок пока нет

- The Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtДокумент16 страницThe Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtArancha LucianaОценок пока нет