Академический Документы

Профессиональный Документы

Культура Документы

Soal Soal Ekonomi Teknik Kimia

Загружено:

pratitatriasalinОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Soal Soal Ekonomi Teknik Kimia

Загружено:

pratitatriasalinАвторское право:

Доступные форматы

1.

A Rustic Wood Products Manufactures a line of childrens toys , Th following is an analysis of their

accounting data: Fixed costs : $,90,000 per year, Variable costs: $.5.00, Capacity: 25,000 toys per year

and Selling pric : $.18.50 per toy.

a. Compute the break even point in number of toys

b. Find the number of toys the company must sell to show a profit $.40,000 per year

c. At 75% of capacity, what is the fixed cost per toy, At that capacity what are the variable cost per toy

d. What is the shot -down point

2. A small manufacturing company is considering the expansion of its plastics operation. To meet sales demand

, a new molding machine must be installed. An economic analysis based upon cash flow will have to be made

using the following data:

Machine A Machine B

Installed Fixed Investment, $ 285,000 197,000

Annual Cash Operating Expenses, 42,000 38,000

$

Depretiation may be taken as 5 years by the straighi-line method. The income tax rate is ....%. Determine:

a. Cash Flow analysis for installing machine A and B

b. Based on cash flow diagram , which machine is to be purchased

3. Suatu perusahaan mendapatkan kredit lunak $.1000.000,- dengan jangka waktu 10 tahun. Tahun 1 dan 2

ditentukan sebagai grace periode atau tidak membayar angsuran. Apabila suku bunga 5% pertahun , Berapa

angsuran yang harus dibayarkan pertahunnya. Apabila setelah 2 kali angsuran dibayarkan sisa kreditnya akan

dilunasi.Berapa uang yang dibutuhkan untuk melunasi sisa kreditnya.

4. A company is considering the manufacture a pharmaceutical product . Land for the project is $300,000. The

fixed capital invesment for the plant estimated to be $10,000,000 and the construction period is expected to be 2

years. A market survey for the proposed plant resulted in the following information:

Sales Selling Cash

Million $ price, operating

Tahun..T per year $/lb Expenses.,$/lb

TTahun

1 6.0 0.86 0.30

2 6.5 0.87 0.31

3 7.0 0.87 0.31

4 8.0 0.88 0.33

5 10.0 0.88 0.34

6 10.0 0.88 0.35

7 10.0 0.88 0.35

8 9.0 0.90 0.36

9 7.0 0.87 0.36

10 6.0 0.85 0.37

At start-up , $2,000,000, working capital is allocated to the project. If the income taxes is 10%. prepare a

cumulative cash position diagram for the proposed project (depreciation calculated by S0YD methode)

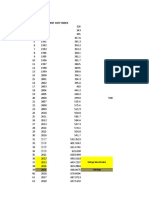

5. AN INVESTMENT RESULTED IN THE FOLLOWING CASH FLOW:

Year 0 1 2 3 4 5 6 7 8

CASH FLOW,$ -15000 5000 2500 2500 2500 2500 2500 2500 2500

CALCULATE THE RATE OF THE RETURN THIS INVESTMENT?

Pembelian tanah di tembalang merupakan investasasi yang sangat

menarik. Harga tanah saat ini 1 jt dan dibeli oleh investor se luas 1000 m2.

Biaya PBB tahun pertama 500.000 dan setiap tahunnya naik 100.000.

Apabila pada tahun kelima kepemilikannya tanah itu akan dijual dengan

mengharapkan Return on Invesmentnya 20%.

Berapa harga yang layak yang harus ditawarkan kepada pembeli.

Вам также может понравиться

- Tugas Simulasi OptimasiДокумент3 страницыTugas Simulasi Optimasidimas wОценок пока нет

- Heat Capacity of Liquids - Critical Review and Recommended ValuesДокумент404 страницыHeat Capacity of Liquids - Critical Review and Recommended ValuesDoris AngОценок пока нет

- Lant in PT. Petrokimia Gresik: Flow Diagram of The Process To Making Sulfuric AcidДокумент3 страницыLant in PT. Petrokimia Gresik: Flow Diagram of The Process To Making Sulfuric AcidAnisa SudarmajiОценок пока нет

- RP44B TocДокумент13 страницRP44B TocPiespi PitwomОценок пока нет

- Distillation and Hydrotreating ComplexДокумент1 страницаDistillation and Hydrotreating ComplexKatharina AjengОценок пока нет

- Database CP Delta H Delta GДокумент18 страницDatabase CP Delta H Delta GsafinaОценок пока нет

- Basic Accounting ModuleДокумент25 страницBasic Accounting ModuleJayson Miranda100% (2)

- Optimalisasi Kompresor SentrifugalДокумент27 страницOptimalisasi Kompresor SentrifugalDea Amelia100% (1)

- Kelompok 4 TRK 2Документ5 страницKelompok 4 TRK 2Katharina AjengОценок пока нет

- Chapter 2 LLE-part 2 - 18nov2020Документ22 страницыChapter 2 LLE-part 2 - 18nov2020CaratsSVTОценок пока нет

- Appendix F - SteamTable PDFДокумент68 страницAppendix F - SteamTable PDFEirojram MarjorieОценок пока нет

- Calculation of Plug Flow Reactor DesignДокумент3 страницыCalculation of Plug Flow Reactor DesignTegar BagaskaraОценок пока нет

- Tabel Antoine 1Документ3 страницыTabel Antoine 1atikaindrnОценок пока нет

- Batch Manufacture of Propylene GlycolДокумент6 страницBatch Manufacture of Propylene Glycolprassna_kamat1573Оценок пока нет

- All References of Chapter 6Документ53 страницыAll References of Chapter 6Thomas BrouwerОценок пока нет

- 4 - Rotary DryerДокумент24 страницы4 - Rotary DryerkhawarОценок пока нет

- Data BPS NitroselulosaДокумент36 страницData BPS Nitroselulosawilly dwinovОценок пока нет

- Tugas Terjemah Kern 98-100Документ3 страницыTugas Terjemah Kern 98-100Diiah 'bubull' LestariiОценок пока нет

- Tutorial 5Документ7 страницTutorial 5Saints Burner ChristopherОценок пока нет

- Patent Pabrik Phenyl Ethyl AlcoholДокумент6 страницPatent Pabrik Phenyl Ethyl AlcoholFaizhal DimazОценок пока нет

- Solid Gas FluidizationДокумент9 страницSolid Gas FluidizationHaris PratamaОценок пока нет

- W1 - Sistem Utilitas Pabrik PDFДокумент28 страницW1 - Sistem Utilitas Pabrik PDFAndrianPratamaОценок пока нет

- S16 CPSDДокумент4 страницыS16 CPSDGohit BhatОценок пока нет

- Assignment 1Документ1 страницаAssignment 1Sai Hemanth MathiОценок пока нет

- Pabrik Baturaja III PT. Semen Baturaja (Persero) TBKДокумент3 страницыPabrik Baturaja III PT. Semen Baturaja (Persero) TBKIzzy Rss Outsiders100% (1)

- AfdhalДокумент11 страницAfdhalRiky Mario YuluciОценок пока нет

- Vapor/Liquid Equilibrium: Vle by Modified Raoult'S LawДокумент16 страницVapor/Liquid Equilibrium: Vle by Modified Raoult'S LawAby JatОценок пока нет

- Proposal KP HolcimДокумент27 страницProposal KP HolcimPutu Trisnayadhi DharmawanОценок пока нет

- 2 Agustus BaruДокумент121 страница2 Agustus BaruAyu permata sariОценок пока нет

- Neraca Massa Dan Neraca Panas Ball Mill (Revisi FIXED)Документ18 страницNeraca Massa Dan Neraca Panas Ball Mill (Revisi FIXED)astrianyОценок пока нет

- Back To School PowerPoint TemplateДокумент12 страницBack To School PowerPoint TemplateRahmasari Nur Setyono0% (1)

- EKOTEKДокумент6 страницEKOTEKDHILA AYUNINGTYASОценок пока нет

- Reaction Kinetics of Ammonia & Nitric AcidДокумент116 страницReaction Kinetics of Ammonia & Nitric AcidMonica Garcia100% (1)

- Chemical Engineering Projects Can Be Divided Into Three TypesДокумент25 страницChemical Engineering Projects Can Be Divided Into Three Typestrungson1100% (1)

- File1 - Laporan 5Документ48 страницFile1 - Laporan 5Bhaskoro AbdillahОценок пока нет

- Rahmanda Luthfia - Tugas 1Документ9 страницRahmanda Luthfia - Tugas 1Rahmanda LuthfiaОценок пока нет

- Neraca Energi Reaktor Word Kelompok 14Документ8 страницNeraca Energi Reaktor Word Kelompok 14Rani khairaniОценок пока нет

- Chapter 4 م. احسان حبيبДокумент22 страницыChapter 4 م. احسان حبيبعبد اللهОценок пока нет

- PK Kel 4Документ3 страницыPK Kel 4SheilaОценок пока нет

- DestilasiДокумент11 страницDestilasiDwiky DarmawanОценок пока нет

- 123dok PRARANCANGAN+PABRIK+MONOBASIC+POTASSIUM+PHOSPHATE+DARI+ASAM+FOSFAT+DAN+POTASSIUM+HIDROKSIDA+KAPASITA - DikonversiДокумент190 страниц123dok PRARANCANGAN+PABRIK+MONOBASIC+POTASSIUM+PHOSPHATE+DARI+ASAM+FOSFAT+DAN+POTASSIUM+HIDROKSIDA+KAPASITA - DikonversiIndra Setio PujiОценок пока нет

- Hargreaves ProcessДокумент7 страницHargreaves ProcessMuhammad BilalОценок пока нет

- AND Optimization OF Three Existing Ethylbenzene Dehydrogenation Reactors in SeriesДокумент5 страницAND Optimization OF Three Existing Ethylbenzene Dehydrogenation Reactors in SeriesMuhammad Ridwan TanjungОценок пока нет

- Question: (B) It Is Desired To Agitate A Liquid Having A Viscosity of 1.5 × 10Документ2 страницыQuestion: (B) It Is Desired To Agitate A Liquid Having A Viscosity of 1.5 × 10Prabhasha JayasundaraОценок пока нет

- 1.3 Boiler OperationДокумент23 страницы1.3 Boiler OperationLydia RupidaraОценок пока нет

- 05 PDFДокумент491 страница05 PDFNatasha Mgt JoharОценок пока нет

- Inorganic Compounds: Physical and Thermochemical DataДокумент21 страницаInorganic Compounds: Physical and Thermochemical DataAna MardianaОценок пока нет

- Daftar PustakaДокумент2 страницыDaftar PustakaHammany Nur ZulkyОценок пока нет

- Tutorial Katalis BerporiДокумент2 страницыTutorial Katalis BerporiMichael LevyОценок пока нет

- M AZIZ - PMO470S - MultiComp Dist - TUTORIAL 1 - 2020Документ1 страницаM AZIZ - PMO470S - MultiComp Dist - TUTORIAL 1 - 2020BigОценок пока нет

- Keuntungan Dan Operasi EvaporatorДокумент9 страницKeuntungan Dan Operasi EvaporatorRavina Fatma Nazaretha100% (1)

- Lampiran PerhitunganДокумент20 страницLampiran PerhitunganArdago LenggaОценок пока нет

- Pembuatan Pembersih Lantai Sni 06-1842-1995 DenganДокумент7 страницPembuatan Pembersih Lantai Sni 06-1842-1995 DenganEma SetyaningsihОценок пока нет

- Sizing StrippingДокумент14 страницSizing StrippingEka trisnawatiОценок пока нет

- Tugas Fenper 1 IДокумент8 страницTugas Fenper 1 IGian Restu PrinandaОценок пока нет

- 4 2020 Pap Menara DistilasiДокумент48 страниц4 2020 Pap Menara DistilasiAlwan Al AzharОценок пока нет

- Design III HX Design Tutorial 3 Solutions PDFДокумент4 страницыDesign III HX Design Tutorial 3 Solutions PDFhusseinОценок пока нет

- Example 15.3 KernДокумент3 страницыExample 15.3 KernReza Hendy DjoerkaeffОценок пока нет

- Capital Budgeting Simulated ExamДокумент11 страницCapital Budgeting Simulated ExamSarah BalisacanОценок пока нет

- Practise - Chap 12 (Stu)Документ3 страницыPractise - Chap 12 (Stu)Nguyen Trong Bang (K16HCM)Оценок пока нет

- Capital Budgeting QuestionsДокумент3 страницыCapital Budgeting QuestionsTAYYABA AMJAD L1F16MBAM0221100% (1)

- Di Isopropyl BenzeneДокумент66 страницDi Isopropyl BenzenepratitatriasalinОценок пока нет

- Solid Phosporic AcidДокумент7 страницSolid Phosporic AcidpratitatriasalinОценок пока нет

- Global Cumene Capacity, '000 Tonne/Year: Source: ICIS Chemical Business Company Location Capacity EuropeДокумент4 страницыGlobal Cumene Capacity, '000 Tonne/Year: Source: ICIS Chemical Business Company Location Capacity EuropepratitatriasalinОценок пока нет

- Global Cumene Capacity, '000 Tonne/Year: Source: ICIS Chemical Business Company Location Capacity EuropeДокумент4 страницыGlobal Cumene Capacity, '000 Tonne/Year: Source: ICIS Chemical Business Company Location Capacity EuropepratitatriasalinОценок пока нет

- The Production of Cumene Using Zeolite Catalyst Aspen Model DocumentationДокумент16 страницThe Production of Cumene Using Zeolite Catalyst Aspen Model Documentationديانا محمدОценок пока нет

- Dowtherm BookДокумент30 страницDowtherm BookMeghnad M GavitОценок пока нет

- Cumene A PDFДокумент4 страницыCumene A PDFdanena88Оценок пока нет

- Cumene Spesifikasi 01av700 Technical Data Sheet CumeneДокумент2 страницыCumene Spesifikasi 01av700 Technical Data Sheet CumenepratitatriasalinОценок пока нет

- The Production of Cumene Using Zeolite Catalyst Aspen Model DocumentationДокумент16 страницThe Production of Cumene Using Zeolite Catalyst Aspen Model Documentationديانا محمدОценок пока нет

- Soal Kimia Analis - GravimetriДокумент3 страницыSoal Kimia Analis - GravimetripratitatriasalinОценок пока нет

- Financial Reporting and AnalysisДокумент7 страницFinancial Reporting and AnalysisSagarPirtheeОценок пока нет

- Government of Sierra Leone: OriginalДокумент23 страницыGovernment of Sierra Leone: OriginalRaviОценок пока нет

- FM Part2Документ46 страницFM Part2himewendyОценок пока нет

- HHHHHHHH PDFДокумент31 страницаHHHHHHHH PDFmohamed saedОценок пока нет

- Digest - PFRS 3 and PFRS 10Документ4 страницыDigest - PFRS 3 and PFRS 10Elizabeth DumawalОценок пока нет

- 3 Years Financial ProjectionДокумент11 страниц3 Years Financial Projectionoerderm5629Оценок пока нет

- Statement of Comprehensive IncomeДокумент23 страницыStatement of Comprehensive IncomeMarie FeОценок пока нет

- Chapter 4: Consolidation Techniques and Procedures: Advanced AccountingДокумент47 страницChapter 4: Consolidation Techniques and Procedures: Advanced AccountingRizki BayuОценок пока нет

- Discussion QuestionsДокумент12 страницDiscussion QuestionschandoraОценок пока нет

- ACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineДокумент16 страницACCOUNTING FAIR - Soal Babak 1 Penyisihan OnlineGaidon HercОценок пока нет

- Board ProblemsДокумент30 страницBoard ProblemsGlyzel Dizon100% (1)

- DuPont Analysis - Wikipedia, The Free EncyclopediaДокумент3 страницыDuPont Analysis - Wikipedia, The Free EncyclopediaidradjatОценок пока нет

- 1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Документ10 страниц1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Margaux Phoenix KimilatОценок пока нет

- Balance SheetДокумент2 страницыBalance SheetK JОценок пока нет

- Financial and Technical AnalysisДокумент62 страницыFinancial and Technical AnalysisBhupender Singh RawatОценок пока нет

- Assignment From Text P2Документ3 страницыAssignment From Text P2pedroОценок пока нет

- ACCA Interpreting Financial Statements Requires Analysis and Appraisal of The Performance and Position of An EntityДокумент6 страницACCA Interpreting Financial Statements Requires Analysis and Appraisal of The Performance and Position of An Entityyung kenОценок пока нет

- MGT 111 - Course SyllabusДокумент2 страницыMGT 111 - Course SyllabusFerraci Sanvictores0% (1)

- Suggested - Answer - CAP - II - June - 2011 4Документ64 страницыSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- Event Budget Template 2019 SoBo Summer Music Series Event GrantДокумент1 страницаEvent Budget Template 2019 SoBo Summer Music Series Event GrantDavid D. MitchellОценок пока нет

- Payroll Tamayao, BsaДокумент3 страницыPayroll Tamayao, BsaGentry PamplonaОценок пока нет

- Principle CH 8 Ed.23 Oxley Internal Control, and Cash)Документ8 страницPrinciple CH 8 Ed.23 Oxley Internal Control, and Cash)Heri SiringoringoОценок пока нет

- Audit of Inventory PDFДокумент7 страницAudit of Inventory PDFMae-shane SagayoОценок пока нет

- Advance Accounting Chapter 3 NotesДокумент4 страницыAdvance Accounting Chapter 3 NotesUmema SiddiquiОценок пока нет

- Manufacturing Accounts PowerpointДокумент12 страницManufacturing Accounts PowerpointRaynardo KnightОценок пока нет

- PDF Solution Manual Partnership Amp Corporation 2014 2015pdfДокумент85 страницPDF Solution Manual Partnership Amp Corporation 2014 2015pdfGenevieve Anne AlagonОценок пока нет

- Advanced Accounting 23Документ77 страницAdvanced Accounting 232Ng0Оценок пока нет

- FR Examiner's Report M20Документ10 страницFR Examiner's Report M20Saad Khan YTОценок пока нет

- Activity 1Документ2 страницыActivity 1Harold Beltran DramayoОценок пока нет