Академический Документы

Профессиональный Документы

Культура Документы

Quiz 1 Study Guide

Загружено:

usernames358Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Quiz 1 Study Guide

Загружено:

usernames358Авторское право:

Доступные форматы

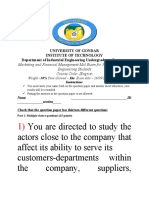

ACG3401 QUIZ 1 STUDY GUIDE

Syllabus Questions

1. When and where are my office hours?

a. Monday and Wednesday (days when we have class) (1:55-2:45)

b. Gerson 331

2. Where should you ask questions about the class?

a. Generally, post questions to e-Learning (Canvas) Discussion forums, especially

questions related to course content, or coverage on exams/ quizzes, rather than

emailing me directly.

3. Who is the TA and what are his/her office hours?

a. Gabriella Munneke

b. Tuesday and Thursday period 7& 8 (1:55-3:50) at Gerson 125

4. Objective of this course?

a. Learn the role of accounting information in a business organization

5. Learning goals of this course?

a. Recognize accountings relationship to each fundamental business discipline

b. Identify the major accounting system inputs and process flows of information within the

accounting system

6. What are the texts required for this course?

a. Accounting Information Systems 9th edition by James A. Hall

b. Systems Understanding Aid (9th edition)

7. What are your grades composed of?

a. 100 points each for Midterm 1, Midterm 2, and Final Exam

b. 25 points for Accounting Fraud Paper

c. 75 points Systems Understanding Aid Project

d. 100 points for quizzes

8. When are there quizzes and how many are counted towards your grade?

a. Weekly quizzes every Wednesday we are in class (except the 1 st week and last 2

weeks)

b. I will count your 10 highest quiz grades for a max. of 100 points

9. When is the Accounting Fraud Paper due?

a. Monday September 12th

10. Exams are on what and in what format?

a. Can be any question format

b. Material can relate to anything presented in class, assigned readings, the System

Understanding Aid project, and homework problems.

c. No more than 60% of the questions on the final will relate to material covered on the 1 st

two exams

d. The 2nd midterm exam will focus on the material covered since the 1 st midterm exam

and thus is only cumulative to the extent that the material builds on prior material

Intro to Class PowerPoint

11. What might change and not change in the syllabus?

a. Policies WONT change, dates might

12. How to succeed in this class?

a. Read chapters prior to class

b. Go to class & office hours

c. Work every assigned problem

d. Keep up & have professional behavior in class

13. How to take good notes?

a. Listen for an organizing pattern

b. Recognize verbal cues

c. Consider learning style (such as lecture maps)

d. Create consistent shorthand system

14. What are Tiny Habits?

a. The idea that success in life is driven by series of tiny habits

b. Key is to design environment to reduce reliance on motivation and/or willpower

c. Need anchor (previous routine) to attach new habit

d. Keep habit small (& then build up on it)

e. Celebrate success (neurochemistry)

15. What is Accounting?

a. An information system

b. Information about firms activities classified into accounts aggregated across time (over

a period of time) and space (over diff locations)

c. Communicated to set of interested individuals

i. Investors, Debt holders, shareholders

ii. Managers-to know the performance of the business

iii. *Auditors-they are the ones brought in to attest to the financial information

iv. IRS

v. Suppliers- want to know if the firm can pay on time

vi. *Customers-what to know position of a company (it can affect delay of delivery of

products, quality of products)

vii. Competitors- how well I am doing compared to peer firms in my industry

viii. *Employees-want to work for a company doing well

d. ****Financial reporting is not the only purpose & wasnt even the initial purpose

16. What are our objectives?

a. We need to know: what information about business processes is relevant? Where it

comes from, whats the source of this information

b. How does firm capture, process, and assure reliability of information?

i. Reliable: means you can actually put weight on the information you captured and

make decisions

c. How does firm organize and report information?

d. How does management use information?

17. Calendar of our class and what we are going to learn?

a. These 3 parts together: What does it mean as accounting as a profession?

b. Part 1: History, Accounting Cycle

c. Part 2: Business processes part- needs some tools on how to document those

processes, internal control

d. Part 3: how to convert these things that are required into the cash and revenue cycle

18. What are you writing on in your Accounting Fraud Paper?

a. Qwest Communications

19. Why is writing important for accounting?

a. Auditors-a lot of the information they accumulated, they have to write in memos

b. Writing is a key skill needed to be successful

c. Useful in both formal and informal communications

d. CPA firms are not satisfied with many entry-level (complain they have poor writing skills)

20. What is good writing?

a. Content e. Clarity

b. Critical thinking f. Coherence

c. Audience-focused g. Revision

d. Conciseness

h. Fundamental Demand of Accounting Information PowerPoint

21. Explain the in-class experiment

a. We set up an asset market with sellers and buyers

b. Sellers choose the asset to produce (either high or normal quality)

c. Value is a function of quality but not 100% predictor

i. Super (400 points) or Regular (100 points)

ii. Expected values of 340 & 160 respectively

d. There was a Double Auction to discover prices

i. Double Auction means that both sides can put in offers (buyers and sellers)

e. Each team tracks costs, revenues (value), and profits

22. General Impressions of the Market?

a. Sellers Impressions to sell due to the salvage value (salvage value is less than the cost,

so you had a loss if you didnt sell)

b. Sellers Impressions to sell due to opportunity cost: based on the market value there, if

you didnt sell, there would be an opportunity cost (cost compared to the market price;

the cost not engaged in the market period)

23. What strategy did you use?

a. Sellers: start selling high quality and see from there if we made profit; sell early dont

wait;

b. Buyers: buy later (lower prices later on); price ceilings, waiting for competition from

selling side to lower price

24. What information did you use to make your decisions?

a. Prices, Profit margin, expected values (to not bid higher than that)

25. What was your impression of the market trading?

a. Buyers compete among themselves for prices

b. Competition brings out other peoples willingness to pay, which can be diff than yours

c. Efficient Markets decide prices quicklyspeed to price (deciding prices quickly because

of time limit to sell or buy)

26. What is the role of the Market Maker?

a. Market makers stay on the side that had more demand (buyers) until they even it out

b. If there was more demand on one side compared to the other, the market maker would

stay with that side for a while to try to balance it out.

c. If there was lots of demand on the buyer side, that means the price is still lower than

what we can get to.

27. What is bid-ask spread?

a. How apart or what is the difference between the highest price that a buyer is willing to

pay and the lowest price that a seller is willing to accept to sell.

b. Market makers try to close those gaps

28. Difference between market A and market B?

a. Market A: auditing mechanism

i. Buyers: knew what they were getting

b. Market B: no credible mechanism to communicate quality

i. Buyers didnt know if it was high or normal; sellers couldnt signal if it was high or

normal

ii. Information Asymmetry: sellers knew something buyers didnt; buyers dont have

quality information

iii. Because of this: buyers will price protect (eventually)

c. d. MARKET A (AUDIT) e. MARKET B

(NON-AUDIT)

f. Mechanis g. Auditing mechanism h. No

m to auditing/credible

communic mechanism

ate

quality?

i. Avg j. Big differences between k. Started same: big

Market high & normal quality diff between high

Prices products because and normal price

expected values are l. Ended: same

very different price for both

(buyers started to

price protect and

treated high q as

low)

m. Asset Sold n. Started out even, then o. Opposite-mostly

by Quality realized profit margin for normal

high Q was higher than p. Groups started

normal; groups started switching to

switching to selling high selling normal

quality quality

q. Avg Profit r. Sellers had higher t. Same

profits than buyers

s. 1st period only-buyers

had a loss

u. Wealth v. High Q more profit than w. Still lots of wealth

Created normal Q (economy created

much better off in the x.

high quality market)

y.

29. In Market B: Why dont firms sell the more valuable asset?

a. Price they were getting was a lot lower than the expected values

30. In Market B: Why dont buyers want to pay more?

a. They didnt know what quality product they were getting

b. Started to just assume that sellers were just selling normal

c. Didnt want to pay more for it cause they were sure of quality

31. In Market B: Why cant sellers signal quality credibly?

a. No way to verify if they started to signal by bidding high or low; cheaptalk

32. In Market B: Why might emerge if we allowed communication?

a. Communication within groupscollusion

b. But competition will work against collusion (cant keep collusion unless you have some

enforcement mechanism)

33. What is the Market for Lemons? Explain

a. George Akerlof came up with this idea; context he used was buying a used car

b. Imagine in a market where there is a distribution of quality from low to high.

c. Restrictions in this market: no signals about quality (Like market B)

d. What is going to happen in a market like this?

i. Buyer: Rational person will look at a given car and assume to basically pay the

avg price. WTP (willingness to pay) is average

ii. Seller: hard time selling high quality cars; WTA goes down and gets out of the

market

iii. New average keeps moving left and left

iv. Towards the end, all we have is either no market or the very worst quality cars.

MARKET OF LEMONS (lemon= car that has the lowest quality)

v. End: market disappears entirely or whatever is left is the lowest quality

vi. Summary: buyers dont know quality; all they want to pay is the average.

Because of that, sellers that are selling higher gets out of the market; Average

goes down, and then higher quality sellers keep getting out of the market until

there is no market yet or only the lowest quality is available.

vii. EXACTLY LIKE MARKET B: drove out high quality sellers and to only sell

normal quality

e. GOAL: SHOWS HOW DAMAGING INFORMATION ASYMMETRY IS TO THE MARKET

(IT MAKES THE MARKET GO AWAY)

34. How do we make sure normal qualities are sold? What are some ways we overcome it?

a. Reputation of dealer/maker/manufacturer

b. Get verified by a mechanic

c. VIN #, car facts

d. Look at how much miles are in the car

35. Comparison: What does auditing do? (MARKET A)

a. Provides a credible signal (buyers knew that they were getting H or N quality)

b. Provides information to improve the estimation of value (diff price between normal

quality and high quality) just the information of quality, changed the price so much

c. Improves market efficiency (less uncertaintygot to prices quicker)

36. Audit vs. Non-Audit

a. b. Audit c. Non-Audit

d. Avg e. High vs Normal: Big f. Started in between

Pric difference in prices audited high and

e normal, and then

changed. Treated them

as audited normal(price

protect)

g. % h. Mostly high quality i. Almost NONE

High

quali

ty

prod

uced

j. Avg k. Buyers made more l. Less profit than audit

Buy profits group

er

Profi

t

m. Avg n. Seller made more profits o. Less profit than audit

Selle group

r

Profi

t

p. Total q. BETTER !!! r.

Profi

t

s. Weal t. Lot more wealth created u.

th

creat

ed in

each

tran

sacti

on

v. Weal w. BETTER!! x.

th

effici

ency

37. What are the key takeaways? (Market)

a. Markets without credible signals generate less wealth than those with credible signals

(such as audit signals)

b. Economies w/ auditors functioning well have a lot more wealth than those economies

that dont

c. Credible signals in real-world

i. Financial statements (only credible if they are audited-they attest to the quality of

the financial statements)

ii. Disclosure (subject to litigation): fancy word for communicating; credible only if

it is subject to litigation (no way to hold them responsible without litigation)

1. Litigation provides an enforcement mechanism for managers to disclose

truthfully

d. ***Notice this is an unregulated setting*** you dont need it to be regulated; just need

auditors

38. What are they key takeaways (Accounting)

a. There are 3 main roles for accounting information

b. (1) Exchange Guidance Role: accounting information guides production decisions &

determining what to sell based on historical profit

i. Reading: If you go back in the beginning of firms, merchants trying to make

money and based on their experience and record keeping, they made decisions

about what to sell, how much to sell it for he calls it exchange guidance

ii. Guiding this exchange transaction

iii. In market a: the amount of profit margin that you received or saw yourself in the

high quality market compared to the normal helped you make a choice about

which asset to produce

iv. In market b: they also saw that the profit margin for selling high quality was really

low

c. (2) Valuation role: accounting information guides price formation; helping to set prices

i. consider willingness to pay as buyers based on profit history

ii. Market a: more willing to pay high quality based on profit history

iii. Market b: saw they were getting burnt out buying high quality, so now are less

willing to pay more and pay just enough for normal quality

d. ***Credibility of accounting information (auditing) impacts both of those goals

i. Willingness to pay of buyers (if I know its high quality, Im willing to pay more)

ii. Production decisions of producers (I can credibly sell it as high quality, Im going

to produce more of it)

e. (3) Contracting Role

i. (1) Debt contracts

1. Accounting information helps determine if we should even give a loan to a

company, how many liabilities a company already has, D/E ratio, ability to

pay debts, calculate the interest rate to charge.

ii. (2) Management compensation contracts: managers getting compensated based

on accounting performance (bonuses based on income, etc.)

f. ULTIMATELY: ACCOUNTING INFORMATION MAKES ALLOCATION OF CAPITAL

MORE EFFICIENT AT THE ECONOMY LVL

i. (Akerlof) Double Entry Accountingenabled capitalism; biggest accumulator of

wealth

Вам также может понравиться

- Business Plan For Water ProductionДокумент14 страницBusiness Plan For Water ProductionOfosu Anim100% (6)

- Marketing Miracles - Dan KennedyДокумент190 страницMarketing Miracles - Dan Kennedymadgamer70100% (2)

- How To Set Up Travel AgenciesДокумент22 страницыHow To Set Up Travel AgenciesEima Abdullah50% (2)

- Industrial Marketing ReviewДокумент30 страницIndustrial Marketing ReviewAkram MagdyОценок пока нет

- Test Paper 1 - MarketingДокумент4 страницыTest Paper 1 - MarketingAbhijit DasОценок пока нет

- Accounting TheoryДокумент5 страницAccounting TheoryMichelle AОценок пока нет

- Role of Creative StrategiesДокумент40 страницRole of Creative StrategiesSunil Bhamu67% (3)

- Diagnostic Examination: A. B. C. DДокумент6 страницDiagnostic Examination: A. B. C. DJahred ParasОценок пока нет

- B2B Marketing - Jyoti - Sagar - P19052Документ5 страницB2B Marketing - Jyoti - Sagar - P19052JYOTI TALUKDARОценок пока нет

- Entrepreneurship 2nd Quarter ExamДокумент5 страницEntrepreneurship 2nd Quarter ExamAian Cortez100% (4)

- Clayton Christensen Stephen R. Covey Dale Carnegie Chris ArgyrisДокумент12 страницClayton Christensen Stephen R. Covey Dale Carnegie Chris ArgyrisAyezza LaoОценок пока нет

- Solution Design Template: Target MarketДокумент3 страницыSolution Design Template: Target Marketmax68iiОценок пока нет

- MKT100 Revision QuestionsДокумент10 страницMKT100 Revision Questionsdeklerkkimberey45Оценок пока нет

- Final ExamДокумент18 страницFinal ExamnmfreedomОценок пока нет

- 12 Diagnostic Exam 2nd QuarterДокумент3 страницы12 Diagnostic Exam 2nd Quarterdkenneth rbalimbinОценок пока нет

- Review Checklist For Final Exam (Comprehensive)Документ7 страницReview Checklist For Final Exam (Comprehensive)file0077Оценок пока нет

- Entrepreneurship 1Документ5 страницEntrepreneurship 1Dexter Bola100% (1)

- Principles of Mktg-Q4-Module-2Документ32 страницыPrinciples of Mktg-Q4-Module-2Edson Liganan100% (1)

- MGTДокумент11 страницMGTChryshelle LontokОценок пока нет

- Entrepreneurship Essentials - Unit 6 - Week 3Документ1 страницаEntrepreneurship Essentials - Unit 6 - Week 3SANDEEP JADAUNОценок пока нет

- Midterm BA PDFДокумент4 страницыMidterm BA PDFPhạm Ngọc MỹОценок пока нет

- Sales BudgetsДокумент34 страницыSales BudgetsRaman KulkarniОценок пока нет

- Marketing PB Set 1Документ8 страницMarketing PB Set 1Dheeraj KumarОценок пока нет

- Principles of MKTNG Q4 Module 2 For StudentsДокумент15 страницPrinciples of MKTNG Q4 Module 2 For StudentsRich Allen Mier UyОценок пока нет

- Technical Aptitude Test 1Документ6 страницTechnical Aptitude Test 1dhinesh01Оценок пока нет

- INGLES 165f8e4bc553c37Документ6 страницINGLES 165f8e4bc553c37Andres Leonardo Benitez DuarteОценок пока нет

- GR 6 Quarter ExamДокумент7 страницGR 6 Quarter ExamAnuar AliОценок пока нет

- E Marketing 6th Edition Strauss Test BankДокумент9 страницE Marketing 6th Edition Strauss Test Bankquynhagneskrv100% (31)

- Ebook E Marketing 6Th Edition Strauss Test Bank Full Chapter PDFДокумент30 страницEbook E Marketing 6Th Edition Strauss Test Bank Full Chapter PDFrobertrandallsmweqgpyzc100% (11)

- Managerial Economics Project (Term 1, 2020-21) : Prof. Tanushree HaldarДокумент3 страницыManagerial Economics Project (Term 1, 2020-21) : Prof. Tanushree HaldarAnkit SanodiyaОценок пока нет

- Chapter 10 Proposals and Formal ReportsДокумент15 страницChapter 10 Proposals and Formal ReportsHà HoàngОценок пока нет

- Multiple Choice QuestionsДокумент2 страницыMultiple Choice QuestionsMuthusamy SenthilkumaarОценок пока нет

- Department of Education: Entrpreneurship 12 Midterm ExaminationДокумент4 страницыDepartment of Education: Entrpreneurship 12 Midterm ExaminationAlex PanerioОценок пока нет

- 12e.MCQ For sts.C10Документ15 страниц12e.MCQ For sts.C10quynhlannn7Оценок пока нет

- Marketing Can Ban de On Tap Cuoi KyДокумент11 страницMarketing Can Ban de On Tap Cuoi KyKim DungОценок пока нет

- Updated Quiz BeeДокумент11 страницUpdated Quiz Beedandy boneteОценок пока нет

- Multiple Choice QuestionsДокумент2 страницыMultiple Choice QuestionsababsenОценок пока нет

- Answers Sss WorksheetДокумент4 страницыAnswers Sss WorksheetUtkarsh ChoudharyОценок пока нет

- BusinessStudies SQPДокумент8 страницBusinessStudies SQPRakshit VermaОценок пока нет

- Sample Paper - MergedДокумент58 страницSample Paper - MergedRaghav AgarwalОценок пока нет

- CBSE SP Business Studies 12th 2023 EduBackДокумент20 страницCBSE SP Business Studies 12th 2023 EduBackMin HwanОценок пока нет

- Supply Chain Sourcing NotesДокумент4 страницыSupply Chain Sourcing NotesAsghar RayОценок пока нет

- Odd-Supply Management A Mid Spring 21Документ8 страницOdd-Supply Management A Mid Spring 21Usama Niazi0% (1)

- CMBA Exam Sample QuestionsДокумент6 страницCMBA Exam Sample QuestionsAhsan MoinОценок пока нет

- Thcore 7 Reviewer For Prelim Examination 1 Semester 2021-2022Документ3 страницыThcore 7 Reviewer For Prelim Examination 1 Semester 2021-2022Sophia Joril CantorneОценок пока нет

- j15 Marketing Exam Paper FinalДокумент20 страницj15 Marketing Exam Paper FinalSahar Osama BashirОценок пока нет

- Business Plan OutlineДокумент11 страницBusiness Plan OutlineEaron Jay CadungogОценок пока нет

- B2B Marketing Mid Term Exam Instructions Marks 20 Duration 30 MДокумент5 страницB2B Marketing Mid Term Exam Instructions Marks 20 Duration 30 MGaurav KishoreОценок пока нет

- Handout 1 - Introduction To Cost and Management Accounting PDFДокумент4 страницыHandout 1 - Introduction To Cost and Management Accounting PDFKurt CaneroОценок пока нет

- Internatioanal MarketingДокумент3 страницыInternatioanal MarketingArman HossainОценок пока нет

- BIE Exam Garrone 16 July 2018 SolutionsДокумент5 страницBIE Exam Garrone 16 July 2018 SolutionsomerogolddОценок пока нет

- Chapter 1Документ6 страницChapter 1P XVinh100% (1)

- Exam QS-CBAP-4Документ36 страницExam QS-CBAP-4kareem3456Оценок пока нет

- AssamДокумент4 страницыAssamAbhijit DasОценок пока нет

- MKTG10001Документ38 страницMKTG10001Jessica KokОценок пока нет

- Isipan Mo Muna Bago Mo Sagutin Yung Tanong NG Love Mo. ERASURES ARE NOT ALLOWED. Mahirap Na Magkamali Baka Iwan Ka Pa NiyaДокумент6 страницIsipan Mo Muna Bago Mo Sagutin Yung Tanong NG Love Mo. ERASURES ARE NOT ALLOWED. Mahirap Na Magkamali Baka Iwan Ka Pa Niyamary jed veraizОценок пока нет

- Chapter 10 - Pricing and Credit Strategies: "The Price Is What You Pay The Value Is What You Receive." AnonymousДокумент15 страницChapter 10 - Pricing and Credit Strategies: "The Price Is What You Pay The Value Is What You Receive." AnonymousMutya Neri Cruz100% (1)

- Entrepreneurship TQ SFNHSДокумент9 страницEntrepreneurship TQ SFNHSRUTH MIASCO100% (1)

- ICFAI Proj. Apr. Test IДокумент6 страницICFAI Proj. Apr. Test Iapi-3757629Оценок пока нет

- Code 1Документ7 страницCode 1Temesgen GashuОценок пока нет

- Principles of Microeconomics Course OutlineДокумент7 страницPrinciples of Microeconomics Course OutlineChance...Оценок пока нет

- BST Practice PaperДокумент21 страницаBST Practice PaperManmeet Kaur AroraОценок пока нет

- ACCBP 100 Quiz 2Документ2 страницыACCBP 100 Quiz 2Ikang CabreraОценок пока нет

- Real Estate Realtor Knows HOW....The Easiest Path To The Biggest CASHОт EverandReal Estate Realtor Knows HOW....The Easiest Path To The Biggest CASHОценок пока нет

- Midterm Exam Review Rev VersionДокумент1 страницаMidterm Exam Review Rev Versionusernames358Оценок пока нет

- Evaluating A Company'S External Environment: Student VersionДокумент21 страницаEvaluating A Company'S External Environment: Student Versionusernames358Оценок пока нет

- Textbook Lecture Notes 2Документ9 страницTextbook Lecture Notes 2usernames358Оценок пока нет

- Worksheet ProblemДокумент4 страницыWorksheet Problemusernames358Оценок пока нет

- 12 13InternalControl ClassДокумент53 страницы12 13InternalControl Classusernames358Оценок пока нет

- Chapter 2 & 3 TXT ExercisesДокумент6 страницChapter 2 & 3 TXT Exercisesusernames358Оценок пока нет

- Polar GraphsДокумент1 страницаPolar Graphsusernames358Оценок пока нет

- Chapter 1 Textbook NotesДокумент3 страницыChapter 1 Textbook Notesusernames358Оценок пока нет

- Chapter 1 Textbook NotesДокумент3 страницыChapter 1 Textbook Notesusernames358Оценок пока нет

- Transition WordsДокумент2 страницыTransition Wordsusernames358Оценок пока нет

- 14 Sales Strategies To Increase Sales and RevenueДокумент4 страницы14 Sales Strategies To Increase Sales and Revenuenurul aminОценок пока нет

- Summer Training Report On KazoДокумент55 страницSummer Training Report On KazoAbhishek Kumar100% (3)

- Case Study 5Документ7 страницCase Study 5baby xoОценок пока нет

- Responsibility Accounting and Transfer Pricing ReviewerДокумент44 страницыResponsibility Accounting and Transfer Pricing ReviewerMaxyne Dheil CastroОценок пока нет

- Flora Logistics Limited EN590 SCOДокумент2 страницыFlora Logistics Limited EN590 SCOPadilaОценок пока нет

- 样本Digital Marketing Service Plan ProposalДокумент9 страниц样本Digital Marketing Service Plan ProposalDigital SG SupportОценок пока нет

- Strategic Marketing Plan For Warid TelecomДокумент48 страницStrategic Marketing Plan For Warid TelecomUsman Raza100% (5)

- AuditingДокумент54 страницыAuditingSuresh ReddyОценок пока нет

- Brandtailing-Advertising at The Speed of SmartДокумент8 страницBrandtailing-Advertising at The Speed of SmartThokalayОценок пока нет

- ManualДокумент10 страницManualzfrlОценок пока нет

- Demand Planning 2019 PDFДокумент16 страницDemand Planning 2019 PDFpearlveeramОценок пока нет

- Key Personnel 1.docx UpdatedДокумент20 страницKey Personnel 1.docx UpdatedPranav HarmilapiОценок пока нет

- Gcse Business Coursework Small BusinessДокумент6 страницGcse Business Coursework Small Businessfqvtmyzid100% (2)

- Relationship QualityДокумент28 страницRelationship QualityMoh SaadОценок пока нет

- POM Chapter 9Документ46 страницPOM Chapter 9Mazhar Ul HaqОценок пока нет

- Ferry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireДокумент21 страницаFerry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireFerdinandAlxОценок пока нет

- 7P Mango El AlmibarДокумент12 страниц7P Mango El Almibareider cuentaОценок пока нет

- Business Enterprise Simulation: Mr. Mark Anthony D. ReligiosoДокумент17 страницBusiness Enterprise Simulation: Mr. Mark Anthony D. ReligiosoGuanella GaviñoОценок пока нет

- Mansi Resume-1Документ1 страницаMansi Resume-1Mansi AnandОценок пока нет

- NR Art Gallery ManagerДокумент2 страницыNR Art Gallery ManagerRanjit SankarОценок пока нет

- Answer - M5 - Communication For Relationship BuДокумент18 страницAnswer - M5 - Communication For Relationship Budashyyy 0129Оценок пока нет

- Ip CameraДокумент2 страницыIp CameraRaghavendar Reddy BobbalaОценок пока нет

- 2015 Part II Case Syllabi Civil LawДокумент335 страниц2015 Part II Case Syllabi Civil LawNeapolle FleurОценок пока нет

- Marketing of Soft DrinkДокумент55 страницMarketing of Soft Drinkkhalidziya100% (1)

- Val - Valenti - Resume - PDF PDFДокумент2 страницыVal - Valenti - Resume - PDF PDFThe order of the 61st minuteОценок пока нет

- Notes - Crown Cork & Seal in 1989Документ4 страницыNotes - Crown Cork & Seal in 1989rae sОценок пока нет