Академический Документы

Профессиональный Документы

Культура Документы

Monetary Policy in India

Загружено:

Renuka KhatkarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Monetary Policy in India

Загружено:

Renuka KhatkarАвторское право:

Доступные форматы

MONETARY POLICY IN INDIA

Definition: The Monetary Policy is a process whereby the monetary authority,

generally the central bank controls or regulate the money supply in the

economy.

The goals of the monetary policy are to control the money supply and set the

inflation rate and the interest rate at a level such that the price stability and

overall trust in the currency are ensured. Also, the monetary policy contributes

towards the economic growth and stability, reduce unemployment and maintain

a predictable exchange rate with other currencies.

The scope of monetary policy encompasses the area of economic transactions

and macroeconomic variables that can be influenced by the monetary authority

through its monetary policy. Depending on the effectiveness, the scope of

monetary policy depends, by and large, on two factors:

1. Level of Monetized Economy: In the case of a fully monetized

economy, the scope of monetary policy covers the entire gamut of economic

activities. This means, all the economic activities are carried out with money as

a medium of exchange. Under this situation, the monetary policy works by

changing the general price level.

Thus, it is capable of affecting all the economic activities, Viz., consumption,

production, savings, foreign trade, and investments. Also, the monetary policy

can affect the macroeconomic variables such as GDP, savings and investments,

general price level, foreign exchange, and employment.

2. Level of Development of Capital Market: Another contributory factor

is the level of development in the capital market. Since the change in the supply

of money affects the level of economic activities through a change in the price

level, the other monetary control instruments Viz. Bank rate and Cash

Reserve Ratio work through the capital market. Where the capital market is

developed, the changes in the economic activities are attributed to the changes

in the capital market. A market is said to be a developed capital market if

it fulfills the following criteria:

Most of the financial transactions are routed through a capital market.

A large number of financially strong credit organizations, financial

institutions, commercial banks, and short-term bill market.

The commodity market is highly sensitive to the changes in the capital

market.

The working of several capital sub-markets is interlinked and interrelated.

Instruments of Monetary Policy

1. Quantitative Measures: These are the traditional measures of monetary

control. All the quantitative methods affect the entire credit market in the same

direction. This means their impact on all the sectors of the economy is uniform.

But however it does not take into consideration the objectives of credit control.

The quantitative measure includes the following methods:

Open Market Operations

Bank Rate or Discount Rate

Cash Reserve Ratio

2. Selective Credit Controls: Since the objectives of credit control are not

served by the quantitative methods, the economists rely on selective control

methods to fulfill the purpose. The credit objectives may include rationing the

credit, directing the flow of credit from least important sectors to the most

important sectors, controlling a speculating tendency based on the availability of

bank credit. Thus, these objectives are very well served by the selective control

methods. It includes the following monetary measures:

Credit Rationing

Change in Lending Margins

Moral Suasion

In addition to these measures, the central bank uses a Liquidity Adjustment

Facility, Repo Rate, and Reverse Repo Rate, to control and regulate the

money supply in the economy. The Repo Rate is the rate at which commercial

banks borrow from RBI while the Reverse Repo Rate is the opposite of Repo

rate. It is the rate at which RBI borrows from the commercial banks against the

government securities. The RBI keeps changing these rate at its discretion.

The Repo Rate increases the money supply while the Reverse Repo Rate

decreases the money supply in the economy.

TYPES OF MONETARY POLICY

1. Expansionary Monetary Policy: The expansionary monetary policy is

adopted when the economy is in a recession, and the unemployment is the

problem. The expansion policy is undertaken with an aim to increase the

aggregate demand by cutting the interest rates and increasing the supply of

money in the economy. The money supply can be increased by buying the

government bonds, lowering the interest rates and the reserve ratio. By doing

so, the consumer spending increases, the private sector borrowings increases,

unemployment reduces and the overall economy grows. Expansionary policy is

also called as easy monetary policy.

Although the expansionary monetary policy is useful during the slow period in a

business cycle, it comes with several risks. Such as the economist must know

when the money supply should be expanded so as to avoid its side effects

like inflation. There is often a time lag between the time the policy is made

and the time it is implemented across the economy, so up-to-the-minute

analysis of the policy is quite difficult or impossible. Also, the central bank and

legislators must know when to stop the supply of money in the economy and

apply a Contractionary Policy.

2. Contractionary Monetary Policy: The Contractionary Monetary policy is

applied when the inflation is a problem and economy needs to be slow down by

curtailing the supply of money. The inflation is characterized by increased

money supply and increased consumer spending. Thus, the Contractionary

policy is adopted with an aim to decrease the money supply and the spendings

in the economy. This is primarily done by increasing the interest rates so that

the borrowing becomes expensive.

Вам также может понравиться

- What Is Monetary PolicyДокумент12 страницWhat Is Monetary PolicyNain TechnicalОценок пока нет

- Monetary Policy in India - BlackbookДокумент65 страницMonetary Policy in India - BlackbookKinnari SinghОценок пока нет

- Monetary PolicyДокумент10 страницMonetary PolicyGc Abdul RehmanОценок пока нет

- All Print Macro Nad MicroДокумент15 страницAll Print Macro Nad MicrosmitaОценок пока нет

- Instruments of Monetary Policy and Its ObjectivesДокумент4 страницыInstruments of Monetary Policy and Its ObjectivesfarisktsОценок пока нет

- Monetary Policies Shaping Economies and Navigating ChallengesДокумент2 страницыMonetary Policies Shaping Economies and Navigating ChallengesRadosavljevic Dimitrije DidiОценок пока нет

- Monetary Policy New 1Документ15 страницMonetary Policy New 1Abdul Kader MandolОценок пока нет

- Types of Monetary Policy: Definition: The Monetary Policy Is A Programme of Action Undertaken by The Central Banks andДокумент3 страницыTypes of Monetary Policy: Definition: The Monetary Policy Is A Programme of Action Undertaken by The Central Banks andShafeeq GigyaniОценок пока нет

- Note Monitary PolicyДокумент7 страницNote Monitary PolicyPark Min YoungОценок пока нет

- Presentation Development 20Документ8 страницPresentation Development 20Hussain RizviОценок пока нет

- International Financial Management1Документ23 страницыInternational Financial Management1Khushboo AngelОценок пока нет

- Monetary Policy and Fiscal PolicyДокумент13 страницMonetary Policy and Fiscal PolicyAAMIR IBRAHIMОценок пока нет

- Types of Monetary PolicyДокумент1 страницаTypes of Monetary PolicyVersha MalikОценок пока нет

- Lectures of Monetary PolicyДокумент4 страницыLectures of Monetary PolicyMughees AhmedОценок пока нет

- Meaning of Monetary PolicyДокумент11 страницMeaning of Monetary PolicysirsintoОценок пока нет

- What Is RBI's Monetary Policy: Objectives & Instruments: Fiscal Policy in IndiaДокумент12 страницWhat Is RBI's Monetary Policy: Objectives & Instruments: Fiscal Policy in IndiaNIKHIL KUMAR SAHAОценок пока нет

- Overview of Central BanksДокумент6 страницOverview of Central BanksMehwish AsimОценок пока нет

- Monetary Policy of IndiaДокумент13 страницMonetary Policy of IndiaNannu Sharma100% (1)

- UCP AssignmentДокумент16 страницUCP AssignmentSaniya SaddiqiОценок пока нет

- Monetary PolicyДокумент11 страницMonetary PolicyWaqar100% (1)

- Ashraf Sir AssignmentДокумент12 страницAshraf Sir AssignmenthimelОценок пока нет

- Final ProjectДокумент42 страницыFinal ProjectAnonymous g7uPednIОценок пока нет

- Monetary PoliciesДокумент5 страницMonetary PoliciesA.D. BhattОценок пока нет

- Monetary Policy ToolsДокумент7 страницMonetary Policy ToolsDeepak PathakОценок пока нет

- DirectorДокумент9 страницDirectorRubab SaleemОценок пока нет

- Conduct of Monetary PolicyДокумент16 страницConduct of Monetary PolicyuzmaОценок пока нет

- Economic Policy - Monetary PolicyДокумент17 страницEconomic Policy - Monetary PolicyNikol Vladislavova NinkovaОценок пока нет

- Assignment On Monetary Policy in BangladeshДокумент6 страницAssignment On Monetary Policy in BangladeshAhmed ImtiazОценок пока нет

- LBE-Class Activity29-30-31-32 Dated-30.04.2020Документ3 страницыLBE-Class Activity29-30-31-32 Dated-30.04.2020Shafiulla BaigОценок пока нет

- FIN301 - Week 05 - Monetary PolicyДокумент28 страницFIN301 - Week 05 - Monetary PolicyAhmed MunawarОценок пока нет

- Monetary Policy of India and Its EffectsДокумент24 страницыMonetary Policy of India and Its EffectsManish Bajari100% (1)

- Monetory PolicyДокумент8 страницMonetory PolicyRaul JainОценок пока нет

- Lecture 8 Monetary PolicyДокумент16 страницLecture 8 Monetary PolicyAwab HamidОценок пока нет

- What Is "Monetary Policy?"Документ2 страницыWhat Is "Monetary Policy?"sajjadОценок пока нет

- Monetary Policy of BangladeshДокумент11 страницMonetary Policy of BangladeshGobinda sahaОценок пока нет

- Definition of Monetary Policy: SajibДокумент28 страницDefinition of Monetary Policy: SajibHitisha agrawalОценок пока нет

- Unit 5 - Monetary & Fiscal PolicyДокумент23 страницыUnit 5 - Monetary & Fiscal Policytempacc9322Оценок пока нет

- What Is Monetary Policy?: Key TakeawaysДокумент5 страницWhat Is Monetary Policy?: Key TakeawaysNaveen BhaiОценок пока нет

- Economic PoliciesДокумент9 страницEconomic PoliciesMeherji DuvvuriОценок пока нет

- Macro Term PaperДокумент10 страницMacro Term PaperMoshfeqa KarimОценок пока нет

- Monetary Policy - Its Meaning, Definitions ObjectivesДокумент17 страницMonetary Policy - Its Meaning, Definitions Objectivespunjab03Оценок пока нет

- Yashasvi Sharma Public FinanceДокумент18 страницYashasvi Sharma Public FinanceYashasvi SharmaОценок пока нет

- CH-1.3 Monetary & Fiscal PolicyДокумент21 страницаCH-1.3 Monetary & Fiscal PolicyAmrit KaurОценок пока нет

- Monetary PolicyДокумент21 страницаMonetary PolicyRenuka BabuОценок пока нет

- Which Limit The Success of Monetary PolicyДокумент2 страницыWhich Limit The Success of Monetary PolicyNahidul Islam IUОценок пока нет

- Monetary Policy in IndiaДокумент9 страницMonetary Policy in IndiaShubhakeerti RaoОценок пока нет

- White Down The Review On Monetary Policy As Pakistan PerspectiveДокумент4 страницыWhite Down The Review On Monetary Policy As Pakistan PerspectiveAmeer hamzaОценок пока нет

- Monetary PolicyДокумент29 страницMonetary PolicyPaula Joy AngОценок пока нет

- Monetary Policy and Money Market in IndiaДокумент39 страницMonetary Policy and Money Market in Indiahafizsuleman100% (1)

- Monetary Policy (Group 15)Документ24 страницыMonetary Policy (Group 15)Darwin SolanoyОценок пока нет

- Monetary Policy: By-Rahul Prajapat Cmat 1St SemДокумент6 страницMonetary Policy: By-Rahul Prajapat Cmat 1St SemRahul PrajapatОценок пока нет

- What Is Fiscal PolicyДокумент5 страницWhat Is Fiscal PolicyJanhvi AroraОценок пока нет

- ObjectivesДокумент4 страницыObjectivespurviОценок пока нет

- Introduction To Monetary PolicyДокумент6 страницIntroduction To Monetary Policykim byunooОценок пока нет

- Ch09 Monetary PolicyДокумент21 страницаCh09 Monetary Policymxdxcr2229Оценок пока нет

- Monetary Policy CHДокумент5 страницMonetary Policy CHMD. IBRAHIM KHOLILULLAHОценок пока нет

- Baking CH 2Документ5 страницBaking CH 2Endalkachew BefirdeОценок пока нет

- Ch. 2 MONETARY POLICY FRAMEWORKДокумент15 страницCh. 2 MONETARY POLICY FRAMEWORKcarsongoticosegalesОценок пока нет

- CHAPTER 6 - Monetary PolicyДокумент23 страницыCHAPTER 6 - Monetary PolicyReggie AlisОценок пока нет

- Understanding The Research ProcessДокумент25 страницUnderstanding The Research ProcessthensureshОценок пока нет

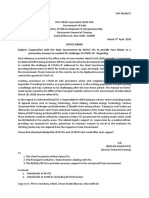

- Group D CRF Pendency List at 3.45 PM On 3.4.2020Документ14 страницGroup D CRF Pendency List at 3.45 PM On 3.4.2020Renuka KhatkarОценок пока нет

- New Doc 2019-08-01 11.36.09 - 2Документ1 страницаNew Doc 2019-08-01 11.36.09 - 2Renuka KhatkarОценок пока нет

- Unit 2Документ12 страницUnit 2Renuka KhatkarОценок пока нет

- WhatsApp Groups Tracking - 3Документ3 страницыWhatsApp Groups Tracking - 3Renuka KhatkarОценок пока нет

- Constituion Micro LevelДокумент12 страницConstituion Micro LevelRenuka KhatkarОценок пока нет

- 600computer MCQДокумент132 страницы600computer MCQRenuka KhatkarОценок пока нет

- Group D CRF Pendency List at 3.45 PM On 3.4.2020 PDFДокумент14 страницGroup D CRF Pendency List at 3.45 PM On 3.4.2020 PDFRenuka KhatkarОценок пока нет

- Office Order Subject: Cooperation With The State Government by Nstis/ Itis To Provide Face Masks As A Preventive Measure To Combat The Challenge of Covid-19 - RegardingДокумент8 страницOffice Order Subject: Cooperation With The State Government by Nstis/ Itis To Provide Face Masks As A Preventive Measure To Combat The Challenge of Covid-19 - RegardingRenuka KhatkarОценок пока нет

- Directorate of Ayush, Haryana (Government of Haryana) : Advertisement For RecruitmentДокумент8 страницDirectorate of Ayush, Haryana (Government of Haryana) : Advertisement For RecruitmentRenuka KhatkarОценок пока нет

- Amended List of The Officers For Monitoring of E-Learning and Follow-UpДокумент1 страницаAmended List of The Officers For Monitoring of E-Learning and Follow-UpRenuka KhatkarОценок пока нет

- Corona Report No of EmployeeДокумент2 страницыCorona Report No of EmployeeRenuka KhatkarОценок пока нет

- Scientific Research Methodologies and Techniques: Unit 11: Intellectual Unit 11: Intellectual Property RightsДокумент27 страницScientific Research Methodologies and Techniques: Unit 11: Intellectual Unit 11: Intellectual Property RightsManohar_3020Оценок пока нет

- 2.0 History of IpДокумент10 страниц2.0 History of IpRenuka KhatkarОценок пока нет

- Patenting Under PCTДокумент3 страницыPatenting Under PCTRenuka KhatkarОценок пока нет

- Procedure For Grants of PatentsДокумент15 страницProcedure For Grants of PatentsRenuka KhatkarОценок пока нет

- Patenting Under PCT PDFДокумент3 страницыPatenting Under PCT PDFRenuka Khatkar100% (1)

- Wipo Pub 1012-Chapter2 PDFДокумент24 страницыWipo Pub 1012-Chapter2 PDFHana AfifahОценок пока нет

- Ip Panorama 3 Learning Points PDFДокумент34 страницыIp Panorama 3 Learning Points PDFRenuka KhatkarОценок пока нет

- Intellual Property RightДокумент25 страницIntellual Property RightsinghalshilpiОценок пока нет

- Presented By: Anvita M. Pharm (IP)Документ40 страницPresented By: Anvita M. Pharm (IP)Renuka KhatkarОценок пока нет

- Patent Filing ProcedureДокумент34 страницыPatent Filing ProcedureANILОценок пока нет

- Research Problem: Mr. Jayesh PatidarДокумент42 страницыResearch Problem: Mr. Jayesh PatidarRenuka KhatkarОценок пока нет

- Principles of Drug DeliveryДокумент42 страницыPrinciples of Drug DeliverySureshCoolОценок пока нет

- Acid Attackson Womenin IndiaДокумент4 страницыAcid Attackson Womenin IndiaRenuka KhatkarОценок пока нет

- Research Problem: Dr. Maheswari JaikumarДокумент38 страницResearch Problem: Dr. Maheswari JaikumarMourian AmanОценок пока нет

- Piis014067361362228x PDFДокумент10 страницPiis014067361362228x PDFRenuka KhatkarОценок пока нет

- Biomaterials Science and Engineering PDFДокумент468 страницBiomaterials Science and Engineering PDFmuk_hawkОценок пока нет

- Attachment and Sale Under The Code of Civil ProcedureДокумент21 страницаAttachment and Sale Under The Code of Civil Procedurelnagasrinivas0% (2)

- Cashless Economy-Reality or Pipe Dream - OdtДокумент2 страницыCashless Economy-Reality or Pipe Dream - OdtRenuka KhatkarОценок пока нет

- A5 - Risk ManagementДокумент30 страницA5 - Risk ManagementNoel GatbontonОценок пока нет

- 3 - Determination of Income NewДокумент68 страниц3 - Determination of Income NewSrihairharanОценок пока нет

- 9772 Economics Pre-U Final SyllabusДокумент26 страниц9772 Economics Pre-U Final SyllabusDavidOSARaphaelReeceОценок пока нет

- Fundamental Analysis of ItcДокумент22 страницыFundamental Analysis of ItcAnjali Angel Thakur100% (1)

- 2024 01 Visual Capitalist Global Forecast Report 1705752631Документ53 страницы2024 01 Visual Capitalist Global Forecast Report 1705752631Linus XОценок пока нет

- CHPT 1 MacroecosДокумент30 страницCHPT 1 MacroecossylbluebubblesОценок пока нет

- Inflation DeflationДокумент18 страницInflation DeflationSteeeeeeeeph100% (2)

- Oil Price HikeДокумент2 страницыOil Price HikeHannah Lat VillavicencioОценок пока нет

- Informationalism PDF - AshxДокумент73 страницыInformationalism PDF - AshxIgor MikhailovОценок пока нет

- Solved Now Consider A TFP Shock That Is Permanent For ExampleДокумент1 страницаSolved Now Consider A TFP Shock That Is Permanent For ExampleM Bilal SaleemОценок пока нет

- VKCatWeb2015 16Документ134 страницыVKCatWeb2015 16Mohit Kothari0% (1)

- Blockchain and Central BankingДокумент22 страницыBlockchain and Central BankingPeterОценок пока нет

- ECO102-Chapter 2:inflationДокумент17 страницECO102-Chapter 2:inflationAbeda SultanaОценок пока нет

- Chandana & Ambar Ghosh - Keynesian Macroeconomics Beyond The ISLM ModelДокумент263 страницыChandana & Ambar Ghosh - Keynesian Macroeconomics Beyond The ISLM ModelShaurya Singru100% (1)

- Financial Innovation, Sustainable Economic Growth, and Credit Risk: A Case of The ASEAN Banking SectorДокумент10 страницFinancial Innovation, Sustainable Economic Growth, and Credit Risk: A Case of The ASEAN Banking SectorEspecialista ContabilidadОценок пока нет

- 20 Years of Safe Withdrawal Rate Research: Executive SummaryДокумент14 страниц20 Years of Safe Withdrawal Rate Research: Executive SummaryMichael KitcesОценок пока нет

- Chapter 2: Critical Review of The OrganizationДокумент15 страницChapter 2: Critical Review of The OrganizationMaddah Hussain60% (5)

- Who's Afraid of A Sideways MarketДокумент9 страницWho's Afraid of A Sideways Marketutah777Оценок пока нет

- Chapter 1aweДокумент27 страницChapter 1aweJessica FortunaОценок пока нет

- Test Bank For Macroeconomics For Today 10th Edition Irvin B TuckerДокумент11 страницTest Bank For Macroeconomics For Today 10th Edition Irvin B TuckerMarcusDavidfpgo100% (25)

- El Panorama de Las Políticas de Desarrollo Productivo en México (2018)Документ78 страницEl Panorama de Las Políticas de Desarrollo Productivo en México (2018)JuanОценок пока нет

- 德银 全球投资策略之全球固定收益2021年展望:还需要迎头赶上 2020.12.22 110页Документ112 страниц德银 全球投资策略之全球固定收益2021年展望:还需要迎头赶上 2020.12.22 110页HungОценок пока нет

- ECOCB/535 Competency 3 - Assessment and Rubric: Assignment DirectionsДокумент7 страницECOCB/535 Competency 3 - Assessment and Rubric: Assignment DirectionsVixo9090Оценок пока нет

- International Finance Assignment 2 Chapter 2: International Flow of FundsДокумент3 страницыInternational Finance Assignment 2 Chapter 2: International Flow of FundsZ the officerОценок пока нет

- Principles of Macroeconomics 7th Edition Taylor Test BankДокумент41 страницаPrinciples of Macroeconomics 7th Edition Taylor Test Bankbirdmanzopiloter7te2100% (23)

- Inflation: Its Causes, Effects, and Social Costs: MacroeconomicsДокумент61 страницаInflation: Its Causes, Effects, and Social Costs: MacroeconomicsTai612Оценок пока нет

- Economic Research BNPДокумент29 страницEconomic Research BNPRudolphe GaertyОценок пока нет

- GRP Assignment - Intro To HospitalityДокумент20 страницGRP Assignment - Intro To HospitalityNabil JefriОценок пока нет

- Challenges and Prospects Confronting Commercial Water Production and Distribution Industry: A Case Study of The Cape Coast MetropolisДокумент13 страницChallenges and Prospects Confronting Commercial Water Production and Distribution Industry: A Case Study of The Cape Coast MetropolisRenelyn Natibo-ocОценок пока нет

- Key EspДокумент16 страницKey Espngoca_2450% (2)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОт EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОценок пока нет

- Look Again: The Power of Noticing What Was Always ThereОт EverandLook Again: The Power of Noticing What Was Always ThereРейтинг: 5 из 5 звезд5/5 (3)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationОт EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationРейтинг: 4 из 5 звезд4/5 (11)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumОт EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumРейтинг: 3 из 5 звезд3/5 (12)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesОт EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsОт EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsРейтинг: 4.5 из 5 звезд4.5/5 (94)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (97)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОт EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОценок пока нет

- The New Elite: Inside the Minds of the Truly WealthyОт EverandThe New Elite: Inside the Minds of the Truly WealthyРейтинг: 4 из 5 звезд4/5 (10)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyОт EverandChip War: The Quest to Dominate the World's Most Critical TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (227)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationОт EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationРейтинг: 4.5 из 5 звезд4.5/5 (46)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentОт EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentРейтинг: 4.5 из 5 звезд4.5/5 (92)

- The Meth Lunches: Food and Longing in an American CityОт EverandThe Meth Lunches: Food and Longing in an American CityРейтинг: 5 из 5 звезд5/5 (5)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistОт EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistРейтинг: 4.5 из 5 звезд4.5/5 (37)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailОт EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailРейтинг: 4.5 из 5 звезд4.5/5 (237)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОт EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОценок пока нет

- This Changes Everything: Capitalism vs. The ClimateОт EverandThis Changes Everything: Capitalism vs. The ClimateРейтинг: 4 из 5 звезд4/5 (349)

- Nickel and Dimed: On (Not) Getting By in AmericaОт EverandNickel and Dimed: On (Not) Getting By in AmericaРейтинг: 3.5 из 5 звезд3.5/5 (197)