Академический Документы

Профессиональный Документы

Культура Документы

Chaikin Power Gauge Report INTC 19apr2017

Загружено:

Agus Ivan VerdianОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chaikin Power Gauge Report INTC 19apr2017

Загружено:

Agus Ivan VerdianАвторское право:

Доступные форматы

Intel Corp (INTC)

Industry: Electronic-Semiconductors

Chaikin Power Gauge Report | Generated: Wed Apr 19 08:32 EDT 2017

Power Gauge Rating

Neutral+

The Chaikin Power Gauge Rating for INTC is Neutral with attractive financial

metrics, average earnings performance, neutral price/volume activity and

positive expert activity.

Expert activity about INTC is positive which is evidenced by relative strength

of the stock's industry. INTC's financial metrics are very good due to a low

long term debt to equity ratio.

Despite bullish factors, INTC has moved below its long-term trend, resulting in

a Power Gauge rating of Neutral+.

Power Trend - 5 Year Chart

38

36

34

32

30

28

26

24

22

20

0.0

Oct Jan Ap r Jul Oct Jan Ap r Jul Oct Jan Ap r Jul Oct Jan Ap r Jul Oct Jan Ap r

www.chaikinanalytics.com p. 1 o f 5 Chaikin Power Gauge Report

Financial & Earnings

Financials

Financials

LT Debt/Equity

Bullish

Price to Bo o k

INTC's financial metrics are very good. The company does not hold much long

term debt and yields a high return on shareholder's equity.

Return o n Equity

The factor rank is based on the stock having low long term debt to equity ratio,

Price to Sales low price to book value, high return on equity, low price to sales ratio, and

relatively high cash flow.

Free Cash Flo w

Assets and Liabilities Valuation Returns

Ratio Ratio Ratio

Current Ratio 1.75 Pric e/Bo o k 2.56 Return o n Inves t 15.47%

LT Deb t/Eq uity 0.31 Pric e/Sales (TTM) 2.84 Return o n Eq uity 21.02%

All values latest quarter, except where noted.

Earnings Earnings

Earnings Gro wth

Neutral

Earnings Surprise

INTC's earnings performance has been neutral. The company has a stable 5

year earnings trend and has a history of weak earnings growth.

Earnings Trend

The factor rank is based on the stock having better than expected earnings in

Pro jected P/E recent quarters, a relatively low projected P/E ratio, and consistent earnings

over the past 5 years, but poor EPS growth over the past 3-5 years, and a

relatively poor yearly earnings trend.

Earnings Co nsistency

5 Year Revenue and Earnings Growth EPS Estimates

12/12 12/13 12/14 12/15 12/16 fac to r Ac tual EPS Prev EST EPS Current Chang e

Revenue(M) 53,341.00 52,708.00 55,870.00 55,355.00 59,387.00 Q uarterly EPS $ 0.79 $ 0.64 -0.15

Rev % G ro wth -1.22% -1.19% 6.00% -0.92% 7.28% Yearly EPS $ 2.18 $ 2.80 + 0.62

EPS $ 2.20 $ 1.94 $ 2.39 $ 2.41 $ 2.18 Ac tual EPS G ro wth Es t EPS G ro wth Chang e

EPS % G ro wth -10.57% -11.82% 23.20% 0.84% -9.54% 3-5 year EPS 1.99% 8.42% + 6.43

EPS Surprise EPS Quarterly Results

Es timate Ac tual Differenc e % Differenc e FY Q tr1 Q tr2 Q tr3 Q tr4 To tal

Lates t Q tr $ 0.75 $ 0.79 $ 0.04 5.33 12/14 $ 0.56 $ 0.68 $ 0.77 $ 0.42 $ 2.43

1 Q tr Ag o $ 0.73 $ 0.80 $ 0.07 9.59 12/15 $ 0.57 $ 0.65 $ 0.77 $ 0.43 $ 2.42

2 Q tr Ag o $ 0.53 $ 0.59 $ 0.06 11.32 12/16 $ 0.28 $ 0.71 $ 0.75 - -

3 Q tr Ag o $ 0.49 $ 0.54 $ 0.05 10.20 Fis c al Year End Mo nth is Dec emb er.

www.chaikinanalytics.com p. 2 o f 5 Chaikin Power Gauge Report

T echnicals & Expert Activity

T e chnicals Technicals

Relative Strength vs Market

Neutral

Chaikin Mo ney Flo w

Price/volume activity for INTC is neutral. INTC has accelerating 4-month trend

momentum and has underperformed the S&P 500 over the past 6 months.

Price Strength

The factor rank is based on the stock having strong Chaikin Money Flow

Price Trend ROC persistency, strength vs. its long-term price trend, positive trend momentum,

and an increasing volume trend, but relative weakness versus the market.

Vo lume Trend

Rel Strength vs S&P500 Index Chaikin Money Flow

36 36

33 33

0.164

0.152 0.0

May Jun Jul Aug Sep Oct No v Dec Jan Feb Mar Ap r May Jun Jul Aug Sep Oct No v Dec Jan Feb Mar Ap r

Price Activity Price Activity Volume Activity

Fac to r Value Fac to r Value Fac to r Value

52 Week Hig h 38.10 % Chang e Pric e - 4 Weeks 2.07% Averag e Vo lume 20 Days 18,216,664

52 Week Lo w 29.63 % Chang e Pric e - 24 Weeks 3.61% Averag e Vo lume 90 Days 22,364,571

% Chang e YTD Rel S&P 500 -4.19% % Chang e Pric e - 4 Wks Rel to S&P 2.15% Chaikin Mo ney Flo w Pers is tenc y 53%

% Chang e Pric e - 24 Wks Rel to S&P -6.59%

Expe rt s Experts

Earnings Estimate Trend

Bullish

Sho rt Interest

Expert activity about INTC is positive. The Electronic-Semiconductors industry

group has been outperforming the market and shorting of INTC is low.

Insider Activity

The factor rank is based on the stock having analysts revising earnings

Analyst Rating Trend estimates upward, a low short interest ratio, optimistic analyst opinions, and

strong performance of the industry group, but insiders not purchasing

significant amounts of stock.

Industry Rel Strength

Earnings Estimate Revisions Analyst Recommendations EPS Estimates Revision Summary

Curr 7d Ag o % Chg Fac to r Value Las t Week Las t 4 Weeks

Current Q tr 0.65 0.65 0.00% Mean this Week Buy Up Do wn Up Do wn

Next Q tr 0.64 0.64 0.00% Mean Las t Week Buy Curr Q tr 0 0 0 0

Curr 30d Ag o % Chg Chang e + 0.04 Curr Yr 0 0 0 0

Current FY 2.80 2.80 0.00% Mean 5 Weeks Ag o Buy Next Q tr 0 0 0 0

Next Yr 0 0 0 0

www.chaikinanalytics.com p. 3 o f 5 Chaikin Power Gauge Report

T he Company & Its Competitors

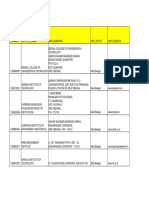

INTC's Competitors in Electronic-Semiconductors

Company Power Gauge Historic EPS growth Projected EPS growth Profit Margin PEG PE Revenue(M)

INTC 1.99% 8.42% 17.37% 1.51 13.15 59,387

XCRA 17.48% 20.00% 3.86% 1.36 51.16 324

ASYS 7.69% - -2.39% - 0.00 120

STM -6.35% - 2.37% - 50.28 6,973

TXN -0.42% 9.60% 25.89% 2.22 24.65 13,370

NVDA 12.37% 10.30% 23.82% 3.47 37.47 6,910

Company Details Company Profile

Intel Corp Intel Corporation is one of the world's largest semiconductor chip maker. The Company

2200 MISSION COLLEGE BLVD develops advanced integrated digital technology products, primarily integrated circuits, for

SANTA CLARA, CA 95054 industries such as computing and communications. It also develops platforms, which it

USA defines as integrated suites of digital computing technologies that are designed and

Phone: 408-765-8080 configured to work together to provide an optimized user computing solution compared to

Fax: 408-765-9904 components that are used separately. Intel designs and manufactures computing and

Website: http://www.intel.com communications components, such as microprocessors, chipsets, motherboards, and

Full Time Employees: 105000 wireless and wired connectivity products, as well as platforms that incorporate these

Sector: Computer and Technology components. The Company sells its products primarily to original equipment manufacturers,

original design manufacturers, PC and network communications products users, and other

manufacturers of industrial and communications equipment. Intel Corporation is based in

Santa Clara, California.

This report describes the position of Chaikin Power Gauge factors relative to the Russell 3000 universe or the stock's Industry Group, depending on

the factor. The Industry used for comparison is provided by portfolio123.com, and may differ from the classification displayed in the Report, which is

provided by Zacks Investment Research.

Chaikin Analytics (CA) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange

Commission or with any state securities regulatory authority. CA is not responsible for trades executed by users of this research report, our web

site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy

or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic

by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own

investment research and should seek the advice of a qualified investment professional before making any investment decisions.

Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1)

includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute

investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct,

complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use

of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin

Analytics.

This report from Chaikin Analytics is for informational purposes only and is not a recommendation to buy or sell securities.

Data Provided by ZACKS Investment Research, Inc. www.zacks.com

www.chaikinanalytics.com p. 4 o f 5 Chaikin Power Gauge Report

www.chaikinanalytics.com p. 5 o f 5 Chaikin Power Gauge Report

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Clark SM 616 Service ManualДокумент20 страницClark SM 616 Service Manualenid100% (55)

- FuzzingBluetooth Paul ShenДокумент8 страницFuzzingBluetooth Paul Shen许昆Оценок пока нет

- Food ResourcesДокумент20 страницFood ResourceshiranОценок пока нет

- Sociology As A Form of Consciousness - 20231206 - 013840 - 0000Документ4 страницыSociology As A Form of Consciousness - 20231206 - 013840 - 0000Gargi sharmaОценок пока нет

- UntitledДокумент216 страницUntitledMONICA SIERRA VICENTEОценок пока нет

- Lesson 6 - Vibration ControlДокумент62 страницыLesson 6 - Vibration ControlIzzat IkramОценок пока нет

- Astm B19Документ6 страницAstm B19Davor IbarraОценок пока нет

- Tesco True Results Casing Running in China Results in Total Depth PDFДокумент2 страницыTesco True Results Casing Running in China Results in Total Depth PDF123456ccОценок пока нет

- Evs ProjectДокумент19 страницEvs ProjectSaloni KariyaОценок пока нет

- Sample Resume For Supply Chain Logistics PersonДокумент2 страницыSample Resume For Supply Chain Logistics PersonAmmar AbbasОценок пока нет

- Unsuccessful MT-SM DeliveryДокумент2 страницыUnsuccessful MT-SM DeliveryPitam MaitiОценок пока нет

- WarringFleets Complete PDFДокумент26 страницWarringFleets Complete PDFlingshu8100% (1)

- Resume: Mr. Shubham Mohan Deokar E-MailДокумент2 страницыResume: Mr. Shubham Mohan Deokar E-MailAdv Ranjit Shedge PatilОценок пока нет

- WBДокумент59 страницWBsahil.singhОценок пока нет

- Aleutia Solar Container ClassroomДокумент67 страницAleutia Solar Container ClassroomaleutiaОценок пока нет

- Dermatology Skin in Systemic DiseaseДокумент47 страницDermatology Skin in Systemic DiseaseNariska CooperОценок пока нет

- Miguel Augusto Ixpec-Chitay, A097 535 400 (BIA Sept. 16, 2013)Документ22 страницыMiguel Augusto Ixpec-Chitay, A097 535 400 (BIA Sept. 16, 2013)Immigrant & Refugee Appellate Center, LLCОценок пока нет

- Man As God Created Him, ThemДокумент3 страницыMan As God Created Him, ThemBOEN YATORОценок пока нет

- Literatura Tecnica 3Документ10 страницLiteratura Tecnica 3Christian PerezОценок пока нет

- ELEVATOR DOOR - pdf1Документ10 страницELEVATOR DOOR - pdf1vigneshОценок пока нет

- RFID Seminar AbstractДокумент2 страницыRFID Seminar Abstractanushabhagawath80% (5)

- Friction: Ultiple Hoice UestionsДокумент5 страницFriction: Ultiple Hoice Uestionspk2varmaОценок пока нет

- Teaching Profession - Educational PhilosophyДокумент23 страницыTeaching Profession - Educational PhilosophyRon louise PereyraОценок пока нет

- Shakespeare Sonnet EssayДокумент3 страницыShakespeare Sonnet Essayapi-5058594660% (1)

- 2011-2012 - Medical - DirectoryДокумент112 страниц2011-2012 - Medical - DirectoryЈелена КошевићОценок пока нет

- Performance Task 1Документ3 страницыPerformance Task 1Jellie May RomeroОценок пока нет

- How To Configure PowerMACS 4000 As A PROFINET IO Slave With Siemens S7Документ20 страницHow To Configure PowerMACS 4000 As A PROFINET IO Slave With Siemens S7kukaОценок пока нет

- Bom Details FormatДокумент6 страницBom Details FormatPrince MittalОценок пока нет

- NCP - Major Depressive DisorderДокумент7 страницNCP - Major Depressive DisorderJaylord Verazon100% (1)

- Head Coverings BookДокумент86 страницHead Coverings BookRichu RosarioОценок пока нет