Академический Документы

Профессиональный Документы

Культура Документы

Natixis ECB Report

Загружено:

JaphyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Natixis ECB Report

Загружено:

JaphyАвторское право:

Доступные форматы

June 30, 2010 – No.

157

Authors: Jean Francois Robin

Evariste Lefeuvre

What will be the impact on liquidity of the EUR 442bn LTRO reaching maturity

The first 12-month long-term refinancing operation (LTRO) matures this Thursday. At EUR 442bn, this means

that nearly half the liquidity provided by the European Central Bank (excluding covered bond purchases) is

being withdrawn. While a 3-month tender and a fine-tuning operation (FTO) at 1% are being staged as a bridge

until the next main refinancing operation (MRO), there remains to be seen how the expiry of the 12-month

LTRO will affect: (1) Eonia rates; and (2) sovereign spreads within the Eurozone. There will be less excess

liquidity, which ought to push up Eonia rates, albeit gradually. As collateral will be returned, this may trigger

some selling, causing spreads to widen although the possibility to roll at 1% via the European Central Bank’s

weekly tender ought to limit the extent of this selling.

When the European Central Bank staged the 12-month All in all, the European Central is providing almost

LTRO back in 2009, this led to a very sharp increase in the EUR 940bn of liquidity, i.e. EUR 340bn more than is

liquidity made available to banks. The lasting disconnection strictly needed by the European banking system.

between the repo rate and Eonia shows there really was

excess liquidity swilling about. The question now is how the

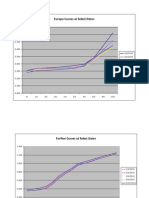

ECB - Excess liquidity

banks will behave come the roll on 1 July 2010.

300 350

More generally, will banks arbitrage between the different

maturities? Or will banks be tempted to lock in liquidity? What 250 300

arbitrages will there be between asset classes (bonds, asset- 250

200

backed securities, etc.)? Finally, what will be the

200

short/medium-term impact on the Eonia-repo spread? 150

150

100

Liquidity before redemption of the 12-month LTRO 100

50

50

Significant excess liquidity has been provided by the 0 0

European Central Bank. By excess liquidity, we mean the Sources : Bloomberg

surplus liquidity in relation to autonomous liquidity factors and -50 -50

reserve requirements, which are normally what steer liquidity 02/99 02/01 02/03 02/05 02/07 02/09

management by the central bank. Liquidity requirements This is reflected in the overnight deposits at the European

currently amount to around EUR 600bn (autonomous Central Bank, which towered at more than EUR 305bn

liquidity factors for EUR 390bn and reserve requirements for yesterday.

EUR 213bn).

ECB- Deposit facility at 0.25%

The European Central Bank currently provides EUR 878bn,

in addition to which it has purchased EUR 60bn of covered 320000 320000

300000 300000

bonds that have not been sterilised. While the central bank 280000 280000

Source : ECB, Bloomberg

has said that it does not intend to make further purchases of 260000

240000

260000

240000

covered bonds, it will keep in portfolio the bonds purchased 220000 220000

200000 200000

to date and will probably keep them until maturity. In other 180000 180000

words, EUR 60bn has been advanced to the banks for keeps. 160000 160000

140000 140000

120000 120000

On the other hand, the EUR 55bn of debt instruments 100000 100000

80000 80000

acquired in connection with the European bailout plan do not 60000 60000

40000 40000

enter into the equation since these purchases have been 20000 20000

totally sterilised. 0 0

08/07 12/07 04/08 08/08 12/08 04/09 08/09 12/09 04/10

With the EUR 442bn 12-month LTRO reaching maturity,

nearly half the liquidity provided by the European Central

Bank will be withdrawn on 1 July. In theory, the surplus

liquidity experienced by the Eurozone could give way to

a liquidity shortfall. As we go on to explain, this will not ECB – Excess liquidity with continuous adjustment of MROs

happen and measures are being taken to prevent the

changeover from being too chaotic. bn MRO + LTRO

Banking system’s theoretical requirement

Benefit for the banks of participating in 12 –month LTRO EUR 150bn allotted at 3m LTRO

The 12-month LTRO was arranged when the interbank 1100

No allotment at 3m LTRO

market was experiencing very serious strains and EUR 150bn at 3m LTRO + EUR 250bn rolled into MROs

anticipations regarding short rates were clearly on the upside.

900

Much of the EUR 442bn allocated to 1,100 banks must be

analysed as a desire to benefit from this windfall by locking in 700

liquidity at 1%. This is in stark contrast to the situation now.

500

Liquidity will remain abundant even after withdrawing

EUR 442bn Source: Bloomberg

300

The EUR 442bn of collateral released when the 12-month 01/09 05/09 09/09 01/10 05/10 09/10 01/11

LTRO expires will not vanish into thin air. This collateral could

be recycled at the weekly MROs (kicking of this week with a

6-day fine tuning operation), which are being done at a fixed This may appear a little optimistic but the reality is likely to be

rate and for unlimited amounts, also at the 3-month LTRO somewhere between these two extreme scenarios, with

scheduled for 1 July. One can therefore expect these around EUR 100bn of excess liquidity probably left in the

operations to be well bid. system.

Accordingly, the 6-day FTO, 3-month LTRO and MROs are

likely to balloon in size. Banks will need time to see how best Excess liquidity will be reduced, possibly by EUR 150-

to employ the collateral lodged for the last year at the 200bn, but excess liquidity there will still be

European Central Bank.

That was the case at yesterday’s MRO maturing on 7 July, a The European Central Bank clearly does not want to impose

way therefore of anticipating the redemption, when restrictive conditions given the strains experienced by the

EUR 162.9bn was allocated to the 157 bidding banks. interbank market and the effects this is having on certain

In terms of size, the MROs are likely to exceed EUR 200bn, banks and certain countries.

and the 3-month LTRO could well approach this level (results

due to be released today at 11.20 am). Could the end of the 12-month LTRO cause a widening of

sovereign spreads?

How to apply the collateral retrieved?

One can expect part of the collateral scraped together by the Clearly, the impact will not be a tightening but rather a

banks last year will now find its way back into the market. widening.

While it is difficult to determine precisely the extent to which

Quality collateral is unlikely to find its way back to the the collateral consists of sovereign debt instruments, one can

European Central Bank, and while it may take several weeks, wager that government bonds represent at least 20%. In

it will probably be sold or used in interbank repo market. 2006, the collateral consisted for 21% of government bonds,

In this respect, the European Central Bank’s own liquidity is a proportion that went on to decline to 10% in 2008. Given

likely to decline. On the other hand, liquidity in the interbank the upturn in sovereign risk, it is likely that the proportion of

repo market could increase. government bonds has increased sharply. With the repo rate

Banks, notably in Greece, Portugal, Spain and some in standing above the interbank offered rate, banks will tend to

Germany, that are finding it hard to obtain refinancing, will give the European Central Bank securities that will not be

continue to seek refinancing not in the interbank market but readily accepted as collateral in the interbank repo market (in

at the European Central Bank by lodging each week the 2008, asset-backed securities accounted for much of the

collateral retrieved when the 12-month LTRO matures. securities provided as collateral to the European Central

Several scenarios can be envisaged (see below). One can Bank).

image there being no rolls from the 12-month LTRO into the

MROs and for demand to reach EUR 150bn at today’s MRO, It is in the banks’ interest to offer as collateral the least liquid

but the most likely scenario in our view is that there will be a and lowest rated securities, therefore Greek, Portuguese and

partial roll today through the 3-month LTRO and the MROs Spanish government bonds. More liquid securities can be

could be increased up to EUR 200bn. If EUR 150bn is offered as collateral easily enough in the interbank repo

allocated at the 3-month LTRO and MROs were once again market.

to average EUR 250bn, there would once again be significant For the lowest rated securities, i.e. GGBs, the European

excess liquidity compared with theoretical requirements Central Bank has announced that it was accepting all

(frozen at current levels for this purpose). securities issued or guaranteed by the Greek State with no

minimum rating criterion. It is therefore likely that GGBs

retrieved by banks will be offered as collateral to the

European Central Bank or sold in the market.

The others will be kept because they are can be used more

readily as collateral in the interbank repo market.

No 157 - 29 June, 2010 I 2

Banks having lodged non-core securities as collateral with

the European Central Bank and which are able to obtain

refinancing in the interbank market (at 0.33% on 29 June) will

probably look to unload securities that cannot be used readily

as collateral in the repo market.

However selling GGBs at current levels, therefore at a loss,

may not do marvels for the banks’ P&L.

As these securities may not be readily accepted in repos,

banks are likely to provide them as collateral for the 6-day

FTO and then roll them at the MROs to begin with (which is

why the 3-month MRO is expected to be very well bid).

One can imagine that refinancing 3-year GGBs yielding

11% at 1% is an excellent strategy in terms of carry. If

losses are going to be incurred when marking to market, one

might as well play the carry.

For portfolios accounted for as loans and receivables, not

therefore valued on a market-to-market basis, for which the

“only” risk is a default before maturity, there is also less

urgency to unload.

Selling is thus likely to be the preferred course of action but

this should be limited to begin with.

Markets for certain securities such as GGBs will not be

reopened totally, meaning that such securities may well

continue to be refinanced at the European Central Bank in

the meantime. However, there is the risk that at each bid in

the market, those banks that have seen their limits reduced

since July will be tempted to sell the securities. This would

reduce in proportion bids at the European Central Bank’s

MROs, hence the liquidity in the system since these

operations are on a full allotment basis.

Impact on Eonia

Eonia rates are clearly set to trend upwards in coming

months, with these rates gradually converging towards repo,

probably more quickly than is being priced currently.

Eonia swap rate 1 month forward on ECB dates

1.800

1.700 Eonia curve

1.600

1.500 Natixis ECB repo scenario

1.400

1.300

1.200

1.100

1.000

0.900

0.800

0.700

0.600

0.500

0.400

0.300

Jul Aug Oct Dec Feb Apr Jun Aug Oct Dec

Jul Sep Nov Jan Mar May Jul Sep Nov

2011

Nonetheless this process will take place gradually, maybe

over several weeks of MROs and could end only in 2011.

No 157 - 29 June, 2010 I 3

AVERTISSEMENT / DISCLAIMER

Ce document et toutes les pièces jointes sont strictement confidentiels et établis à l’attention exclusive de ses destinataires. Ils ne sauraient être transmis à quiconque sans l’accord préalable

écrit de Natixis. Si vous recevez ce document et/ou toute pièce jointe par erreur, merci de le(s) détruire et de le signaler immédiatement à l’expéditeur.

Ce document a été préparé par nos économistes. Il ne constitue pas un rapport de recherche indépendant et n’a pas été élaboré conformément aux dispositions légales arrêtées

pour promouvoir l’indépendance de la recherche en investissement. En conséquence, sa diffusion n’est soumise à aucune interdiction prohibant l’exécution de transactions

avant sa publication.

La distribution, possession ou la remise de ce document dans ou à partir de certaines juridictions peut être limitée ou interdite par la loi. Il est demandé aux personnes recevant ce document

de s’informer sur l’existence de telles limitations ou interdictions et de s’y conformer. Ni Natixis, ni ses affiliés, directeurs, administrateurs, employés, agents ou conseils, ni toute autre

personne accepte d’être responsable à l’encontre de toute personne du fait de la distribution, possession ou remise de ce document dans ou à partir de toute juridiction.

Ce document et toutes les pièces jointes sont communiqués à chaque destinataire à titre d’information uniquement et ne constituent pas une recommandation personnalisée d’investissement.

Ils sont destinés à être diffusés indifféremment à chaque destinataire et les produits ou services visés ne prennent en compte aucun objectif d’investissement, situation financière ou besoin

spécifique à un destinataire en particulier. Ce document et toutes les pièces jointes ne constituent pas une offre, ni une sollicitation d’achat, de vente ou de souscription. Ce document ne peut

en aucune circonstance être considéré comme une confirmation officielle d'une transaction adressée à une personne ou une entité et aucune garantie ne peut être donnée sur le fait que cette

transaction sera conclue sur la base des termes et conditions qui figurent dans ce document ou sur la base d’autres conditions. Ce document et toutes les pièces jointes sont fondés sur des

informations publiques et ne peuvent en aucune circonstance être utilisés ou considérés comme un engagement de Natixis, tout engagement devant notamment être soumis à une procédure

d'approbation de Natixis conformément aux règles internes qui lui sont applicables.

Natixis n’a ni vérifié ni conduit une analyse indépendante des informations figurant dans ce document. Par conséquent, Natixis ne fait aucune déclaration ou garantie ni ne prend aucun

engagement envers les lecteurs de ce document, de quelque manière que ce soit (expresse ou implicite) au titre de la pertinence, de l’exactitude ou de l’exhaustivité des informations qui y

figurent ou de la pertinence des hypothèses auxquelles elle fait référence. En effet, les informations figurant dans ce document ne tiennent pas compte des règles comptables ou fiscales

particulières qui s’appliqueraient aux contreparties, clients ou clients potentiels de Natixis. Natixis ne saurait donc être tenu responsable des éventuelles différences de valorisation entre ses

propres données et celles de tiers, ces différences pouvant notamment résulter de considérations sur l’application de règles comptables, fiscales ou relatives à des modèles de valorisation.

De plus, les avis, opinions et toute autre information figurant dans ce document sont indicatifs et peuvent être modifiés ou retirés par Natixis à tout moment sans préavis.

Les informations sur les prix ou marges sont indicatives et sont susceptibles d’évolution à tout moment et sans préavis, notamment en fonction des conditions de marché. Les performances

passées et les simulations de performances passées ne sont pas un indicateur fiable et ne préjugent donc pas des performances futures. Les informations contenues dans ce document

peuvent inclure des résultats d’analyses issues d’un modèle quantitatif qui représentent des évènements futurs potentiels, qui pourront ou non se réaliser, et elles ne constituent pas une

analyse complète de tous les faits substantiels qui déterminent un produit. Natixis se réserve le droit de modifier ou de retirer ces informations à tout moment sans préavis. Plus généralement,

Natixis, ses sociétés mères, ses filiales, ses actionnaires de référence ainsi que leurs directeurs, administrateurs, associés, agents, représentants, salariés ou conseils respectifs rejettent toute

responsabilité à l’égard des lecteurs de ce document ou de leurs conseils concernant les caractéristiques de ces informations. Les opinions, avis ou prévisions figurant dans ce document

reflètent, sauf indication contraire, celles de son ou ses auteur(s) et ne reflètent pas les opinions de toute autre personne ou de Natixis.

Les informations figurant dans ce document n’ont pas vocation à faire l’objet d’une mise à jour après la date apposée en première page. Par ailleurs, la remise de ce document n’entraîne en

aucune manière une obligation implicite de quiconque de mise à jour des informations qui y figurent.

Natixis ne saurait être tenu pour responsable des pertes financières ou d’une quelconque décision prise sur le fondement des informations figurant dans la présentation et n’assume aucune

prestation de conseil, notamment en matière de services d’investissement. En tout état de cause, il vous appartient de recueillir les avis internes et externes que vous estimez nécessaires ou

souhaitables, y compris de la part de juristes, fiscalistes, comptables, conseillers financiers, ou tous autres spécialistes, pour vérifier notamment l’adéquation de la transaction qui vous est

présentée avec vos objectifs et vos contraintes et pour procéder à une évaluation indépendante de la transaction afin d’en apprécier les mérites et les facteurs de risques.

Natixis est agréée par l’Autorité de contrôle prudentiel (ACP) en France en qualité de Banque – prestataire de services d’investissements et soumise à sa supervision. Natixis est réglementée

par l’AMF (Autorité des Marchés Financiers) pour l’exercice des services d’investissements pour lesquels elle est agréée.

Natixis est agréée par l’ACP en France et soumise à l’autorité limitée du Financial Services Authority au Royaume Uni. Les détails concernant la supervision de nos activités par le Financial

Services Authority sont disponibles sur demande.

Natixis est agréée par l’ACP et régulée par la BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) pour l’exercice en libre établissement de ses activités en Allemagne. Le transfert /

distribution de ce document en Allemagne est fait(e) sous la responsabilité de NATIXIS Zweigniederlassung Deutschland.

Natixis est agréée par l’ACP et régulée par la Banque d’Espagne (Bank of Spain) et la CNMV pour l’exercice en libre établissement de ses activités en Espagne.

Natixis est agréée par l’ACP et régulée par la Banque d’Italie et la CONSOB (Commissione Nazionale per le Società e la Borsa) pour l’exercice en libre établissement de ses activités en Italie.

Natixis ne destine la diffusion aux Etats-Unis de cette publication qu’aux « major U.S. institutional investors », définis comme tels selon la Rule 15(a) (6). Cette publication a été élaborée et

vérifiée par les économistes de Natixis (Paris). Ces économistes n'ont pas fait l'objet d'un enregistrement professionnel en tant qu'économiste auprès du NYSE et/ou du NASD et ne sont donc

pas soumis aux règles édictées par la FINRA.

This document (including any attachments thereto) is confidential and intended solely for the use of the addressee(s). It should not be transmitted to any person(s) other than the original

addressee(s) without the prior written consent of Natixis. If you receive this document in error, please delete or destroy it and notify the sender immediately.

This document has been prepared by our economists. It does not constitute an independent investment research and has not been prepared in accordance with the legal

requirements designed to promote the independence of investment research. Accordingly there are no prohibitions on dealing ahead of its dissemination.

The distribution, possession or delivery of this document in, to or from certain jurisdictions may be restricted or prohibited by law. Recipients of this document are therefore required to ensure

that they are aware of, and comply with, such restrictions or prohibitions. Neither Natixis, nor any of its affiliates, directors, employees, agents or advisers nor any other person accept any

liability to anyone in relation to the distribution, possession or delivery of this document in, to or from any jurisdiction.

This document (including any attachments thereto) are communicated to each recipient for information purposes only and do not constitute a personalised recommendation. It is intended for

general distribution and the products or services described therein do not take into account any specific investment objective, financial situation or particular need of any recipient. It should not

be construed as an offer or solicitation with respect to the purchase, sale or subscription of any interest or security or as an undertaking by Natixis to complete a transaction subject to the

terms and conditions described in this document or any other terms and conditions. Any undertaking or commitment shall be subject to Natixis prior approval and formal written confirmation in

accordance with its current internal procedures. This document and any attachments thereto are based on public information.

Natixis has neither verified nor independently analysed the information contained in this document. Accordingly, no representation, warranty or undertaking, express or implied, is made to the

recipients of this document as to or in relation to the accuracy or completeness or otherwise of this document or as to the reasonableness of any assumption contained in this document. The

information contained in this document does not take into account specific tax rules or accounting methods applicable to counterparties, clients or potential clients of Natixis. Therefore, Natixis

shall not be liable for differences, if any, between its own valuations and those valuations provided by third parties; as such differences may arise as a result of the application and

implementation of alternative accounting methods, tax rules or valuation models. In addition, any view, opinion or other information provided herein is indicative only and subject to change or

withdrawal by Natixis at any time without notice.

Prices and margins are indicative only and are subject to changes at any time without notice depending on inter alia market conditions. Past performances and simulations of past

performances are not a reliable indicator and therefore do not predict future results. The information contained in this document may include the results of analysis derived from a quantitative

model, which represent potential future events, that may or may not be realised, and is not a complete analysis of every material fact representing any product. The information may be

amended or withdrawn by Natixis at any time without notice. More generally, no responsibility is accepted by Natixis, nor any of its holding companies, subsidiaries, associated undertakings or

controlling persons, nor any of their respective directors, officers, partners, employees, agents, representatives or advisors as to or in relation to the characteristics of this information. The

opinions, views and forecasts expressed in this document (including any attachments thereto) reflect the personal views of the author(s) and do not reflect the views of any other person or

Natixis unless otherwise mentioned.

It should not be assumed that the information contained in this document will have been updated subsequent to date stated on the first page of this document. In addition, the delivery of this

document does not imply in any way an obligation on anyone to update such information at any time.

Natixis shall not be liable for any financial loss or any decision taken on the basis of the information contained in this document and Natixis does not hold itself out as providing any advice,

particularly in relation to investment services. In any event, you should request for any internal and/or external advice that you consider necessary or desirable to obtain, including from any

financial, legal, tax or accounting advisor, or any other specialist advice, in order to verify in particular that the investment(s) described in this document meets your investment objectives and

constraints and to obtain an independent valuation of such investment(s), its risks factors and rewards.

Natixis is authorised in France by the Autorité de contrôle prudentiel (ACP) as a Bank –Investment Services providers and subject to its supervision. Natixis is regulated by the AMF in respect

of its investment services activities.

Natixis is authorised by the ACP in France and subject to limited regulation by the Financial Services Authority in the United Kingdom. Details on the extent of our regulation by the Financial

Services Authority are available from us on request.

Natixis is authorised by the ACP and regulated by the BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) for the conduct of its business in Germany. The transfer / distribution of this

document in Germany is done by / under the responsibility of NATIXIS Zweigniederlassung Deutschland.

Natixis is authorised by the ACP and regulated by Bank of Spain and the CNMV for the conduct of its business in Spain.

Natixis is authorised by the ACP and regulated by Bank of Italy and the CONSOB (Commissione Nazionale per le Società e la Borsa) for the conduct of its business in Italy.

This research report is solely available for distribution in the United States to major U.S. institutional investors as defined by SEC Rule 15(a)(6). This research report has been prepared and

reviewed by research economists employed by Natixis (Paris). These economists are not registered or qualified as research economists with the NYSE and/or the NASD, and are not subject

to the rules of the FINRA

No 157 - 29 June, 2010 I 4

Вам также может понравиться

- Rehypothecation in The Shadow Banking SystemДокумент16 страницRehypothecation in The Shadow Banking SystemJaphy100% (1)

- Fitch - Spanish Banks Stress TestsДокумент7 страницFitch - Spanish Banks Stress TestsJaphyОценок пока нет

- SSRN-Id1629688 Interest Rate Modeling With Multiple Yield CurvesДокумент27 страницSSRN-Id1629688 Interest Rate Modeling With Multiple Yield CurvesJaphyОценок пока нет

- Two Models of Land Overvaluation and Their Implications: October 2010Документ33 страницыTwo Models of Land Overvaluation and Their Implications: October 2010JaphyОценок пока нет

- Hist Panel EURIBOR Jul 2010Документ12 страницHist Panel EURIBOR Jul 2010JaphyОценок пока нет

- Thoughts About FTPДокумент10 страницThoughts About FTPJaphyОценок пока нет

- US CMBS Loss Study - 2009Документ11 страницUS CMBS Loss Study - 2009JaphyОценок пока нет

- BBA LIBOR Strengthening PaperДокумент15 страницBBA LIBOR Strengthening PaperJaphyОценок пока нет

- Financial Stability Review Summary 201006enДокумент6 страницFinancial Stability Review Summary 201006enJaphyОценок пока нет

- Cpi-Monthly Ccaroc (Sa)Документ1 страницаCpi-Monthly Ccaroc (Sa)JaphyОценок пока нет

- International Fisher EffectДокумент6 страницInternational Fisher EffectJaphy100% (1)

- Meyer 5-3-2000Документ7 страницMeyer 5-3-2000JaphyОценок пока нет

- GDP Velocity MZM 5-30-10Документ2 страницыGDP Velocity MZM 5-30-10JaphyОценок пока нет

- Japan GPIF 08 Operations ReviewДокумент50 страницJapan GPIF 08 Operations ReviewJaphyОценок пока нет

- OECD - Stat ExportДокумент1 страницаOECD - Stat ExportJaphyОценок пока нет

- EONIA Euribor Eurepo CurvesДокумент3 страницыEONIA Euribor Eurepo CurvesJaphyОценок пока нет

- Debt To GDP ComparisonДокумент1 страницаDebt To GDP ComparisonJaphyОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Accounting Assignment Sample SolutionsДокумент20 страницAccounting Assignment Sample SolutionsHebrew JohnsonОценок пока нет

- International Corporate FinanceДокумент8 страницInternational Corporate FinanceAnirudh DewadaОценок пока нет

- ABM 104 Financial ManagementДокумент20 страницABM 104 Financial ManagementGenner RazОценок пока нет

- Stock ExchangeДокумент43 страницыStock ExchangeGaurav JindalОценок пока нет

- BURATДокумент19 страницBURATLucas MenteОценок пока нет

- Devos FinancialДокумент80 страницDevos FinancialThe Washington PostОценок пока нет

- Mutual Fund Insight Jul 2023Документ104 страницыMutual Fund Insight Jul 2023Ram Yadav100% (1)

- P43AДокумент5 страницP43AAquanetta OrtonОценок пока нет

- Ekotek - Alfiano Fuadi3Документ50 страницEkotek - Alfiano Fuadi3Alfiano Fuadi0% (1)

- HW 1 SolutionsДокумент7 страницHW 1 Solutionsjinny6061Оценок пока нет

- NICASA E-Newsletter June 2022Документ83 страницыNICASA E-Newsletter June 2022Poresh TewaryОценок пока нет

- OLFM Accounting R12.1Документ21 страницаOLFM Accounting R12.1Kumar N Penumantra100% (1)

- (USED) OR1 - 04 - Formulations (Case Studies)Документ19 страниц(USED) OR1 - 04 - Formulations (Case Studies)FrandesОценок пока нет

- Simple and Discount Interest: Mathematics of InvestmentДокумент12 страницSimple and Discount Interest: Mathematics of InvestmentzahidacaОценок пока нет

- Top Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingДокумент3 страницыTop Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingJajahinaОценок пока нет

- A. Saffer: RobertДокумент5 страницA. Saffer: Robertashish ojhaОценок пока нет

- Company LawДокумент100 страницCompany LawPranay PasrichaОценок пока нет

- Poland-Student Md. Rohidul IslamДокумент2 страницыPoland-Student Md. Rohidul IslamChishty Shai NomaniОценок пока нет

- Cases Castillo Vs BalinghasayДокумент4 страницыCases Castillo Vs BalinghasayBerch Melendez100% (1)

- Master Fee AgreementДокумент5 страницMaster Fee Agreementmeeshelz81450% (2)

- Business: Learn Accounting Through An ExampleДокумент6 страницBusiness: Learn Accounting Through An ExampleKunal SajnaniОценок пока нет

- CH 8 Cost of CapitalДокумент18 страницCH 8 Cost of CapitalJohn DavidsonОценок пока нет

- SAUDA DETAIL REPORT cl3Документ1 страницаSAUDA DETAIL REPORT cl3Prachi PatwariОценок пока нет

- J.P. Morgan Reuters RiskMetricsДокумент296 страницJ.P. Morgan Reuters RiskMetricsolgutza27100% (1)

- Class25 EvaДокумент21 страницаClass25 EvaAnshul SehgalОценок пока нет

- Raghee Horner 34 EMA Wave and GRaB Candles PDFДокумент3 страницыRaghee Horner 34 EMA Wave and GRaB Candles PDFjust.gopal100% (1)

- Nego Cases 2Документ28 страницNego Cases 2Jake CastañedaОценок пока нет

- Advanced Accounting Part 2 Take Home Activity: - Total Present Value)Документ3 страницыAdvanced Accounting Part 2 Take Home Activity: - Total Present Value)Airille CarlosОценок пока нет

- Solution - Problems and Solutions Chap 10Документ6 страницSolution - Problems and Solutions Chap 10سارة الهاشميОценок пока нет

- Who Bears The Cost of Excessive Executive Compensation (And OtherДокумент23 страницыWho Bears The Cost of Excessive Executive Compensation (And OtherJanelleОценок пока нет