Академический Документы

Профессиональный Документы

Культура Документы

Declaration Format For Salary For FY 2017-18 A.Y 2018-19

Загружено:

Sudeep SinghИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Declaration Format For Salary For FY 2017-18 A.Y 2018-19

Загружено:

Sudeep SinghАвторское право:

Доступные форматы

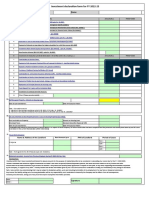

Declaration Format for Claiming Deduction from Salary for F.Y. 2017-18 (A.

Y 2018-19)

PLEASE NOTE:

PAN & Address are mandatory. Please do not fail to furnish the same.

Please indicate details of your investments in appropriate columns only.

(1)FullName:

Mr. /Mrs./Ms. ______________________________________________

Address:-_________________________________________________

Department __________________Designation ___________________

Unit ______________________________________________________

Contact No. __________________ Male / Female ________________

Email Id __ ________________________________________________

Date of Birth __________________Date of Joining _________________

(2)IncomeTaxPermanentA/c.(PAN)No.:_________________

(MANDATORY)Please provide Xerox of PAN Card.

Deduction available from salary income under chapter VI A:

Sr. No. Description of Investment Documents Required Maximum Limit (Rs.) Amount in Rs.

1 House Rent paid to the Landlord Original Rent Receipts every month (with Revenue Stamp above Rs.

4999/-) or Rent Agreement. Receipt should contain PAN of Landlord if Nil

Rent for the year exceeds one Lakh.

2 New Pension Plan-80CCD(1) Copy of Payment Receipt / Passbook 150,000/- or 10% of

Basic Pay + D.A

3 New Pension Plan-80CCD(1B) Copy of Payment Receipt / Passbook (Atal Pension Yojna has been 50,000/-

notified by CG for this additional 50,000/- dedcution)

4 Mediclaim 80D (Self, Family & Parents) Mediclaim Policy Copy or Premium Certificate 25,000/-

5 Mediclaim 80D (Self, Family & Parents Sen. Citizen) Mediclaim Policy Copy or Premium Certificate 30,000/-

6 Preventive Health Check-up for Himsefl & Family & parents Original Medical Bills 5,000/-

(Senior Citizen or Not)-80D

7 Medical Expenditure for Himself, Family, Parents (Sen. Citizen Original Medical Bills 30,000/-

or not) (not having Mediclaim Policy) -80D

8 Interest on Housing Loan (Loan taken prior to 01/04/99) Certificate from Bank / Financial Institution 30,000/-

9 Interest on Housing Loan(Loantakenafter01/04/99) Certificate from Bank / Financial Institution 2,00,000/-

10 Expenditure on Maintainence or Medical treatment being Certificate from Prescribed Authority in Rule 11A Form No. 10-IA Sec. 80 75,000/- or 1,25,000/-

Dependant with Disability Rs. 75,000 Several Disability Rs. DD

1,25,000-80DD

11 Expense on Dependent for Specified Disease [Very Sen. Citizen Prescription from Prescribed Authority in Rule 11DD Sec. 80 DDB 40,000 or 80,000/-

ie., (80 years) Rs 80,000 for others Rs 40,000]-80DDB

12 Himself with Disability Rs. 75,000 Several Disability Rs. Certificate from Prescribed Authority as per Rule 11A Form No. 10-IA 75,000/- or 1,25,000/-

1,25,000-80U

13 Medical Bill Reimbursement Original Medical Bills (including Parents, Wife/Husband, Children) 1250/- every month

14 Donations -Section 80 G Prime Minister Relief Fund Receipt Donation Amount

Deduction u/s 80C

Sr. No. Description of Investment Documents Required Maximum Limit (Rs.) Amount in Rs.

1 Public Provident Fund Copy of Payment Receipt / Passbook

2 Life Insurance Premium:- Pension Plan & ULIP Copy of Premium Payment Receipt

3 Repayment of Housing Loan Principal Certificate from Bank / Financial Institution

4 Stamp duty, Registration fee and other expenses for the purpose Stamp Duty Receipt from Registration Authority

of transfer of such house property to the assessee

5 Mutual Fund (Equity) (Sec. 10(23D)) Statement of Holding

1,50,000/-

6 NSC Purchased during the year Copy of NSC Certificate/s

7 Interest on NSC Purchased Statement regarding date of purchase & amount

8 Tuition Fees (Up to Two Children) Copy of Payment Receipt from School

9 National Saving Scheme Copy of NSS Certificate/s

10 Bank Fixed Deposit (More than 5 Years) Copy of FD Receipt

11 Sukanya Samriddhi Account Copy of Deposit Receipt

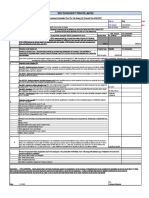

Please Note:-

1.Deduction under section 80C+80CCC+80CCD(1) cant excedds Rs 150,000/- ( Section 80CCE)

2. Deduction of Rs. 50,000/- under section 80CCD(1B) is over & above deductuon under section 80CCD(1). Thus Section 80CCE in point 1. above will not applicable to this deduction.

3. Provided No Deduction under section 80CCD(1B) shall be allowed in respect of the amount on which a deduction has been claimed and allowed u/s 80CCD(1)

4. Deduction u/s 80D shall be allowed only if the payment is made by any mode other than cash. Exception is only for amount paid for Preventive health check up.

5. Maximum Deduction u/s 80D shall be allowed only upto RS 30,000/- in case point 5 & 7 AND RS 25,000/- in any other case.

6. For Inerest on housing loan:- provided such acquisition or construction is completed within [three] years from the end of the financial year in which capital was borrowed.

DECLARATION

I, declare that the above statement is true to the best of my knowledge and belief. In the event of any change that may occur during the year pertaining to the information

given in the form, I undertake to inform the same to the company. Income Tax liability arising due to failure, if any, for not making / not intimating payment / investment

made or proposed to be made by me and / or any wrong declaration would be my responsibility.

I further undertake to provide all documentary proofs of payment made by me before 15th Febuary 2018 and if I fail to do so, the company can make full

deduction of income tax dues from Febuary 2018 & March 2018 salary.

For Any Queries

Date : ___________________________ Please Conatct:- ______________________________

Sahil Sachdeva Sign. of the Employee

(Finance Analyst)

(+91) 7876073737

Вам также может понравиться

- BUFIN ITDeclarationFormДокумент2 страницыBUFIN ITDeclarationFormdpfsopfopsfhopОценок пока нет

- Investment GuidelinesДокумент20 страницInvestment GuidelinesGarima2009Оценок пока нет

- CFP Theory MaterialДокумент45 страницCFP Theory MaterialShobhit KumarОценок пока нет

- Guidelines For Investment Proof Submission 2018-19Документ7 страницGuidelines For Investment Proof Submission 2018-19AsifОценок пока нет

- Investment Declaration Form FY 2019-20 v2Документ5 страницInvestment Declaration Form FY 2019-20 v2Rehan ElectronicsОценок пока нет

- Guidelines For Investment Proofs FY23Документ16 страницGuidelines For Investment Proofs FY23Mani Paul Chinnam (Michy)Оценок пока нет

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Документ3 страницыEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaОценок пока нет

- IT DeclarationДокумент2 страницыIT Declarationummar farooqОценок пока нет

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationДокумент1 страницаThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantОценок пока нет

- Employee Tax Declaration - FY 22-23-DBMPДокумент3 страницыEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023Оценок пока нет

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Документ2 страницыArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050Оценок пока нет

- Tax Decalaration 2023-24Документ3 страницыTax Decalaration 2023-24thetrilight2023Оценок пока нет

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Документ3 страницы(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredОценок пока нет

- Investment Declaration Form - 2022-2023Документ3 страницыInvestment Declaration Form - 2022-2023Bharathi KОценок пока нет

- IT Declaration Form 2019-20Документ1 страницаIT Declaration Form 2019-20KarunaОценок пока нет

- PL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)Документ3 страницыPL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)TA ED,SafetyОценок пока нет

- Deductions On Section 80CДокумент12 страницDeductions On Section 80CViraja GuruОценок пока нет

- Investment Declaration Form-2Документ2 страницыInvestment Declaration Form-2Pramod KumarОценок пока нет

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Документ4 страницыOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BОценок пока нет

- Investment Declaration Form F.Y 2023-24Документ4 страницыInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Taxation Ce2Документ10 страницTaxation Ce2Ratnesh PalОценок пока нет

- Bifurcation of Salary ArrearsДокумент3 страницыBifurcation of Salary ArrearsSrikant SheelОценок пока нет

- Investment Declaration Form For FY - 2017-18Документ2 страницыInvestment Declaration Form For FY - 2017-18arunОценок пока нет

- Pensioners - IT Declaration Form - Annexure1Документ3 страницыPensioners - IT Declaration Form - Annexure1Sudeep MitraОценок пока нет

- Atria Institute of TechnologyДокумент3 страницыAtria Institute of TechnologykiranОценок пока нет

- Investment Proof Guidelines - Fy 2021-22Документ14 страницInvestment Proof Guidelines - Fy 2021-22vibha sharmaОценок пока нет

- Guidelines For Investment Proof PDFДокумент2 страницыGuidelines For Investment Proof PDFsamuraioo7Оценок пока нет

- Net Income How To Calculate Net Income in Income TaxДокумент34 страницыNet Income How To Calculate Net Income in Income TaxSeetha SenthilОценок пока нет

- DeductionsДокумент11 страницDeductionsguest1Оценок пока нет

- Saving Form-Income Tax 12-13Документ9 страницSaving Form-Income Tax 12-13khaleel887Оценок пока нет

- Chapter 12 TaxdeductionsДокумент16 страницChapter 12 TaxdeductionsRiya SharmaОценок пока нет

- WLT Proof Form - 2022Документ2 страницыWLT Proof Form - 2022Jebis DosОценок пока нет

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsДокумент4 страницыFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiОценок пока нет

- IT DeclarationДокумент5 страницIT Declarationkalpanagupta_purОценок пока нет

- Some of The Tax Saving SavingsДокумент3 страницыSome of The Tax Saving SavingsNira SinhaОценок пока нет

- Employee Tax Declaration - AY 2019-20Документ1 страницаEmployee Tax Declaration - AY 2019-20mathuОценок пока нет

- AIL-Investment Declaration Form 2013-2014Документ2 страницыAIL-Investment Declaration Form 2013-2014G A PATELОценок пока нет

- Investment PlanДокумент1 страницаInvestment PlanNitin AgarwalОценок пока нет

- DeductionsДокумент7 страницDeductionsManjeet KaurОценок пока нет

- Tax Declaration Form 2021 22Документ4 страницыTax Declaration Form 2021 22Kasiviswanathan ChinnathambiОценок пока нет

- ClubbingДокумент8 страницClubbingSiddharth VaswaniОценок пока нет

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherДокумент6 страницMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yОценок пока нет

- Employees Declaration For IncomeДокумент1 страницаEmployees Declaration For Incomehareesh13hОценок пока нет

- Employee Declaration Form 15Документ4 страницыEmployee Declaration Form 15Bliss BilluОценок пока нет

- Income Tax Material: Unit 9 - DeductionsДокумент9 страницIncome Tax Material: Unit 9 - DeductionsKARAN WADHWA 2012168Оценок пока нет

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledДокумент2 страницыSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarОценок пока нет

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenДокумент8 страницInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaОценок пока нет

- D COMPUTATION OF TOTAL INCOME (TAX) LatestДокумент6 страницD COMPUTATION OF TOTAL INCOME (TAX) LatestOmkar NakasheОценок пока нет

- Section Deduction On Allowed Limit (Maximum) FY 2018-19Документ3 страницыSection Deduction On Allowed Limit (Maximum) FY 2018-19Praveen kumarОценок пока нет

- Unit 4 Deductions From Gross Total IncomeДокумент31 страницаUnit 4 Deductions From Gross Total IncomeDisha GuptaОценок пока нет

- Employee Tax Declaration - AY 2019-20Документ4 страницыEmployee Tax Declaration - AY 2019-20mathuОценок пока нет

- FormДокумент40 страницFormSundar PabbareddyОценок пока нет

- Investment Declaration Form - 2021-22Документ3 страницыInvestment Declaration Form - 2021-22rajamani balajiОценок пока нет

- Deductions From Gross Total IncomeДокумент4 страницыDeductions From Gross Total Income887 shivam guptaОценок пока нет

- Auto Income Tax Calculator Version 5.1 2010-11Документ19 страницAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyОценок пока нет

- Deductions 2021 22Документ5 страницDeductions 2021 22Karan RajakОценок пока нет

- Investment Declaration Form - FY 2023-24Документ2 страницыInvestment Declaration Form - FY 2023-24kunal singhОценок пока нет

- Setting up, operating and maintaining Self-Managed Superannuation FundsОт EverandSetting up, operating and maintaining Self-Managed Superannuation FundsОценок пока нет

- The Lion and The Boar Story EnglishДокумент2 страницыThe Lion and The Boar Story EnglishKemal AmarullahОценок пока нет

- Internship Proposal FormДокумент3 страницыInternship Proposal FormMuhammad FidaОценок пока нет

- Small Incision Cataract SurgeryДокумент249 страницSmall Incision Cataract SurgeryAillen YovitaОценок пока нет

- Project Proposal Environmental Protection Program-DeNRДокумент57 страницProject Proposal Environmental Protection Program-DeNRLGU PadadaОценок пока нет

- 1 SAP HCM Overview - IntroductionДокумент32 страницы1 SAP HCM Overview - IntroductionashwiniОценок пока нет

- STAS 111 - Information AgeДокумент20 страницSTAS 111 - Information AgeMayeee GayosoОценок пока нет

- Consumer Information On Proper Use of YogaДокумент168 страницConsumer Information On Proper Use of Yogaskwycb04Оценок пока нет

- Of Gods, Glyphs and KingsДокумент24 страницыOf Gods, Glyphs and KingsBraulioОценок пока нет

- Job Board Week WhituДокумент5 страницJob Board Week WhituAnonymous MZh1KUUXОценок пока нет

- Soal Materi 1 KLS X IntroductionДокумент2 страницыSoal Materi 1 KLS X IntroductionFira AnandaОценок пока нет

- Activity 9 Let's Check and Let's AnalyzeДокумент3 страницыActivity 9 Let's Check and Let's AnalyzeJean Tronco100% (5)

- Regional Trial Court National Capital Judicial Region: ComplainantДокумент5 страницRegional Trial Court National Capital Judicial Region: ComplainantNeil Patrick QuiniquiniОценок пока нет

- Es PS 0614Документ6 страницEs PS 0614陳相如Оценок пока нет

- ReportДокумент6 страницReportLâmViênОценок пока нет

- Name: - Date: - Week/s: - 2 - Topic: Examining Trends and FadsДокумент3 страницыName: - Date: - Week/s: - 2 - Topic: Examining Trends and FadsRojelyn Conturno100% (1)

- Natural Gas DistributionДокумент46 страницNatural Gas DistributionscribdmisraОценок пока нет

- Projects & Operations: IN: NE Power Systm ImprvmДокумент5 страницProjects & Operations: IN: NE Power Systm ImprvmGaurang PatelОценок пока нет

- The Appropriate Biochemical Oxygen Demand Concentration For Designing Domestic Wastewater Treatment PlantДокумент8 страницThe Appropriate Biochemical Oxygen Demand Concentration For Designing Domestic Wastewater Treatment PlantabdulОценок пока нет

- Region XiДокумент2 страницыRegion XiGarcia, Rafael Rico O.Оценок пока нет

- 1.2 Introduction To PHP - PHP KeywordsДокумент12 страниц1.2 Introduction To PHP - PHP KeywordsOvie Nur FaizahОценок пока нет

- Shyla Jennings Ebook FinalДокумент17 страницShyla Jennings Ebook FinalChye Yong HockОценок пока нет

- Report End of Chapter 1Документ4 страницыReport End of Chapter 1Amellia MaizanОценок пока нет

- Mutants Genetic Gladiators Hack PDFДокумент2 страницыMutants Genetic Gladiators Hack PDFFercho GarciaОценок пока нет

- Marketing Scales HandbookДокумент27 страницMarketing Scales Handbookhasib_ahsanОценок пока нет

- Expanding The Product Range of Leena by Bata (Report)Документ104 страницыExpanding The Product Range of Leena by Bata (Report)Rabya TauheedОценок пока нет

- South WestДокумент1 страницаSouth WestDarren RadonsОценок пока нет

- RLB Procuring For Value 18 July PDFДокумент56 страницRLB Procuring For Value 18 July PDFDaniel LixandruОценок пока нет

- Moatiz Riaz - Area Sales ManagerДокумент1 страницаMoatiz Riaz - Area Sales ManagerMoatiz RiazОценок пока нет

- PoGo GymDef Cheat SheetДокумент1 страницаPoGo GymDef Cheat SheetFerni Panchito VillaОценок пока нет

- Markets and Commodity Figures: Total Market Turnover StatisticsДокумент6 страницMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupОценок пока нет