Академический Документы

Профессиональный Документы

Культура Документы

2010122310125314625monthly Taxdeduction Statement 2008

Загружено:

Wajahat GhafoorОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2010122310125314625monthly Taxdeduction Statement 2008

Загружено:

Wajahat GhafoorАвторское право:

Доступные форматы

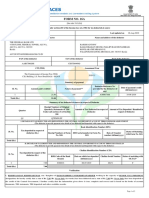

Part X

Monthly Statement of Collection or Deduction of Income Tax Page No. ____ of ________

Section 165 (2)

[ See rule 44(2) ] Year Month

Particulars of withholding agent/payer/collector LTU/RTO

NTN/ FTN ______________________ Address : ____________________________________________________________________________________________ (in block letters

Name of Withholding Agent Telephone:_________________ Fax:__________________________ E-Mail

Details of payment etc. where tax has been collected, deducted, short deducted or not deducted at source

Particulars of Person from whom tax collected/ deducted Particulars of Payment Made Particulars of Tax Paid Reasons, if Tax Not Collected/ Deducted

Taxpayer Id. Value/ Amount on Exemption Certificate

Payment Date of which tax Amount of Tax Date of Tax

ID CNIC/NTN/ Phone/ Nature of Payment Section Payment collectabl or Rate of Tax Collected or Amount of Tax Deposit

Sr. Type Mobile Number/PP Name Address etc. Code dd/mm/yyyy deductable (%) Deducted Deposited dd/mm/yyyy CPR Number Section of Law Number Date Issuing Authority

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) (16) (17) (18)

(2) Taxpayer Id. N => NTN, C=> CNIC, P => Passport No. (only for Non-Residents), T => Telephone/Mobile Phone No. TOTAL

I, _____________________________holder of CNIC No________________________ in my capacity as Self / Member or Partner of Association of Persons / Principal Officer / Trustee / Representative of the Withholding Agent named above (tick the relavent) do hereby solemnly declare

that to the best of my knowledge and belief the information given in this Statement is correct, complete and in accordance with the provisions of the Income Tax Ordinance, 2001 and Income Tax Rules, 2002. I further certifiy that the amount of chargeable salary indicated against each

employee has been determined / calculated, keeping in view the provisions of the Income Tax Ordinance 2001 and Income Tax Rules, 2002.

Date _________________ (dd/mm/yyyy) Signature

Вам также может понравиться

- UTI - New Editable Transaction Application Form For Purchase Redemption and SwitchДокумент2 страницыUTI - New Editable Transaction Application Form For Purchase Redemption and SwitchAnilmohan Sreedharan0% (1)

- Obligation Request and Status: Appendix 11Документ2 страницыObligation Request and Status: Appendix 11Rogie ApoloОценок пока нет

- NEFT MandateДокумент1 страницаNEFT MandateAyan ParuiОценок пока нет

- DISBURSEMENT REQUEST FORM - V4.1revisedДокумент2 страницыDISBURSEMENT REQUEST FORM - V4.1revisedAnshul RastogiОценок пока нет

- Syllabus On Statutory ConstructionДокумент3 страницыSyllabus On Statutory ConstructionWajahat GhafoorОценок пока нет

- Obligation Request and Status Budget Utilization Request and StatusДокумент2 страницыObligation Request and Status Budget Utilization Request and StatusKatrina SedilloОценок пока нет

- Cos Jo Annex A1 Sample-TemplateДокумент1 страницаCos Jo Annex A1 Sample-TemplateGamy Glazyle100% (1)

- Application Form Business Permit UnifiedДокумент2 страницыApplication Form Business Permit UnifiedNameless DevelopmentОценок пока нет

- Monthly Billing Statement: Account InformationДокумент2 страницыMonthly Billing Statement: Account Informationarianne Dela cruz100% (1)

- Lessee Information StatementДокумент4 страницыLessee Information StatementDarryl Jay Medina67% (3)

- Abc Elementary School: Purchase OrderДокумент16 страницAbc Elementary School: Purchase OrderRexell MaybuenaОценок пока нет

- To Be Filled Up by The Licensee (For Payment) or by Concerned Licensing Branch (In Case of Bank Guarantee Proceeds)Документ1 страницаTo Be Filled Up by The Licensee (For Payment) or by Concerned Licensing Branch (In Case of Bank Guarantee Proceeds)khushroo aliОценок пока нет

- To Be Filled Up by The Licensee (For Payment) or by Concerned Licensing Branch (In Case of Bank Guarantee Proceeds)Документ1 страницаTo Be Filled Up by The Licensee (For Payment) or by Concerned Licensing Branch (In Case of Bank Guarantee Proceeds)khushroo aliОценок пока нет

- To Be Filled Up by The Licensee (For Payment) or by Concerned Licensing Branch (In Case of Bank Guarantee Proceeds)Документ1 страницаTo Be Filled Up by The Licensee (For Payment) or by Concerned Licensing Branch (In Case of Bank Guarantee Proceeds)khushroo aliОценок пока нет

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NДокумент6 страниц(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashОценок пока нет

- Annex C of Rmo On TadДокумент1 страницаAnnex C of Rmo On TadChaОценок пока нет

- TDS Form 16 & 16AДокумент14 страницTDS Form 16 & 16AVaibhav NagoriОценок пока нет

- Rmo 29-2014 Annex AДокумент1 страницаRmo 29-2014 Annex AteekeiseeОценок пока нет

- Annex F - Cancelled LAs-TVNsДокумент2 страницыAnnex F - Cancelled LAs-TVNsJoel SyОценок пока нет

- Proof of Debt FormДокумент2 страницыProof of Debt FormRyanHartonoОценок пока нет

- Please Read The Notes Overleaf Before Completing This FormДокумент2 страницыPlease Read The Notes Overleaf Before Completing This FormTnes 1995Оценок пока нет

- Itax Form 2006Документ4 страницыItax Form 2006AliMuzaffarОценок пока нет

- CP 139 FormДокумент1 страницаCP 139 FormghaniОценок пока нет

- GH DepotДокумент12 страницGH DepotNormelita S. Dela CruzОценок пока нет

- Agent Link FormДокумент1 страницаAgent Link Formmaia quevedoОценок пока нет

- Form GST PMT 01Документ4 страницыForm GST PMT 01Akash KamathОценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToRajesh AntonyОценок пока нет

- Form No. 16A (See Rule31 (L) (B) )Документ4 страницыForm No. 16A (See Rule31 (L) (B) )Nirmal MalooОценок пока нет

- FM-FN-304 - Customer Profile Maintenance Form 022619Документ2 страницыFM-FN-304 - Customer Profile Maintenance Form 022619Lester OrbeОценок пока нет

- Acceptance Payment Form: Tax Amnesty On DelinquenciesДокумент1 страницаAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonОценок пока нет

- TJSB Neft RTGS FormДокумент1 страницаTJSB Neft RTGS FormGreta BathwareОценок пока нет

- BillingStatement - JO-ANN V. ESTEBANДокумент2 страницыBillingStatement - JO-ANN V. ESTEBANJo-Ann Chan ValleОценок пока нет

- Application For Registration (Federation - National Union) With ChecklistДокумент3 страницыApplication For Registration (Federation - National Union) With ChecklistErica ParamioОценок пока нет

- Return 2008Документ73 страницыReturn 2008sahil-ujОценок пока нет

- Annex CДокумент1 страницаAnnex CJoel SyОценок пока нет

- Form 16a - TDS - Blank 16aДокумент1 страницаForm 16a - TDS - Blank 16aJayОценок пока нет

- 1a. Refund Formats17052017 Revised3 28Документ28 страниц1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaОценок пока нет

- Income Tax Payment Challan: PSID #: 165866486Документ1 страницаIncome Tax Payment Challan: PSID #: 165866486Ashok KumarОценок пока нет

- Customer Request Form - CLGДокумент1 страницаCustomer Request Form - CLGtheblueflame21Оценок пока нет

- RMC No. 73-2019 - Annex BДокумент2 страницыRMC No. 73-2019 - Annex BLeo R.Оценок пока нет

- MO W-4 Employee's Withholding Certificate: Reset Form Print FormДокумент1 страницаMO W-4 Employee's Withholding Certificate: Reset Form Print FormAmina chahalОценок пока нет

- Annual Statement of Collection or Deduction of Income Tax (Other Than From Salary) (See Rule 44 (1) )Документ1 страницаAnnual Statement of Collection or Deduction of Income Tax (Other Than From Salary) (See Rule 44 (1) )Sajid GillaniОценок пока нет

- Certificate of Collection or Deduction of Tax: (See Rule 42)Документ1 страницаCertificate of Collection or Deduction of Tax: (See Rule 42)Ali ButtОценок пока нет

- Canara Rebecco Page 2Документ1 страницаCanara Rebecco Page 2nirajthacker93620Оценок пока нет

- Report of Collections and Deposits: AppendixДокумент3 страницыReport of Collections and Deposits: Appendixhehehedontmind me100% (1)

- UTIMF Transaction SlipДокумент2 страницыUTIMF Transaction SlipVinayak SavanurОценок пока нет

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Документ3 страницыD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarОценок пока нет

- UTI Transaction SlipДокумент2 страницыUTI Transaction SlipSanjay Puri0% (1)

- Adjustable Tax-PSIDДокумент1 страницаAdjustable Tax-PSIDWaris Corp.Оценок пока нет

- 0002 Payment Certificate 2010Документ3 страницы0002 Payment Certificate 2010SreedharanPNОценок пока нет

- BIR Abatement FormДокумент1 страницаBIR Abatement FormJecky Delos ReyesОценок пока нет

- It 000129964508 2022 11Документ1 страницаIt 000129964508 2022 11SkjhkjhkjhОценок пока нет

- Annex B - Cortt FormДокумент3 страницыAnnex B - Cortt FormJaniceОценок пока нет

- CORTT Form (BIR)Документ3 страницыCORTT Form (BIR)jane calipayОценок пока нет

- Endorsement Instruction Form - ETB - v1.0 - 20140617 Final PDFДокумент2 страницыEndorsement Instruction Form - ETB - v1.0 - 20140617 Final PDFSyahril Adzim Md RejabОценок пока нет

- Appendix 34 - CkADADRecДокумент4 страницыAppendix 34 - CkADADReccabanbanan nhsОценок пока нет

- Application Form For Outward Remittance From Nre AccountДокумент1 страницаApplication Form For Outward Remittance From Nre AccountArjun WadhawanОценок пока нет

- Obligation Request (ObR)Документ2 страницыObligation Request (ObR)Lester CuanicoОценок пока нет

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- British Virgin IslandsДокумент7 страницBritish Virgin IslandsWajahat GhafoorОценок пока нет

- The World Factbook: O C e A N S:: Atlantic OceanДокумент5 страницThe World Factbook: O C e A N S:: Atlantic OceanWajahat GhafoorОценок пока нет

- The World Factbook: South Asia:: BhutanДокумент12 страницThe World Factbook: South Asia:: BhutanWajahat GhafoorОценок пока нет

- The World Factbook: Europe:: BelarusДокумент13 страницThe World Factbook: Europe:: BelarusWajahat Ghafoor100% (1)

- The World Factbook: Australia-Oceania:: BakerislandДокумент1 страницаThe World Factbook: Australia-Oceania:: BakerislandWajahat GhafoorОценок пока нет

- The World Factbook: Central America and Caribbean:: AnguillaДокумент6 страницThe World Factbook: Central America and Caribbean:: AnguillaWajahat GhafoorОценок пока нет

- The World Factbook: Oceans:: ArcticoceanДокумент4 страницыThe World Factbook: Oceans:: ArcticoceanWajahat GhafoorОценок пока нет

- Central America and Caribbean:: Aruba: (Part of The Kingdom of The Netherlands)Документ8 страницCentral America and Caribbean:: Aruba: (Part of The Kingdom of The Netherlands)Wajahat GhafoorОценок пока нет

- Sindhi Solved MCQs 2000-2012Документ16 страницSindhi Solved MCQs 2000-2012Wajahat GhafoorОценок пока нет

- Qbs em Complementary Political Science PartДокумент26 страницQbs em Complementary Political Science PartWajahat GhafoorОценок пока нет

- The World Factbook: Antarctica:: AntarcticaДокумент6 страницThe World Factbook: Antarctica:: AntarcticaWajahat GhafoorОценок пока нет

- Nikhat Sattar Islamic ArticlesДокумент20 страницNikhat Sattar Islamic ArticlesWajahat GhafoorОценок пока нет

- LAW 323-Tax Law-Asim Zulfiqar-Akhtar AliДокумент7 страницLAW 323-Tax Law-Asim Zulfiqar-Akhtar AliWajahat GhafoorОценок пока нет

- FPOE-Tentative Schedule PDFДокумент1 страницаFPOE-Tentative Schedule PDFWajahat GhafoorОценок пока нет

- Office of The District and Sessions Judge, Sukkur: Publication NoticeДокумент1 страницаOffice of The District and Sessions Judge, Sukkur: Publication NoticeWajahat GhafoorОценок пока нет