Академический Документы

Профессиональный Документы

Культура Документы

Chapter 1 Solution

Загружено:

abeera0 оценок0% нашли этот документ полезным (0 голосов)

5 просмотров3 страницыafm

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документafm

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

5 просмотров3 страницыChapter 1 Solution

Загружено:

abeeraafm

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

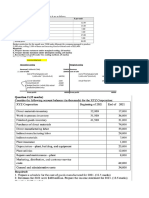

CHAPTER 1 EXERCISES

Q.1-6 AVAILABLE FOR SALES

ITEM TOT P.U.

4 20,000 5,000 PER UNIT = 20,000 / 4

REVENUE

SALES 2 UNITS @ 6,000 12,000

EXPENSES

COST OF GOODS SOLD @ 5,000 10,000

LOSS

2 UNITS @ 5,000 10,000

Q.1-7 PLAN-1 PLAN-2

PRODUCTION IN UNITS 4,500 7,200

FIXED COST 20,000 20,000

VARIABLE COST @ 2.25 P.U. 10,125 16,200

TOTAL PRODUCTION COST 30,125 36,200

Q.1-9 PRIME COST

DIRECT MATERIAL 25,000

DIRECT LABOR 30,000

55,000

CONVERSION COST

DIRECT LABOR 30,000

FOH (OTHER) 15,000

INDIRECT MATERIAL 5,000

INDIRECT LABOR 4,500

TOTAL FOH 24,500

54,500

PRODUCT COST

DIRECT MATERIAL 25,000

DIRECT LABOR 30,000

FOH 24,500

79,500

Q.1-12 COMPUTATION OF FIXED COST OF GOODS SOLD

TOTAL COGS FOR 800 UNITS 40,000

LESS: VAR COGS (800 X 35) 28,000

FIXED COST OF GOODS SOLD 12,000

COMPUTATION OF FIXED OPERATING EXPENSES

TOTAL OPERATING EXP FOR 800 UNITS 10,000

LESS: VAR OPERATING EXP (800 X 5) 4,000

FIXED OPERATING EXP 6,000

TRIPPLED SALES = EXISTING SALES X 3 = 800 X 3 = 2,400

PROJECTED INCOME STATEMENT FOR 2,400 UNITS

SALES 2,400 UNITS @ 90 216,000

LESS: COST OF GOODS SOLD

FIXED COGS 12,000

VARIABLE COGS (2,400 X 35) 84,000

TOTAL COGS 96,000

GROSS PROFIT 120,000

LESS: OPERATING EXPENSES

FIXED OPERATING EXP 6,000

VARIABLE OPERATING EXP (2,400 X 5) 12,000

TOTAL OPERATING COST 18,000

OPERATING INCOME 102,000

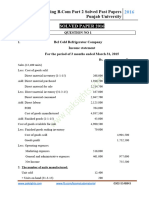

CHAPTER 1 PROBLEMS

P. 1-1 PRIME COST

DIRECT MATERIAL 78,000

DIRECT LABOR (71,500 - 12,000) 59,500

137,500

PRODUCT COST

DIRECT MATERIAL 78,000

DIRECT LABOR (71,500 - 12,000) 59,500

FOH (DEP) 50,000

INDIRECT MATERIAL (82,000 -78,000) 4,000

INDIRECT LABOR 12,000

TOTAL FOH 66,000

203,500

CONVERSION COST

DIRECT LABOR 59,500

FOH 66,000

125,500

PERIOD COSTS

SELLING,GENERAL & ADMN EXP 62,700

P.1-2 COST OF GOODS MANUFACTURED 300,000

PRODUCTION IN UNITS 75,000

UNIT COST (300,000 / 75,000) 4.00

MULTILE STEP INCOME STATEMENT

SALES 59,000 UNITS @ 5 PER UNIT 295,000

LESS: COST OF GOODS SOLD (59,000 X 4) 236,000

GROSS PROFIT 59,000

LESS: LOSS ON DEFECTIVE UNITS (2,000 X 4) 8,000

NET INCOME 51,000

P.1-4 PRIME COST

DIRECT MATERIAL (375,000 X 80%) 300,000

DIRECT LABOR (400,000 X 65%) 260,000

560,000

PRODUCT COST

DIRECT MATERIAL (375,000 X 80%) 300,000

DIRECT LABOR (400,000 X 65%) 260,000

FOH

INDIRECT MATERIAL (375,000 X 20%) 75,000

INDIRECT LABOR (400,000 X 35%) 140,000

HEAT, LIGHT & POWER 160,000

DEPRECIATION 45,000

PROPERTY TAX 85,000

REPAIRS & MAINTENANCE 20,000

TOTAL FOH 525,000

1,085,000

CONVERSION COST

DIRECT LABOR 260,000

FOH 525,000

785,000

PERIOD COSTS

SELLING EXP 125,000

GENERAL & ADMN EXP 80,000

205,000

P.1-7 TOTAL SALES IN DOZEN 100,000

TOTAL COST OF GOODS SOLD 40,000

LESS: FIXED COGS 10,000

VARIABLE COST OF GOODS SOLD 30,000

TOTAL OPERATING EXPENSES 50,000

LESS: FIXED OPERATING EXPENSES 25,000

VARIABLE OPERATING EXP 25,000

CONTRIBUTION MARGIN INCOME STATEMENT

SALES (100,000 DOZEN @0.60 PER DOZEN) 60,000

LESS: VARIABLE COST

VARIABLE COST OF GOODS SOLD 30,000

VARIABLE OPERATING EXP 25,000

55,000

CONTRIBUTION MARGIN 5,000

LESS: FIXED COST

FIXED COGS 10,000

FIXED OPERATING EXPENSES 25,000

35,000

OPERATING LOSS (30,000)

Вам также может понравиться

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- Chapter 2 SolutionДокумент19 страницChapter 2 SolutionabeeraОценок пока нет

- Cost AccountingДокумент39 страницCost AccountingNadir ParachaОценок пока нет

- 9.1 Solution - Standard CostingДокумент3 страницы9.1 Solution - Standard CostingKendall Anne MendozaОценок пока нет

- COSMAN2 Final ExamДокумент18 страницCOSMAN2 Final ExamRIZLE SOGRADIELОценок пока нет

- Chater 5Документ9 страницChater 5Shania LiwanagОценок пока нет

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoДокумент7 страницDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaОценок пока нет

- Marginal Costing Values Inventory at The Total Variable Production Cost of A UnitДокумент3 страницыMarginal Costing Values Inventory at The Total Variable Production Cost of A UnitNiomi GolraiОценок пока нет

- Practical Accounting Problems 2 SolutionsДокумент9 страницPractical Accounting Problems 2 SolutionsJimmyChaoОценок пока нет

- Assignment 1 M.Rabi Ijaz 10678Документ23 страницыAssignment 1 M.Rabi Ijaz 10678Rabi IjazОценок пока нет

- CostconДокумент33 страницыCostconDanica VillaganteОценок пока нет

- Cost Sheet of Dalia (Broken Wheat)Документ15 страницCost Sheet of Dalia (Broken Wheat)bhaskar banerjeeОценок пока нет

- Variable and Absorption CostingДокумент11 страницVariable and Absorption CostingJohn Anjelo MoraldeОценок пока нет

- CostingДокумент6 страницCostingLove IslamОценок пока нет

- Variableabsorption CostingДокумент77 страницVariableabsorption Costingandrea arapocОценок пока нет

- Local Media1729003455024620414Документ8 страницLocal Media1729003455024620414Jovie LynnОценок пока нет

- Gestión Contable - T5 CASO IIДокумент2 страницыGestión Contable - T5 CASO IIKenneth MosqueraОценок пока нет

- Flexible Budget Examples (Chapter 18)Документ9 страницFlexible Budget Examples (Chapter 18)Muhammad azeemОценок пока нет

- 7Документ8 страниц7Indu DahalОценок пока нет

- Accounting Chapter 06 Full SolutionДокумент15 страницAccounting Chapter 06 Full SolutionAsadullahil GalibОценок пока нет

- Book 1Документ12 страницBook 1Vincent Luigil AlceraОценок пока нет

- Prachi and VithikaДокумент15 страницPrachi and Vithikabhaskar banerjeeОценок пока нет

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyДокумент6 страницJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacОценок пока нет

- Tut 8 - Management AccountingДокумент29 страницTut 8 - Management AccountingTao LoheОценок пока нет

- CT SS For Student Apr2019Документ5 страницCT SS For Student Apr2019Nabila RosmizaОценок пока нет

- 2) Solution To Problem No 2 On Flexible BudgetДокумент7 страниц2) Solution To Problem No 2 On Flexible BudgetVikas guptaОценок пока нет

- Act.4-8 Ae23Документ6 страницAct.4-8 Ae23Damian Sheila MaeОценок пока нет

- Absorption Costing vs. Variable CostingДокумент8 страницAbsorption Costing vs. Variable CostingShaira GampongОценок пока нет

- Problem 2-14 Product Cost Sunk Cost Direct LaborДокумент8 страницProblem 2-14 Product Cost Sunk Cost Direct LaborarijitmajeeОценок пока нет

- Problem 2-29Документ6 страницProblem 2-29Love IslamОценок пока нет

- Costing Systems - Lessons ExamplesДокумент15 страницCosting Systems - Lessons ExamplesNicolasОценок пока нет

- Task Performance - Managerial AccountingДокумент4 страницыTask Performance - Managerial AccountingJenОценок пока нет

- Standard Costing - 08 January 2022Документ6 страницStandard Costing - 08 January 2022Emmanuel VillafuerteОценок пока нет

- (Mas) Week1 Solutions ManualДокумент17 страниц(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Chapter 1-3Документ21 страницаChapter 1-3Alexsandra GarciaОценок пока нет

- Chapter 14 AnswersevenДокумент4 страницыChapter 14 AnswersevenJulianne Mejia100% (1)

- Ch8 PDFДокумент11 страницCh8 PDFGiang NguyenОценок пока нет

- MA1 Sample of Midterm TestДокумент4 страницыMA1 Sample of Midterm TestLoan VũОценок пока нет

- CMA Garrison SuggestedSolutions Chap2Документ12 страницCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHОценок пока нет

- MAS-03 WorksheetДокумент32 страницыMAS-03 WorksheetPaupauОценок пока нет

- CAC Computations Chap 4 1 20Документ9 страницCAC Computations Chap 4 1 20rochelle lagmayОценок пока нет

- Variable Cost Tools: As A DecisionДокумент17 страницVariable Cost Tools: As A DecisionTusif Islam RomelОценок пока нет

- Q3 SolutionДокумент1 страницаQ3 SolutionSuhani JainОценок пока нет

- Raw Material ConsumedДокумент5 страницRaw Material ConsumedPrithviraj PadgalwarОценок пока нет

- Tutorial 1 - Topic 4 - OAR - QДокумент6 страницTutorial 1 - Topic 4 - OAR - QJong HannahОценок пока нет

- EE Financial ProjectionsДокумент2 страницыEE Financial Projectionsnishatmridula06Оценок пока нет

- Mock Exam QuestionДокумент11 страницMock Exam QuestionSubmission PortalОценок пока нет

- Manac3 Main Exam Memo June 2023Документ9 страницManac3 Main Exam Memo June 2023LuciaОценок пока нет

- Budget SolutionДокумент19 страницBudget Solutionmohammad bilalОценок пока нет

- ABsorption Variable COSTINGДокумент12 страницABsorption Variable COSTINGNaman SinghОценок пока нет

- 36 - Problems On Cost Sheet1Документ5 страниц36 - Problems On Cost Sheet1pat_poonam0% (1)

- Cost Accounting: C S F EOQДокумент6 страницCost Accounting: C S F EOQShehrozSTОценок пока нет

- Charles AKMENДокумент11 страницCharles AKMENCharles GohОценок пока нет

- Budgeted Statement ExamДокумент11 страницBudgeted Statement ExamNelz KhoОценок пока нет

- Strategic Cost Management 101Документ8 страницStrategic Cost Management 101Hoope JisonОценок пока нет

- Cost Accounting Adc Bcom Part 2 Solved Past Paper 2016Документ8 страницCost Accounting Adc Bcom Part 2 Solved Past Paper 2016Imran JuttОценок пока нет

- COGS Practise Questions 2 SolutionДокумент13 страницCOGS Practise Questions 2 SolutionBisma ShahabОценок пока нет

- Variable and Absorption CostingДокумент52 страницыVariable and Absorption CostingcruzchristophertangaОценок пока нет

- Cost and Management AccountingДокумент7 страницCost and Management AccountingJoseph PhaustineОценок пока нет

- PresentationДокумент5 страницPresentationabeeraОценок пока нет

- Change Magt Case StudyДокумент2 страницыChange Magt Case StudyBhavna JaiswalОценок пока нет

- Course Outline - Comp & BenefitsДокумент1 страницаCourse Outline - Comp & BenefitsabeeraОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Leadership & Team Building OutlineДокумент1 страницаLeadership & Team Building OutlineabeeraОценок пока нет

- Corporate Turnaround TheoryДокумент4 страницыCorporate Turnaround TheoryabeeraОценок пока нет

- Cost Behavior SolutionДокумент10 страницCost Behavior SolutionabeeraОценок пока нет

- Chapter 1 SolutionДокумент3 страницыChapter 1 SolutionabeeraОценок пока нет

- Chapter 1 SolutionДокумент3 страницыChapter 1 SolutionabeeraОценок пока нет

- HR MNGMT - Training Development - Gary DesslerДокумент42 страницыHR MNGMT - Training Development - Gary DesslerberitahrОценок пока нет

- 20 Zero ConditionalsДокумент5 страниц20 Zero ConditionalsabeeraОценок пока нет

- Chapter 1Документ35 страницChapter 1abeeraОценок пока нет

- Mcgraw-Hill Technology Education Mcgraw-Hill Technology EducationДокумент17 страницMcgraw-Hill Technology Education Mcgraw-Hill Technology Educationirfan900Оценок пока нет

- CH 01 Afm BasicsДокумент45 страницCH 01 Afm BasicsabeeraОценок пока нет

- Turbine Flowmeters-Commonly Asked Questions and Answers: For Chemical Composition Information.)Документ8 страницTurbine Flowmeters-Commonly Asked Questions and Answers: For Chemical Composition Information.)Alexander KlmОценок пока нет

- Paper:Introduction To Economics and Finance: Functions of Economic SystemДокумент10 страницPaper:Introduction To Economics and Finance: Functions of Economic SystemQadirОценок пока нет

- Deep Sea 500 Ats ManДокумент18 страницDeep Sea 500 Ats ManLeo Burns50% (2)

- LhiannanДокумент6 страницLhiannanGreybornОценок пока нет

- Invenio Flyer enДокумент2 страницыInvenio Flyer enErcx Hijo de AlgoОценок пока нет

- C7.5 Lecture 18: The Schwarzschild Solution 5: Black Holes, White Holes, WormholesДокумент13 страницC7.5 Lecture 18: The Schwarzschild Solution 5: Black Holes, White Holes, WormholesBhat SaqibОценок пока нет

- Case Studies InterviewДокумент7 страницCase Studies Interviewxuyq_richard8867100% (2)

- TSR 9440 - Ruined KingdomsДокумент128 страницTSR 9440 - Ruined KingdomsJulien Noblet100% (15)

- Enzymatic Hydrolysis, Analysis of Mucic Acid Crystals and Osazones, and Thin - Layer Chromatography of Carbohydrates From CassavaДокумент8 страницEnzymatic Hydrolysis, Analysis of Mucic Acid Crystals and Osazones, and Thin - Layer Chromatography of Carbohydrates From CassavaKimberly Mae MesinaОценок пока нет

- HW Chapter 25 Giancoli Physics - SolutionsДокумент8 страницHW Chapter 25 Giancoli Physics - SolutionsBecky DominguezОценок пока нет

- Service Manual: NISSAN Automobile Genuine AM/FM Radio 6-Disc CD Changer/ Cassette DeckДокумент26 страницService Manual: NISSAN Automobile Genuine AM/FM Radio 6-Disc CD Changer/ Cassette DeckEduardo Reis100% (1)

- Evidence Based Practice in Nursing Healthcare A Guide To Best Practice 3rd Edition Ebook PDFДокумент62 страницыEvidence Based Practice in Nursing Healthcare A Guide To Best Practice 3rd Edition Ebook PDFwilliam.tavares69198% (50)

- New Client QuestionnaireДокумент13 страницNew Client QuestionnairesundharОценок пока нет

- 1Документ14 страниц1Cecille GuillermoОценок пока нет

- -4618918اسئلة مدني فحص التخطيط مع الأجوبة من د. طارق الشامي & م. أحمد هنداويДокумент35 страниц-4618918اسئلة مدني فحص التخطيط مع الأجوبة من د. طارق الشامي & م. أحمد هنداويAboalmaail Alamin100% (1)

- Know Your TcsДокумент8 страницKnow Your TcsRocky SinghОценок пока нет

- Idoc - Pub - Pokemon Liquid Crystal PokedexДокумент19 страницIdoc - Pub - Pokemon Liquid Crystal PokedexPerfect SlaNaaCОценок пока нет

- LCP-027 VectraLCPDesignGuideTG AM 0613Документ80 страницLCP-027 VectraLCPDesignGuideTG AM 0613Evert100% (1)

- Preboard Practice PDFДокумент25 страницPreboard Practice PDFGracielle NebresОценок пока нет

- Trading Rules To Successful ProfitsДокумент89 страницTrading Rules To Successful ProfitsOuattaraОценок пока нет

- JLPT Application Form Method-December 2023Документ3 страницыJLPT Application Form Method-December 2023Sajiri KamatОценок пока нет

- DOMESДокумент23 страницыDOMESMukthesh ErukullaОценок пока нет

- Reflection - Reading and Writing 3Документ3 страницыReflection - Reading and Writing 3Quỳnh HồОценок пока нет

- Sample Paper Book StandardДокумент24 страницыSample Paper Book StandardArpana GuptaОценок пока нет

- Alan Freeman - Ernest - Mandels - Contribution - To - Economic PDFДокумент34 страницыAlan Freeman - Ernest - Mandels - Contribution - To - Economic PDFhajimenozakiОценок пока нет

- MJDF Mcqs - Mixed - PDFДокумент19 страницMJDF Mcqs - Mixed - PDFAyesha Awan0% (3)

- Integrated Management System 2016Документ16 страницIntegrated Management System 2016Mohamed HamedОценок пока нет

- Photoshoot Plan SheetДокумент1 страницаPhotoshoot Plan Sheetapi-265375120Оценок пока нет

- Mythology GreekДокумент8 страницMythology GreekJeff RamosОценок пока нет

- Xbox One S Retimer - TI SN65DP159 March 2020 RevisionДокумент67 страницXbox One S Retimer - TI SN65DP159 March 2020 RevisionJun Reymon ReyОценок пока нет

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditОт EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditРейтинг: 5 из 5 звезд5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 5 из 5 звезд5/5 (13)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyОт EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyРейтинг: 5 из 5 звезд5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОт EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОценок пока нет

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageОт EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageРейтинг: 4.5 из 5 звезд4.5/5 (109)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)От EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Рейтинг: 4.5 из 5 звезд4.5/5 (24)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет