Академический Документы

Профессиональный Документы

Культура Документы

RMC No. 51-2014

Загружено:

Lorenzo Balmori0 оценок0% нашли этот документ полезным (0 голосов)

60 просмотров2 страницыrrtt

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документrrtt

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

60 просмотров2 страницыRMC No. 51-2014

Загружено:

Lorenzo Balmorirrtt

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

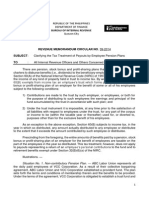

June 6, 2014

REVENUE MEMORANDUM CIRCULAR NO. 051-14

SUBJECT : Clarifying the Inurement Prohibition under Section 30 of the

National Internal Revenue Code of 1997

TO : All Internal Revenue Officers and Others Concerned

Section 30 of the National Internal Revenue Code (NIRC) of 1997, as

amended, enumerates the non-stock and/or non-profit

corporations/associations/organizations that are exempt from income tax in respect to

income received by them as such. "Non-stock" means "no part of its income is

distributable as dividends to its members, trustees, or officers" and that any profit

"obtain[ed] as an incident to its operations shall, whenever necessary or proper, be

used for the furtherance of the purpose or purposes for which the corporation was

organized" (Section 87, Corporation Code). "Non-profit" means that "no net income

or asset accrues to or benefits any member or specific person, with all the net income

or asset devoted to the institution's purposes and all its activities conducted not for

profit" (CIR vs. St. Luke's Medical Center, Inc., G.R. Nos. 195909 and 195960 dated

26 September 2012).

Therefore, in order for an entity to qualify as a non-stock and/or non-profit

corporation/association/organization exempt from income tax under Section 30 of the

NIRC, as amended, its earnings or assets shall not inure to the benefit of any of its

trustees, organizers, officers, members or any specific person. The following are

considered "inurements" of such nature:

1. The payment of compensation, salaries, or honorarium to its

trustees or organizers;

2. The payment of exorbitant or unreasonable compensation to its

employees;

3. The provision of welfare aid and financial assistance to its

members. An organization is not exempt from income tax if its

principal activity is to receive and manage funds associated with

savings or investment programs, including pension or retirement

Copyright 1994-2015 CD Technologies Asia, Inc. Taxation 2014 1

programs. This does not cover a society, order, association, or

non-stock corporation under Section 30 (C) of the NIRC providing

for the payment of life, sickness, accident and other benefits

exclusively to its members or their dependents;

4. Donation to any person or entity (except donations made to other

entities formed for the purpose/purposes similar to its own);

5. The purchase of goods or services for amounts in excess of the fair

market value of such goods or value of such services from an

entity in which one or more of its trustees, officers or fiduciaries

has an interest; and ACcTDS

6. When upon dissolution and satisfaction of all liabilities, its

remaining assets are distributed to its trustees, organizers, officers

or members. Its assets must be dedicated to its exempt purpose.

Accordingly, its constitutive documents must expressly provide

that in the event of dissolution, its assets shall be distributed to one

or more entities formed for the purpose/purposes similar to its

own, or to the Philippine government for public purpose.

All other issuances inconsistent herewith are hereby repealed or modified

accordingly.

All concerned are hereby enjoined to be guided accordingly and give this

Circular as wide a publicity as possible.

This Circular shall take effect immediately.

(SGD.) KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

Copyright 1994-2015 CD Technologies Asia, Inc. Taxation 2014 2

Вам также может понравиться

- G.R. No. 101689 Alvizo Vs SandiganbayanДокумент2 страницыG.R. No. 101689 Alvizo Vs SandiganbayanjericglennОценок пока нет

- Remedial Law (CivPro)Документ21 страницаRemedial Law (CivPro)Justin CebrianОценок пока нет

- 2021 FORECAST - Criminal LawДокумент30 страниц2021 FORECAST - Criminal LawConcia Fhynn San Jose100% (1)

- San Beda Corporation Law ReviewerДокумент29 страницSan Beda Corporation Law ReviewerMuhammad FadelОценок пока нет

- People Vs EduarteДокумент1 страницаPeople Vs EduarteCarl Philip100% (1)

- Civ Pro Introduction InigoДокумент7 страницCiv Pro Introduction InigoMyrna ValledorОценок пока нет

- Victorias Milling v. Philippine Ports AuthorityДокумент3 страницыVictorias Milling v. Philippine Ports Authoritybile_driven_opusОценок пока нет

- Answer 6 Answer 6: Accounting (Green Valley College Foundation, Inc.) Accounting (Green Valley College Foundation, Inc.)Документ16 страницAnswer 6 Answer 6: Accounting (Green Valley College Foundation, Inc.) Accounting (Green Valley College Foundation, Inc.)AJSIОценок пока нет

- Invitation LetterДокумент1 страницаInvitation LetterMohibur RahmanОценок пока нет

- Certificate of Non-Forum Shopping - ImportanceДокумент1 страницаCertificate of Non-Forum Shopping - ImportanceDO SOLОценок пока нет

- Doctrines in Labor RelationsДокумент27 страницDoctrines in Labor RelationsJoshua LaronОценок пока нет

- CrimRev Notes - Book IДокумент34 страницыCrimRev Notes - Book IAgnes Bianca MendozaОценок пока нет

- The Law On PubCorp Notes (Updated As of Nov. 7, 2014 - JCSB)Документ28 страницThe Law On PubCorp Notes (Updated As of Nov. 7, 2014 - JCSB)James Christian Ballecer100% (1)

- VAT Digest PDFДокумент31 страницаVAT Digest PDFangelicaОценок пока нет

- RMC No 67-2012Документ5 страницRMC No 67-2012evilminionsattackОценок пока нет

- 2019 Labrel 2nd ExamДокумент62 страницы2019 Labrel 2nd ExamBethany Joy AberillaОценок пока нет

- Rednotes Labor LawДокумент72 страницыRednotes Labor LawNaomi Yumi - GuzmanОценок пока нет

- OBLICON - 2nd Exam Cases - FIRST PAGEДокумент83 страницыOBLICON - 2nd Exam Cases - FIRST PAGESean LebosadaОценок пока нет

- Lawon SalesДокумент50 страницLawon SalesIanCaryTabujaraОценок пока нет

- People vs. DavaДокумент7 страницPeople vs. DavaheyoooОценок пока нет

- Perlas-Bernabe Cases SyllabusДокумент682 страницыPerlas-Bernabe Cases SyllabusKMBH100% (9)

- ObliCon Digests IIДокумент119 страницObliCon Digests IIJulius AlcantaraОценок пока нет

- Week 2: Alternative Dispute Resolution: Katarungang Pambarangay LawДокумент17 страницWeek 2: Alternative Dispute Resolution: Katarungang Pambarangay LawMonica FerilОценок пока нет

- R.A. 1125 Creating The Court of Tax AppealsДокумент6 страницR.A. 1125 Creating The Court of Tax AppealsJose Van TanОценок пока нет

- Administrative Order No. 22 (Appeals To Office of The President)Документ6 страницAdministrative Order No. 22 (Appeals To Office of The President)macel0308100% (1)

- 9 Aratea Vs COMELECДокумент5 страниц9 Aratea Vs COMELECJ CaparasОценок пока нет

- Labor HierarchyДокумент12 страницLabor HierarchyfebwinОценок пока нет

- ADR Operations Manual - AM No 01-10-05 SC - ADR GuidelinesДокумент15 страницADR Operations Manual - AM No 01-10-05 SC - ADR GuidelinesRaffy PangilinanОценок пока нет

- Rule 21-71 RocДокумент43 страницыRule 21-71 RoclawkalawkaОценок пока нет

- AAAAACompiled Poli DigestДокумент774 страницыAAAAACompiled Poli DigestVeah CaabayОценок пока нет

- Modes of Acquiring Immovable PropertyДокумент4 страницыModes of Acquiring Immovable PropertyGuidance ValueОценок пока нет

- What Is Toyota Financial ServicesДокумент3 страницыWhat Is Toyota Financial ServicesSaurabh TyagiОценок пока нет

- Requirement For Provisional RemedyДокумент5 страницRequirement For Provisional RemedyEdsel Ian S. FuentesОценок пока нет

- Labor Law CasesДокумент31 страницаLabor Law CasesFerdinand VillanuevaОценок пока нет

- Compiled Peralta SyllabusДокумент153 страницыCompiled Peralta SyllabusB-an JavelosaОценок пока нет

- Partisan PoliticalДокумент2 страницыPartisan PoliticalArmstrong BosantogОценок пока нет

- Fernando Vs Sto TomasДокумент4 страницыFernando Vs Sto TomasYram DulayОценок пока нет

- Case 21-23 Digests Doctrines (Labor Law)Документ14 страницCase 21-23 Digests Doctrines (Labor Law)Aldrin LoyolaОценок пока нет

- Commercial Law ReviewДокумент3 страницыCommercial Law ReviewElijahBactolОценок пока нет

- Mercantile LawДокумент4 страницыMercantile LawRoger Montero Jr.Оценок пока нет

- Chapter I: Bangko Sentral NG Pilipinas Law: Upplement To Aragraph A PPДокумент25 страницChapter I: Bangko Sentral NG Pilipinas Law: Upplement To Aragraph A PPsaintkarriОценок пока нет

- Art 8 Onsuco Vs Malones 604 Scra 499Документ9 страницArt 8 Onsuco Vs Malones 604 Scra 499Omar Nasseef BakongОценок пока нет

- Remedial Law ReviewerДокумент42 страницыRemedial Law ReviewerNicolo ManikadОценок пока нет

- Topacio vs. OngДокумент4 страницыTopacio vs. OngLaura MangantulaoОценок пока нет

- Development Bank of The Philippines, Petitioner, V. Ruben S. Go and Angelita M. Go, and The Honorable Court of APPEALS, Respondents. DecisionДокумент2 страницыDevelopment Bank of The Philippines, Petitioner, V. Ruben S. Go and Angelita M. Go, and The Honorable Court of APPEALS, Respondents. Decisionchappy_leigh118Оценок пока нет

- ObliCon 1139-1155Документ36 страницObliCon 1139-1155Ernest Talingdan CastroОценок пока нет

- Page 584 Cir Vs KepcoДокумент2 страницыPage 584 Cir Vs KepcoDaniel GalzoteОценок пока нет

- (G.R. No. 212683, November 12, 2018) THIRD DIVISION (G.R. No. 212683, NoveДокумент36 страниц(G.R. No. 212683, November 12, 2018) THIRD DIVISION (G.R. No. 212683, NoveAlexandria ThiamОценок пока нет

- Heirs of Eugenio Lopez v. EnriquezДокумент11 страницHeirs of Eugenio Lopez v. EnriquezLeidi Chua BayudanОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент55 страницBe It Enacted by The Senate and House of Representatives of The Philippines in Congress Assembledjayrkulit16Оценок пока нет

- AUSL Bar Operations 2017 LMT Property EditedДокумент6 страницAUSL Bar Operations 2017 LMT Property EditedEron Roi Centina-gacutanОценок пока нет

- The Honorable Office of The Ombudsman v. Leovigildo Delos Reyes, JRДокумент12 страницThe Honorable Office of The Ombudsman v. Leovigildo Delos Reyes, JRRAINBOW AVALANCHEОценок пока нет

- Labor Standards and Relations ReviewerДокумент157 страницLabor Standards and Relations ReviewerSoc SaballaОценок пока нет

- Civ ProДокумент126 страницCiv ProliboaninoОценок пока нет

- Miscellaneous Sales PatentДокумент2 страницыMiscellaneous Sales PatentJhodhel AbiganiaОценок пока нет

- Book Iii Title V. - Prescription: Eneral Rovisions Hat Is PrescriptionДокумент166 страницBook Iii Title V. - Prescription: Eneral Rovisions Hat Is PrescriptionJerick BartolataОценок пока нет

- Test 1Документ3 страницыTest 1Simran SinghОценок пока нет

- Labor Procedure Charts (Edited)Документ11 страницLabor Procedure Charts (Edited)Edward Kenneth KungОценок пока нет

- Bir Rmo - No.38-2019 (Digest)Документ3 страницыBir Rmo - No.38-2019 (Digest)karl kevinОценок пока нет

- CreatePDF - Screen Shot 2021-03-29 at 8.42.16 AMawДокумент1 страницаCreatePDF - Screen Shot 2021-03-29 at 8.42.16 AMawLorenzo BalmoriОценок пока нет

- CreatePDF - Choose A Plan - ScribdДокумент3 страницыCreatePDF - Choose A Plan - ScribdLorenzo BalmoriОценок пока нет

- RR 13-1998Документ17 страницRR 13-1998nikkaremullaОценок пока нет

- CreatePDF - Choose A Plan - ScribdДокумент3 страницыCreatePDF - Choose A Plan - ScribdLorenzo BalmoriОценок пока нет

- CreatePDF - Screen Shot 2021-01-09 at 9.50.32 AM - PdfsДокумент1 страницаCreatePDF - Screen Shot 2021-01-09 at 9.50.32 AM - PdfsLorenzo BalmoriОценок пока нет

- CreatePDF - Oriel Window House by Shinsuke Fujii Offers Cherry Blossom Views - 1.pdafdasdДокумент15 страницCreatePDF - Oriel Window House by Shinsuke Fujii Offers Cherry Blossom Views - 1.pdafdasdLorenzo BalmoriОценок пока нет

- CreatePDF - Choose A Plan - ScribdДокумент3 страницыCreatePDF - Choose A Plan - ScribdLorenzo BalmoriОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- RR No. 7-2003Документ9 страницRR No. 7-2003Lorenzo BalmoriОценок пока нет

- RR 2-98 and 3-98 PDFДокумент103 страницыRR 2-98 and 3-98 PDFLorenzo BalmoriОценок пока нет

- RR 13-1998Документ17 страницRR 13-1998nikkaremullaОценок пока нет

- RR 1-2011Документ3 страницыRR 1-2011Jaypee LegaspiОценок пока нет

- RR No. 2-2014 PDFДокумент3 страницыRR No. 2-2014 PDFLorenzo BalmoriОценок пока нет

- RMC No 39-2014Документ2 страницыRMC No 39-2014Mark OyalesОценок пока нет

- RMR No. 1-2001Документ14 страницRMR No. 1-2001Lorenzo BalmoriОценок пока нет

- RR 12-2013 Withheld or Your Expenses Will Be DisallowedДокумент1 страницаRR 12-2013 Withheld or Your Expenses Will Be DisallowedMarita Ragus Victorino CabreraОценок пока нет

- Cta 1D CV 08607 D 2015aug14 AssДокумент21 страницаCta 1D CV 08607 D 2015aug14 AssIa Dulce F. AtianОценок пока нет

- Dof Order No. 137-87Документ3 страницыDof Order No. 137-87matinikki100% (2)

- TrailBlood PDFДокумент25 страницTrailBlood PDFLorenzo BalmoriОценок пока нет

- RMR No. 2-2002Документ22 страницыRMR No. 2-2002Lorenzo BalmoriОценок пока нет

- Six StepsДокумент17 страницSix StepsmaniiiiiiiiОценок пока нет

- Dof Order No. 149-95Документ1 страницаDof Order No. 149-95matinikkiОценок пока нет

- Rmo 31-2009Документ0 страницRmo 31-2009Peggy SalazarОценок пока нет

- Fungiculture (Manual Small Scale)Документ86 страницFungiculture (Manual Small Scale)Dedy Lesmana86% (7)

- Windows Firewall: If You Are Not Using A Network Environment (I.e. USB Connection Only)Документ0 страницWindows Firewall: If You Are Not Using A Network Environment (I.e. USB Connection Only)Milan KrcmarОценок пока нет

- Republic of The Philippines Philippine Statistics Authority ManilaДокумент1 страницаRepublic of The Philippines Philippine Statistics Authority ManilaLorenzo BalmoriОценок пока нет

- NEGOtiable Instruments Class NotesДокумент20 страницNEGOtiable Instruments Class NotesCattleyaОценок пока нет

- The Manila GalleonДокумент6 страницThe Manila GalleonSergio FernandezОценок пока нет

- Pinoyfitness Rexonarun Results 5KДокумент58 страницPinoyfitness Rexonarun Results 5KLorenzo BalmoriОценок пока нет