Академический Документы

Профессиональный Документы

Культура Документы

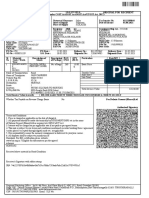

ONE PAGER - Puerto Rico Tax Incentives - Essentium Group

Загружено:

EdgardoVRАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ONE PAGER - Puerto Rico Tax Incentives - Essentium Group

Загружено:

EdgardoVRАвторское право:

Доступные форматы

Full service consulting firm that specializes in Regulatory Compliance, Government Affairs and Business CONTACT US NOW FOR

CONTACT US NOW FOR MORE DETAILS:

Solutions. With over 100 years of combined experience, we offer ethical and effective solutions with 787-931-7471 www.essentium.net

quantifiable results. We provide the tools, resources and strategies that will allow our clientele to reach Caparra Office Center, Suite 222

the next level and develop long-term value in a rapidly changing environment. 22 Calle Gonzlez Giusti, Guyanabo PR 00968

Puerto Rico currently offers a COMPREHENSIVE INCENTIVES PACKAGE that is

TAX INCENTIVES

the pillar of the islands investment promoting strategy. It is a set of incentives and benefits

granted by the government as tools for the development of Export Services, Individual

Investors, International Financial Entities, International Insurers, and Medical Professionals.

ACT 20 ACT 22 ACT 273 ACT 399 ACT 14 ACT 73

EXPORT INDIVIDUAL INTERNATIONAL INTERNATIONAL MEDICAL MANUFACTURE

SERVICES INVESTORS FINANCIAL INSURERS PROFESSIONALS

ENTITIES

20 ACT 20 EXPORT SERVICES

22

ACT 22 INDIVIDUAL INVESTORS

Offers nonresident individuals 100% tax exemptions

Applies to any entity with a bona fide establishment in Puerto Rico that is engaged in an eligible service

for export. Eligible services include investment banking, financial services, R&D, advertising,

consulting, IT development, call centers, professional services, centralized management services and

on all interest, all dividends, and all hospitals and laboratories.

long-term capital gains to entice nonresidents to 4% fixed income tax rate on income related to the export of services

INCENTIVES:

relocate to Puerto Rico.

100% tax exemption on income tax rate from dividends or profit distributions

0% tax on dividend and interest income for new

INCENTIVES:

90% tax exemption on personal and real property taxes

Puerto Rico residents

60% tax exemption on municipal taxes

0% tax on short-and-long term capital gains for

20 year tax decree renewable for an additional 10-year period

new Puerto Rico residents

273

0% federal taxes on Puerto Rico source income

Tax savings on your investment ACT 273 INTERNATIONAL FINANCIAL ENTITIES

portfolio returns

Provide tax incentives for new banking and financial activity in Puerto Rico that is provided for

clients outside of Puerto Rico.

399 4% Corporate flat tax rate on net income

INCENTIVES:

ACT 399 INTERNATIONAL INSURERS

0%-6% Dividend tax rate to Puerto Rico resident shareholders

Establishes the legal basis for the International Insurance 100% Dividend tax exemption to non-resident shareholders

Center of Puerto Rico, through which insurers and reinsurers, 100% Exemption on municipal taxes

or business entities organized as such, can export and import 100% Exemption on Real and personal property taxes

insurance and services related to the insurance industry.

0%-4% Corporate tax rate

14

INCENTIVES:

ACT 14 MEDICAL PROFESSIONALS

100% Exemption on Puerto Rico dividends

and capital gains taxes Offers tax incentives to qualified medical professionals to attract the setup of new medical practices.

100% Exemption on real and personal

INCENTIVES:

0%-4% Fixed income tax rate

property taxes

100% Exemption from Puerto Rico taxes on dividends and capital gains

100% Exemption on municipal taxes

100% Exemption on real and personal property

73

100% Exemption on municipal taxes

ACT 73 MANUFACTURE

Economic Development Incentives 50% tax credit with multiple uses

INCENTIVES:

Act provides tax incentives for 0% - 1% pioneer tax rate Pre-qualified free trade zones throughout Puerto Rico

companies that establish and Income tax exemption on property and inventory

4% income tax rate /12% withholding on royalty payments

expand their island operations as

100% exemption on distributions for Puerto Rico residents 4% income tax rate on the provision of services to entities outside of Puerto Rico

well as tax credits for creating

jobs and investing in research Excise tax on sales to affiliates 100% exemption for earnings distributions for Puerto Rico residents

and development. 4% income tax rate 90% property tax exemption

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Inr One Lakh Twenty Three Thousand Two Hundred & Thirty Six OnlyДокумент2 страницыInr One Lakh Twenty Three Thousand Two Hundred & Thirty Six OnlyRaja HussainОценок пока нет

- Six Eleven Global Services and SolutionsДокумент38 страницSix Eleven Global Services and SolutionsShane Rubino AdremesinОценок пока нет

- Declaration by Salaried Persons To Be Submitted To The Employer by The EmployeeДокумент4 страницыDeclaration by Salaried Persons To Be Submitted To The Employer by The EmployeeM. AamirОценок пока нет

- Oppo Enco M31 Ewn1O Bluetooth Headset: Grand Total 1964.00Документ2 страницыOppo Enco M31 Ewn1O Bluetooth Headset: Grand Total 1964.00Ganesh Prabu0% (1)

- W8-BEN PaypalДокумент3 страницыW8-BEN PaypalKarol Machajewski67% (6)

- Taxation in Islamic PrespectiveДокумент17 страницTaxation in Islamic PrespectivekhyroonОценок пока нет

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Документ3 страницыMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)appipinnim100% (2)

- ManojДокумент1 страницаManojAjit pratap singh BhadauriyaОценок пока нет

- FABM2 Q2 Mod14Документ26 страницFABM2 Q2 Mod14Fretty Mae AbuboОценок пока нет

- Well KidДокумент1 страницаWell Kidtahirliayla0Оценок пока нет

- Case DigestДокумент33 страницыCase DigestAngela AngelesОценок пока нет

- Vinay Shraff CVДокумент4 страницыVinay Shraff CVapi-3822396Оценок пока нет

- Acc 421 JanДокумент42 страницыAcc 421 JanMay ChenОценок пока нет

- ATO Phone ListДокумент35 страницATO Phone Listrani.christine91Оценок пока нет

- Taxation Virgilio D. Reyes 2 PDFДокумент194 страницыTaxation Virgilio D. Reyes 2 PDF?????Оценок пока нет

- Chapter 10 v2Документ15 страницChapter 10 v2Sheilamae Sernadilla Gregorio0% (1)

- FNF 02 I33514 Ankit ShuklaДокумент3 страницыFNF 02 I33514 Ankit ShuklaAnkit ShuklaОценок пока нет

- Arch Waterfront, 5th Floor, Plot No. F4, Block - GP, Sector V, Kolkata-700091, West Bengal, IndiaДокумент1 страницаArch Waterfront, 5th Floor, Plot No. F4, Block - GP, Sector V, Kolkata-700091, West Bengal, Indiabhavesh kalalОценок пока нет

- HassanДокумент9 страницHassanHassan IjazОценок пока нет

- Origin Original AL: InvoiceДокумент1 страницаOrigin Original AL: InvoiceMelike MichelleОценок пока нет

- Financial Coaching Worksheet: Financial Coach: Gidget Gayle OnteДокумент4 страницыFinancial Coaching Worksheet: Financial Coach: Gidget Gayle OnteCelmer Charles Q. VillarealОценок пока нет

- Petitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutДокумент16 страницPetitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutAggy AlbotraОценок пока нет

- Challan 280Документ2 страницыChallan 280Rahul SinglaОценок пока нет

- Applied Taxation ACCT 370: Rabia SaleemДокумент23 страницыApplied Taxation ACCT 370: Rabia Saleemsultan siddiquiОценок пока нет

- Order FL0200682072: Mode of Payment: NONCODДокумент1 страницаOrder FL0200682072: Mode of Payment: NONCODShubham NamdevОценок пока нет

- Himanshu Sharma PDFДокумент1 страницаHimanshu Sharma PDFHimanshu SharmaОценок пока нет

- CS Professional Income Tax Handwritten Class NotesДокумент240 страницCS Professional Income Tax Handwritten Class Notesmittalansh899Оценок пока нет

- E-Way BillДокумент1 страницаE-Way BillShriyans DaftariОценок пока нет

- Burgum's BallsДокумент4 страницыBurgum's BallsRob PortОценок пока нет

- Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectДокумент1 страницаBranch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectShivani MishraОценок пока нет