Академический Документы

Профессиональный Документы

Культура Документы

Tata Motors One Pagers

Загружено:

didwaniasИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tata Motors One Pagers

Загружено:

didwaniasАвторское право:

Доступные форматы

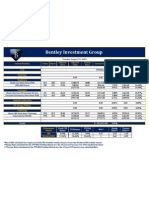

TATA MOTORS Nifty: 2784 Date: 08.12.

08

Automobiles ie Commercial and Passenger Vehicles. Price: 152.10

BSE NSE % fall 80.75

Avg. volume 600015 1908142 High/ Low 790.24 124.80

PARTICULARS FV No. of Sh. Sh.Hold. 30.09.08 %

Rs.(In crores) (In crores) Promoters 33.34

Equity- Latest 514.29 10.00 51.43 FII 14.91

Reserves (excluding Rev. Reserve)- Latest 12304.88 Ind.Inst.& MF 17.4

Shareholders Funds 12819.17 ADR/GDR 14.91

Book Value (Rs.Per share) 249.26 Others 19.44

Dividend % 112.5 PROJECTED

Market Price (Rs. Per share) 152.10 150 135 125 120

Dividend Yield (%) 7.40 7.50 8.33 9.00 9.38

Market Price/ B V 0.61 0.60 0.54 0.50 0.48

Loans- 31.03.08 11584.87

Market Cap 7822.35 7714.35 6942.92 6428.63 6171.48

EV 19407 19299 18528 18013 17756

EBITDA Year end 31.03.2008 4572.78

EV/ EBITDA 4.24 4.22 4.05 3.94 3.88

To finance the early repayment of short term funding for JLR deal, Co. has issued 64294118 ordinary shares at a premium of Rs.330 per share through

rights issue in the ratio of 1:6.Also 64295082 'A' Ordinary shares with differential voting rights at a premium of Rs.295 per share in the ratio of 1:6.

Therefore, share capital has increased by Rs.128.59cr and I have incresed Reserves (Premium) by Rs.4018.41.DVR shares will carry 5% more

dividend and will have one- tenth of voting rights for ordinary shares.

Note: Dividend paid 150% pre Right issue of 1:3 ratio hence Div % adjusted accordingly.

Running Year 31/03/2008 30/06/2008 30/09/2008 30/06/2008 31/03/2009

12 Months Q1 Q2 Q1 Q4E

Cons. Standalone Standalone Cons. Exc JLR

Net Sales 35413.19 6928.44 7029.33 8680.01

Other Income 617.93 315.61 119.99 250.47

EBITDA 4572.78 838.14 635.37 1060.15

PAT - Excl Ext.Ord.Exp/Inc./Frx Loss 2283.13 515.00 275.47 463.62

EPS - (Annualised) 44.39 40.06 21.43 36.06

PE 3.43 3.80 7.10 4.22

Extra Ord. Gain/ (Loss) (net of tax) 114.31 0.00 356.54 0.00

Forex Gain/ (Loss) 137.61 (199.88) (285.02) (199.88)

*PAT is excluding Deferred Tax

EBITDA excludes forex fluc

Exceptional Gain in Qtr ended Sep, 08 is Profit on Sale of Investments in Tata Steel

Profits have reduced due to high interest costs, high input costs and constraints in availability of finance

But with the loweing interest rates, fall in steel prices , condition can improve.

Remarks

Tata Motors had to shift their Nano Plant from Singur (W.B.) (invested Rs. 1500cr ) to Sanand, Gujarat. This will delay the production and thus earnings.

Higher burden due to relocation costs. Merill Lynch estimated Rs.200cr as relocation exp.

Reports recommended - (Last 6 months coverage)

Report by Date Buy/ Recom. TARGET

Sell Price Price Period

Recommendation

(SAJAN DIDWANIA)

DISCLAIMER

This document has been prepared by FRONTLINE CAPITAL SERVICES LIMITED (FRONTLINE), for the use by the reipient

only and not for circulation. The information and opinions contained in the document have been complied from sources

believed to be reliable. FRONTLINE does not warrant its accuracy, completeness and correctness. This document is not, and

should not be construed as, an offer to sell or solicitation to buy any securities. This document may not be reproduced,

distributed or published, in whole or a part, by any recipient hereof for any purpose without prior permission from us.

FRONTLINE and analyst(s), including his dependent family members may have an interest in the securities or maket

recommended above.

Вам также может понравиться

- Sun Microsystems Case JasdeepДокумент6 страницSun Microsystems Case JasdeepJasdeep SinghОценок пока нет

- People v. Lamahang CASE DIGESTДокумент2 страницыPeople v. Lamahang CASE DIGESTRalson Mangulabnan Hernandez100% (1)

- Motion To Disqualify MCAO - 7-31-13Документ14 страницMotion To Disqualify MCAO - 7-31-13crimefileОценок пока нет

- Community Affairs PlanДокумент4 страницыCommunity Affairs PlanFranklin Onuorah67% (3)

- IDEA One PagerДокумент6 страницIDEA One PagerdidwaniasОценок пока нет

- BHEL One PagerДокумент1 страницаBHEL One PagerdidwaniasОценок пока нет

- Guj Apollo FinancialsДокумент1 страницаGuj Apollo FinancialsdidwaniasОценок пока нет

- GHCL One PagerДокумент1 страницаGHCL One PagerdidwaniasОценок пока нет

- Reliance Relative ValuationДокумент15 страницReliance Relative ValuationHEM BANSALОценок пока нет

- Dabur One PagerДокумент1 страницаDabur One PagerdidwaniasОценок пока нет

- Balaji Published Results 28-102010Документ2 страницыBalaji Published Results 28-102010Saurabh YadavОценок пока нет

- Lbo W DCF Model SampleДокумент33 страницыLbo W DCF Model Samplejulita rachmadewiОценок пока нет

- Published Results 31 March 2010Документ2 страницыPublished Results 31 March 2010Ravi ChaturvediОценок пока нет

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaДокумент4 страницыJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloОценок пока нет

- Consolidated Q4Документ6 страницConsolidated Q4Qazi MudasirОценок пока нет

- 634085163601250000financial Highlights0310-Correcte-1Документ2 страницы634085163601250000financial Highlights0310-Correcte-1arunnair1985Оценок пока нет

- Quarter1 2008Документ2 страницыQuarter1 2008Raghavendra DevadigaОценок пока нет

- Axis Bank LTD.: Economic ActivityДокумент3 страницыAxis Bank LTD.: Economic ActivityhitekshaОценок пока нет

- Asian Paints (Autosaved) 2Документ32 767 страницAsian Paints (Autosaved) 2niteshjaiswal8240Оценок пока нет

- Pidilite Industries Limited BSE 500331 Financials Income StatementДокумент4 страницыPidilite Industries Limited BSE 500331 Financials Income StatementRehan TyagiОценок пока нет

- 1070954147bharti AirtelДокумент3 страницы1070954147bharti AirtelSanjeedeep Mishra , 315Оценок пока нет

- Midway Securities LTD.: Room # 508, 9/F Motijheel C/A Dhaka - 1000Документ1 страницаMidway Securities LTD.: Room # 508, 9/F Motijheel C/A Dhaka - 1000Ashraful Haque TusharОценок пока нет

- LS India Cements Q1FY11Документ2 страницыLS India Cements Q1FY11prateepnigam355Оценок пока нет

- Consolidated Financial ReportДокумент4 страницыConsolidated Financial ReportVineet DixitОценок пока нет

- P-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementДокумент12 страницP-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDave Emmanuel SadunanОценок пока нет

- ShimanoIncTSE7309 PublicCompanyДокумент1 страницаShimanoIncTSE7309 PublicCompanyss xОценок пока нет

- Fin June 09Документ41 страницаFin June 09Timothy BrownОценок пока нет

- 16 Financial HighlightsДокумент2 страницы16 Financial HighlightswasiumОценок пока нет

- Portfolio - Home 15 OctoberДокумент3 страницыPortfolio - Home 15 OctobermukeshinsaaОценок пока нет

- BajajДокумент1 страницаBajajnuthan singhОценок пока нет

- AC Penetration Accross CountriesДокумент21 страницаAC Penetration Accross Countrieshh.deepakОценок пока нет

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactДокумент11 страницDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531Оценок пока нет

- Group 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Документ20 страницGroup 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Reeja Mariam MathewОценок пока нет

- Revenues & Earnings: All Figures in US$ MillionДокумент4 страницыRevenues & Earnings: All Figures in US$ MillionenzoОценок пока нет

- Financial Statistical Summary: Ratio AnalysisДокумент1 страницаFinancial Statistical Summary: Ratio AnalysisZeeshan KhanОценок пока нет

- SynopsisДокумент1 страницаSynopsisntkmistryОценок пока нет

- Salient Features of The Financial Statements of Subsidiaries Joint Ventures and Associates Aoc 1Документ5 страницSalient Features of The Financial Statements of Subsidiaries Joint Ventures and Associates Aoc 1Subrahmanya ShastryОценок пока нет

- Profit Loss AccountДокумент8 страницProfit Loss AccountAbhishek JenaОценок пока нет

- Bentley Investment Group: Tuesday August 25, 2009Документ1 страницаBentley Investment Group: Tuesday August 25, 2009bentleyinvestmentgroupОценок пока нет

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreДокумент12 страницMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhОценок пока нет

- Competitors Bajaj MotorsДокумент11 страницCompetitors Bajaj MotorsdeepaksikriОценок пока нет

- Tata Global Beverages LTDДокумент3 страницыTata Global Beverages LTDKapil Singh RautelaОценок пока нет

- July 2009 Return SheetsДокумент3 страницыJuly 2009 Return SheetsbentleyinvestmentgroupОценок пока нет

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingДокумент4 страницыPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorОценок пока нет

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Документ3 страницыColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaОценок пока нет

- Quarter1 2010Документ2 страницыQuarter1 2010DhruvRathoreОценок пока нет

- Class 9 SolutionsДокумент14 страницClass 9 SolutionsvroommОценок пока нет

- Portfolio Holdings: Investment SummaryДокумент2 страницыPortfolio Holdings: Investment SummaryAshutosh GuptaОценок пока нет

- Airtel DividdendДокумент6 страницAirtel DividdendRishab KatariaОценок пока нет

- Ramco Annual Report 2014Документ2 страницыRamco Annual Report 2014nithinОценок пока нет

- Accounts Assignement 21MBA0106Документ4 страницыAccounts Assignement 21MBA0106TARVEEN DuraiОценок пока нет

- Corporate Valuation: Tata Motors LTDДокумент10 страницCorporate Valuation: Tata Motors LTDUTKARSH PABALEОценок пока нет

- Financial Performance Trend: Sno. ParticularsДокумент2 страницыFinancial Performance Trend: Sno. ParticularsASHOK JAINОценок пока нет

- Dominic InterpretationДокумент11 страницDominic Interpretationdominic wurdaОценок пока нет

- Major IndicatorsДокумент1 страницаMajor IndicatorsShrestha Photo studioОценок пока нет

- Bharti Airtel LTDДокумент7 страницBharti Airtel LTDNanvinder SinghОценок пока нет

- MTF Readyreckoner..Документ1 страницаMTF Readyreckoner..JAII26Оценок пока нет

- Microsoft ValuationДокумент4 страницыMicrosoft ValuationcorvettejrwОценок пока нет

- ValueResearchFundcard KotakGiltInvestmentRegular 2010nov24Документ6 страницValueResearchFundcard KotakGiltInvestmentRegular 2010nov24zankurОценок пока нет

- DCFValuation JKTyre1Документ195 страницDCFValuation JKTyre1Chulbul PandeyОценок пока нет

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Документ6 страницChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhОценок пока нет

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisОт EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisОценок пока нет

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentДокумент10 страницRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasОценок пока нет

- Industry Report Card April 2018Документ16 страницIndustry Report Card April 2018didwaniasОценок пока нет

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveДокумент8 страницRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasОценок пока нет

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsДокумент8 страницInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasОценок пока нет

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayДокумент2 страницыMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasОценок пока нет

- Shareholding Pattern BSEДокумент3 страницыShareholding Pattern BSEdidwaniasОценок пока нет

- Ready Reckoner, November 2015Документ92 страницыReady Reckoner, November 2015didwaniasОценок пока нет

- 'A' Grade Turnaround: Associated Cement CompaniesДокумент3 страницы'A' Grade Turnaround: Associated Cement CompaniesdidwaniasОценок пока нет

- The Subprime Meltdown: Understanding Accounting-Related AllegationsДокумент7 страницThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasОценок пока нет

- CKP PresentationДокумент39 страницCKP PresentationdidwaniasОценок пока нет

- Nurturing A Distinct Corporate Identity,: DifferentlyДокумент10 страницNurturing A Distinct Corporate Identity,: DifferentlydidwaniasОценок пока нет

- Competitors' Product Knowledge and Marketing in Changing ScenarioДокумент62 страницыCompetitors' Product Knowledge and Marketing in Changing ScenariodidwaniasОценок пока нет

- Strategy, Knowledge and Success: Presented byДокумент55 страницStrategy, Knowledge and Success: Presented bydidwaniasОценок пока нет

- IndiaEconomicsOverheating090207 MF PDFДокумент4 страницыIndiaEconomicsOverheating090207 MF PDFdidwaniasОценок пока нет

- Vitanzos April Mae E. Long Quiz ApДокумент5 страницVitanzos April Mae E. Long Quiz ApMitch MinglanaОценок пока нет

- ANOINTING of The SICKДокумент44 страницыANOINTING of The SICKStef FinОценок пока нет

- Business ProcessesДокумент2 страницыBusiness ProcessesjeffОценок пока нет

- Keys of The Kingdom-EbookДокумент18 страницKeys of The Kingdom-EbookBernard Kolala0% (1)

- 23 September Paula Stratton - Has Received Documents For PID - Notification of Decision Not To Allocate A Disclosure SECOFFICIALSensitive ACCESSPersonalPrivacyДокумент20 страниц23 September Paula Stratton - Has Received Documents For PID - Notification of Decision Not To Allocate A Disclosure SECOFFICIALSensitive ACCESSPersonalPrivacyricharddrawsstuffОценок пока нет

- Final Managerial AccountingДокумент8 страницFinal Managerial Accountingdangthaibinh0312Оценок пока нет

- DRAFT FY2014-FY2018 Transportation Capital Investment PlanДокумент117 страницDRAFT FY2014-FY2018 Transportation Capital Investment PlanMassLiveОценок пока нет

- Powerpoint For Chapter Four of Our Sacraments CourseДокумент23 страницыPowerpoint For Chapter Four of Our Sacraments Courseapi-344737350Оценок пока нет

- Asuncion Bros. & Co., Inc. vs. Court Oflndustrial RelationsДокумент8 страницAsuncion Bros. & Co., Inc. vs. Court Oflndustrial RelationsArya StarkОценок пока нет

- Engine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Документ9 страницEngine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Akmal NizametdinovОценок пока нет

- Configure Quota Arrangement in SAP MM - SCNДокумент9 страницConfigure Quota Arrangement in SAP MM - SCNArchana Ashok100% (1)

- Public +Private+PartnershipsДокумент18 страницPublic +Private+PartnershipsNuha MansourОценок пока нет

- Hernandez Vs Go - A.C. No. 1526Документ4 страницыHernandez Vs Go - A.C. No. 1526Kevin GalegerОценок пока нет

- SnapLogic - Market Leader 3 Industry Reports Jan 2019Документ5 страницSnapLogic - Market Leader 3 Industry Reports Jan 2019dharmsmart19Оценок пока нет

- Ioana Ramona JurcaДокумент1 страницаIoana Ramona JurcaDaia SorinОценок пока нет

- Tort Outline .. Internet SourceДокумент43 страницыTort Outline .. Internet SourceColeman HengesbachОценок пока нет

- GA Tax GuideДокумент46 страницGA Tax Guidedamilano1Оценок пока нет

- Shrimp Specialists V Fuji-TriumphДокумент2 страницыShrimp Specialists V Fuji-TriumphDeaОценок пока нет

- Andreí Gómez. A Genocidal Geopolitical Conjucture. Contextualising The Destruction of The Union Patriotica in ColombiaДокумент261 страницаAndreí Gómez. A Genocidal Geopolitical Conjucture. Contextualising The Destruction of The Union Patriotica in ColombiaAndres Caicedo RamirezОценок пока нет

- Leave of Absence Authorisation 2.0Документ3 страницыLeave of Absence Authorisation 2.0灭霸Оценок пока нет

- Development of Equation of Motion For Nonlinear Vibrating SystemsДокумент45 страницDevelopment of Equation of Motion For Nonlinear Vibrating SystemsSteve KrodaОценок пока нет

- Revocation of Patent in IndiaДокумент8 страницRevocation of Patent in IndiaAartika SainiОценок пока нет

- 7 PDFДокумент123 страницы7 PDFGo GoОценок пока нет

- Electronic Ticket For 1gjtsx Departure Date 20-05-2022Документ3 страницыElectronic Ticket For 1gjtsx Departure Date 20-05-2022Vikas BalyanОценок пока нет

- The Sorcerer's Tale: Faith and Fraud in Tudor EnglandДокумент224 страницыThe Sorcerer's Tale: Faith and Fraud in Tudor Englandnevernevernever100% (1)

- Form 6: Thorat Kashinath Vishwanath Thorat Vishwanath Mariba Shelgaon Partur, in Jalna Matang 46 Scheduled CasteДокумент1 страницаForm 6: Thorat Kashinath Vishwanath Thorat Vishwanath Mariba Shelgaon Partur, in Jalna Matang 46 Scheduled Castesundar khandareОценок пока нет

- Copyreading and HWДокумент16 страницCopyreading and HWJenniferОценок пока нет